How do coefficients affect UTII?

UTII is calculated from the amount of imputed income, taking into account two coefficients:

- Deflator coefficient K1;

- Correction factor K2.

These coefficients allow you to adjust the basic profitability taking into account the influence of various external conditions (factors) on the amount of income received (clause 4 of Article 346.29 of the Tax Code of the Russian Federation).

Correction coefficient K1

K1 is a deflator coefficient. It is used to bring imputed income to the level of consumer prices for goods (work, services) of the past year. That is, to take into account inflation indicators for the past year (paragraph 5 of Article 346.27 of the Tax Code of the Russian Federation).

The value of K1 for the next calendar year is established by the Ministry of Economic Development of Russia and publishes its value in the Rossiyskaya Gazeta no later than November 20 of the previous year (clause 2 of the order of the Government of the Russian Federation of December 25, 2002 No. 1834-r). That is, the K1 value for 2021 must be published no later than November 20, 2017.

Let us remind you that for 2021 the K1 coefficient was set at 1.798. Compared to the previous value (1.798), it increased by 3.4%. This means that even if the value of the physical indicator by type of activity remains the same and the size of K2 is set by local authorities at the same level, the “imputed” tax that you will pay to the budget will increase in 2021.

Correction coefficient K2

K2 – correction factor. With its help, factors affecting the basic profitability of various types of business activities are adjusted. For example, the range of goods, seasonality, operating hours, amount of income, features of the place of business (paragraph 6 of Article 346.27 of the Tax Code of the Russian Federation).

K2 is established and adjusted by representative bodies of municipal districts, city districts, legislative (representative) government bodies of federal cities of Moscow and St. Petersburg (clause 3, clause 3, article 346.26, clause 6, article 346.29 of the Tax Code of the Russian Federation).

The period during which the established K2 must be applied may not be limited in time. At the same time, local authorities may approve an adjustment factor for a particular year. That is, it is possible that local authorities may also change K2 for 2021.

Indicators for calculation

The calculation base for UTII is not the amount of revenue or profit, but imputed income. The UTII tax rate in 2021 is calculated using the following indicators:

- physical. They imply the quantitative expression of the resources involved in the production process. Example: number of employees, square meters of area, pieces of equipment, etc.;

- profitability at the basic level - a conditionally taken amount of income for one calendar month;

- coefficients for adjustment. There are two of them. The first is established by the Ministry of Economy, the second by local authorized bodies. The first coefficient has been applied since 2014 in the amount of 1.672. Taking into account the individuality of the second coefficient, the final amount will depend on the region of activity of the business entity.

Increasing UTII from 2021: calculation example

Let's try using examples to calculate UTII from 2021 taking into account the new coefficient (Order of the Ministry of Economic Development of Russia dated October 30, 2021 No. 579) and compare the indicators with 2021. So, the general formula for calculating UTII in 2021 remains the same:

| UTII for the quarter = Tax base (imputed income) for the quarter X Tax rate |

Let us give examples of calculations adjusted for K1.

An example of calculating UTII in 2021

Tsvetochek LLC is engaged in retail trade through its own store with a sales area of 80 sq. m. m. In the city where trade is carried out, the use of UTII is allowed. The tax rate for retail is 15%. Alpha LLC conducted imputed activities in January, February and March. The calculation will be based on the following indicators:

- in 2021, the new value of the deflator coefficient K1 is 1.868;

- The regional authorities set the value of the correction coefficient K2 at 0.7.

- the basic profitability for retail trade in the presence of trading floors is 1800 rubles/sq.m. m.

Imputed income for February–March 2021 (that is, for the 1st quarter) will be:

564,883.20 rubles. = 1800 rub./sq. m × (80 sq. m + 80 sq. m + 80 sq. m) × 0.7 × 1,868.

