State fee for arbitration: sizes

State duty is a mandatory fee paid when filing a claim. In 2021, the fee is transferred to the Arbitration Court of First Instance, to the Arbitration Court of Appeal and is paid strictly in accordance with the payment details. Here are the main amounts of the state duty, which in 2021 are applied when applying to the arbitration courts of the Russian Federation and the Supreme Court of the Russian Federation (in cases considered in accordance with the Arbitration Procedural Code of the Russian Federation):

| Case | Duty amount |

| Filing a property claim subject to assessment. | For the value of the claim: · up to 100,000 rubles - 4% of the claim price, but not less than 2,000 rubles; · from 100,001 rubles to 200,000 rubles - 4,000 rubles + 3% of the amount exceeding 100,000 rubles; · from 200,001 rubles to 1,000,000 rubles - 7,000 rubles + 2% of the amount exceeding 200,000 rubles; · from 1,000,001 rubles to 2,000,000 rubles - 23,000 rubles + 1% of the amount exceeding 1,000,000 rubles; · over 2,000,000 rubles - 33,000 rubles + 0.5% of the amount exceeding 2,000,000 rubles, but not more than 200,000 rubles. |

| Submission of applications to recognize a non-normative legal act as invalid and to recognize decisions and actions (inaction) of state bodies, local governments, other bodies, and officials as illegal. | · for individuals - 300 rubles; · for organizations - 3,000 rubles. |

| Filing a statement of claim for disputes arising during the conclusion, amendment or termination of contracts, as well as for disputes regarding the invalidation of transactions. | 6,000 rubles. |

| Filing other claims of a non-property nature, including applications for recognition of rights, applications for an award to perform duties in kind. | 6,000 rubles. |

| Filing an application for securing a claim | 3,000 rubles |

| Filing an appeal and (or) cassation complaint against decisions and (or) resolutions of the arbitration court, as well as against court rulings on refusal to accept a statement of claim (statement) or an application for issuing a court order, on termination of proceedings in a case, on leaving a statement of claim without consideration, in the case of challenging the decisions of the arbitration court, on the issuance of writs of execution for the forced execution of decisions of the arbitration court, on the refusal to issue writs of execution. | 3000 rubles. |

| Filing a cassation appeal against a court order. | 3000 rubles. |

| Filing a supervisory complaint. | 6000 rubles. |

| Filing an application to declare the debtor insolvent (bankrupt). | · for individuals - 300 rubles; · for organizations - 6,000 rubles. |

| Filing an application to establish facts of legal significance. | 3,000 rubles. |

According to clause 2, part 1, art. 126 of the Arbitration Procedure Code of the Russian Federation, the statement of claim is accompanied by a document confirming the payment of the state duty in the established manner and in the amount, or the right to receive a benefit in the payment of the state duty, or a petition for a deferment, installment plan, or a reduction in the amount of the state duty.

Sample of filling out a payment order for state duty

| Notice Bank marks | Index doc. 18209965171147669381 | (101) 13 | Form No. PD (tax) | |

| FULL NAME MUKHINA MARIA MIKHAILOVNA | Address 119019, st. ARBAT, 1, KV. 1, MOSCOW | |||

| TIN | Sum 4000.00 | |||

| Recipient bank of the State Bank of Russia for the Central Federal District | BIC 044525000 | |||

| Account No. 000000000000000000000 | ||||

| Recipient of the Federal Tax Code for Moscow (MIFTS of Russia No. 46 for Moscow) | Account No. 40101810045250010041 | |||

| TIN 7733506810 | ||||

| Gearbox 773301001 | ||||

| KBK 18210807010011000110 | OKTMO 45373000 | |||

| (107) 05.11.2017 | ||||

| (106) TP | (110) | |||

| date | Signature | |||

| Receipt Bank marks | Index doc. 18209965171147669381 | (101) 13 | Form No. PD (tax) | |

| FULL NAME MUKHINA MARIA MIKHAILOVNA | Address 119019, st. ARBAT, 1, KV. 1, MOSCOW | |||

| TIN | Sum 4000.00 | |||

| Recipient bank of the State Bank of Russia for the Central Federal District | BIC 044525000 | |||

| Account No. 000000000000000000000 | ||||

| Recipient of the Federal Tax Code for Moscow (MIFTS of Russia No. 46 for Moscow) | Account No. 40101810045250010041 | |||

| TIN 7733506810 | ||||

| Gearbox 773301001 | ||||

| KBK 18210807010011000110 | OKTMO 45373000 | |||

| (107) 05.11.2017 | ||||

| (106) TP | (110) | |||

| date | Signature | |||

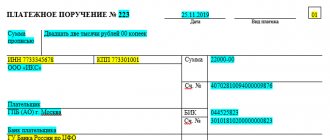

Example of a payment order for 2021

Let us say right away that you can issue a receipt for payment of the state duty on the official websites of arbitration courts. You can calculate the exact amount of the duty using the official state duty calculator. https://my.arbitr.ru/#commission

