Despite extensive experience and high qualifications, there are a number of issues that cause disagreements and questions even among experienced accountants. One of these includes the month of accrual of vacation pay, if the vacation is from the 1st day. In this article we will look in detail at the procedure for calculating vacation pay.

Month of accrual of vacation pay if vacation is on the 1st

Legal basis

According to the Labor Code, every employee of the Russian Federation has the right to 28 days of paid leave. At the request of the employee, this period can be divided into parts, and the minimum part of the entire vacation cannot be less than two weeks. There are also a number of preferential categories and specialties where employees are entitled to additional days of vacation. Depending on the legal basis, they can be paid or issued at your own expense.

If holidays that are considered public holidays fall during the vacation period, then the vacation is extended by this number of days. An employee has the right to reschedule a planned vacation, but this can be done no more than twice a year. When an employee is dismissed and has unofficial leave, the employee is entitled to compensation for these days.

Compensation is due for late payment

According to the law, benefits must be accrued and paid to the employee three days before the specified date in the application. Ignoring this will result in serious fines and administrative penalties for the employer.

If the audit reveals the fact of incorrect and untimely accrual of money, then for an individual entrepreneur this threatens with a fine of up to 5 thousand rubles, and for an LLC - up to 50 thousand. This rule is regulated by Article 136 of the Labor Code of the Russian Federation.

Art. 136 TK

Even if for some reason the employer is unable to meet this three-day deadline, he should be compensated for each day of delay. And the amount of compensation and the basis for its calculation must be formalized in a special local act. Only then, when checked by regulatory authorities, will the situation not be considered a violation.

But when an employee indicates the start date of vacation on the 1st, the situation raises many questions. After all, in fact, the month has not yet been fully worked at the time of actual payroll. And wages must be issued along with benefits. How to be in this case?

Vacation next month: personal income tax

From January 1, 2021, a new rule is in effect - personal income tax on vacation pay must be transferred no later than the last day of the month in which you paid it to the employee. And if this day is a day off, then no later than the next working day. In this case, as before, the tax must be withheld at the time of payment. This rule also applies to rolling holidays. For personal income tax, only the date of payment is important (subclause 1, clause 1, article 223, clause 6, article 226 of the Tax Code of the Russian Federation).

Example . Vacation next month: personal income tax accrual A company employee goes on vacation from July 1st. He must be given vacation pay no later than June 28. The accountant accrued them to the employee on June 28 and on the same day transferred vacation pay and withheld personal income tax from them. And the tax itself was paid to the budget on June 30.

The amount of vacation pay amounted to RUB 34,561.11. Personal income tax on this amount is 4,493 rubles. The company is small and does not create a reserve for vacations. The accounting entries will be as follows. June 28: DEBIT 44 CREDIT 70 – 34,561.11 rub. – accrued vacation pay;

DEBIT 70 CREDIT 68 subaccount “Personal Tax Payments” – 4493 rubles. – personal income tax accrued;

DEBIT 70 CREDIT 51 – 30,068.11 rub. (34,561.11 – 4493) – vacation pay is transferred to the employee minus personal income tax.

June 30: DEBIT 68 subaccount “Personal Income Tax Payments” CREDIT 51 – 4493 rub. – Personal income tax on vacation pay is paid to the budget.

I have a question. The employee is asking for leave from the next day. The management doesn't mind. When should personal income tax be transferred in this case?

You need to start from the date of payment of vacation pay. For personal income tax, it does not matter whether you violated the requirement to pay vacation pay “no later than three days” or not. For example, on July 4, an employee agreed to leave on March 5. His vacation pay was transferred to him on July 4th. This means that you can withhold personal income tax on the same day, and you can transfer the tax any day until the end of July.

Determining the billing period

Considering that the accrual must occur before the reporting period is fully exhausted, the calculation should be made on the average. The accountant must calculate the average salary for the last 12 months. If an employee has only worked for six months, then the average is calculated for 6 months.

When calculating vacation pay, the average annual salary is taken into account

If an employee goes on vacation from July 1, 2021, then the period that, on average, will be taken as the basis for the calculation will be 07/1/2018 to 06/30/2019. There is one more nuance of the legislative framework that may raise questions. If the first day falls on a public holiday. How to calculate benefits in this case? This provision is regulated by Article 136 of the Labor Code (Part 8), which provides for such a situation. If the vacation coincides with a holiday, the payment must be made the day before.

