Each participant in a limited liability company owns a certain share in the authorized capital. Usually the size of shares is expressed as a percentage, but their fractional ratio can also be indicated. Initially, shares in the management company are distributed at the stage of company registration. But later situations may arise when it is necessary to redistribute shares in the LLC between participants.

Most often, this happens after a participant leaves the company, because his share passes to the LLC itself. In addition, the ratio of shares changes with an increase and decrease in the authorized capital.

Changes to the Unified State Register of Legal Entities in Moscow on a turnkey basis

The procedure for distributing shares in an LLC

In the LLC law we will find the following possible options for distributing the company's share :

- Free transfer to participants in equal proportions. This means that the share should not be divided equally among everyone, but in accordance with the shares that the participants already have. Thus, the overall ratio of shares in percentage terms will not change. Please note that this method of distribution is only possible when the share has previously been paid. Otherwise, it will not be possible to distribute the share free of charge. It can only be sold.

- Sale to all or some of the LLC members.

- Sales to third parties other than members. This option for distributing the company's share is possible in the absence of a direct prohibition on such a transaction in the charter of the LLC.

The sale of a share (both to some of the participants and to third parties), followed by a change in the ratio of participants’ shares in percentage terms, is possible only if all LLC participants, without exception, vote for such a transaction. Moreover, the share of the society itself is not taken into account when counting votes.

IMPORTANT! The legislation does not require contacting a notary to certify a transaction for the distribution of a company’s share , regardless of whether the share is transferred or sold to participants or third parties. This conclusion is confirmed in the letter of the Federal Tax Service of Russia dated January 11, 2016 No. GD-4-14/52.

Answer

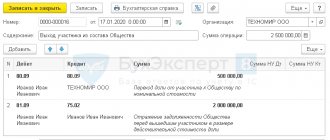

A participant in an LLC has the right to leave the company at any time, regardless of the consent of other participants or the company itself. At the same time, his share passes to the company from the moment of filing an application to leave the company (clause 2 of article 26 of Law No. 14-FZ). It should be noted that an application for withdrawal from the company must be submitted in writing and there are no specific requirements for its content and format defined by law. At the same time, the time for submitting such an application should be considered the day it was submitted by the participant to both the board of directors (supervisory board) or the executive body of the company (sole or collegial), and the employee of the company, whose duties include transmitting the application to the appropriate person, and in the case of sending the application by mail - the day of his admission to the expedition or to an employee of the company performing these functions (clause 16 of the resolution of the Plenum of the Armed Forces of the Russian Federation and the Plenum of the Supreme Arbitration Court of the Russian Federation dated December 9, 1999 N 90/14 “On some issues of application of the Federal Law “On Limited Liability Companies”). Accounting: Debit 81 “Other capital” Credit 75 “Settlements on deposits in the management company” - 2,000 rubles, reflects the nominal value of the share of the participant leaving the company as of the date of filing the application; Debit 81 “Other capital” Credit 75 “Settlements on deposits in the management company” - 230,750 rubles. (232750-2000) - reflects the amount of excess of the actual value of the share of a participant leaving the company over its nominal value as of the date of filing the application; Debit 75 “Settlements on deposits in the management company” Credit 68 “Personal income tax” -29,998 rub. (230,750 x 13%) personal income tax is withheld from the actual value of the share at a rate of 13% (When selling a share in the authorized capital, the purchasing organization is recognized as a tax agent and is obliged to calculate, withhold from the taxpayer and pay the amount of personal income tax in the generally established manner (letters from the Ministry of Finance of Russia dated 7.11. 07 N 03-04-06-01/376, dated 2.05.07 N 03-04-06-01/137) However, in this situation, the share of an individual in the authorized capital of the company is not transferred as a result of its purchase - sale, and in connection with the withdrawal of a participant from the company, therefore, the income of an individual in the form of the actual value of the share is subject to personal income tax with the tax agent withholding tax on the full amount of income without deducting expenses associated with obtaining this income.Grounds for applying the deduction in this case Tax Code RF are not provided for. A similar opinion was expressed in the letter of the Ministry of Finance of Russia dated October 9, 2006 N 03-05-01-04/290. That is, in this case there is not a sale, but only a return of the actual value of the share as a financial investment, which is confirmed arbitration practice (resolution of the FAS of the East Siberian District dated July 25, 2006 N A33-18719/05-F02-3629/06-S1). At the same time, the letter of the Federal Tax Service for Moscow dated May 4, 2007 N 28-10/043011 states that when individual participants leave the LLC founders, the value of the participant’s share is not subject to personal income tax within the limits of his initial contribution made to the charter capital. The amount of payment of the actual value of the share in the authorized capital of the company (in cash or in kind), exceeding the amount of the initial contribution, is subject to inclusion in the tax base of individuals, taxed at a rate of 13% for individuals who are tax residents of the Russian Federation, and at a rate of 30% - for individuals who are not tax residents of the Russian Federation.) Debit 75 “Settlements on deposits in the management company” Credit 50 (51) – 202,752 rubles. the participant is paid the actual value of the paid part of the share minus personal income tax; Debit 91-2 Credit 81 “Other capital” - 230,750 rubles. — the difference between the cost of the share paid to the withdrawing participant and its nominal value is expensed; (clause 11 of PBU 10/99); Debit 75 “Settlements on deposits in the management company”, Credit 81 “Other capital” - 2,000 rubles. — the debt of the new participant in the company is reflected at the nominal value of his share; Debit 99 “PNO”, Credit 68 “Calculation of income tax” - 46,150 rubles. (230,750 x 20%) - a permanent tax liability is reflected (in tax accounting, the difference between the nominal value of the participant’s share and its value paid when the participant leaves the company is also not taken into account for profit tax purposes as expenses not related to the implementation of activities aimed at receipt of income (clause 1 of article 252 of the Tax Code of the Russian Federation)).

