In case of untimely or partial transfer of mandatory insurance contributions, the legislation of the Russian Federation provides for certain penalties. This rule is specified in the Tax Code of the Russian Federation in Art. 75. Penalties are charged for each calendar day of late payment. It is worth considering that they are accrued for weekends and non-working days.

The calculation of penalties includes the period that begins from the date of the deadline for payment of contributions until the date on which the payment was made. Since 2017, changes have been made to the tax legislation of the Russian Federation regarding the transfer of extra-budgetary contributions. Now insurance payments are transferred to the Federal Tax Service of the Russian Federation.

Important! The changes did not affect only contributions from accidents, which are still supervised by the Federal Social Insurance Fund of the Russian Federation. Penalties for these payments are calculated in accordance with the Social Insurance Law No. 125-FZ Art. 26.11.

In view of these innovations, penalties began to be calculated in accordance with the Tax Code of the Russian Federation, Article 75, clause 4. Its amount is the interest rate for the day of delay. And it, in turn, depends on the category of taxpayer.

Thus, if a legal entity is overdue for mandatory payment of insurance premiums by more than 30 calendar days, it will have to pay 1/150 of the current refinancing rate approved by the Government of the Russian Federation. If payment is overdue by up to 30 calendar days, legal entities, individuals and individual entrepreneurs will have to pay 1/300 of the Central Bank of the Russian Federation rate.

Where to pay in 2021

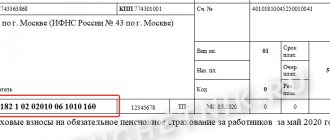

In 2021, the Federal Tax Service will continue to control the calculation and payment of insurance contributions for compulsory pension, medical and social insurance (with the exception of contributions for injuries). The listed types of insurance premiums in 2021 must be paid to the Federal Tax Service, and not to the funds. Accordingly, the payment order for the payment of contributions in 2021 must be completed as follows:

- in the TIN and KPP field of the recipient of the funds - TIN and KPP of the tax inspectorate;

- in the “Recipient” field - the abbreviated name of the Federal Treasury body and in brackets - the abbreviated name of the Federal Tax Service;

- in the KBK field - budget classification code, consisting of 20 characters (digits). In this case, the first three characters indicating the code of the chief administrator of budget revenues should take the value “182” - Federal Tax Service.

In 2021, there were a number of changes in the legislation on insurance premiums. You can see a detailed overview in the article “Changes in insurance premiums from 2021”.

KBK for personal income tax for 2021 for legal entities

In field 104 of the payment slip, the tax agent indicates the budget classification codes. The latest changes have not affected the BCC for personal income tax for employees in 2021. But remember that the codes are different for the tax itself, penalties and fines. The BCC for personal income tax for employees in 2021 is in the table below.

KBK for personal income tax on the income of employees, legal entities and individual entrepreneurs for 2018

| Employee income tax | 182 1 0100 110 |

| Penalties on employee income tax | 182 1 0100 110 |

| Employee income tax penalties | 182 1 0100 110 |

| Tax paid by entrepreneurs on the general system | 182 1 0100 110 |

| Penalties on the tax paid by entrepreneurs on the general system | 182 1 0100 110 |

| Tax penalties paid by entrepreneurs on the general system | 182 1 0100 110 |

KBK table for payment of insurance premiums for employees and other individuals in 2021

| Payment | KBK payments | ||

| on compulsory pension insurance (OPI) | for compulsory health insurance (CHI) | for compulsory social insurance (OSI) | |

| Contributions | 182 1 0210 160 | 182 1 0213 160 | 182 1 0210 160 |

| Penalty | 182 1 0210 160 | 182 1 0213 160 | 182 1 0210 160 |

| Fines | 182 1 0210 160 | 182 1 0213 160 | 182 1 0210 160 |

Contributions paid to the Social Insurance Fund - KBK for 2018

I Insurance contributions for compulsory social insurance in case of temporary disability and in connection with maternity

1) Contributions for billing periods starting from January 1, 2021

182 1 0210 160 Payment amount (recalculations, arrears and payment arrears)

182 1 0210 160 Payment penalties

182 1 0210 160 Interest on payment

182 1 0210 160 Amounts of monetary penalties (fines) for payment

2) Contributions for billing periods expired before January 1, 2017

182 1 0200 160 Payment amount (recalculations, arrears and payment arrears)

