The employer, upon application of the employee, must issue a certificate of income received and personal income tax withheld. An employee can request such a certificate at any time, for example in the middle of the year, in order to then apply to the inspectorate for social deductions or to the bank for a loan. Since 2021, there are two forms of certificates of income and personal income tax amounts for an individual: one must be reported to the INFS, the other must be presented to employees. 1C experts tell you how to generate a certificate of income and personal income tax amounts for an employee in the 1C: Salaries and Personnel Management 8 program, edition 3.

Preparation and testing

To correctly calculate personal income tax, all necessary data on employees must be entered:

- Salary, vacation and sick leave;

- Standard, personal, social, professional deductions;

- All other income and deductions from them.

Payroll accruals are entered using the “Payroll accruals” documents in the “Salary - All accruals” section. Sick leave and vacations are also introduced here. The documents automatically generate deductions, personal income tax and insurance premiums.

Fig.1 All charges

Other documents on personal income tax are located in the section “Taxes and contributions/All documents on personal income tax”.

Fig. 2 All documents on personal income tax

Here you can generate 2-NDFL certificates. Let's look at some commonly used types of documents.

Application for deductions for personal income tax - the document indicates standard Deductions for children and personal deductions. For standard deductions, the validity period is indicated: in the header of the document the general details are the month the deductions are valid, and in the table – the month the validity of each deduction ends.

Fig. 3 Application for personal income tax deductions

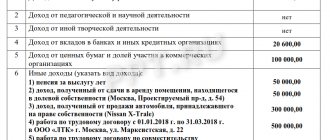

Personal income tax accounting operation - the document takes into account all other income received that is not taken into account in the program, as well as which must be registered manually, accruals, deductions and transfers of personal income tax and some types of deductions. All transactions are recorded on a specific date.

Fig.4 Personal income tax accounting operation

Notification of a non-commercial organization about the right to deductions - the document is used to calculate and accrue property and social deductions. The validity period is specified in the document header.

Fig.5 Notification of the non-commercial organization about the right to deductions

Changes in the calculation of personal income tax from 2021 in the Fireplace: Salary 5.0 program

Federal Law No. 113-FZ dated 05/02/2015 introduced the obligation of tax agents to quarterly submit information on income in respect of which personal income tax was calculated and withheld by them. The calculation is made on an accrual basis for the first quarter, half a year, nine months and a year.

In connection with the advent of the new form 6-NDFL, new opportunities have appeared in the Kamin programs. The main feature is the fact of reflecting the date of receipt of income and transfer of tax. Let's look at the new features of personal income tax calculation. To set up the calculation of personal income tax in a new way, in the section Enterprise -

Accounting setup - Salary calculation,

check the box

Calculate personal income tax

upon payment.

Note: when updating to the latest versions of the Fireplace program, check the Calculate personal income tax upon payment

installed automatically

Then in the settings of the Types of income

(section

Directories and classifiers

-

Types of income

) check for income that does not relate to salary (for example, sick leave), check

the box to calculate personal income tax when paying income

.

Let's consider the mechanism of the new

Personal income tax as an example. Let's send employee Goroshko on vacation.

We will pay the employee wages during the interpayment period. Paid when ticked

, the checkbox

to submit personal income tax

is checked automatically. It is not recommended to remove it.

Also, if due to reason the NFDL is not withheld, you can go to the settings

and check for a checkmark

excluding personal income tax

.

In this case, the document transfers personal income tax

filled in with the filling mode

based on the payment

and select our payment.

Next, when calculating personal income tax for the month, we will see the calculation of only salary

Personal income tax, but to check yourself, our

vacation personal

income tax is also visible in the calculation.

When filling out the document Transfer of personal income tax

at the end of the month, the program tracks that a piece of personal income tax has already been transferred.

It is important to pay attention to the settings

to fill out a document according to

what is not listed

, and not

according to what was withheld

.

The situation is the same with the calculation of sick leave.

Employee Davydova went on sick leave from to.

Let's consider payment of sick leave using an inter-settlement statement. You can fill out the document on the basis of the document - and indicate our calculation, and on the basis - sick leave, sick leave at the expense of the employer.

