Transport tax: what is it and who is obliged to pay it

Important: only vehicle owners are payers. All other persons operating the vehicle do not pay it. This means that only the legal owner is considered a taxpayer and is obliged to annually pay tax for this car to the state treasury. It doesn’t matter that she doesn’t even have a license and the car actually belongs to her grandson.

Transport tax is classified as regional, but the deadlines for its payment, maximum rates and calculation procedures are the same throughout the Russian Federation. The deadlines can be changed by the authorities of the constituent entity of the Russian Federation, but only upward. The calculation of the amount is carried out by employees of the Federal Tax Service (FTS) for the previous calendar year, based on the established tariffs (Article 52 of the Tax Code (TC)).

After reading this article, you can check the correctness of the calculation yourself by using a special online calculator, for example, on the official website of the Federal Tax Service. Note: this portal automatically determines the region from which the request is made, therefore calculations are carried out according to the tariff schedule of a specific subject. If you need to calculate the amount of tax payment in another region, you should select its name in the top line of the main page of the site.

The information on the basis of which the Federal Tax Service issues a notice of the need for payment is provided by state registration authorities. For reference: these are the organizations where the state was produced. vehicle registration.

The taxable base for calculating transport tax, according to Article 358 of the Tax Code, in the Russian Federation is the following objects:

- cars and trucks;

- self-propelled special equipment;

- motorcycles, scooters and ATVs;

- buses;

- snowmobiles and motor sleighs;

- boats with motors;

- sailing ships;

- boats, yachts, barges;

- jet skis;

- airplanes and helicopters;

- unmanned quadcopters weighing more than 30 kg (Letter of the Federal Tax Service dated February 11, 2021 N BS-4-21 / [email protected] ).

Many owners of so-called “small equipment”, namely motor boats, jet skis, ATVs and snowmobiles, mistakenly believe that the property they own is not transport. But this is fundamentally wrong. These objects are subject to mandatory registration either with the State Traffic Safety Inspectorate, or with the State Inspectorate for Small Vessels (GIMS) or with the Federal Air Transport Agency. They are also subject to mandatory taxes.

There are exceptions in the legislative framework. There is no need to pay transport tax in 2021 for the following types of transport (Article 358 of the Tax Code, clause 2):

- cars equipped for disabled people;

- cars with a power of less than 100 horsepower (hp), purchased through social security authorities;

- water vessels engaged in fishing;

- agricultural transport and special equipment, provided that they are registered to an individual who is an agricultural producer and is used for agricultural purposes. works;

- Vehicles on the wanted list;

- watercraft and aircraft registered by persons having the status of a participant in the special administrative region of the Kaliningrad Region and Primorsky Territory.

About citizens who are exempt from paying

First, you need to remember which individuals are required to pay this tax. This obligation applies to individuals and legal entities, individual entrepreneurs. If there is at least one vehicle registered to this citizen.

But there is an opportunity not to pay tax on such cars:

- If a ship is present in the Russian register of international scale, it ceases to be an object for taxation.

- The company is not obliged to pay for a vehicle owned when providing transportation services of any type.

- The RF Tax Code does not apply to a group of airplanes and helicopters owned by medical and sanitary services. These are platforms in a floating and stationary state, vessels. This also includes drilling rigs.

- Segways with bicycles are not subject to transport taxes.

- Finally, rowing boats are also exempt from this type of payment.

The list of persons exempt from paying tax is individually determined in each of the constituent entities of the Russian Federation. Beneficiaries often include veterans and disabled people, members of large families.

Sometimes concessions are provided for organizations if local authorities make an appropriate decision.

What determines the size of the tax payment?

