One of the most important stages of furniture quality examination is the process of identifying defects in the appearance of furniture items that are of a production or non-production nature.

The reasons for the write-off of furniture, regardless of its functional purpose, are largely the loss of operational indicators and criteria that mark the further use of the item being disposed of. Let's try to understand this issue in more detail.

Depreciation: Economic Goods and Their Valuation

Depreciation/amortization is allowed only for assets that are in operating capacity and used to generate taxable income. Whether or not tax depreciation is permissible depends further on the nature and quality of the economic goods. The final definition of the term “economic asset” is not contained in the tax legislation. Its meaning has developed in the practice of business, administration and jurisprudence.

Common criteria for furniture write-off

Because assets, goods, rights and other economic advantages are the means through which companies want to make profits. Onerous and unused, depreciable economic goods may be tangible and immaterial in nature. Material goods can also be mobile or immovable. . For tax purposes it is also important that the asset in question is independently used. The division of an asset into its components, acquisition or production costs cannot be influenced, for example, to intentionally fail to comply with depreciation cost limits.

Fiscal position

The Russian Ministry of Finance expressed its position on the issue under consideration in a letter dated June 15, 2012 No. 03-03-10/71, which the Federal Tax Service of Russia communicated to lower tax authorities in a letter dated June 27, 2012 No. ED-4-3/10519 and posted on its official website in the section “Explanations of the Federal Tax Service, mandatory for application by tax authorities.” True, financiers considered a situation where an organization created an advertising video, which is recognized as an intangible asset. But the approach outlined in the explanations is also applicable to fixed assets. Let us give the reasoning of the officials.

Other expenses associated with production and sales include, inter alia, expenses for advertising manufactured (purchased) and (or) sold goods (works, services), taxpayer activities, trademarks and service marks, including participation in exhibitions and fairs (sub. 28 clause 1, clause 4 of article 264 of the Tax Code of the Russian Federation). That is, the cost of property purchased for use in company promotional events is an advertising expense.

At the same time, according to paragraph 1 of Art. 256 of the Tax Code of the Russian Federation, if the property is owned by a company, is used to generate income, its useful life is more than 12 months, and the original cost is more than 40,000 rubles, then it is considered depreciable.

Based on the above standards, officials made the following conclusion. If the conditions for recognizing property as depreciable are met in relation to objects purchased for use for advertising purposes, then their cost is written off as expenses through depreciation. In this case, the amounts of accrued depreciation relate to advertising expenses.

Let us remind you that special rules have been established for the recognition of advertising expenses. According to paragraph 4 of Art. 264 of the Tax Code of the Russian Federation, advertising expenses include:

— expenses for advertising events through the media (including advertisements in print, broadcast on radio and television), information and telecommunication networks, for film and video services;

— expenses for illuminated and other outdoor advertising, including the production of advertising stands and billboards;

- expenses for participation in exhibitions, fairs, expositions, for the design of shop windows, sales exhibitions, sample rooms and showrooms, production of advertising brochures and catalogs containing information about goods sold, work performed, services provided, trademarks and service marks, and (or) about the organization itself, for the discounting of goods that have completely or partially lost their original qualities during exhibition.

The above expenses are taken into account when calculating income tax in full. But advertising expenses that are not included in this list, as well as the costs of purchasing (manufacturing) prizes awarded to the winners of drawings of such prizes during mass advertising campaigns, are normalized. They are recognized in an amount not exceeding 1% of sales revenue.

If we follow the position of officials, then in the situation under consideration the company must recognize the advertising stand as depreciable property and take into account the accrued depreciation amounts as part of advertising expenses. In this case, depreciation is written off as expenses in full, without applying the standard.

The courts are not so categorical

We were able to find only one court decision in which the arbitrators supported the fiscal position. This is the resolution of the Federal Antimonopoly Service of the Central District dated July 5, 2006 No. A68-AP-4/11-05.

In other disputes that reach the courts, the arbitrators side with the taxpayers. An example is the resolution of the Federal Antimonopoly Service of the Ural District dated July 21, 2010 No. A34-4973/2009. In this case the following situation was considered. When calculating income tax, the company took into account the cost of an illuminated sign as part of advertising expenses. According to tax authorities, its cost should be expensed through depreciation.

The courts supported the company and recognized the taxpayer’s actions as lawful, since these expenses relate to outdoor advertising and can be written off at a time in accordance with sub-clause. 28 clause 1 and clause 4 art. 264 Tax Code of the Russian Federation.

