Form P-5(m) 2021 statistical reporting is included in the list of those that have changed since 2021. What amendments were made to the form of this report? How have the deadlines for submitting form P-5(m) changed in 2021? Has the list of respondents changed? The answers are in our material. In addition, here you can download the new form P-5(m) 2021 for free and see a sample of filling it out.

Also see:

- New form P-3 to Rosstat: form and sample filling from 2020

What adjustments have been made to form P-5(m)

Statistical reporting form P-5(m) reflects general data on the organization’s activities. When filling out the P-5(m) report in 2020, it is necessary to rely on the following legislative framework:

You can download the current 2021 form P-5(m) from the link below.

Rosstat Order No. 419 introduced the following innovations:

- specified the list of respondents;

- postponed the deadline for submitting form P-5(m);

- made technical corrections in the tabular section.

We will describe the first two points in more detail below in the article. Here we will add technical amendments to the table in form P-5(m):

| WHERE DID IT CHANGE? | WHAT CHANGED |

| Section 1 “General economic indicators” | Column 2 “For the corresponding period of last year” has been excluded |

| Lines 03 – 16 excluded | |

| Section 2 “Production and shipment by type of product” | Column D “OKEY Code” is excluded |

And here is what was previously reflected in the excluded lines 03 -16:

As can be seen from the diagram, a fairly large number of indicators were excluded from the P-5(m) form. All that remains is data on sales of goods, works, and services in certain detail (more on this later).

Results

Conducting routine observations, Rosstat collects data on the work of enterprises represented by different categories: in particular, legal entities with fewer than 15 employees must report to the agency quarterly. For these purposes, reporting form P-5m .

You can learn more about reporting to Rosstat in the articles:

- “Find out what kind of statistical reporting and in what time frame you must submit”;

- “Rosstat has updated statistical forms on fixed assets.”

You can find more complete information on the topic in ConsultantPlus. Free trial access to the system for 2 days.

Respondents of form P-5(m)

Updated respondent information is provided on the cover page of the form itself.

Let's put them in a diagram for clarity:

Let us note some nuances regarding those who must report to statistics in Form P-5(m) in 2021:

- Non-profit organizations submit form P-5(m) subject to the presence of operations for the shipment of goods, works, services to other legal entities or individuals;

- separate divisions fill out the report for themselves, while the “head” also fills out the report without taking into account these separate divisions;

- after the reorganization, the successor submits a report, starting from the moment the new reorganized company appears;

- Representative offices and branches of foreign companies operating in the Russian Federation report in accordance with the general procedure.

Nuances of reporting by certain categories of legal entities

Instructions for filling out Form 5-P(m), contained in Appendix 17 to Order No. 414 and Appendix 21 to Order No. 541, reveal the specifics of reporting by individual companies, depending on the specifics of their activities, taxation regime or other nuances.

The company is required to report information about the company’s performance indicators to the statistical authorities, regardless of whether:

- They conduct economic activities or are temporarily unemployed. If during the reporting period the company produced goods and provided services part of the time, form 5-P(m) is filled out on a general basis, indicating since what time there has been no activity.

- Whether they are in bankruptcy or not. It is necessary to submit a report in the general manner until the arbitration court issues a ruling on the completion of bankruptcy proceedings and makes a record of liquidation in the Unified State Register of Legal Entities.

The report is also prepared by:

- Trustees, if they manage companies as entire property complexes.

- Associations of legal entities (unions and associations). The data in the report is presented on the activities recorded on the balance sheet of the association, and the members of the association report on their activities independently.

“Simplers” fill out the form on a general basis.

Dates for submitting form P-5(m) in 2020

On the title of form P-5(m) there is a note that this form relates to quarterly reporting. That is, it must be submitted 4 times a year based on the results of the quarter.

