Account

76 is used to distribute finances between creditors and debtors. More than 7 business transactions are provided for it. Account closed “in real time”, and not at the end of the billing period. The balance on the register can be credit or debit. To reflect mutual settlements with debtors and creditors in accounting, a register of the same name is used. It involves opening different sub-accounts depending on the transaction being performed. Let's consider the procedure and frequency of closing account 76.

Is it necessary to restore tax on advances received?

When receiving an advance payment, in most cases the seller is obliged to calculate the tax on it for payment to the budget (clause 1 of Article 154 of the Tax Code of the Russian Federation), and later, when making a shipment, against this advance payment, take all or part of the amount of the tax paid from the advance tax as deductions (clause 8 Article 171 and Clause 6 Article 172 of the Tax Code of the Russian Federation). In other situations (when the advance is returned to the buyer or the overdue debt on it is written off), VAT restoration will also not be required. In the 1st case, it can be taken as a deduction on the date of return (clause 5 of Article 171 of the Tax Code of the Russian Federation), and in the 2nd case it must be written off as expenses not taken into account in the calculation of income tax.

Thus, for advances received, the picture always turns out to be the opposite of the main condition for recovery: first, the tax is calculated for payment, and then taken as a deduction or written off. That is why there will never be a situation of VAT restoration on these payments.

The meaning of account 76AB in accounting

Good morning. Subaccount 76.AB is used to reflect VAT when receiving an advance from the buyer (customer). If you are a VAT payer, then upon receiving an advance you are required to issue an invoice for the advance and pay tax to the budget (clause 1 of Article 168 of the Tax Code of the Russian Federation). When an advance is received, you make entries in accounting D 51 K 62.02 (based on a bank statement, reflecting your debt to the buyer for the advance received) and D 76.AV K 68.02 (by issuing an invoice and reflecting your debt to the budget in terms of VAT calculation) . Further, after the shipment of goods (performance of work, provision of services), on account of which the advance has been received, you have the right to apply a VAT deduction from the previously issued invoice for the advance (Article 171, Article 172 of the Tax Code of the Russian Federation) and make an entry in the purchase book D 68.02 K 76.AB. That is, subaccount 76.AB serves as a “storage” of information about advances received in the analytics of invoices issued. Subaccount 76.VA is used similarly (VAT on advances issued), when you pay an advance to the supplier, apply a deduction from this advance, and subsequently restore VAT upon shipment. By the way, this numbering (precisely 76.AB and 76.BA) is suggested by the developers of accounting programs in their built-in charts of accounts. Based on the Chart of Accounts (approved by Order of the Ministry of Finance of the Russian Federation of October 31, 2000 N 94n), organizations develop a working chart of accounts containing a complete list of synthetic and analytical accounts necessary for accounting in a particular organization. Therefore, when reflecting the above operations, you can in your working chart of accounts have the necessary subaccounts with a different numbering, for example, 76.10, 76.11, if these numbers are not occupied, 76.AP (advance received), 76.AB (advance issued), etc. ., the main thing is that the possibility of ensuring completeness of accounting is provided.

Conditions for deducting tax on advances issued

When calculating the tax on the advance payment received, the seller issues an invoice for it and sends 1 copy of it to the buyer. Based on this document, the buyer has the right to take into account the amount of tax allocated in it as deductions (clause 12 of article 171 of the Tax Code of the Russian Federation). Although he may not do this, since deductions are not an obligation, but are made voluntarily (clause 1 of Article 171 of the Tax Code of the Russian Federation). It is better to consolidate the taxpayer’s position regarding deductions for advances issued (whether they will be applied or not) in some document (for example, in the VAT accounting policy).

However, these 2 circumstances (payment and invoice) are not enough for the buyer to deduct it. Additional conditions for carrying out such an operation follow from other provisions of the Tax Code of the Russian Federation:

- a condition on the possibility of transferring an advance payment must be included in the supply agreement (clause 9 of Article 172 of the Tax Code of the Russian Federation);

- The invoice for the advance payment must be dated within the 5-day period allotted for issuing such documents (clause 3 of Article 168 of the Tax Code of the Russian Federation), and have all the required details for it (clause 5.1 of Article 169 of the Tax Code of the Russian Federation).