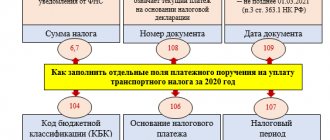

The payment amount is calculated for each specific vehicle by arithmetic multiplication of the following indicators:

- transport power in horsepower, specified in the technical passport of the taxable object, or the thrust of a jet engine, or the capacity of a non-self-propelled vessel. This is the tax base regulated by Art. 359 NK;

- tariff rate. It is determined per unit of vehicle power and is calculated centrally. Subjects of the Russian Federation have the right to increase or decrease the size of the approved tariff, but not more than 10 times the base value (Article 361 of the Tax Code). For vehicles with a power of less than 150 hp. With. There is no reduction in the base value. If the tariff rates of transport tax in the region are not approved, then those fixed in Article 361 are applied:

| Name of taxable object | Bid |

| Passenger cars | |

| up to 100 l. With. inclusive | 2.5 rub. |

| from 100 to 150 l. With. inclusive | 3.5 rub. |

| from 150 to 200 l. With. inclusive | 5 rub. |

| from 200 to 250 l. With. inclusive | 7.5 rub. |

| over 250 l. With. | 15 rub. |

| Motorcycles and scooters | |

| up to 20 l. With. inclusive | 1 rub. |

| from 20 l. With. inclusive | 2 rub. |

| over 35 l. With. | 5 rub. |

| Buses | |

| up to 200 l. With. inclusive | 5 rub. |

| over 200 l. With. | 10 rub. |

| Trucks | |

| up to 100 l. With. inclusive | 2.5 rub. |

| from 100 to 150 l. With. inclusive | 4 rub. |

| from 150 to 200 l. With. inclusive | 5 rub. |

| from 200 to 250 l. With. inclusive | 6.5 rub. |

| over 250 l. With. | 8.5 rub. |

| Dr. self-propelled vehicles, pneumatic and tracked machines and mechanisms | 2.5 rub. |

| Snowmobiles, motor sleighs | |

| up to 50 l. With. inclusive | 2.5 rub. |

| over 50 l. With. | 5 rub. |

| Boats, motor boats and other water vehicles | |

| up to 100 l. With. inclusive | 10 rub. |

| over 100 l. With. | 20 rub. |

| Yachts and other sailing and motor vessels | |

| up to 100 l. With. inclusive | 20 rub. |

| over 100 l. With. | 40 rub. |

| Jet skis | |

| up to 100 l. With. inclusive | 25 rub. |

| over 100 l. With. | 50 rub. |

| Non-propelled (towed) vessels (gross ton) | 20 rub. |

| Airplanes, helicopters and other aircraft with engines | 25 rub. |

| Jet-powered aircraft (per kilogram of thrust) | 20 rub. |

| Dr. water and air vehicles without engines (per vehicle unit) | 200 rub. |

- duration of vehicle ownership in the past year. If the owner owned the equipment for all 12 months, then this indicator is equal to one. If the vehicle was purchased or sold (disposed of) during the reporting period, then the duration of ownership coefficient is calculated as the ratio of the number of months of ownership to the number of months in a year (i.e., 12). Note: if registration occurred after the 15th, then this month is not included in the calculation. If deregistration was carried out before the 15th day, then this month is also not taken into account when calculating. For example, if a car is sold and then deregistered on, say, March 20, then the multiplier value is 3/12. If October 4, then 9/12;

- increasing coefficient applied to cars whose cost exceeds three million rubles. This is the so-called “luxury fee”. The list of such cars is approved annually by the Russian Ministry of Industry and Trade, taking into account the number of years from the date of manufacture. The list is published on the official Internet resource of this organization annually before March 1. In 2021, the list for 2021 is used, since this period is a reporting period. The value of the coefficient depends on the cost of the car at the time it left the assembly line and the number of years that have passed since that time:

| Price | Car age | Increasing factor |

| 3 - 5 million rubles. | up to 3 years | 1,1 |

| 5 - 10 million rubles. | up to 5 years | 2 |

| 10 - 15 million rubles. | up to 10 years | 3 |

| from 15 million rubles. and higher | up to 20 years | 3 |

After the vehicle's age limit has expired, the increasing multiplier for calculating the vehicle tax is not used.

