From June 1, 2021, a special instruction of the Bank of Russia dated October 14, 2019 No. 5286-U “On the procedure for indicating the type of income code in orders for the transfer of funds” (hereinafter referred to as Instruction No. 5286-U) is in effect. According to it, from this date, when transferring income to the purpose of payment, the payment order must indicate which category it belongs to. In this consultation we will help you cope with this problem.

Also see:

- Payment order to transfer wages to a card: sample for 2021

Why were new codes introduced?

Directive No. 5286-U establishes the procedure for indicating the type of income code in orders for the transfer of funds. It applies not only to employers, but in general to persons paying:

- wages;

- other income in respect of which Art. 99 of Federal Law No. 229-FZ “On Enforcement Proceedings” establishes restrictions and/or which, in accordance with Art. 101 of this Federal Law cannot be levied.

The codes were introduced so that the bank and bailiffs immediately understand that the debtor’s income cannot be touched at all, or that the debt can be collected from them, but with certain restrictions (see below).

Sample of filling out a salary slip according to the new rules

The changes introduced by Law 12-FZ will enter into force on 06/01/2020. From now on, it is necessary to fill out payment orders according to the new rules. By the same period, the rules developed by the Central Bank of the Russian Federation and regulating what will be new in payments in 2020 will come into force.

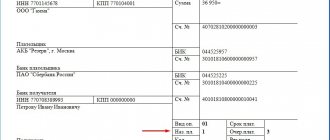

A sample of filling out a payment slip for the transfer of wages and other payments in favor of individuals from June 1

Income type codes from 2021

According to Directive No. 5286-U, from June 1, 2021, the following codes of the type of income are indicated in orders for the transfer of funds:

| Code | Legal basis | Explanation |

| «1» | When transferring funds that are:

| When transferring wages and other income (for example, payments under GPC agreements), for which there is a limit on the amount for withholding debts. As a general rule, no more than 50% of wages and other income can be withheld from a debtor-citizen. Alimony for minor children, compensation for harm caused to health, compensation for harm in connection with the death of the breadwinner and compensation for damage caused by a crime - the amount of withholding is not more than 70%. |

| «2» | When transferring funds that are income, for which, in accordance with Art. 101 of Law No. 229-FZ cannot be foreclosed on | For 2021, these are 18 types of income. Exception: income to which, in accordance with Part 2 of Art. 101 of Law No. 229-FZ, restrictions on foreclosure do not apply. Let us remind you that, according to this norm, alimony for minor children or compensation for damage due to the death of the breadwinner can be recovered from the amounts of compensation for harm to health or compensation received from budgets by citizens injured in radiation and man-made disasters |

| «3» | When transferring funds that are income, to which, in accordance with Part 2 of Art. 101 of Law No. 229-FZ, restrictions on foreclosure do not apply | When paying amounts that are exceptions mentioned above |

Read also

15.07.2020

Payroll codes for personal income tax

Every year, each employer is required to submit to the Federal Tax Service certificates in form 2-NDFL for each individual to whom income was paid. Also, Form 2-NDFL is often requested by employees to submit to various organizations as confirmation of the amount of income received (for example, when applying for a loan).

Each type of income of an individual corresponds to a specific code.

Their list is approved by the Federal Tax Service (Order No. ММВ-7-11/ dated 09/10/2015). The list is often subject to changes; certain codes appear and are excluded. 2021 was no exception (Order of the Federal Tax Service dated October 24, 2017 No. ММВ-7-11/). Moreover, the changes must be used by indicating the salary code in the 2-NDFL certificate 2021. Severance pay in excess of three months’ earnings

| Accrual | Revenue code |

| Salary | 2000 |

| Prize | 2002 |

| Payment under contract agreements with individuals | 2010 |

| Vacation pay | 2012 |

| Disability benefits | 2300 |

| Introduced with reporting for 2021. | |

| Compensation for unused vacation | 2013 |

| Severance pay in excess of three months' salary | 2014 |

Filling out field 110 in the payment slip

If you are transferring budget funds, you must enter the number “1” in this field. This code will tell the recipient's bank to check whether the account owner has an issued Mir payment card. For regular transfers at the expense of the organization’s own funds, field 110 still does not need to be filled in.

If during the verification it turns out that the recipient has a Mir card attached to his bank account, or that any issued payment card is missing, the recipient’s bank must credit him with the payment amount. If the recipient does not have a Mir card, the bank reflects the payment amount in the account for accounting for amounts of unknown purpose. After this, the bank must, no later than the next business day, send a notice to the recipient of the funds with an offer to appear within ten working days to receive the payment amount in cash.

In addition, the recipient can submit an order to the bank to credit the payment amount to a bank account that provides for transactions using the Mir card. If within these 10 days the citizen does not receive his money or does not provide an order for transfer to another suitable account, then the bank must return it to the payer.

Other payments to government contractors

We have public sector contractors. The program does not allow you to open settlement accounts of counterparties indicating the BIC of the UFK instead of the BIC of the bank. How to do this correctly in 1C?

From 01/01/2021, settlements with all budgetary organizations take place through accounts opened with the Treasury (with a transition period until May). Therefore, these changes are relevant for settlements with the budget not only for taxes, but also for other agreements - settlements with public sector counterparties. The algorithm for specifying bank details in 1C: Accounting 8.3 has been implemented since release 3.0.87.28. The algorithm used is that described in Filling out the details of a Federal Treasury bank using the BIC classifier.

New recommendations of the Central Bank

Let us dwell in more detail on information from the field of tax and banking control regarding the fight against tax evasion schemes. Payment orders are also used to identify the purpose of payments and the legality of transactions between organizations and individuals. This information is monitored by the tax office and serves as the basis for audits.

