The cost of production is the enterprise's costs for its production and sale, measured in monetary terms (Fig. 1). Without calculation and analysis of costs, it is impossible to make effective management decisions at all levels. Let's look at what types of costs there are and typical accounting entries.

Rice. 1. List of enterprise costs that form the cost.

Cost indicators can be planned and actual. Planned ones are calculated based on planned resource consumption rates. Actual expenses are determined after all expenses have actually been incurred.

Types of cost

Depending on the sequence of formation, the cost is divided:

- operational or technological;

- workshop;

- production;

- complete.

Technological

Technological cost serves to determine comparative economic efficiency when choosing the most effective of several technology upgrade options, and includes costs for all technological operations with the product. It is formed on account 20 without taking into account general shop and production expenses.

Shop

Workshop cost , in addition to technological costs, includes costs for organizing and managing the work of the workshop, which cannot be clearly attributed to a specific type of product. These costs are accumulated in the account and distributed monthly by type of product when calculating their workshop, production and full costs.

Production

Production cost , in addition to the workshop cost, includes the costs of managing the enterprise (general business expenses), which accumulate in the account and are also written off monthly for certain types of products.

Full

In addition to cost, the total cost also includes non-production costs associated with the sale of products.

According to their economic essence, they distinguish between cost, determined by economic elements, or by costing items.

By summing up costs by economic elements, it is impossible to determine the costs of producing a specific product; therefore, costing items are used to determine the cost of individual types of products.

Primary documents for accounting services

In tax accounting, services are also included in costs and reduce taxable profit, subject to economic justification and the availability of primary accounting documents (Article 252 of the Tax Code of the Russian Federation). The exception is standardized expenses, when only part of the costs according to the rate specified in tax legislation is included in the base when calculating profits.

As noted above, most often, to confirm the fact that the service has been provided, a certificate of completion of work is drawn up. The form of the act is not contained in the album of unified forms (with the exception of the KS-2 form); it is developed and agreed upon by the parties to the agreement independently, taking into account the conditions of each specific transaction. In this case, the form must contain the mandatory details listed in Art. 9 of the Law “On Accounting” dated December 6, 2011 No. 402-FZ:

- Name and date of the document.

- The name of the company that prepared the document.

- The name of the work performed, indicating the cost and quantitative characteristics.

- Signatures of the parties indicating the positions and names of the signatories.

For a sample of filling out the acceptance certificate for completed work, see the material “Acceptance certificate for completed work - sample.”

The fact of provision of construction services is confirmed by an act in the KS-2 form.

The algorithm for filling out this document is given in the article “Acceptance certificate for completed construction work - sample”.

When providing transport services by a carrier company, in addition to the work completion certificate, there must be transport documents. Such documents, in particular, include invoices.

IMPORTANT! Since 2013, unified forms are not mandatory for use; organizations have the right to develop them independently.

The procedure for accounting for transportation costs is described in detail in the publication “Transportation costs are charged to the buyer’s account - posting.”

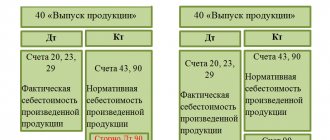

Postings for the release of finished products

The output of finished products can be accounted for by the accounting department at actual or standard cost. In the first case, the write-off goes directly to account 43. When using account 40, two entries are made:

| Account Dt | Kt account | Wiring Description | Transaction amount | A document base |

| 20, , | Finished products of the main, auxiliary and service shops and divisions were capitalized at actual cost | 10000 | Certificate of calculation, certificate of release of finished products | |

| 20, , | The actual cost of finished products of the main, auxiliary and service departments and workshops is written off | 10000 | Certificate of calculation, certificate of release of finished products | |

| Standard cost of finished products written off (planned) | 10200 | Help-calculation |

Account 26 in accounting

Determination of general business expenses

General business expenses include all costs for administrative needs that are not directly related to production, provision of services or performance of work, but relate to the main type of activity.

The list of general business expenses depends on the profile of the organization and is not closed, according to the recommendations for using the chart of accounts.