About general provisions

Transport Tax appeared in Russia starting in 2003. This tax is justified from an economic point of view. It allows you to compensate for the damage caused to the road surface and the environment. To perform the same function, the following were created:

- A fee for negative environmental impact that is levied on organizations.

- Tolls.

- Excise taxes related to the production of machinery and fuel.

The Tax Code of the Russian Federation has Article 28, which is devoted to the regulation of these issues. Funds from taxes go to the budgets of the constituent entities of the Russian Federation. The Code defines:

- The period for tax reporting along with minimum rates.

- Payment deadlines.

- Betting limits, upper and lower.

Legislative bodies on the territory of constituent entities of the Russian Federation can govern:

- Actions required to submit reports and receive benefits.

- Payment deadlines.

- Upper, lower limit.

Article 363 of the Tax Code of the Russian Federation is devoted to this issue. If the subject is large, then a separate payment procedure is introduced for it. But, in general, paying transport tax for them is no different from other situations.

The transport tax applies to:

- Towed, river, sea, air vessels.

- Helicopters with airplanes.

- Buses with motorcycles and cars.

The text of Article 358 of the Tax Code of the Russian Federation is devoted to other groups of vehicles with special rules.

The determination of the tax base is largely based on the type of vehicle:

- If we are talking about airplanes, then the base is determined depending on the thrust, which is calculated in kilograms.

- If horsepower is taken to measure transport power, then the tax base will be equal to their number. When calculating, they rely only on the data from the technical data sheet. Separate rules are for power measured in kilowatts. 1 kilowatt is then equal to 1.3593 horsepower.

In some regions, owners of electric vehicles are exempt from paying taxes. Or only those with a hybrid engine type pay tax on “gasoline” horsepower.

The calendar year is considered the standard tax period for this type of payment.

Changes in the legislative framework in 2021

There have been minor adjustments to the legislative codes:

- the benefit for owners of heavy vehicles (over 12 tons) was cancelled;

- The payment date has been set for legal entities. persons - until March 1 after the reporting period;

- a non-application algorithm has been established for providing discounts to pensioners, disabled people, and large families. Tax officials will be in charge of identifying the grounds for reducing the tax burden. This is stated in Art. 2 (clause 66) of Federal Law No. 325-FZ of September 29, 2019. Note: if the benefit is not reflected in the sent notice (although it should be), then you should contact the Federal Tax Service. How to do this is discussed further in the article;

- a new list of the Ministry of Industry and Trade of cars worth more than 3 million rubles, containing about 1,100 items, was approved;

- in some regions the rates, the list of beneficiaries and current benefits have changed.

New rules for car registration. Where to pay tax? №1 (139) 2014

In 2013, Order No. 605 of the Ministry of Internal Affairs of the Russian Federation of August 7, 2013 came into force. Now a car can be registered in any region. Where to pay transport tax?

The new order makes life easier for car owners. The order came into force on October 15, 2013. Now we are waiting for this order to be implemented. We present to you some changes that do not relate to taxation, but are useful to every citizen, because almost no entrepreneur can do without a car. This means that this concerns him directly.

If the numbers were stolen

Serious changes have affected the procedure for issuing registration plates. It's easy to lose your license plate on our roads. But if previously it was necessary to re-register a car and get new license plates, now this is a thing of the past.

Now, if registration plates are lost, the car owner is not obliged to contact the traffic police to obtain new plates, but has the legal opportunity to make a duplicate of the lost registration plates. He can contact any organization for their production at his own discretion.

However, if the car owner believes that his registration plates have been stolen and is sure that they can be used for illegal purposes, then he must contact any nearby police department and report the theft. In this case, the numbers will be entered into the search database, and there is no need to talk about their further use. You will have to re-register the car. Fortunately, this can be done in any region.

