This article describes the method of reflecting an increase in the initial cost of fixed assets in 1C: Accounting 8. All operations related to modernization are considered, as well as its consequences (in particular, changes in the useful life of fixed assets, the procedure for calculating depreciation in tax and accounting). The second part of the article is devoted to reflecting the costs of modernization, completion and additional equipment of fixed assets when applying a simplified taxation system with the object of taxation “income reduced by the amount of expenses.”

When reflecting transactions related to an increase in the initial cost of fixed assets and a change in their useful life in accounting, one should be guided by PBU 6/01 (approved by order of the Ministry of Finance of Russia dated March 30, 2001 No. 26n) and Methodological guidelines for accounting of fixed assets (approved. by order of the Ministry of Finance of Russia dated October 13, 2003 No. 91n), and when reflected in tax accounting - Chapter 25 of the Tax Code of the Russian Federation.

According to the rules established by the listed acts, changes in the initial cost of fixed assets at which they are accepted for accounting are allowed in the case of completion, additional equipment, reconstruction, modernization, partial liquidation and revaluation of fixed assets. At the same time, the costs of modernization and reconstruction may increase the initial cost of fixed assets of such an object if, as a result of modernization and reconstruction, the initially accepted standard performance indicators (useful life, power, quality of use, etc.) of such fixed assets are improved (increased). Similar rules are established for tax accounting.

The useful life in accounting must be revised if, as a result of reconstruction or modernization, there has been an improvement (increase) in the initially adopted standard indicators of the functioning of a fixed asset item. If the useful life of a fixed asset in accounting increases, it can also be increased for tax accounting purposes, but only within the limits established for the depreciation group in which such a fixed asset was previously included.

In the 1C: Accounting 8 program, the “OS Modernization” document is used to reflect the increase in the initial cost of fixed assets for accounting and tax accounting, as well as to change their useful life. Let's consider the method of reflecting an increase in the value of a fixed asset using an example.

Example 1

The organization purchased a computer in January 2008 worth 20,000 rubles, with a useful life of 60 months. Depreciation is calculated using the straight-line method in both accounting and tax accounting. In May of the same year, it was decided to increase the computer's RAM capacity. The amount of modernization expenses (both for accounting and tax purposes) amounted to 1,500 rubles. (excluding VAT). This amount was made up of the cost of the RAM module (1,200 rubles) and the cost of installing it in the computer system unit, performed by a specialist from a service company. The useful life did not change as a result of modernization.

Construction objects

Before increasing the cost of a fixed asset, it is necessary to first collect the costs associated with its modernization at the construction site. To accumulate such costs, account 08.03 “Construction of fixed assets” is intended, which allows you to conduct analytics on construction projects, cost items and construction methods. In our case, we should create a construction object for which the costs of upgrading the computer will be collected. It is convenient to enter the name of the construction project the same as that of the fixed asset for which costs are accumulated. This will make it easier to find and increase the visibility of analytical information.

Collection of modernization costs

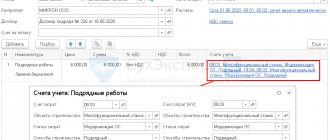

Goods purchased from third-party suppliers are registered using the document “Receipt of goods and services” with the transaction type “purchase, commission”. In our example, on the “Products” tab of this document, you should fill in information about the memory module being registered. Since the module is intended for equipment modernization, it can be taken into account on account 10.05 “Spare parts” (see Fig. 1).

Rice. 1

Services for installing a memory module can be reflected in the same document, on the “Computer” tab. This can be done using the “Demand-invoice” document (see Fig. 2).

Rice. 2

As a cost account, you need to specify the construction project accounting accounts with the corresponding analytics for accounting and tax accounting. In our example, this will be invoice 08.03 with the same analytics that were used when registering services for installing a memory module:

- Construction objects: Computer;

- Cost items: cost accounting item for modernization of fixed assets;

- Construction methods: Contract.