Similar conclusions are contained in the decisions of the Federal Antimonopoly Service of the North-Western District dated March 12, 2008 No. A21-3735/2006 (Decision of the Supreme Arbitration Court of the Russian Federation dated June 26, 2008 No. 7751/08 refused to transfer this case to the Presidium of the Supreme Arbitration Court of the Russian Federation for review in the manner of supervision), the Ural District dated January 30, 2008 No. A07-6671/07.

And in the resolution of the Federal Antimonopoly Service of the North-Western District dated January 18, 2010 No. A05-8466/2009, the judges noted that the taxpayer is given the right to independently determine the group of expenses in the event that some of them can equally justifiably be attributed simultaneously to several groups of expenses (clause 4 Article 252 of the Tax Code of the Russian Federation). The same position was expressed by the arbitrators in the resolution of the FAS of the North-Western District dated 04/05/2007 No. A56-4732/2006 (Decision of the Supreme Arbitration Court of the Russian Federation dated 08/14/2007 No. 9542/07 refused to transfer this case to the Presidium of the Supreme Arbitration Court of the Russian Federation for review in the order of supervision) .

Causes of damage to pallet racks and measures to prevent them

If the warehouse is equipped with high racks, it is optimal to equip the cabins of lifting equipment with monitors, and the forks with video cameras.

2) Mechanical damage to the connections of shelving frames or vertical posts. As a rule, damage occurs due to incorrect operation of stackers, reach trucks, loaders and other warehouse equipment. Any minor impacts change the geometry of the frame post and lead to the collapse of the rack.

It is recommended that the operator use electromagnetic or mechanical guides during the work, which help the loader to keep the correct course and minimize the risk of accidentally hitting the frames or posts of metal shelving. You can also protect the bases of the shelving frames with front or end bumpers.

In the case when vehicles with cargo drive directly into a warehouse for unloading, special guides and stops will not be superfluous. 3) Use of pallets not provided for by a specific type of racking.

If the furniture is damaged

Furniture purchased by an organization for use in public premises (offices, hotels, cafes, shops, doctors' offices, concert halls, etc.) falls into disrepair much more often than its domestic counterparts. As a result of intensive use, individual items may be broken, dirty, the upholstery may be torn, etc.

Information that the organization’s property has fallen into disrepair is recorded in the process of drawing up annual inventory documents or at the time such facts are discovered. The documents drawn up indicate the types of damage to furniture for further write-off, for example:

- damage to the furniture frame (legs, seats, backs of chairs and armchairs, walls, shelves and doors of cabinets and cabinets, legs and table tops, etc.);

- breakdown of mechanisms that ensure the operation of furniture (door hinges, drawer mechanisms, chair casters, etc.);

- deformation of individual parts of furniture due to wetness, excessive heat, etc.;

- wear and tear of the upholstery (fading, thinning, tearing, etc.);

- defects in furniture surface cladding (cuts, cracks, chips, etc.);

- irremovable stains on furniture surfaces, etc.

All of the listed damages can become a reason for writing off the furniture in the write-off act if an essential condition is met: the costs of eliminating these defects are equal to or exceed the cost of purchasing a similar new piece of furniture.

Information on the cost of repairs can be provided by organizations specializing in this type of service.

Inspection of metal structures, types of defects and damage

2.

Of course, damaged old furniture can easily ruin the reputation of an establishment, which, in turn, will reduce the influx of customers.

PREPARATORY WORK. Before the start of the survey, it is necessary to carry out a preliminary (reconnaissance) inspection of the object to determine the volume, specifics and focus of the survey, the necessary preparatory work (making scaffolding and ladders to provide direct access to structures, cleaning surfaces, etc.), as well as identifying the need for special research (measurement of dynamic characteristics, geodetic survey, etc.).

During the preliminary inspection, first of all, you should pay attention to the structures that cause concern, and, if necessary, limit the loads or completely unload the structures. In the event of an emergency, reliable safety anchorages should be immediately assigned. The inspection of metal structures must be carried out by specialists from organizations that have the appropriate licenses, under agreements with the management of the energy enterprise.

Is it possible to write off boring but still usable furniture?