Vacation next month: accounting for vacation pay

When calculating income tax, vacation pay must be included in expenses in proportion to the vacation days falling within each reporting period. This position is shared by employees of the Russian Ministry of Finance (letters dated May 12, 2015 No. 03-03-06/27129, dated June 9, 2014 No. 03-03-RZ/27643). The arguments of the employees of this department are as follows.

Vacation pay is classified as labor costs (Clause 7, Article 255 of the Tax Code of the Russian Federation). And such payments are the same salary, only paid in advance. This means that a general principle applies to vacation pay: they are recognized as expenses in the reporting (tax) period to which they relate, regardless of the date of actual payment (clause 1 of Article 272 of the Tax Code of the Russian Federation).

For example, an organization has income tax reporting periods of the first quarter, half a year and nine months. If vacation falls in June and July, then vacation pay must be distributed. The amount of vacation pay that relates to June should be included in expenses for the six months. And the July part of vacation pay should be reflected in expenses for 9 months. That is, the expenses will be taken into account in any case, but later.

Example . Tax accounting of carryover vacation pay We use the condition of the two previous examples. The employee's vacation begins on July 1. This means that the entire amount of vacation pay must be included in the expenses of the third quarter. At the same time, the amount of insurance premiums from them can be taken into account in the first half of the year.

In accounting, the accountant included vacation pay as expenses for June. But since the company is small, there is no need to reflect temporary differences in accounting.

Features of granting vacations

Vacation pay is accrued at the request of the employee. Large enterprises maintain a vacation schedule, which is laid out before the start of the calendar year. This helps create a continuous production process and allows the accounting department to make all payments correctly and on time. The vacation schedule is maintained in accordance with Article 123 of the Labor Code of the Russian Federation.

123 Article of the Labor Code of the Russian Federation

In small companies there may not be such a schedule, in which case the manager can independently designate the recommended vacation period. But in any case, if an employee writes a statement, according to the law he cannot be refused. In addition, the enterprise must maintain a time sheet. This is a document that controls employee visits. An Order must be drawn up for the enterprise, which designates the person responsible for maintaining the Timesheet.

Timesheet of Working Days

The document can be completed in writing or electronically. The choice of report card designation (letter or code) is also determined by management.

Article 135 of the Labor Code clearly regulates the procedure for registering leave and calculating money. Payment to an employee can be made in any way:

- to a current bank account;

- on the map;

- cash at the cash register.

Each employer independently establishes for itself a convenient form of payment.

Vacation pay can be issued to an employee either in cash or in non-cash form.

Transferring money to a card is much more convenient for an enterprise, as it allows you to minimize the costs of cash transactions. When hiring an employee, the company must control the opening of a bank account. The employee writes a statement to the accounting department, where he indicates the account details. According to this statement, all accruals and payments (vacation pay, sick leave, bonuses, wages) are carried out in the future.

The procedure for granting vacations

Accrual of vacation pay if vacation from the 1st day

In which month's payroll should the amount of accrued vacation pay be included if the vacation starts on the 1st? For example: vacation from 03/01/2016. We include in the calculation the 12 months preceding the start of the vacation, i.e. from 03/01/2015 to 02/29/2016 Because Vacation pay must be issued no later than 3 days before the start of the vacation; we accrue without taking into account February (it is not possible to accrue salary for February in advance - the employee is on a piecework basis). We calculate and issue vacation pay without taking into account February, after calculating the salary for February, we recalculate vacation pay. Everything is clear here. The question is, in which month should vacation pay be included? After all, the payment for them was made in February, and recalculation in March, and the start of the vacation in March?

You include the amount of vacation pay in the salary slip of the month in which you accrue these amounts. So, if an employee’s vacation begins on March 1, you must give him vacation pay no later than 3 days before the start of the vacation, that is, in February.

In this case, you accrue vacation pay in February. You also reflect this operation in accounting in February. If you are a small business and do not create reserves for vacation pay, then you can include the entire amount of vacation pay in your accounting as February expenses. Despite the fact that the vacation itself will be in March. The fact is that since 2011, expenses incurred by the organization in the reporting period, but relating to the following reporting periods, may not be reflected in the balance sheet as deferred expenses (in a separate line) (clause 65 of the Accounting Regulations, approved by order Ministry of Finance of Russia dated July 29, 1998 No. 34n).

In such a situation, insurance premiums from vacation pay must also be calculated in February, when the payments themselves are accrued (Part 1 of Article 7 and Part 1 of Article 11 of the Federal Law of July 24, 2009 No. 212-FZ and letter of the Ministry of Labor of Russia of September 4, 2015 No. 17-4/Вн-1316. dated 08/12/2015 No. 17-4/ОOG-1158 and dated 06/17/2015 No. 17-4/В-298).

