A patent is issued for a period of 1 to 12 months. If the patent is issued for less than 6 months, the tax is paid until its expiration. If the period is from 6 to 12 months, a third of the amount must be paid within 90 days from the date the patent began, the rest - before its expiration.

When an individual entrepreneur completes work on a patent ahead of schedule or completely closes the business, the tax is recalculated taking into account unused days. Based on the results of reconciliation with the Federal Tax Service, an overpayment may result. It's really possible to bring her back. Or it can be offset against payments for other taxes. How to do this - read below.

How can an individual entrepreneur renounce a patent?

Entrepreneurs may need to terminate a patent early for voluntary or compulsory reasons. You can change the taxation system before it expires in different ways, depending on the situation.

Refusal before patent registration

If you have just submitted an application to purchase a patent, the tax office has 5 days to register and issue documents. During this time, you can withdraw your application, which will be considered lawful.

Early closure of a patent

If the need for early closure of a patent arose after its registration, then you need to notify the tax office. When PSN is terminated ahead of schedule, an application is submitted in Form 26.5-3, approved by Order of the Federal Tax Service No. MMV 7-3/ [email protected]

Termination of activities under a patent

PSN applies to a limited number of activities. If you decide to change your business area and the new activity is not covered by a patent, you must also submit an application to the Federal Tax Service, but in Form 26.5-4 (Order No. MMV 7-3/957).

In case of loss of the right to use a patent

The need to terminate a patent may not only be at one’s own request. An entrepreneur will lose the right to use PSN if the amount of annual income exceeds 60 million rubles or more than 15 employees are hired.

If the right to use a patent is lost, the individual entrepreneur must submit a tax application in form 26.5-3 in order to switch to another taxation system.

We recommend reading: Patent renewal for individual entrepreneurs and deadlines for filing an application.

How to restore PSN payer status

An entrepreneur who has ceased patenting activities and lost the status of a PSN payer can issue a new patent no earlier than January 1 of the next calendar year. This rule is established by clause 8 of Art. 346.45 of the Tax Code of the Russian Federation and concerns both cases where an entrepreneur voluntarily renounces a patent, as well as situations where the status of a PSN payer is lost due to a violation of the terms of application of the tax system.

Let us remind you that according to clause 4 of Art. 346.45 of the Tax Code of the Russian Federation, a patent is terminated early if:

- The income of individual entrepreneurs from patent activities during the year exceeded 60 million rubles. (when combining the simplified tax system and the personal tax system, the total amount of income under the two tax regimes is taken into account);

- the average number of employees of an individual entrepreneur during the period of validity of the patent exceeded 15 people.

Recalculation of a patent upon closure of an individual entrepreneur

In case of termination of activities, the individual entrepreneur submits an application for deregistration. When closing an individual entrepreneur on the PNS, you must submit an application for recalculation of the patent in order to find out whether there is a debt or overpayment on it. The patent can be recalculated immediately, on the day the individual entrepreneur is deregistered.

Refund of overpayment

If, after recalculating the patent, an overpayment is revealed, the tax office will return the money to you. To do this, an application for a refund of the amount of overpaid tax is submitted, its form was approved by order of the Federal Tax Service No. ММВ 7-8 / [email protected] app.8.

And also, according to this application, you can not only return the money to your account, but also dispose of it as follows:

- offset against future payments;

- pay off debts on fines or penalties;

- reduce arrears on other mandatory payments.

But the tax office will not take into account the overpayment towards a future period if there is arrears of penalties and fines - its repayment is a priority.

How long does it take to pay the balance of the patent?

If an individual entrepreneur closes a patent and recalculation reveals a debt in the form of an unpaid balance, it must be repaid in full. The money must be transferred before the end of the patent period for which it was originally opened.

The tax office obliges

The patent tax system is a convenient and beneficial form of activity for entrepreneurs in certain regions, since individual entrepreneurs with a patent do not pay many taxes and fees typical for other types of tax systems, and there is also no requirement to provide regular reports and declarations that are mandatory for all other entrepreneurs. Additional conveniences include permission not to conduct accounting and not to use cash registers. The relationship between the tax office and individual entrepreneurs on the PSN is extremely transparent and as simplified as possible.

The only serious requirement put forward by the tax office to “patent holders,” in addition to timely payment of fees, is to correctly close tax reporting upon liquidation of an individual entrepreneur.

IMPORTANT! Violation of the procedure for closing an individual entrepreneur in the patent taxation system may result in the accrual of fines and penalties as a result of the occurrence of tax arrears.

How long does it take to file a patent waiver application?