If the desire to purchase new furnishings for an organization is not due to the fact that the furniture has lost its performance qualities, but to another reason, for example, updating the overall design concept of a restaurant or the transition of a business to the “luxury” segment, which requires a more solid office environment, then there are no physical defects in the furniture for write-off .

In this case, you can be guided by the service life of the furniture established by the manufacturer in the technical data sheet.

Furniture manufacturers are required to set a service life for it in accordance with Decree of the Government of the Russian Federation dated June 16, 1997 No. 720. After this period, furniture can become dangerous to people and the environment. Therefore you cannot use it.

If the service life of the furniture is established in the technical passport and by the time of write-off it has expired, then the reason for writing off the furniture in the write-off act can be formulated as follows:

“Write off office furniture in accordance with Appendix 1 to the act in connection with the expiration of the service life established by the manufacturer of the specified furniture LLC Furniture for Everyone in the technical passport (Appendix 2), as posing a potential danger to the health of employees, property of the organization and the environment in accordance with the standards of the Government Decree RF dated June 16, 1997 No. 720.”

The reasons for writing off upholstered furniture are determined similarly. If the furniture has lost its performance qualities - the upholstery is torn, worn out or dirty, the frame is broken or deformed, etc., then it can be written off if the cost of repair costs is comparable to the cost of a new similar item.

If upholstered furniture has no physical damage, then the basis for write-off may be the expired service life established for it.

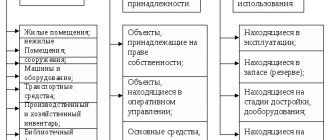

Any equipment has its own service life, after which it must be written off. To do this correctly, you need to act in a certain order, regulated by law. We will look at how to write off fixed assets in 2021 in the article.

Any accountant directly involved in the acceptance, depreciation and write-off of fixed assets must clearly know the procedure and the required list of documents. Otherwise, the tax service may have questions regarding the legality of the write-off and the lack of required documents.

Before writing off fixed assets at an enterprise, it is necessary to study the order of the Ministry of Finance of the Russian Federation No. 33n dated July 20, 1998. It contains information about mandatory activities and documents and regulates the procedure for accounting for fixed assets.

Indicators of feasibility of repair

You already know what are the reasons for writing off furniture. The types of damage to the furniture determine the further actions of the expert commission: complete disposal or organization of repairs. The second is only possible if the cost of repairs does not exceed the cost of purchasing a new headset or office set (analogues) or is commensurate with it.

First of all, the discreet furnishings and everyday objects of private wealth are often forgotten. For many solo entrepreneurs and small business owners, success is often only possible because the initial investment is limited. It is enough reasoning to take into account the company's use in collecting taxes and attracting the treasury to the value of former private property.

Another benefit is that amortization on the initial capitalized intangible assets and subsequently introduced into operating assets is an important “reminder” of the sooner or later imminent replacement of purchases. In a complete workshop or ready storage room and use an existing private vehicle. In the long run, such work should be paid out of profit! If the replacement purchase is not taken into account in the calculation of the price or fee, sooner or later evil will awaken in the form of a funding gap!

The final decision on the fate of the inventory of interior items is made by an expert commission dealing with such issues.

Write-off (disposal) is a forced measure caused by the presence of defects, the elimination of which is more expensive than a new set. And since this option for expensive repairs is unprofitable, recycling becomes the only profitable solution.

Note that it is not always beneficial to use tax assets from private assets. This applies in particular to older vehicles, whose private interest must be determined after making a contribution to operating assets using the one percent method.

Due to the huge selection of products available, there are usually a large number of suitable products from the same manufacturer and brand in comparable age and condition. It is best to document product details and sales prices of multiple similar products. You will subsequently keep a record of the reasons why you accepted the deposit value on this basis. You can also simply use the average price of comparison offers as your deposit value. As long as you don't base completely unrealistic "moon prices", you will be giving financial power to plausible and reliable valuation criteria.

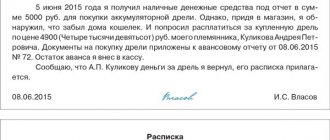

It is not uncommon for an accountant, when paying a certain amount to an employee, to ask the question: is this payment subject to personal income tax and insurance contributions? Is it taken into account for tax purposes?

The interior design of work premises can be updated for various reasons. This may be the need to replace pieces of furniture that have fallen into disrepair, but there may also be a desire of management to change the design of the offices, decorating them in a single corporate manner. How to correctly formulate in this case the reasons for writing off the furniture and what types of damage to the furniture will be the reason for drawing up a document on its write-off, we will consider further.