If subsequently, that is, in March, you find out that you have accrued less vacation pay to the employee than necessary, you accrue additional payment in March. That is, you indicate the amount of this surcharge in the payslip for March, make accounting entries in March and charge insurance premiums for the surcharge in this month.

If you apply the simplified tax system with the object income minus expenses, then you have the right to include the amount of paid vacation pay in expenses on the date of payment of money to the employee (subclause 6, clause 1, article 346.16 and subclause 1, clause 2, article 346.17 of the Tax Code of the Russian Federation).

Have a question? Our experts will help you within 24 hours! Get answer New

The procedure for registering vacation at the enterprise

According to Article 123 of the Labor Code of the Russian Federation, the following registration procedure has been developed:

- the employee writes a statement indicating the period worked and the start date;

- the manager checks this data and signs the application;

- an Order is created at the enterprise;

- The accounting department makes the payment three days before the date indicated in the application.

Vacation pay is calculated based on the employee’s average earnings.

Employees often ask how many days they have already “earned” for vacation. This applies to newly registered employees who have not worked for another full year without a break. According to the law, an employee can take advantage of vacation 6 months after employment. For each month 2 days are credited.

Calculation of vacation days

But the Law also defines a separate category of persons who are entitled to benefits. These include:

- Chernobyl victims;

- mothers who raise children themselves;

- workers with many children, etc.

There is also the concept of standard and extended vacation. Workers in the field of education, health care, the Ministry of Internal Affairs and the category of people working in enterprises with hazardous conditions have an extended period of rest.

Table 1. Number of vacation days for different categories of employees

| Category of workers | Main holiday | Preferential vacation |

| Most of the workers | 28 | — |

| Doctors | 36 | + |

| Teachers | 56 | — |

| Chernobyl victims | 28 | From 7 to 15 days |

| Workers under 18 years of age | 31 | — |

| Working disabled people | From 30 | + |

| Category of “harmful” work | From 50 | + |

| Employees of the Ministry of Internal Affairs | 30 | + |

Reference. A separate category includes people who work in the Far North. Given the difficult working and living conditions, they are entitled to extended rest and accrual of length of service according to a different coefficient.

The general rules for providing rest are regulated by Chapter 9, Art. 114 RF TC.

Chapter 9, art. 114 RF TC

The calculation period for accrual includes all time worked including holidays. But maternity leave and temporary disability are not included in the billing period.

How to pay employees who have vacation next month

If an employee goes on vacation next month (in the early days), it will inevitably turn out that he will need to be paid vacation pay before the end of the previous month. After all, you must issue them no later than three calendar days before the start of your vacation. The period of three days is prescribed in Article 136 of the Labor Code of the Russian Federation. And Rostrud, in a letter dated July 30, 2014 No. 1693-6-1, indicated that this article refers to calendar days.

For example, vacation starts on July 1st. This means that vacation pay needs to be transferred at the end of June. But this does not mean that June should not be included in the calculation period. If an employee, say, gets sick on June 29 or 30, that is, after his vacation pay has been paid. they can always be counted.

But it is not necessary to pay salaries for June along with vacation pay. It can be paid within the terms established by the company.

You can exclude vacations from the 1st day of the month at the stage of preparing the vacation schedule. Then you won’t have to recalculate anything in any case. But in practice this is not always possible.

Rules for calculating vacation pay

When calculating vacation pay, it is important to rely on a few simple tips:

- in order to calculate vacation pay, it is necessary to determine the average earnings (AS). To do this, you need to divide the amount of wages by the number of days in the month, taking into account workdays, weekends and holidays;

- Knowing the average daily earnings, you can easily calculate the amount of vacation pay. To do this, the SDZ should be multiplied by the number of days according to the application;

- After calculating vacation pay, the amount of income tax is determined, which must be withheld no later than the day the vacation pay is paid. The accounting department must transfer personal income tax in the same month to the budget in which the payment was made.

Algorithm for calculating vacation pay

Benefits must be accrued clearly according to the number of days specified in the application. Even if this period coincides with public holidays, the vacation is simply extended, but vacation pay for these days is not paid.

Thus, the month in which vacation pay was accrued in a situation where vacation starts on the 1st will be considered the month in which vacation pay was paid. This happens because income tax and its transfer to the budget will also be made last month.