As for filling out payment orders for state fees to the arbitration court, they are filled out according to the generally accepted rules for filling out payment orders in 2021. The details of the recipient of the state duty (name of the arbitration court, INN, KPP, OKTMO, bank account) can be found directly in the court or on its website. When filling out the fields, fill out the main positions like this:

- Payer status, field 101 – “01”;

- TIN and KPP of the payer, fields 60 and 102 – TIN and KPP of the organization;

- Payer, field 8 – name of the organization;

- Payment order, field 21 – “5”;

- Code, field 22 – “0”;

- KBK, field 104 – KBK state duties;

- Reason for payment, field 106: – “0”;

- Tax period, field 107 – “0”;

- Document number, field 108 – “0”;

- Document date, field 109 – “0”

- Purpose of payment, field 24 – text explanation. For example, “State fee for consideration of a case in the Arbitration Court on ....”.

Below is a sample payment order that lists the state duty for payment of state duty in 2021:

Read also

14.12.2017

What is a payment order?

A payment order is a document in a prescribed form that regulates the account holder’s instructions to make non-cash transfers in favor of the recipient of funds.

The instruction has been sent to the bank that maintains the payer’s account. Funds are transferred from a deposit account. If for some reason the account does not have the required amount of money, but the agreement between the bank and the payer provides for an overdraft, the transfer will be carried out. This document must be drawn up and submitted to the bank for execution in electronic or paper form.

Individuals can also process payment orders without opening a bank account.

When submitting an order to the bank from an individual, the order can be drawn up in the form of an application, which must include the following information:

- payer details;

- details of the recipient of funds;

- bank details of the payer and recipient;

- amount of money;

- purpose or purpose of payment;

- other information established by the bank.

Based on the order, the bank employee generates a payment order.

When drawing up an order to the bank electronically, it is very important to correctly indicate the payer, recipient of the transfer, amount, and purpose of payment.

Validity period of payment order for state duty

According to the payment order, the bank is obliged to transfer funds to the recipient within the deadlines established by law, but provided that other deadlines are not specified in the agreement concluded between the bank and the account holder.

In accordance with the Regulations on the Rules for Transferring Funds, approved by the Bank of Russia on June 19, 2012 No. 383-P, a payment order is valid for 10 days from the day following the day the order was drawn up . It is during this period that the payment order must be submitted to the bank for its execution.

It is necessary to understand that we are talking about calendar days, including weekends and holidays.

If the validity period expires, you can go in two ways:

- change the date of the order;

- create a new payment.

It is clear that if a new payment order is generated, an unprocessed payment order will appear in the chronology, but this situation does not entail any punitive measures and is easily explained by the expiration of the document.

Errors in payment order for state duty

When generating a payment order, errors are often encountered that can have some consequences. In this article we will look at the most common mistakes:

| Error | What to do? |

| Error in amount | If the amount of transfers exceeds the required amount, then in this case several options are possible:

If the payment amount turns out to be less than necessary, in this case the payment is not taken into account. It is necessary to transfer the missing amount. |

| Invalid KBK code specified | The payment in this case will fall into the category of “unexplained payments”. The entrepreneur will need to write an application with the obligatory attachment of a paper copy of the payment order. |

Payment basis 106: decoding, filling rules

In the “Type of transaction” field the payment code is entered, in the “Payment purpose” - what exactly the payment is for. If we are talking about budget payments, then the information from this field should complement the “Base of payment” (106). Penalties and fines are paid with a unique code, but goods and services are paid without it. After filling out all the fields, the stamp and signature of the bank’s responsible person is affixed.

Before redistributing funds, the Federal Tax Service will reconcile the calculations of enterprises with the budget. If a positive decision is made, the inspectorate will cancel the accrued penalties. The taxpayer will be informed about the decision within 5 days. You can do it differently:

How to fill out a payment form for a representative of an individual or legal entity

According to paragraph 1 of Article 45 of the Tax Code, payment of the state duty can be made for the payer by another person - a representative. But at the same time, it must be clear from the payment document for whom the state duty was paid. For non-cash payments, it is necessary to indicate in the payment order both the applicant and his representative:

- Payer's TIN (box 60) - TIN of the individual for whom the payment is made.

- Payer (box 8): Full name representative who actually pays the state fee.