Ask your question on the forum|All questions

Shchepetilnikova Svetlana, expert of the magazine “Raschet”

Distribution of shares owned by the company: registration procedure and accounting entries

Let's consider what documents will need to be completed to complete the procedure for distributing shares owned by the company .

If the share is distributed among the participants, the set of documents, in addition to the decision (protocol) of the participants, will include:

- form p14001, the signature on which must be certified by a notary;

- documents justifying the transfer of the share to the company (for example, a letter of resignation from an LLC participant).

If the share is sold (to a participant or a third party), then in addition to the documents listed above, you must draw up a share sale agreement.

IMPORTANT! The charter of an LLC should not reflect information about the participants of the LLC and the size of their shares. Therefore, changes will only need to be made to the Unified State Register of Legal Entities.

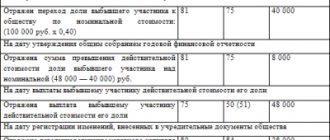

The share transferred to the company is accounted for in account 81 (own shares) at the price at which the share went to the company (for example, in the amount of payments to the withdrawing participant). If the share is distributed among the participants, this operation is reflected in account 75, and then the value of the share is written off from the LLC’s own capital (accounts 82, 83, 84).

If the share is redeemed by a participant or a third party, the write-off will occur to subaccount 75-1.

Is the distribution of the share of a retired LLC participant subject to personal income tax, ConsultantPlus explains in its ready-made solution. If you do not yet have access to the ConsultantPlus system, you can obtain it free of charge for 2 days.

Redistribution of shares when increasing the authorized capital

The authorized capital of an LLC can be increased due to:

- property of the company itself;

- additional contributions from some or all participants;

- contribution of the new participant(s).

In this case, redistribution can occur based on the ratio of the nominal value of the participants’ shares to the amount of the authorized capital received after the increase. Let's show it with an example.

✐ Example ▼

The authorized capital of Parus LLC is 100,000 rubles, which is distributed among three participants as follows:

- Petrenko S.V. – share size 50%, nominal value 50,000;

- Sidorchuk G.A. – share size 35%, nominal value 35,000;

- Ivanenko V.I. – share size 15%, nominal value 15,000.