UTII for the first quarter of 2021 with the new value of the K1 coefficient will be:

RUB 84,732.48 = RUB 571,838 × 15%

Comparison of calculation with 2021

If the project to increase the coefficients for “imputation” had not been adopted and in 2021 the K1 coefficient had remained at the same level - 1.798, then, under the same conditions, the amount of UTII payable for the 1st quarter of 2017 would have been less. In this case, the basic profitability indicator would be equal to 543,715 rubles. = 1800 rub./sq. m × (80 sq. m + 80 sq. m + 80 sq. m) × 0.7 × 1.798 . The amount of tax payable would be RUB 81,557 = RUB 543,715. × 15%

But the new coefficient for UTII was approved. Therefore, with similar indicators, the amount of UTII for the 1st quarter of 2021 increased by 3175.48 rubles. (84,732.48 – 81,557 rubles). In percentage terms, the increase in 2021 will be 3.4 percent.

At the same time, we note that individual entrepreneurs have the right to reduce UTII by the amount of insurance premiums. For more information about this, see “Insurance contributions of individual entrepreneurs on UTII”.

K1 UTII 2021 by type of activity

Companies often make changes to their OKVED regulations. This situation is completely legal and arises for various reasons - from a change in activities to the complete cessation of one and the creation of another. For example, in 1 sq. 2021 The individual entrepreneur was engaged in retail sales of equipment, but in March he stopped trading and started providing hairdressing services. When working on UTII for the 1st quarter of 2021, will K1 remain the same or change?

The answer is given in 346.27, which says that K2, but not K1, depends on the characteristics of the company’s activities. This means that no matter how often OKVED changes, the deflator indicator is always the same. If the value of the coefficient has already been officially approved by the Ministry of Justice, its value for the year (calendar) will be the same for all imputed taxpayers without any exceptions. Let’s say that K1 for 2021 for UTII in Kursk and K1 in Krasnodar for UTII are identical. Differences are possible only when we are talking not about imputation, but about other taxes. For example, about UTII and PSN or about UTII and simplified tax system, etc.

What else is changing according to UTII since 2018?

From January 1, 2021, consumer cooperation organizations whose average number of employees over the past year exceeded 100 people can apply UTII until December 31, 2021. Previously, the deadline was December 31, 2021. Basis: Clause 4 art. 3 of the Law of October 2, 2012 No. 161-FZ, Law of October 30, 2021 No. 300-FZ

The validity of the norm of the Tax Code of the Russian Federation, allowing some consumer cooperation organizations to apply UTII with a staff of more than 100 people, ended on December 31, 2021. According to this norm, organizations and individual entrepreneurs whose average number of employees for the previous calendar year exceeded 100 people were not entitled to pay UTII. However, this restriction did not apply to organizations whose authorized capital consists entirely of contributions from public organizations of disabled people, if the average number of disabled people among their employees is at least 50%, and their share in the wage fund is at least 25%, to consumer cooperation organizations operating in accordance with Law No. 3085-1, as well as business companies whose sole founders are consumer societies and their unions (paragraph 2, sub-clause 1, clause 2.2 of Article 346.26 of the Tax Code).

Read also

16.11.2017

Tax rate for UTII

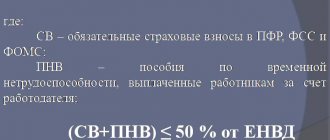

The tax rate is established in paragraph 2 of Art. 346 Tax Code of the Russian Federation. Its coefficient is 15%. Some business entities can reduce the amount of tax within the limits of the law. The maximum permissible reduction is no more than 50%. The paths are as follows:

- contributions to the Pension Fund;

- compulsory medical insurance payments;

- previously contributed funds calculated in case of disability, pregnancy and childbirth;

- social contributions for compensation of accidents.

The amount of the reduction will depend on the type of contribution chosen, as well as their total amount.

At the same time, companies and entrepreneurs who choose UTII are exempt from a number of mandatory payments. For example, the following taxes are excluded for organizations:

- at a profit;

- on property directly involved in business processes falling under UTII;

- unified social tax. It is excluded for individuals who conduct activities that fall under UTII.

By choosing UTII, individual entrepreneurs free themselves from the need to pay unified social tax, property tax and personal income tax.

Expert opinions

The Department of Social and Political Reforms reported that the average increase in the fiscal burden of 4 percent will not greatly impact small businesses. So, if K1 for 2021 UTII in Murmansk can be compensated by the authorities at the expense of the same K2 and the basic rate. Meanwhile, it is entrepreneurs who have not used the tax regime for a long time due to the lack of actual benefits. The K1 limit for UTII for 2021 only increased the unattractiveness of the regime for conducting commercial activities.