The accountant must make the calculation based on average daily earnings. If, after the end of the billing period, it turns out that the SDZ is higher, then the employee will be recalculated and the money will be credited from above. When determining the average salary of an employee, the accountant does not take into account the following items:

- travel allowances;

- compensation;

- benefit payments;

- bonuses;

- payment for a particularly important task, etc.

Calculation of average daily earnings

Also, if an employee is one of the company’s shareholders and is paid monthly dividends, they are not included in the amount of average earnings by the accountant.

To calculate the accrual amount, use the vacation pay calculator.

Vacation next month: insurance premiums

Insurance premiums must be calculated in the month when the payment itself is accrued (Article 11 of the Federal Law of July 24, 2009 No. 212-FZ). That is, no later than three calendar days before the start of the vacation. If such a day falls on the previous month, then vacation pay must be included in the contribution base for this month (letter of the Ministry of Labor of Russia dated June 17, 2015 No. 17-4/B-298). And you can take into account the same amount of contributions in the same month when calculating your income tax. The Ministry of Finance thinks the same (letter dated June 1, 2010 No. 03-03-06/1/362).

The same procedure must be applied in case of violation of the terms of payment of vacation pay. If an employee requests vacation starting tomorrow, contributions must be calculated in the same month as vacation pay. Even if, according to the Labor Code, you should have paid them last month.

Let's say an employee goes on vacation in July, and vacation pay is paid to him in June. If contributions are calculated in the same month in which the vacation begins (July), this may lead to a dispute with fund inspectors. They will accuse the company of understating contributions. And if vacation pay is issued in one quarter, and the vacation begins in another, you will face not only penalties, but also a fine.

Insurance premiums must be transferred no later than the 15th day of the month following the date when the premiums were calculated (letter of the Federal Insurance Service of the Russian Federation dated December 16, 2014 No. 17-03-09/08-4428P). From January 1, this rule also applies to contributions for injuries.

Example. Calculation of insurance premiums for carryover vacation pay We use the condition of the previous example. The accountant made entries for contributions on June 28: DEBIT 44 CREDIT 69 subaccount “Settlements with the Pension Fund” - 7603.44 rubles. (RUB 34,561.11 × 22%) – contributions to the Pension Fund have been accrued;

DEBIT 44 CREDIT 69 subaccount “Calculations for health insurance” – 1762.62 rubles. (RUB 34,561.11 × 5.1%) – medical insurance contributions accrued;

DEBIT 44 CREDIT 69 subaccount “Calculations for social insurance in case of temporary disability and in connection with maternity” - 1002.27 rubles. (34,561.11 rubles × 2.9%) – contributions to the Social Insurance Fund of the Russian Federation have been accrued;

DEBIT 44 CREDIT 69 subaccount “Calculations for social insurance against accidents at work” – 69.12 rubles. (RUB 34,561.11 × 0.2%) – contributions for injuries are reflected.

The accountant transferred the vacation pay contributions as part of the company's total payment for June. The deadline is July 15.

What to do if vacation pay is late or incomplete

If an employee does not receive vacation pay on time or does not receive it in full, then there are a number of government bodies where you can turn to for clarification of the current situation and to challenge it. But first, of course, it is better to contact the accounting department directly and clarify why vacation pay was not paid on time and in full. Perhaps the employee himself did not keep track of his wages correctly. For example, when receiving your basic salary in a “gray” way, you should not expect that the same money will be credited during your vacation.

The State Labor Inspectorate monitors violations by employers and protects the interests of workers

If, nevertheless, a fact of illegal actions on the part of the employer is recorded (denial of leave, untimely accrual of benefits, incorrect calculation of the amount), then you can contact the state labor inspectorate and appeal this situation.

Understanding the regulations on the interaction between employer and employee, knowledge of the rights of labor legislation will help to insure yourself against unlawful actions on the part of superiors.

How does a salary increase affect vacation pay?

As you know, wage indexation entails a change in the amount of vacation pay. Decree of the Government of the Russian Federation dated December 24, 2007 No. 922 considers several options for increasing average earnings, which directly affects the calculation of vacation pay:

- if an increase in tariff rates, salaries, or remuneration occurred during the billing period, then all payments in this period are subject to indexation,

- if the increase occurred after the billing period, but before the basis for payments taking into account the average earnings, then the average earnings calculated for the billing period increase;

- if an increase in tariffs/salaries, etc. occurred during the main vacation, then average earnings increase only from the moment the tariff rate is increased until the end of the vacation.