Have you noticed that in our example, despite the presence of a checkmark, submit personal income tax

(in the settings the fact of personal income tax withholding is noted), the personal income tax amount is missing.

Personal income tax was not calculated because the employee’s deductions exceeded her income for the current month. This example shows us how we can use another innovation in the document; for this, in the settings you can check the box not to provide standard deductions

, and then the deductions will be provided in the personal income tax document.

After this setting, it is important not to forget to click on the update

.

When calculating personal income tax for the month of April, we also see the calculation of only salary

Personal income tax, personal income tax, sick

leave

is shown for reference.

If the payment is not salary

income occurs along with the payment of wages, then in the

payment

personal income tax calculation

window will be filled in .

So we looked at the new features of the Fireplace program for non-salary

accruals.

Sincerely, Yulia Timoshenkova

Specialist - salary consultant Simple solutions

Source

Filling out the 2-NDFL certificate for submission to the Federal Tax Service

You can create a certificate in the “Taxes and contributions-2-NDFL for transfer to the Federal Tax Service” section or by selecting the appropriate document in the “Taxes and contributions-All documents for personal income tax” section. In the journal that opens, click the “Create” button to generate a new certificate. First you need to fill out the header of the document:

- Year – the year (reporting period) for which the certificate is provided to the Federal Tax Service;

- OKTMO/KPP – territorial reference of the organization at the place of submission of tax reports. Filled out in the “Main – Organizations” section in the card on the “Registrations with tax authorities” tab;

- In the Federal Tax Service (code)/from the checkpoint - details of the tax office;

- Type of certificate – can take the values “Annual reporting” and “On the impossibility of withholding personal income tax”;

- Buttons “Initial”, “Correcting”, “Cancelling” - indicate the status of the certificate.

Fig.6 Filling out the 2-NDFL certificate for submission to the Federal Tax Service

Filling out the 2-NDFL certificate is done by clicking the “Fill” button. The “Number” button is needed when manually entering employees, which in turn is done with the “Selection” button. Before posting the document, you can check the correctness of the entered data using the “Check” button. In this case, the verification algorithm embedded in the program will be used. The accuracy of the calculations provided and the personal information of the employees included in the card will be checked. Before sending, the certificate must be completed by clicking the “Submit” button. Sending to the Federal Tax Service can be done through a universal data exchange file in xml format using the “Upload” button.

With the 1C-Reporting service connected, you can immediately send the prepared document to the tax office. If this service is not connected, contact us: as part of the business support program with 1C specialists, we will advise you on how to quickly set up and connect this service. If you use this service, go to the menu item “Send-Send to regulatory authorities”. Also in this case, it is possible to check the accuracy of the calculation on-line. In the menu there is the item “Send-Check on the Internet”. If an error occurs, you can see the reason (the line will be red when checking, and the reason will be marked). By double-clicking on any line, you can generate a 2-NDFL reference report in 1C for any employee from the list, but you cannot save and print a certificate obtained in this way.

Free expert consultation

Tatiana Panchenko

Consultant-analyst 1C

Thank you for your request!

A 1C specialist will contact you within 15 minutes.

1C-KAMIN: Salary. Version 5.0

To withhold personal income tax according to the 2021 rules, the following documents are used:

Document “Personal Income Tax” - for withholding personal income tax from wages (for example, type of income 2000 - “Salaries”). Date – last day of the month.

Document “Payment” with the transaction type “Intersettlement payment” or “Salary payment” - for withholding personal income tax on all other types of income (for example, 2012 - “Vacation, vacation compensation, compensation upon dismissal”, 2300 - “Temporary disability benefits”, 2760 – “Material assistance”) – at the time of income payment!

What settings need to be made in the program?

In the “Types of Income” directory, indicate from which types of income tax is withheld when paying income: check the box “calculate personal income tax when paying income.”

For types of income for which this attribute is set, personal income tax will be calculated at the time of payment of income in the “Payment” document when selecting the type of operation “Intersettlement payment” in the “pay document amount” or “pay accrued amount” operating modes. For other types of income, personal income tax will be calculated in the personal income tax document.

