An enterprise necessarily owns certain property of various types. It is necessary not only to ensure the activities of the company, but also to manage it, as well as for other purposes. A certain part of the property consists of fixed assets, they are subject to mandatory accounting.

- What are fixed assets?

- What are the principles of their accounting and reflection in financial documentation?

- Where do they come from and where do they go?

- How does their value and, accordingly, accounting change?

More details about everything.

What applies to fixed assets

Fixed assets include an asset, that is, the property of an organization, for which four conditions are met:

- The object is intended for use in production, performing work or providing services; for management needs, or for rental.

- The item is intended to be used for a period exceeding 12 months (or the normal operating cycle if it exceeds 12 months).

- Subsequent resale of the property is not expected.

- The facility is capable of bringing economic benefits in the future.

Examples of fixed assets: buildings and structures, working and power machines, equipment, computers, vehicles, tools, household equipment, breeding livestock, perennial plantings, etc.

In addition, fixed assets include land, water, subsoil and other natural resources, as well as capital investments in leased property and for radical land improvement.

Maintain tax and accounting records of fixed assets according to the new rules

Results

Fixed assets are an important component of the property of any enterprise.

Correct qualification of objects that are classified as fixed assets is the key not only to correct accounting of such assets, but also to the ability to manage the costs of the enterprise and avoid undesirable tax consequences. You can find more complete information on the topic in ConsultantPlus. Free trial access to the system for 2 days.

What is an inventory object

This is the unit of accounting for fixed assets. An inventory object can be a separate item (for example, a cabinet), or a complex of structurally articulated items that constitute a single whole. Such a complex consists of several objects with common fixtures and accessories, mounted on the same foundation. They may have the same or different purposes. The main thing is that each item can perform its functions only as part of the complex, and not independently.

The accountant assigns each inventory item its own inventory number and creates a separate card. There is a unified form - Form OS-6 (approved by Decree of the State Statistics Committee of Russia dated January 21, 2003 No. 7). In 2012 and earlier, the use of this form was mandatory. Starting from 2013, organizations have the right to develop and approve their own form of inventory card for accounting for fixed assets.

In practice, many questions arise regarding how to correctly take into account the various components of a computer: processor, monitor, printer, mouse, etc. Officials believe that all of the listed devices belong to one object (see, for example, letter of the Ministry of Finance of Russia dated November 6, 2009 No. 03-03-06/4/950). But some experts hold a different point of view and believe that since the computer parts are not mounted on a single foundation, they can be counted as separate objects. This approach seems to us to be the most correct. (Also see “Accounting for complex objects: depreciate or write off at a time?”).

How to determine the initial cost of an object

To accept an asset for accounting, an accountant must determine its initial cost. This is the amount of costs for the acquisition, construction and production of a fixed asset. The initial cost includes, in particular:

- amount transferred to the supplier;

- payment for delivery and for bringing into a condition suitable for use;

- payment for work under construction contracts;

- the cost of consulting and information services related to the purchase of OS;

- remuneration of the intermediary through whom the fixed asset was acquired;

- customs duties and fees paid upon import of fixed assets;

- state duty transferred in connection with the purchase of the object;

- other costs directly related to the object.

Please note: the original price does not include VAT. For example, a fixed asset cost the company 120,000 rubles, including VAT 20% - 20,000 rubles. Only 100,000 rubles should be included in the initial cost, and the VAT amount should be taken into account separately.

General business expenses (salaries of administration, accountants, office rent, etc.), as a rule, are not included in the initial cost. The exception is the situation when such costs are not associated with the entire organization, but only with this fixed asset (for example, a bonus awarded to an engineer for setting up new equipment).

In general, the initial cost is fixed once and is not revised in the future. But there are exceptions to this rule. Thus, a change is possible in the case of completion, additional equipment, reconstruction, modernization, partial liquidation and revaluation.

Related Concepts

Let's analyze the key terms directly related to fixed assets.

Depending on what actions entrepreneurs perform with their fixed assets, several important concepts can be distinguished.

- Audit. The term used to account for fixed assets is "inventory object" is a single asset, part of fixed assets, considered as a separate independent value. These can be:

- a separate object with its own attributes;

- a structure designed to perform one or another separate function;

- a complex of objects that makes up a single whole, intended for a specific activity.