The deadline for filing an application for termination of an individual entrepreneur’s patent may be different, depending on the conditions of closure:

| Conditions for termination of a patent | Application deadline |

| After filing an application and before receiving patent registration | Within 5 days from the date of submitting an application to the tax office for its opening |

| Before its expiration date, at the sole request of the individual entrepreneur | Within 10 days from the date of this decision |

| Forcibly, in case of loss of the right to use the patent | Within 10 days from the date of the events that influenced the loss of this right |

We recommend reading: Reporting of individual entrepreneurs on a patent with and without hired employees.

Documenting

For each type of early closure of a business, a special application form is provided.

In the first case, the entrepreneur fills out the form approved by the order of the Federal Tax Service No. ММВ-7-3 / [email protected] dated December 14, 2012 (Appendix 4).

In the second case, the application form was approved by order of the Federal Tax Service No. MMV-7-3 / [email protected] dated April 23, 2014 (Appendix 3).

IMPORTANT!

The deadline for filing an application is 10 days from the date of termination of activity. The application for early termination of work will be registered, and the day of filing is recognized as the date of completion of the activities of the PSN and deregistration as a taxpayer.

Application form

Sample application for refusal of a patent

In order for a patent to cease to be valid, you need to submit an application to the tax office, using Form 26.5-3 (in case of early abandonment of the patent or loss of the right) or Form 26.5-4 (upon completion of activities under the patent). The application form can be taken from the tax office in paper form and filled out by hand. We recommend downloading the application on our website, filling it out electronically and printing it out - it will be easier and faster.

applications to terminate the activities of an individual entrepreneur on a patent. applications for loss of the right to use PSN.

All fields in the application are filled in by the entrepreneur or his authorized representative, with the exception of the area “To be filled out by a tax authority employee.”

Patent system: brief description

The main feature of PSN is the absence of the need to submit tax reports. However, not every entrepreneur is allowed to apply this regime, since the type of activity of a businessman must be included in the established Art. 346.43 Tax Code of the Russian Federation list.

In addition, a number of restrictions are imposed on financial indicators and the number of employees. Thus, income from activities at PSN cannot be more than 60 million rubles per year, and the number of personnel should not exceed 15 people.

The cost of a patent can be calculated by the taxpayer himself or using the Federal Tax Service service.

Patent application from 2021

You have made the necessary calculations and decided to switch to a patent tax system. To do this, you must submit an application to the tax office. We will tell you in this article how to fill it out, within what time frame to submit it, and how to obtain the patent itself.

A document certifying the right to use the patent taxation system is a patent. A patent is issued separately for each type of activity that the entrepreneur decides to transfer to PSN. When switching from the simplified tax system to a patent within a year for one type of activity, there are nuances.

Thus, let us formulate the first rule

— for each type of activity that an entrepreneur decides to transfer to PSN, a separate application must be submitted. In addition to the application for the transition to PSN, the taxpayer does not need to submit any other documents.

Second rule. Application form

An application for transition to PSN is submitted in a form approved by the Federal Tax Service of Russia and valid at the time of submission of the application. Today, Application Form No. 26.5-1 is in force (Form for KND 1150010), which was approved by the Federal Tax Service of Russia on July 11, 2017, order No. MMV-7-3/

However, if you want to apply the patent for less than a full calendar year, the Federal Tax Service of Russia has developed an application form for obtaining a patent. It is recommended for use by letter of the Federal Tax Service of Russia dated February 18, 2021 N SD-4-3/

Today these are two parallel operating forms.

Third rule. Place and method of application

As a general rule, an individual entrepreneur submits an application to the tax authority at the individual entrepreneur’s place of residence.

If an individual entrepreneur plans to apply PSN in various municipalities of the same constituent entity of the Russian Federation in whose territory he is registered as an individual entrepreneur, then he also submits an application for a patent to the tax authority at his place of residence.

If an individual entrepreneur plans to carry out activities on the basis of a patent in a constituent entity of the Russian Federation in which he is not registered with the tax authority at his place of residence, the application is submitted to any territorial tax authority of this constituent entity of the Russian Federation at the individual entrepreneur’s choice.

If a subject of the Russian Federation differentiates the territory of a region according to the areas of validity of patents by municipalities, and in this territory the individual entrepreneur is not registered with the tax authority at the place of residence or as a PSN payer, the specified application is submitted to any territorial tax authority at the place of planned business activity ( This procedure does not apply to the following types of activities: freight and passenger transportation, delivery and delivery trade).

The application is submitted:

- personally or through a representative by notarized power of attorney;

- by mail with a description of the attachment. In this case, the day of its presentation is considered to be the date of dispatch of the postal item;

- in electronic form via telecommunication channels (TCS). Accordingly, the day of its submission is considered the date of its dispatch.