The deadline for submitting Form P-5(m) for 2021 has been adjusted:

As can be seen from the diagram, the date for submitting the report in Form P-5(m) has become floating since 2020. Therefore, check the table of dates by which in 2021 you must report to the statistics authority in form P-5(m):

| REPORTING PERIOD | DEADLINE DATE FOR SUBMISSION OF THE REPORT FOR 2021 |

| I quarter 2021 | April 14, 2021 |

| half year 2021 | July 14, 2021 |

| 9 months of 2021 | October 14, 2021 |

| 2020 | January 22, 2021 (estimated) |

Annual statistical reporting for 2021

| Form | Deadline | Form |

| No. 1-T “Information on the number and wages of employees” (Rosstat order No. 404 dated July 15, 2019) | No later than 01/30/2020 | |

| No. 7-injuries - on injuries at work and occupational diseases (Rosstat order No. 417 dated June 21, 2017) | No later than 01/27/2020 (January 25 and 26 - Saturday and Sunday) | |

| No. MP (micro) - data on the main performance indicators of a micro-enterprise (Rosstat order No. 461 dated July 27, 2018) | No later than 02/05/2020 | |

| No. 1-Enterprise - on the activities of the organization (Rosstat order No. 461 dated July 27, 2018) | Until 04/01/2020 | |

| No. 12-F - on the use of funds (Rosstat order No. 421 dated July 24, 2019) | Until 04/01/2020 | |

| No. 57-T - on wages of workers by profession and position (Rosstat order No. 404 dated July 15, 2019) | Once every two years for odd-numbered years No later than November 30, 2020 | |

| No. 23-N - on the production, transmission, distribution and consumption of electrical energy (Rosstat order No. 419 dated July 22, 2019) | Until 02/01/2020 | |

| No. 4-TER - on the use of fuel and energy resources (Rosstat order No. 419 dated July 22, 2019) | Until 02/17/2020 (February 16 - Sunday) |

Instructions for filling out form P-5(m) in 2020

Let's look at how to correctly fill out form P-5(m) and present a sample.

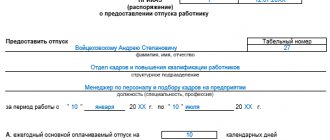

Title page

The title must contain basic information about the organization.

You should also fill out the reporting period. Please note that the form is quarterly and must be filled out with an accrual total. The reporting period will always start in January and end:

- March – I quarter;

- June – half a year;

- September – 9 months;

- December is a year.

Section 1

In Section 1 of form P-5(m), you need to fill out one table (severely truncated from 2021), in which you should reflect line by line:

| SECTION LINE 1 | WHAT DATA TO ENTER |

| 01 | The volume of shipped products of own production, services provided and work performed in-house. The data is provided excluding VAT, excise taxes and other similar payments. They do not reflect products, services, or work for their own needs. NPOs do not reflect the founder’s targeted funding for the maintenance of the organization. |

| 02 | Volume of non-owned goods shipped. The data is provided excluding VAT, excise taxes and other similar payments. Sales to the side of surplus inventories of non-own production also indicate. |

| 03 | Determine retail trade turnover (including VAT, excise taxes and other similar payments) |

| 04 | Wholesale trade turnover is highlighted (including VAT, excise taxes and other similar payments). Commission agents only show the amount of remuneration received. Does not reflect data on sold real estate. |

| 05 | The turnover of public catering is distinguished (including VAT, excise taxes and other similar payments) |

Section 2

The table of Section 2 “Production and shipment by type of product” is filled out differentially in accordance with the following scheme:

In the columns of the table it is necessary to show how many products were produced and shipped on a cumulative basis since the beginning of the year.

The shipped products should be detailed:

- select those produced not from raw materials supplied by customers;

- show in physical and value terms.

Column 5 is intended to reflect the balances of finished products at the end of the reporting period.

Data for column D (“Product codes according to OKPD2”) should be taken from Appendix No. 1 to Order No. 711.

Finally, the report must be signed, sealed and dated when completing the form.

Rates

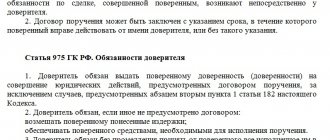

Federal statistical observation form N P-5(m) “Basic information about the activities of the organization” is provided by all legal entities that are commercial organizations, as well as non-profit organizations of all forms of ownership that produce goods and services for sale to other legal entities and individuals, organizations customers carrying out investment activities, the average number of employees of which does not exceed 15 people, including part-time workers and civil contracts.

