Which depreciation group does the Server belong to?

Some experts classify servers as OKOF code 320.26.20.13 - Electronic digital computers containing in one housing a central processor and an input and output device, whether combined or not for automatic data processing

OKOF code (version from 01/01/2021) 330.28.23.23 - Office machines others (including personal computers and printing devices for them; servers of various capacities ; network equipment for local computer networks; data storage systems; modems for local networks; modems for backbone networks);

Video surveillance system - a complex of technical optical-electronic mechanisms

From 01/01/2020, public sector institutions must organize accounting (budget) accounting using 5 federal standards, including the federal standard “Fixed Assets”, approved. by order of the Ministry of Finance of Russia dated December 31, 2020 N 257n (hereinafter referred to as the “Fixed Assets” Standard). There are no references to OKOF in the Fixed Assets Standard. However, this fact does not mean that there is no need to determine OKOF codes for fixed assets, because clause 53 of the Instructions, approved. No one canceled the order of the Ministry of Finance of Russia dated December 1, 2010 N 157n. The above norm stipulates that the grouping of fixed assets is carried out according to property groups and types of property corresponding to the classification subsections established by OKOF.

Depreciation groups server equipment

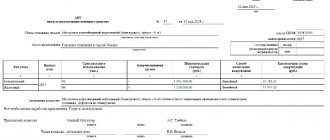

OKOF code version c Some experts classify servers as OKOF code OKOF code version up to The second depreciation group is property with a useful life of more than 2 years up to 3 years inclusive. Which depreciation group does the fixed asset belong to? Depreciation group - a group of depreciable property, fixed assets and intangible assets, formed on the basis of useful life. The main purpose of a depreciation group is to determine the useful life of an object.

The server belongs to the Second Depreciation Group, property with a useful life of over 2 years up to 3 years inclusive. Accordingly, the useful life of the Server is set in the range from 2 years and 1 month to 3 years. The 2nd group of fixed assets includes Classification of fixed assets included in depreciation groups:.

Furniture in the office from the point of view of legal regulations

Office furniture, as a rule, meets the requirements of current regulatory documents dictating the conditions for accepting property objects into the company's fixed assets. Thus, in accordance with clause 4 of PBU 6/01, fixed assets (FA) include the following assets:

- used in production or for the management needs of the company for a long time (more than 12 months);

- purchased for use and not for subsequent resale;

- bringing economic benefits in the future.

Office furniture fully falls under the listed conditions, and if it exceeds the value limit for recognition of an asset as part of material assets (more than 40 thousand rubles per unit), then it is undoubtedly subject to accounting as an object of fixed assets. Note that in tax accounting, fixed assets are considered to be property worth more than 100 thousand rubles.

When recognizing such property as fixed assets, the question arises about the need to depreciate these objects. Let's figure out which depreciation group office furniture belongs to, and what criteria should be used when assigning a group to these assets and determining the period of use.

Classification of fixed assets included in depreciation groups

The fixed assets classifier serves to assign a depreciation period for material assets and uses codes from the All-Russian Classifier of Fixed Assets. For fixed assets put into operation from 2021, the useful life is determined by the codes of the new OKOF OK 013-2021. For fixed assets introduced before 2021, the deadlines are determined by the codes of the old OKOF OK 013-94. If, according to the new classifier, the fixed asset belongs to another group of the organization, then the terms do not change. For tax accounting, refer to clause 8, clause 4, article 374 of the Tax Code of the Russian Federation and clause 58, article 2 of the Law of November 30, 2021 No. 401-FZ.

- The first group is all short-lived property with a useful life from 1 year to 2 years inclusive

- cars and equipment

- The second group is property with a useful life of more than 2 years up to 3 years inclusive

- cars and equipment

- Means of transport

- Industrial and household equipment

- Perennial plantings

- Third group - property with a useful life of more than 3 years up to 5 years inclusive

- Facilities and transmission devices

- cars and equipment

- Means of transport

- Industrial and household equipment

- The fourth group is property with a useful life of over 5 years up to 7 years inclusive

- Building

- Facilities and transmission devices

- cars and equipment

- Means of transport

- Industrial and household equipment

- Cattle working

- Perennial plantings

- Fifth group - property with a useful life of over 7 years up to 10 years inclusive