Acceptance of deductions from the buyer will be reflected in the following posting (for each individual document):

Dt 68/2 Kt 76/VA,

How to close account 26 in 1C 8.3

Account 26 in 1C is closed automatically in the same way as account 20 in the procedure Closing a month using the routine operation Closing accounts 20, 23, 25, 26 (section Operations - Closing a month).

The procedure for accounting for costs on account 26 is configured in the organization’s Accounting Policy (section Main – Accounting Policy).

If the use of account 20 is enabled, options for reflecting costs on account 26 are available:

In the second option, Methods for allocating indirect costs must be configured using the appropriate link.

Account 26 does not close in 1C 8.3

If account 26 does not close, the problem lies in the incorrect configuration of the distribution methods. When closing a month, a warning is issued indicating errors:

The message states:

- problem;

- correct option;

- ways to fix it.

Accounting entries for VAT recovery from advance payment

The VAT recovery posting will always be the same for each individual invoice:

Dt 76/VA Kt 68/2,

68/2 - subaccount for accounting for settlements with the budget for VAT on account 68;

76/VA - subaccount for accounting for VAT on advances issued in account 76.

The results of VAT recovery for specific advance invoices will vary depending on the ratio of the amount of the advance and the cost of supply associated with it:

- for the first 2 cases (the amounts of the advance and delivery are the same or the amount of the advance is less than the cost of delivery), with this posting the amount of tax on the advance, listed in subaccount 76/AB, will be closed completely;

- in the 3rd and 4th cases (the amount of the advance is greater than the cost of delivery or the contract contains a condition on partial offset of the advance towards payment for the supply), in subaccount 76/AB after the restoration of VAT there will be a balance of unrecovered tax.

Read about the latest changes in the document reflecting tax recovery operations in the material “Sales Book - 2021: new form”

.

Purpose

Settlements with other debtors and creditors are carried out in one way or another in almost every organization. Any sub-accounts can be opened to the register at the discretion of the company, in addition to those specified in the Plan.

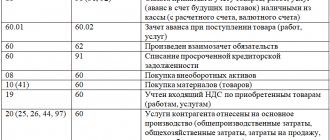

Basic business transactions requiring the use of an account. 76 are as follows:

- Additional insurance for employees. Compulsory medical is reflected on the account. 69.

- Claims from counterparties.

- Wages not received on time (deposited).

- Executive documents of employees.

- Other operations. These, for example, include settlements on loans issued by an organization to its founder, and on interest on the account balance accrued by the bank.

- Advances received and issued. In this case, on the account. 76 AB and 76 VA value added tax will be accumulated from the prepayment received or transferred

- Leasing payments, etc.

Account 76 is active-passive, so the balance can be either debit or credit.

Pros and cons of deducting VAT on advances issued

The positive aspects of the use of such deductions occur with significant amounts of advances issued and manifest themselves as follows:

- A large deduction amount can not only significantly reduce the total of the declaration drawn up for the period of its application, but also make it result in the amount of tax reimbursement from the budget.

- A deduction for an advance on account of several deliveries for it is made one-time, ahead of time and in a larger amount than deductions would be made for each of the deliveries separately. At the same time, VAT restoration occurs in parts and can be extended over several tax periods.

On the plus side, there are also conditions for payment of only part of the delivery using the transferred advance payment. In this case, deductions for the advance payment issued and for the delivery document will occur earlier and will be taken in full, and the VAT restoration will be made only in part of these amounts and will be extended over time.

The following points will be negative:

- increasing the volume of accounting operations and document flow;

- there is no point in using deductions for advances if we are talking about small amounts and the period for transferring the advance often coincides with the period of shipment for it.

Read about the rules for issuing invoices for advance payments.

