Deflator coefficient for simplified tax system

When applying the simplified tax system, the deflator coefficient is used to adjust the amounts of the marginal income: 45 million rubles. — the limit at which a transition to the simplified tax system is possible and 60 million rubles. - the maximum income of a “simplified person”, if exceeded, he loses the right to apply the simplified tax system (clause 2 of article 346.12 of the Tax Code of the Russian Federation and clause 4 of article 346.13 of the Tax Code of the Russian Federation). In 2016, the coefficient is 1.329. In 2021 it will increase to 1.425. Therefore, the above-mentioned limits on income of organizations and individual entrepreneurs that use a simplified taxation system will also increase. Note that this is good news for those who are on the “simplified” regime, since they will be able to earn more without the risk of “flying off” the special regime.

Results

When applying this or that special tax regime, individual entrepreneurs or organizations, it is important to understand how the tax regime affects it.

For example, with the simplified tax system, this is the amount of income that allows you to apply this regime, and with UTII, it is the imputed income from which the amount of tax due for payment to the budget is calculated. The value of the coefficient changes once a year and is usually known in advance. You can find more complete information on the topic in ConsultantPlus. Free trial access to the system for 2 days.

Deflator coefficient for personal income tax

For personal income tax, the deflator coefficient is used to adjust payments of foreign citizens from “visa-free countries” working on the basis of a patent for hire from individuals (in particular, for personal, household and other similar needs not related to business activities). These foreign workers are required to independently make monthly fixed advance payments for personal income tax for the period of validity of the patent in the amount of 1,200 rubles (Clause 2 of Article 227.1 of the Tax Code of the Russian Federation). The size of the deflator coefficient for 2021 for these purposes was 1.514. And for 2021 it has increased and is 1.623.

K2 coefficient

The K2 coefficient for UTII for 2021 is set at the level of local municipal authorities. Its indicator, unlike K1, either leads to a decrease in the tax base or does not change it and can range from 0.005 to 1. The adjustment coefficient can be changed annually.

K2 was created in order to create more similar conditions for building a business in various regions of our country. Its value may be different for different types of activities and depends on profitability, seasonality, and operating mode. The indicator is rounded to three decimal places.

As can be seen from previous years, municipal authorities very rarely change this indicator, since entrepreneurs do not approach them with such a request. If you think that the K2 value is high in your region, contact local authorities with a request to reduce it, preferably justifying your desire with numbers. The minimum value can be 0.005. Please note how large the range of values of this indicator is, and by reducing it even by 0.01, you can save a little on taxes. Don't forget, you can do this until November 20th.

What to do if K2 was not initially installed by municipal authorities. The Federal Tax Service believes that in this case taxpayers should take the maximum value of the indicator “1” for calculation. The judges take the opposite side, considering it legitimate to use the minimum value of 0.005. This is indicated by the resolution of the Federal Antimonopoly Service of the West Siberian District dated December 13, 2010 No. A03-16513/2009.

Some people believe that if the coefficient is not calculated, it can be ignored. This is what the Federal Antimonopoly Service of the Northwestern District thinks in its resolution dated October 18, 2010 No. A 133618/2010.

Therefore, if you want to avoid misunderstandings on the part of the tax authorities, you must apply K2=1, otherwise you will have to resolve the issue through the courts.

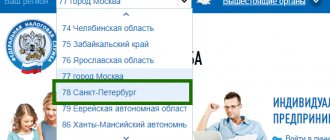

Where can I find out the value of K2

This question will be answered by your local tax office, or go to the website of the Federal Tax Service of the Russian Federation, select the region you are interested in, and find out the required value.