- Building

- Facilities and transmission devices

- cars and equipment

- Means of transport

- Industrial and household equipment

- Fixed assets not included in other groups

- Sixth group - property with a useful life of over 10 years up to 15 years inclusive

- Facilities and transmission devices

- Dwellings

- cars and equipment

- Means of transport

- Industrial and household equipment

- Perennial plantings

- Seventh group - property with a useful life of over 15 years up to 20 years inclusive

- Building

- Facilities and transmission devices

- cars and equipment

- Means of transport

- Perennial plantings

- Fixed assets not included in other groups

- Eighth group - property with a useful life of over 20 years up to 25 years inclusive

- Building

- Facilities and transmission devices

- cars and equipment

- Vehicles

- Industrial and household equipment

- Ninth group - property with a useful life of over 25 years up to 30 years inclusive

- Building

- Facilities and transmission devices

- cars and equipment

- Vehicles

- Group ten - property with a useful life of over 30 years inclusive

- Building

- Facilities and transmission devices

- Dwellings

- cars and equipment

- Vehicles

- Perennial plantings

This is interesting: Application for a Certificate of No Criminal Record

Third group (property with a useful life of more than 3 years up to 5 years inclusive)

Students who successfully complete the program are issued certificates of the established form. Students who successfully complete the program are issued certificates of the established form. On this issue, we adhere to the following position: For office furniture, the most suitable code will be the OKOF code. The telecommunications cabinet refers to communication equipment with a code. For accounting purposes, the useful life for the operating system is established by the organization in accordance with the accounting policies of the organization.

Based on the Classification, both the telecommunications cabinet and office furniture can be classified in the fourth depreciation group for industrial and household equipment with a useful life of over 5 years up to 7 years inclusive.

We also believe that it is possible to establish a useful life for accounting purposes based on information from the manufacturer or the expected useful life, unless otherwise specified in the accounting policy.

For tax accounting purposes for office furniture, due to the lack of a direct indication of the grouping in accordance with the Classification, it is possible to establish a useful life based on the manufacturer’s information. In accordance with paragraph. In accordance with paragraph. The useful life is recognized as the period during which the fixed assets object serves to fulfill the goals of the taxpayer’s activities. The useful life is determined by the taxpayer independently on the date of commissioning of this depreciable property in accordance with the provisions of Art.

Norm clause. Thus, if, based on the documents available to the organization, it is impossible to determine the useful life of the OS, then you can contact the manufacturer or seller with a corresponding request. Next, based on the established useful life, you can determine the depreciation group in accordance with paragraph.

Let us note that specialists of the Ministry of Finance of Russia, when considering taxpayers’ questions regarding the determination of depreciation groups, also often turn to the norm. At the same time, on the issue of classifying fixed assets included in depreciation groups, the Ministry of Finance of Russia sends taxpayers to the Ministry of Economic Development of Russia, see letters from the Ministry of Finance of Russia from Let’s immediately make a reservation , paragraph four paragraph.

The specified period is determined by the organization based on clause. Thus, for accounting purposes, the organization has the right to independently determine the useful life of the OS, without relying on any norms, but only guided by the principles established in clause.

We believe that the Classification can also be used for accounting purposes. The chosen method of calculating depreciation, as well as the useful life of the fixed assets, must be fixed in the accounting policy for accounting purposes. The objects of classification in OKOF are fixed assets.

The classifier was developed on the basis of harmonization with the System of National Accounts of the United Nations SNA, the European Commission, the Organization for Economic Cooperation and Development, the International Monetary Fund and the World Bank Group, as well as with the All-Russian Classifier of Products by Type of Economic Activity OKPD2 OK CPE and is intended, among other things, , for the transition to the classification of fixed assets accepted in international practice.

Before At the same time, financial department specialists note that in the description of the new OKOF there is no procedure for assigning classification objects to a specific code. Therefore, the determination of the OKOF code is in any case based on subjective judgment. In addition, when choosing an OKOF code, it is advisable to proceed from the principle of prudence. The main thing is to prevent overestimation of depreciation charges and, as a consequence, underestimation of the taxable base for property tax, see the letter of the Ministry of Finance of Russia dated Regarding the telecommunications cabinet, we note the following.

