- October 7, 2019

- Finance

- Lazareva Valeria

As you know, each employer acts as a tax agent for its own employees. This imposes on him an obligation related not only to paying taxes, but also to making insurance contributions. Let's find out how to calculate the amount of insurance premiums, because there should be no mistakes. If there are any, the tax office has the right to charge a fine and also demand payment of the missing amount.

What is the difference between the taxes of an employer and its employees?

First, let's look at the differences in the payment of taxes by employees and employers, since they are often confused, although these concepts are polar opposites. Insurance premiums are calculated based on wages. You cannot mix such different concepts as employer and employee payments. The employee pays personal income tax on the amount of the salary accrued to him personally, and the employer pays 30% of the entire staff salary fund to various funds. By the way, acting as a tax agent, a company or individual entrepreneur withholds and transfers to the budget the full amount of personal income tax from its employees. This is the difference between the taxes paid by employees and business managers.

Insurance premiums: what are they?

Contributions paid by the employer to social funds are called insurance or social contributions. All payments are calculated and transferred monthly within the time limits established by law. The overwhelming majority of the Russian population are hired workers of various enterprises. For companies operating on a traditional taxation system, the basis for calculating insurance premiums is based solely on the amount of the accrued salary and related payments, for example, bonuses or additional payments for work on holidays and weekends, class, territorial coefficient, etc. Payments characterized as social are not included in the calculation base. These include:

- material compensation;

- assistance from the company for restoring health or purchasing medicines on the basis of a collective agreement or industry tariff agreements;

- benefits accrued upon dismissal of employees caused by reduction in production and elimination of jobs;

- business travel expenses that are of a production nature but not related to payroll.

So, all accruals are made on the amount of accrued wages. We will find out to which funds enterprises using OSNO transfer contributions, their amounts and calculation features, as well as for which companies and in what cases reduced tariffs apply.

FSS

One of the most important social funds to which insurance premiums are paid is the Social Insurance Fund. It works in two directions: it monitors and pays for temporary disability benefits and compensates for damages caused by work-related injuries.

In this regard, contributions to the Social Insurance Fund are calculated at the following rates:

▪ 1st – for temporary disability and maternity – 2.9% of employees’ wages. For 2015, the maximum level of wages from which contributions are calculated is set in the amount of 670 thousand rubles. No tariff is charged on income received above this level.

▪ 2nd – insurance against industrial accidents. The contribution amount varies from 0.2% to 8.5% and corresponds to one of 32 occupational risk classes, legally established for companies with varying degrees of occupational injuries. For this type of insurance there is no size of the maximum base; deductions from wages are made regardless of the amount of income according to the risk class established for each enterprise. Only for budgetary enterprises the professional risk is limited to first class.

Pension Fund

For enterprises operating on a general basis, contributions are 22%.

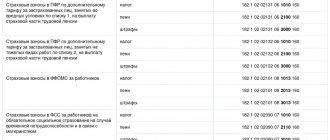

The maximum income for their accrual in the current year is 711 thousand rubles. Unlike other funds, in the Pension Fund for amounts exceeding the standard, deductions are made in the amount of 10%. But they are no longer distributed to the employee’s separate account, but to a general, consolidated account. The presented table indicates the amounts of deductions and the maximum levels of income on which they are accrued for enterprises using OSNO. Amounts of deductions for enterprises using the traditional tax system

| fund into which contributions are transferred | % of deductions | marginal income in thousand rubles, on which the contribution is calculated | % of deductions on income received above the established limit | notes |

| Pension Fund | 22 | 711 | 10 | |

| FSS | 2,9 | 670 | ||

| FSS from accidents sl. | 0,2-8,5 | not installed | 0 | contributions are calculated for any amount from the payroll |

| FFOMS | 5,1 | 624 | 0 |

1. Example of calculation of insurance premiums

An employee of the enterprise received a salary of 68 thousand rubles for January. It includes payments:

- salary - 40,000 rubles;

- vacation pay - 15,000 rubles;

- paid sick leave - 13,000 rubles.

Total accrued: RUB 68,000.

