January 4, 2021

Hello, dear readers of the KtoNaNovenkogo.ru blog. To obtain the status of a legal entity, you need to comply with many formalities and register with the tax office.

This is necessary to identify the organization among thousands of others like it. Obtaining various details containing information about the created company is an important stage of legal registration. faces.

Today we will look at what a checkpoint is, to whom it is assigned, what it is needed for and how its numbers are deciphered.

Decoding checkpoint

KPP is an acronym.

Its decoding sounds like “Registration reason code”. We are talking about tax accounting, and it is the tax authorities who assign this code. In general, it consists of nine digits.

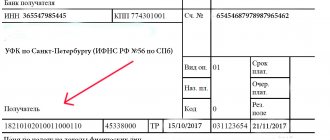

- The first and second characters indicate the code of the subject of the Russian Federation in which the inspectorate that assigned the checkpoint is located. So, for the capital's Federal Tax Service, the first two digits are 77, for those near Moscow - 50, etc. If the code was assigned by the interregional inspectorate for the largest taxpayers, then the first two digits will be 99;

- The third and fourth characters indicate the number of the Federal Tax Service that assigned the code. For example, for inspection No. 23 in Moscow, the third and fourth signs will be 23;

- The fifth and sixth digits show the actual reason why tax authorities register the company. According to the SPPUNO directory, if accounting occurs at the location of the organization, then the fifth and sixth digits will be 01; by location of separate units - 02, 03, 04, 05, 31, 32; by property location - 06, 07, 08; at the location of the vehicles - from 10 to 29. To register an organization as the largest taxpayer, the fifth or sixth digits will be 50. There is also a letter from the Federal Tax Service dated 06/02/08 No. CHD-6-6 / [email protected] which reads: branches are assigned a value of 43, representative offices - 44, OP - 45. In practice, tax authorities are guided by this letter;

- the seventh, eighth and ninth digits represent the serial number of the organization’s registration with the tax office on the appropriate basis.

Fill out a payment form for free in the accounting web service

Details necessary for conducting business activities

When filling out various documentation, persons registered as individual entrepreneurs should indicate a number of mandatory details. Such details include a tax identification number (TIN) and a code assigned by the All-Russian Classifier of Enterprises (OKPO). In addition, the required details are the number obtained in the All-Russian State Register of Individual Entrepreneurs (OGRNIP) and the OKATO code - containing the company location index. Small businesses also need to provide counterparties with general information about themselves as an individual.

Quite often, managers of individual entrepreneurs are asked to indicate the checkpoint code when filling out financial documents in credit institutions. In this case, a dash is placed in the column reserved for this code. This procedure is also followed when filling out agreements with business partners. Please note that specifying zero values is prohibited. This fact is fixed by Order of the Federal Tax Service number one hundred and forty-eight.

Indicating any fictitious values is considered a gross violation, which can lead to various penalties from regulatory authorities.

In 9 signs of the checkpoint, unlike the TIN, information about the organization is encrypted

Why do you need a checkpoint?

A legal entity can be registered simultaneously with several Federal Tax Service Inspectors: one - at its location, another - at the location of its unit, a third - at the location of the real estate, etc. To reflect information about a particular reason, each of them is assigned a separate code.

IMPORTANT. The company always has only one TIN, and it remains unchanged. But there may be several checkpoints, and under certain circumstances they will change. For example, if a change of legal address entails a transfer to another Federal Tax Service, tax authorities will assign a new checkpoint to the legal entity to replace the previous one.

If you need to specify

If a particularly persistent (and, as a result, legally illiterate) counterparty still demands that the individual entrepreneur indicate a checkpoint somewhere, it is worth drawing his attention to the following legislative and by-laws:

- Federal Law “On Registration of Legal Entities and Individual Entrepreneurs”, art. 5, paragraph 1, paragraphs. “o”, where it is said about assigning checkpoints to organizations, and paragraphs. “n” clause 2 of the same article. 5 of the same law, which says that individual entrepreneurs, in the Unified State Register of Entrepreneurs, indicate only the TIN. It doesn't say anything about checkpoints.

- The mentioned Order of the Federal Tax Service of Russia dated June 29, 2012 N ММВ-7-6/ [email protected] , it also says that checkpoints are assigned only to organizations.

- Letter of the Ministry of Finance of Russia dated February 28, 2013 No. 03-02-08/14, entirely devoted to the issue of the need for a checkpoint for individual entrepreneurs. Moreover, the wording clearly shows the bewilderment of the official answering such a strange question.

Some people “invent it” for themselves, but in general this is wrong.

In the checkpoint column, you usually do not fill out anything or write: the checkpoint is not assigned.

To whom is the checkpoint assigned, in what documents is it indicated?

The Federal Tax Service assigns a reason code for registration only to legal entities. Individual entrepreneurs do not have this requisite.

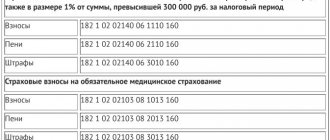

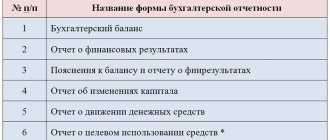

Legal entities must indicate the checkpoint (as well as the tax identification number) in all documents related to taxes and insurance premiums. Among these papers:

- Declarations and calculations, income certificates in form 2-NDFL.