In our opinion, a telecommunications cabinet according to the new OKOF refers to communication equipment with the code We draw your attention to the “Note” column, which contains an indication of “furniture for cable and wire communications enterprises.” We also believe that it is possible to establish a useful life based on information from the manufacturer or for accounting purposes the expected useful life.

Regarding office furniture, we note the following. According to the old OKOF, furniture for offices, the code “Furniture sets for administrative premises” is assigned to the subsection “Industrial and household equipment” code, to the class “Special furniture” code According to the Classification in the edition in force before. At the same time, according to the new OKOF as amended in force since This conclusion also follows from the direct transition key. However, in the current edition of the Classification “Furniture for offices and trade enterprises” code At the same time, we draw your attention to the explanations of representatives of the financial department, which were given in relation to a budgetary organization in a letter from In relation to material assets that, in accordance with the Instructions, do not belong to objects of fixed assets, but the specified values are not included in the OKOF OK SNA, in which case such objects are taken into account as a group according to the All-Russian Classifier of Fixed Assets OK ".

See also the letter from the Ministry of Finance of Russia from In our opinion, office furniture would be more correctly classified in the grouping of the new OKOF “Other machinery and equipment, including household equipment, and other objects.” The most suitable code in this grouping will be the OKOF code. In relation to the situation under consideration, in the absence of a direct indication of the corresponding grouping in the Classification for office furniture for tax accounting purposes, it is possible to establish a useful life based on the manufacturer’s information.

We recommend that you familiarize yourself with the following materials: — Encyclopedia of solutions. Depreciation groups for income tax purposes. Classification of fixed assets; — Encyclopedia of solutions.

We define the OKOF code. Search by purpose of the fixed asset; — Encyclopedia of solutions. Search by name of fixed asset.

The material was prepared on the basis of individual written consultation provided as part of the Legal Consulting service. Advanced training program “On corporate orders” Federal Law from News and analytics Legal consultations Accounting and reporting Office furniture and an iron telecommunications cabinet measuring 60 x 60 were purchased by IT specialists to install various equipment in it in the field of IT technologies. The specified property is also classified as fixed assets - fixed assets and is depreciated.

To determine the useful life of fixed assets in both accounting and tax accounting, the organization applies the Classification of fixed assets included in depreciation groups approved by the Decree of the Government of the Russian Federation dated What is the useful life in accounting and tax accounting of these fixed assets?

Office furniture and an iron telecommunications cabinet measuring 60 x 60 were purchased by IT specialists to install various equipment in the field of IT technologies.

Requirements for depreciation groups

The purpose of accounting is not only to reflect the presence, condition and movement of the company's fixed assets, but also to correctly distribute depreciation charges among cost items. To achieve this, different methods of classifying fixed assets are used.

Innovations apply only to operating systems introduced on January 1, 2021. There is no need to re-determine the depreciation group of fixed assets available to the enterprise. Depreciation on them will be carried out in the same manner.

Calculate depreciation correctly: new classifier of fixed assets

Mobile scraper belt conveyors; equipment, tools and fixtures, fastening devices for the production and installation of ventilation and sanitary products and products; mechanisms, tools, devices, instruments and devices for electrical installation and commissioning work on equipment for industrial enterprises

It will not be difficult for a specialist to find the necessary information in the list of depreciation groups. All codes of fixed assets are listed in the OK 013-2021 register (approved by Order of Rosstandart No. 2021-st dated December 12, 2021). The classification table of groups has three columns - OKOF, name, note.

OKOF codes for office electronics

Let's start with the Intel 3000 and Intel 3010. Both chipsets are designed for use with the dual-core Xeon 3000 line of processors, the Pentium 4 600, Pentium D 800 and Pentium D 900 lines, as well as the Celeron D processors in the LGA775 form factor (entry-level servers ). Traditionally, these chipsets include two components (controller hub) - MCH and ICH7. In this case, the MCH contains interfaces for the processor, main RAM, PCI Express bus, and connecting bus to ICH7. ICH7 (“south bridge”, although Intel stubbornly refuses such slang names for chipset components) is an I/O controller-hub. The differences between the Intel 3000 and Intel 3010 are minor - the first supports one PCI Express x8 port, and the second supports two PCI Express x8 or one PCI Express x16.