182 1 0200 160 Penalty for the corresponding payment

182 1 0200 160 Interest on payment

182 1 0200 160 Amounts of monetary penalties (fines) for payment

II Insurance contributions for compulsory social insurance against accidents at work and occupational diseases

393 1 0200 160 Payment amount (recalculations, arrears and payment arrears)

393 1 0200 160 Penalty for the corresponding payment

393 1 0200 160 Interest on the corresponding payment

393 1 0200 160 Amounts of monetary penalties (fines) for payment

III Insurance premiums paid by persons who voluntarily entered into a relationship under compulsory social insurance in case of temporary disability and in connection with maternity

393 1 1700 180 Payment amount

Post:

KBK table for payment of pension contributions by employers at the additional tariff in 2018

| Payment | KBK payments on OPS | |

| the tariff does not depend on the special assessment | the tariff depends on the special assessment | |

| For insured persons employed in the work specified in clause 1, part 1, article 30 of the Federal Law of December 28, 2013 No. 400-FZ (list 1) | ||

| Contributions | 182 1 0210 160 | 182 1 0220 160 |

| Penalty | 182 1 0200 160 | |

| Fines | 182 1 0200 160 | |

| For insured persons employed in the work specified in paragraphs. 2-18 Part 1 Article 30 of the Federal Law of December 28, 2013 No. 400-FZ (list 2) | ||

| Contributions | 182 1 0210 160 | 182 1 0220 160 |

| Penalty | 182 1 0200 160 | |

| Fines | 182 1 0200 160 | |

KBC insurance premiums for 2021: tables

In general, KBK are 20-digit digital codes used to group income, expenses and sources of financing budget deficits at all levels (clause 1 of Article 18 of the Budget Code of the Russian Federation). Although companies and entrepreneurs most often encounter these codes when they draw up payment documents for the transfer of taxes, fees and contributions to the budget system of the Russian Federation. In them, BCC is a mandatory requisite that allows you to determine the identity of the payment.

Thus, in the payment order, a special field 104 is provided to indicate the BCC (Appendix No. 3 to the Regulations of the Bank of Russia dated June 19, 2012 No. 383-P, clause 5 of Appendix No. 2 to the Order of the Ministry of Finance of Russia dated November 12, 2013 No. 107n) .

Try to fill out details “104” correctly so that you don’t have to clarify the payment later (clause 7 of Article 45 of the Tax Code of the Russian Federation, letter of the Ministry of Finance of Russia dated January 19, 2017 No. 03-02-07/1/2145). To do this, let us remember the important changes that have occurred in the KBK regarding insurance premiums since 01/01/2017.

Firstly, now all budget classification codes (BCC) for paying contributions to compulsory health insurance, compulsory health insurance and compulsory social insurance in the case of VNiM begin with the number 182 . It denotes the administrator code, which has become the Federal Tax Service of Russia since 2017. (Until 2021, this administrator was the Pension Fund and the Social Insurance Fund with codes 392 and 393, respectively.)

Secondly, the code of the income subtype group has changed (in the KBK these are numbers from 14 to 17). For example, if previously the code 1000 was indicated when sending current payments for pension contributions, now the numbers 1010 are entered.

Thirdly, there are now not two, but four CSCs for paying contributions to OPS at additional rates for “harmful” employees, and they depend not only on the type of heavy, harmful and dangerous work, but also on whether a special assessment has been carried out at the enterprise working conditions or not.

All current BCCs for insurance premiums can be found in the Instructions on the procedure for applying the budget classification of the Russian Federation, approved. By Order of the Ministry of Finance of Russia dated July 1, 2013 No. 65n, as well as in the tables presented below.

Table 1 – BCC for payment of insurance premiums (penalties and fines thereon) for employees and other individuals in 2018

| Payment | KBK payments | ||

| on compulsory pension insurance (OPI) | for compulsory health insurance (CHI) | for compulsory social insurance (OSI) | |

| Contributions | 182 1 02 02010 06 1010 160 | 182 1 02 02101 08 1013 160 | 182 1 02 02090 07 1010 160 |

| Penalty | 182 1 02 02010 06 2110 160 | 182 1 02 02101 08 2013 160 | 182 1 02 02090 07 2110 160 |

| Fines | 182 1 02 02010 06 3010 160 | 182 1 02 02101 08 3013 160 | 182 1 02 02090 07 3010 160 |

