The normal activities of any company today are closely related to the good equipment of its existing services with communications equipment, communication systems, computers, and office equipment. But the acquisition of this property often poses a number of questions to the enterprise related to establishing their service life and the depreciation group that must be assigned to a particular object, since all of the listed assets are depreciable property. Let's figure out what should be considered when solving such problems.

Switch useful life

- OKOF - All-Russian Classifier of Fixed Assets

- 300.00.00.00.000 - Machinery and equipment, including household equipment, and other objects

- 320.00.00.00.000 - Information, computer and telecommunications (ICT) equipment

- 320.26.30 — Communication equipment

- 320.26.30.1 - Communication equipment, radio or television transmitting equipment

- 320.26.30.11 — Communication transmitting equipment with receiving devices

- 320.26.30.11.110 - Communication facilities performing the function of switching systems

Grouping 320.26.30.11.110 in OKOF is final and does not contain subgroups.

In the classification of fixed assets included in depreciation groups, code 320.26.30.11.110 is listed in the following groups:

To move from the old OKOF to the new OKOF, use a direct transition key:

What the group includes This group also includes: • equipment included in the transit, terminal-transit and terminal communication nodes of the fixed telephone network; • equipment of automatic telephone exchanges; • equipment that implements switching and service management functions; • equipment for providing intrazonal, intercity and international telephone services with the help of a telephone operator; • equipment of service centers for calls to emergency operational services; • equipment of call centers for information and reference services; • telegraph communication equipment; • switching equipment for mobile radiotelephone networks; • switching equipment for mobile radio networks; • switching equipment for mobile satellite radio networks

What the group does not include This group does not include: • equipment of switching systems, including software that ensures the implementation of established actions during operational investigative activities, see 320.26.30.11.160

OKOF wifi access point

Contents Having considered the issue, we came to the following conclusion: The wireless audio conferencing system can be classified as the fourth depreciation group - property with a useful life of more than five years up to seven years inclusive.

Rationale for the conclusion: According to paragraph.

1 tbsp. 256 of the Tax Code of the Russian Federation, depreciable property is property that is owned by the taxpayer, used by him to generate income, and the cost of which is repaid by calculating depreciation. Depreciable property is property with a useful life of more than 12 months and an original cost of more than 40,000 rubles. In accordance with paragraph.

1 tbsp. 258 of the Tax Code of the Russian Federation, depreciable property is distributed among depreciation groups in accordance with its useful life. The useful life is recognized as the period during which an item of fixed assets serves to fulfill the goals of the taxpayer's activities. The useful life is determined by the taxpayer independently on the date of commissioning of this item of depreciable property in accordance with the provisions of Art.

258 of the Tax Code of the Russian Federation and taking into account the Classification of fixed assets included in depreciation groups (hereinafter referred to as the Classification), approved by Decree of the Government of the Russian Federation dated January 1, 2002 N 1. When assigning a fixed asset object to a depreciation group according to the Classification, one should be guided by the All-Russian Classifier of Fixed Assets OKOF (OK 013-94), approved by Decree of the State Standard of Russia dated December 26, 1994 N 359. In our opinion, the wireless audio conferencing system can be classified as the fourth depreciation group - property with a useful life of over five years to seven years inclusive, according to OKOF code 14 3230000 “Equipment” television and radio receiving", subsections: 14 3230030 "Equipment receiving for radiotelephone and radiotelegraph communication"; 14 3230210 "Equipment receiving signals for radiotelephone and radiotelegraph communication". In any

OKOF 320.26.30.11.110 - Communication equipment that performs the function of systems...

Code 320.26.30.11.110 is included in the classification of fixed assets:

Includes: This group also includes: • equipment included in the transit, terminal-transit and terminal communication nodes of the fixed telephone network; • equipment of automatic telephone exchanges; • equipment that implements switching and service management functions; • equipment for providing intrazonal, intercity and international telephone services with the help of a telephone operator; • equipment of service centers for calls to emergency operational services; • equipment of call centers for information and reference services; • telegraph communication equipment; • switching equipment for mobile radiotelephone networks; • switching equipment for mobile radio networks; • switching equipment for mobile satellite radio networks

Does not include: This group does not include: • switching system equipment, including software that ensures the implementation of established actions during operational investigative activities, see 320.26.30.11.160

amortizacionnaya_gruppa_kompyuterov_i_ofisnoy_tehniki.jpg

Related publications

The normal activities of any company today are closely related to the good equipment of its existing services with communications equipment, communication systems, computers, and office equipment. But the acquisition of this property often poses a number of questions to the enterprise related to establishing their service life and the depreciation group that must be assigned to a particular object, since all of the listed assets are depreciable property. Let's figure out what should be considered when solving such problems.

Regulatory grounds

A depreciation group that determines the useful life (SPI) is assigned to each fixed asset. There are 10 of them in total, and the objects assigned to them differ in their service life. OS groups are united by the OS Classifier, which standardizes accounting information on objects, which, in turn, are grouped by types of OS. Thus, office devices are concentrated in groups, the code of which begins with the numbers 320 and 330. The depreciation group of the object is determined, focusing on the period of effective operation of the device. As a rule, the objects in question tend to undergo rapid moral and physical aging, so their SPI is small, and they are classified into the 2nd or 3rd depreciation groups.

