How do BSOs differ from regular forms?

In contrast to ordinary forms, BSOs in an institution are subject to special requirements for registration and storage. As a rule, BSO forms are approved by the relevant authorities and have a series and form number. In addition, they can be applied to different degrees of protection.

The most common BSO used in the activities of government institutions include forms of work books, inserts for them, receipts, certificates, diplomas, certificates, tickets and subscriptions, certificates of incapacity for work.

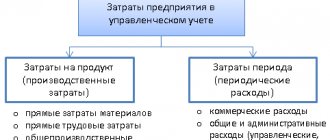

Accounting for blank products

General provisions Accounting for strict reporting forms Receipt of strict reporting forms Issuing, monitoring the use of strict reporting forms Accounting for damaged, canceled strict reporting forms, their destruction Accounting

General provisions

Forms of primary accounting documents are presented to us in the form of strict reporting forms and forms that are not such.

Forms that are not strict reporting forms can be developed by the organization itself; they can be downloaded from any information and legal system or purchased. Forms that are not purchased are not subject to posting and write-off, unless the paper used to print the forms is subject to write-off. Purchased blank products are subject to capitalization:

DEBIT 10 – CREDIT 60.

Based on the requirements of clause 3 of the Inventory Accounting Instructions, approved by Decree of the Ministry of Finance dated November 12, 2010 No. 133 (hereinafter referred to as Instruction No. 133), individual items included in funds in circulation include:

- inventory;

- household supplies;

- tools;

- equipment and devices;

- replacement equipment;

- special (protective), uniform and branded clothing and shoes;

- temporary (non-title) structures and fixtures.

It is clear from the list that blank products do not apply to individual items as part of funds in circulation; therefore, clause 107 of Instruction No. 133, which provides for the procedure for transferring the cost of individual items as part of funds in circulation to accounts for recording production costs and sales costs, is unacceptable .

And since this is so, blank products should be written off as they are used (issued to responsible executors as consumables). However, to write off used blank products, an additional document is required. The register of blank products issued to responsible executors or a write-off act can be used as such a document. According to the final data of the register (act), blank products can be written off as general business expenses (or) as sales expenses:

DEBIT 26 – CREDIT 10.

Accounting for strict reporting forms

A completely different procedure is established when recording strict reporting forms (documents with a certain degree of protection).

In accordance with sub. 3.2 clause 23 of the Resolution of the Council of Ministers of December 22, 2001 No. 1846 “On some issues of the production and use of forms of securities and documents with a certain degree of protection, as well as documents with a certain degree of protection” forms and documents include printed products made with elements ( means) of protection against counterfeiting, meeting the requirements determined by the Ministry of Finance in agreement with the Ministry of Internal Affairs and the Ministry of Justice, and (or) the numbering (identification number) applied during its manufacture, which is manufactured, distributed, used and destroyed in the manner prescribed by law. Forms of securities and documents with a certain degree of protection, as well as documents with a certain degree of protection (hereinafter - forms and documents) are subject to:

- mandatory registration in the State Register of forms of securities and documents with a certain degree of protection, as well as documents with a certain degree of protection;

- accounting during their manufacture and use.

Maintaining the State Register of forms of securities and documents with a certain degree of protection, as well as documents with a certain degree of protection, is entrusted to the Ministry of Finance.

Accounting for strict reporting forms is carried out in accordance with the requirements of the Instructions on the procedure for using and accounting for strict reporting forms, approved by Decree of the Ministry of Finance dated December 18, 2008 No. 196 (hereinafter referred to as Instruction No. 196). Strict reporting forms can include not only forms of documents included in the State Register, but also forms recognized as such by the organization itself. Therefore, the list of documents related to strict reporting forms, the place, procedure for their storage and use are established by order of the head of the organization (individual entrepreneur). At the same time, proper accounting must be organized and the safety of strict reporting forms must be ensured.

Receipt of strict reporting forms

Strict reporting forms received by the organization must be recorded by the financially responsible person.