Table 2 - BCC for payment by employers of pension contributions at the additional rate (penalties and fines for them) for employees in 2018

| Payment | KBK payments on OPS | |

| the tariff does not depend on the special assessment | the tariff depends on the special assessment | |

| For insured persons employed in the work specified in clause 1, part 1, article 30 of the Federal Law of December 28, 2013 No. 400-FZ (list 1) | ||

| Contributions | 182 1 0210 160 | 182 1 0220 160 |

| Penalty | 182 1 0200 160 | |

| Fines | 182 1 0200 160 | |

| For insured persons employed in the work specified in paragraphs. 2-18 Part 1 Article 30 of the Federal Law of December 28, 2013 No. 400-FZ (list 2) | ||

| Contributions | 182 1 0210 160 | 182 1 0220 160 |

| Penalty | 182 1 0200 160 | |

| Fines | 182 1 0200 160 | |

You can learn more about insurance premium rates for 2021 from this consultation.

Table 3 – BCC for individual entrepreneurs’ payment of insurance premiums “for themselves” (penalties and fines for them) in 2018

| Payment | KBK payments | |

| on compulsory pension insurance (OPI) | for compulsory health insurance (CHI) | |

| Fixed contributions | 182 1 02 02140 06 1110 160 | 182 1 02 02103 08 1013 160 |

| Contributions of 1% on income over RUB 300,000. | — | |

| Penalty | 182 1 02 02140 06 2110 160 | 182 1 02 02103 08 2013 160 |

| Fines | 182 1 02 02140 06 3010 160 | 182 1 02 02103 08 3013 160 |

The KBK of insurance premiums to the Social Insurance Fund for accidents at work and occupational diseases did not change. What codes were in 2016, they remain the same in 2021 and will be in 2021.

Table 4 – BCC for payment of contributions “for injuries” (penalties and fines for them) for employees in 2021

| Payment | KBK of payments for compulsory social insurance against accidents at work and occupational diseases |

| Contributions | 393 1 0200 160 |

| Penalty | 393 1 0200 160 |

| Fines | 393 1 0200 160 |

KBK table for individual entrepreneurs to pay insurance premiums “for themselves” in 2021

| Payment | KBK payments | |

| on compulsory pension insurance (OPI) | for compulsory health insurance (CHI) | |

| Fixed contributions | 182 1 0210 160 | 182 1 0213 160 |

| Contributions of 1% on income over RUB 300,000. | – | |

| Penalty | 182 1 0210 160 | 182 1 0213 160 |

| Fines | 182 1 0210 160 | 182 1 0213 160 |

KBK for income tax 2021 for legal entities

If you indicate the wrong KBK or completely forgot to write down the code, inspectors will receive a notification of refusal to accept the declaration. It will say: there was an error in filling out the data for the “Budget Classification Code” indicator. The error code is 300300027.

If you do not solve the problem and are late in submitting the report, then a fine cannot be avoided. Delay the report for more than 10 days and tax inspectors will suspend transactions on bank accounts. To avoid such troubles, check

KBK of income tax to the federal and regional budgets - 2018

| Purpose of payment | Mandatory payment | Penalty | Fine |

| to the federal budget (except for consolidated groups of taxpayers) | 182 1 0100 110 | 182 1 0100 110 | 182 1 0100 110 |

| to the budgets of the constituent entities of the Russian Federation (except for consolidated groups of taxpayers) | 182 1 0100 110 | 182 1 0100 110 | 182 1 0100 110 |

| to the federal budget (for consolidated groups of taxpayers) | 182 1 0100 110 | 182 1 0100 110 | 182 1 0100 110 |

| to the budgets of the constituent entities of the Russian Federation (for consolidated groups of taxpayers) | 182 1 0100 110 | 182 1 0100 110 | 182 1 0100 110 |

| when implementing production sharing agreements concluded before October 21, 2011 (before the Law of December 30, 1995 No. 225-FZ came into force) | 182 1 0100 110 | 182 1 0100 110 | 182 1 0100 110 |

| from the income of foreign organizations not related to activities in Russia through a permanent representative office | 182 1 0100 110 | 182 1 0100 110 | 182 1 0100 110 |

| from the income of Russian organizations in the form of dividends from Russian organizations | 182 1 0100 110 | 182 1 0100 110 | 182 1 0100 110 |

| from the income of foreign organizations in the form of dividends from Russian organizations | 182 1 0100 110 | 182 1 0100 110 | 182 1 0100 110 |

| from dividends from foreign organizations | 182 1 0100 110 | 182 1 0100 110 | 182 1 0100 110 |

| from interest on state and municipal securities | 182 1 0100 110 | 182 1 0100 110 | 182 1 0100 110 |

| from the profits of controlled foreign companies | 182 1 0100 110 | 182 1 0100 110 | 182 1 0100 110 |

What are the consequences of errors in the details for transferring contributions in 2021?