Results

The question of recovering VAT on advances paid to suppliers arises if the taxpayer takes tax deductions on invoices issued by the supplier for prepayment. The provision for advance payment must be included in the supply agreement. VAT on advances issued is recorded in a separate subaccount of account 76.

In this article we will talk about the restoration of VAT and the reflection of this operation in 1C 8.3 using the example of the 1C Enterprise Accounting configuration.

“VAT restoration” itself

raises questions.

Let's try to explain it. In short, restoration

is the reverse operation

of receiving a

VAT deduction, i.e.

an adjustment is made based on the deduction already received, reducing this deduction or completely canceling it. If it makes more sense to someone, then theoretically we can say that we will reverse the VAT deduction completely or partially, depending on the situation. But the term “reversal”

is not used in this case, but they say that

“VAT must be restored.”

In more detail, upon receipt of materials, goods, fixed assets, etc. Input VAT is often a tax deduction that reduces the amount of tax payable at the time of receipt. In order to apply such a deduction, several conditions must match, for example:

- Correctly executed SF;

- The received values are used in activities subject to VAT;

- The recipient of the valuables is a VAT payer, etc.

Now let’s imagine a situation where, at the time of capitalization of the assets, all these conditions were met, and the deduction was accepted. After some time, the conditions changed, and it turned out that the deduction could not be used. This is where VAT is restored.

Another option when it is necessary to restore VAT is prepayment to the supplier by the buyer. By making an advance payment, the buyer can use a VAT deduction by creating an accounting entry 68.VAT – 76.VA. When the buyer receives the shipment for such an advance, he will make a deduction for the received items with posting 68.VAT - 19. Then it turns out that there will be two deductions for one shipment. This situation is impossible, so the first deduction must be restored.

The list of situations when VAT should be restored is given in the Tax Code, Art. 170 clause 3. And although the practice of court decisions suggests that this list is closed, nevertheless, tax authorities often require the restoration of VAT in other cases, for example, in case of theft of property. Here the enterprise itself must decide whether to restore the tax or not (in this case, court hearings will be necessary).

Since the restoration of VAT always leads to an increase in the amount of tax payable, in the transactions Kt there will always be 68.VAT, and for Dt options are possible, depending on the situation. Such transactions should be reflected in the Purchase Book.

Let's look at the most common cases of VAT recovery.

VAT recovery using the example of 1C: Accounting configuration

Now from theory to practice. Let's consider two options for how to reflect the restoration of VAT in 1C Accounting.

Example 1. The most common case of VAT recovery.

The buyer made an advance payment for the consignment of goods, both counterparties are VAT payers. The prepayment amount is 118,000 rubles, incl. VAT 18,000. A few days after the prepayment, the organization received material assets in the amount of 94,400 rubles, incl. VAT 14,400 rub.

Accounting for advance payments in 1C is well automated. The correct transactions were automatically generated for payment.

If at this moment you create a Purchase Book,

we will have two deductions for one delivery.

VAT should be restored. To do this, in the Operations

select an item

Offers to repost documents and create routine operations - creating purchase and sales ledger entries.

We are interested in Clicking the Fill out the document button,

the tabular part will be generated automatically.

Let's look at the wiring. The program automatically recovers VAT by analyzing the advance amount and subsequent shipments. In our case, the delivery is less than the advance payments paid, we restore the amount in an amount equal to the shipment received from the supplier.

Example 2.

In the 4th quarter, on the received batch of materials from example 1, VAT should be restored from the amount of 40,000 rubles, the estimated amount of VAT is 7,200 rubles.

In this case, the program cannot automatically determine in what period and volume the VAT should be restored. Therefore, we create the corresponding VAT Restoration document.

It is in the section

Click the Create

From the list of options, select a document for VAT restoration.

To prevent VAT from getting stuck on account 19, it must be written off. A document can be created based on receipt.

By default, the entire receipt amount is offered for adjustment; we should adjust it.

On the Write-off account

indicate the account 91.02.

Please note the meaning of the expense guide. Here you can set the parameter whether expenses are accepted as expenses for the purpose of calculating income tax or not.