If there are discrepancies between the actual availability of books of strict reporting forms and the data of accompanying documents, a report on checking the availability of strict reporting forms is drawn up (Appendix 1 to Instruction No. 196). This act reflects the number of books of strict reporting forms that were not available, with the obligatory indication of the series and numbers of the forms themselves. The act must be drawn up in two copies, of which the first copy is sent to the supplier to clarify the reasons for the discrepancy and take action, and the second copy remains with the organization (individual entrepreneur). The receipt of strict reporting forms is reflected by the financially responsible person in the receipt and expenditure book for recording strict reporting forms (Appendix 2 to Instruction No. 196). Before entries can be made in it, the book must be numbered, laced, sealed and signed by the head and chief accountant of the organization (individual entrepreneur).

Maintaining a receipt and expenditure book on computer storage media is not excluded. In this case, the protection of information, the preservation of an archive of this information for the period established by the legislation of the Republic of Belarus, and the possibility of obtaining a duly certified paper copy must be ensured.

Issuance and control over the use of strict reporting forms

Accounting for the movement (receipt, expense) of strict reporting forms is carried out by financially responsible persons in quantitative terms by numbers and series and is reflected in the receipt and expenditure book for accounting of strict reporting forms in the columns “receipt”, “expense”, “balance”.

The issuance of strict reporting forms to responsible executors for reporting is carried out using invoices on strict reporting forms (Appendix 3 to Instruction No. 196) with the permission of the head and chief accountant of the organization (individual entrepreneur) or persons authorized by them, indicating the series and numbers of the forms.

As strict reporting forms are issued to responsible executors, the data of invoices is entered by the organization's accounting department (individual entrepreneur) into a certificate card for issued and used strict reporting forms (Appendix 4 to Instruction No. 196).

If strict reporting forms are lost or stolen, the financially responsible person is obliged to inform the head of the organization (individual entrepreneur) about this. In this case, the appointed commission checks the actual availability of the forms and draws up a report indicating the circumstances of loss (theft), damage, the number of missing strict reporting forms, listing their series and numbers. The act is presented to the head of the organization (individual entrepreneur) to make an appropriate decision.

Strict reporting forms issued to responsible executors by the financially responsible person are written off from the register on the basis of an act for writing off used strict reporting forms (Appendix 5 to Instruction No. 196).

Accounting for damaged and canceled strict reporting forms and their destruction

Damaged and (or) canceled strict reporting forms are retained by the organization (individual entrepreneur) along with a compiled register of strict reporting forms subject to destruction, in the form in accordance with Appendix 6 to Instruction No. 196 for a month after the tax authorities have checked compliance with tax legislation.

Preparation for the destruction of damaged and (or) canceled strict reporting forms begins after the expiration of the above period, with the written permission of the head of the organization (individual entrepreneur) or persons authorized by him. For this purpose, the order appoints a commission consisting of officials of the organization (individual entrepreneur), which is obliged to check the presence of strict reporting forms subject to destruction and give an opinion confirming the need for their destruction.

In the presence of the commission, the verified strict reporting forms are packaged and sealed. Then an act is drawn up for the write-off of damaged, canceled strict reporting forms (Appendix 7 to Instruction No. 196) indicating the series and numbers of strict reporting forms to be destroyed.

Written off strict reporting forms are left for storage in the same organization (with the same individual entrepreneur). Within 3 days, the act for writing off strict reporting forms is submitted for approval to the head of the organization (approved by the individual entrepreneur). The head of the organization approves the act within 5 days after its receipt.

After approval of the act on the write-off of damaged, canceled strict reporting forms, the commission carries out their actual destruction, about which an act on the destruction of strict reporting forms is drawn up in the form approved by the head of the organization (individual entrepreneur).

The act of destroying strict reporting forms within 3 days is approved by the head of the organization (individual entrepreneur).

Accounting

Accounting for strict reporting forms is carried out by the accounting department of the organization (individual entrepreneur) in cost and quantitative terms:

- commercial organizations and individual entrepreneurs maintaining accounting records - on the account. 10 "Materials";

- budgetary organizations - on the account. 21 “Other expenses” subaccount 210 “Expenses for distribution”.

In addition, analytical records of strict reporting forms are maintained.