Organizations carrying out construction activities on the territory of two or more regions, including on separate forms of Form N P-5m, provide information on the actual location of the construction site. At the same time, on each report form the following is written: “including in the territory of ________________” (its name is given, indicating the city and district).

Organizations that have switched to a simplified taxation system must indicate in the column “Name of the reporting organization” after the name of the organization: “simplified taxation system”. Section 1. General economic indicators

115. Lines 01, 02 of form N P-5(m) are filled out by all legal entities (except for small businesses, banks, insurance and other financial and credit organizations).

Line 01 of Section 1 of Form N P-5(m) reflects the volume of all goods shipped or released by way of sale, as well as direct exchange (under an exchange agreement) of all goods of own production, work performed and services rendered on one’s own in actual selling (sale) prices (excluding VAT, excise taxes and similar mandatory payments), including amounts of compensation from budgets of all levels to cover benefits provided to certain categories of citizens in accordance with the legislation of the Russian Federation.

The formation of this indicator is carried out in accordance with clause 13 of these Instructions.

Line 02 reflects the cost of goods sold, purchased externally for resale (their acquisition was reflected in accounting on the Debit of account 41) (products, materials, products purchased specifically for sale, or finished products intended for assembly, the cost of which is not included in cost of goods sold, and is subject to reimbursement by buyers separately).

The cost of these goods is shown taking into account the reimbursements and subsidies received (for example, on sold medicines, fuel, etc.).

This line also indicates the sold surplus of raw materials and supplies, the purchase of which was recorded in the inventory accounts.

Line 02 data is formed in accordance with clause 14 of these Instructions.

Lines 03 - 16 of form N P-5(m) are filled out by all legal entities (except for small businesses, budgetary organizations, banks, insurance and other financial and credit organizations).

If a legal entity has separate divisions allocated to a separate balance sheet and keeping records of income and expenses in full, lines 03 - 16 are filled in both for each such separate division and for the legal entity, excluding the data of such separate divisions.

These indicators are compiled on the basis of synthetic and analytical accounting. Hints to the indicators are given on the basis of the Chart of Accounts for the financial and economic activities of organizations and the Instructions for its application, approved by Order of the Ministry of Finance of Russia dated October 31, 2000 N 94n.

Organizations that have switched to a simplified taxation system submit data in Form N P-5(m) in accordance with clause 125 of these Instructions.

Data on lines 04 - 13 in form N P-5(m) are given in column 1 at the end of the reporting period; in column 2 - at the end of the corresponding period of last year.

Line 03, column 1 shows the amount of profit (loss) before tax received by the organization for the reporting period, i.e. the final financial result identified on the basis of accounting of all business transactions of the organization. It consists of the sum of the financial result from the sale of goods, products, works and services, fixed assets, other property, as well as other income, reduced by the amount of expenses for these operations. Line 03, column 1 corresponds to the indicator “Profit (loss) before tax for the reporting period” f. N 2 “Profit and Loss Statement”.

Line 03, column 2 reflects information about profit (loss) before tax for the corresponding period of the previous year. The data is presented in accordance with the accounting policies adopted in the current reporting period, but without recalculation into the prices of the reporting year, i.e. at prices in force in the corresponding period of the previous year. Line 03, column 2 corresponds to the indicator “Profit (loss) before tax for the same period of the previous year” of Form No. 2 “Profit and Loss Statement”.

Data on the accounting accounts of the organization's settlements with other organizations and citizens in the reporting are presented in expanded form: for analytical accounting accounts for which there is a debit balance - as part of accounts receivable, for which there is a credit balance - as part of accounts payable.

Line 04 reflects the receivables of this organization, line 05 - including overdue ones, i.e. debt not repaid within the terms established by the agreement.

