The Russian economy is undergoing significant changes, which have a significant impact on the activities of all enterprises.

Dear readers! The article talks about typical ways to resolve legal issues, but each case is individual. If you want to find out how to solve your particular problem , contact a consultant:

8 (800) 700 95 53

APPLICATIONS AND CALLS ARE ACCEPTED 24/7 and 7 days a week.

It's fast and FREE !

Only by joining their efforts can market participants survive, stay afloat, and optimize taxation and management of legal entities.

The pressing question remains: “How is the reorganization in the form of affiliation carried out in 2021?”

Reduction during reorganization in the form of merger

When reorganizing in the form of affiliation, staff reductions are permitted only if employees are properly notified. Such notice is given to each employee personally against signature no later than two months before the date of joining.

What to do if an employee does not agree to move to a new organization? Personnel have the right to agree to new working conditions or a new position (if such a condition is provided for by the terms of affiliation).

If the notified employee does not agree with the new working conditions, or if there are no vacant positions for employment, the employees are subject to dismissal at the initiative of the company's management for layoffs.

Deadlines

The specific timing of the reorganization procedure depends on many factors, in particular the company’s debts and creditors’ claims . If the latter force the management of the acquired company to pay off all debts, the process may be delayed.

On average, reorganization takes more than two months . If there are no serious problems, the accession procedure may be completed earlier. The participation of experienced lawyers and jurists in the case will help to significantly speed up

Order on reorganization by merger

The legal basis for carrying out organizational and staffing measures with the company’s workforce will be an order for reorganization by merger. This order is issued after approval of the decision to begin the procedure and must contain a number of mandatory conditions:

- Establishing deadlines for all personnel activities (notifying employees, transferring them to a new company, dismissal due to reduction, etc.).

- The procedure and forms for paying severance pay to employees and calculating wages.

The reorganization order is the main personnel document for carrying out organizational and staffing measures with the employees of the enterprise. Each employee must personally sign to become familiar with the terms of the order.

Results

Often, joining can be a good (and in most cases the only) way for a company to save itself from impending bankruptcy and ruin.

This form of reorganization is suitable for small businesses that find it difficult to cope with the problems that arise alone , as well as for entrepreneurs who want to expand their activities and improve economic performance.

In most cases, when reorganizing by merging a company that is being liquidated, there is no risk of a tax audit - all debts and unpaid contributions will be paid by its legal successor. Therefore, this option may also be an alternative to voluntary bankruptcy - it is a safer and more convenient way for an entrepreneur to terminate his activities.

Transfer of employees during reorganization in the form of affiliation

In case of agreement to work under new conditions, employees are transferred during reorganization in the form of affiliation. Activities for the transfer of personnel are carried out by the personnel service of the enterprise in strict accordance with the requirements of the law and the terms of the manager’s order.

If job responsibilities and other essential terms of the employment agreement are retained in full, it is subject to change indicating the new organization - the employer.

If an employee’s working conditions change, appropriate changes are made to his employment contract.

An order is issued regarding the transfer of each specific employee to the staff of a new enterprise, and an entry about the transfer is made in the work book.

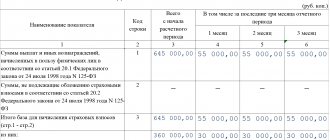

Debts of participants and final reporting

Before carrying out the procedure, each reorganized company must prepare final financial statements, the date of which will be the day before the merger is recorded in the Unified State Register of Legal Entities. This includes the balance sheet, as well as statements of profit and loss, cash flows and changes in equity.

This reporting should reflect all transactions that have occurred in the company since the date of drawing up the transfer deed.

The “Profit and Loss” account must also be closed, funds from which are distributed according to the decision of the owners.

After the reorganization, all debts of the old companies are completely transferred to the legal successor.

If one of the predecessor enterprises had debts to the tax authorities or funds, they will be transferred to the account of the new organization.

It is advisable to submit tax returns to reorganized companies, but this can also be done by their legal successor after the procedure is completed.

An important point is the fact that reorganization is not a basis for changing the periods for paying taxes or submitting reports.

The new company is obliged to submit all documents within the period established by law.

Cancellation of reorganization in the form of merger

Even if most of the measures to join a legal entity to a new organization are completed, the initiators of this procedure always have the opportunity to cancel further actions. Cancellation of reorganization in the form of merger is carried out by the same structures that made the decision on reorganization:

- For limited liability companies - the general meeting of founders or the only participant.

- For joint stock companies – a general meeting of shareholders.

- For state budgetary institutions and enterprises - the executive authority of the state or subject of the Russian Federation.

- For municipal institutions or enterprises - local authorities.

A decision to cancel the reorganization can be made at any time, up to the time the information is entered into the Unified State Register of Legal Entities, and is subject to forwarding to the tax authority.