An off-balance sheet account is intended for their accounting. 006 “Strict reporting forms”, and in budgetary organizations - to an off-balance sheet account. 04 “Strict reporting forms.” Analytical accounting is maintained for each type of form and the place where it is stored (materially responsible persons). Coming. Received strict reporting forms in accordance with clause 21 of Instruction No. 196 are reflected in accounting:

- commercial organizations and individual entrepreneurs maintaining accounting records - by debit of the account. 10 “Materials” and credit account. 60 “Settlements with suppliers and contractors” in the assessment based on the actual costs incurred for their acquisition. At the same time, the receipt of forms of specific series and numbers is reflected upon receipt in the off-balance sheet account. 006 “Strict reporting forms” at face value or conditional valuation;

- budgetary organizations - on the debit of the account. 21 “Other expenses” subaccount 210 “Expenses for distribution” and credit account. 17 “Settlements with various debtors and creditors” subaccount 178 “Settlements with other debtors and creditors”; at the same time, receipt of forms of specific series and numbers - on the debit of the account. 04 “Strict reporting forms” (sub-accounts for financially responsible persons) for the actual costs incurred for their acquisition.

Issue. The issuance of strict reporting forms is reflected in the following accounting entries:

- commercial organizations and individual entrepreneurs maintaining accounting records - by debit of the account. 08 “Investments in long-term assets”, 20 “Main production”, 23 “Auxiliary production”, 26 “General production costs”, 29 “Servicing production and facilities”, 44 “Sales expenses” and other accounts in correspondence with the credit account. 10 "Materials";

- budgetary organizations - by debit of accounts:

20 “Budget expenses” (subaccounts 200 “Budget expenses”, 202 “Expenditures from other budgets”);

21 “Other expenses” (subaccounts 211 “Expenditures on extra-budgetary funds”, 215 “Expenditures on extra-budgetary funds”); 08 “Production costs” subaccount 080 “Production costs”. In this case, the account is credited. 21 “Expenses for distribution” subaccount 210 “Expenses for distribution”. Write-off. Write-off of strict reporting forms from the accounts of financially responsible persons (write-off of specific series and numbers of forms) is reflected in the expense of the corresponding off-balance sheet account:

- commercial organizations and individual entrepreneurs maintaining accounting records - 006 “Strict reporting forms”;

- budgetary organizations - 04 “Strict reporting forms”.

The deregistration of damaged and (or) canceled strict reporting forms, if the damage or cancellation did not occur through the fault of a specific employee when storing the forms before they were transferred by the financially responsible person to the responsible executors, is reflected in the following accounting entries:

- commercial organizations and individual entrepreneurs maintaining accounting records - by debit of the account. 90 “Income and expenses for current activities” subaccount 10 “Other expenses for current activities.”

The account is used as a corresponding account. 10 "Materials". At the same time, specific series and numbers of forms are written off for the consumption of the off-balance sheet account. 006 “Strict reporting forms”;

- budgetary organizations - by debit of accounts:

20 “Budget expenses” (subaccounts 200 “Budget expenses”, 202 “Expenditures from other budgets”);

21 “Other expenses” (subaccounts 211 “Expenditures on extra-budgetary funds”, 215 “Expenditures on extra-budgetary funds”); 08 “Production costs” subaccount 080 “Production costs”. The account is used as a corresponding account. 21 “Expenses for distribution” subaccount 210 “Expenses for distribution”. At the same time, budgetary organizations write off specific series and numbers of forms for the consumption of off-balance sheet accounts. 04 “Strict reporting forms.”

If damage or cancellation of strict reporting forms occurred due to the fault of persons who did not ensure the safety of strict reporting forms in storage areas, the cost of these forms is reflected in the following accounting entries:

- commercial organizations and individual entrepreneurs maintaining accounting records - by debit of the account. 94 “Shortages and losses from damage to property” and a credit to one of the accounts where the cost of the forms was written off when they were issued to the responsible executors:

10 "Materials";

08 “Investments in long-term assets”; 20 “Main production”; 23 “Auxiliary production”; 26 “General production costs”; 29 “Service industries and farms”; 44 “Implementation costs”; other accounts. At the same time, the write-off of forms of specific series and numbers is reflected in the expense of the off-balance sheet account. 006 “Strict reporting forms.”