1C: Salary and personnel management 8.2, version 2.5

As an example of possible errors, you can consider the formation of the “Vacation” document. For example, an accountant accrued vacation pay, and its payment was planned for January 31. But the employee received these funds on January 30. In this case, there is a change in the date in the vacation pay accrual statement. That is, the report records January 30.

If you go to the tax register after such an error, you will see that it displays the date indicated in the personal income tax tabular section. It is located in the “Payment” tab, which is located in the “Accrual of leave for employees of organizations” document.

Using this example, you can understand the consequences of mismatching dates within any month. For the numbers to start matching, you need to do one of two things:

- Recalculate the entire document.

- Only recalculate personal income tax.

It happens that for various reasons it is impossible or undesirable to perform a recalculation. In this case, the date can be changed manually.

If you post a document with different dates, the program will not work correctly. There will be a discrepancy in the data that contains the two registers.

Mismatched dates will lead to process conflicts.

After making payment for vacation pay, you need to look at the movement of this document in the register, which takes into account taxes. It will record the tax already withheld. If the date displayed in it coincides with the date of the accrual register, the system will record an error.

For example, the date when the income was actually received (line 100) is January 31. The document shows that the tax was withheld on January 30. (line 110).It turns out that the tax was withheld before the employee received income from the company in the form of vacation pay. But it can’t be like that. Therefore, you need to correct the dates so that the documents are posted correctly. In the case of vacation pay, this should be one day. If tax was calculated on 30, then the same number should be indicated in the payment document.

Another error may appear. When the payroll process starts in the system, the program begins to harmonize personal income tax data. Let's say the dates were entered incorrectly. First, payroll is calculated (the 30th) and then the tax is withheld (the 31st).

The system records this order as incorrect and independently corrects the numbers. For this reason, the tax is automatically canceled from the date of 31.01 and it is withheld on the day of payroll - 30.01, without changing the amount.

When wages are paid, the program records withheld tax in a similar manner. The line in personal income tax 31.01 comes with a minus, and in the second line (30.01) a plus is noted.

Another possible consequence of incorrect dates is the appearance of two groups of lines (from 100 to 140). In the first group, the program will reverse everything, in the second, it will accrue everything again.

You can avoid such errors by tracking dates in two lists. This refers to accounting for taxes and income.

If these dates match, the program will work correctly.

Other Features

As you have already understood, there are two ways to generate certificates and they depend on the final recipient:

- You must issue a document for your subordinate upon his dismissal or upon his personal request upon written application.

- For the tax inspectorate, you, as a tax agent, annually submit information on your people’s taxes to the tax office according to their territorial reference. When you are reporting for people up to 25 people, it will be enough to submit information on paper, but when this number of people exceeds this threshold, you will have to send an electronic report.

Next, I suggest you familiarize yourself with the status of taxpayers:

- Assigned to a resident of the Russian Federation.

- Designed for non-residents of our country.

- Include all highly qualified specialists of your company here.

- Invented for subordinates participating in the state program for the voluntary resettlement of compatriots living abroad;

- This status is assigned to foreign employees with refugee status or those who have received temporary asylum in the Russian Federation;

- If your subordinate is a foreigner and works for you under a patent, then you classify him in this category.

Know that in order to print the certificate, you just need to click on print the income certificate (2-NDFL). Certificates of income of individuals will be generated.

Calculation of personal income tax in PP “KAMIN: Payroll calculation. Version 3.0."

At the beginning of this year, significant changes took place in accounting for personal income tax, based on changes to Articles 223 and 226 of the Tax Code of the Russian Federation. A new form of the 6-NDFL report has appeared and, as a result of legislative changes, changes have occurred in the software, including the KAMIN: Payroll program. Version 3.0. The work of other programs for the formation of 6-personal income tax is similar.

Let's consider the theory of legislative changes.

Article 223 of the Tax Code determines the date of actual receipt of income. :

"1.