A new member, Levshin A.R., entered the society, whose contribution is 25,000 rubles. Now the total authorized capital of the LLC is 125,000 rubles, and the shares of participants will be as follows:

- Petrenko S.V. – share size 40%, nominal value 50,000;

- Sidorchuk G.A. – share size 28%, nominal value 35,000;

- Ivanenko V.I. – share size 12%, nominal value 15,000;

- Levshin A.R. – share size 20%, nominal value 25,000.

In this case, only the size of the shares has changed, but their nominal value remains the same. In addition, a situation is possible when both the ratio and the nominal value of the shares change.

Distribution of the company's share between participants: minutes of the general meeting

Distribution of the company's share is possible only on the basis of the decision of the participants. The meeting of participants is convened and held according to the general rules established by the law on LLCs (Articles 36, 37). In addition, it is necessary to take into account the provisions of Chapter. 9.1 of the Civil Code of the Russian Federation, especially since they are a novelty in civil legislation.

The protocol must include the following information:

- about the day, time and place of the meeting;

- participants who took part in the meeting;

- voting results for each issue;

- the person doing the counting.

Let us remind you that shares owned by the company do not vote.

Art. 67.1 of the Civil Code of the Russian Federation requires confirmation of the presence of participants and their voting. This is done:

- Through certification of the fact by a notary, who must be present at the meeting (FNP letter dated 09/01/2014 No. 2405/03-16-3).

- In another way, fixed in the charter or by unanimous decision of the participants. These methods include:

- affixing the signatures of all participants on the protocol;

- use of special means (audio recording or video recording of the meeting);

- other ways to confirm that a decision has been made.

IMPORTANT! If the protocol is not confirmed, this entails its nullity (resolution of the plenum of the RF Armed Forces dated June 23, 2015 No. 25).

Is it possible for a founder to leave an LLC without paying out a share?

Withdrawal from the membership of an LLC is always accompanied by the alienation of a share.

In this case, the exiting founder may decide to leave the share to the company. If this method of exit is not limited by the charter of the LLC, then the law does not require the exit to be coordinated with other participants (Article 26 of the Law “On Limited Liability Companies” No. 14-FZ of 02/08/1998). The charters of most LLCs do not contain such restrictions, but if they do, you will have to obtain the consent of all founders.

Important! Another condition under which the law limits the right of a founder to withdraw from an LLC without paying a share is the case when he is its only participant. In this case, the company must be subject to liquidation.

Registration of changes in authorized capital

Information about changes in shares or their alienation is entered into the Unified State Register of Legal Entities. To do this, you need to contact the Federal Tax Service or the MFC with a regulated set of documents. To notarize a transaction for the sale and purchase of a share or part thereof, the following is required:

- application in form P14001;

- cover letter (written by a notary);

- power of attorney, if the founder himself is not involved in the transaction.

According to paragraph 14 of Art. 21 Federal Law “On LLC”, the listed list of documents must be submitted to the notary within three days after the transaction with the share.

The same list of documents and conditions are provided for registering the transfer of a share under the preemptive right. To register with the Federal Tax Service the sale by the Company of a share in its own management company, the following is required:

- application in form P14001;

- original of the founder's decision to sell the share of the management company;

- contract of sale;

- documents (for example, a bank statement) confirming payment of the share;

- notarized power of attorney, if they are signed by a person who acts under a power of attorney.

According to paragraph 6 of Art. 24 Federal Law “On LLC”, the listed list of documents must be submitted no later than a month (30 days) after the transaction with the share.

To register the distribution of the share that belongs to the LLC between members of the company, within a month after the decision on the share is made, the following are submitted to the Federal Tax Service:

- application in form P14001;

- the original decision of the founder (or all founders) on the distribution of the share or part thereof;

- If the documents are submitted by a person who acts under a power of attorney, then a notarized power of attorney must be provided.

Complex issues of calculating personal income tax when a participant leaves an LLC | IT company Simple solutions

When a business is at the initial stage, the founders of an LLC do not think about what tax consequences their withdrawal from the membership will entail. Let's look at these issues in detail.

In today's material we will focus on the issues of personal income tax, which the retiring participant will have to pay. We will consider the following situations: sale of his share in whole or in part to another participant or third party investor; exit from the LLC when the share becomes the property of the company itself.

