The UTII tax regime, contrary to forecasts, will continue to operate in 2021, still remaining very profitable for many entrepreneurs. Real income is not taken into account in calculating the “imputed” tax, but a conditional basic profitability established by the Tax Code of the Russian Federation is applied. To determine the taxable base for UTII, the basic profitability is multiplied by the adjustment coefficients K1 and K2, as well as by the amount of physical indicators for each month (Article 346.29 of the Tax Code of the Russian Federation). What these coefficients mean, and what the values of K1 and K2 UTII will be in 2021, we will explain further.

Table with new odds

Here is a table with new deflator coefficients for 2018.

| Type of tax | Deflator coefficient 2018 |

| simplified tax system | 1,481 |

| Personal income tax | 1,686 |

| UTII | 1,868 |

| Patent | 1,481 |

| Property tax | 1,481 |

| Trade fee | 1,285 |

The deflator coefficient is needed to adjust the amount of income that gives the company the right to switch and work on the simplified tax system. However, there is no need to index income limits until 2020 (Clause 4, Article 5 of Law No. 243-FZ of July 3, 2021). Accordingly, a company will be able to switch to the simplified tax system from 2021 if its income for 9 months of 2021 does not exceed 112.5 million rubles. But she will be able to apply the “simplified system” until income from activities exceeds 150 million rubles. (clause 4 of article 346.13 of the Tax Code of the Russian Federation). Also see “Conditions for the transition to the simplified tax system from 2021: criteria.”

What are the predicted values

The official order of the Ministry of Economic Development on the deflator index for 2021 has not yet been published, but forecast values in various production areas have already been presented. These values will still be adjusted taking into account recent economic changes.

When developing the budget and planning procurement activities for the next year and planning periods, use the existing coefficient values calculated by the ministry’s specialists.

Let's present the deflator indices of the Ministry of Economic Development until 2024 in the table.

| Industries | 2021 | 2022 | 2023 | 2024 |

| Mining | 103,1 | 103,8 | 104,1 | 104,2 |

| Mining of oil and gas | 102,7 | 103,5 | 103,7 | 103,9 |

| Manufacturing industries | 103,3 | 104,1 | 104,2 | 104,3 |

| Industry | 103,4 | 104,0 | 104,1 | 104,2 |

| Providing electricity, gas and steam | 104,0 | 104,0 | 104,0 | 104,0 |

| Water supply and sanitation | 104,0 | 104,0 | 104,0 | 104,0 |

| Construction | 104,1 | 105,1 | 104,3 | 104,4 |

| Agriculture | 103,1 | 103,9 | 103,9 | 104,2 |

| Transport | 104,1 | 104,0 | 104,0 | 104,0 |

| Investments in fixed assets (capital investments) | 103,7 | 103,7 | 103,8 | 103,8 |

| Retail trade turnover | 103,5 | 104,3 | 103,9 | 104,0 |

| Paid services to the population | 104,2 | 103,9 | 104,2 | 104,1 |

The index for consumer goods is planned at 104.2. Retail electricity prices will be indexed to 104.0.

On September 30, 2021, the Ministry of Economic Development published a forecast of social development until 2024. Experts determined the level of economic growth and inflation:

According to calculations, the consumer price index of the Ministry of Economic Development for 2021 will be:

Deflator coefficient for UTII

“Imputers” use a deflator coefficient (another name is the K1 deflator coefficient, Article 346.27 of the Tax Code of the Russian Federation) to adjust the values of the basic profitability of a particular type of activity. The deflator coefficient for UTII for 2021 was set at 1,868 rubles. Compared to the previous value in 2021 (1.798), it increased by 3.4%. This means that even if the value of the physical indicator by type of activity remains the same and the size of K2 is set by local authorities at the same level, the “imputed” tax that you will pay to the budget will increase in 2021.

Development scenarios

Currently, the Ministry of Economic Development is developing three types of scenarios for the Russian economy:

- The basic plan, which implies that the indicators of the main factors of the Russian economy will remain at the base or current level. That is, they will not undergo any changes.

- The conservative scenario provides for a significant deterioration in socio-economic indicators. The plan takes into account not only internal but also external factors.

- A target plan under which the optimal development of events is expected for the Russian economy both in the domestic and foreign markets. For example, the lifting of sanctions, the reduction of fiscal duties and encumbrances, rising prices for raw materials, etc.