When posting the document, a posting will be made relating the cost of the memory module from the credit of account 10.05 to the debit of account 08.03. As a result, all costs for upgrading the computer will be collected in account 03/08.

Increase in initial cost

After the costs related to the modernization of a fixed asset are allocated to the construction site, you can fill out the “OS Modernization” document, with the help of which the amount of such costs will be transferred from the construction site to the fixed asset.

In the “Event” input field, you need to select an event that characterizes the modernization of a fixed asset. The selected event when posting a document is entered into the information register “Events with fixed assets”. Using this register, you can obtain information about all events that occurred with the fixed asset by setting up the appropriate selection. The event type must be "Upgrade". If an event with this type is not in the directory, it needs to be created.

In the “Object” input field, you should select the construction object at which the costs for modernizing the fixed asset were collected.

On the “Fixed Assets” tab in the tabular section, you should list the fixed assets that are being modernized. To do this, it is convenient to use the “Selection” button located in the command panel of the tabular section. In our example, the main tool “Computer” is being upgraded (see Fig. 3).

Rice. 3

After selecting fixed assets in the “OS Modernization” document, you can automatically fill in the remaining columns of the tabular section based on the program data. To do this, click on the “Fill” button in the command panel of the tabular part of the document, and select “For OS list” in the drop-down menu.

If several fixed assets are selected in the tabular part of the OS Modernization document, then the amount of costs accumulated at the construction site will be distributed among these fixed assets in equal shares.

Then, on the “Accounting and Tax Accounting” tab, you should indicate the total amount of costs (for both accounting and tax accounting) accumulated at the construction site. After the accounting accounts for construction projects are indicated (in our example, 03/08), you can click on the “Calculate amounts” button in the “OS Modernization” document and the corresponding fields will be filled in automatically by the program.

After filling out the document, you can print out the acceptance certificate for repaired, reconstructed, modernized fixed assets (form No. OS-3).

When posting, the “OS Modernization” document transfers the amount of costs from the credit of the construction projects accounting account to the debit of the fixed assets accounting account. In our example, the following postings will be made:

Debit 01.01 Credit 08.03 - in the amount of 1,500 rubles.

The corresponding entry will be generated in tax accounting.

Features of calculating depreciation after modernization...

...for accounting purposes

According to the clarifications of the Ministry of Finance of Russia, in accounting, when the initial cost of an item of fixed assets increases as a result of modernization and reconstruction, depreciation should be calculated based on the residual value of the item, increased by the costs of modernization and reconstruction, and the remaining useful life (letter of the Ministry of Finance of Russia dated June 23, 2004 No. 07-02-14/144).

Consequently, after the modernization, the cost must be calculated, which will serve as the basis for further depreciation. It is defined as follows - see diagram.

Scheme

The amount received is reflected in the “Remaining” column. cost (BU)". In our example, this amount will be 20,166.68 rubles. (20,000 - 999.99 - 333.33 + 1,500).

When carrying out the “OS Modernization” document, the residual value and remaining useful life are remembered. In our example, the remaining useful life is 56 months. (60 - 4).

The new value and the new useful life for calculating depreciation are applied starting from the month following the month in which the modernization was carried out.

In our example, starting from June 2005, the amount of depreciation charges for accounting purposes will be 360.12 rubles. (20,166.68:56).

...for tax accounting purposes

The procedure for calculating depreciation after modernization for tax accounting purposes differs from how it is accepted in accounting. The rules for calculating depreciation in tax accounting are established by Article 259 of the Tax Code of the Russian Federation.

Starting from the month following the month in which the modernization was carried out, the changed original cost and useful life are used to calculate depreciation.

In our example, starting from June 2005, the amount of depreciation deductions for tax accounting purposes will be 358.33 rubles. (21,500.00: 60).

It remains to add that after the expiration of its useful life, the cost of the computer in tax accounting will not be fully repaid, since over 60 months the depreciation amount will be 21,399.80 rubles. (333.33 x 4 + 358.33 x 56).

