The article provides a brief description of budget classification codes and a definition of the structure of the cipher. If you want to understand how to find out the BCC of an organization by TIN and OKTMO, then let’s say right away that this is impossible: these concepts are in no way related to each other. However, you can find the KBK online - detailed instructions are given in the corresponding paragraph.

Any financial transactions made by the organization are reflected in payment orders when sending funds. When making contributions or paying tax amounts, the payer indicates in the payment slip the type of payment, encrypted under the abbreviation KBK.

What is KBK (budget classification code)

The concept of the BCC was first mentioned in the summer of 1998 in the edition of the Budget Code of the Russian Federation dated July 31, 1998 No. 145 Federal Law. The meaning of a long sequence of characters was explained here - this is a means of grouping the budget.

Our country’s budget receives a huge amount of cash flows every day. To systematize them and control the sources of funds, a system of codes was needed that would detail the purpose of financial resources.

For this purpose, the first KBK directory was created, which, of course, has been frequently amended since 1998. The introduction of the CBC allowed:

- reduce the number of errors made when making payments to the budget;

- systematize financial information;

- if necessary, view the history of a specific financial transaction;

- simplify the process of monitoring debts to the budget;

- make the budget planning procedure more clear.

Important!

Changes to the KBK directory are made almost every year. Therefore, it is necessary to check the latest information every time. Read below about where to find the latest CBC.

“When specifying the KBK code, be sure to focus on the latest version of the classifier. Since, due to frequent changes in the economic life of the country and the emergence of new sectors of the economy, changes are made to the code system. An incorrect indication by the KBK is a tax offense and, accordingly, entails penalties.”

Consultant of the Federal Tax Service Yakimova A.A.

Value in payment document

The KBK in the payment form has the form of a special digital code indicating the revenue and expenditure parts of the budget. Business accountants often have to deal with such details, but not everyone understands the meaning of each part of the code in a certain encrypted sequence.

In the “Recipient” column there is a field in which you must enter a 20-digit code. This indicates the path and purpose of the transferred funds. This field is numbered under column 104.

If the accountant made a mistake and transferred money to the wrong account, then, according to Article 45 of the Tax Code of the Russian Federation, the tax or fee is still considered paid. The main thing is to promptly submit an application for the correct redistribution of funds. Sometimes payers are faced with fines and penalties because they did not pay attention to the incorrect code in the payment in time.

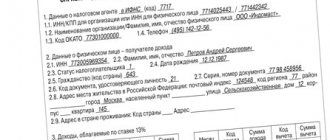

What is an INN (individual tax number)

TIN is a required detail for many documents. There are TINs for individuals (consists of 12 digits) and TINs for legal entities (10 characters long). This code is required by the Federal Tax Service. With the help of the TIN, tax payers are monitored as part of a single database. This simplifies tax accounting and contributes to the correct conduct of business.

The TIN of a legal entity is as follows: XX YY ZZZZZ R, where

- XX is the code of the subject of our country in which the taxpayer is registered;

- YY – number of the tax office with which the taxpayer is registered;

- ZZZZZ – number under which the legal entity is registered in the unified journal of the tax authority;

- R is a control character that checks the provided information.

Where can I find the current code?

The value of the budget classification code is determined for each region according to a single principle. Current values are indicated in the above-mentioned order of the Ministry of Finance of the Russian Federation. The receipt has a special field for filling out the BCC number “104”.

You can also get advice from the tax authority, in special official directories that are published every year. Sberbank or a commercial bank also have reliable information and will provide free consultation.

Many online services fill out the KBK automatically for the convenience of users.

What is OKTMO

This abbreviation stands for All-Russian Classifier of Municipal Territories. OKTMO shows which subject of our country the legal entity belongs to. This detail, indicated in the declarations, is important for Rosstat. This is how the organization determines, for example, the volume of financial revenues for municipalities. This data is then used in budget planning. OKTMO approved by order of Rostandart dated June 14, 2013 No. 159-st.

The code may consist of 8 or 11 digits, which indicate the following:

- 1 and 2 digits are a subject of the Russian Federation;

- 3,4,5 symbols - district, district or intracity formations of some constituent entities of the country (Sevastopol, St. Petersburg, Moscow);

- 6,7,8 signs – rural or urban settlement, intra-city areas;

- 9,10,11 numbers are intended for objects that are part of municipal entities (for example, an 11-digit code is provided for the village of Zhukovka, which is considered an integral part of Moscow).