Not only internal development indicators (GDP, tax system, minimum wage, price indicators, size of the consumer basket) are analyzed. But also external factors. Currently, special attention is paid to the sanctions that were applied by the United States and the European Union.

Deflator coefficient for the patent system

For the patent taxation system used by individual entrepreneurs, the deflator coefficient increases the maximum amount of potential annual income by type of business activity. Let us recall that the basic value of the maximum possible annual income of an individual entrepreneur is 1 million rubles (clause 7 of Article 346.43 of the Tax Code of the Russian Federation). In 2021, the coefficient applied was 1.425. And in 2021 it will increase to 1.481. Consequently, the maximum amount of potential annual income for a “patent” business will be 1.481 million rubles (1 million rubles × 1.4481). Thus, the maximum cost of a patent per month in 2021 will be 7,405 rubles (1.481 million rubles × 6%: 12 months). Note that regional authorities can increase the amount of potential annual income for certain types of activities by three, five and even 10 times (clause 8 of Article 346.43 of the Tax Code of the Russian Federation).

How they are used in procurement under 44-FZ

When carrying out public procurement within the framework of Law 44-FZ, indices are used in the calculation and justification of the NMCC (letter of the Ministry of Economic Development No. D28i-1688 dated June 22, 2016). The customer calculates the initial (maximum) price of the contract in accordance with the provisions of Art. 22 44-FZ.

When justifying the NMCC calculated using the market analysis method, it is necessary to use annual deflator coefficients, since in accordance with Part 3 of Art. 22 44-FZ information on the cost of goods, works, services must be analyzed taking into account price and commercial offers comparable to the base period.

When planning purchases for 2021 and subsequent periods and when justifying the NMCC, an industry deflator is used in accordance with the Forecast of socio-economic development of the Russian Federation until 2024. This document contains forecast indicators of the index by type of economic activity both for the next year, 2021, and for the planning period 2022–2024.

Deflator coefficient for trade tax

Trade fee payers use a deflator coefficient to adjust the fee rate determined for activities related to the organization of retail markets (clause 4 of Article 415 of the Tax Code of the Russian Federation). The basic value of this rate is 550 rubles per 1 square meter of retail market area. The coefficient value for 2021 was 1.237. For 2018, the coefficient will increase to 1.285. Accordingly, the fee rate for this type of activity in 2021 will increase and amount to 706.75 rubles (550 rubles × 1.285).

This might also be useful:

- UTII changes in 2021

- Tax calendar for 2021 for individual entrepreneurs

- Act of joint reconciliation of taxes and fees with the Federal Tax Service

- Deadline for submitting transport tax returns for 2021

- What income is not subject to personal income tax in 2021?

- IP reporting on a patent

Is the information useful? Tell your friends and colleagues

Dear readers! The materials on the TBis.ru website are devoted to typical ways to resolve tax and legal issues, but each case is unique.

If you want to find out how to solve your specific issue, please contact the online consultant form. It's fast and free!

Deflator coefficient for personal income tax

For personal income tax, the deflator coefficient is used to adjust payments of foreign citizens from “visa-free countries” working on the basis of a patent for hire from individuals (in particular, for personal, household and other similar needs not related to business activities). These foreign workers are required to independently make monthly fixed advance payments for personal income tax for the period of validity of the patent in the amount of 1,200 rubles (Clause 2 of Article 227.1 of the Tax Code of the Russian Federation). The size of the deflator coefficient for 2021 for these purposes was 1.623. And for 2021 it has increased and is 1.686

Comments

03/07/2018 at 18:22 # Reply

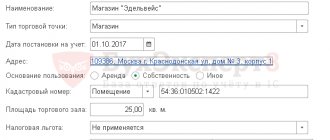

Good afternoon! Please tell me, if I am a private hairdresser and my work is traveling (I do wedding hairstyles), I do not have a lease agreement, can I indicate my registration address in the application for UTII? Is this tax regime applicable to my activities?

03/08/2018 at 10:26 am # Reply

Good afternoon. For hairdressing services on UTII, the basic profitability is the number of employees engaged in this activity, including the individual entrepreneur himself, i.e., you. My opinion is that you can indicate your home address in the application for the use of UTII, since the area of the premises in this case does not matter for the amount of tax. But how will other regulatory authorities - SES, Rospotrebnadzor - react to this issue? For this type of activity, you must submit an application to Rospotrebnadzor to begin the activity. The SES also controls this type of activity; all sanitary norms and rules must be observed.