Preparation of financial statements

Until the end of the reorganization procedure (that is, from the date of the decision on this by the board and until the enterprise is deregistered), the current activities and all operations of the company are carried out as usual . This means that all necessary reporting for this period must be submitted to the tax office, the Pension Fund and other funds.

Paying taxes and filing returns also continues as before. All transactions performed continue to be recorded in a generally established form; information about the upcoming reorganization is not displayed anywhere in the financial statements.

In this case, the following accounting entries and accounts are used: 51, 62, 76.

Before completing the reorganization procedure, the acquired company must prepare and submit to the successor a final report on the results of its activities . A complete list of required documents is approved by law. The last reporting year will be the period from January 1 to the official date of termination of the company's activities.

We suggest you read materials about changes and transformations, namely how to change the passport data of the general director of an LLC or founder, how to make changes to the OKVED of an individual entrepreneur or change the main type of activity, in which cases it is necessary to make changes to the constituent documents, how to reorganize a closed joint stock company into an LLC, how to carry out reorganization in the form of separating a new legal entity, as well as dividing an LLC into two LLCs.

Reorganization procedure in the form of merger

The reorganization procedure in the form of affiliation provides for the implementation of a number of mandatory measures provided for by law:

- Approval of the decision to initiate reorganization in the form of merger.

- Sending a notification to the Federal Tax Service inspection about the initiation of the procedure.

- Two publications of notices in the “Bulletin of State Registration”.

- Approval of the transfer deed of the organization.

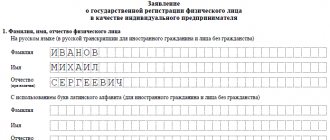

- Submitting an application to the Federal Tax Service inspection for state registration based on the results of the reorganization.

Violations committed during the implementation of at least one of these stages entail the invalidity of the entire reorganization procedure. Failure to comply with the deadlines for procedural measures, the procedure for publishing notices and filling out document forms will also result in a refusal by the registration authority.

Cancel

If, after the start of the reorganization procedure, the owners change their minds and decide to keep their companies as they are, they can cancel the process. In most cases, a change in decision occurs due to one of the parties (most often the acquired company) providing false information about its financial condition.

Since the legislation does not directly provide for the obligation of the entrepreneur to complete the reorganization procedure and does not contain a prohibition on this , at the initiative of one of the participants, the begun process may be terminated.

To do this, you need to submit a notification to the tax service about the cancellation of the previously made decision. There is no specially approved form for this, just as there are no legally established requirements regarding the procedure for canceling the reorganization.

If for some reason employees of the Federal Tax Service refuse to make entries in the register about canceling the start of the reorganization procedure, the owners or founders have the right to appeal the refusal in court . As practice shows, most of these cases are resolved in favor of the plaintiff.

Dismissal of a manager

Since the merger procedure implies the actual existence of a legal entity, the owners of the company have the right to terminate the contract with the manager. Labor legislation allows for this possibility while simultaneously respecting the labor rights of the manager.

The dismissal of a manager during a reorganization in the form of a merger is formalized by a decision of the owners of the enterprise, which, as a rule, coincides with the decision to initiate the reorganization procedure.

This procedural decision provides for the date of termination of the contract with the director, and also determines the conditions for paying him severance pay.

In practice, the owner of educational institutions most often uses this right by dismissing an objectionable school director during the merger process.

Satisfaction of creditors' demands

Publishing a notice in the Bulletin, as well as sending written notices to all known creditors are the main ways to inform them in the event of an upcoming reorganization.

Within 30 days after each of these events, creditors have the right to demand early payment of all debts and payments from the acquired company.

After this, a register of claims that were put forward by creditors is compiled, indicating the amount of debt and the grounds for its repayment. Before the reorganization procedure is completed, the company must pay off all these claims.

In practice, creditors do not always put forward such demands, because after merger, all debts of the old enterprise are transferred to the new one . Therefore, many creditors agree to maintain the previous payment terms and are not in a hurry to pay off the debt.

How long does reorganization in the form of merger take?

To the question of how long reorganization in the form of affiliation lasts, only an approximate answer can be given - within three months. This period includes time for preparing documents, making and processing a decision on reorganization, notifying the tax authority, publishing notices of merger, and registration actions of the Federal Tax Service inspectorate.

Qualified specialists from a legal or consulting company will help reduce the time required to prepare document forms, as well as ensure careful compliance with legal requirements at each stage of the reorganization procedure.

Experienced lawyers will undertake the preparation of the entire set of documents and represent the client’s interests in the tax office at every stage of the process. will provide the law firm's client with full legal support and ensure the required result in the shortest possible time.

Tax audit

After making a decision on reorganization, the next mandatory step is notification of the upcoming procedure to the tax authority.

Before the merger is completed, tax officials have the right to conduct an on-site audit , regardless of when the previous one was conducted. In its process, data for the last three years of operation of the enterprise can be covered.