Untimely accounting

It will also no longer be possible to deceive the tax service, as well as cameras that automatically record photo-video recording of violations, by riding on transit license plates. The operation of vehicles not registered with the State Traffic Safety Inspectorate is practically excluded. There is no provision for such an operation as deregistration. And the transfer of ownership from October 15, 2013 is carried out at the traffic police simultaneously with the deregistration of the car from the old one and registration with the new owner.

Also, the concept of temporary accounting has disappeared from everyday life. This registration action is no longer available. Any car owner who has permanent registration within the country immediately registers his car permanently. Those who are still operating their car under temporary registration will be able to re-register the car at the end of the period and receive a registration plate from the traffic police at the place of application. Or get your previously passed signs.

Personal marks

Motorists retain the right to keep their favorite license plate number and put it on their new car. At the same time, the shelf life of registration plates has been increased from 30 to 180 days. This also applies to signs deposited before the entry into force of the regulations. Their shelf life is automatically extended.

In order to retain the license plates you like, before the re-registration procedure for a new owner, the car owner must pay for the issuance of other plates and sell the car with license plates.

Owner - within an hour

The time interval provided for completing the registration action has been reduced from three to one hour.

But we must take into account that here the authors of the regulations indicated the real execution time of the registration function for ideal conditions. There are exceptions to this rule. The regulations provide for reasons and force majeure circumstances under which this time may be extended. For example, if additional checks and queries are required. If the department to which the car owner applied, or the department where the car was previously registered, does not have access to an automated accounting system. In these cases, the period will be increased. The time allotted for such checks is also specified in the regulations.

But, nevertheless, traffic police officers must strive for this established hour. This is one of the factors in evaluating their work.

The car is not registered

Any registration actions with cars can now be performed in any region convenient for the car owner. Currently, it does not matter the place of residence of the seller or buyer, information about the registered car, the new and old owner will be received by the traffic police from all regions that are related to the vehicle.

Registration plates lose their connection to a specific region and can be re-registered with a car in another region. However, regardless of the place of residence of the seller or buyer, the car that receives the signs again will be assigned the numbers of the region where the registration action actually takes place.

Applicable rates and benefits

In Russia, when calculating transport tax in 2021 (for 2019), the rates are within the permissible 10-fold difference with those approved by the Government of the Russian Federation. The table below shows the tariffs that are current in some of the regions:

| Region | Rate for 1 l. With. | ||||

| 0 — 100 | 100 — 150 | 150 — 200 | 200 — 250 | from 250 | |

| Amur region | 15 rub. | 21 rub. | 30 rub. | 75 rub. | 150 rub. |

| Voronezh region | 25 rub. | 35 rub. | 50 rub. | 75 rub. | 150 rub. |

| Kaliningrad region | 2.5 rub. | 15 rub. | 35 rub. | 66 rub. | 147 rub. |

| Moscow, city | 12 rub. | 35 rub. | 50 rub. | 75 rub. | 150 rub. |

| Saint Petersburg, city | 24 rub. | 35 rub. | 50 rub. | 75 rub. | 150 rub. |

To be fair, it is worth noting that when calculating transport tax, not only an increasing coefficient is used, but also benefits are provided.

A zero rate may be applied for some categories of citizens. This means that they will be exempt from paying this fee. Tax relief may be granted in percentage or monetary terms. Beneficiaries are determined at the regional level.

You can get acquainted with the payment procedure, tariffs, benefits and deductions in a specific region on the Federal Tax Service reference service using this link. Simply select the name of the desired subject of the Russian Federation and the period of interest from the pop-up menu. Preferential categories include many groups of the population, but in each region their list may differ slightly.

Main beneficiaries:

- Heroes of Russia and the USSR;

- veterans of the Great Patriotic War;

- liquidators of the accident at the Chernobyl nuclear power plant and victims of nuclear tests;

- large families;

- single mothers;

- citizens who received ownership of a car from the social service;

- disabled people of the first and second groups;

- pensioners;

- persons whose car is wanted. Note: to exercise this right, you must present a police certificate about the theft of the car to the Federal Tax Service at the place of permanent or temporary registration. Payment is not charged from the month of theft until the month of return to the owner.

