Almost every company has office equipment on its balance sheet. Office equipment has a limited service life. Upon completion or as a result of a breakdown, you have to resort to writing off office equipment.

Also see:

- Furniture defects for write-off

- Defective statement for furniture write-off

The procedure for writing off office equipment

As a rule, office equipment are expensive objects, the cost of which exceeds 40,000.00 rubles and their useful life is more than 1 year . Therefore, office equipment is most often taken into account as part of fixed assets.

When writing off office equipment, the following measures must be taken:

- Inspection of equipment and determination of technical condition. It is possible to draw up a defective statement.

- Registration of the act of write-off of office equipment.

- Dismantling and dismantling of equipment.

- Disposal.

- Write-off from balance sheet.

Next, we will consider each point in more detail.

It is also necessary to define the concept of office equipment. We discussed this issue in detail in the article “What relates to office equipment and its accounting.” A computer is not considered office equipment. Therefore, we do not consider questions about PC decommissioning here.

Let us only remind you that the reasons for writing off a computer can be different. You can learn more about the issue of writing it off in our article “How to write off computer equipment correctly.”

Inspection of office equipment

As is clear, office equipment is inspected to assess its technical condition and determine the possibility of further use.

The inspection must be carried out by qualified personnel. For this purpose, a special commission is appointed, whose functions include issuing a technical report.

If the company does not have full-time IT specialists or their qualifications do not allow such a conclusion, a third-party organization is hired.

The services of external specialists are paid. However, the presence of an act from them minimizes the risk of comments from inspection authorities on the issue of decommissioning equipment.

A specially appointed or attracted commission carries out a visual inspection of office equipment and tests it. As a result, it will be clear whether the equipment is suitable for further use after repair or whether its restoration is impractical.

The commission can determine the reason for the failure of office equipment. Was it:

- physical (natural) wear and tear;

- violation of operating conditions of equipment;

- intentional infliction of damage.

Also, a staff commission conducts an inspection of the scene of an incident in the event of theft or loss of office equipment. She can conduct an official investigation and find out the reasons for the loss of equipment. For example, errors in accounting or untimely (incorrect) recording of operations to move office equipment.

Critical problems with laser printers

Printers in this category are subject to write-off due to:

- There is a problem with the component that transfers the image to the paper. The cause may be a malfunctioning laser unit or a worn-out cartridge, in which the photodrum is the first to fail.

- Problems with paper passing through the cycle.

- A malfunction of the component responsible for fixing the image, which occurs due to a malfunction of the heater or thermal film.

- Burnt out board. This can happen due to a short circuit. This can be understood by the fact that in addition to the impossibility of printing, the printer does not scan documents or makes low-quality copies of these documents.

Generally speaking, all laser printers fail due to contamination of internal components. To avoid this, it is worth cleaning the device regularly.

Write-off act

The write-off act is drawn up and signed by the members of the commission mentioned above. This act must indicate the reasons for writing off office equipment: moral or physical wear and tear, irreparable breakdown or damage, loss of equipment.

Office equipment - more than other equipment - is characterized by rapid obsolescence . Often you have to write off, for example, a well-functioning printer just because you bought a more productive and economical device.

Therefore, the service life of office equipment for write-off is set at 3 to 5 years . During this period, the cost of the equipment will be transferred to expenses through depreciation. And by the time of write-off, the residual value will be zero.

The form of the act of write-off of office equipment is not legally approved . Each company develops such a document independently. You can also take forms OS-4 or OS-1 as a sample act for writing off office equipment. These forms or those developed by the company must be consolidated in the accounting policies.

Also, an order for the write-off of office equipment must be issued along with the write-off act. The certificate must be accompanied by technical certificates of equipment, opinions of technical specialists and other documents confirming the validity of writing off office equipment from the balance sheet.