Deflator coefficient for PSN

For the patent taxation system used by individual entrepreneurs, the deflator coefficient increases the maximum amount of potential annual income by type of business activity. Let us recall that the basic value of the maximum possible annual income of an individual entrepreneur is 1 million rubles (clause 7 of Article 346.43 of the Tax Code of the Russian Federation). In 2021, the coefficient applied was 1.329. And in 2021 it will increase to 1.425. Consequently, the maximum amount of potential annual income for the “patent” business was 1.425 million rubles (1 million rubles × 1.425). Thus, the maximum cost of a patent for a month will be 7,250 rubles (1.425 million rubles × 6%: 12 months). Note that regional authorities can increase the amount of potential annual income for certain types of activities by three, five and even 10 times (clause 8 of Article 346.43 of the Tax Code of the Russian Federation).

Deflator coefficients for 2021

(Order of the Ministry of Economic Development of the Russian Federation dated November 3, 2016 No. 698 “On the establishment of deflator coefficients for 2021”, registered with the Ministry of Justice of the Russian Federation on November 17, 2016 No. 44353)

According to Art. 11 of the Tax Code of the Russian Federation deflator coefficient –

this is

a coefficient established annually

for each subsequent calendar year and calculated as the product of the deflator coefficient used for the purposes of the relevant chapters of the Tax Code of the Russian Federation in the previous calendar year, and a coefficient taking into account changes in consumer prices for goods (work, services) in the Russian Federation in the previous calendar year year.

Deflator coefficients are established

, unless otherwise provided by the legislation of the Russian Federation on taxes and fees,

the Ministry of Economic Development of the Russian Federation

in accordance with the data of state statistical reporting and, unless otherwise provided by the legislation of the Russian Federation on taxes and fees, are subject to official publication in the Rossiyskaya Gazeta

no later than November 20

of the year in which deflator coefficients are established.

The order of the Ministry of Economic Development of the Russian Federation established deflator coefficients for 2021

.

Personal income tax

According to Art.

227.1 of the Tax Code of the Russian Federation, foreign citizens engaged in labor activities for hire from individuals, organizations and individual entrepreneurs on the basis of a patent

issued in accordance with Federal Law No. 115-FZ of July 25, 2002

“On the legal status of foreign citizens in the Russian Federation”

, calculate and pay tax on income received from such activities.

Tax payment is carried out in the form of fixed advance payments

.

Size

fixed advance payments

are subject to indexation by a deflator coefficient

established for the corresponding calendar year.

For 2021

the deflator coefficient required for the purpose of applying Chapter 23 of the Tax Code of the Russian Federation is set at

1,623

.

Simplified taxation system

According to paragraph 2 of Art. 346.12 Tax Code of the Russian Federation

An organization

has the right to switch to the simplified tax system

if,

based on the results of nine months

of the year in which the organization submits a notice of transition to the simplified tax system,

income

determined in accordance with

Art.

248 of the Tax Code of the Russian Federation, did not exceed 45 million rubles. Specified value

the maximum amount of income of an organization, limiting the right of the organization to switch to the simplified tax system,

is subject to indexation no later than December 31

of the current year

by the deflator coefficient

established for the next calendar year.

The deflator coefficient required for the purposes of applying Chapter 26.2 of the Tax Code of the Russian Federation was established for 2021

at the rate of

1,329

.

To switch to the simplified tax system

from 2021, income

for the nine months of 2021 should not exceed

59,805 thousand rubles.

(RUB 45 million × 1.329).

According to paragraph 4 of Art. 346.13 Tax Code of the Russian Federation from January 1, 2021

if, based on the results of the reporting (tax) period, the taxpayer’s income, determined in accordance with

Art.

346.15 and

paragraphs.

1 and

3 paragraphs 1 art.

346.25 of the Tax Code of the Russian Federation , exceeded

120 million rubles

, such a taxpayer is considered to

have lost the right to use the simplified tax system

from the beginning of the quarter in which the specified excess and (or) non-compliance with the specified requirements was allowed.

From January 1, 2021 to 2021

the effect of the provision that

the specified value of the maximum amount

of a taxpayer’s income, limiting the taxpayer’s right to use the simplified tax system,

is subject to indexation

.