If accepted, the postings will be as follows:

Another common example that many businesses may encounter is a change in the supply amount due to an adjustment in price and/or quantity of items shipped, which may result in the need to recover VAT. Such operations lead to the appearance of adjustment invoices, the procedure for reflecting which we will discuss in detail in another article.

An amateur's cheat sheet regarding filing a VAT return (quarterly). What should you immediately remember to watch in the next quarter?

Help line answers

Section navigation:

- 1C:ITS - for employees

- LC Taxes and contributions - methods regardless of personal income tax programs methodological issues

- SZVM

- Online cash registers KKT / 54 Federal Law / OFD - consultations LC

- FSIS "Mercury" (accounting for products of animal origin)

- UNF Money

- UT-11 Procurement

- FC: Accounting in public catering

- Retail. Regulatory and reference information

- 1C database maintenance

- 1C:Enterprise 8. Accounting in management companies of housing and communal services, homeowners' associations and housing cooperatives.

- BP Bank and cash desk

- BPSelhoz OS and intangible assets

- ZUP-3 Personnel records

- KA Salary

- Data exchange between 1C: Accounting 8 and 1C: Management of a small company 8

- 1C: Salaries and personnel of a government institution. Ed. 3.1 WKSU 3 Contributions

- ZKBU PFR Salary

- BGU Bank and Cash Office

- 1C:Fresh / 1C:Fresh

- UPP Manufacturing Enterprise Management

- 1C-Reporting 1C-Reporting Key transfer

- Taxcom Reporting

- 1S-ETP

Personal account statistics

Traditionally, closing accounts in 1C causes a lot of difficulties for accountants. Most often - closing account 20 in 1C 8.3. And if an organization receives advances, difficulties may arise with how to close account 76.AB in 1C 8.3.

In this article we will look at the procedure for closing main accounts in 1C and analyze the most common errors associated with them.

Suppliers count 60

60.01 D remainder = 0! 60.02 K remainder = 0 !

76.VA D balance = 0 76.VA K = 60.02*18/118 - provided that all suppliers have issued an account for the advance. But in reality this doesn’t happen: 76.VA loan

It is useful to view the status of documents - Invoices from suppliers

60 - see Purchases - Invoices from suppliers? status = Not Received!

19.3 19.4 VAT from suppliers

19.3 balance Credit = Debit = 0 - everything should be closed without balances, all debit turnovers within the quarter are equal to credit ones.

Count 76 – active or passive?

The final balance for these entries can be of a debit or credit nature, depending on the specified conditions. Debit records any debt owed to the company. The loan collects information on the debts of the enterprise itself to third parties. Therefore, the account belongs to active-passive.

76 account in the balance sheet can be taken into account both in the active part and in the passive part. To do this, its expanded balance is analyzed. Debit balances constitute the asset item “Debit Accounts”. The credit balance increases the liability of the balance sheet under the item “Accounts payable”.

Buyers 62.01 62.02

62.01 K remainder = 0 62.02 D remainder = 0

do not forget to create sales ledger entries and create purchase ledger

Search in " VAT reporting"

". I have a document created by 1C itself once at the end of the quarter.

This is where interesting moments arise in accounting. In fact, VAT from the buyer’s advance payment falls into the document “formation of the purchase book”. This is how things are - it’s like you’re buying VAT.

don't forget to make a count. in advance to buyers!

1C can do this automatically. Search in " VAT reporting"

«.

76.AB K balance = 0 Remember balance debit 76.AB = 62.2*0.18/1.18.

Note: during the transition from 18% to 20%, this formula will not work.

Invoice: Reflect the VAT deduction in the purchase book by the date of receipt

If payment and shipment (receipt) are in the same period, then everything is taken into account very simply: all my documents “Receipt of goods” in the Invoice received have a checkbox “Reflect VAT deduction in the purchase book by the date of receipt.” Those. here we immediately make postings for VAT refund (68.02 All shipments are similar to and accordingly there are postings (90.03

Thus, as a result, the document formation of the purchase book and sales book is almost empty. And all sorts of advances and other evil spirits ended up there, which makes the life of an accountant bright and eventful. The problem is that if you give up and don’t deal with the advances, then it will all come out anyway. Therefore, we are looking for algorithms for checking advances.