Fourth rule. Patent start date

The entrepreneur determines the start date of application of the PSN himself, and it can be arbitrary. That is, you can start activities from any day of the month, as from 01/01/2021, and from 01/09/2021, and from 01/20/2021. and any other date. Now the validity period of a patent is not tied to full months - it can be started from any date and issued for any period. The main thing to remember is that the minimum period for which a patent is issued is a month. And you can only get a patent within a calendar year. What does it mean? For example, you decided to start working on a patent after the New Year holidays, for example from 01/09/2021, and until the end of 2021. In this case, you will be issued a patent valid from 01/09/2021. until December 31, 2021 inclusive.

Fifth rule. Deadline for filing a patent application.

The application is submitted to the tax office no later than 10 days before the start of application of the PSN. It is important to remember that the period for filing an application for a patent is calculated in working days.

Thus, if you want to apply the patent tax system from January 1, 2021, then the deadline for submitting an application to the tax office is December 17, 2021.

Attention!

What to do if you missed this deadline, and the calendar already says, say, December 23? Is it very important for you to start using PSN from 01/01/2021? The Federal Tax Service of Russia agreed to meet entrepreneurs. By her letter dated December 9, 2021 N SD-4-3/ she obliged local tax inspectorates, “in order to ensure a “seamless” transition from UTII to PSN,” to ensure the acceptance of patent applications until December 31, 2020 inclusive.

This tax decision, in principle, does not violate the requirements of the Tax Code of the Russian Federation, since the Tax Code of the Russian Federation contains another interesting rule.

If the patent application is filed less than 10 days before the patent commencement date, but:

- this application was received by the tax authority before the patent commencement date

- the date of issue of the patent occurs before the start date of the patent specified in the application

the tax authority has the right

consider the possibility of issuing an IP patent indicating the start date of the patent in accordance with the application for a patent.

That is, the tax office has the right, although not the obligation, to issue you a patent from the date you need, even if you missed the deadline for filing the application. But in this particular case, the Federal Tax Service of Russia obliged the lower tax authorities to issue a patent to everyone who correctly filled out the application and submitted it before December 31, 2020. (subject to all other requirements established by the Tax Code of the Russian Federation for the possibility of applying PSN).

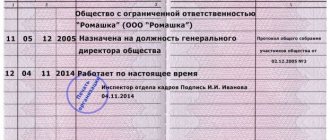

Filling out an application for a patent

Let's consider the procedure for filling out an application for a patent in the form approved by Order of the Federal Tax Service dated July 11, 2021 N ММВ-7-3/ for the type of activity “Retail trade carried out through objects of a stationary retail chain with trading floors”

.

And if you don’t want to figure it out, then leave a request for service with our company. Our specialists will be happy to take on the hassle of switching to a patent, advise on how to legally reduce taxes and take on the work of maintaining your accounting and personnel records. You can get acquainted with the services we provide by following the link.

Text fields are filled in in capital block letters. If there is no data to fill out the indicator or if the information is incomplete, a dash is added. If you fill out an application using the appropriate software, there may be no dashes for empty acquaintances.

The Application itself consists of two pages, which all applicants must fill out.

Sample of filling out page 001 Applications

Pay attention to the following fields:

- in the field “requests to issue a patent for ______ months” the number of months from one to twelve inclusive within the calendar year is indicated

- in the field “from the date of commencement of the patent” the date of commencement of application by the individual entrepreneur of the patent taxation system is indicated

Sample of filling out page 002 Applications

Pay attention to the following fields:

- in the field “in relation to the type of business activity carried out by him:” the full name of the type of business activity established by law of the subject of the Russian Federation, in respect of which the individual entrepreneur plans to apply the patent, is indicated

- The field “Individual entrepreneur applies the tax rate ______ percent established” is filled in only if the individual entrepreneur applies a reduced tax rate or a tax rate of 0 percent established by the law of the constituent entities of the Russian Federation, in accordance with paragraphs 2 or 3 of Article 346.50 of the Tax Code

Sheets A, B and C of the Application

Sheet A of the Application is filled out by all individual entrepreneurs, with the exception of patents for carrying out types of business activities specified in subparagraphs 10, 11, 19, 32, 33, 45, 46, 47 and 48 of paragraph 2 of Article 346.43 of the Code.