The remaining 100.20 rubles. will be included in the depreciation amount calculated in the 61st month of using the computer.

Documenting

The decision to modernize fixed assets must be formalized by order of the head of the organization, which must indicate:

- reasons for modernization;

- timing of its implementation;

- persons responsible for modernization.

This is explained by the fact that all operations must be confirmed by primary documents (Article 9 of the Law of December 6, 2011 No. 402-FZ).

If an organization does not carry out the modernization of fixed assets using its own resources, it is necessary to conclude a contract agreement with the contractors (Article 702 of the Civil Code of the Russian Federation).

When transferring a fixed asset item to the contractor, issue an act of acceptance and transfer of the fixed asset item for modernization. It can be compiled in any form. If the fixed asset is lost (damaged) by the contractor, the signed act will allow the organization to demand compensation for losses caused (Articles 714 and 15 of the Civil Code of the Russian Federation). In the absence of such an act, it will be difficult to prove the transfer of fixed assets to the contractor.

When transferring a fixed asset for modernization to a special division of the organization (for example, a repair service), you should draw up an invoice for internal movement in form No. OS-2. If the location of the fixed asset does not change during modernization, no transfer documents need to be drawn up.

Upon completion of modernization, an act of acceptance and delivery of modernized fixed assets is drawn up, for example, in form No. OS-3. It is filled out regardless of whether the modernization was carried out economically or by contract. Only in the first case, the organization draws up the form in one copy, and in the second - in two (for itself and for contractors). The act is signed by:

- members of the acceptance committee created in the organization;

- employees responsible for the modernization of fixed assets (or representatives of the contractor);

- employees responsible for the safety of fixed assets after modernization.

After this, the act is approved by the head of the organization and it is transferred to the accountant.

If the contractor carried out the modernization of a building, structure or premises, which relates to construction and installation work, then in addition to the act, for example, in form No. OS-3, an acceptance certificate in form No. KS-2 and a certificate of the cost of work performed and costs in form No. KS-3, approved by Decree of the State Statistics Committee of Russia dated November 11, 1999 No. 100.

What is it - definition

In order to correctly reflect modernization costs in accounting, it is necessary to conceptually separate this procedure from repair work and the reconstruction project.

It should be noted that the very concept of “modernization” is quite clearly regulated by the Tax Code of the Russian Federation (TC RF).

The regulatory act stipulates that modernization covers factors leading to modification of the service and technical functions of the corresponding fixed asset item.

Typical results of OS modernization are often the following achievements:

- strengthening the overall power of the equipment used;

- increasing its productivity (productivity);

- the appearance of new properties and characteristics in an object that are useful for economic activity.

Accounting

The costs of modernizing fixed assets change (increase) their initial cost in accounting (clause 14 of PBU 6/01).

The organization is obliged to keep records of fixed assets according to the degree of their use:

- in operation;

- in stock (reserve);

- on modernization, etc.

This is stated in paragraph 20 of the Methodological Instructions, approved by order of the Ministry of Finance of Russia dated October 13, 2003 No. 91n.

Accounting for fixed assets by degree of use can be carried out with or without reflection on account 01 (03). Thus, during long-term modernization, it is advisable to account for fixed assets in a separate sub-account “Fixed assets for modernization”. This approach is consistent with paragraph 20 of the Methodological Instructions, approved by Order of the Ministry of Finance of Russia dated October 13, 2003 No. 91n.

Debit 01 (03) subaccount “Fixed assets for modernization” Credit 01 (03) subaccount “Fixed assets in operation”

– fixed assets were transferred for modernization.

After completing the upgrade, make the following wiring:

Debit 01 (03) subaccount “Fixed assets in operation” Credit 01 (03) subaccount “Fixed assets for modernization”

– a fixed asset adopted from modernization.

