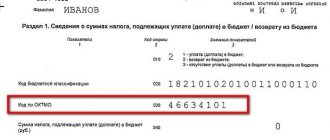

OKATO code structure

The OKATO code includes from 8 to 11 digits. Their number depends on the classification level at which the object is located. There are three levels:

- The first includes republics, territories, regions, cities of federal significance, autonomous regions, autonomous districts that are part of the Russian Federation.

- The second level includes objects subordinate to the first: autonomous okrugs of territories and republics; regions of republics, territories and districts; cities of regional significance and urban-type settlements.

- The third level is objects of regional subordination: intra-city areas, cities of regional significance, villages of regional subordination and village councils.

The first and second characters of the code mean objects of the first level, characters from the third to the fifth - the second level, from the sixth to the eighth - the third. To reflect rural settlements in the code, characters from ninth to eleventh are used. Detailed guidelines for the compilation and structure of the code are approved by Gosstandart Resolution No. 413.

Nuances when filling out documents

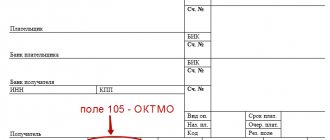

When filling out documents in which you need to indicate OKTMO and OKATO, it is important to remember: these classifiers contain a different number of digits. The OKATO code, which was used instead of the OKTMO code until 2014, consisted of eight characters. Now the OKTMO classifier uses 11 characters, although sometimes there can also be eight if the organization belongs to settlements that are part of municipalities.

In any case, in the documentation, the field for OKTMO will always provide 11 empty cells for the code, but this does not mean that if the code is eight-digit, something else needs to be additionally entered in the remaining empty cells.

Please note that you should not add zeros to the empty space, as this will lead to an erroneous determination of the destination, and the payment made will not be received as intended. It is also not recommended to put dashes here - it is better to simply leave empty fields blank.

Application of OKATO

The OKATO code is used for tax accounting and reporting. The tax authorities need it to determine in which administrative territory the organization is located and where it pays taxes. OKATO allows state statistical bodies to take into account and systematize economic entities, with its help government agencies:

- automate information exchange;

- sum up the collection of payments in each region;

- determine the standard of living of citizens;

- Welfare coefficients are recorded.

For us, OKATO is important as a document requisite. Until 2014, it was used in reporting, payment documents for tax purposes, tax returns, and government forms. But since January 2014, it was replaced by the OKTMO code, which now replaces OKATO in documents. It was introduced to clarify the classification; the OKTMO code specifies the locality in which the company operates.

If instead of OKTMO in the document details you indicate the OKATO code, then using the correspondence tables the tax authorities will determine the OKTMO code and credit the payment to it. But this will lead to the transfer of funds to another budget, then you will need to submit an amendment.

Organizations registered in 2014 and later are issued an OKTMO code upon registration. And each obsolete OKATO code corresponds to an OKTMO code.

What sites and services allow you to view OKTMO

Currently, many sites and services offer to find the OKTMO code online. Knowing only some data, for example, TIN, OGRN, address, place of business, etc., you can find the necessary MO classifier code.

Important! Most sites offer paid services, including finding OKTMO by TIN for an individual entrepreneur. Before sending money, you need to think about the fact that such data can be obtained for free using the tips above or using free services. Moreover, many of these paid sites are included in the TOP search engines, while free services do the opposite.

Listed below are several sites that provide their services for searching the OKTMO code for free:

- https://kod-oktmo.ru/;

- https://okato-oktmo.rf/;

- https://www.ifias.ru/oktmo;

- https://na46.ru/okato-oktmo/;

- https://classinform.ru/inn/search.html, etc.

Thus, OKTMO is an important innovation in the Russian statistical and tax system. The structure of the code is a special system of control data that allows you to minimize possible errors when entering information about organizations and individual entrepreneurs into the database. With its help, effective separation is carried out in statistical databases. The main purpose of using the new classifier is to ensure effective exchange of data and useful information between various structures and departments, and to simplify the statistical accounting procedure. You can obtain and find the OKTMO code of any individual entrepreneur using free services provided by both government agencies and private companies.

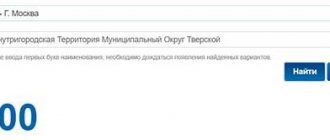

OKATO (OKTMO) code for Moscow

Moscow belongs to the first level of the OKATO classification, coded in the first two characters - 45. For organizations located in Moscow, the OKATO code includes 11 characters and displays the region, city, district, street, house and apartment number. Since 2014, Moscow organizations have indicated OKTMO in reports and documents. And from January 1, 2018, municipal areas were transformed into urban districts.

Muscovites should be more careful when preparing reports. When filling out payment orders, you must indicate a new code, otherwise the payment will fall into the “unclarified” category.

What is the OKTMO code and what is it used for?

OKTMO is an acronym.

Its decoding sounds like “All-Russian Classifier of Territories of Municipal Entities.” The code for this classifier shows which municipality the organization or individual entrepreneur belongs to. OKTMO codes are used so that Rosstat can systematize information about the activities of organizations and individual entrepreneurs. First, Rosstat reads the codes from the reports submitted by the payer (organization or individual entrepreneur). Then, using the codes, it recognizes which municipal entity the legal entity or entrepreneur belongs to.

Please note: in web services, current OKTMO codes are installed automatically, without user intervention. When filling out a report, the accountant only has to select the name of his municipality.