- Multiplication . The enterprise, in an effort to expand its activities, pays attention to the acquisition of fixed assets, their creation, modernization, improvement, etc. Costs allocated for such needs are called capital investments .

- Depreciation . Over time, any thing loses some of its useful properties, which means it loses in value. Regularly subtracting this loss, that is, taking into account depreciation, is called ascertaining the residual value . After depreciation is deducted, what remains is net fixed assets .

- Increased efficiency. If inventory items are subject to restoration and correction, they are repaired:

- current - worn parts are replaced, for which such replacement was initially provided;

- medium – the object is disassembled and restored to the extent possible;

- capital – complete replacement of all worn-out elements or their restoration.

How to accept an OS object for accounting

All expenses for the acquisition, construction and production of fixed assets are recorded as a debit to account 08 “Investments in non-current assets”. As a result, a value equal to the initial cost is formed here. At the moment when the object is accepted for accounting as fixed assets, the accountant writes off this value as a debit to account 01 “Fixed Assets”.

There are no clear rules regarding exactly when an object should be transferred to fixed assets. Therefore, companies have the right to independently establish this point and record it in their accounting policies. Most often, a fixed asset is placed on the balance sheet on the date of commissioning, or on the date when the object is ready for operation (for example, after successful testing).

Get a free sample accounting policy and do accounting in a web service for small LLCs and individual entrepreneurs

Assets whose value does not exceed 40,000 rubles can be reflected as part of inventories. This means that the company has the right to record such objects on account 10 “Materials”, and immediately write off the cost as current expenses. Similar rules apply in tax accounting, but there is a minimum value that allows the property to be classified as fixed assets higher, namely 100,000 rubles.

Special rules are established for real estate objects, the rights to which are subject to state registration. If the building has already been built and capital investments in it have been completed, the object must be recognized as a fixed asset, regardless of the fact of state registration. In a situation where the building has not yet been registered, it should be reflected in a special subaccount to account 01.

When accepting a fixed asset for accounting, the accountant draws up a report. You can use a unified form according to the OS-1 form (for buildings and structures - according to the OS-1a form, for groups of objects - according to the OS-1b form), or you can develop your own form.

Useful life

One of the important characteristics of a fixed asset is its useful life. This is the period during which the object generates income for the organization. The organization determines it independently.

There is a classification of fixed assets, approved by Decree of the Government of the Russian Federation dated January 1, 2002 No. 1. In it, all fixed assets are divided into groups, and for each group a lower and upper limit on the useful life is specified. For example, computer equipment is classified in the second group with a useful life of two to three years inclusive.

For accounting purposes, the use of this classification is voluntary, and for tax accounting purposes it is mandatory. Therefore, in order to bring the two types of accounting as close as possible, most companies, when assigning a useful life in accounting, are also guided by the classification.

For complex objects consisting of several parts, the useful lives for each component may differ significantly. In this case, each part must be taken into account as an independent fixed asset.

What has changed in 2021

The government has introduced the following changes from 2021:

- Starting from January 1, 2021, some changes were made to the Tax Code of the Russian Federation, Art. 259.3, clause 1 - expanded the list of equipment operated under the best available technologies. This equipment is depreciated with an increasing factor of two.

- A new list of equipment for accelerated depreciation was approved in accordance with Government Decree No. 622-r 04/07/2018.

Attention! Now 583 items of equipment fall under accelerated depreciation, i.e. There are now 2 times more positions than before (there were 246).

Depreciation

After a fixed asset is accepted for accounting, the accountant must depreciate it, that is, regularly write off part of the cost of the object as current expenses. An exception is provided only for land plots and environmental management facilities. Such fixed assets are not subject to depreciation, because their consumer properties do not change over time.

According to accounting rules, there are four methods of depreciation: linear; reducing balance method; the method of writing off the cost by the sum of the numbers of years of the useful life and the method of writing off the cost in proportion to the volume of products (works).

This or that method is established not for an individual fixed asset, but for a group of homogeneous objects, for example, vehicles, buildings, etc. The selected method must be applied throughout the useful life of the object; the method cannot be changed.