Important: discounts and a zero transport tax rate for pensioners and other preferential categories of citizens apply to one vehicle unit of a certain category. For example, if a pensioner has 2 cars, then he will be able to take advantage of the benefit only for one (of his choice), for the other he will have to pay the full amount of accruals.

Place of registration of a citizen and place of registration of a car: the same thing or not?

Let's start with the fact that each of us must have a place of registration. This is the first. Of course, the ideal option is to register your car at this address at the nearby traffic police department.

But there are regulatory documents that state: a citizen of the Russian Federation can register his vehicle at any traffic police department, without reference to the place of registration.

And this norm has been in effect since 2013. Therefore, the answer is quite logical: the place of registration of the car owner and the place of registration of the car may be different. Another interesting thing is that everyone knows that transport tax is a regional fee.

This means that local authorities approve the procedure for benefits, accruals and payments. Therefore, if in the region where the car is registered, the same rates and benefits apply, and in the region where the owner lives, they are completely different, then the owner is guided by the rules of the second region. Something like this. In other words, if in your city you do not belong to a preferential category, but in the region where the vehicle is registered, there are, then you are not entitled to such benefits. It is also worth understanding that paying the transport fee is not a fundamental issue. The owner of the vehicle can pay for it using the details of the inspection, which is located in his city or the city where the vehicle is registered. But more on this.

How to check if benefits are taken into account

The Federal Tax Service sends the taxpayer a notice in paper or electronic format about the need to pay transport tax 30 days before the payment deadline. This document states:

- tax base, i.e. name of the vehicle and its capacity;

- current tariff rate;

- multiplying factor (if available);

- applied discounts and deductions (if any);

- total payment amount.

You should check whether this notice contains any information in the columns “Amount of tax benefits” and “Tax deduction”. If there is a dash in the indicated positions, but there is a basis for preferential taxation, then you should submit an application for the implementation of these benefits.

About advance payments

Advance payments in organizations are paid by those in whose name the vehicle was registered. And for those cars that are recognized as subject to taxation, in accordance with the law.

Transport tax belongs to the regional group. Therefore, the specifics of its payment in some constituent entities of the Russian Federation are determined individually. Moreover, there are regions where advance payments have not been introduced in principle.

If the advance payment is valid, then the reporting periods for it are three quarters. There is a general formula for calculating payments that looks like this:

AP=1\4xNBxNSxKv x Kp

The Tax Base is determined as NB. For cars, it is the same as their horsepower. NS – tax rate. Ownership coefficient – Sq. Kp - to indicate the increasing coefficient.

Advance payments must be reflected in the tax return submitted for the year.

Application for benefits

In Art. 361.1 states that if there are no documents for the provision of a tax benefit for transport tax from the Federal Tax Service, then the applicant for its receipt must independently submit an application and confirm this right with documents. In the absence of documents, employees of the Federal Tax Service themselves request information from the relevant authorities.

You can submit an application:

- when visiting the inspection;

- through the official portal of the Federal Tax Service - nalog.ru;

- by post;

- through the MFC;

- on the “State Services” portal in your personal account.

The period for providing discounts and deductions is 30 days from the date of receipt of the application. In some cases, the duration of execution may be extended for another month. After this time, the applicant receives a message about the benefit provided or a written refusal to provide it with justification of the reason.

If a citizen did not know that he was entitled to a tax break, then he can submit an application:

- to recalculate the calculated tax taking into account the required benefits or privileges;

- for a refund of overpaid money, a citizen can also ask to offset the overpayment to pay taxes for the following periods.

The statute of limitations for such actions is 3 calendar years.

Making payments through the Federal Tax Service

The tax office website provides many services. For example, it makes it possible to submit tax for payment using one of the available payment systems.

