The provisions of Law No. 402-FZ of December 6, 2011 “On Accounting” separate the concepts of preparation and approval of annual accounting reports (clauses 8, 9, Article 13 of Law No. 402-FZ). It becomes fully formed after the paper copy is signed by management or certified with an electronic signature by the corresponding electronic version of the report, but the reporting of companies of different organizational forms is approved in different ways. In addition, due to the complicated situation in the country due to the pandemic, legislators have made changes to the deadlines for approving reports. Let's try to understand this issue.

Obligation to approve the balance

A year has passed, the reporting has been submitted - it’s time to approve the balance sheet at the meeting of the founders. Article 34 of Federal Law 14 states that it is carried out at the end of the year from March 1 to April 30 of the year following the reporting year. At this meeting, the financial results of the activities are approved, or, more simply, the annual balance sheet of the LLC.

Important! The timing of meetings of founders must be specified in the charter of a limited liability company, but must not contradict 14 Federal Law.

What about the sole participants of JSC and LLC?

From December 26, 2021, all the considered rules on notarization apply to organizations consisting of one participant. The Federal Chamber of Notaries also agreed with this position of the Supreme Court.

Thus, the previously applied position on this issue has been changed. Let us recall that previously the FNP’s point of view was as follows: for JSCs and LLCs consisting of one participant, the provisions of Art. 67.1 of the Civil Code do not apply (clause 2.3 of the Manual for certifying by a notary the adoption by a general meeting of participants of a business company of a decision and the composition of the company participants present at its adoption, sent by letter of the Federal Tax Service of September 1, 2014 N 2405/03-16-3).

Sample protocol for approval of annual reporting of LLC

A standard form for the protocol for approving annual reporting has not been established, but it should contain several important points:

- Number of meeting participants: all founders;

- Agenda - approval of the annual financial statements of the LLC;

- Voting – number of votes “for”, “against”, “abstained”;

- Results - the decision to approve or not.

If the LLC has only one founder, then the annual financial statements must be approved not by the minutes of the meeting, but by the decision of the sole founder. Here are the samples:

- If there are several founders - Sample protocol for approval of the annual reporting of the LLC;

- If there is one founder - Approval of the annual financial statements of the LLC sample.

Date of approval of statements in the balance sheet: what to put

Since 2021, all enterprises, except for SMEs, submit their reports to the Federal Tax Service in electronic format. The title page of the electronic version of the balance sheet contains not only a line to indicate the date of preparation of the report, but also a field “Date of approval of statements.” In this line, the company enters the date of approval, if before the reporting was submitted to the Federal Tax Service, a general meeting was held, the reporting was approved and the result was recorded.

But since legislators allow more time for approval of balance sheets and statements than for submitting reports to the Federal Tax Service (until March 31), companies often do not have time to approve the results. In 2021, the deadline for submitting accounting reports for most companies is 05/06/2020, and the deadline for approval of LLC and JSC reports, as is already known, has been extended until September 30. If the reports have not yet been approved before submission to the regulatory authority, then the “Date of balance sheet approval” field is not filled in.

And one more nuance: starting from 2021, the minutes of general meetings of an LLC with any decision made must be notarized, since now they can be declared invalid and decisions canceled. This became clear from the “Review of judicial practice on the application of legislation on business companies”, approved by the Presidium of the Supreme Court of the Russian Federation on December 25, 2019.

From the conclusions given in this document, it follows that every decision of the general meeting of the LLC, including those for which an alternative confirmation method is used, requires notarization. This condition also applies to LLCs with a single participant (clause 3 of Article 67.1 of the Civil Code of the Russian Federation). Taking into account this position of the Supreme Court, the LLC will have to notarize each decision or amend the charter in terms of the possibility of using alternative methods of confirming decisions.

Fine 700,000 rubles

The Internet is full of headlines with huge fines if the balance is not approved. We want to clarify the situation. In fact, there is no penalty for not approving the balance. There is a fine for refusing to convene a meeting of founders. If you didn’t hold a meeting of the founders on time, you’ll get a fine of 500 to 700 thousand rubles. But if the meeting was held as expected - once a year based on the results of the previous year - and simply did not approve the reporting at it, then you will not be punished with any fine.

Important! The fine for the absence of an annual meeting of founders is established by Article 15.23.1 of the Code of Administrative Offenses (clause 11).

Sample protocol on balance approval

The minutes are usually kept by an elected secretary. His full name, as well as the chairman’s, must be reflected in the text. It should also contain the following information:

- date and place of the event;

- participants present (full name) and shares in the authorized capital;

- a note about compliance (non-compliance) with quorum - everyone must participate in decision-making (see Article 37 of Federal Law No. 14-FZ);

- what was decided and with what voting result (must be unanimous, in accordance with the mentioned Article 37);

- signatures of the chairman and secretary.

The document itself is also approved by voting.

Sample protocol on approval of financial statements

Who monitors compliance with the deadlines for convening meetings?

Officials of the Bank of Russia are authorized to impose penalties for the fact that the LLC did not hold meetings of founders (clause 81 of Article 28.3 of the Code of Administrative Offenses). But they are not specifically involved in identifying this violation; an inspection can be initiated based on someone else’s complaint.