Payment of sick leave is not included in the calculation base, reducing the amount of income for calculating contributions.

68 – 13 = 55 thousand rubles.

Contributions accrued for January: • to the Pension Fund: 55,000 * 22% = 12,100 rubles. • in the Social Insurance Fund: 55,000 * 2.9% = 1,595 rubles.

• in the FSS (from uncounted words):

55,000 * 0.2% = 110 rub. • in FFOMS: 55,000 * 5.1% = 2805 rubles. Total accrued contributions for the month - 16,610 rubles.

Let's continue the example:

The salary of this employee for 10 months of the year amounted to 856,000 rubles. The amount of contributions accrued during this time:

• in the Pension Fund: 711,000 * 22% + (856,000 – 711,000) * 10% = 156,420 + 31,900 = 188,320 rubles. • in the Social Insurance Fund: 670,000 * 2.9% = 19,430 rubles.

• FSS (from nesch/sl.):

856,000 * 0.2% = 1,712 rubles. • FFOMS: 624,000 * 5.1% = 31,824 rubles. Accrued for 10 months - RUB 241,286.

Next, we will consider the features of settlements with extra-budgetary funds of entrepreneurs and organizations that use various special regimes for simplified accounting.

Example

If an employee’s salary is ten thousand rubles, it will not be difficult to make calculations.

You need to transfer 2.2 thousand rubles to the Pension Fund. We received this amount by multiplying the employee’s income (10 thousand rubles) by the current rate (22%).

We carry out calculations for other funds in a similar way.

- 10 thousand rubles * 5.1% = 510 rubles. This amount must be transferred to the Compulsory Health Insurance Fund.

- 10 thousand rubles * 2.9% = 290 rubles. This is the amount of contributions for the Social Insurance Fund.

Insurance premiums: calculation for individual entrepreneurs

Often entrepreneurs, when organizing their own business, work in the singular, without recruiting staff. The individual entrepreneur does not pay himself a salary; he receives income from entrepreneurial activities. This category also includes the so-called self-employed population - privately practicing lawyers, doctors and other specialists who have organized their own businesses.

For such entrepreneurs, a special procedure for calculating such payments has been established by law - fixed (mandatory) insurance premiums.

Mandatory insurance premiums are calculated based on the minimum wage, which is indexed annually. Therefore, the amount of fixed contributions increases every year, not counting the experiment of legislators in 2013, when not one minimum wage, but two were taken as the basis for calculating deductions.

This amount is clearly defined and is calculated as the product of 12 times the minimum wage and the tariffs established for the Pension Fund at 26% and the Federal Compulsory Medical Insurance Fund at 5.1%:

This year the mandatory contribution amounted to 18,610.80 rubles. and 3650.58 rub. respectively. A total of 22,261.38 rubles must be transferred for the year.

Individual entrepreneurs do not calculate insurance contributions to the Social Insurance Fund, since they are not provided for settlements with the fund either for payment of sick leave or for work-related injuries.

The legal limit for earning income for the possibility of paying deductions in a fixed amount is 300 thousand rubles. Exceeding this level of income will require additional assessment of the amount of contributions: 1% is charged on the amount received in excess of this standard. This rule applies only to the calculation of contributions to the Pension Fund. It does not apply to contributions to the Federal Compulsory Medical Insurance Fund. The size of the contribution to this fund is not affected by the amount of income; it is stable.

Description

In accordance with current legislation, individual entrepreneurs, as well as legal entities operating on the territory of the Russian Federation, have an obligation to pay insurance premiums.

They are required to make contributions to the Pension Fund, the Social Insurance Fund, and the Mandatory Medical Insurance Fund.

The tariffs at which the calculation takes place differ significantly. This will be discussed below. However, you need to understand that the established rates greatly influence how the amount of insurance premiums is calculated.