See also about entries in accounting for repairs of fixed assets

Arbitrage practice

The judges, taking into account these definitions, in their decisions come to the conclusion that repair work includes work that does not change the technological or service purpose of fixed assets, does not improve production and does not increase its technical and economic indicators. For example, this position is adhered to in the resolution of the Federal Antimonopoly Service of the Moscow District dated June 8, 2011 No. KA-A40/5373-11. In their decision, the arbitrators indicate that when qualifying the work performed for the purpose of classifying expenses as repair or modernization, it is necessary to proceed from the purpose and focus of such work, taking into account that repair (costs that do not increase the inventory value of the facility) include such types of work , after which the object’s performance does not improve (increase). The purpose of repair is to eliminate existing faults, the presence of which makes the operation of the fixed asset dangerous (impossible). A similar position is expressed in decisions of the FAS North-Western District dated August 30, 2010 No. A56-35754/2009, FAS North Caucasus District dated June 24, 2011 No. A53-18544/2010, FAS Moscow District dated May 11, 2011 No. KA-A41/3691-11.

Replacement of individual failed elements of a fixed asset, not associated with a change in the technological or service purpose of the equipment, or a change in its technical and economic indicators, is not modernization and is considered as a repair of a fixed asset (letter of the Ministry of Finance of the Russian Federation dated August 3, 2010 No. 03-03 -06/1/518). A similar point of view is expressed in the Resolution of the Federal Antimonopoly Service of the Volga Region dated May 17, 2011 No. A65-20282/2010).

Accounting for modernization costs

The costs of modernizing fixed assets are taken into account in account 08 “Investments in non-current assets” (clause 42 of the Methodological Instructions approved by Order of the Ministry of Finance of Russia dated October 13, 2003 No. 91n). To ensure the possibility of obtaining data on types of capital investments, it is advisable to open a subaccount “Modernization Expenses” for account 08.

The costs of modernizing fixed assets using economic methods are:

- from the cost of consumables;

- from employee salaries, deductions from it, etc.

Reflect the costs of carrying out modernization on your own by posting:

Debit 08 subaccount “Modernization expenses” Credit 10 (16, 23, 68, 69, 70...)

– the costs of modernization are taken into account.

If an organization is modernizing fixed assets with the involvement of a contractor, then reflect his remuneration by posting:

Debit 08 subaccount “Modernization expenses” Credit 60

– the costs of modernizing fixed assets carried out by contract are taken into account.

Upon completion of the modernization, the costs recorded on account 08 can be included in the initial cost of the fixed asset or taken into account separately on account 01 (03). This is stated in paragraph 2 of paragraph 42 of the Methodological Instructions, approved by order of the Ministry of Finance of Russia dated October 13, 2003 No. 91n.

When including the costs of modernization in the initial cost of a fixed asset, make the following entry:

Debit 01 (03) Credit 08 subaccount “Modernization expenses”

– the initial cost of the fixed asset was increased by the amount of modernization costs.

In this case, reflect the costs of modernization in the primary documents for accounting for fixed assets. For example, in an act in form No. OS-3 and in an inventory card for accounting for fixed assets in form No. OS-6 (No. OS-6a) or in an inventory book in form No. OS-6b (intended for small enterprises). This is stated in the instructions approved by the State Statistics Committee of Russia dated January 21, 2003 No. 7. If it is difficult to reflect information about the modernization carried out in the old card, open a new one instead (clause 40 of the Methodological instructions approved by order of the Ministry of Finance of Russia dated October 13, 2003 No. 91n).

When accounting separately, write off the costs of modernization to a separate subaccount to account 01 (03). For example, subaccount “Expenses for modernization of fixed assets”:

Debit 01 (03) subaccount “Costs on modernization of fixed assets” Credit 08 subaccount “Costs on modernization”

– the costs of modernizing fixed assets are written off to account 01 (03).

In this case, for the amount of expenses incurred, open a separate inventory card, for example, according to form No. OS-6. This is stated in paragraph 2 of paragraph 42 of the Methodological Instructions, approved by order of the Ministry of Finance of Russia dated October 13, 2003 No. 91n.