The cost of damaged and (or) canceled strict reporting forms is reflected in the debit of the account. 73 “Settlements with personnel for other operations” and account credit. 94 “Shortages and losses from damage to property”;

- budgetary organizations - on the debit of the account. 17 “Settlements with various debtors and creditors” subaccount 170 “Debtors for shortages” and a credit to one of the accounts where the cost of the forms was written off when they were issued to the responsible executors:

20 “Budget expenses” (subaccounts 200 “Budget expenses”, 202 “Expenditures from other budgets”);

21 “Other expenses” (subaccounts 211 “Expenditures on extra-budgetary funds”, 215 “Expenditures on extra-budgetary funds”); 08 “Production costs” subaccount 080 “Production costs”. At the same time, the write-off of specific series and form numbers is reflected in the expense of the off-balance sheet account. 04 “Strict reporting forms.”

As established by paragraph 26 of Instruction No. 196, the following accounting entries are compiled for the amount of VAT calculated in the presence of guilty persons from the cost of damaged and (or) canceled strict reporting forms:

- commercial organizations and individual entrepreneurs maintaining accounting records - by debit of the account. 94 “Shortages and losses from damage to valuables” and credit account. 68 “Calculations for taxes and fees”;

- budgetary organizations carrying out entrepreneurial activities - on the debit of the account. 17 “Settlements with various debtors and creditors” subaccount 170 “Debtors for shortages” and credit of the same account. 17 “Settlements with various debtors and creditors” subaccount 173 “Settlements with the budget”.

Vasily Pasevich , auditor

Can tax authorities conduct test purchases?

In order to bring the violator to justice, the violation must be identified. But can Federal Tax Service employees do this? For a long time, judges did not have a common opinion as to whether tax authorities had the right to carry out test purchases. A little history. In 2008, the Supreme Arbitration Court came to the conclusion that Federal Tax Service inspectors do not have the right to do this, since test purchases (called test purchases in the law) are recognized as operational investigative measures (Resolution of the Presidium of the Supreme Arbitration Court of the Russian Federation dated September 2, 2008 No. 3125/08). But tax authorities do not have the right to implement them. Evidence obtained in violation of the law cannot be taken into account. The federal arbitration courts armed themselves with similar explanations from the Supreme Arbitration Court, massively canceling fines for non-compliance with cash discipline.

A little later, the Supreme Court of the Russian Federation (resolution No. 46-AD09-1 dated July 24, 2009) expressed the exact opposite opinion: control over the use of cash registers and the issuance of cash documents is entrusted to tax authorities in accordance with Art. 7 of Law No. 54-FZ of May 22, 2003, the provisions of which do not prohibit Federal Tax Service employees from conducting test purchases; therefore, they have the right to carry them out.

And in mid-2021, the same position was confirmed by the Presidium of the Supreme Court (review of judicial practice of the Supreme Court of the Russian Federation No. 2 (2015)), explaining that the provisions of the law of August 12, 1995 No. 144-FZ are not applied to the performance of cash settlements by employees of the Federal Tax Service as part of a test purchase “On operational intelligence activities,” which means that such an event is not operational intelligence activity. The judges also focused on the fact that the test purchase report drawn up by the tax authorities is evidence when considering cases of imposition of liability under Art. 14.5 Code of Administrative Offenses of the Russian Federation.

For other types of audit activities, see the material “Tax audit - what is it and what is the procedure?”

Accounting book of strict reporting forms: sample filling

Example of filling out the sheet:

Sample of filling out the back sheet (the magazine must be bound and numbered):

Don't forget about important nuances:

- It is necessary to conclude a written agreement with the employee supervising the BSO on full financial responsibility in accordance with Art. 244 of the Labor Code of the Russian Federation (clause 14 of Resolution No. 359);

- form a commission for the reception of BSO (clause 15 of Resolution No. 359);

- forms are accepted on the day they are received from the printing house (clause 15 of Resolution No. 359);

- draw up an act of acceptance of documents and have it approved by the manager (clause 15 of Resolution No. 359).

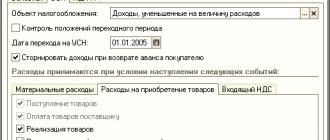

New KOSGU code

In accordance with the Procedure for applying the classification of operations of the general government sector, approved by Order of the Ministry of Finance of the Russian Federation dated November 29, 2017 No. 209n (hereinafter referred to as Procedure No. 209n), from January 1, 2021, costs for the acquisition (production) of strict reporting forms are included in subarticle 349 “Increase in cost other material stocks of single use" (previously - under subarticle 226 "Other works, services") of KOSGU.