From January 1, 2021, by Resolution No. 526 dated April 28, 2018, changes were made to the OS Classifier, some depreciation groups were updated and expanded. However, the updates did not affect the categories of office equipment in question. OKOF codes previously assigned to these property groups have not undergone any changes. Let us remind you which depreciation groups include various types of office equipment.

Switch Which Group of Fixed Assets in 2021

» Author Daria Aleksandrovna Reading time: 10 min. Published 08/26/2021 Fixed assets of an organization, depending on their useful life, belong to one or another depreciation group for profit tax purposes (clause.

1 tbsp. 258 of the Tax Code of the Russian Federation). The organization determines the useful life of the OS itself, taking into account the special classification approved by the Government of the Russian Federation. If your OS is not named in the Classification, then you have the right to independently determine the useful life of this property, focusing on the service life specified in the technical documentation or recommendations manufacturer.

The established SPI will tell you which depreciation group your OS falls into, including rural and institutional communication stations, analog ten-step systems; equipment of analogue telephone exchanges, including international ones - sixth group (property with a useful life of over 10 years to 15 years inclusive) OKOF-2 (as amended on 05/08/2018, taking into account amendments to art.

in force 01.07.2018) All-Russian classifier of fixed assets OK 013-2014 (SNA 2008) came into force on January 1, 2021 to replace OKOF OK 013-94 To convert the OKOF code to the OKOF2 code, use the OKOF code converter to OKOF2. The organization determines the period useful use of a fixed asset in order to calculate depreciation in accounting and tax accounting. From 12 May 2021, accountants will apply the updated Classification of Property, Plant and Equipment. Let's tell you in more detail what has changed and how to determine depreciation groups in 2021.

- Check the code specified in the OKOF in the first column of the OS classification.

- If there is a code in the OS classification, look at which depreciation group the OS belongs to.

- In the first column of OKOF, find the type of property to which the OS belongs (9 digits).

First you need to determine whether the object belongs to the OS.

The service life of the asset in tax accounting must be more than 12 months and have a cost of 100 thousand rubles (clause 1 of Article 256 of the Tax Code of the Russian Federation).

Computer: shock absorption group

The PC is listed in the note to the 2nd depreciation group with code OKOF 330.28.23.23 “Other office machines.” This also includes printers, servers of various capacities, network equipment, information storage systems, as well as modems - all of them are listed in the note to this code, and, therefore, belong to the 2nd group, the SPI of equipment in which is a period of 2 years and 1 month to 3 years.

Laptops also belong to the PC category, which means they can be classified in group 2 and assigned the same code. Note that there is code 320.26.20.11 “Portable computers - laptops...”, which is also quite suitable for PCs. An enterprise has the right to choose which code is most suitable for designating a laptop, focusing on the parameters of the object and independently establishing the SPI.

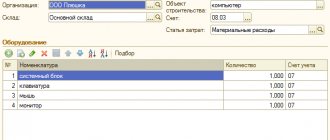

There is one caveat that accompanies the installation of a PC. Sometimes the company purchases computer components (hard drive, monitor, keyboard, mouse) separately, reflecting the purchase on material accounts. There, these objects are taken into account if further resale is expected, but in these cases there is no talk of classifying the object by depreciation group, since they are materials/goods, but not fixed assets, and cannot function independently. Thus, it is impossible to assign a code to a monitor or system unit separately from the articulated working structure called a computer.

What does it depend on?

The depreciation rate depends on the following parameters:

- The method of calculating depreciation - affects both accounting and tax accounting; below are the features of calculating the rate depending on the method used.

- Useful life - in accounting is established independently, in tax accounting in accordance with the depreciation group suitable for the fixed asset.

- Depreciation group - relevant only for tax accounting with a non-linear method of calculating depreciation, when the rate is set in accordance with the selected group.

Who sets depreciation charges?

Norms are not established in accounting; they are calculated by the accountant for each individual fixed asset, depending on the chosen method of calculating depreciation and the established service life.

In practice, the annual figure is always calculated. The exception is the production method, in which the monthly norm is calculated.

In tax accounting, the rate is calculated only using the linear calculation method, and its monthly amount is always calculated.

This value is established at the legislative level using a non-linear method in tax accounting. There is no need to count anything. It is enough to determine the depreciation group for the fixed asset, then from clause 5 of Article 259.2 of the Tax Code of the Russian Federation, select the appropriate value of the norm.

How to calculate annual percentage in accounting?

In accounting, the amount of the average annual depreciation rate is determined by the accountant independently. To do this, it is enough to set a suitable useful life for the fixed asset.

In addition, you need to decide on the depreciation method to be used. There are four of them in accounting - linear, declining balance, production, by the sum of the numbers of years of SPI.

The definition and essence of the concept of depreciation rate is most clearly visible for the linear method.

Formula for the linear method (defined by clause 19 of PBU 6/01):

Formula:

Annual N. = 1 / SPI in years * 100%.