The main general operating costs can be identified:

- Administrative and management expenses

- Business trips;

- Salaries of administration, accounting, management personnel, marketing, etc.;

- Entertainment expenses;

- Security, communication services;

- Consultations of third-party specialists (IT, auditors, etc.);

- Postal services and office.

- Repair and depreciation of non-production fixed assets;

- Rent of non-industrial premises;

- Budget payments (taxes, fines, penalties);

- Other:

Organizations not related to production (dealers, agents, etc.) collect all costs on account 26 and subsequently write them off to the sales account (account 90).

Important! Trade organizations may not use account 26, but assign all expenses to account 44 “Sales expenses”.

Main properties of account 26

Let's consider the main properties of account 26 “General business expenses”:

- Refers to active accounts, therefore, it cannot have a negative result (credit balance);

- It is a transaction account and does not appear on the balance sheet. At the end of each reporting period it must be closed (there should be no balance at the end of the month);

- Analytical accounting is carried out according to cost items (budget items), place of origin (divisions) and other characteristics.

How to reflect the sale of finished products in transactions

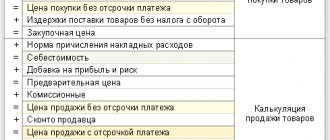

When accounting without using an account, the actual cost of production is written off to account 90.02. If an account is used to account for finished products at their standard cost, then another entry is made to correct deviations of the actual cost from the planned one.

| Account Dt | Kt account | Wiring Description | Transaction amount | A document base |

| 90.02 | Finished products are sent for sale at actual production costs | 10000 | Help-calculation, TTN | |

| 90.02 | Adjusting cost variances | 200 | Help-calculation |

Concept and types of services

Services are a type of activity that does not have a material expression, the results of which are sold and consumed in the process of economic activity of the enterprise (Clause 5 of Article 38 of the Tax Code of the Russian Federation).

Services exist in a wide variety, in particular:

- informational;

- audit;

- transport;

- storage;

- consulting;

- real estate agents;

- communications;

- training, etc.

In accounting, all services are included in costs based on primary accounting documents.

The main primary documents confirming the execution of services are:

- Agreement.

- Certificate of completion of work or other document confirming acceptance of services.

IMPORTANT! The Ministry of Finance believes that if the agreement does not provide for a clause on drawing up an act, then it needs to be drawn up only in cases provided for by law (letter dated November 13, 2009 No. 03-03-06/1/750). The Civil Code obliges to draw up an act confirming the acceptance of work only in the case of a construction contract (Article 720 of the Civil Code of the Russian Federation).

The procedure for concluding and terms of the contract for the provision of services are regulated by Ch. 37–41, 47–49, 51, 52 Civil Code of the Russian Federation. The main actors in the contract are the contractor and the customer of the services. Let's look at the accounting procedures for each of them.

Zero revenue: what to do with general business expenses

In the absence of activity, general business expenses may also arise. What to do with them? General business expenses (as well as other types of expenses) must be recognized in accounting in a timely manner: in the reporting period in which they are actually incurred:

If expenses are not taken into account while waiting for revenue to appear, accounting and reporting indicators will be distorted. Users of reporting will be misled by the company's break-even indicator in conditions where there is actually a loss (there are expenses in the absence of income). In addition, for gross violation of the rules for keeping records of income and expenses, fines are provided (Article 120 of the Tax Code of the Russian Federation, Article 15.11 of the Administrative Code).

The question arises: how can they be fined under an article of the Tax Code if the procedure for accounting for expenses is violated? The answer is contained in paragraph 3 of Art. 120 Tax Code of the Russian Federation. The text of the article explains what is meant by the expression “gross violation of the rules for accounting for income and expenses”:

Thus, in the absence of activity, general business expenses must be reflected in the accounting accounts and written off in a timely manner. In the next section we will tell you how general business expenses are written off in this case.

Nomenclature and nomenclature groups

Nomenclature is a directory (section Directories - Nomenclature) for storing information:

- about goods and materials;

- about finished products;

- about returnable packaging;

- about equipment;

- about semi-finished products;

- about the work performed and services provided.

It is recommended to create the Nomenclature Directory in the form of a multi-level, hierarchical structure, that is, to combine homogeneous nomenclature items into groups. Such a hierarchy will simplify the work and take into account the peculiarities of reflecting in the accounting of elements of the nomenclature directory that have different purposes for their economic use. Created groups in any program directories are depicted as an icon with a folder image.