Unlike the situation with liquidation, during reorganization the risk of a tax audit is much lower . If in the first case it is carried out almost always (according to statistics, in 90% of situations), then during reorganization the audit covers about 10% of enterprises.

This 10% includes mainly large taxpayers; representatives of small businesses are practically not checked.

This is an additional advantage of reorganization over liquidation.

The low percentage of tax audits is due, first of all, to the fact that after merger, all debts and obligations of the enterprise are transferred to its legal successor.

Even if the audit process reveals unpaid fines, penalties and taxes, this will not stop the reorganization process - all these payments will become the responsibility of the enterprise to which the debtor joins.

Transfer act during reorganization in the form of merger

One of the most important documents in carrying out this procedure is the transfer act during reorganization in the form of affiliation. This method of reorganization implies the transfer in full of all rights and obligations of the acquired company in the form of succession.

The transfer act is drawn up on the date the decision on reorganization is made and includes the following information:

- A complete list of property assets of a legal entity.

- Detailed composition of the organization's financial assets.

- List of accounts payable claims, including financial obligations for which the due date has not arrived.

- List and forms of accounts receivable.

The transfer act is drawn up with the participation of representatives of both organizations, after which it is subject to approval by the owners of the enterprise. The approved transfer act is submitted to the tax authority as part of the documents for state registration of the reorganization in the form of merger.

According to the list of tasks that reorganization in the form of affiliation can solve, this procedure is one of the most popular among legal entities of any organizational legal form.

Strict adherence to the deadlines and procedure for processing documents will allow the merger to be completed in strict accordance with the goals pursued by the owners of the enterprise at the stage of making the decision on reorganization.

Useful information on business disputes

- Company reorganization

- Reorganization of the JSC

- LLC reorganization

- Reorganization of Federal State Unitary Enterprise

- Reorganization of a legal entity

- JSC reorganization

- Reorganization of JSC

- Reorganization of NPOs

- Reorganization by merger

- How does reorganization differ from liquidation of a legal entity?

- Reorganization of an individual entrepreneur

- Ready-made companies with a license

- Reorganization by merger

- Reorganization of a budgetary institution in the form of annexation

- Reorganization by spin-off

- Reorganization in the form of division

- Mixed reorganization

- Reorganization by transformation

Which form to choose and what will be the consequences?

The choice of the form of LLC reorganization depends, first of all, on the reasons that served as the basis for it . It could be:

- expansion of production;

- improving market position and competitiveness;

- improving economic indicators;

- creation of a joint venture;

- alternative to liquidation of the enterprise.

The last reason is the most common reason why the accession procedure is carried out. Unlike a merger, in which all participants are liquidated and a new legal entity is created, affiliation involves the liquidation of only one enterprise.

Most often, this enterprise is a debtor or potential bankrupt who is trying to escape his obligations or is forced to join the creditor company.

Another difference between a merger and an accession is the companies that can take part in the procedure. In the case of merger, these can only be companies of the same legal form, in case of merger, an enterprise with a new form can be founded.

If the owners choose a form of reorganization such as merger, then they must be prepared for the fact that their company will be liquidated , and all rights and obligations will be transferred to the successor company. In this case, the acquired enterprise will be liquidated and deregistered.

Components of a document

The deed of transfer is one of the annexes to the agreement of several parties. It is structured according to the same principles by which most of these types of papers are drawn up. The presented sample contains all the necessary and sufficient information. The act reads from top to bottom:

- In the upper right corner of the paper there is a note indicating approval of the document by the decision of a single participant or by a resolution of the general meeting. In any case, references to these documents must indicate their date and number.

- Name of the act. The main agreement should be mentioned here, and the names of the successor organization and the joining legal entity should be listed.

- A decision is made regarding the acceptance of liabilities and assets of one organization by another.

- The total book value is presented as a separate figure at the beginning of the transfer deed. It is usually calculated by the organization’s accountant by subtracting the payable amount from the total receivables. It can be both positive and negative.

- Listing the structural composition of assets and liabilities. It includes: fixed assets, inventories, cash in the bank account and in the cash register, short-term financial investments, settlements with debtors and creditors.

In addition, several annexes are usually prepared for the transfer deed. They correspond to the articles of the structural composition of the company's assets and liabilities. They list everything that is on the company’s accounts and in its ownership (separately what relates to fixed assets, and separately to financial investments).

Also, through a separately attached application, the figures of financial relations with counterparties are recorded: how much the organization owes, how much the organization owes.

Changes

In 2014, some changes were made to the reorganization procedure. They concern:

- Simultaneity. Now you can “crank out” several types of reorganization at once.

- Number of participants. Only two companies can appear in the documents. Moreover, they both must be LLC or OJSC, that is, have the same organizational and legal form. This is clearly stated in the Resolution of the Plenum of the Supreme Arbitration Court No. 19, paragraph 20 of November 18, 2003. Then this postulate was once again enshrined in a new document.

- Companies cannot transform into unitary companies of any kind.