Sheet B Applications are filled out by individual entrepreneurs by type of activity:

- provision of motor transport services for the transportation of goods - pp. 10 clause 2 art. 346.43

- provision of motor transport services for the transportation of passengers - pp. eleven

- provision of services for the transportation of passengers by water transport pp. 32

- provision of services for the transportation of goods by water transport - pp. 33

Sheet B Applications are filled out by individual entrepreneurs by type of activity:

- leasing (hiring) of own or rented residential and non-residential premises, land plots - pp. 19 clause 2 art. 346.43

- retail trade carried out through stationary retail chain facilities with trading floors - pp. 45

- retail trade carried out through objects of a stationary trading network that do not have sales floors, as well as through objects of a non-stationary trading network - pp. 46

- public catering services provided through public catering facilities - pp. 47

- public catering services provided through public catering facilities that do not have a customer service hall - pp. 48

In sheet B of the Individual Entrepreneur Application, information is indicated for each object used in the implementation of activities, and the required number of sheets B is filled out.

Sample of filling out sheet B of the Application (for retail trade through a store)

Pay attention to the following fields:

- in the field “Object type code” the object code is indicated in accordance with the type of business activity being carried out:

09 - store;

10 - pavilion.

- The field “Object characteristic (sq.m)” is filled in if, by law of the constituent entity of the Russian Federation, the size of the PVGD is established depending on the area of the object. In this case, the following characteristics of the object are established:

2 - area of a stationary retail chain facility with a sales floor (store, pavilion);

3 - area of the trading floor at the trade organization facility;

- in the field “Object area (sq.m)” the area of the object in square meters is indicated. if the law of a constituent entity of the Russian Federation establishes the size of the PVGD depending on the area of the facility - respectively, either the area of the facility of a stationary retail chain, or the area of the trading floor.

Patent period

Within 5 days from the date of receipt of the application for a patent, the tax authority, in accordance with clause 3 of Art. 346.45 of the Tax Code of the Russian Federation, is obliged to issue or send to an individual entrepreneur a patent or a notice of refusal to issue a patent.

Grounds for refusal by the tax authority to issue a patent to an individual entrepreneur

These grounds are listed in paragraph 4 of Art. 346.45 Tax Code of the Russian Federation. This:

- discrepancy in the application for a patent of the type of entrepreneurial activity with the list of types of entrepreneurial activity in respect of which a PSN has been introduced on the territory of a constituent entity of the Russian Federation;

- indication of an incorrect patent validity period;

- violation of the conditions for transition to PSN;

- the presence of arrears of tax payable in connection with the application of the PSN;

- failure to fill in required fields in the patent application.

Please note that the tax authority does not have the right to refuse to issue a patent to an individual entrepreneur due to the fact that the law of the subject of the Russian Federation establishing the amount of potential income for the next calendar year has not been adopted or has not come into force.

Update dated December 14. The deadline for filing a patent application has been extended from January 1, 2021.

An application for a patent must be submitted no later than 10 days before the start of application of the PSN. A patent is issued from any date of the month specified by the individual entrepreneur in the application for a patent, for any number of days, but not less than a month and within a calendar year.

Please note - if you want to apply the patent from the beginning of 2021

, then such an application can be submitted

until December 31, 2021.

If you have already submitted an application for a patent tax system, then read our article where we talk in detail about the procedure for maintaining tax accounting under PSN.

Step-by-step instruction

We offer a step-by-step algorithm for closing a patent. There are four steps required.

Step 1. Compose an application

On form 25.5-4 we indicate the following information:

- code of the tax authority where we are going to submit the application;

- FULL NAME.;

- the date from which we are going to close the patent early;

- patent number.

Closing of a patent when closing an individual entrepreneur occurs in a declarative manner. You can stop working using the PSN without closing the IP.

Step 2. Contact the Federal Tax Service

We submit the application to the Federal Tax Service (at the place of registration of the individual entrepreneur) before the expiration of 10 days from the date of termination of activity under the patent. We apply independently at the place of registration, or send documents by mail, or fill out an electronic application on the Federal Tax Service website.

Step 3. Deregistration

Within 5 days, the Federal Tax Service deregisters PSN as a payer, and the individual entrepreneur becomes a payer on a general basis.

Step 4. Recalculation

If an individual entrepreneur has paid the contribution by the end of the year, but stops working before its expiration, he has the right to submit an application to the Federal Tax Service for recalculation; if not, he pays in proportion to the number of days of use.

IMPORTANT!

Don’t forget to return the overpayment if you paid the price in full: the Ministry of Finance agrees that this can be done. He expressed his consent in letter No. 03-11-11/29934 dated May 25, 2016. For more details on the conditions for a refund or reduction of the tax amount, see >Federal Law No. 325-FZ of September 29, 2019.