If the details for transferring insurance premiums in 2021 are incorrectly specified, the funds will not reach the recipient and will remain stuck in the accounts of unexplained payments. The organization will have overdue debt, on which the tax authorities will charge penalties.

If the error is due to an incorrect indication of the KBK, then it will be enough to submit an application clarifying this payment order details. If the error concerns the indication of an incorrect Treasury account of the Russian Federation or the details of the recipient's bank, you will need to pay the insurance premium again, and then return the incorrect amounts through the bank.

From 2021, it is possible to count overpayments on contributions of only one type, for example, overpaid contributions to compulsory medical insurance against future payments on the same. Offsetting between different types of insurance premiums cannot be made. If the overpayment under the OPS was posted to the employees’ personal cards, it cannot be returned in any way (according to clause 6.1 of Article 78 of the Tax Code of the Russian Federation).

KBK for personal pension contributions of individual entrepreneurs

At the end of last year, the Ministry of Finance established a separate BCC for individual entrepreneurs paying 1% contributions on individual entrepreneurs’ income over 300 thousand rubles.

- 182 1 0210 160 (order dated December 27, 2017 No. 255n). This news did not receive wide publicity, since order No. 255n was published only at the end of February, and already on March 1, the Ministry of Finance posted a new order on its website - dated 02.28.18 No. 35n. Order No. 35n cancels the separate BCC for contributions from the excess amount. That is, after the order comes into force, all “pension” contributions for themselves (both fixed and from the excess amount) individual entrepreneurs will have to transfer according to the “old” KBK - 182 1 0202140 06 1110 160. Now the new order of the Ministry of Finance is being registered with the Ministry of Justice . If the Ministry of Justice recognizes the order as not requiring registration (as it did previously with similar orders), then the new CBC will take effect from the date of publication on the official Internet portal of legal information.

Let us recall that previously entrepreneurs and other “private traders” (for example, lawyers) had to pay pension contributions on income exceeding 300,000 rubles no later than April 1 of the following year. However, starting with reporting for 2021, this part of the contributions must be paid no later than July 1 (new edition of clause 2 of Article 432 of the Tax Code of the Russian Federation).

This means that contributions from the excess amount for 2021 must be transferred no later than July 2, 2021 (since July 1, 2021 falls on a Sunday). So for those who have not yet managed to pay contributions from the excess amount, it is better to wait for the publication of the order of the Ministry of Finance and transfer them according to the same BCC as the fixed part.

Calculate contributions “for yourself”, tax according to the simplified tax system, fill out payments in the web service Fill out for free

Changes in the KBK in 2021 - 2021

Starting from 2021, the list of KBK codes will be determined by a new order of the Ministry of Finance dated 06/08/2020 No. 99n, and in 2021 the order dated November 29, 2019 No. 207n is in effect. Fortunately, these regulations did not introduce changes to the BCC regarding contributions.

Find out which BCCs have changed in 2021 here.

From 01/01/2019, the values of the BCC were determined by departmental order dated 06/08/2018 No. 132n. Immediately after its adoption, he made changes to the BCC on penalties for insurance premiums for compulsory health insurance paid at additional rates. Thus, from 01/01/2019 to 04/13/2019 there is no separate BCC for a tariff depending on the results of the SOUT. There are only two codes during this period, and not four, as there were in 2021. And they are:

- for list 1 - 182 1 0210 160;

- for list 2 - 182 1 0210 160.

But as of April 14, 2019, everything was returned back to the 2018 division.

The current BCCs for insurance premiums for 2020-2021, including those changed from April 14, 2019, can be seen by downloading our table.

You can double-check all KBK using a ready-made solution from ConsultantPlus. And the analytical material ConsultantPlus will help you fill out the payment form correctly for the transfer of penalties and fines on insurance premiums. You can get trial access to K+ for free.