K1 and K2 in the calculation of UTII

Coefficient K1 and K2 are always involved in the calculation of UTII. The established amount of basic profitability for a certain type of activity is multiplied by these indicators.

Knowledge of the coefficients allows the entrepreneur to independently make calculations for the single tax, as well as compare the data obtained with the results of calculations by tax officials. In case of discrepancies, the error can be identified in a timely manner and possible disputes can be resolved.

Similar articles

- Deflator coefficient for UTII for 2016-2017

- Latest changes in the Tax Code of the Russian Federation on UTII

- Deflator coefficient for 2021 for UTII

- Basic yield

- Basic profitability of UTII-2018 by type of activity

Size K2 for UTII for 2021

Why is this indicator “at the mercy” of regional authorities, and not approved by federal regulations? The answer can be found if we carefully study the concept of K2 again. In accordance with stat. 346.27, this coefficient is established taking into account the aggregate characteristics of the imputed business. For example, the value of K2 is affected by the address of commercial activity; types of business; range of products sold or manufactured; seasonality of work, etc.

According to paragraph 7 of Art. 346.29 the value of K2 is approved by the state authorities of the constituent entities of the Russian Federation and individual cities for a year (calendar), taking into account the minimum and maximum limits. Thus, the lower threshold of the coefficient is set as 0.005, and the upper is equal to 1. In the same case, when the region did not have time to approve the value of the indicator for the next year in a timely manner, it is necessary to apply the K2 value for the previous year. Accordingly, it is the regional authorities who have the right to decide where it is more profitable for companies to carry out commercial activities, as well as in which particular industry sector.

When analyzing the values of the indicator, it is easy to trace a proportional relationship - the larger the city and the more profitable the activity, the higher the value of K2. In villages, for example, this coefficient is significantly lower than in the capital or other large cities. And jewelry making is considered a more profitable business than, say, laundry. This means that K2 for jewelry activities is 2-3 times higher.

How is the tax on entrepreneur's income calculated?

The imputed value tax, despite its conventionality, is quite difficult to calculate. If K1 UTII itself is 1 sq. 2021 is a constant figure, but the remaining parameters are floating. Take the K2 deflator and the basic profitability, which is calculated based on the key characteristics of the business. Considering what K1 for UTII is expected in 2021, representatives of small and medium-sized businesses will reduce precisely these parameters. We can confidently say that there will be a direct relationship between the initial ones for the basic profitability and the increase in the size of the unchanged coefficients, because entrepreneurs can hardly count on relaxations in the remaining components of the calculation formula, where K1 UTII is involved in 2021 in Perm:

- provision of services – 7,500 per employee;

- service station – 12,000 rubles per employee;

- rental of property - by area;

- retail and wholesale trade - by the number of service points or square footage.

Studying what K1 UTII 2021 is equal to, many owners of commercial properties will come to the need to modify their business under other tax regimes (for example, simplified, where you can indicate income in the region of 300,000 rubles, or withdraw some assets from accounting, including personnel and property) .

Since K1 UTII 2021 by type of activity remains the same for everyone, the possibility of saving on taxes remains only due to K2 and the collection rate itself.

How to find out K2 for UTII 2021

At first glance, it seems that it is difficult to independently determine the value of K2. But that's not true. You can correctly calculate the coefficient yourself. However, if you have difficulties, it is recommended that you contact your tax authorities directly for assistance. The inspector will help you calculate the effective value of K2. Keep in mind that many ATPs post current versions of legislative documents on their websites. But updates don't always arrive on time. Be careful when studying the regulatory framework: look for current versions of documents.

Conclusion - in this article we examined in detail what adjustment factors are under tax law and what they are. The procedure for approving the K2 indicator, its minimum and maximum possible values are given separately. Due to the fact that K2 is approved by the authorities of the constituent entities of Russia, so that the taxpayer can obtain accurate information about the size of the coefficient, it is recommended to obtain a certificate from your tax office.

In addition, everyone can get acquainted with the latest data on the official portal of the Federal Tax Service. All regulatory changes are taken into account here, and information is posted by region of the Russian Federation. Do not forget that the approval of the coefficient must take place before the beginning of the next year (calendar), otherwise the sizes of the previous period are used.