The procedure for transferring and calculating insurance contributions to the Pension Fund of the Russian Federation by entrepreneurs

The algorithm for settlements with the pension fund is as follows:

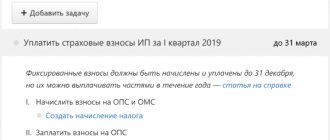

• A fixed contribution must be paid before the end of the current year. This is the responsibility of all entrepreneurs. As already mentioned, when paying this contribution, neither the financial result of the activity, nor the taxation regime, nor the amount of income, nor its complete absence plays a role. This fee is paid because it is mandatory.

• Until April 1 of the next year, the part of the contributions received by calculation is transferred - 1% of the amount of income exceeding the three hundred thousand limit.

3. Consider an example of calculating insurance premiums for an individual entrepreneur working without staff:

The annual income of a practicing doctor was 278 thousand rubles. Let's calculate insurance premiums:

in the Pension Fund = 5965 * 12 * 26% = 18,610.80 rubles.

in FFOMS = 5965 * 12 * 5.1% = 3650.58 rubles.

Payments are made in equal quarterly installments or in full at once. The main thing is that they are submitted before the end of the year.

4. Consider the following example:

Individual entrepreneur’s income for the year is RUB 2,560,000.

Contribution to the Pension Fund = 18,610.80 + 1% * (2,560,000 – 300,000) = 18,610.80 + 22,600 = 41,210.80 rubles.

In FFOMS - 3650.58 rubles.

Important! Fixed amount RUB 22,261.38. must be transferred before the end of the tax year, the contribution from the difference is 18,949.42 rubles. must be paid by April 1.

The maximum contribution amount for the current year is RUB 148,886.40. It is calculated using the formula: 8 times the minimum wage for the year, multiplied by the established Pension Fund tariff.

Deadlines for payment of fixed payments in 2021

Contributions for compulsory health insurance must be transferred no later than December 31 of the current year (clause 2 of article 432 of the Tax Code of the Russian Federation). Since December 31, 2021 has been declared a holiday (by Government Decree No. 1648 dated October 10, 2020), the deadline for payment of these contributions for 2021 is postponed to the first working day of 2022, that is, January 10 (clause 7 of Article 6.1 of the Tax Code of the Russian Federation ).

During the same period, part of the contributions for compulsory pension insurance in the amount of 32,448 rubles must be transferred to the budget. The remaining amount of pension contributions (if any, based on the amount of income) is transferred no later than July 1 of the following year (clause 2 of Article 432 of the Tax Code of the Russian Federation). This means that for 2021, contributions to compulsory pension insurance must be finally paid before July 1, 2022 inclusive.

Features of calculating individual entrepreneur contributions: how to correctly calculate the amount of income of an individual entrepreneur

The calculation of insurance premiums for individual entrepreneurs has been radically changed. And if previously all calculations were based on the amount of profit, today the basis for their calculation is the amount of income received. And these concepts should be distinguished, since an incorrectly calculated amount of income and, therefore, payment may lead to the imposition of penalties.

Let's figure out what receipts should be considered income in different taxation regimes used by entrepreneurs:

- Under OSNO, all income subject to personal income tax is taken into account.

- The simplified tax system must take into account income from the sale of goods, provision of services, as well as non-operating income (for example, rental payments received). Important! It cannot be reduced by the amount of expenses, even if the “Income minus expenses” regime is applied. This formula is valid for calculating tax, but not social contributions.

- With UTII, the previously calculated imputed income for the entire year is summed up, for which you can add up the indicators in line No. 100 for quarterly declarations, where the calculation of UTII is indicated.

- Insurance premiums under the patent taxation system are charged on the amount of income actually received during the validity of the patent. To do this, all income recorded in KUDiR is calculated or determined by calculation, proportionally dividing the amount of income by the duration of the patent.

When combining several tax regimes, income from activities in each of them must be summed up. If the entrepreneur’s income for the year is no more than 300 thousand rubles or is absent, then the individual entrepreneur is obliged to transfer only a fixed contribution.

Application of reduced tariffs: who can count on benefits?

Russian legislation regulates the possibility of using reduced tariffs for certain categories of employer enterprises.