As average earnings increase, payments in absolute amounts do not increase.

Important! These provisions apply only to situations where salary increases occur within an organization/structural unit. If the salary of only one employee has increased, there will be no indexation of average earnings.

Example 1. A factory employee is on vacation from June 1 to June 28. He has a salary of 30,000 rubles and a bonus of 10%. The average salary for vacation will be equal to (30,000 + 3000) × 12 / (12 × 29.3) = 1126.28 × 28 = 31,535.84.

On June 18, the company increased salaries by 5%. This means that the average salary must be indexed from June 18, that is, the employee must receive an additional payment for vacation in the amount of 5% for the period from June 18 to June 28:

((30 000 + 3 000) × 1,05 × 12 / (12 × 29,3) – 1126,28) × 11 = 56,31×11 = 619,41

Example 2. The employee was on vacation from June 4 to June 28, 2021. He was paid a salary of 30,000 and a production bonus of 5,000. His average salary for vacation is (30,000 + 5,000) × 12 / (12 × 29.3) = 1194.54, the amount of vacation pay is 1194.54 × 25 = 29863 ,5. Vacation pay was paid no later than May 31.

From June 1, there is a 5% increase in salaries. That is, the increase occurred after the billing period, but before the onset of vacation. Thus, the average earnings for the entire vacation period are indexed. At the same time, the employee receives a bonus, determined not as a percentage of the salary, but as a specific amount.

The amount of the surcharge will be calculated as follows:

(30 000 × 1,05 + 5 000) × 12/ (12 × 29,3) = 1245,73

1245,73 × 25 — 29 863,5 = 1279,75

Please note that all amounts given in the examples are rounded to the nearest hundredth. In real calculations you will end up with a long line of digits after the decimal point. In the recommendations of the Federal Tax Service and the Ministry of Labor there are no special instructions on rounding amounts, but in the letter of the Ministry of Health and Social Development of the Russian Federation dated December 7, 2005 No. 4334-17, department specialists recommend using intermediate values when calculating average earnings, rounded according to mathematical rules to two decimal places, that is, to hundredths .

Example. The employee was on vacation from June 1 to June 28, 2021. He receives a salary of 30,000 and a bonus of 20%. Based on this, the calculation of the average salary for a vacation looks like this: (30,000 + 6,000) × 12 / (12 × 29.3) = 36,000 / 29.3 = 1,228.668941979…

1228,67 × 28 = 34 402,76

1228,669 × 28 = 34 402,732

1228,6689 × 28 = 34 402,7292

Rounding options show that more decimal places in intermediate calculations provide greater calculation accuracy. However, it should be taken into account that payments are calculated in rubles and kopecks, and therefore it is advisable to round the amounts to the nearest hundredth of a decimal point for the accuracy of calculations.

Payments excluded from annual wages for calculating SDZ

According to the article of the Labor Code of the Russian Federation, calendar days are excluded from the billing period for calculating SDZ along with payment:

- regular leave and leave without pay;

- being on a business trip;

- temporary disability benefits;

- maternity leave;

- downtime and organized strikes.

The non-inclusion of previous holidays in the calculation of subsequent holiday pay corresponds to the principle of the inadmissibility of double payment for one period.

Payments that do not take part in the formation of SDZ include social payments:

- one-time financial assistance;

- payment for travel tickets, food and recreation;

- Payment of utility services;

- social help;

- payment for workwear;

- compensation of interest on loans under corporate agreements;

- dividends from shares.

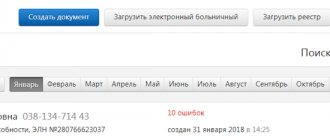

Preliminary program setup

Setting up in 1C Accounting 8.3 is necessary so that program users can work with personnel and wages documents. To do this, go to the “Administration” section and click “Accounting Settings”.

Now you can set up sick leave and vacation accruals. You should go to “Salary Settings” to check:

- sick pay;

- vacations;

- executive documents.

This will allow the program to understand that it will maintain personnel and payroll records. Without the required parameters, it will be impossible to create the corresponding documents. It should be noted that personnel records will be carried out in full. This means that documents on admissions, dismissals and various transfers regarding employees will be checked.

Working with small firms should be done after one more setup. Necessary:

- go to “Salary accounting procedure” if you are accounting for up to 60 employees. You should check the box next to the corresponding parameter;

- go to “Vacation Reserves” if you need to create reserves. In the functional section “Accounting for vacation reserves”, you need to check the corresponding menu.