Thus, the application of the new sub-article assumes that BSO are objects of material reserves, while Instruction No. 157n, on the contrary, excludes them from the composition of material reserves.

Control over the use of BSO

Monitoring compliance with the rules for using strict reporting forms is carried out by employees of the Federal Tax Service. In case of inspection of BSO for periods before mid-2021, it is necessary to provide inspectors with a book of their records or information from an automated system on the number of forms issued. From July 1, 2021, data from the BSO is received by the Federal Tax Service immediately after the form is generated, while the taxpayer stores information about their formation in the memory module of the online cash register - the fiscal drive.

Can an employee of a company or individual entrepreneur be held liable?

According to Art. 2 of Law No. 54-FZ of May 22, 2003, only organizations or individual entrepreneurs are required to use cash register equipment (or BSO). What does this mean? The fact that the legislation does not provide for the obligation of an individual - an employee of a company or individual entrepreneur (for example, a cashier) to issue a BSO or a cash receipt. Such an obligation is assigned to the employee exclusively by employers on the basis of the relevant provisions of the employment contract concluded between the employee and the legal entity (or individual entrepreneur).

Thus, only the employer can be held liable for failure to issue BSO, since in this situation his employee performs actions on the basis of an employment contract, but is not a party to the purchase and sale agreement (letter of the Federal Tax Service dated June 13, 2006 No. MM-6-06/ [email protected] ). However, this fact does not prevent the employer from demanding compensation from his employee for losses if they were caused through his (the employee’s) fault.

Read about the financial liability of the employee and the employer in the article “Financial liability of the parties to an employment contract.”

When can the fine be reduced and punishment avoided?

Even if a fine for failure to issue a BSO (or failure to use a cash register) was imposed if there were compelling reasons for it, judges can mitigate the punishment by reducing the amount of the monetary penalty or not applying it at all. The most significant mitigating circumstance in this situation is the initial bringing of a company or individual entrepreneur to the appropriate type of administrative liability. For example, the arbitrators, making a resolution of the Federal Antimonopoly Service of the North-Western District dated 05/07/2007 No. A56-11958/2006, considered it possible to reduce the amount of penalties imposed on the company from 35,000 to 30,000 rubles.

Judges may treat a violator of cash discipline favorably and release him from administrative liability also if the violation is considered minor. Most often, this happens when the amount that should have been recorded in the unissued document is small, and a legal entity or entrepreneur is held accountable for the first time (Resolution of the Federal Antimonopoly Service of the Volga-Vyatka District dated August 26, 2008 No. A28-3765/2008-144/14).

Another point that should be taken into account: the period during which punishment can be imposed is enshrined in Art. 4.5 Code of Administrative Offences. According to this norm, a decision to impose an administrative penalty cannot be made if more than 2 months have passed from the date of the violation.

And the last nuance that will help you avoid punishment: according to Art. 7 of Law No. 54-FZ, the supervisory function of the use of cash register and cash register systems by business entities is assigned to the tax authorities. At the same time, only certain employees of the Federal Tax Service can draw up protocols in case of detection of violations and impose liability (Article 23.5 of the Code of Administrative Offenses of the Russian Federation):

- Head of the Federal Tax Service of the Russian Federation and his deputies;

- heads of inspections of constituent entities of the Russian Federation and their deputies;

- heads of city and district branches of the Federal Tax Service.

If the protocol is drawn up by another official, the violator may be exempt from administrative liability (Resolution of the Federal Antimonopoly Service of the Moscow District dated April 30, 2004 No. KA-A40/3113-04).

Administrative responsibility

What happens if form 0504045 (BSO accounting book) is not available in the organization? The answer to this question is in Article 14.5 of the Code of the Russian Federation on Administrative Offenses. So, improper control over the BSO and failure to provide the book at the request of the Federal Tax Service threatens:

- officials with a warning or a fine in the amount of 1.5 thousand to 3 thousand rubles;

- legal entities with a warning or a fine in the amount of 5 thousand to 10 thousand rubles.

Thus, each organization and individual entrepreneur can independently decide what is more profitable for it: a book of strict reporting forms, which can be purchased at any printing house, or a fine for each request from the Federal Tax Service.