By the way, different rules apply in tax accounting. There are only two methods available: linear and nonlinear. One method or another is established not for a group, but for all objects belonging to the organization, and the chosen depreciation method can be changed.

To avoid discrepancies, many companies, whenever possible, use the straight-line method in both accounting and tax accounting. To use it, it is necessary to calculate the annual depreciation rate. It is equal to 100% divided by the number of years of useful use. So, if the useful life is five years, then the annual rate will be 20% (100%: 5 years). Then the initial cost of the object must be multiplied by the norm, and the annual amount of depreciation charges will be obtained.

Regardless of which depreciation method the company uses, the accountant must make a monthly entry for an amount equal to the amount of annual depreciation charges divided by 12. The debit of the entry is the “cost” account, and the credit is account 02 “Depreciation of fixed assets.”

Let us add that depreciation should begin on the 1st day of the month following the month when the object was accepted for accounting and reflected on account 01. Depreciation should be stopped upon disposal of the fixed asset, or after its cost has been fully repaid. Depreciation cannot be suspended, except in cases of conservation for a period of more than three months and repair, modernization or reconstruction of an object for a period of more than 12 months.

The difference between the original cost and accrued depreciation is called the residual value of the object. It is necessary to indicate the residual value in the balance sheet, and provide information about the initial cost and depreciation in the explanations.

The balance sheet for 2021 must be submitted online Submit for free

Depreciation and revaluation of fixed assets in accounting

The company depreciates the OS over the course of its operation, i.e., gradually transfers its value to account 02.

NOTE! Depreciation in accounting for the operating system used should not be interrupted. An exception exists only for OS preserved for more than 3 months, as well as for OS, the restoration of which should last longer than 12 months (clauses 17, 23 of PBU 6/01).

However, accounting specialists should remember that some categories of fixed assets do not need to be depreciated. These include, for example, land plots.

For information on how to calculate depreciation and display it in accounting, read the material “Methods of calculating depreciation in accounting.”

The company also has the right to revaluate its fixed assets, that is, recalculate both the cost of fixed assets and the amounts of previously accrued depreciation. This follows from clause 15 of PBU 6/01. Such revaluation must be carried out at the end of each year. In this case, the results of revaluation (the value of revaluation or discount) can both influence the financial results of the company and increase/decrease the company’s additional capital.

How to formalize the revaluation of OS in practice, read in the Typical situation from ConsultantPlus. If you do not have access to the K+ system, get a trial online access for free.

For more information about the revaluation of fixed assets, see the article “Why is the revaluation of fixed assets necessary?” .

Revaluation of fixed assets

Conducting a revaluation is a right, not an obligation of the organization. In other words, the company may refuse revaluation. If the corresponding decision is made, then the operating system will have to be revalued annually as of December 31. Revaluation is carried out in relation to all fixed assets included in the group of homogeneous objects.

As a result of revaluation, the value of an object can either be reduced (depreciation) or increased (revaluation). The changed cost is called replacement cost.

The accountant reflects the results of the markdown on account 91 “Other income and expenses.”

The postings will be as follows:

DEBIT 91 CREDIT 01 - reflects the amount of depreciation of the object DEBIT 02 CREDIT 91 - reflects the amount of depreciation adjustment made based on the results of the depreciation.

If in subsequent periods the same object is again revalued by the same amount, then the amount of the revaluation must be shown on the credit of account 91.

The accountant credits the results of the revaluation to additional capital and reflects it on the credit of account 83.

The postings will be as follows:

DEBIT 01 CREDIT 83 - reflects the amount of revaluation of the object DEBIT 83 CREDIT 02 - reflects the amount of depreciation adjustment as a result of revaluation.

If in subsequent periods the same object is marked down, then the amount of the markdown must be attributed to the reduction of additional capital and reflected in the debit of account 83. The markdown, which in magnitude exceeds the initial revaluation, must be partially written off as a decrease in additional capital, and the remaining amount must be reflected in the debit of the account 91.

For fixed assets that are revalued annually, the amount of depreciation is calculated based on replacement cost, not original cost.