During the transition to VAT 20% (2018/2019)

We analyze invoice 90.03 and see if we issued invoices with VAT 18% in 1Q. 2021 — We correct it by 20%.

What follows is old nonsense, it’s better not to read: What logic first tells us (or an amateur is delusional) is that all options (where there are 2 periods, payment in one, shipment in the other) are divided into:

- 1.

- 1.1 client prepayment

- 1.1a счф. for advance payment (76АВ

- 1.2 shipment of goods to the client + regular invoice (there are no postings here, but see its shipment 90.03

- 1.2a we cancel the SCHF. for an advance payment (occurs when creating a purchase book - oddly enough).

- 2.

- 2.1 shipment of goods to the client

- 2.2 payment by the client

- 3.

- 3.1 prepayment to the supplier

- 3.1a supplier to you SCHF. for advance payment (68.02 Purchases - invoice for advance payment

- 3.2 receipt of goods from the supplier + regular invoice (68.02

- 3.2a we cancel the SCHF. for advance payment (76VA

- 4.

- 4.1 receipt of goods from the supplier (19.03

- 4.2 payment to the supplier

Please note that for paragraphs. 2 and 4 no SCHF is created. for advance They only appear if payment is made first.

76AB This appears as a result of creating an invoice for the advance payment. The verification algorithm is as follows: according to 62.2, we look at the total amount at the end of the period, highlight from it how much VAT there will be, and this amount is the total according to 76.AB. This is provided, of course, that all goods have the same VAT.

God, how can I check all this crap with contractors, since since 2015. Each invoice must contend with the counterparty's accounting department.

Let's look at what the document “formation of a purchase book” contains. Attention! : the document can only be found through this path: Operations - Regulatory VAT reports

(it is not in the log of all transactions).

- “Creating a purchase book” - there is a division here:

- acquired values 68.02

- advances received 68.02

- Let’s look at what the document “formation of a sales book” contains:

- recovery on advances 76VA

First conclusions:

1. If the transaction has gone through 2 stages (shipment and payment) in full, then logically this can be seen in account 62 (there are no balances there) and, as a result, all advances are on the account. 76 of this counterparty must close, i.e. There should also be no leftovers.

2. If the client has an advance payment (there is a balance on account 62.2), then accordingly there will be a balance on account 76 in the ratio (62.2*0.18/1.18=76.AB). This is where a report on 62 with additional would be stupid. column according to the formula (62.2*0.18/1.18=76.AB).

3. If we made an advance payment to the supplier, then by law he must make an invoice. for an advance payment and send it to us, but usually this does not happen for obvious reasons: the supplier has made an SSF for himself. for an advance payment (paid VAT), but he doesn’t care about you - your problems, you need it - come for the SCHF yourself. for advance And it can also be understood - invoice documents and regular invoices are handed over with the delivery of goods, usually in boxes. If, after all, there is such a financial system. for an advance payment from the supplier, then it must be handled in Purchases - Invoices received - Invoice for advance payment

.

4. If there were schf. for an advance from the supplier, then after the full cycle the balance is on the account. 60 of our supplier is empty and, accordingly, the balance of 76.VA for our supplier is empty.

5. If there is a balance left in the prepayment to the supplier at 60.2, then there should also be a balance at 76.VA, in the ratio (60.2*0.18/1.18=76VA).

That's all, miracles don't happen. Everything is very simple! And by the way, having calmly spent 1 day getting to grips with the meaning of VAT charges and another 1-2 days sorting out mutual settlements with suppliers and customers, as well as re-processing documents + re-closing months 30 times, I had noticeable confidence (turning into euphoria ) that we did VAT correctly.

We reclose sequentially January, February, March through “close month”. In the same place, see the formation of a book of purchases and sales; by the way, the creation of these documents must be controlled manually, since it has been noted that they may not be created automatically.