Unusual service life

This gives you a realistic upper and lower limit on the cost.

If you only wrote off part of the purchase price, the remaining book value can be set as the default value. The law applies only to the specific special case of amortizable intangible assets: “The useful life of the goodwill of an enterprise or an agricultural and forestry enterprise is 15 years.” Useful lives are estimated for most other depreciable assets. Special operating conditions must be taken into account. Tax authorities do not allow taxpayers to do this. The so-called “lifetime values” record the normal useful life of all current business items. They are based on tax audit experience and are coordinated with professional associations.

Write-off of fixed assets: documentation

Writing off fixed assets seems common and simple, but in reality the company needs to draw up a number of papers that would confirm the legality of disposal of fixed assets.

The disposal is preceded by the execution of an order to create a special commission, which is tasked with writing off fixed assets (documentary registration of the formation of such a commission is strictly necessary). It includes the following persons:

- chief accountant of the company;

- technical specialists;

- MOLs to which fixed assets subject to disposal are assigned.

Responsibilities and functions of the commission for writing off fixed assets

During the creation of the commission, their powers are determined. The guidelines provide for the inclusion of the following functionality in this list:

- The commission is inspecting the decommissioned facility. She is also responsible for drawing up all documentation related to write-offs. This includes not only technical and commercial documents, but also accounting documents.

- The reason for write-off is established, as well as the impossibility of using the OS object for subsequent use, restoration or sale.

- The circle of culprits is determined if the OS has become unusable before the established service life, was damaged or partially damaged. During the proceedings, the Commission develops proposals to involve these workers in compensation for damages.

- If some parts of a fixed asset can be used in further work (for example, as a spare part for other equipment), then a list of these parts is compiled and their cost assessment is carried out. In the future, it is the commission that is responsible for the dismantling of all the listed parts.

- Filling out write-off acts, signing all necessary documentation.

Order to write off fixed assets: sample

According to the guidelines, when writing off a fixed asset item, the organization must draw up a corresponding act. No additional documents are required to be drawn up in accordance with the law. For example, an order to write off fixed assets, a sample of which will help you draw up the paper correctly, is not mandatory.

But sometimes tax authorities may request it when auditing an enterprise. This is possible if during the write-off procedure associated expenses appeared. Sometimes an order is needed to indicate it as the basis for drawing up a write-off act.

Letter of the Ministry of Finance of the Russian Federation No. 03-03-06/1/454 dated July 9, 2009 also makes it clear that it is better to draw up an order for write-off in order to avoid confusion. But not a single legislative act specifies what such a document should look like, so it can be drawn up in any form.

In addition to the standard details (number and date of the order, name of the organization, city), the text of the order must contain:

- object inventory number;

- reason for write-off;

- liquidation period (if implied);

- the basis for drawing up the order;

- instructions to an accountant, MOL, storekeepers or other responsible persons.

All persons receiving instructions in accordance with the order must affix a signature indicating their familiarity with the document. The order must also be signed by the head of the enterprise.

Write-off of material assets as a natural process of production

Writing off valuables during the production process is a natural process. It is impossible to make a product without using up certain materials. It does not matter what type of final product is manufactured - write-off of raw materials is inevitable. Its quantity and types depend on the complexity and composition of the final product.

The main feature of this write-off process is its regularity. Raw materials and materials are written off at the enterprise according to reporting periods (daily, ten-day, monthly, quarterly). The accuracy of accounting information depends on the timeliness of write-off of raw materials and materials:

- about the cost of products (semi-finished products, work in progress, etc.);

- about the stock balances in the warehouse at the current (reporting) point in time.

The process of writing off material assets for production needs is organized taking into account the Guidelines for accounting of inventories, approved. by order of the Ministry of Finance dated December 28, 2001 No. 119n.

Write-off of fixed assets: postings

Write-off of fixed assets involves making changes to the balance sheet of the enterprise. The responsible accountant, knowing the reasons, makes appropriate entries. Depending on the reason for which fixed assets are written off, different entries may be used.

Write-off of fixed assets unfit for use

If an organization writes off due to wear and tear of an object, then the following entries must be used:

- D01 (a special subaccount for the disposal of fixed assets is used) – K01 – to write off the original cost;

- D02 – K01 (subaccount) – depreciation is written off;

- D91 - K01 (by subaccount) - write-off of the remaining (non-depreciated) cost of the object.