Server depreciation group of fixed assets 2021

If your OS is not named in the Classification, then you have the right to independently determine the useful life of this property, focusing on the service life specified in the technical documentation or the manufacturer’s recommendations. The established SPI will tell you which depreciation group your OS falls into.

- The first group is all short-lived property with a useful life from 1 year to 2 years inclusive

- cars and equipment

- The second group is property with a useful life of more than 2 years up to 3 years inclusive

- cars and equipment

- Means of transport

- Industrial and household equipment

- Perennial plantings

- Third group - property with a useful life of more than 3 years up to 5 years inclusive

- Facilities and transmission devices

- cars and equipment

- Means of transport

- Industrial and household equipment

- The fourth group is property with a useful life of over 5 years up to 7 years inclusive

- Building

- Facilities and transmission devices

- cars and equipment

- Means of transport

- Industrial and household equipment

- Cattle working

- Perennial plantings

- Fifth group - property with a useful life of over 7 years up to 10 years inclusive

- Building

- Facilities and transmission devices

- cars and equipment

- Means of transport

- Industrial and household equipment

- Fixed assets not included in other groups

- Sixth group - property with a useful life of over 10 years up to 15 years inclusive

- Facilities and transmission devices

- Dwellings

- cars and equipment

- Means of transport

- Industrial and household equipment

- Perennial plantings

- Seventh group - property with a useful life of over 15 years up to 20 years inclusive

- Building

- Facilities and transmission devices

- cars and equipment

- Means of transport

- Perennial plantings

- Fixed assets not included in other groups

- Eighth group - property with a useful life of over 20 years up to 25 years inclusive

- Building

- Facilities and transmission devices

- cars and equipment

- Vehicles

- Industrial and household equipment

- Ninth group - property with a useful life of over 25 years up to 30 years inclusive

- Building

- Facilities and transmission devices

- cars and equipment

- Vehicles

- Group ten - property with a useful life of over 30 years inclusive

- Building

- Facilities and transmission devices

- Dwellings

- cars and equipment

- Vehicles

- Perennial plantings

This is interesting: Are there any discounts on travel on commuter trains for labor veterans?

Server what depreciation group for fixed assets accounting 2021

And when a depreciable monoblock is accepted for accounting, the depreciation group for it will similarly be established from SPI over 2 years to 3 years inclusive. This means that the organization will be able to choose the depreciation period itself in the range from 25 months to 36 months inclusive.

Similarly, depreciation group 4 of fixed assets according to the 2021-2021 Classifier assumes that the useful life of fixed assets belonging to this group is over 5 years up to 7 years inclusive.

RISCUNIX server platforms

Our company operates on the simplified tax system and is engaged in telephony and the provision of Internet to various clients. We bought 1. INT telematics services server in the amount of 239525. 2. another telematics services server in the amount of 78045. 3. another server in the amount of 310531.20. 4. Digital gateway chassis 4 slots in the amount of 146,630 rubles. 5. Submodule for the gateway in the amount of 42,640 rubles. 6. Router worth 230208.90. 7. Agro-industrial complex for protecting network information infrastructure including a system module in the amount of 8258805.76. I have a question: what is the useful life of these products and what group should they be classified into? If possible, I can’t find it specifically for each one. These products are for working with clients via the Internet and telephony.

Depreciation groups of fixed assets – 2021

The organization's fixed assets, depending on their useful life, belong to one or another depreciation group for profit tax purposes (Clause 1, Article 258 of the Tax Code of the Russian Federation). The useful life of the asset is determined by the organization itself, taking into account the special classification approved by the Government of the Russian Federation.

If your OS is not named in the Classification, then you have the right to independently determine the useful life of this property, focusing on the service life specified in the technical documentation or the manufacturer’s recommendations. The established SPI will tell you which depreciation group your OS falls into.

Hanger shock-absorbing group 2021

Office furniture of an organization generally satisfies the conditions for recognizing it as an object of fixed assets. Recognizing furniture as an object of fixed assets, it must be depreciated. We will tell you about this in our consultation.