That is, in 2021

the amount is 120 million rubles.

not indexed .

Consequently, for tax payers under the simplified tax system, the income limit is

for the tax (reporting) period

of 2017 should not exceed 120 million rubles.

A single tax on imputed income

In accordance with Art.

346.29 of the Tax Code of the Russian Federation, the tax base

for calculating the amount of UTII is

the amount of imputed income

, calculated

as the product of the basic profitability

for a certain type of business activity, calculated for the tax period,

and the value of the physical indicator

characterizing this type of activity.

To calculate the amount of single tax depending on the type of business activity, physical indicators

, characterizing a certain type of business activity, and

basic profitability per month

.

Basic yield

adjusted (multiplied)

by coefficients K1 and K2

.

Art. 346.27 Tax Code of the Russian Federation

It has been established that

K1

is a deflator coefficient established for a calendar year,

calculated as the product of the coefficient applied in the previous period and the coefficient

taking into account changes in consumer prices for goods (work, services) in the Russian Federation

in the previous calendar year

, which is determined and subject to official publication in the manner established by the Government of the Russian Federation.

Deflator coefficient K1

, required for the purpose of applying Chapter 26.3 of the Tax Code of the Russian Federation,

for 2021

is set at

1.798

.

That is , the same as in 2021

.

Let us recall that the deflator coefficients established for previous years and the deflator coefficient established

for the next year, taxpayers

should not multiply when calculating UTII

(letter of the Federal Tax Service of the Russian Federation dated February 21, 2011 No. KE-4-3 / [email protected] ).

Patent tax system

Art. 346.43 Tax Code of the Russian Federation

It has been established that the laws of the constituent entities of the Russian Federation establish

the amount of annual income that an individual entrepreneur can potentially receive

by type of business activity in respect of which the PSN is applied.

At the same time, the maximum amount potentially obtainable

an individual entrepreneur's

annual income

cannot exceed 1 million rubles, unless otherwise established

by clause 8 of Art.

346.43 Tax Code of the Russian Federation .

Specified maximum size

The annual income potentially received by an individual entrepreneur

is subject to indexation by the deflator coefficient

established for the corresponding calendar year.

Deflator coefficient for 2021

, required for the purpose of applying Chapter 26.5 of the Tax Code of the Russian Federation, is set at

1,425

.

In this regard, for these types of business activities, constituent entities of the Russian Federation can increase the maximum size

potential

annual income for an individual entrepreneur, taking into account indexation by the deflator coefficient established for 2021

.

At the same time, as the Ministry of Finance of the Russian Federation explained in a letter dated January 13, 2015 No. 03-11-09/69405, if

The legislative act of a constituent entity of the Russian Federation establishes that

the amount of annual income potentially

received by an individual entrepreneur

in 2021 is applied taking into account the approved deflator coefficient

, then the tax authorities, when calculating tax, take into account the potential income taking into account indexation.

In case the law

Subject of the Russian Federation, the amount of annual income potentially received by an individual entrepreneur for these types of activities

was not increased by a deflator coefficient; tax authorities

do not have the right

the amount of potential income for the purpose of calculating the amount of tax under PSN .

Property tax for individuals

According to Art. 404 of the Tax Code of the Russian Federation, tax base for property tax for individuals

is determined in relation to each taxable object as its inventory value, calculated

taking into account the deflator coefficient

a on the basis of the latest data on inventory value submitted in the prescribed manner to the tax authorities

before March 1, 2013

.

Deflator coefficient

, required for the purpose of applying Chapter 32 “Property Tax for Individuals” of the Tax Code of the Russian Federation, is set

for 2021

in the amount of

1.425

.

Trade fee

For 2021

the deflator coefficient required for the purpose of applying Chapter 33 “Trade Fee” of the Tax Code of the Russian Federation is set at

1,237

.