In tax returns, 11 cells are always allocated for OKTMO. If your code consists of 8 digits, you need to fill in 8 cells from left to right, and put a dash in the remaining three. Writing zeros in empty cells is a gross violation

(letter of the Federal Treasury for the Moscow Region and the Ministry of Finance of the Moscow Region dated 02/03/14 No. 48-12-13/02-728 and No. 22ish-693/22-07-02).

KBK in payment in 2021

What is income for the budget, for taxpayers is payment to the state treasury of taxes and equivalent payments and insurance premiums (except for “injuries”). Therefore, each of them first goes to the accounts of the territorial body of the Federal Treasury and is classified there on the basis of the BCC.

For any taxpayer or tax agent, regardless of its organizational and legal form, it is very important to correctly fill out a payment order, since errors, for example, incorrectly filling out this field in a payment order, can lead to money being credited to the “wrong address.” The Federal Treasury may classify it as “unclarified.” This means that the payer has an unpaid obligation to the state, i.e., outstanding arrears, penalties, fines and other sanctions from the state, in this case to the payment administrator. This can be avoided if you indicate the budget classification code correctly.

Order No. 245n dated November 30, 2018, which amended the current guidelines for the application of the BCC, contains new budget classification codes:

- excise taxes New budget classification codes have been introduced for dark marine fuel, petroleum raw materials for refining, state duties for issuing excise stamps, etc.;

- a new BCC for a single tax for individuals on professional income, a fee introduced for self-employed citizens;

- codes for paying taxes on additional income from the production of hydrocarbons, calculated according to the norms of Art. 333.45 Tax Code of the Russian Federation.

KBK structure

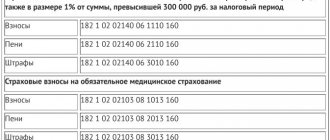

So, KBK consists of 20 characters. It is more convenient to see the structure of the indicator in the table.

| Characters in order | Explanation | Example |

| 1,2,3 | Indicate the body that manages budget funds | 182 – tax service, 392 – Pension Fund of the Russian Federation, 393 – Social Insurance Fund |

| 4,5,6 | Type of contribution paid | 101 – income tax, 102 – insurance fees for pension insurance. |

| 7,8 | Budget level for which funds are intended | 01 – federal level. 02 – local |

| 9,10,11 | Sub-item of income | Determined by the classifier; for personal income tax, for example, 010. |

| 12,13 | Income element | Also determined by the classifier. For personal income tax – 01 |

| 14,15,16,17 | Payment type | 1000 – contribution or arrears of tax, 3000 – fine, 2100 – pennies, etc. |

| 18,19,20 | Type of income | 110 – tax revenue, 160 – social insurance contributions. |

Example. The BCC for paying property tax (which is not part of the Unified Gas Supply System) looks like this: 182 1 0600 110.

The digital digits in this long number indicate the following:

- 182 – this block indicates that the manager of the funds is the Federal Tax Service.

- 106 – numbers indicate a specific tax – property tax.

- 02 – address for receiving funds – local budget.

- 010 – property tax subsection number.

- 02 – code of the income element for this tax.

- 1000 - the symbols indicate the type of payment - this is a tax, and not a fine or penalty, for example.

- 110 – the numbers indicate the type of budget income: this is tax revenue, not a social insurance contribution.

Part 1: 3-digit administrator code

Administrator

- occupies 1-3 categories of the KBK, consisting of three characters (symbols) and corresponding to the number assigned to the main manager in accordance with the list of main managers of the corresponding budget.

Administrators of budget revenues are:

- tax authorities;

- other government bodies;

- governing bodies of state extra-budgetary funds;

- local government bodies;

- legal entities or individuals authorized by the specified government bodies, as well as state (municipal) institutions created by these bodies

As an example, here are the codes of individual administrators:

- code of the Federal Tax Service of Russia - 182-0-00-00-000...;

- code of the Federal Customs Service of Russia - 153-0-00-00-000...;

- code of the Pension Fund of the Russian Federation – 392-0-00-00-000...;

- code of the Social Insurance Fund of the Russian Federation – 393-0-00-00-000...;

- code of the Federal Compulsory Medical Insurance Fund - 394-0-00-00-000... etc.