Fill out and submit all reports to Rosstat using today’s current forms via the Internet

How to find out the OKATO code by INN, address, OKTMO, OGRN or OKPO

You need to know the OKATO code in order to determine your OKTMO code. Organizations registered before 2014 were issued only OKATO, but knowing the old code, you can determine the new one using correspondence tables or use special services.

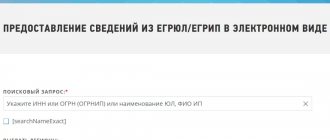

To find out OKATO, you can contact the Federal Tax Service office, use the tax service terminal, or call the tax service hotline. However, such methods require time and effort; it is much easier to find out the OKATO code online using the Internet. You can find out OKATO by INN, organization address, OKTMO code, OGRN or OKPO.

The website https://kladr-rf.ru is a classifier of Russian Federation addresses and contains a complete list of OKATO codes. By entering the organization's address in the search bar, you will find out the exact OKATO code.

On the Federal Tax Service website you can download the “Legal Taxpayer” program and use it to determine the OKATO code.

Search OKATO by tax identification number is offered by various services and programs, for example, the service for generating notifications https://statreg.gks.ru/ from Rosstat.

He suggests identifying OKATO by INN, OKPO or OGRN.

Does the individual entrepreneur have OKTMO?

Yes, OKTMO has any legal entity or individual entrepreneur (IP). There are no exceptions here. This is quite easy to check. The main verification methods are given below.

OKTMO at IP

OKTMO is assigned to everyone who is registered in Russia as a person carrying out entrepreneurial activities. At the same time, the meaning of the OKTMO code for several individual entrepreneurs may coincide, since it is assigned according to one criterion - localization in a particular municipal entity.

Reference! The MO classifier code is not unique. The same code can be assigned to several legal entities/individual entrepreneurs at the same time.

How to find out the OKTMO code from OKATO

Since OKATO codes are no longer needed to fill in the details, it is worth knowing how to determine the OKTMO code based on OKATO.

For this purpose, a table of code correspondence has been developed, it is posted on the official website of the Ministry of Finance and is regularly updated https://www.minfin.ru/ru/ismf/eiasmfrf/. Let's figure out how to use it:

- The second column contains the name of the municipality or locality.

- Column 4 shows the OKATO code as of November 1, 2013, column 5 shows the currently valid code. If your OKATO code was valid before 2013, you can find the current one.

- Column 6 contains the current OKTMO codes for populated areas.

- The following is the data that relates to the new OKTMO code, that is, republic, city, district, village, etc.

On the Federal Tax Service website there is an electronic service “Find out OKTMO”. By entering the OKATO code or the name of the municipality, you can find out the current OKTMO.

Author of the article: Elizaveta Kobrina

The cloud service Kontur.Accounting enters the OKTMO code into payment documents and reports automatically. Using the service, you can quickly and efficiently maintain records, submit reports, calculate salaries and benefit from expert support. All new users have a free 30-day trial period.

OKTMO replaces OKATO

Payment documents must indicate the code. Before the introduction of OKTMO, the OKATO code (all-Russian classifier of administrative-territorial division objects) was used for the same purposes. Its disadvantage is that it does not indicate the city, urban area or village in which the enterprise is located. OKTMO clarifies this information. The main difference between the codes is the division principle. OKATO depends on the subject of the Russian Federation, and OKTMO depends on the municipality.

Until 2021, specifying the OKATO code instead of OKTMO was acceptable. Now the transition period is over, and incorrectly filling in the details will lead to sanctions. Payments using incorrect details fall into the “unclarified” category and slow down the redistribution of funds between budgets. If you indicated incorrect details, then submit an application to clarify the payment to the Federal Tax Service, Social Insurance Fund or Pension Fund of the Russian Federation, depending on the damaged document. Based on the application, government agencies will decide to clarify the payment and write off accrued penalties.

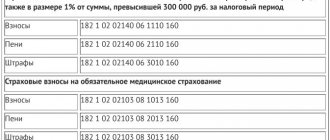

How to find out the KBK of a kindergarten?

1. You can find out the budget classification code (BCC) of the kindergarten in the notice itself, in the available details. This is the easiest way. If for some reason your BCC is not printed on your receipt, then you can find it out in another way. 2. You can find out the KBC of the kindergarten in the accounting department. At the same time, the number of the accounting department itself is open and accessible information. Often the number can be found on information boards in the preschool institutions themselves, or you can ask the teacher or director for it. 3. Of course, you can find out the KBC of a kindergarten on the Internet. But this is the most difficult path, in my opinion.

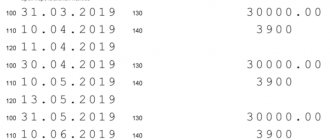

Which OKTMO should be indicated in the reporting for 2021?

As a general rule, in all tax returns and payment orders, starting from January 2021, it is necessary to indicate the new OKTMO, incl. in the reporting for 2021, which is due in 2020. Tax authorities should automatically make changes to the taxpayer’s card.

However, we recommend that on January 15-25, you request an extract of transactions with the budget or a certificate of the status of settlements for taxes, fees, penalties and fines to ensure that all advance payments for taxes are reflected in the new OKTMO.

If it is not possible to order an extract or certificate, you can check in your personal account which OK, for example, insurance premiums for the 4th quarter of 2021.

If your balances for taxes and contributions are reflected by reconciliation on the old OKTMO, then you can send a declaration, for example Calculation of insurance premiums, with the old OKTMO, but it is better to do this not on the last day of reporting. If you do not receive a notification about clarification in response, then after a couple of days you need to request a reconciliation again and check how taxes or contributions were calculated. Unfortunately, auto-replacement of OKTMO did not occur in many inspections.