Example. you have been the founder of Rezvaya Turtlesha LLC for 5 years. But during all this time, the general director never convened a meeting of the founders. you complained to the Central Bank, and a fine of 700,000 rubles was imposed on LLC “Frisky Turtle”. True, it’s not clear why you need this - after all, the LLC’s money is your money too.

The legislative framework

Article 13 of Federal Law No. 402-FZ of December 6, 2011 puts forward a number of requirements for the financial reporting of organizations. In particular, Part 9 states that in certain cases it must be approved and published.

According to Information of the Ministry of Finance of Russia No. PZ-10/2012, this applies to:

- joint stock companies - in accordance with Article 48 of Federal Law No. 208-FZ of December 26, 1995;

- limited liability companies - in accordance with Article 33 of Federal Law No. 14-FZ of 02/08/1998;

- unitary enterprises - in accordance with Article 20 of Federal Law No. 161-FZ of November 14, 2002.

Accordingly, the minutes of the annual general meeting of LLC participants must contain information on the approval of accounting records.

How to approve

To approve the balance sheet, the executive body (director, general director) convenes a meeting of participants by sending each of them a notice of convocation.

Notices must be given at least 30 days before the proposed date of the meeting. Based on the results of the meeting of participants, a protocol is drawn up, which indicates the voting results.

Do you feel what I'm getting at?

Moreover, approving a document whose numbers tell you nothing is a dangerous business. This is not a sales report, but about the financial results of the entire company, which will go to open sources and will be looked at not only by potential investors, but also by enemies, envious people, and competitors.

And before you sign the protocol stating that the company’s profit is 8 million, of which you decided to use 6 million as dividends, you should know what is behind this and where it may lead next year.

To say that I am the owner and my task is to put pressure on sales, or marketing, or management, or purchasing means avoiding responsibility for what has already been done and losing control over what awaits the company tomorrow.

Types of financial statements

Financial statements can be divided into the following types:

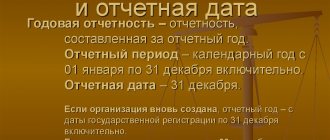

Annual and interim reporting

Interim reporting differs from annual reporting in that it covers a shorter period. It is compiled once a month, quarter or six months. There is no need to submit such reports to the tax office, since most organizations prepare them at their own discretion and for themselves or certain external users.

Interim reporting includes a balance sheet and income statement. Intermediate forms are not approved by law. An organization can take annual reports as a basis and modify them for interim ones.

Full and simplified reporting

Simplified reporting is available to organizations that can conduct accounting according to a simplified scheme. These are small businesses and Skolkovo residents.

The annual simplified reporting must include a balance sheet and a report on financial results. The need for other reporting forms depends on whether they contain information without which it is impossible to objectively assess the financial position and results of the organization’s activities. That is, it is not necessary to include them.

The forms of the balance sheet and financial results report differ from the standard ones. They include indicators only for groups of articles without detail.

Reporting of commercial and non-profit organizations

Commercial and non-profit organizations have different reporting compositions. Thus, commercial organizations usually report on all the forms listed above, but for non-profit organizations there are special features.

Non-profit organizations may not submit any reports to the tax authorities, except for the balance sheet and the report on the intended use of funds, if there is no information for other forms. However, it is recommended to additionally include a report on financial results in the reports in cases where the NPO received significant income from business activities and the data in the target report is not enough to form a reliable picture of the organization’s performance.

Primary and summary consolidated statements

The organization's primary reporting is compiled based on current accounting data. It includes data about one specific organization.

Consolidated reporting is prepared for a group of interrelated organizations. It presents capital, liabilities, income and expenses as total. Consolidated statements show the financial position and financial performance of the entire group rather than each individual organization.

Reporting procedure

The procedure for submitting annual financial statements and the auditor’s report was approved by Order of the Federal Tax Service of Russia dated November 13, 2019 No. ММВ-7-1/ [email protected]

Organizations must submit reports to the tax office at their location. The deadline for this is 3 months after the end of the reporting period. In 2021, the reporting deadline is March 31.

There is no need to submit reports for 2021 to the statistical authorities. This obligation remains only for organizations whose reports contain state secret information, as well as in cases established by the Government of the Russian Federation.

The reporting form is exclusively electronic. As of 2020, all organizations cannot submit forms on paper.

What will happen if you don’t approve

Responsibility arises for failure to hold the meeting itself. But its results cannot be predicted. If the participants do not agree on the balance sheet, the company will not incur sanctions for this.

And the conduct itself is monitored exclusively by the Central Bank based on third-party complaints. Therefore, in practice, such a violation rarely becomes known. So, in fact, logging is only necessary for your own peace of mind for impeccable document flow.

Source: www.ppt.ru

What about fines?

Article 15.23.1. The Code of Administrative Offenses (clause 11) scares us with crazy numbers - for illegal refusal to convene or evasion of convening a general meeting of participants, as well as violation of the requirements for the procedure for convening, preparing and holding general meetings of participants, a fine is imposed on citizens in the amount of 2 to 4 thousand. rubles, for officials - from 20 to 30 thousand rubles; for legal entities - from 500 to 700 thousand rubles.

And, as usual, the devil is in the details: the operator of this fine is the Central Bank and it itself does not go to the offices of companies to impose fines. However, a complaint from one of the offended members of society is enough and a Central Bank employee will come, check, impose an administrative fine and trouble awaits not only the manager and other participants, but also the initiator of the appearance of a mega-regulator employee in your office.