How to become a member of an LLC

Let us say right away that the procedure for calculating and paying taxes arising from the alienation of a share is directly related to how exactly this share was acquired and subsequently alienated. Therefore, before moving on to the intricacies of taxation, you need to understand in more detail how an individual can become the owner of a share in an LLC, as well as the ways in which a share can be disposed of.

Let's start in order, with the acquisition. If we put aside such exotic methods as inheriting a share or receiving it through reorganization, then, by and large, there are only two possible ways to become a member of an LLC.

True, each of them has several branches. From the point of view of civil law, there is no big difference in how exactly the share was acquired. The scope of rights and obligations of a participant depends only on the size of the share.

But for tax purposes, the procedure for receiving a share is very important.

Capital contribution

So, the first option is to receive a share by contributing money (or other property) to the authorized capital of the organization. Note that this can happen not only during the creation (establishment) of an organization, but also subsequently, in relation to an already existing company.

After all, paragraph 2 of Art. 17 and art. 19 Federal Law of 08.02.

98 No. 14-FZ “On Limited Liability Companies” allows for an increase in the authorized capital of an already existing LLC both from contributions of participants and from contributions of third parties accepted into the company.

There is one important nuance here: in both cases, the company is not obliged to use everything received from participants (no matter old or new) to increase the authorized capital. In Art.

19 of the LLC Law directly states that in the case of additional contributions, the decision to amend the company’s charter in connection with an increase in the authorized capital and to determine the nominal value and size of the share, as well as to change the size of the shares of the company’s participants, is made by the general meeting (in companies consisting of one participant - them alone).

It is separately stipulated that the nominal value of the share can be determined by the general meeting (participant) either equal to the contribution made or at a level less than the value of the contribution.

Accordingly, in cases where the nominal value of the share is determined at a level lower than the value of the contribution, part of the money contributed by the participant will be used not to increase the authorized capital, but to other needs determined by the general meeting (decision of the sole participant).

But even in this case, the entire amount contributed by the participant is recognized as his contribution to the LLC, which directly follows from the wording of Art. 19 of the LLC Law. This point is very important, because...

in the future, when determining tax liabilities for amounts received upon sale of a share or exit from the LLC, the former participant will have the opportunity to reduce the tax base by these amounts.

Buying a share

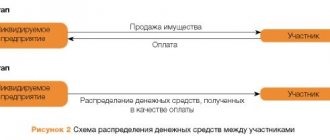

The second way to get a share is to buy it. Not only one of the participants, but also the company itself can sell a share. The company has such an opportunity if the share of the withdrawing participant is transferred to it.

Either the entire share or part of it can be sold. For example, a participant who owns 100 percent of the share can sell part of his share to third parties. As a result, the number of LLC participants will increase. But, unlike the above-mentioned case of admitting a new participant to an LLC, the money for the share is received not by the LLC, but directly by the participant.

Regardless of who the seller is (participant or company), and regardless of the size of the share being sold, no special subtleties that could subsequently affect taxation arise when registering such transactions. It is only important for a new LLC participant not to lose documents confirming the actual payment of the share.

How to sell a share

Now, keeping in mind the two different ways of acquiring a share, let's move on to issues related to its alienation. Here the participant also has a choice. A member may sell his share to another member, or, if permitted by the company's articles of association, to any third party.

In addition, a participant can write an application to withdraw from the LLC and receive from the company the actual value of the share, which will be determined according to the accounting records of the LLC for the last reporting period preceding the one in which the application to withdraw was submitted.

In the first case, a share purchase and sale agreement is drawn up. Clause 4 art. 454 of the Civil Code of the Russian Federation directly allows its use in the implementation of property rights, a type of which is precisely a share in an LLC. This means that from the point of view of taxation we are talking about the sale of a share, or, in terms of Art. 38 and art. 39 of the Tax Code of the Russian Federation, implementation of property rights.

It is somewhat more difficult to qualify the essence of what is happening in the case when a participant leaves the LLC, giving his share to the company in exchange for part of its net assets. According to Art. 26 of the Law on LLC “a company participant has the right to leave the company by alienating a share to the company.”