Latest materials:. Most popular:. Wardrobes universal storage system When designing a BNK in a separate building located on a common site with the main building of the educational institution, it is allowed to provide a reduced set of general school premises. Dressing room with metal guides Corner portals made of plasterboard are placed between two adjacent walls.

This is interesting: Can Bailiffs Seize Wages from the Debtor's Spouse?

Depreciation group of fixed assets in 2021

To include the cost of a fixed asset in the cost of manufactured products, depreciation is charged on it during the useful life of this fixed asset. Depreciation is nothing more than deduction of part of the cost of fixed assets to compensate for their wear and tear.

The organization must determine the useful life of fixed assets in 2021 independently, using the classifications of fixed assets included in depreciation groups. This Classification is a table of three columns.

Depreciation group for the server in 2021

Their cost is included in expenses on the day the computer is put into operation. That is, initially all the components are system, sound and video cards, keyboard, monitor, mouse, etc. Typically, tax authorities require that the computer be accounted for as one fixed asset item. Posting Operation D 10 - K 60 The server computer components were purchased or the laptop was purchased D 20 26 - K 10 The cost of the server computer components or the cost of the laptop is included in the costs during commissioning Option 2.

This is interesting: Can an Inheritance Be Taken for Debts?

All accountants are required to take into account documents the OKOF codes of the year - from the current version of the All-Russian Classifier of Fixed Assets. Let us remind you that fixed assets include property with a useful life of more than 12 months and more expensive than rubles. Depreciation is calculated based on the useful life of a fixed asset, which is determined using a classifier in which objects are combined into depreciation groups. This classifier contains an object code, a decoding of this code with the name of the object and a note.

Depreciation period of server equipment

special tool kits for telecommunications equipment and line-cable works; devices and equipment for operational work in communications - first group

(all short-lived property with a useful life from 1 year to 2 years inclusive)

Depreciation groups for fixed assets from the beginning of 2021 are determined based on new rules regulated by the adopted Classification of fixed assets by depreciation groups and updated OKOF codes. In this regard, ordinary users have many questions regarding the determination of the depreciation group of a particular property.

Code OKOF-2

Nehalem is the name of a small town in Oregon, overlooking the Pacific coast near Intel's headquarters in Santa Clara, California. Nehalem processors are a logical improvement of Intel x86 microarchitectures. These solutions have a distributed cache of the second and third levels, as well as the new QuickPath system bus, which was previously known as the Common-System Interface, or CSI. Additionally, these new quad-core processors support Hyper-Threading's successor, Simultaneous Multi-Threading technology. Nehalem is manufactured on a 45nm process using High-K technology and metal gate transistors.

Depreciation groups of fixed assets: how to determine in 2021

The organization determines the useful life of a fixed asset in order to calculate depreciation in accounting and tax accounting. From 12 May 2021, accountants will apply the updated Classification of Property, Plant and Equipment. Let's tell you in more detail what has changed and how to determine depreciation groups in 2021.

- depreciation group to which the fixed asset belongs. All depreciable property is combined into 10 depreciation groups depending on the useful life of the property (clause 3 of Article 258 of the Tax Code of the Russian Federation). Depreciation groups are also important in determining the amount of depreciation bonus that can be applied to a specific asset;

- the useful life must be within the limits established for each depreciation group (Letter of the Ministry of Finance of Russia dated July 6, 2021 No. 03-05-05-01/39563). Choose any period within the SPI, for example the shortest, in order to quickly write off the cost of the fixed assets as expenses (Letter of the Ministry of Finance of the Russian Federation dated 07/06/2021 No. 03-05-05-01/39563).

This is interesting: Will there be payment to Chernobyl victims in April 2021?

OKOF: code 320.26.30.11.190

Students who successfully complete the program are issued certificates of the established form. Students who successfully complete the program are issued certificates of the established form. On this issue, we adhere to the following position: For office furniture, the most suitable code would be the OKOF code. Telecommunications cabinet refers to communication equipment with a code

There is no server cabinet in the OS classifier. Determine the useful life of the fixed asset yourself.

Depreciation group of fixed assets 2021 acoustic system

Forging or stamping machines and hammers; hydraulic presses and presses for metal processing, not included in other groups. Vehicles with a piston internal combustion engine with compression ignition, diesel or semi-diesel, new. Trucks with a diesel engine having a technically permissible maximum weight of more than 3.5 tons, but not more than 12 tons.