That is, this indicator is always expressed as a percentage.

The formula for the declining balance method is distinguished by the introduction of an increasing acceleration factor, which the organization independently accepts within 3.

Formula for calculation:

Annual N. = 1 * Ku / SPI s years * 100%.

For the method of writing off the cost in proportion to the volume of products, works, services, as well as for writing off by the sum of the numbers of years of SPI, the norm is not calculated either on an annual or monthly basis.

Calculation example

The enterprise received an asset for which a useful life of 3 years (36 months) was selected in accounting and a linear calculation method was established.

Annual N. = 1/3 * 100% = 33.33 percent.

How to determine the monthly value in accounting - formulas

The procedure for calculating the monthly rate depends on the chosen method of calculating depreciation charges.

For the linear method, the monthly indicator is not calculated, however, if necessary, it can be calculated as follows:

Formula:

Monthly N. = 1 / SPI in months * 100%

Similarly, for the reducing balance method, the calculation formula can be presented as follows:

Formula:

Monthly N. = 1 * Ku / SPI in months * 100%

If the cost of a fixed asset is written off using the production method, that is, in proportion to the products produced or services or work performed, the monthly rate is not calculated. In this case, it is impossible to predict in advance what amount of depreciation charges will be transferred to expenses for the year, since this indicator depends on the monthly volume of production.

How to find it in tax accounting?

Tax accounting provides only 2 methods for calculating depreciation:

- Linear - the monthly rate is calculated by dividing the unit by the useful life expressed in months. Next, the parameter is converted to percentage.

- Non-linear - the norm is established at the legislative level depending on the depreciation group of the fixed asset, the current values of the monthly norm can be found in Article 259.2 of the Tax Code of the Russian Federation, the annual parameter is not established.

Depreciation rate by groups of fixed assets:

In tax accounting, a depreciation group should be established for the received fixed asset, based on which the period of use is already selected.

Example

For fixed assets, depreciation group 3 and SPI equal to 60 months are established.

If the enterprise uses the linear method, then the monthly rate will be 1.6667 percent (1/60 * 100%).

With the non-linear method, you need to look at Article 259.2 of the Tax Code of the Russian Federation, where for depreciation group 3 a monthly rate of 5.6 percent is established.

Shock absorption group of the phone

To designate a telephone (smartphone), the code 320.26.30.11.150 “Radio-electronic communications equipment” is provided, contained in the 3rd depreciation group, the belonging to which is determined by the SPI of this item - from 3 to 5 years. Depending on the quality and technical characteristics of the device, it can be classified under code 320.26.30.11.190 “Communication transmitting equipment” or under code 320.26.30.22 “Telephone devices for cellular/wireless networks”, also available in the 3rd group of the Classifier.

conclusions

Depreciation rate is a concept used in both accounting and tax accounting. The indicator is always expressed as a percentage and shows what share of the cost of the fixed asset will need to be transferred to the organization’s expenses for a certain period of time (year, month).

For accounting purposes, this value is always calculated on an annual basis, after which the annual amount of depreciation is determined and then divided into 12 parts.

For tax accounting purposes, the rate is determined monthly. Moreover, for the linear method it needs to be calculated, but for the non-linear method, just look at the tax code, where all the values are written down depending on the depreciation group.

Depreciation groups for other office equipment objects

In addition to the listed items of office equipment, enterprises also use other property. For example, televisions, which are considered by manufacturers in the category of household appliances. Therefore, televisions operating in the company, including plasma ones, are classified as depreciation group 3 with a service life of 3 to 5 years, assigning OKOF code 320.28.29, the note to which includes household appliances.

Office and industrial premises are often equipped with digital video cameras. Their SPI ranges from 3 to 5 years. The 3rd group of the Classifier contains the corresponding code - 330.26.70.13 “Digital video cameras”.

The efficient operation of enterprise services is often ensured by a switch. This equipment is more durable and can function reliably for a significant period of time. It belongs to the 6th group (code 320.26.30.11.110 “Communication facilities with the function of switching systems”). The service life of the switch is from 10 to 15 years.

Let’s combine the information given in the publication on depreciation groups of office equipment in the table:

Switch useful life

- OKOF - All-Russian Classifier of Fixed Assets

- 300.00.00.00.000 - Machinery and equipment, including household equipment, and other objects

- 320.00.00.00.000 - Information, computer and telecommunications (ICT) equipment

- 320.26.30 — Communication equipment

- 320.26.30.1 - Communication equipment, radio or television transmitting equipment

- 320.26.30.11 — Communication transmitting equipment with receiving devices

- 320.26.30.11.110 - Communication facilities performing the function of switching systems

What is it - definition

To understand the concept of depreciation rate, you need to understand the mechanism and significance of the depreciation process.

The depreciation procedure is an important process because:

- directs cash flows to the reproduction of fixed assets;

- divides large investments by periods.

The norm is expressed as a percentage and shows what share of the costs of acquiring a fixed asset should be transferred to expenses and invested in the cost of products, goods, and work during the year.

In other words, the norm is the part of the cost of fixed assets that the organization recognizes as expenses in the reporting year.