As we can see, the legislator has established that upon leaving the company, the share belonging to the participant is alienated in favor of the company itself. Moreover, if we look at clause 2 of Art.

21 of the LLC Law, we will see that by the term “alienation” the legislator understands, among other things, the sale of a share.

Thus, in its legal essence, the alienation of a share upon exit from an LLC is completely identical to a purchase and sale transaction. After all, in this case there also occurs a compensated (in exchange for part of the net assets) transfer (from the participant to the LLC) of ownership of the property right (share). And in addition, the legislator directly calls what is happening alienation, a term equivalent to sale.

Member's personal taxes

Having understood the legal nuances of what is happening, you can move on to taxation issues. Here you need to pay attention to the following points.

Firstly, there is a provision in clause 17.2 of Art. 217 of the Tax Code of the Russian Federation, which makes it possible to completely exempt from taxation everything received by the taxpayer upon the sale of a share. But for this to happen, two conditions must be met.

First: the share in the LLC must be acquired by the participant after December 31, 2010. The method of acquisition (purchase, inheritance, establishment or joining an existing legal entity) does not matter in this case; all these methods are equivalent.

Second: at the time of sale, the participant must continuously own such a share for more than 5 years.

Please note that in this provision the legislator used the general term “implementation”. It is clear that the sale of a share falls under it without any problems.

What about the income upon exit? We have already come to the conclusion above that from the point of view of the Civil Code of the Russian Federation, this operation is identical to purchase and sale. From the point of view of the Tax Code of the Russian Federation, the situation is even simpler. After all, the definition of the term “implementation” is in Art.

39 of the Tax Code of the Russian Federation and it means the transfer of ownership rights on a paid basis. This is exactly what happens when leaving an LLC.

So the exemption provided for in paragraph 17.2 of Art. 217 of the Tax Code of the Russian Federation, applies equally both when selling a share to other LLC participants or third parties, and when leaving the LLC by transferring the share to the disposal of the company. Which, by the way, is confirmed by the Ministry of Finance (see letter dated 09/06/16 No. 03-04-05/52095). Additionally, when applying clause 17.2 of Art.

217 of the Tax Code of the Russian Federation, it must be taken into account that the exemption is applied without providing any documents on the value of the property contributed by the participant “at the entrance” and any other documents, because information on the date of acquisition of the share and the period of continuous ownership can be obtained directly from the Unified State Register of Legal Entities. Also, this exemption does not require the provision of a tax return (clause

4 tbsp. 229 of the Tax Code of the Russian Federation).

Secondly, those participants whose conditions of ownership of shares do not allow them to take advantage of the exemption on the basis of Art. 217 of the Tax Code of the Russian Federation (i.e. their share was acquired before December 31.

2010 inclusive, or after, but at the time of exit they continuously owned the share for less than 5 years), are entitled to a tax deduction according to the rules of paragraphs. 1 clause 1 art. 220 code. Moreover, in this provision, the legislator directly provided for both possible options for “getting rid of” a share: both sale and exit.

So there won’t be any tricks in this part. But they are sufficient in the remaining part related to the size of the deduction and the procedure for its application.

So, the main deduction option, according to paragraphs. 2 p. 2 art. 220 of the Tax Code of the Russian Federation, represents a reduction in the amount of income received upon the sale of a share (part thereof), or upon exit from an LLC, by the amount of actually incurred and documented expenses associated with its acquisition.

Here, the first thing you need to pay attention to is that not any expenses are taken into account, but only those directly named in Art. 220 Tax Code of the Russian Federation. In particular, such expenses include initial and subsequent contributions to the management company, as well as expenses for the acquisition of a share.

This means that only contributions to the authorized capital are taken into account (no matter whether they were made upon establishment or after), as well as the amounts indicated (and actually paid) in the application when joining an LLC or when increasing a share, as well as in the purchase agreement -sales.

Conversely, contributions to the property of the LLC that do not increase the authorized capital, which were made during the period of ownership of the share, are not taken into account.