- The purpose of payment (cell 24) for the state fee when applying to the court is filled out according to the following model: “TIN of the representative // Full name. and the registration address of the applicant for whom the fee is paid, the number and date of the notarized power of attorney.”

Petition for deferment of payment of state duty, example, sample, + how to write

A petition to defer or installment payment of the state fee, as well as to reduce the amount of the state fee is submitted to the court by the interested party, and it must be submitted in writing. This petition can be stated either in a statement of claim, appeal or cassation complaint, or in a separate statement, which is attached to the corresponding statement or complaint. If the petition is filed before going to court with a statement of claim or complaint, then the court returns it without consideration (Article 333.22 of the Tax Code of the Russian Federation, Article 65 of the Arbitration Procedure Code of the Russian Federation).

The petition for a deferment or installment payment of the state duty, as well as a reduction in its amount, must indicate the justifications and attachments of documents that indicate that the property status of the interested party does not allow it to pay the state duty in the established amount when filing a statement of claim, or an appeal or cassation complaint (clause 4 of the Resolution of the Plenum of the Supreme Arbitration Court of the Russian Federation dated March 20, 1997 N 6 “On some issues of application by arbitration courts of the legislation of the Russian Federation on state duties”):

Refund of state duty

Accounting for state duty will not be complete without considering the situation regarding the return of state duty. As a result of the trial, the buyer was obliged to return the goods supplied, as well as reimburse our company for the costs of paying state duty. The return of funds is reflected in the document “Receipt to the current account” with the transaction type “Other receipt”.

The return of funds from the buyer is reflected by posting Dt 51-Kt 76. Next, using an accounting statement through the document “Operation”, we register the accrual of other income in terms of refund of state duty: Dt 76 - Kt 91.01.

Carrying out the state duty correctly and assigning it to the appropriate cost items when using the 1C program is an easy task. The use of electronic scanned copies of primary documents attached to electronic ones allows you to significantly save time on searching for documents and implementing internal control.

If you have any questions about working with OKOF, leave a request for consultation on 1C:Enterprise issues on our website or contact our 1C program support specialists.

What is the state duty paid for?

According to Article 333.16, State duty is a fee collected from persons when applying to state bodies, local government bodies, other bodies and (or) officials who are authorized in accordance with the legislative acts of the Russian Federation, legislative acts of the constituent entities of the Russian Federation and regulatory legal acts of local government bodies, for the performance of legally significant actions in relation to these persons, with the exception of actions performed by consular offices of the Russian Federation.

In other words, payment of the state duty is made in:

- government agencies;

- local government bodies;

- other organs

- performing legally significant actions in relation to state duty payers.

Article 333.18 of the Tax Code of the Russian Federation provides an explanation of the reasons that are mandatory for paying the state duty:

- when contacting judicial authorities to submit a request, petition, application, statement of claim, administrative claim, complaint;

- when applying for notarial acts;

- when applying for the issuance of documents (their duplicates);

- when applying for an apostille.

State duty payer status 01 or 08

The payment for the state duty is drawn up according to the general principle of filling out, but it is very important to fill out line 104 correctly, that is, reflect the BCC code of the organization to which the funds are sent. It is indicated depending on the action for which the amount of state duty was charged. When filing a lawsuit, payment of the state fee is sent to the details of the court hearing the case.

This cell is filled in to identify the person making the non-cash payment. In connection with the bill of the Ministry of Finance of the Russian Federation “On Amendments...”, starting from the beginning of 2021, many accountants are wondering if the state duty is paid, should the payer status be 01 or 08 in field 101? This will be discussed in our editorial office.

Basis of payment when paying state duty

Only if the court obliges. And so... These are their problems. In any case, paying in advance is not logical. wait for the court hearing. Only the courts need to fulfill the requirements; all the other “notes,” although annoying, in 90% of our utility workers’ “wish lists” actually have nothing behind them. It is very rare that something real is under threat.

Yes, but if the HOA refuses the claim, then the property will be returned to him. As for the costs of a lawyer, it’s not clear - she’s not on the staff of the HOA, or what? If she is on staff, then she receives a salary for her work, no extras. there can be no expenses. Not supporting the claim and withdrawing the claim, abandoning the claim are different procedural requirements, with different consequences.

conclusions

Therefore, we believe that it is necessary to declare to the court, when receiving a ruling on the provision of the “original” payment order, that this is impractical and is not a case where the original document is necessary to resolve the case.

Is it true that it is enough for a court employee to check in the GIS GMP that the applicant has actually paid the fee? In order to administer justice, is it really necessary for court workers to send accountants and representatives to the bank, forcing them to spend time and money on receiving the original payment, while the modern development of banking and society as a whole allows this to be done promptly in electronic form?