For the purposes of this chapter, unless otherwise provided for in paragraphs 2 - 5 of this article, the date of actual receipt of income is defined as the day of:

1) payment of income, including transfer of income to the taxpayer’s bank accounts or, on his behalf, to the accounts of third parties - upon receipt income in cash;"

That is, the general rule ties the date of receipt of income to the date of payment. For us, the date of receipt of income is the first date for filling out the line of the second section of 6-NDFL. There are exceptions to this rule, a full list of which you should study yourself in Article 223 of the Tax Code.

Corrections in intersettlement documentation 1C: ZUP 8.2, version 2.5

When working with this version of the software, the situation is a little different. The dates recorded in the “Vacation” document do not affect the process of calculating personal income tax that was withheld.

If the date January 30 is entered in the statement, and the payment of accrued vacation pay is determined on January 28, then after the completion of the procedure, no tangible changes will occur.

Having examined the registers, you can see that the program noticed the withheld personal income tax and registered it despite the discrepant dates.

Drawing up a payment order for personal income tax payment

The Table shows the procedure for filling out the fields of the payment order when paying personal income tax on a monthly basis:

Tax payment details must be obtained from your tax office or on the official websites of the tax authorities. For Moscow, you can use the website www.mosnalog.ru

An example of filling out a payment order for personal income tax payment

Please rate this article:

Registered users have access to more than 300 video lessons on working in 1C: Accounting 8, 1C: ZUP

Registered users have access to more than 300 video lessons on working in 1C: Accounting 8, 1C: ZUP

I am already registered

After registering, you will receive a link to the specified address to watch more than 300 video lessons on working in 1C: Accounting 8, 1C: ZUP 8 (free)

By submitting this form, you agree to the Privacy Policy and consent to the processing of personal data

Login to your account

Forgot your password?

Working with interpayment documents 1C: ZUP 8.3, version 3.1

Let’s say in the “Vacation” document the planned payment date is January 28. An error may result from setting a different number as the day the document was created. For example, 30.01.

If you make sure that the day the “Vacation” document is created is earlier than the planned payment date, then there will be no problems when registering the tax.

The program will allow you to fill out the form.

The tax will be determined without any difficulties and will be recorded as withheld during the process of conducting the Statement.

How to check data for preparing information on form 2-NDFL in 1C 8.2

At the first stage, the information necessary to prepare information in form 2-NDFL is checked.

Checking the correctness of filling in information about the Organization

You can check the correctness of filling in information about the Organization in 1C 8.2 through the Enterprise → Organizations.

Verification of personal data for individuals

- Menu Personnel → Individuals ;

- The personal data of an individual must include the following information: on the General – full name; TIN; identity document details, etc.; on the Addresses and telephones – the address of an individual:

1C: ZUP 8.3, version 3.1

In this version of the software, the date when income is received is also recorded in two registers:

- income accounting;

- tax accounting.

For an example of working with errors, you can again take the “Vacation” document. The Register, which contains information about income accounting, displays the payment day recorded in the main form of the document.

The Tax Registration Register contains the date from the form “More details about the calculation of personal income tax”.

You need to make sure that these two dates coincide. This task is made easier by the convenient features of the program. If dates change in the main form of the document, the numbers will automatically change in the other one.

That is, the ZUP program 3.1. Helps keep documents consistent.

But there is one possible error in this release of the 1C software product. It may appear in the “Sick Leave” document.

If it is carried out together with the payment of wages and the date is changed incorrectly, then the automatic replacement of numbers will not work. The previous date will remain in the “More details about personal income tax calculation” form.

There are two ways to fix the error:

- manually set the correct date in this form;

- perform recalculation.

In all other cases, the program should automatically replace the numbers when entering the payment date. But it is still recommended to check compliance.

Errors in interpayment documentation 1C: Accounting 3.0

To test possible errors, you can enter incorrect dates in the “Vacation” document. The payment date is set to 09/05. In this case, the day of creation of the document will be different - September 10. After these steps you need to post the document.

As a result, the system will display a date error and will not allow you to post the document.

Keeping track of dates in reports is especially important in software version 3.0. In this configuration, the user cannot see the withheld personal income tax in the error form, which is displayed on the desktop screen.

If the dates do not match, this can only be noticed by studying the register yourself.