It is important to remember that a decrease in income is possible only if there are documents confirming the costs of acquiring the share. If there are no such documents, the taxpayer has the right to apply a fixed deduction in the amount of income received as a result of termination of participation in the company, but not more than 250,000 rubles for the tax period.

Thus, if the amount that a participant receives upon parting with the LLC does not exceed 250,000 rubles, then there is no point in searching for documents confirming the costs of acquiring the share. After all, the entire amount of income will be exempt from personal income tax even without it.

Also, documents will not be needed if the actual costs of acquiring a share are less than 250,000 rubles.

But if the payment exceeds a quarter of a million, and the actual costs of acquiring it are higher, then you should worry about searching for supporting documents to further reduce the tax amount.

Required documents

Standard package of documents, as for any registration action with exit and/or distribution of shares:

When filling out an application

To fill out the application, you will need a current extract from the Unified State Register of Legal Entities to obtain the following data on the company:

- Name

- OGRN

- TIN

And also, information about the participants:

- Full name

- TIN

The director's passport will also be required since he is the applicant.

For a notary

For a kit to authenticate the applicant's signature on P14001 by a notary, please check with a specific notary. On average, the following documents are required:

- Certificate/Sheet of registration of state. registration (OGRN);

- Certificate of registration with the Federal Tax Service (TIN);

- Protocol/decision on the creation of an LLC;

- Protocol/decision on the appointment of a director of the LLC;

- Charter

Documentation of the transfer of the share of the withdrawing participant

- The co-owner of the company sends an application to the executive body to resign from the founders. From the moment this application is received, the share of the withdrawing founder is automatically transferred free of charge, as a result of which the voting results are determined without taking it into account, i.e. all decisions are made only by the remaining participants.

- Provisions of Art. 24 of the LLC Law provide for the need to notify the registration authority of the transfer of a share to the company and its subsequent redistribution. To do this, you must send an application to the Unified State Register of Legal Entities, to which is attached a document indicating the existence of grounds for transfer of the share. Such a document is a statement of the founder’s intention to leave the company.

- To make changes to the Unified State Register of Legal Entities, the following documents are required:

- application in form P14001;

- statement of the participant's intention to leave the society;

- minutes of the meeting of participants at which a decision was made to redistribute the share.

Note! From 08/11/2020, a participant is considered to have left the moment an entry is made about his withdrawal from the LLC in the Unified State Register of Legal Entities (Clause 2 of Article 94 of the Civil Code of the Russian Federation as amended by the Law “On Amendments...” dated 07/31/2020 No. 251-FZ).

In what cases is it used?

This version of the registration action is used when distributing the share of a participant who left, and transferred to the LLC, when this distribution was postponed and was not done simultaneously with the registration of the participant’s withdrawal.

Since participants have a whole year to decide the fate of the undistributed share, this action can be taken at any time during this period. It is convenient when, for example, at the time a participant left, it was not possible to convene a meeting of the remaining participants (on the road, living far from each other, just time pressure).

Actual value of the participant's share

The withdrawal of a participant from an LLC is associated with a number of important issues regarding the payment to such a participant of the value of his share and the taxation of payments made.

By law, when a participant leaves the LLC, he must be paid the actual value of his share. The actual value of the share is equal to part of the value of the LLC’s net assets, which is determined in proportion to the size of the company participant’s share in the authorized capital. For example, if the size of the share of a company participant is ¼ or 25%, and the value of the company’s net assets is 1,000,000 rubles, then the actual value of the participant’s share will be equal to 1,000,000 x ¼ = 250,000 rubles.

Thus, the determining factor for establishing the actual value of an LLC participant’s share is the value of the company’s net assets. How to set this cost? By law, the value of the LLC's net assets must be determined based on the financial statements for the last reporting period preceding the day the company participant applied for resignation. If financial statements are prepared quarterly, then the value of net assets will be determined based on the reporting data for the previous quarter. For example, if a requirement to leave the company is presented in September, then the value of the assets will be determined according to the financial statements as of July 1.

In addition, it is necessary to take into account judicial practice. In arbitration courts, a common approach is when the value of a company's net assets is determined based on the market assessment of the value of property, which may not coincide with the financial statements.