The amounts of these tariffs are different for different companies and depend on the activities in which they are engaged. The tariff rates are listed in Part 1 of Art. 58 Z-na No. 212-FZ. This is a very extensive register that contains a number of payers who have the right to use benefits. The table provides a list of enterprises whose activities allow the use of preferential tariffs when calculating social contributions. Amounts of reduced insurance premium rates

| Companies eligible to apply preferential tariffs | Pension Fund % | FSS % | FFOM %S |

| Enterprises working on the Unified Agricultural Tax, agricultural producers, public representations of people with disabilities | 21 | 2,4 | 3,7 |

| Partnerships organized by budgetary, non-profit institutions, IT companies, etc. | 8 | 4 | 2 |

| Companies and individual entrepreneurs working on a patent and the simplified tax system for the types of activities listed in the law, entrepreneurs-pharmacists on UTII, non-profit organizations on the simplified tax system, enterprises working in the field of social security, R&D, healthcare, culture, charitable activities | 20 | 0 | 0 |

| Enterprises participating in the Skolkovo project | 14 | 0 | 0 |

In paragraph 8, part 1 of Art. 58 a list of activities for which preferential tariffs have been established has been published. Organizations and individual entrepreneurs working with any of them are given the right not to count social and health insurance contributions, and for contributions to the Pension Fund a rate of 20% is established. The maximum income for calculating deductions is 711 thousand rubles. For income received in excess of this amount, contributions are not calculated. Legislators have also established certain restrictive barriers that must be applied for enterprises to exercise their right to use preferential tariffs.

Let's look at the calculation of insurance premiums at preferential rates using the following several examples.

1. From the annual income of an employee of an agricultural producer enterprise entitled to a preferential payment in the amount of 264,000 rubles. deductions amounted to:

• in the Pension Fund: 264,000 * 21% = 55,440 rubles. • in the Social Insurance Fund: 264,000 * 2.4% = 6,336 rubles.

• in FFOMS:

264,000 * 3.7% = 9,768 rubles.

Total: 71,544 rub.

2. The following contributions must be calculated from the salary of an employee of a social security enterprise conducting activities that are eligible for benefits in the amount of 210,000 rubles:

• in the Pension Fund: 210,000 * 20% = 40,500 rubles. Total: 40,500 rub.

3. From the annual income of an IT company employee in the amount of 547,000 rubles. deductions made:

• in the Pension Fund: 547,000 * 8% = 43,760 rubles. • in the Social Insurance Fund: 547,000 * 4% = 21,880 rubles.

• in FFOMS:

547,000 * 2% = 10,940 rub.

Total: 76,580 rub.

Another innovation since the beginning of this year is that the amounts of contributions when paid are not rounded to the nearest ruble, as was previously accepted, but are calculated and paid in rubles and kopecks, without creating tiny overpayments when settling with funds.

What control ratios must be met in the DAM

The situation became even clearer after the Federal Tax Service published the control ratios that must be met for this category of payers in the form of the RSV (letter of the Federal Tax Service dated May 29, 2020 No. BS-4-11 / [email protected] ).

These new control ratios complement the previous list of controls for the DAM form (letter of the Federal Tax Service dated 02/07/2020 No. BS-4-11 / [email protected] ). In the list they are listed under numbers 1.193–1.199, 2.8–2.10. Then these control ratios were supplemented once again (letter of the Federal Tax Service dated June 23, 2020 No. BS-4-11/ [email protected] ).

Let us explain what the wording of these control ratios means.

| Control ratio - wording in the letter from the Federal Tax Service | What does it mean |

| If field 001 adj. 1 rub. 1 SV = 20, then the presence of adj. 1 rub. 1 SV with value 01 in field 001 is required | If there is an application with code “20” in the calculation, then there must also be an application with code “01” |

| If in subsection 3.2.1 p. 3 SV according to FL (according to SNILS + full name indicators) field value 130 = MS, then the presence of subsection 3.2.1 r. 3 SV for this FL with a value in the field of 130 = NR required | If in section 3 of an individual there is subsection 3.2.1 with the code “MS”, then subsection 3.2.1 with the code “NR” must be present |

| If in subsection 3.2.1 p. 3 SV according to FL (according to SNILS + full name indicators) field value 130 = MS, then in subsection 3.2.1 p. 3 SV for this FL with a value in field 130 = NR line 150 for each value of field 120 = minimum wage (based on a base not exceeding the limit value) | If in subsection 3.2.1 there is a line with the code “MS”, then in the line with the code “NR” for the same month the amount in column 150 (base) should be equal to the minimum wage. This requirement applies as long as the base does not exceed the limit |

Thus, the right to apply a reduced tariff appears if the base for calculating contributions for the basic tariff is not less than 12,792 rubles. If less, the reduced rate does not apply that month.