How to calculate the value of line 1150 “Fixed assets” (balance sheet formula)

When filling out line 1150, the value of the indicator can be calculated using the formula below based on the Balance Sheet database:

Important! The cost of fixed assets must be reduced only by depreciation related to fixed assets (which are recorded on account 01). Often, missing this point leads to errors in calculations. As mentioned earlier, line 1150 does not take into account fixed assets that are intended for rental and are subject to accounting under account 1160 “Income-generating investments in tangible assets.” But depreciation on such fixed assets is also accrued on account 02. Therefore, it is important to remember that depreciation related to fixed assets of account 03 is not taken into account when calculating the value on line 1150, because such fixed assets are not included in this line.

How to take into account the costs of maintaining and repairing fixed assets

Amounts spent by the company on current or major repairs of fixed assets are written off as expenses and recorded in the debit of “cost” accounts. The same applies to the costs of technical inspection, maintenance, etc.

During modernization and reconstruction, another accounting option is possible. If, as a result of these measures, the initially accepted indicators improve (useful life, power, quality of application, etc.), then the costs are not written off as current expenses, but increase the initial cost of the object. In other words, the accountant must reflect the costs of modernization or reconstruction on account 08, and upon completion of the work, write off on account 01. The amount of monthly depreciation must be recalculated based on the increased initial cost and extended useful life.

Modernization and reconstruction must be recorded on the card. The company has the right to use a unified form in form OS-6, or develop its own form. If the characteristics and purpose of a fixed asset have changed significantly, it is permissible to create a new card and store the old one as a source of information.

What is reflected in line 1150 “Fixed assets”

It is obvious that the line of the Balance Sheet, which is called “Fixed Assets,” should reflect the fixed assets of the enterprise as of the reporting date. However, not everything is so simple - accountants should be aware of three nuances associated with filling out line 1150:

- The mentioned line does not account for all fixed assets of the company without exception. Only those objects that are reflected in account 01 “Fixed Assets” are taken into account. The situation is relevant when registering objects whose sole purpose is to hand them over for temporary use (possession) by the owner of the enterprise for a certain fee to third parties. Such operating systems will be reflected on line 1160, and not on line 1150.

- Like other indicators, fixed assets should be displayed on the balance sheet in a net valuation (i.e., at residual value).

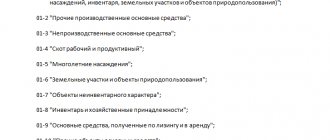

- It is also possible to display in line 1150 information about the debit balance of account 08 for subaccounts 01-04 in terms of fixed assets, as well as the debit balance of account 07. The accounting department of an enterprise has the right to independently make such a decision on the inclusion of this information; the law does not prohibit this. However, if the data values are insignificant, it is recommended to reflect them on line 1190.

Write-off of fixed assets

An object should be written off if it ceases to generate profit, or in the event of its disposal (for example, sale). The company must create a special commission, which must include a chief accountant. The commission inspects the object and signs a decommissioning act. You can use a unified form according to the OS-4 form (for transport - according to the OS-4a form, for groups of objects - according to the OS-4b form), or develop your own form. A note about disposal is made on the inventory card, after which the organization stores the card for at least five years.

When writing off, the accountant needs to open a special sub-account for account 01 (usually called 01-B) and use it in the corresponding transactions.

The residual value and costs associated with disposal are shown in the debit of account 91, proceeds from sales are shown in the credit of account 91. Income and expenses from write-off are reflected in the reporting period to which they relate.

In case of write-off of a fixed asset that has ceased to generate profit, the postings will be as follows:

DEBIT 01-B CREDIT 01 - the original cost of the object is written off DEBIT 02 CREDIT 01-B - depreciation is written off DEBIT 91 CREDIT 01-B - the residual value of the object is written off DEBIT 91 CREDIT 60 - the cost of services of a third-party organization to liquidate the object is written off.

In case of sale of a fixed asset, the postings will be as follows:

DEBIT 01-B CREDIT 01 - the original cost of the object is written off DEBIT 02 CREDIT 01-B - depreciation is written off DEBIT 91 CREDIT 01-B - the residual value of the object is written off DEBIT 62 CREDIT 91 - proceeds from the sale of the object are received DEBIT 91 CREDIT 68 - VAT on the sale is taken into account object.