How to find out an organization’s BCC online

In order to find out the BCC for the payment you are interested in, follow these steps:

- Go to the official website of the Federal Tax Service https://www.nalog.ru.

- Hover your cursor over the “Activities” tab and select “Taxation in the Russian Federation.”

1

3. In the window that opens “Russian Federation Budget Revenue Classification Codes....” select the type of payer - legal entity, individual, individual entrepreneur. Let's take a legal entity as an example.

2

4. A list of contributions and payments opens. We choose the one we need. Let's say personal income tax.

3

5. The screen displays a list of BCCs for various cases related to the payment of personal income tax. If this is a contribution or tax arrears (and not a penny, for example), select the code shown in the figure.

4

The significance and role of the BCC in the system of budget regulation

The use of KBK budget classification codes is carried out on the basis of instructions approved by Order of the Ministry of Finance dated 06/08/2018 No. 132n.

The instructions establish the structure, principles of purpose, general requirements for the procedure for the formation and application of the CBC and are mandatory for everyone. The instructions contain a budget classification of income, expenses and sources of financing of various budgets of the Russian Federation, which is used for maintaining budget accounting, generating budget and other reporting and includes the classification:

- budget revenues;

- budget expenditures;

- sources of financing budget deficits.

The codes of operations of the general government sector are enshrined in Order of the Ministry of Finance No. 209n dated November 29, 2017.

Budget revenues are replenished, among other things, by taxes and similar payments. They are quite varied, but each is assigned its own separate budget classification code, with the first three digits of the code indicating the payment administrator. The most common administrator code is 182, code of the Federal Tax Service of the Russian Federation.

Errors on the topic “How to find out the BCC of an organization by TIN or OKTMO”

Error.

The accountant, filling out the payment slip for the transfer of income tax, indicated the same BCC for both of its parts - intended for the federal and local budgets: 182 1 0100 110.

It is not right. As a result, there is an overpayment of taxes for the federal budget (which in itself is not scary, because the payment can be reduced by this amount in the next period). But arrears are recorded in the local budget. This is already a tax offense punishable by financial measures.

To avoid problems with tax authorities, the accountant should indicate a different BCC for income tax going to the local budget: 182 1 0100 110.

Wrong data

But what should you do if, for example, you need to pay for kindergarten, but the KBK that was entered from the receipt is not suitable? After all, this is fraught with consequences if the terminal passes the wrong number. The money will simply go to another account, and problems may arise due to late payment. In this case, it is better if the error is discovered as quickly as possible.

If the payment has gone through, you need to immediately contact the organization to which the money was transferred. Write an application for payment clarification or search.

Depending on the structure of the body, the application is submitted in any form. It is advisable to attach a receipt with payment using incorrect details. If the error was discovered before making the payment, then you just need to contact the organization and find out the code or go to the website of this authority.

The state body must accept an application for clarification of payment within ten days from the date of submission. When this deadline has passed, you will need to take the budget calculation document into your tax file to ensure that the money was credited to the correct BCC.

These are the measures that need to be taken if the BCC is incorrectly indicated on the receipt. But you need to accept them in order to avoid paying a fine for late crediting of funds.

How to automate the generation of payment orders for fines

The Onlinegibdd.ru service checks the legal entity’s vehicle fleet daily for new regulations and provides a report in the user’s personal account and by email. Allows mass payment in one click.

There are two ways to pay fines through the service:

- From the company's current account. Payments are generated automatically using the service. They can be printed on paper or uploaded to the organization’s client bank.

- Online, from your personal account in the service. In this case, the service takes full responsibility for generating payments, passing them through its bank and monitoring the repayment of the fine. A report is provided on the results.

Automatic filling of payments eliminates errors and their consequences. And daily monitoring helps pay fines with a 50% discount, saving the company time and money.

Details of work on the page:

according to article

Write to our lawyer and he will help you understand automobile legislation. We will consider controversial situations and tell you how to act according to the law.

Don't miss new useful publications

We will tell you about the intricacies of the legislation, help you understand it and tell you what to do in controversial situations.

How to control the repayment of a fine paid by bank transfer

Paying a fine from a current account does not guarantee its repayment. The fine may remain unpaid.

The reason may be an error in the payment order or a software glitch in the bank. Or the bank simply did not fulfill the obligation established by law: it did not send information about payment of the fine to the special state payment system - GIS GMP.