Transfer employees from the previous period and check the DAM for free

Accounting for calculations of insurance premiums: accrual, postings, features

Insurance premiums are calculated by employers in the same month for which salaries are calculated. Important! The accrual and calculation of insurance premiums for vacation pay is made immediately when calculating vacation pay, and for the entire amount, regardless of the length of the vacation period. It often begins in one month and ends in another. However, the calculation of accrued insurance premiums is made for the entire amount at once.

Accounting for insurance contributions is carried out on account No. 69 “Calculations for social insurance” and its subaccounts for the separate allocation of types of deductions and funds. It corresponds with the production cost accounts, the amount of accrued contributions is reflected in the credit of the 69th account:

D-t 20 (23, 26, 44 ...) K-t 69 - contributions to the Pension Fund, Social Insurance Fund and Federal Compulsory Medical Insurance Fund are accrued to the corresponding sub-accounts approved by the company.

Paid contributions are debited to subaccounts 69 and reflected in the credit of account 51 “Current Account”, confirming the payment made and the settlement of insurance premiums paid.

Where can I see contributions to the Pension Fund?

How to find out contributions to the Pension Fund is of interest not only to entrepreneurs, but also to employees of enterprises. Information may be needed for various reasons, and you can obtain a certificate from the Pension Fund about deductions directly from the Pension Fund or through the government services website.

For each citizen, an ILS (individual personal account) is opened in the Pension Fund, where employer payments for pensions are accumulated. A certificate from the pension fund on contributions contains information about the insurance and funded parts of the pension, the name of the company paying the contributions, and the amounts of transactions. You can also order a statement of accrued contributions directly at your place of work by completing a free-form application addressed to the employer.

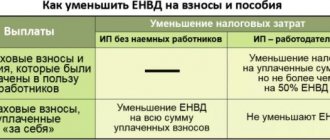

Peculiarities of applying benefits when paying contributions for “simplified people”

The law establishes the possibility of reducing the tax base of enterprises using special regimes. Insurance premiums paid in full of the calculated amount reduce the base for the accrued tax provided for by the special regime in the following cases:

• Individual entrepreneurs apply the simplified tax system and/or UTII and operate without hired personnel;

• The company operates on a simplified “income minus expenses” regime.

1/2 of the amount of deductions reduces the basis for calculating tax when the following regimes are applied:

• simplified tax system “Income * 6%”;

• UTII.

For patent holders, insurance premiums do not reduce their value.

It should be noted that the right to use these benefits is exercisable only in the period for which the tax is calculated, and the base can be reduced only by the amount of contributions paid (not accrued!) in the same reporting period.

What do you mean by base?

The concept of the base for insurance premiums is understood as the total accruals from the number of positions established by law, for a certain billing period, in relation to a specific payer, with the exception of funds from which these payments are not withheld.

The base is calculated taking into account the calendar month.

Penalties

Insurance premiums, the calculation of which is made, must be paid to the funds within the prescribed period. According to the law, if monthly payments are not made on time, regulatory agencies have the right to present the organization with a penalty for each day of delay.

Penalties not provided for by law cannot be applied as sanctions, but fines can be quite impressive. There are many reasons that may cause displeasure of extra-budgetary funds. They have the right to fine a company for late registration in funds or for being late in reporting contributions, as well as for using forms of an unspecified form. This is not a complete list of violations; the extra-budgetary fund has considerable power and it is better to prepare and submit all the necessary reporting forms in advance in order to be able to change anything and report on time.