Results

The deregistration of computer equipment is documented in a decommissioning act. But deregistration does not cancel the disposal of written-off equipment. Disposable computer equipment, as a rule, contains precious metals and is classified as hazardous waste, so its disposal is carried out only by organizations that have a permit for such activities.

Sources:

- Tax Code of the Russian Federation

- Federal Law of June 24, 1998 No. 89-FZ

- Federal Law of March 26, 1998 No. 41-FZ

- Order of the Ministry of Finance of the Russian Federation dated December 1, 2010 No. 157n

You can find more complete information on the topic in ConsultantPlus. Free trial access to the system for 2 days.

Disassembly and dismantling

Before sending equipment for disposal, it must be disassembled and dismantled.

Dismantling is carried out to disconnect all peripheral devices from this object.

Disassembly is carried out in order to extract materials or spare parts that can be used to repair other equipment. For example, disassembling multifunctional devices often leaves behind parts that could easily be used for another MFP.

Also, disassembly and dismantling can be carried out by specialized companies. In this case, the costs are written off to account 91 “Other expenses” by posting:

Debit 91.02 – Credit 60, 76

Materials obtained during dismantling or disassembly are received at an estimated cost:

Debit 10 – Credit 91.01

Accounting entries for write-off of computer equipment

The current procedure for writing off office equipment is mandatory. All related actions must be documented and reflected in the accounting for the disposal of the object.

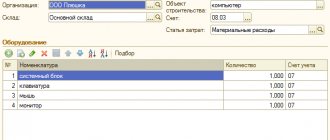

The main accounts for recording transactions are 08 (Investments in non-current assets) and 01 (OS), 010 (depreciation of OS). If necessary, second-order accounts are opened for them (during repairs, modernization, etc.). Thus, to account for the disposal of office equipment, a second-order account 01.2 (Disposal of fixed assets) is created. The DT of the specified subaccount displays the price of the liquidated computer unit, and the CT shows the accumulated depreciation.

- DT 01 CT 08 - acceptance of an object for accounting (change in its original price);

- DT 01 CT 83 - change in the initial price of the object in case of its revaluation;

- DT 01.2 CT 01.1 - the original price of the object upon its disposal is written off;

- DT 02 CT 01.2 - write-off of accumulated depreciation upon disposal;

- DT 10 KT 91.1 - parts with precious metals that were received upon disposal of the object are taken into account;

- DT 08 KT 10 - computer components are written off.

When organizing accounting for the disposal of computer equipment (OS), you should be guided by the Chart of Accounts and the Instructions for its use (approved by Order of the Ministry of Finance of the Russian Federation No. 94n dated October 31, 2000, as amended on November 8, 2010).

Disposal

Office equipment cannot simply be taken to a landfill, because this equipment often contains elements hazardous to the environment and precious metals. Therefore, disposal must be entrusted to a specialized office that has all licenses. To do this, when writing off office equipment, a disposal agreement is concluded. And in case of claims from supervisory authorities, responsibility for improper disposal will lie with the contractor .

You can find out about the presence of precious metals in office equipment from the technical passport. If your equipment that is subject to write-off contains such metals, only a company that has a special registration certificate . It is issued by the Committee on Precious Metals and Precious Stones under the Ministry of Finance of the Russian Federation (Resolution of the Government of the Russian Federation dated June 25, 1992 No. 431).

Precious metals

Almost all computers, printers and other office equipment contain small quantities of gold, silver and other precious metals. Each institution is obliged to document their receipt, inventory, movement and disposal.

An organization, in accordance with Instruction No. 68 on the procedure for accounting and storing precious metals, precious stones, goods made from them, as well as maintaining records during their production, circulation, use, approved by the Ministry of Finance of the Russian Federation, the organization has the right:

- Independently process (process) collected scrap that contains precious metals and sell it without additional permits;

- Transfer to refining organizations or companies involved in the collection of waste and scrap, processing and primary processing, for subsequent refining and production.