Purchasing spare parts

Reflect the receipt of the engine with the document Receipt (act, invoice) transaction type Goods (invoice) in the Purchases - Receipts (acts, invoice) section.

Please indicate:

- Nomenclature - purchased spare parts, selected from the Nomenclature directory;

- Accounting account - 10.05 “Spare parts”.

Postings according to the document

The document generates transactions:

- Dt 10.05 Kt 60.01 - spare parts are accepted for accounting;

- Dt 19.03 Kt 60.01 - VAT accepted for accounting.

Depreciation during modernization

When carrying out modernization with a period of no more than 12 months, calculate depreciation on the fixed asset. If the modernization of a fixed asset takes more than 12 months, then suspend depreciation on it. In this case, resume depreciation after completion of the modernization. This procedure is established in paragraph 23 of PBU 6/01 and paragraph 63 of the Methodological Instructions, approved by Order of the Ministry of Finance of Russia dated October 13, 2003 No. 91n.

Situation: at what point in accounting should you stop and then resume depreciation on a fixed asset transferred for modernization for a period of more than 12 months?

For accounting purposes, the specific moment of termination and resumption of depreciation on fixed assets transferred for modernization for a period of more than 12 months is not established by law. Therefore, the month from which the accrual of depreciation for accounting purposes for such fixed assets stops and resumes must be established independently by the organization. In this case, possible options could be:

- depreciation is suspended from the 1st day of the month in which the fixed asset was transferred for modernization. And it resumes from the 1st day of the month in which the modernization was completed;

- depreciation is suspended from the 1st day of the month following the month in which the fixed asset was transferred for modernization. And it resumes on the 1st day of the month following the month in which the modernization was completed.

The chosen option for suspending and resuming depreciation for accounting purposes for fixed assets modernized for a period of more than 12 months should be reflected in the organization’s accounting policy for accounting purposes.

Advice: in your accounting policy for accounting purposes, establish the same procedure for stopping and resuming depreciation on fixed assets transferred for modernization for a period of more than 12 months, as in tax accounting.

In this case, temporary differences will not arise in the organization’s accounting, leading to the formation of a deferred tax liability.

Registration of SF supplier

Register the supplier's invoice by indicating its number and date at the bottom of the Receipt (act, invoice) , click the Register .

Invoice document will be automatically filled in with the data from the Receipt document (act, invoice) .

- Operation type code : “Receipt of goods, works, services.”

If the document has the Reflect VAT deduction in the purchase book by date of receipt checkbox , then when it is posted, entries will be made to accept VAT for deduction.

Operating lifespan after upgrading

Modernization can lead to an increase in the useful life of a fixed asset. In this case, for accounting purposes, the remaining useful life of the modernized fixed asset must be revised (clause 20 of PBU 6/01, clause 60 of the Methodological Instructions approved by Order of the Ministry of Finance of Russia dated October 13, 2003 No. 91n). This is what the acceptance committee does when accepting a fixed asset from modernization:

- based on the period during which it is planned to use the fixed asset after modernization for management needs, for the production of products (performance of work, provision of services) and other generation of income;

- based on the period after which the fixed asset is expected to be unsuitable for further use (i.e., physically worn out). This takes into account the mode (number of shifts) and negative operating conditions of the fixed asset, as well as the system (frequency) of repairs.

This follows from paragraph 20 of PBU 6/01.

The acceptance committee may indicate that the modernization did not lead to an increase in useful life in the act in form No. OS-3.

The results of reviewing the useful life in connection with the modernization of a fixed asset are formalized by order of the manager.

Situation: how to calculate depreciation in accounting after modernizing a fixed asset?

The procedure for calculating depreciation after modernization of a fixed asset is not defined by accounting legislation. Paragraph 60 of the Methodological Instructions, approved by Order of the Ministry of Finance of Russia dated October 13, 2003 No. 91n, provides only an example of calculating depreciation charges using the linear method. So, according to the example, with the linear method, the annual amount of depreciation of a fixed asset after modernization is determined in the following order.