Lines 04, 05, column 1 (at the end of the reporting period) and column 2 (at the end of the corresponding period of the previous year) show the debt for settlements with buyers and customers for goods, work and services; including debt secured by bills received; debt on settlements with subsidiaries and dependent companies; amounts of advances paid to other organizations for upcoming settlements in accordance with concluded agreements; debt on settlements with other debtors, including debt from financial and tax authorities (including overpayments of taxes, fees and other payments to the budget); indebtedness of the organization's employees for loans and borrowings provided to them at the expense of the funds of this organization or credit (loans for individual and cooperative housing construction, acquisition and improvement of garden plots, interest-free loans to young families to improve living conditions or start a household, etc.); debt of accountable persons; suppliers for shortages of inventory items discovered upon acceptance; debt under government orders, federal programs for goods, works and services supplied, as well as fines, penalties and penalties recognized by the debtor or for which decisions have been received from a court (arbitration court) or other body that, in accordance with the legislation of the Russian Federation, has the right to make a decision about their collection and included in the financial results of the organization. To fill out this line, use analytical data for the accounting accounts of the financial and economic activities of the organization in Section 6 “Calculations”, except for accounts 66, 67.

Lines 04 and 05 correspond to the sum of lines 230 and 240 in column 4 of Form No. 1 “Balance Sheet”.

Line 06 reflects the debt of buyers and customers for goods shipped, work performed and services rendered, for which income is recognized in the prescribed manner, including debt for settlements with buyers and customers for goods, work performed and services rendered, secured by bills received, etc. (accounts 62, 76, 63), on line 07 - including overdue. Lines 06 and 07 correspond to the sum of indicators characterizing the debt of buyers and customers, payments for which are expected more than 12 months after the reporting date and within 12 months after the reporting date, provided for in Section II in Column 4 of Form No. 1 “Balance Sheet”.

Lines 08 - 13, column 1 reflects the accounts payable of this organization for the period since the beginning of the year, and column 2 - debt for the corresponding period since the beginning of last year.

Line 08 shows the debt for settlements with suppliers and contractors for received material assets, work performed and services rendered, including debt secured by bills of exchange issued; debt on settlements with subsidiaries and dependent companies for all types of transactions; with workers and employees on wages, representing accrued but not paid amounts of wages; debt on contributions to state social insurance, pensions and medical insurance of the organization's employees, debt on all types of payments to the budget and extra-budgetary funds; the organization's debt in payments for compulsory and voluntary insurance of property and employees of the organization and other types of insurance in which the organization is the insured; advances received, including the amount of advances received from third-party organizations for upcoming settlements under concluded agreements, as well as fines, penalties and penalties recognized by the organization or for which decisions of a court (arbitration court) or other body entitled, in accordance with the legislation of the Russian Federation, to making a decision on their collection and attributed to the financial results of the organization, outstanding amounts of borrowed funds to be repaid in accordance with the agreements; on line 09 - expired.

To fill out these lines, use analytical data for the accounts of section 6 “Calculations”, except for accounts 66, 67. Lines 08 and 09 correspond to the sum of lines 520, 620, 630 in column 4 of form No. 1 “Balance Sheet”.

Line 10 shows the organization’s debt to suppliers and contractors for material assets received, work performed and services rendered, including those secured by bills issued); on line 11 - expired. Lines 10 and 11 also reflect debt to suppliers for uninvoiced supplies (accounts 60, 76). Line 10 of Column 1 corresponds to the indicator “Debt to suppliers and contractors” provided for in Section V in Column 4 of Form No. 1 “Balance Sheet”.

Line 12 indicates the organization's debt for all types of payments to the budget, except for the unified social tax (account 68); on line 13 - expired. Lines 12 and 13 correspond to the indicator “Debt on taxes and fees”, provided for in Section V in Column 4 of Form No. 1 “Balance Sheet”.

Line 14 shows revenue from the sale of products and goods, income related to the performance of work and provision of services, and the implementation of business transactions, which are income from ordinary activities. Column 1 reflects data for the reporting period, column 2 - for the corresponding period of the previous year. When filling out this line, you should be guided by the Accounting Regulations “Income of the Organization” PBU 9/99, approved by Order of the Ministry of Finance of Russia dated 06.05.99 N 32n.