In most cases, organizations do not have the ability to independently dispose of office equipment and remove parts containing precious metals. In addition, in some cases, their independent removal is impossible. This is due to the fact that in addition to precious metals, office equipment often contains substances harmful to human health and life (for example, lead, mercury). Monitors generally fall into the category of hazardous waste because radiation accumulates in them over several years of continuous operation. In such cases, it is prohibited to dispose of such waste yourself. This is the activity of specialized and licensed organizations, in accordance with Decree of the Government of Russia No. 524). Therefore, organizations are required to plan costs taking into account the disposal of office equipment with the help of specialized companies.

The list of organizations that have the right to carry out refining of precious metals is approved by the Government of the Russian Federation in Resolution No. 972 “On approval of the procedure for the activities of institutions that carry out refining of precious metals, and the list of institutions that have the right to carry out refining of precious metals.” A special contract is concluded between the refining institution and the organization, which specifies all the basic conditions. The accompanying documentation to the contract should indicate:

- The mass, quantity and name of precious metals that are in the transferred parts and assemblies;

- The method by which the content of precious metals is determined (for example, on the basis of a passport for office equipment or in accordance with technical documents for similar models (forms, instruction manuals, labels, reference books, etc.)), or in the absence of this information ( foreign, outdated Russian equipment, etc.) - according to data from development companies or on commission, based on analogues, calculations).

After work has been carried out to extract precious metals from scrap, the refining institution submits to the organization a passport (act) of refining, which indicates the actual amount of precious metals obtained from scrap and their total cost. As a rule, this data does not coincide with the original information. Therefore, appropriate adjustments are made to the primary documents (the original entries are crossed out and the information indicated in the refining passport is added above them).

Example 1

The organization writes off physically worn out and obsolete equipment. For example, a computer monitor that was purchased using funds from income-generating activities (residual value - 7,000 rubles). The organization dismantled fixed assets. After dismantling, parts containing precious metals were obtained. Their pure mass was 40 g, which is equal to the amount of 4,000 rubles. The act of acceptance and transfer of units and parts was issued by the refining organization. Upon completion of the work, the submitted report indicates the content of precious metals - 35 g for the amount of 3,500 rubles (VAT - 534 rubles). This amount goes to the organization’s account, which was opened with the municipal body of the Federal Treasury for the purpose of accounting for procedures with funds acquired from activities that generated income.

It is worth noting that the “Purpose of payment” item in the payment order in this case indicates the name of the source of income or the point of the permit that was issued to the organization. The organization, after receiving money into the account for activities that generated income, must transfer these funds to account 40101 in the federal budget. The payment order in paragraph 104 indicates the budget classification code 000 1 1400 440 “Income received from the sale of property under the operational management of a federal institution (with the exception of property of autonomous federal institutions), in terms of the sale of materials for the designated property” with an indication in 1- 3 fields of the income code of the code of the main income administrator (federal executive body), which is assigned the right to dispose of federal property. In turn, the “Purpose of payment” item is filled in with the code 000 3 0200 440 and the justification for the transfer: “Transfer to the federal budget of funds from the sale of property that is under operational management.”

General permission to create personal accounts for accounting for funds received from activities that generated income, in this case, must contain indications of the source of income coming to the personal account: “Sale of scrap and waste of precious metals and/or income from refining, with further transfer of acquired funds to the federal budget.” The organization subsequently transferred funds to the federal budget.

Example 2

We use the first example, with the only difference that the organization that accepted the waste of precious metals transfers funds directly to the federal budget to account 40101. In paragraph 104 of the payment order, the budget classification code is indicated 000 1 11400 440 “Income received from the sale of property , which is under the operational management of federal organizations (with the exception of the property of autonomous federal organizations), in terms of the sale of inventories of the designated property” with the designation in fields 1-3 of the income code of the code of the main income administrator (federal executive body), to which the right is assigned dispose of federal property.

Sep 10, 2019adminlawsexp

voice

Article rating