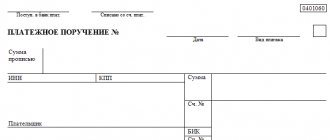

- Payment orders for the payment of taxes, fees, insurance premiums, as well as penalties and fines for them. In such payments, the checkpoints of the payer and the recipient are mandatory bank details. If money is transferred to a counterparty, this code does not need to be specified.

- Invoices, sales books, purchase books, journals of received and issued invoices. Here it is necessary to indicate the checkpoints of both the supplier and the buyer.

ATTENTION. For legal entities that have several checkpoints, it is important to choose the right code. In particular, when issuing an invoice by a separate division, it is necessary to indicate the code of this division. If an employee is registered in a branch, the 2-NDFL certificate for such an employee must indicate the branch code.

Fill out and submit 2‑NDFL online for free with new codes

What details do individual entrepreneurs need?

Any individual entrepreneur must indicate the details according to which he can:

- To identify without the risk of confusion with another individual entrepreneur (for example, by full name), which means you need to indicate unique numbers:

- OGRNIP (assigned upon state registration);

- TIN (either assigned to an individual or upon state registration of an individual entrepreneur);

- Code for OKPO (according to clause 2 of section II of the Regulations on OKPO, Order of Rosstat dated March 29, 2017 No. 211, individual entrepreneur has OKPO);

- OKTMO (instead of OKATO, code of administrative-territorial unit, reference to location).

- Passport data, as an additional unique identifier (but in general OGRNIP and other numbers are sufficient), you can also indicate in the contract that the individual entrepreneur acts on the basis of a Certificate (Record Sheet) of state registration, with the assignment of OGRNIP number.

- IP seal, although it is not required.

How to find out the checkpoint of an organization

The reason code for registration can be found from the certificate or notification issued by the inspectorate. In addition, the checkpoint is indicated in the entry sheet of the Unified State Register of Legal Entities (USRLE). The company receives this sheet upon registration.

To summarize, we note: an accountant needs to understand what a checkpoint is in an organization’s details and how to decipher it. This will help you avoid mistakes when preparing important documents, such as invoices and bank payment orders.

Errors when filling out payment slips can be eliminated if payment documents are generated automatically. Some web services for submitting reports (for example, “Kontur.Extern”) allow you to generate a payment in 1 click based on data from the declaration (calculation) or the request for payment of tax (contribution) sent by the inspectorates. All necessary data (recipient details, including checkpoint, current budget classification codes - KBK, account numbers of Federal Treasury departments, codes for payer status) are promptly updated in the service without user participation. When filling out a payment slip, all current values are entered automatically.

What is it for?

The importance of this code can be easily understood by studying the purpose of this tool. With its help, the tax service determines the TIN of the enterprise. In addition, it is the checkpoint that allows the tax service and the company’s counterparties to find out exactly how and where the company was registered, for what reason and how many times.

Taken together, this data allows both the Federal Tax Service and the FSSP in the event of a precedent, and the organization’s counterparties to immediately view information about the company in open sources. In this way, transparency of market relations is achieved, higher trust and, at the same time, increased legality in the market and the gradual “strangulation” of unscrupulous taxpayers.

If an entrepreneur does not indicate his checkpoint in the details, he automatically shows himself from the worst side. Moreover, to participate in government tenders, indicating the checkpoint is mandatory - without this, the application for participation will simply be rejected without consideration.

Also, the checkpoint is absolutely necessary for the correct preparation of payment orders addressed to any organization or regulatory authority, systematization and preparation of accounting and tax reporting and documentation. With the help of this data, the bank and authorized persons will know exactly how and where to send the transfer; The tax office knows whether taxes were paid, and if they were not paid, then which inspection should be responsible for this, etc. In addition, without a checkpoint it is often impossible to conclude an agreement between legal entities.

To summarize, without a checkpoint it is almost impossible to conduct business or, at a minimum, it is associated with significant risks and problems.

Where information may be needed

A business entity prepares a lot of reporting documentation for the tax office. Regulatory documents regulating the procedure for filling it out oblige entrepreneurs to indicate the checkpoint code in a specially designated column. Its display is mandatory in payment documents issued for the purpose of making tax and insurance payments, as well as in invoices.

Since a business entity may have several codes, the documentation must indicate the code that is relevant for the specific organization whose information is displayed in it.

Where can you find the details in question?

Quite often you can hear the question of how to find out a company’s checkpoint. To obtain information about these details, you should visit the official tax office website on the Internet . This value is also contained in the Unified State Register of Legal Entities certificate. You can obtain this act from the tax office.

In order to find out all the details of a company, you should know its TIN. Knowing this information will allow you to use the “Federal Tax Database” and the “Contour Database” to search for the necessary information. These sites provide information about all active and canceled companies registered in Russia.

Comments: 1

Your comment (question) If you have questions about this article, you can tell us. Our team consists of only experienced experts and specialists with specialized education. We will try to help you in this topic:

Author of the article Irina Rusanova

Consultant, author Popovich Anna

Financial author Olga Pikhotskaya

- Alexander

01/05/2021 at 09:18 I hope everything works out

Reply ↓

Where can I find information about the code?

Decoding the gearbox code

The checkpoint code is reflected in the document in which the business entity is notified that it has been registered, as well as in the registration certificate. The parameter is a mandatory information element in the unified database of the register of legal entities. In fact, it is not relevant for individual entrepreneurs.

Code assignment and replacement

The checkpoint is displayed in all tax reporting and appears in the unified taxpayer database

The initial assignment of a code occurs after registration actions due to the opening of a business. The procedure is implemented at the place of registration of the legal entity. It is carried out in parallel with the assignment of an identification number.