In organizations whose subject of activity is the provision for a fee for temporary use (temporary possession and use) of their assets under a lease agreement, revenue is considered to be receipts the receipt of which is associated with this activity (rent).

In organizations whose subject of activity is the provision for a fee of rights arising from patents for inventions, industrial designs and other types of intellectual property, revenue is considered to be receipts the receipt of which is associated with this activity (license payments (including royalties) for the use of intellectual property).

In organizations whose subject of activity is participation in the authorized capital of other organizations, revenue is considered to be receipts of which are associated with this activity.

Trading and supply organizations on line 14 reflect the cost of goods sold. Intermediary organizations operating under commission, commission, agency, etc. agreements reflect on line 14 the cost of intermediary services provided by them.

Line 14 corresponds to the indicator “Revenue (net) from the sale of goods, products, works, services (minus value added tax, excise taxes and similar mandatory payments)” of Form No. 2 “Profit and Loss Statement”.

According to the line 15 gr. 1 reflects the costs of production of sold goods, products, works, services for the reporting period (column 2 - for the corresponding period of the previous year).

If an organization, in accordance with the established procedure, recognizes administrative and commercial expenses in full in the cost of goods, products, works, services sold as expenses for ordinary activities, this line reflects the costs of producing goods, works, services sold, excluding general production expenses , sales expenses.

Organizations engaged in trading activities reflect under this item the purchase price of goods, the proceeds from the sale of which are reflected in this reporting period.

Organizations that are professional participants in the securities market reflect under this item the purchase (accounting) cost of securities, the proceeds from the sale of which are reflected in this reporting period.

Line 15 corresponds to the indicator “Cost of goods, products, works, services sold” of Form No. 2 “Profit and Loss Statement”. Column 1 reflects data for the reporting period, column 2 - for the corresponding period of the previous year.

Line 16 shows general production costs, costs associated with the sale of products, as well as distribution costs. Column 1 reflects data for the reporting period, column 2 - for the corresponding period of the previous year. Line 16 corresponds to the sum of the indicators “Commercial expenses”, “Administrative expenses” of Form No. 2 “Profit and Loss Statement”.

Organizations that have switched to a simplified taxation system (except for small enterprises and individual entrepreneurs), when filling out lines 03 to 15 of the federal statistical observation form N P-5 (m), use the information contained in the Book of Income and Expenses of Organizations and Individual Entrepreneurs Using simplified taxation system approved by Order of the Ministry of Finance of Russia dated December 30, 2005 N 167n.

Lines 03 to 15 are filled in only by those organizations that have chosen income reduced by the amount of expenses as an object of taxation.

Organizations that have switched to a simplified taxation system show:

On line 03, column 01 - the amount of profit (loss) before tax for the reporting period. The volume of profit (loss) before tax for the reporting period is calculated as the difference between the organization’s income taken into account when calculating the tax base and expenses taken into account when calculating the tax base for the reporting period (section 1 “Income and expenses”, total for the reporting period in the column 4 minus the total in column 5). For the reporting period, data is taken for the first quarter, first half of the year, 9 months and a year.

On line 03, column 02 - the amount of profit (loss) before tax for the corresponding period of the previous year. The volume of profit (loss) before tax for the corresponding period of the previous year is calculated as the difference between the organization’s income taken into account when calculating the tax base and the expenses taken into account when calculating the tax base for the corresponding period of the previous year.

Page 3 = page 14 - page 15 (gr. 1, 2).

On lines 04 - 13, column 1 - all debt of this organization for the period from the beginning of the year, on column 2 - debt for the corresponding period from the beginning of last year (see paragraphs 64 - 67 of these Instructions for filling out and submitting unified forms).

On line 14 - income taken into account when calculating the tax base (section 1 “Income and expenses”, total for the reporting period in column 4).

On line 15 - expenses taken into account when calculating the tax base (section 1 “Income and expenses”, total for the reporting period in column 5).