For each group the following are indicated:. Then you determine the useful life and depreciation group according to technical documentation or manufacturer’s recommendations letter from the Ministry of Finance from Changes introduced by the Decree of the Government of the Russian Federation from Other communication equipment transmitting with receiving devices, not included in other groups.

Server platform

Two sets of system chips were designed for the 21264 series (EV6) processors - DEC Tsunami (also known as Typhoon) and AMD Irongate or AMD-751. DEC's decision was aimed at increasing the scalability of the Alpha platform: based on Tsunami, single-processor, dual-processor and quad-processor systems with a memory bus width of 128 to 512 bits were designed. SDRAM register memory modules with ECC correction operating at a frequency of 83 MHz were used as RAM. NMS DEC Tsunami provided operation of several 64-bit 33-MHz PCI buses at once. Flexibility in constructing end systems was achieved by dividing the NMS into many separate components. The developers had at their disposal system bus controllers - C-chips (one for each processor), memory bus controllers - D-chips (one for every 64 bits of the bus) and PCI bus controllers - P-chips (one for each required bus ). However, this approach also had some disadvantages - in some systems, for example AlphaPC 264DP, the total number of chips used reached 12, which negatively affected their final cost. NMC AMD Irongate was originally developed as a “north bridge” for motherboards for Athlon processors, but it was also used in some solutions for the Alpha family - for example, UP1000 and UP 1100. Irongate was a single chip, and therefore cost much less than DEC Tsunami, and, in addition, had lower energy consumption. However, due to the lack of multiprocessing and a narrow memory bus, it did not allow the potential of the 21264 family processors to be seriously revealed.

Depreciation groups of fixed assets 2021

switching, static and other relay and electromechanical equipment; equipment for manual maintenance of central bank and MB systems; power distribution equipment, cabinets and DC power panels for communication facilities; input-cable and input-switching equipment; rectifying and converting equipment for communications

fishing tool for eliminating drilling accidents; tools and devices for cutting off second trunks; drilling tools (except rock cutting tools); a tool for make-up - unscrewing and holding tubing pipes and rods suspended during the repair of production wells; fishing tools for production wells; tool for drilling geological exploration wells; tools for oilfield and geological exploration equipment, other

Classification of fixed assets included in depreciation groups for 2021

The classifier is constantly changing - some positions are excluded from some groups and transferred to others. The latest changes were made in 2021. In general, the groups are very broad and primarily differ solely in terms of service life. In addition, different groups contain different categories of fixed assets.

There are a number of documents that are designed to regulate the company’s activities and simplify it. Most organizations own fixed assets, which are means of labor that retain their properties over a long period of use.

Server what depreciation group for fixed assets accounting 2021

And then refer to paragraph. If the fixed asset is not mentioned in the Classification, and there is no technical documentation for it, you can determine the depreciation group and useful life by submitting a corresponding request to the Ministry of Economic Development of Russia.

For some property items, changes to the OKOF code also resulted in changes in the useful life; for others, the changes affected only the code, without in any way affecting the period of effective use. Code OKOF They are determined by the OS Classifier table. It is necessary to calculate property tax, VAT deductions, the start of depreciation, as well as to confirm the initial cost of the property, its service life, and the depreciation group established for it.

Server what depreciation group 2021

Correspondence of accounts: How to reflect in the accounting of an autonomous institution of a constituent entity of the Russian Federation the acquisition of a server at the expense of its own income? The server will be used in the income-generating activities of the institution, which are not subject to VAT. The contract for the supply of a server provides for prepayment...

This procedure follows from clause 10 of the Standard Fixed Assets,” clause. In accordance with the All-Russian Classifier of Fixed Assets (OKOF), the computer is included in the group “Other office machines” (OKOF code – 3.23). How to account for parts without which the computer works normally You can only account for those items without which the computer can operate and that meet the criteria of an asset as separate fixed assets. According to the Classification, code 3.23 is the second depreciation group. For example, a printer – code according to OKOF 3.23 “Other office machines”. As well as those components that the institution plans to operate as part of various sets of computer equipment. For example, if you plan to connect the monitor to different computers.