03/20/2018 at 09:16 # Reply

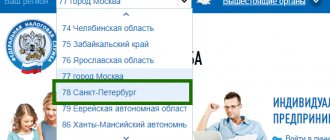

UTII

Good afternoon Please tell me, individual entrepreneur on UTII, car service, we want to open another car service in this city, but the tax district is different. Do I understand correctly that I must submit an application within 5 days from the start of opening a car service or from the start of receiving income from a car service to another tax office? Otherwise, our tax office said that if you come to them, if the program does not accept your UTII-2 application, then you will go to another tax office, where a new car service will be opened. Are they right or wrong? And what should we do now with the declarations, where should we include the individual entrepreneur and the accountant? What to show in both declarations are extra taxes? Thanks in advance for your answer.

03/20/2018 at 14:06 # Reply

Good afternoon. According to Article 346.28 of the Tax Code of the Russian Federation, the deadline for filing an application for UTII is five working days from the date of commencement of the imputed activity. The only clarification of what is considered the start date of activities on UTII is given in the letter dated September 7, 2007 of the Ministry of Finance of Russia No. 03-11-04/3/355. Based on it, for the purposes of Article 346.28 of the Tax Code of the Russian Federation, the date of commencement of activities subject to UTII should be considered the date when the sale of goods through stores and pavilions began. By analogy, when providing services, the moment of commencement of activities on UTII is considered the date of commencement of the provision of the relevant services or performance of work. This may be the first concluded service agreement, the moment of receipt of funds for the service, etc. Now about the place of registration as a UTII payer. Section 346.28. The Tax Code of the Russian Federation, paragraph 2, states that it is necessary to register as a payer of UTII with the Federal Tax Service Inspectorate in whose territory activities on UTII are carried out. Read on. In the case of the activities of an individual entrepreneur applying UTII, in the territories of which there are several tax authorities, the registration of the UTII payer is carried out with the tax authority in whose jurisdiction the place of business activity is located, indicated first in the application for registration of an organization or individual entrepreneur as single tax payer. That is, when opening a second car service center on the territory of another Federal Tax Service Inspectorate, you have a choice - to register with the same Federal Tax Service Inspectorate in which the first car service center is registered, or register with another Federal Tax Service Inspectorate. Which is exactly what the tax office told you. Well, the fact that the program will not accept your application, then this is a common situation in tax matters, then the program does not accept it, then the report does not “lay down”, etc. All this is illegal, if you want to fight, fight, if not, do as the tax office says. But these two options are absolutely legal and are prescribed in the Tax Code of the Russian Federation. Insurance premiums and fixed contributions for yourself must be paid to the inspectorate at the place of registration of the individual entrepreneur. Personal income tax from employees' wages must be transferred to the Federal Tax Service at the place of activity, i.e. You will pay personal income tax to two inspections if registration occurs in different inspections or to the inspection with which you are registered now, if the Federal Tax Service Inspectorate follows clause 2, paragraph 2, Article 346.28 of the Tax Code of the Russian Federation. Fixed fees and fees for an accountant for accounting are divided in proportion to the income received for the two car services.

05/31/2018 at 14:55 # Reply

Good afternoon, please tell me, due to the fact that organizations buying goods pay by bank transfer, I used the simplified tax system 15 and UTII for retail from a retail space. Which system can I use, leaving both non-cash and retail?

06/03/2018 at 17:03 # Reply

Hello. Your question is not entirely clear. You want to keep only one tax system. But based on your question, you are engaged in different types of activities: on the simplified tax system - wholesale trade, on UTII - retail trade. With UTII, you can sell goods only to the final buyer, and not to an organization for subsequent resale. Consequently, you will not be able to trade wholesale on UTII, this is a violation of the Tax Code of the Russian Federation. You can apply the simplified tax system for both retail and wholesale trade with organizations via bank transfer.

Odds difference 2017-2018

| Tax regime | 2017 | 2018 |

| simplified tax system | 1,425 | 1,481 |

| Personal income tax | 1,623 | 1,686 |

| PSN | 1,425 | 1,481 |

| UTII | 1,798 | 1,868 |

| Trade fee | 1,237 | 1,285 |

| Property tax | 1,425 | 1,481 |

Read also

25.05.2018