Line 16 is not completed by organizations that have switched to a simplified taxation system.

Lines 17 - 22 reflect investments in non-financial assets - fixed capital, environmental management facilities, land, intangible and other non-current assets, research, development and technological work.

If the implementation of investment projects (construction of new buildings and structures, expansion, reconstruction of existing ones, etc.) is carried out by a customer endowed with such right by an investor (or group of investors), then information on such investments is provided by the customer. An investor who is not a customer for the construction of facilities does not include data on investments in such facilities in Form N P-5(m).

Customer organizations that invest in fixed assets in the territory of two or more regions (subjects of the Russian Federation, cities, districts), also provide information on the territory of each such region on separate forms of Form N P-5(m). At the same time, on each report form the following is written: “including in the territory of _________________” (its name is given).

Contracting organizations that combine the functions of subjects of investment activity (investor, customer (developer) and contractor), work performed on completed construction projects are taken into account as part of construction in progress and, accordingly, are reflected in investments in fixed capital.

In column 1, data is shown in prices of the reporting period, and in column 2 - in prices of the corresponding period of the previous year.

If payments for work (services) performed were made in foreign currency, then these volumes are converted into rubles at the rate established by the Central Bank of the Russian Federation at the time the work (services) was performed. Expenses for the purchase of machinery, equipment, and other fixed assets made in foreign currency are converted into rubles at the rate established on the date of acceptance of the cargo customs declaration for customs clearance, the moment of crossing the border or after the moment of change of owner (under the terms of the contract).

For lines 17 - 22, the data is provided without value added tax.

On lines 20 - 23, data is filled in only in the report for January - December.

Line 17 reflects investments in fixed capital (in terms of new and imported fixed assets): costs for new construction, expansion, as well as reconstruction and modernization of facilities, which lead to an increase in their initial cost, purchase of machinery, equipment, vehicles, for the formation of the main herd, perennial plantings, etc. This line reflects investments made from all sources of financing, including budget funds on a repayable and non-repayable basis, loans, technical and humanitarian assistance, and barter agreements.

Costs for the purchase of apartments in housing facilities credited to the organization's balance sheet and recorded in fixed asset accounts are not reflected on line 17.

In cases where, under the terms of the leasing agreement, the leased property is taken into account on the balance sheet of the lessee, then its value is included by the lessee in investments in fixed capital and is reflected on line 17.

Costs for the acquisition of fixed assets worth up to 10 thousand rubles are not included in investments in fixed capital.

In addition, investments in fixed capital do not include and line 17 does not reflect the costs of acquiring fixed assets worth no more than 20 thousand rubles per unit, taken into account in the accounting of commercial organizations (except for credit and budgetary ones) as part of inventories. For budgetary organizations, inventories include soft inventory (linen, clothing, shoes, etc.), as well as utensils, the acquisition costs of which should also not be reflected in investments in fixed capital.

128. From line 17, the following are distinguished: on line 18, investments in fixed capital received by this enterprise from abroad; on line 19, investments in fixed capital carried out at the expense of budget funds of all levels: federal, constituent entities of the Russian Federation, local (including funds from special budget funds). Budget funds allocated on a repayable basis are also reflected on line 19.

When filling out reports in Form N P-5(m), it should be noted that the data shown on line 18 is less than or equal to the data shown on line 17; The data shown on line 19 is less than or equal to the data shown on line 17.

Line 20 reflects investments in intangible assets: intellectual property (patents, certificates, copyrights, trademarks), business reputation of the organization and organizational expenses (expenses associated with the formation of a legal entity, recognized in accordance with the constituent documents as part of the contribution of participants (founders) ) into the authorized (share) capital of the organization), accepted for accounting in accordance with the Accounting Regulations “Accounting for Intangible Assets” PBU 14/2000.

Line 21 of line 20 allocates investments for the creation and acquisition of computer programs and databases.

130. Line 22 shows the costs of acquisition by legal entities of land plots, environmental management facilities and other non-financial assets.