We prepare a VAT return for the 1st quarter. It appears in Reports - Regulated reports - list (VAT Declaration)

. There is a sequence for filling out Sections - see the icon on the right? .

There are two options for VAT recovery.

- Reinstatement of VAT that was paid earlier. In this case, the VAT amount is returned to the account of the payer organization.

Restoration, when the payer organization must pay the tax that the budget has submitted for reimbursement.

Both options have the same term, but the meaning is opposite. You can see the difference by analyzing the VAT on advances when we receive them and when we transfer them. When receiving an advance from a counterparty, obligations arise to pay VAT on the transferred amount. Also, the obligation to pay VAT arises from the sale of goods upon sale. A VAT refund is provided for the received advance payment upon presentation for reimbursement (recovery). When transferring an advance payment to the supplier, it is also possible to recover VAT from the specified amount; on this basis, the total amount of tax is reduced. Subsequently, after receiving the goods, you will need to transfer VAT to the budget (so that the refund does not repeat). We propose to analyze in detail how VAT is restored from the received advance payment, which was transferred by the buyer counterparty.

The program will automatically recognize the received payment as an advance payment and generate the necessary transactions:

Please note that VAT accounting transactions are created by the “Invoice” document. It can be generated either when an advance is received on the account, or through special processing at the end of the accounting period (month).

Let's create an invoice issued based on receipt to the bank account:

Let's check the wiring:

When creating the “Implementation” document, the advance payment should be generated automatically. You can check using the implementation transactions:

The “Invoice” document itself, created upon implementation, does not create any postings, but reflects the movement of VAT in other important accounting registers.

The VAT recovery process is reflected through the document “Creating purchase ledger entries”:

In this case, filling out the “Received Advances” tab in 1C occurs automatically. All amounts for received advance payments that can be submitted for VAT recovery are reflected here:

Checking the wiring:

You can track the results of routine VAT accounting operations by generating the “Sales Book” and “Purchases Book” reports:

If you go to the “Sales Book” report, then for one counterparty-buyer there will be two records reflected for the accounting period (month) for the received advance and the created sales:

If you look at the “Purchases Book” report, the same counterparty will appear here, and the entry for it will compensate for the advance payment in the sales book.

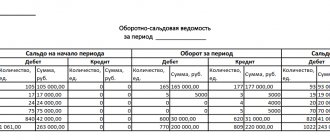

The same amount will be reflected in all entries. It follows from this that payment of VAT to the budget will be one-time. By generating the “Turnover balance sheet” report, you can check the closure of account 76. AB (VAT on advances and prepayments):

With advance payments from suppliers, VAT recovery in the 1C 8.3 program occurs in a similar way. In this case, documents must be generated in the following order:

- Debiting from the current account.

Invoice for advance payment received from the supplier.

Purchase Invoice.

Invoice against delivery note.

The only difference from the previous option is that VAT is restored according to the document “Creating sales book entries”.

The document “Purchase Book” will reflect the records of the advance payment and receipt:

And in the “Sales Book” an entry about VAT restoration will be displayed:

VAT on advance payments to suppliers is accounted for in account 76.VA (VAT on advances and prepayments issued), the movement of which can be viewed in the balance sheet:

A few more nuances when VAT can be restored:

- When selling products at retail (excluding VAT), intended for sale at a rate of 18%. In this case, it is necessary to restore (return to the budget) the VAT on the material used in production.

If the tax office recognizes the supplier’s “Invoice” document as invalid or lost.

There are also reverse situations when an organization can restore previously paid VAT. For reflection in the 1C program there is a standard document “VAT Restoration”:

This document, in fact, is a corrective document for the purchase book and sales book, depending on the purpose of VAT recovery. For example, the amount of recovered VAT can be written off to the expense account:

In this case, the restored VAT will be reflected in the “Sales Book” document as an entry on an additional sheet.

VAT on advances received and advances issued is one of the tools for regulating an organization’s expenses for tax payments. To account for VAT on advances, subaccounts 76 of account are used: 76.VA - for received, 76.AB - for issued.

