January 20, 2021

Hello, dear readers of the KtoNaNovenkogo.ru blog. When we look at the details of any organization, with great amazement we see the mysterious TIN, OKTMO, OGRN (what is this?) and so on.

It is difficult for the uninitiated man in the street to even guess what each of these concepts means. Therefore, let’s continue to “enlighten ourselves.”

Today we will look at what the OKTMO code is, how the term stands for, what it is intended for, and how you can find out this code.

What are identifiers designed for?

OKTMO is an abbreviation that stands for all-Russian classifier of municipal territories. Using this code, you can understand which municipality a certain organization or entrepreneur belongs to. Rosstat systematizes information on the activities of enterprises and individual entrepreneurs using OKTMO codes.

Since the territory of Russia is very large, it is easier to divide it into municipalities and assign each its own code. All these codes are recorded in a specialized reference book.

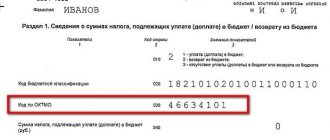

All entrepreneurs and heads of organizations must know their OKTMO code. It is indicated in reporting documentation, payment orders, tax reporting and other documents. The code must be indicated in the declarations of the simplified tax system, UTII, VAT, land and transport taxes, certificates and declarations 2-NDFL, 3-NDFL, 4-NDFL.

In simple words, the OKTMO code is a digital designation of the region. The purpose of territory encryption is to simplify and speed up the analysis of statistical data, as well as the correct distribution of funds from the Russian budget.

OKTMO: how and where to reflect

OKTMO is a code assigned to the territory of a municipality or a settlement that is part of it.

In tax returns and payment orders for the transfer of tax payments and insurance premiums, it is necessary to indicate OKTMO of the territory in which the corresponding taxes, fees or contributions are accumulated. Let's analyze the situation.

In 2021, 2 friends each opened their own business in the Eastern District of Moscow: one organized Sadko LLC in Novogireevo, and the other created IP Zakharov M.N. in the village. Akulovo. They had not been involved in business before and became acquainted with all the intricacies of difficult commercial work in the process of their activities.

At the initial stage of work, both of them kept their own accounts, so when it came time to transfer the first tax payments, everyone thought about how to fill out the payment slip correctly - there were too many codes and ciphers in it.

Read more about decoding the fields of a payment order in the material “How to decrypt a payment order?”.

Friends meticulously tried to understand the intricacies of the contents of this payment document. The basis was taken from the main regulatory document defining the requirements for filling out payment slips when paying taxes - Order of the Ministry of Finance of Russia dated November 12, 2013 No. 107n on the rules for filling out information in payment orders for the transfer of tax payments. And for control, we checked with a ready-made sample taken from the Internet.

Both had to work hard to complete the payment slips: indicate the 20-digit current account numbers without errors, unravel the incomprehensible coded words (KBK, OKTMO, BIC). Finally, this difficult process was completed, and both friends met to reconcile their bills - as a control step before sending them to the bank.

We'll tell you what came out of this later.

How is the digital code generated?

The OKTMO code contains from 8 to 11 digits. Each sign has its own meaning. The structure of the code is based on the definition of classification levels. There are only three steps:

- The first stage contains information about the groupings of the Ministry of Defense of the constituent entities of Russia.

- The second includes municipal districts, cities, districts within a city, territories or municipalities in federal cities.

- The third contains information about urban and rural areas, areas in the city.

The code is distributed into two sections, which contain municipalities and settlements. The first section code consists of 8 characters. The first and second characters are objects of the first stage, the third to fifth characters are the second stage, and the sixth to eighth characters are the third.

At the first stage, objects are encoded using the ordinal method. Values of the code bit in the second stage:

- 3 - intracity territories, municipalities of federal cities;

- 6 - municipal district;

- 7 - city with or without districts within it;

- 9 - territory in the federal city itself.

Autonomous okrugs have their own value of 3 digits - 8:

- 810-849 - municipal areas;

- 850-898 - urban areas.