Calculate the annual depreciation rate of fixed assets after modernization using the formula:

| Annual depreciation rate for fixed assets after modernization using the linear method | = | 1 | : | Useful life of a fixed asset after modernization, years | × | 100% |

Then calculate the annual depreciation amount. To do this, use the formula:

| Annual depreciation amount of fixed assets after modernization using the straight-line method | = | Annual depreciation rate for fixed assets after modernization using the linear method | × | Residual value of fixed assets taking into account modernization costs |

The amount of depreciation that must be accrued monthly is 1/12 of the annual amount (paragraph 5, clause 19 of PBU 6/01).

An organization has the right to use this method of calculation even if, as a result of modernization, the useful life of a fixed asset has not changed (remained the same). This is explained by the fact that paragraph 60 of the Methodological Instructions, approved by Order of the Ministry of Finance of Russia dated October 13, 2003 No. 91n, does not contain conditions on the mandatory increase in useful life as a result of modernization. This means that an organization can calculate depreciation based on the residual value of a fixed asset (taking into account its increase by the amount of modernization costs) and its remaining useful life, regardless of whether this period was extended after modernization or not. Similar explanations are given in the letter of the Ministry of Finance of Russia dated June 23, 2004 No. 07-02-14/144.

If an organization uses other methods of calculating depreciation (the reducing balance method, the method of writing off value by the sum of the numbers of years of useful life, the method of writing off value in proportion to the volume of production (work)), then the annual amount of depreciation charges can be determined in the following order:

- similar to the order given in the example for the linear method;

- independently developed by the organization.

The used option for calculating depreciation on fixed assets after modernization should be fixed in the accounting policy of the organization for accounting purposes.

An example of reflecting depreciation on a fixed asset in accounting after its modernization

Alpha LLC repairs medical equipment. In April 2015, the organization modernized its production equipment, which was put into operation in July 2012.

The initial cost of the equipment is 300,000 rubles. The useful life according to accounting data is 10 years. The method of calculating depreciation is linear. As a result of the modernization, the useful life of the facility increased by 1 year.

Before the modernization of the fixed asset, the annual depreciation rate was 10 percent ((1: 10 years) × 100%). The annual depreciation amount was 30,000 rubles. (RUB 300,000 × 10%). The monthly depreciation amount was 2,500 rubles. (RUB 30,000: 12 months).

RUB 59,000 was spent on equipment modernization. The modernization lasted less than 12 months, so depreciation was not suspended. At the time of completion of the modernization, the actual service life of the equipment was 33 months. Its residual value according to accounting data is equal to: 300,000 rubles. – (33 months × 2500 rub./month) = 217,500 rub.

After modernization, the useful life of the fixed asset was increased by 1 year and amounted to 8.25 years (7.25 + 1).

The annual depreciation rate for equipment after modernization was 12.1212 percent ((1: 8.25 years) × 100%).

The annual amount of depreciation is 33,515 rubles. ((RUB 217,500 + RUB 59,000) × 12.1212%).

The monthly depreciation amount is RUB 2,793. (RUB 33,515: 12 months).

Other definitions of reconstruction

Not only does it seem quite difficult to distinguish between the types of construction and installation work being carried out, it is also necessary to use legislation that has been in force since the times of the Soviet Union and branches of law other than tax law.

Let us note that the Tax Code provides too general a definition and in practice it seems quite difficult to classify exactly what types of construction and installation work were performed.

Typically, accountants use Appendix 1 to Departmental Construction Standards VSN 58-88 (r) “Regulations on the organization and conduct of reconstruction, repair and maintenance of buildings, public utility and social-cultural facilities” (approved by the Order of the State Committee for Architecture of the Russian Federation under the USSR State Construction Committee dated November 23 1988, hereinafter referred to as Appendix 1 to the BSN).