The fine must be paid to the GIS GMP, because all regulatory authorities take payment information from there.

To be sure that there will be no delay, it is necessary to monitor the repayment of paid fines in the GIS GMP.

You can check the payment status on the website of the State Traffic Safety Inspectorate or State Services (for traffic police fines) or on the website of the Moscow Government (for fines of MADI and GKU AMPP). This must be done manually, each time specifying the data of the vehicle being checked or the decision.

For a company with a large fleet, for example, 30 cars, in order to quickly pay fines and track repayments, you will have to hire a separate person who will check each car and driver daily. Or contact a special service for automatic search and payment of car fines.

The service fills out bank payments automatically, uploads them to your client bank, and after payment controls the repayment of fines in the GIS GMP.

Traffic police fines for an organization - who pays?

Fines from photo recording cameras are always issued to the owner of the vehicle, regardless of who was driving it. This rule is stated in paragraph 1 of Art. 2.6.1 Code of Administrative Offenses of the Russian Federation. It turns out that legal entities—transport owners—receive fines for their employees.

Art. 32.2 of the Code of Administrative Offenses of the Russian Federation determines who must pay the fine: “An administrative fine must be paid ... by a person brought to administrative responsibility ...,” that is, by an organization.

In reality, both its employee and another legal entity can pay a fine for an organization.

From what means to pay the fine is decided within the organization. Here are the possible options:

- The organization collects the amount from the hired driver;

- Pays from his own funds;

- Or the fine is paid by another legal entity (for example, a lessee or a car renter).

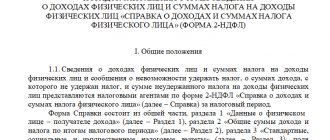

Insurance premiums

From 01/01/2017, all contributions for compulsory insurance of employees, except for contributions for injuries, must be transferred to the Federal Tax Service. For the convenience of payers, the Federal Tax Service website contains information on which BCC to indicate for payments to the budget. To pay insurance premiums for compulsory pension insurance (20%) for June we use 182 1 0210 160.

Payment order details for OPS (20%) for June 2021:

Where:

- field 104 - budget classification code, for example, insurance contribution for compulsory pension insurance;

- field 105 - OKTMO, territory code according to the all-Russian classifier of territories of municipalities at the place of registration of the taxpayer (tax agent);

- field 106 - for current payments, indicate the TP code (current year);

- field 107 - value of the tax period indicator; can take the corresponding value of the period: MC - monthly payments;

- field 108 — document number, in this case it is set to “0”;

- field 109 - date of the document, in this case it is set to “0”;

- field 110 - payment type, not filled in;

- field 24 - purpose, in this case the number of the policyholder in the Pension Fund of the Russian Federation is indicated.

Details for paying a traffic fine, where to get it

The payment order must contain the details of the payee. Using them, the payment system understands who the payment is intended for and where to transfer the money.

find details in the following sources:

- In a resolution or receipt received from the traffic police.

Pros: everything is at hand, no need to scour the Internet.

Disadvantages: sometimes decisions do not reach the addressee and there is a risk of late payment and problems with the FSSP.

- On the website of the State Traffic Safety Inspectorate and State Services.

If you don’t have a resolution on hand, you can find the fine and payment details on the official traffic police website. To do this, enter the vehicle license plate number and STS number into the search form.

Pros: it’s convenient that you can find out the details while at your workplace.

Disadvantages: if we are talking about a large fleet of vehicles, a lot of time will be spent on checking, and on this resource there are only traffic police fines and no fines from MADI, AMPP, MUGADN.

- Through special services like onlinegibdd.ru .

Here you can check information about all fines for violations of traffic rules, parking rules, non-payment of parking, non-payment of the Platon system, overloading across the entire company’s fleet, get a list of unpaid orders and the full details of these orders. And also use the service of automatic generation of payment orders (read more about the service below).

Pros: no need to waste time.

Cons: the service is paid.

KBK for taxes in the general regime

The general taxation system (OSNO) is a tax payment regime that is chosen for an entrepreneur if he himself has not indicated which system he will use. Entrepreneurs on OSNO are payers of:

- Personal Income Tax (Personal Income Tax);

- VAT (Value Added Tax).

And there are corresponding payment codes for them.

| KBK NDFL for individual entrepreneurs | 182 10100 110 |

| VAT for individual entrepreneurs | 182 10300 110 |