Whose account will the bank block due to VAT on payments? This question arose after the Central Bank of the Russian Federation published new instructions on identifying dubious transactions. Explanations were given to credit institutions, and the Central Bank recommended blocking accounts if reasonable doubts arise.

Particular attention is paid to clients' accounting for VAT. One of the main signs of a questionable transaction is the receipt of payments with VAT into a person’s account in the total amount of 70% of the total amount and the subsequent transfer of funds with VAT in total less than 30%. This may indicate the implementation of a tax evasion scheme: the organization received payment with value added tax, subsequently transferred the same funds, but without allocating VAT. Identification of such signs serves as a signal for initiating control measures. The recommendation is based on the experience of credit institutions, when fly-by-night companies received revenue with tax, and then cashed out the funds received. So that trustworthy tax payers do not fall under control sanctions (and in practice, different situations are possible, given that the rules for identifying, paying, offsetting tax on added value are difficult to apply), it is necessary to take into account everything new in payment orders, as stated by the authorities. If any controversial or problematic situation arises, provide the bank with all supporting documents - at the request of the credit institution or on your own initiative.

Payments to the budget to treasury accounts from 01/01/2021

You can specify payment details for transfers to treasury accounts manually (from release 3.0.86).

To do this, in the Federal Tax Service card (Directories - Counterparties - Government bodies) in the Main bank account - Bank the Show all link and go to the Banks .

Click the Create button to create a new bank (the program will offer to select from the classifier - click No ).

Fill in the bank details manually using the Application, click Record and close .

In the Bank , indicate the created bank, and in the Account Number , enter the recipient's account number (treasury account number) - column 6 of the Appendix.

After this, when generating the Payment order document (Bank and cash desk - Payment orders), new payment details are automatically entered in the Recipient's account .

If there is a problem with loading details into 1C, then you should use the recommendations from the discussion New details for paying taxes are not loaded into 1C.

Filling in the details of the Federal Treasury bank according to the BIC classifier

Since release 3.0.87.28, the program has implemented the ability to fill in the details of the Federal Treasury bank using the BIC classifier.

To do this, in the Federal Tax Service Inspectorate card (Directories - Counterparties - Government Bodies) in the Main Bank Account - Bank , indicate the BIC corresponding to your Federal Tax Service Inspectorate (details are given in the Appendix to the Letter of the Federal Tax Service of the Russian Federation dated October 8, 2020 N KCh-4-8 / [email protected] , hereinafter referred to as Appendix).

In the Account Number , indicate the recipient's account number (treasury account number) - column 6 of the Appendix.

This data can be entered from the Payment order by going to the Federal Tax Service card in the Recipient .

After this, when generating the Payment order document (Bank and cash desk - Payment orders), new payment details are automatically entered in the Recipient's account .

If the Payment order created in 2021 contains old payment details, then the Recipient's Account is highlighted in red.

Using the Correct , the program will display the correct details, which can be updated using the button Substitute recommended values .

Rules for filling out payment orders

WITH 01.01.2021

Order of the Ministry of Finance of the Russian Federation dated September 14, 2020 N 199n comes into force. New rules for filling out payment orders are being introduced gradually:

- 01/01/2021 - TIN ( 60

) TIN of 3 persons is NOT allowed, except in certain cases; - 07/01/2021 - UIN (22

); - 10/01/2021 — INN ( 60

), Basis of payment (

106

), Document number (

108

), Date (

109

); - 10/17/2021 - TIN ( 60

), the TIN of a bank, not an individual, is NOT allowed when transferring money through an operator.

Payment

WITH 01.01.2021

the budget switches to a system of treasury payments. This means that when generating tax payments:

- you need to indicate other bank accounts of the Federal Treasury;

- two account fields are filled in: (17) and (15);

- The BIC of the territorial body of the Federal Treasury is filled in (14).

Example of filling out a payment form

During the transition period from 01/01/2021 to 04/30/2021, you can use old and new accounts.

From January 1, 2021 (address of individual payer)

A change is provided for individual payers who are not individual entrepreneurs. Now, so that inspectors can clearly determine who the payment came from, the individual indicates his TIN. There is another option - instead of the TIN, fill in field 108 “Number of the document that is the basis for the payment”, or enter the UIN in field 22 “Code”. And in the absence of a UIN, it is permissible to indicate the address of residence or stay.

In 2021 and beyond, you will not have to enter the individual’s address into the payment order. This follows from the updated version of the rules approved by Order of the Ministry of Finance dated November 12, 2013 No. 107n (amendments were made by Order of the Ministry of Finance dated September 14, 2020 No. 199n; hereinafter referred to as Order No. 199n). Now, in the absence of a TIN and UIN, it is enough to enter another identifier of information about an individual (for example, the series and number of a passport or SNILS).

platezhnoe_poruchenie_po_nalogam_s_2021_goda.jpg

According to Order No. 199n, from 10/01/2021, the codes TR, BF, PR, AP and AR (indicated in the “106” field of payment bills) will be canceled - instead, the code “ZD” will be used - repayment of debt for expired periods. In this case, in field “108” (document number), if there is a document for debt collection, its letter code will be indicated, for example – TR (requirement), number in the format “TR0000000000000” and the date of the document in field “109”.

Explanation in field 110

For the beneficiary's bank, column code 110 will indicate the purpose and type of payment. It is used to decipher banking transactions for non-cash transfers of mandatory insurance and tax contributions to the budget. Subject to the new rules, each individual entrepreneur, legal entity or individual entrepreneur must leave field cell 110 in the payment form empty. Based on the regulations of the Central Bank of the Russian Federation - enter “0”. The double explanation does not add to the understanding of how to proceed when paying taxes and filling out a financial order. Read on to find out where to find the required line and how to fill it out.