It happens that there are two autonomous okrugs in one region. In this case, the 3rd digit for the second AO receives identifiers 9:

- 910-949 - municipal areas;

- 950-998 - urban districts.

At the third stage of encoding, the sixth digit acquires the meaning:

- 1 - urban settlement;

- 3 - area inside the city;

- 4 - rural settlement;

- 7 - intersettlement area.

Urban settlements are coded using signs:

- 01-49 - the composition includes a city;

- 51-99 - includes a village.

OKTMO codes, located in the second section of the directory, already consist of 11 characters. The first to eighth signs are the municipalities in which settlements are located, the remaining signs are the settlements themselves.

To designate cities, a series of codes from 001 to 049 are used. Codes 051-099 belong to urban-type settlements, and for villages and hamlets they take codes from 101 to 999. For those settlements that serve as administrative centers, a three-digit number with a unit at the last digit is determined . Code 001 identifies the city, 051 - urban settlement, 101 - rural settlement.

Decoding

The classifier consists of the encoding:

- municipalities;

- settlements in these formations.

The code consists of 8 or 11 digits depending on what object it represents. If these are municipalities, then the code includes 8 positions, and if settlements - then 11.

Each number carries a semantic load, since they encrypt in a certain sequence the region, region, city or village where the business entity is registered.

OKATO from OKTMO are the same or not

With the abolition of OKATO and the advent of OKTMO, a problem arose. Not everyone understands OKATO and OKTMO are the same thing or they are different codes. In fact, these are different abbreviation combinations, but they mean the same thing, with a small caveat. OKATO means the all-Russian classifier of objects of administrative-territorial division. The general difference between the codes is in the way objects are identified.

OKTMO codes appeared only in 2014. Before this, only OKATO codes were valid. But their drawback was that it was impossible to determine from them the city, the district within the city, the village in which a certain organization is located. Using OKTMO, you can identify the exact location, and this greatly simplifies the work of Rosstat.

| Code | Characteristic |

| OKATO | OKATO objects are subjects of Russia with administrative districts, cities of republican, regional, regional, district, district significance, urban settlements, rural districts, and settlements within them. |

| OKTMO | OKTMO provides systematization and unambiguous identification of municipalities and settlements within them throughout the country. The code contains the structure and stages of the territorial organization of local self-government. The OKTMO code directory is used for coding and distribution of MO. |

The OKATO code takes into account the subjects of the Russian Federation, and the OKTMO code takes into account the administrative-territorial structure of a particular municipality.

What does the OKTMO code consist of?

Rosstandart issued order No. 159-st OK 003-2013 on approval of the OKTMO classifier on June 14, 2013; it came into force at the beginning of 2014 and is in effect to this day. It was on January 1, 2014 that the tax service software was reconfigured to read new codes.

The code is 11-digit, a shortened version of 8 digits is provided for federal cities (Moscow, St. Petersburg, Sevastopol), but it should be remembered that within these entities there are territorial units that are also encrypted with 11 characters. The classifier is divided into 8 subjects of the Russian Federation (territorial districts):

- Central;

- Northwestern;

- North Caucasian;

- Ural;

- Siberian;

- Far Eastern;

- Privolzhsky;

- Southern.

Within these large municipal units, the elements decrease in importance: region - district - regional center - city - village - town - railway station, etc. Each object in the list corresponds to a specific sequence of numbers.

NOTE! The documents must indicate the OKTMO code that belongs specifically to the entrepreneur at his registration address (for individual entrepreneurs - registration), and not to the tax inspectorate or social fund.

How can I find out the code

You can obtain the code in official documentation only at the Russian Tax Service office. When registering with a tax or legal entity, a letter with the codes indicated in it is sent from the regional department of Rosstat. They are assigned to each newly formed organization.

Find out how and where you can open an individual entrepreneur current account online. Choose the best offer from banks →

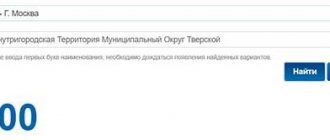

You can also get the OKTMO code online on the tax website in a special section. To do this, you need to enter the OKATO code that existed before, or the name of MO. If you set the search parameters by the name of the MO, you can type only the first few letters, and then wait for the system to automatically find suitable options. You can choose the one you need from those offered. You can find out the OKTMO code in several other ways, which are described below.

By taxpayer code

The OKTMO code can be found from Internet sources. To carry out a search, you only need the TIN of a legal entity or individual entrepreneur. OKTMO encoding by TIN can be obtained on the official website of Rosstat. For this:

- Open the Rosstat website.

- In the TIN request line, enter the appropriate number and click “Get.”

After this, the system will automatically download all the codes that have been assigned to the organization. This list also contains the OKTMO code.

By location

You can also find the OKTMO code at the legal address of the organization - at the official registration address. You can also search for a code by address on the official website of Rosstat. For this:

- Go to the main page of Rosstat.

- Find the “Respondent Information” tab in the menu and hover your cursor over it.

- Select the section with all-Russian classifiers in the list that appears and click on it.

- Specify the OKTMO classifiers item on the page that opens. After this, a list will appear with links to 8 volumes of federal districts.

- Click on the required volume. The electronic file will begin downloading to your computer.

- Open the downloaded document and select the desired location in it.

The corresponding OKTMO code will be written opposite the selected locality. If you know where to find OKTMO and correctly indicate its value, then all payments and taxes will go to their destination. Therefore, it is better to look for such information in advance so that you do not have to redo the documents several times.

about the author

Klavdiya Treskova - higher education with qualification “Economist”, with specializations “Economics and Management” and “Computer Technologies” at PSU. She worked in a bank in positions from operator to acting. Head of the Department for servicing private and corporate clients. Every year she successfully passed certifications, education and training in banking services. Total work experience in the bank is more than 15 years. [email protected]

Is this article useful? Not really

Help us find out how much this article helped you. If something is missing or the information is not accurate, please report it below in the comments or write to us by email

Compliance with the old classifier

With the introduction of OKTMO codes into use, on behalf of the Ministry of Finance, special code correspondence tables were developed, with the help of which you can easily transfer OKATO to OKTMO.

On the Internet you can find a lot of services with the help of which one number is transferred to another with minimal time. The translation table is necessary primarily to avoid an increase in the percentage of uncleared payments to the budget. At this time, it has been brought to the attention of the Federal Tax Service, the Federal Tax Service and Rosstat.

Comments: 0

Your comment (question) If you have questions about this article, you can tell us. Our team consists of only experienced experts and specialists with specialized education. We will try to help you in this topic:

Author of the article: Klavdiya Treskova

Consultant, author Popovich Anna

Financial author Olga Pikhotskaya

What is it needed for

Government agencies

The code is necessary to ensure that the procedure for processing an array of information on business activities in a given region is as quickly and simplified as possible. Rosstat constantly processes a lot of data, and the OKTMO code helps systematize information received from individual entrepreneurs and legal entities.

Any business activity is “tied” to one territory or another; using the OKTMO code, the State Statistics Service can easily determine which one. By studying the structure of the code, you can consistently determine the territorial affiliation of the subject of taxation:

The code contains the information:

- the first two characters are a subject of the Russian Federation;

- the next 3 characters are a city or an association equivalent to it according to classification;

- the remaining positions are the locality of the organization or individual entrepreneur.

You might be interested in:

How to get SNILS for an individual and why it is needed

Attention! In 11-digit OKTMO, the first 8 digits similarly characterize a large municipal entity, and the 9th – 11th positions characterize a settlement within it.

For business entities

An individual entrepreneur or the management of an organization needs to know their OKTMO, because it must be regularly entered in a special field on many important documents, namely:

- tax reporting in the simplified tax system and UTII modes (declaration under the simplified tax system and UTII);

- value added tax declaration;

- income declarations for individuals;

- land tax documents;

- transport tax declaration;

- mining reporting;

- documents on taxes on gambling business;

- excise tax reports.

In addition to reporting forms, the code must be affixed to payment orders for all tax deductions, including penalties and fines.

Attention! A list of all documentation where OKTMO indication is required is contained on the official website of the Federal Tax Service of the Russian Federation.

Determination methods

There are 2 methods

searching for this code using the personal tax number of the entrepreneur:

- By sending a written request to the tax authority where he is registered.

- Using free government Internet resources.

The first option takes at least a week to receive the desired encrypted number. First, the entrepreneur must take an application with a request to inform him of the assigned code to the tax office where he was previously registered, or send it by registered mail and wait for a response message sent in the same way from the tax authority.

A response can only be received after 5 days. This method guarantees the most reliable figures.

, encrypted in the code of the local municipality.

You can quickly obtain the required code via the Internet. There are many sites on the electronic network where you can find answers to the information you request. However, experts advise turning to government portals to obtain reliable information.

According to OKATO

Before changes were made to tax legislation in 2014, the code was used, which was subsequently replaced by OKTMO. To find out the new code for your municipality, you can use OKATO.

For convenience, a corresponding table has been created. On the Internet resource kod-oktmo.ru, it is enough to enter the old code for the program to issue a new OKTMO.

Until 2014, OKATO codes were used when filling out documents. They now need to be replaced based on the table of correspondence between OKATO codes and OKTMO codes.

By the address

It is quite easy to obtain information about the OKTMO code at the address on the Federal Tax Service website nalog.ru and the previously indicated portal kod-oktmo.ru.

If you only know the legal or actual address of the organization, you can try to find out the OKTMO code from this data. On the above service, after entering the exact address, you will receive not only the OKTMO code, but also the address of the registering branch of the Federal Tax Service, postal code and full details.

By TIN

If you need to clarify the OKTMO code by TIN, then the entrepreneur needs to use the state information portal of Rosstat.

So which official sites can provide the necessary data on the existing TIN, address or other code number of an individual entrepreneur.

Where to find out the meaning of classifiers

How to find out OKATO? Is it possible to find OKTMO by OKATO if the meanings of these codes are similar? The easiest way to get information is from the tax office itself.

You can find out the value of OKTMO using the OKATO code directly on the tax website by entering the known code of the territorial entity.

The information is available on the official website of the Federal Tax Service, where you can find out the correct OKTMO of an organization, entrepreneur or other taxpayer by TIN. You can also obtain the necessary data when filling out reporting forms using the “Taxpayer” program.

Other resources also provide the opportunity to familiarize yourself with the correct OKTMO code. As a rule, most programs have a built-in Russian address classifier (KLADR) and OKATO.

What is it: essence, purpose

OKTMO is an official directory with a list of special codes assigned to settlements taking into account their territorial location.

The delimitation of administrative-territorial entities by special codes specified in OKTMO is used by the state statistical department for the following purposes:

- conducting official statistical observations (both continuous and sample);

- systematic collection of data necessary to perform statistical research.

What to do if it is indicated incorrectly?

What should the payer do if he makes a mistake in filling out field 105 of the payment order?

If the code according to the OKTMO reference book is reflected incorrectly in the payment for the Federal Tax Service, this error will not affect the crediting of tax payments to the budget.

If such an error is detected, the payer should make a request to clarify the details to the tax service. The decision is made by the tax department within a ten-day period, counted from the date of acceptance of the relevant application.

In case of such errors and incorrect KBK in field 105, a reconciliation of calculations between the payer and the tax service is often carried out, based on the results of which a corresponding act is drawn up.

Sample letter of clarification to the tax service

Although such a statement is drawn up arbitrarily, it must contain the following data:

- date of payment made;

- the amount transferred under the payment order;

- purpose of the completed payment;

- specific details in which the error was made;

- correct value of the attribute.

This letter should be accompanied by a bank statement certifying the fact of the transfer, and a copy of the order containing the erroneous value of the details in field 105.

letters about clarification of OKTMO - word.