Costs for the acquisition of land plots and environmental management facilities are given on the basis of documents issued by state bodies for land resources and land management according to invoices paid or accepted for payment. This line does not reflect the costs of acquiring rights to use these objects, which are accounted for as intangible assets.

On line 23, commercial organizations (except for credit institutions) that carry out research, development and technological work on their own, or who are contractual customers for the specified work, reflect only those costs for research, development and technological work, according to for which results were obtained that are subject to legal protection, but were not formalized in the prescribed manner, or for which results were obtained that are not subject to legal protection in accordance with the norms of current legislation.

Recognition of expenses for research, development and technological work as investments in non-current assets is established by the Accounting Regulations “Accounting for expenses for research, development and technological work” PBU 17/02.

Line 24 shows retail trade turnover. The formation of this indicator is carried out in accordance with clause 30 of these Instructions.

Line 25 shows the turnover of wholesale trade. The formation of this indicator is carried out in accordance with clause 33 of these Instructions.

Line 26 shows the turnover of public catering. The formation of this indicator is carried out in accordance with clause 34 of these Instructions.

Line 27 - shows the volume of paid services to the population. The formation of this indicator is carried out in accordance with clause 35 of these Instructions. Section 2. Cargo transportation and cargo turnover

road transport

Lines 28 to 31 show data on cargo transportation and cargo turnover performed by trucks. The formation of these indicators is carried out in the same way as filling out the corresponding indicators of Section 4 “Transportation of goods and cargo turnover of road transport” of form N P-1 in accordance with paragraphs 36, 37, 38, 39 of these Instructions. Section 3. Production and shipment

by type of product and service

When filling out data on the production, shipment and balances of specific types of industrial products produced by a legal entity (p. 50), on the sale of individual goods to the population (p. 70), one should be guided by paragraphs 40, 41 of these Instructions.

The free lines of section 3 (code 60) provide the distribution of the volume of paid services to the population, recorded on line 27 in accordance with Appendix No. 3. In column A the name of the service is indicated (according to Appendix No. 3), in column B the code “60” is entered, meaning

that this line contains information about paid services provided to the population, in column B the unit of measurement is entered - thousand rubles, in column D - the service code according to the All-Russian Classifier of Services to the Population (see Appendix No. 3). Column 1 provides information on the volume of paid services provided to the population during the reporting period. Columns G, E, 2 - 5 are not filled in.

With the introduction of these Instructions, the previously existing Procedure for filling out and submitting unified forms of federal state statistical observation, approved by Rosstat Resolution No. 69 of November 20, 2006, with additions and amendments approved by Rosstat Resolution No. 93 of November 23, 2007, is cancelled.

Sample of filling out form P-5(m) in 2020

Let's consider the example of the enterprise LLC "Princip". Let this company provide services for installing monitoring systems on customer vehicles. LLC “Princip” does not produce its own products; it purchases equipment for installation from third parties. Customers are large transport companies.

A sample of filling out form P-5(m) in 2021 for the specified example can be viewed below and downloaded for free from the link below.

How to find out the required forms for a business

If you do not know what reporting forms you will have to send to statistics this year, call the territorial office of the statistical agency or check the information on the official website of Rosstat for the basic details of the organization. Verification is carried out using TIN, OKPO or OGRN. Here's how to find out from OKPO which reports to submit to statistics in 2021:

- Go to the official website of the FSGS - reporting collection system.

- We enter the code according to the All-Russian Classifier of Enterprises and Organizations (OKPO).

- Click the “Get” button.

As a result, you will see a complete list of forms required for the enterprise with deadlines for their submission. Here is an article with step-by-step instructions on how to find out from your TIN which reports to submit to statistics in 2020.

Monthly statistical reports 2021

| Statistical report form | Deadline | Form |

| No. P-1 “Information on the production and shipment of goods and services” (dated July 22, 2019 No. 419) | On the 4th working day of the next month | |

| No. P-4 - on the number and wages of employees (dated July 15, 2019 No. 404) | No later than the 15th of the next month | |

| No. P-3 - on the financial condition of the organization (dated July 24, 2019 No. 421) | No later than the 28th of the next month |