An organization that has paid an advance to a supplier has the right to claim for deduction the VAT paid. Necessary conditions for obtaining a VAT deduction from an advance payment:

- the condition for advance payment must be clearly stated in the contract with the supplier;

- the advance payment must be presented to the SF (no later than 5 days after payment).

VAT deduction is provided in the tax period when the advance was transferred. When the final payment for the delivery occurs, that is, the goods are received from the supplier under the acceptance certificate, the organization is obliged to restore the amount of VAT previously claimed for deduction.

In addition to the receipt of goods, the obligation to restore the deduction arises for the organization in the following cases:

- changes in the terms of the contract;

- termination of the contract and return of the advance.

VAT is restored in the same amount in which it was previously accepted for offset. If the terms of the contract determine that the delivery of goods occurs after receiving 100% advance payment, the buyer can transfer the advance in installments. In this case, the amount of VAT reflected in the SF for the supply is restored. In any case, this value coincides with the amount of VAT on all advance tax payments for this supply.

How to close account 20 in 1C 8.3

Account 20 in 1C is closed automatically in the Month Closing procedure using the routine operation Closing Accounts 20, 23, 25, 26 (section Operations - Month Closing).

The procedure for accounting for costs on account 20 is configured in the organization’s Accounting Policy (section Main – Accounting Policy).

If the Organization requires cost accounting on account 20, check the boxes for the appropriate activities:

And also a way to write off costs:

Learn more about the settings for cost accounting on account 20 in accounting and tax accounting:

- Cost accounting

Account 20 does not close in 1C 8.3

If account 20 is not closed, this may be due to:

- with Accounting Policy settings;

- with accounting errors.

Settings

Errors

If errors are detected when closing account 20, 1C will issue a warning, for example:

In this case, simply follow the links provided in the message and make the corrections required by the program. After this, repeat the closing procedure.

There may be situations when the program does not detect an error, but the account will not be closed.

Make sure that:

- there is no duplication of item groups (section Directories – Nomenclature groups);

- costs are reflected in the same item groups as revenue - create SALT for account 20 in the context of item groups (section Reports - Account balance sheet).

VAT on advances received

When selling products (goods, services) to the buyer, a mandatory condition may be specified in the contract - advance payment in the amount of up to 100%.

On the received advance, the organization issues a tax return and charges VAT at a rate of 18/118%. The amount of this advance is included in the sales book as accrued VAT, that is, a tax that the organization is obliged to pay to the budget.

Get 267 video lessons on 1C for free:

In practice, after issuing a SF for the advance received, 3 situations are possible:

- during the advance period the sale occurred;

- no sales occurred during the advance period;

- return of advance payment to the buyer (termination of contract, change of conditions, etc.).

In the first case, after the shipment has been made, the selling organization has the right to present previously paid VAT on the advance received for deduction. That is, the advance SF is closed with a purchase ledger entry.

In the second case, the amount of the advance and the VAT accrued on it is reflected in the VAT return for the current period in line 070 of Section 3.

In the case of an advance refund, it is also possible to claim the VAT paid for deduction, that is, an entry is created in the purchase book. You can take advantage of the deduction within a year after termination of the contract.

In the event of liquidation of the purchasing organization before full fulfillment of the delivery conditions, if it is impossible to return the advance payment, VAT accrued upon receipt of the advance payment is not subject to deduction.

Examples of entries for accounting for VAT on advances

Example of an operation for advances received

Harmony LLC, under an agreement with the buyer Amalgama LLC, must supply a consignment of goods in the amount of 212,400 rubles, incl. VAT — 32,400 rub. 07/10/2016 "Amalgam" transfers an advance payment of 50% of the contract amount: 106,200 rubles. VAT on advance: 106,200 * 18/118 = 16,200 rub.

We reflect in the postings VAT on advances received from the buyer:

In August, Harmony ships a consignment of goods to Amalgam. Sales transactions and deduction of VAT from advances received: