Having their own business, companies, both large and small, need to fill out a lot of reporting documents, pay all kinds of fees and taxes. Each reporting document and payment of taxes has its own deadlines that taxpayers must comply with.

Situations often arise when the payment of personal income tax occurs untimely, then the organization receives a demand to pay penalties for personal income tax. In this case, the accountant must indicate KBK 18210102010012100110.

All taxpayers are familiar with budget classification codes - both large organizations and small businessmen. They often get confused, and all because regulatory documents and laws are written in complex language.

To understand what tax will need to be paid according to KBK 18210102010012100110, let’s look at the KBK itself and what you should pay attention to.

KBK 18210102010011000110: what is the tax 2021

In order No. 65n dated July 1, 2013, the Ministry of Finance approved the decoding of this budget classification code.

18210102010011000110 KBK transcript 2021: Personal income tax on income the source of which is a tax agent, with the exception of income in respect of which the calculation and payment of tax is carried out in accordance with Art. 227, 227.1 and 228 of the Tax Code of the Russian Federation (payment amount (recalculations, arrears and debt on the corresponding payment, including canceled ones).

In other words, this is personal income tax on employee salaries and other payments.

KBK 18210102010012100110 what tax 2021 - full breakdown and payment procedure, penalties and additional charges.

Individual entrepreneurs and accountants always get confused with budget classification codes, and all because regulations and laws are written in completely idiotic language.

So, the decoding of KBK 18210102010012100110 is a penalty for personal income tax. Absolutely everything, except for those specified in Articles 227, 227.1 and 228 of the Tax Code of the Russian Federation. That is, this BCC is not used for penalties and tax arrears on winnings, for gifts, during the calculation of personal income tax for working foreign citizens, individual entrepreneurs, notaries, lawyers and other categories.

But if we are talking about a simple payroll tax, then when a penalty appears, you need to indicate exactly 18210102010012100110 when filling out the documents before transferring the debt.

You didn't know this! FAQ on KBKQuestion #1: Why are these codes needed? Since 1999, the accountant must indicate a single 20-digit code on the payment slip; this is done to detail taxes and penalties for subaccounts, statistics, and so on. Question No. 2: What happens if you do not indicate the BCC or make a mistake? No money will be credited for taxes or penalties, and the authority may impose additional sanctions. Question No. 3: What to do if the wrong BCC is indicated? Write applications to the tax or pension fund with a payment attached. Question No. 4: The accountant sent many incorrect bills with incorrect budget classification codes... In this case, the application must indicate a request for reconciliation of calculations, and also ask for clarification of the BCC. Sometimes the tax office refuses to reconcile, then you have to sort it out, and sometimes even go to court. Question No. 5: What fines are provided for an accountant? If you contact the tax office in a timely manner, there will be no penalty. But if the tax has not been paid to the address for a long time, they may come with an inspection, and the accountant will be charged from 10 to 30 thousand rubles for errors in the primary documentation, and the company will be fined for non-payment. |

In this case, the principal amount of the debt goes under KBK 18210102010011000110, and the same code is used for recalculations. If the penalty has not been paid for a long time and a fine has appeared, the code 18210102010013000110 is used to pay off the debt. On the one hand, such a large number of codes causes a complete brain explosion, but on the other hand, it has become much easier to sort things out with the tax authorities. Again, it is necessary to carefully monitor the correctness of personal income tax payment.

A common mistake is to include a penalty or fine in the principal amount of the debt indicating the main BCC

. Accordingly, the debt for the tax itself will be repaid, but the debt for penalties will not. And then try to prove that the collection is illegal.

All other categories have their own KBK encoding, so it is better for the organization to immediately publish its own code book, which contains all the decodings, as well as documents and deadlines. This will allow you to achieve order in the accounting department, as well as avoid unpleasant situations when money goes “in the wrong place.”

According to the law, personal income tax penalties begin to accrue for each day of delay immediately after the deadline has expired. Experienced auditors and lawyers have a whole mechanism for canceling penalties from the Federal Tax Service, but it is still better not to waste time on litigation and official correspondence, but to pay personal income tax on time. If a penalty has already begun to accrue, then upon repayment it is necessary to indicate KBK 18210102010012100110, this rule will be in effect until the end of 2021.

The BCC must be indicated at the bottom of the payment order.

Tags: taxes

What does KBK 18210102010011000110 consist of?

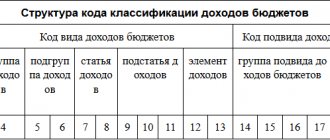

The budget classification code combination is approved by the Ministry of Finance of the Russian Federation. It consists of 20 characters. They are divided into certain groups:

- 1-3 signs – managers of budget funds;

- 4-6 characters – type of tax or contribution paid;

- 7-8 characters – classification of the budget into which the tax is paid;

- 9-11 characters – sub-item of income;

- 12-13 signs – element of income;

- 14-17 characters – type of payment;

- 18-20 signs are a type of income.

So, the code starts with the characters “182”. The manager of funds is the Federal Tax Service. Next, “101” is income tax, personal income tax. Then “01” - the funds go to the Federal Budget. Signs 14-17 - “1000” - the amount of tax or contribution, arrears or arrears in payments. The last three digits of “110” are tax income.

KBK: the secret of the abbreviation

Under the abbreviation “KBK”, which is familiar to all accountants, hides the all-Russian system of budget classification codes, which is an identifying tool in settlements with the budget.

The code consists of twenty characters, each of which carries information about the type and purpose of payment, the recipient, and a number of other accounting information.

When filling out a payment request for taxes and other types of payments, the KBK code is indicated in the “104” field of the payment slip.

KBK 18210102010011000110: what taxes are not paid under this code

According to this, the BCC needs to transfer taxes and fees provided for in Art. 227, 227.1, 228 of the Tax Code of the Russian Federation. According to established legislation, the following taxes are not transferred to this code:

- Personal income tax on income from individual entrepreneurs, notaries, lawyers and other persons whose activities include private practice;

- Personal income tax on lottery winnings, as well as income received by the authors’ legal successors as remuneration for inventions, works of literature, painting, and art;

- Personal income tax on the income of non-residents who work for hire on the basis of an officially issued patent for labor activity.

These tax agents must remit contributions using other BCC codes.

Why indicate KBK

The KBK itself is a special code that is understandable to people sitting in the treasury and redirecting the cash flow coming from taxpayers. Each number will be able to tell which government agency is the recipient of the payment, for which the taxpayer pays this amount. All this can be found out if you decipher KBK 18210102010012100110.

The payment document has a special space for filling out the BCC. This is a mandatory condition, otherwise the money simply will not reach the recipient, and the organization will be subject to a fine and penalties for late payments.

As they conduct business, entrepreneurs face a number of problems. After all, this process is complex and takes a lot of time to learn and understand all the commercial intricacies.

As they say, those who don’t work make no mistakes, so errors that occur when filling out payment orders or late payments are always fraught with additional penalties.

So, your company is late in paying income taxes, and made it a little late. Now you must pay the fine and penalties. So what code will need to be indicated in the payment order? Decoding KBK 18210102010012100110 in 2020 will mean that the taxpayer will have to pay a penalty for the fact that the income tax payment was not received to the treasury on time.

By indicating the correct BCC on the payment, you can be sure that the funds will quickly reach the addressee. It is on the basis of the classification code that money from taxpayers is distributed. On the one hand, this simplifies the work of the treasury, allowing you to track every ruble received and sent, but on the other hand, payers may face a number of problems.

The encrypted numbers that seem scary, upon closer examination, are not at all complex. Therefore, everyone can understand their purpose. Using the example of KBK 18210102010012100110, we can decipher what tax merchants and companies will have to pay in 2021.

By the numbers in the code (they are listed as 14,15,16,17) -2100, you can determine that this is a penalty. If it says 1000, this means the payment itself, but if 3000 is indicated, it means the payment is subject to a fine.

List of KBK for 2021 for payment of personal income tax

| KBK | Decoding |

| 182 1 0100 110 | Personal income tax on income the source of which is a tax agent. In addition to income in respect of which the calculation and payment of tax is carried out in accordance with Art. 227, 227.1, 228 Tax Code of the Russian Federation |

| 182 1 0100 110 | Personal income tax on income paid by individuals registered as individual entrepreneurs, notaries, lawyers and other persons engaged in private practice in accordance with Art. 227 Tax Code of the Russian Federation |

| 182 1 0100 110 | Personal income tax in the form of fixed advance payments of foreign citizens who are employed on the basis of a patent in accordance with Art. 227.1 Tax Code of the Russian Federation |

| 182 1 0100 110 | Personal income tax on income received by individuals in accordance with Art. 228 of the Tax Code of the Russian Federation (taxes from the sale of personal property, income under a rental agreement, etc.) |

Procedure for paying personal income tax

Currently, personal income tax is charged on income taxed at a rate of 13%, in accordance with clause 3 of Art.

226 of the Tax Code of the Russian Federation, occurs on the date of receipt of income, and its transfer to the budget is no later than the next day after payment (clause 6 of Article 226 of the Tax Code of the Russian Federation). Read more about the procedure for paying personal income tax in the article “The procedure for calculating and the deadline for transferring income tax from wages .

If the income paid is vacation amounts or sick leave benefits, personal income tax can be transferred on the last day of the month of payment (clause 6 of Article 226 of the Tax Code of the Russian Federation).

For information on paying personal income tax on vacation pay, see here.

According to Art. 223 of the Tax Code of the Russian Federation, income for the purpose of calculating personal income tax arises, as a rule, at the time of its receipt. However, there are other situations: when approving an employee’s advance report, when issuing borrowed funds to him with savings on interest, income is considered received on the last day of the month (subclauses 6–7, clause 1, article 223 of the Tax Code of the Russian Federation).

Read about personal income tax on travel expenses here.

You can find out how to correctly fill out a personal income tax payment form, as well as see examples of filling out individual details in the ConsultantPlus ready-made solution. To do this, get trial access to K+ for free.

Results

Late transfer of taxes to the budget entails additional tax liability in the form of mandatory payment of penalties.

An incorrectly specified BCC when transferring payments, including penalties, may entail not only additional labor costs to clarify the purpose of the payment, but also disputes with the tax authorities. You can find more complete information on the topic in ConsultantPlus. Free trial access to the system for 2 days.

Decoding KBK 18210102030011000110

The budget classification code allows you to authenticate payment for a particular fee. Thanks to the code, the Federal Tax Service automatically determines the category of the payer - an individual, legal entity or individual entrepreneur - the budget to which the funds are sent, as well as the type of payment. The latter implies payment of the tax itself, penalties, interest and fines.

When filling out a payment receipt, the code is indicated in cell 104 located at the bottom of the form. Individuals are required to write KBK 18210102030011000110, which means payment of the standard personal income tax amount. According to Art. 228 of the Tax Code of the Russian Federation, this code is used to calculate the levy on profits that came from:

- other individuals with whom the citizen cooperates under a GPC contract, including salary from work abroad;

- trade in movable and immovable property;

- winnings, prizes, royalties, cash awards for participation in events;

- the citizen’s possession of securities and money sent to the NPO budget.

Also, a citizen is obliged to pay personal income tax on money that was not subject to taxation by the tax agent.

After calculating the amount of collection from a particular payment, the individual fills out a payment slip, in which he indicates the KBK for depositing tax funds 18210102030011000110. Detailed decoding of the code:

- 182 - determines the department whose budget receives profits: services, agencies, funds. Here is the federal tax office.

- — indicates the type of replenishment. In this code - collection receipt.

- — type of duty: personal income tax.

- 02030 - type of income (personal income tax) that was not paid by the tax agent and category of payer (individual).

- 01 - type of budget in accordance with the territory: federal budget.

- 1000 — name of payment: standard, including recalculations and deductions.

- 110 - parallel to the profitable group, means the type of replenishment is tax.

Personal income tax reporting

Tax agents now have to report on personal income tax not only annually, but also quarterly. Quarterly reporting (form 6-NDFL) applies only to employers. It must be submitted based on the results of reporting periods, determined quarterly on an accrual basis, on the last day of the month following the next period. The reporting contains general tax information for all employees as a whole.

Find a selection of materials on filling out the 6-NDFL calculation in our section .

At the same time, the annual obligation for employers to submit certificates about employees 2-NDFL, and individual entrepreneurs and (in certain situations) individuals declarations in form 3-NDFL is retained.

Read about the specifics of preparing 2-NDFL certificates in the material “Nuances of filling out the 2-NDFL form in 2020.”

2016,2017 cheat sheet for changing the BCC

| tax, contribution | 2016 | note |

| Personal income tax | 18210102010011000110-2016 18210102010011000110-2017 not changed. | (we are an agent) at point 02 |

| PF | 18210202010061000160 2021 18210202010061010160 2017 | |

| FSS | 18210202090071000160 2021 18210202090071010160 2017 | 18210202090070010160 for VLSI |

| FFOMS | 18210202101081011160 2021 18210202101081013160 2017 | 18210202101080013160 for VLSI |

| FSS NS | 39310202050071000160 2021 2017 no difference |