In order to make a payment in this way, you should fill out a form on the Federal Tax Service website: https://www.nalog.ru/rn77/

- Go to the “Payment of taxes by individuals” tab. Required details will appear, after filling them out additional fields will appear.

- Then the taxpayer needs to go to the “Transport Tax” section. A window will open where you need to enter the payment amount and the owner’s registration address.

- After the data has been entered, the vehicle owner must select a tax payment method.

- Having decided on the payment system, a person goes to its website, where he needs to undergo authorization. Invoices payable and a generated receipt will appear. Payment should be made only after carefully checking all the details specified in the receipt. If some data does not match, it is better to choose another payment system.

How can you minimize your tax payment?

This can be done by submitting an application for transport tax relief in a timely manner. This applies only to those persons who are entitled to receive tax privileges. There are no other ways to reduce the payment amount.

Experienced motorists are advised to think about the size of future payments even before purchasing a car.

Expert advice:

- You should take into account the power of the car, especially if its power indicator is near the tariff gradation marks. For example, if you buy a car in Moscow, then the payment amount for a car with a power of 100 hp. With. will be calculated at a price of 12 rubles per “horse”, and if the power is 101 hp. s., then 35 rubles. The difference is obvious: a difference of just 1 horsepower will increase the payment almost 3 times, but the car will not become more powerful;

- you need to choose a car model that is not included in the list of expensive cars specified by the Ministry of Industry and Trade. In this case, no increasing factor will be applied when calculating the tax;

- It is recommended to ensure that after completing the purchase and sale transaction of the car, the new owner registers it with the traffic police in his name. Only from this moment the new owner becomes the taxpayer. If re-registration does not take place within 10 days after the transaction, you can contact the traffic police and deregister the car yourself;

- the contents of the notice should be checked. The influence of the human factor has not been canceled; an error may be made in the calculations or when indicating the tax base.

When moving

If you have to move to another region of the country with your vehicle, then in order to register with the traffic police at your new place of residence, you do not need to contact the tax service at your place of registration in order to be deregistered there as a taxpayer of transport tax for that region.

To properly register your transport in connection with the move, you simply need to register your car with the traffic police upon arrival at the new place.

All information about your actions and about the changed address of your residence and registration of your car, the traffic police service will provide to the tax office at your previous place of residence.

This assumption is stated in the rules (clause 14), which were approved on November 24, 2008. Order of the Ministry of Internal Affairs of the Russian Federation No. 1001.

The traffic police and tax authorities will independently deregister you and register you as a transport tax payer at a new address (clause 5 of article 83 or clause 4 of article 85 of the Tax Code of Russia).

If the time of your move coincides with the end of the reporting tax period after December 31, then for the past year you will still pay the mandatory fee, but only to the new address of the tax office

Suppose you moved for permanent residence after December 31, 2021, for example, somewhere in early January 2021 - then for 2021 you are required to pay transport tax at your new place of residence.

True, for this, the tax service must send a corresponding payment notice to your new address, which you can make even via the Internet and pay the transport tax online on the website of the Federal Tax Service for your region, region, region.

But even earlier, before this, she must also send by mail to the Federal Tax Service of your new place of residence, by registered mail, the accounting file for your car and with your personal data as a taxpayer.

This requirement is taken into account in legislative norms and is regulated by clause 7 of Section III of the Procedure for the formation, use and storage of accounting files of individuals (justification - Order of the Ministry of Taxes of the Russian Federation No. SAE-3-09/357 dated 06/08/2004).

Deadline and methods for paying transport tax

The deadline for payment of transport tax is the same throughout Russia. Payment must be made by December 1 of the year following the reporting year. This means that payment for owning a vehicle in 2021 must be made by December 1, 2020. The notice to the owner of the vehicle must be delivered by November 1 in one of the following ways:

- by post;

- notification to the personal account of the official portal “State Services”, if the citizen is registered on this service.