Appendix 1 to the BSN notes that the reconstruction of a building is a complex of construction work and organizational and technical measures associated with changes in the main technical and economic indicators. For example, the number and area of apartments, construction volume and total area of the building, capacity and throughput or its purpose in order to improve living conditions, quality of service, increase the volume of services.

Definitions of reconstruction can also be found in letter of the USSR Ministry of Finance dated May 29, 1984 No. 80, Methodology for determining the cost of construction products on the territory of the Russian Federation MDS 81-35.2004 (approved by Resolution of the State Committee for Construction of Russia dated March 5, 2004 15/1), letter of the State Planning Committee USSR No. NB-36-D, letter of the USSR State Construction Committee No. 23-D, USSR Stroybank No. 144, USSR Central Administration No. 6-14 dated May 8, 1984 “On the definition of the concepts of new construction, expansion, reconstruction and technical re-equipment of operations

The Law of July 18, 2011 No. 215-FZ “On Amendments to the Town Planning Code and Certain Legislative Acts of the Russian Federation” (with the exception of certain provisions) (hereinafter referred to as Law No. 215-FZ) brought a lot of clarity. These amendments introduced and supplemented the legislative acts of the Russian Federation. First of all, the innovations affected the Town Planning Code. The legislator has significantly supplemented the existing definition of reconstruction.

Thus, from July 22, 2011, you can use a new, more expanded interpretation of the definition of “reconstruction”, as well as the types of work that can be classified as it. The “new” edition contains definitions of reconstruction for capital construction projects, linear objects (communication or power lines, pipelines, roads, etc.). In addition to changing the parameters of an object, such as height, number of storeys, volume area, reconstruction also includes such types of work as: superstructure, reconstruction or expansion of an object, replacement or restoration of its load-bearing building structures, with the exception of individual elements of these structures with similar ones or other improving indicators.

There is no definition of “repair” in either tax or accounting legislation. Therefore, let us turn again to construction regulations. In the letter of the State Statistics Committee of Russia dated April 9, 2001 No. MS-1-23/1480 there is the following definition: the cost of repairs (current, medium and capital) means the cost of work to maintain fixed assets (their individual parts and structures) in working condition during their useful life, which does not lead to an improvement in the initial standard performance indicators.

In paragraph 3.1 of the Regulations on carrying out planned preventative repairs of industrial buildings and structures MDS 13-14.2000 (approved by the resolution of the USSR State Construction Committee dated December 29, 1973 No. 279) there is another definition of “repair”, defining it as a set of technical measures aimed at maintaining or restoration of the original operational qualities of both the building or structure as a whole and their individual structures. Repairs are usually divided into current and major. Law No. 215 - Federal Law made its “mite” in the definition of “repair”. So a major overhaul is the replacement or restoration of:

- building structures of capital construction projects or replacement of their elements (except load-bearing ones);

- engineering support systems and their networks;

- individual elements of load-bearing building structures for similar or other improving indicators.

Supreme Court Opinion

An interesting position is taken by the judges in the Resolution of the Presidium of the Supreme Arbitration Court of the Russian Federation dated February 1, 2011 No. 11495/10. In the said ruling, the arbitrators note that the same work can be qualified as both a major overhaul and a reconstruction. The tax authority qualified the work of cutting out part of the production string intended to lift oil from the bottom to the wellhead and drilling a sidetrack from this place as reconstruction, since as a result of the measures taken, oil production increased. However, the company took them into account in the taxable base as major repairs. The judges in their decision indicated that an increase in oil production in itself is not a sufficient criterion for qualifying the work mentioned as a major overhaul or reconstruction. And it is necessary to classify the type of work performed as repair or reconstruction based on the condition of the well. Thus, drilling sidetracks in idle wells refers to reconstruction. But work carried out in technically faulty wells or due to the extreme water cut of the formations resulting from the breakthrough of formation waters must be recognized as a major overhaul.