OS sales

If an enterprise decides to sell a fixed asset to another organization, then the following transactions are applied:

- D01 (subaccount) – K01 – write-off of the original cost;

- D02 – K01 (subaccount) – depreciation is written off;

- D91 – K01 (sub-account) – the remainder of the cost of the object is written off.

In this case, the residual value is shown as part of other income. Additionally, revenue is displayed in accordance with posting D62 - K91. It is also necessary to reflect the amount of accrued VAT using postings D91 - K68.

Using OS as a contribution to the management company

We are talking about a situation where a fixed asset is transferred to another organization as an investment. Subsequently, the original owner of the object will receive dividends. The write-off of the original cost and depreciation proceeds in the same way as in the two previous cases, but the transfer itself is displayed with the following posting: D58 - K01 (subaccount).

There are several other specific situations that require the use of special entries in the accounting of an enterprise.

Typical defects and damage to metal structures

In modern construction, steel structures have become widespread, used in the load-bearing frames of industrial buildings and structures, residential and public buildings, in the spans of bridges, overpasses, galleries, in the frames of blast furnaces, gas tanks, tanks, masts, towers, etc.

We recommend reading: A soldier can take out sick leave under compulsory medical insurance

Structures made of aluminum alloys are most widely used as enclosing elements and in the form of finishing parts of buildings.

The main advantages of metal structures: high load-bearing capacity - the ability to withstand significant loads with relatively small sections due to the significant strength of the metal; high reliability, since structures can be calculated quite accurately; lightness and transportability.

Metal structures are much lighter compared to structures made of stone, reinforced concrete and wood. They are almost 4 times lighter than reinforced concrete and often lighter than wood (when used under the same loads).

Defective statement for write-off of fixed assets: sample

Write-off of fixed assets due to their unsuitability for further use is not carried out without the use of appropriate documentary evidence. To provide evidence, the following documents are drawn up:

- acts of write-off (they contain information confirming that the asset is being written off);

- defective statements (they are needed to indicate the reasons and arguments indicating the impossibility of using the object by the enterprise).

Why do you need a defect sheet?

There may be several reasons why a defective statement for writing off fixed assets is used (the sample will help you correctly enter all the necessary information):

- explains why it is necessary to write off an OS object, approaching the issue of its use from an economic point of view;

- the use of information from it allows you to analyze the causes of failure of decommissioned equipment (this allows you to eliminate the identified causes in order to further avoid damage to the equipment and the need to write it off before the established service life);

- is evidence of the validity of the write-off of fixed assets from an expert point of view (such a document may be requested by the company’s shareholders, its investors or other interested parties to verify the legality of the write-off).

Mandatory details of the defective statement

The most important part of the defective statement is the indication of the facts due to which the fixed asset cannot be used at the enterprise, and its write-off must be carried out as quickly as possible. In order for all mandatory information to be displayed in a document, it must be compiled in accordance with a certain structure.

A correctly compiled defective statement should contain the following data:

- name of the organization (full name is written);

- the structural unit to which the fixed asset subject to write-off is assigned;

- the composition of the commission that carried out the examination of the write-off object (information about all technical specialists is entered);

- an entry is made about the impossibility of further use of the fixed asset;

- information about all objects under study (the factory and inventory numbers are prescribed for each, the cost of the OS and the previously established planned period of its use are additionally entered);

- information about detected defects and identified malfunctions for each object;

- the commission’s conclusion on the need to write off objects due to the inexpediency of their further repair or sale due to the presence of serious faults.

After drawing up the document, all members of the commission must sign it.

Sample defect sheet

Describe the defects of plastic products

If the content is low, the filler does not have the proper reinforcing effect; if it is in excess, it is not completely wetted by the polymer; increased water absorption is the result of an excess amount of hygroscopic fillers. Molding defects arise due to deficiencies in the design of the mold and molding machines, incorrect selection or violation of the plastic processing regime.

Particularly important is compliance with the temperature regime and duration of the molding operation.

With deviations from the optimal molding temperature, uneven heating of molds, rapid or slow cooling, destructive processes can occur, significant internal stresses may arise, causing deformation of products, appearance of defects in appearance, and also reducing mechanical strength.

The most common molding defects include the following: warping - distortion of the shape of products,