You can make payment in several ways:

- at any bank branch;

- online from the bank’s personal account;

- through the “Payment for Government Services” service. It is enough to enter the document index indicated on the tax accrual form in the request field. This method helps to save time and protect your health from long standing in queues.

Important: you can pay not only for yourself, but also for relatives and friends.

Payment upon personal visit

For those car owners who do not use modern technologies, they have to pay the transport tax upon a personal visit to the organization that provides tax payment services.

Banking organization

All major commercial banks, as a rule, accept payment of transport tax. To make a payment, the payer must have a civil passport and a payment receipt. This can be done through a bank operator, in a live or electronic queue. Some banking organizations charge a commission fee.

Responsibility for non-payment of tax

Failure to pay transport tax in 2021 and in all other periods will result in fines and penalties in addition to the calculated payment.

Penalties are calculated by multiplying the debt by the number of days of delay and by 1/300 of the rate of the Central Bank (CB) of the Russian Federation.

For example, the debt as of December 2, 2021 is 3,000 rubles. If you do not pay before 2021, then the penalty for a month of delay will be: 3,000 rubles. x 31 days x 1/300×4.25% = 13.18 rubles.

Note: the Central Bank rate of 4.25% will remain until December 18, 2020, after this date it may change.

If the required amount is not paid, the Federal Tax Service employees will send the debtor a notice within 3 months demanding payment of the debt. If after 8 days the debt is not repaid, the tax service has the right to collect the debt from the taxpayer along with penalties through the court. Hearings in such cases are usually held without the presence of the defendant. The court's decision will be to collect the following amount: debt + penalties + legal costs. In general, the result will be a rather impressive accrual, which bailiffs have the right to write off from the debtor’s card. If there are not enough funds on the card, the bailiffs can take the following measures:

- block the account;

- close the possibility of traveling outside Russia;

- seize vehicles and other real estate.

Advances within the tax period

Despite the fact that fiscal payments are made after the end of the time for which they are accrued, you can do this earlier. Russian legislation calls this method of implementing obligations to replenish the budget an advance tax payment. It implies that the taxpayer fulfills his obligations before the expiration of the time for which he must pay taxes and fees. That is, funds can be transferred in advance, even before such an obligation occurs, directly during the tax period. You can do this in a single payment, or you can deposit money in small installments every month.

How to get a tax notice if it doesn't arrive in the mail

When registering on the State Services portal, the notice of payment of transport tax on a car or other vehicle ceases to be delivered by Russian Post. The notification is posted in electronic format in the personal account of the State Services user. Therefore, to view the notification, you need to log into your personal account on the portal. As a rule, a link to the notification document is indicated on the first page of the service.

There is another option - come for an appointment at the Federal Tax Service or at the MFC. To receive notification, you will need to submit an application.

The taxpayer must take into account that the tax office has the right not to send him a notice for the following reasons:

- a citizen has a benefit that completely exempts him from paying transport tax in 2021 for the previous year 2019;

- the total payment amount is less than 100 rubles;

- a citizen who is a registered user of the State Services portal did not indicate in his personal account that he needs to send a notice in printed format to his residence address.

In addition, one should not discount the fact that the notification may simply get lost on the way to the addressee. Instead of a resume

: only timely payment of transport tax can protect the taxpayer from penalties, and knowledge of your rights and the possibility of preferential taxation will reduce money expenses.

Excise taxes on gasoline

A category related to the legal field. That is why it deserves separate consideration.

In practice, compensation for the cost of excise taxes by car owners is already happening. How do sellers win?

There are a number of petroleum products that are included in the excise category:

- Diesel fuel.

- Straight-run gasoline.

- Motor oils.

- Automotive gasoline.

Excise duty is calculated on the basis of 1 ton of petroleum product. Excise taxes on fuel are assessed on the same day the buyer ships his purchase.

Excise tax payers are legal entities and enterprises that sell purchased goods and services.