We would like to remind you that no trade tax has been introduced in the Sverdlovsk region.

.

Deflator coefficient for trade tax

Trade fee payers use a deflator coefficient to adjust the fee rate determined for activities related to the organization of retail markets (clause 4 of Article 415 of the Tax Code of the Russian Federation). The basic value of this rate is 550 rubles per 1 square meter of retail market area. The coefficient value for 2021 was 1.154. For 2017, the coefficient will increase to 1.237. Accordingly, the fee rate for this type of activity in 2021 will increase and amount to 680.35 rubles (550 rubles × 1.237).

| Tax system | 2016 | 2017 |

| simplified tax system | 1,329 | 1,425 |

| Personal income tax | 1,514 | 1,623. |

| PSN | 1,329 | 1,425 |

| UTII | 1,798 | 1,798 |

| Trade fee | 1,154 | 1,237 |

| Property tax | 1,329 | 1,425 |

Read also

23.08.2016

For what modes is it relevant?

The deflator coefficient is relevant for the following taxation systems and types of tax:

- “Simplified” (USN).

- Personal income tax.

- Patent (PSN).

- Trade fee.

- “Imputation” (UTII).

- Property tax.

Judging by the above, the deflator coefficients of the Ministry of Economic Development affect all citizens without exception - legal entities and individuals. Foreign persons working in the Russian Federation also fall into this category.

Using this parameter is easy even for beginners. For the calculation, a special formula is presented, which takes a few seconds to calculate. One of the terms of the formula is the deflator coefficient. Knowing its value for 2021, you can accurately calculate and find out the amount of tax.

UTII can be used until the end of 2021

Entrepreneurs can use the “imputation” until 01/01/2021, the validity period of the special regime has been extended for 3 years.

Let us remind you that it was previously assumed that UTII will cease to exist by 2021.

Reason: amendments to Part 8 of Art. 5 of the Federal Law of June 29, 2012 No. 97-F3 by the Law of June 2, 2016 No. 178-FZ.

Scheme: what has changed in the law

How to reduce the size of UTII

We talked about how tax is calculated, what indicators are affected, where you can find out their meaning and what they depend on. Now let's see if it is possible to reduce the amount of tax, and how to do it correctly.

It is not within our authority to make changes to K1, K2, DB (basic profitability). We can change the tax on the amount of insurance premiums accrued and paid in the reporting period.

Therefore, if an individual entrepreneur or LLC has employees and pays taxes on accrued wages, then they have the authority to reduce UTII by the amount of tax paid, but not more than 50%, reflecting these expenses on line 20, section 3, of the UTII declaration. In addition, an individual entrepreneur has the opportunity to reduce the UTII tax by the amount of fixed contributions paid in the reporting period to the Federal Compulsory Medical Insurance Fund and the Pension Fund of the Russian Federation by indicating expenses in line 030, section 3 of the UTII declaration.

Since 2015, a new reporting form for UTII has been used, approved by order of the Federal Tax Service of the Russian Federation dated July 4, 2014 No. ММВ-7-3/353. KND form code 1152016.

Features of calculating UTII in the absence of hired employees

In addition to paying UTII, the entrepreneur is obliged to pay pension insurance contributions and contributions to social insurance funds. The tax base is the wage fund, which is paid by the entrepreneur to his employees (if any). Please note that the presence of hired employees does not exempt a private entrepreneur from paying insurance premiums for himself.

The size of these payments depends on the minimum wage established for the current year.

It should be noted that in the absence of hired employees, the entrepreneur has the right to reduce the amount of UTII by the amount of insurance premiums that he pays for himself. This right is provided for in paragraph 2.1 of Article 346.32 of the Tax Code.

A private entrepreneur loses this right if he has hired employees. You can familiarize yourself with this clarification in the letter of the Ministry of Finance of the Russian Federation dated July 17, 2015 under number 03-11-11/41339.