For example, an organization, one of whose activities is the production of wood products, can create a Furniture nomenclature directory group to store information about finished products. And this group (folder) will include nomenclature items, for example, such as Stool, Table, Wardrobe, etc.

To set up item accounts in “1C: Accounting 8” edition 3.0, the concept of Item Types was introduced. The type is indicated in the nomenclature card; it is required to be filled out along with its name. The program includes a pre-configured list of item types and accounts for them. If necessary, you can add your own types of items. The type can be specified for the Nomenclature directory group. In this case, when you enter a new item in the directory group, the Item Type will be filled in automatically. For example, for the Furniture group you should specify the type - Products. Then for all item items included in this group, the default accounting account will be set to 43 “Finished products”.

Nomenclature groups (not to be confused with the groups (folders) of the nomenclature directory!) are also a directory (section Directories - Nomenclature groups). The Nomenclature Groups directory is used to summarize information about goods, products, works, services into homogeneous categories (for example, by type of activity, by type of product, etc.), for which aggregated accounting is maintained:

- costs of main and auxiliary production;

- revenue received from the sale of goods, products, works, services.

The composition of each product group and the number of product groups for which records are kept are selected by the organization independently, based on the areas of activity and the requirements for calculating costs (for example, Production of wooden products and Wood processing services).

When entering a new item in the Item Groups directory, it is recommended to specify a list of item items (goods, products, works, services) that are part of this item group.

In this case, the Nomenclature group field will be filled in automatically when entering production documents and sales documents.

An item group can include an unlimited number of item items, and each item item can be included in only one item group.

It is unacceptable to combine in one product group products of your own production and goods intended for resale. This requirement is related to the correctness of accounting and tax accounting and filling out corporate income tax returns. In “1C: Accounting 8” edition 3.0, for profit tax purposes, accounting for revenue from the sale of products of own production and revenue from the sale of purchased goods is kept on the same account 90.01.1 “Revenue from activities with the main tax system.”

In Appendix No. 1 to Sheet 02 of the corporate income tax declaration (approved by Order of the Federal Tax Service of Russia dated October 19, 2016 No. ММВ-7-3/ [email protected] , hereinafter referred to as the Order of the Federal Tax Service *) the proceeds from the sale of goods (work, services) own production and revenue from the sale of purchased goods must be shown separately, on lines 011 and 012, respectively.

Note:

* The Federal Tax Service of Russia has developed a new form of income tax declaration.

In the 1C: Accounting 8 program, edition 3.0, when automatically filling out an income tax return, the division of the specified revenue is performed based on membership in product groups. Therefore, if an organization simultaneously sells both goods and products of its own production, then the proceeds from the sale of these item items should be attributed to different item groups.

Those item groups, the revenue for which should be reflected in Appendix No. 1 to Sheet 02 of the declaration on line 011 “revenue from the sale of goods (works, services) of own production,” must be indicated in the information register Nomenclature groups of sales of products and services. Access to the specified register is carried out via the hyperlink of the same name from the income tax settings form (section Main - Settings - Taxes and reports - Income tax).

Issuance of SF for shipment to the buyer

The organization is obliged to issue an invoice within 5 calendar days from the date of shipment and register it in the sales book (clause 3 of article 168 of the Tax Code of the Russian Federation).

You can issue an invoice to the buyer by clicking the Issue an invoice document (act, invoice) . Invoice data is automatically filled in based on the Sales document (act, invoice) .

- Operation type code : “Sales of goods, works, services and operations equivalent to it.”

Documenting

You can print the form of the completed invoice by clicking the button Print the document Invoice issued or the document Sales (act, invoice) . PDF

Sales Book report can be generated from the Reports – VAT – Sales Book section. PDF

VAT declaration

The amount of accrued VAT is reflected in the VAT return:

In Section 3 p. 010 “Implementation (transfer on the territory of the Russian Federation...): PDF

- the amount of sales proceeds, excluding VAT;

- the amount of accrued VAT.

In Section 9 “Information from the sales book”:

- invoice issued, transaction type code "".