Payers of the simplified system must select one of the taxation objects: “Income” or “Income minus expenses.” This choice determines the tax rate and the base from which the tax is calculated. The minimum tax under the simplified tax system is collected only on the object “Income minus expenses”. What is this tax, how is it calculated and in what cases is it paid?

Free tax consultation

Short Game

By the end of the tax period, all business entities that legally apply the simplified tax system with the object “income minus expenses” (hereinafter referred to as the simplified tax system D-R) are required to calculate the amount of the least tax. At the same time, according to Art. 346.19 of the Tax Code of the Russian Federation, the tax period is taken to be a calendar year.

Please note right away: the minimum tax is calculated only by simplifiers with the object “income minus expenses”. If a company or individual entrepreneur pays this tax only on income, then there is simply no need to determine the tax minimum for objective reasons. No matter what, but there is always income.

If a company or merchant using the simplified tax system with the object “income” calculates a suspiciously small amount of tax to be paid to the budget, this fact will certainly be of interest to tax authorities. For them, this is immediately a “beacon” that part of the profit is hidden from the state.

Comments

Tatyana 09.17.2015 at 12:23 # Reply

expenses

Is it possible to include in expenses equipment purchased before registering an individual entrepreneur?

Tatyana 09/17/2015 at 12:28 # Reply

expenses

Is it possible to include in expenses equipment purchased before registering an individual entrepreneur?

Natalia 09/18/2015 at 01:46 pm # Reply

Tatyana, there are two completely opposite opinions on this matter. 1.The expenses of an individual entrepreneur before registration are not related to entrepreneurial activity; the property was acquired for personal purposes. Therefore, expenses do not meet the criteria of clause 1 of Article 252 of the Tax Code, therefore they cannot be included in expenses. 2. Representatives of the financial department in this situation (letter dated 06/06/2013 No. 03-11-11/164) draw the following conclusion: the legislation does not connect the entrepreneurial activity of an individual solely with the fact of registration as an individual entrepreneur (Clause 2 of Article 11 of the Tax Code ). There is also positive judicial practice in favor of the possibility of recognizing expenses on fixed assets, for example, the resolution of the Federal Antimonopoly Service of the North-West District dated March 18, 2008. in case No. A56-20123/2007, Resolution of the Federal Antimonopoly Service dated February 25, 2010. No. Ф09-801/10-С2; FAS ZSO dated January 25, 2010 in case No. A45-13717/2009; Federal Antimonopoly Service of the Northern Territory of March 18, 2008 in case No. A56-20123/2007. The courts emphasize that the condition for recognizing expenses is the USE of property for business activities, and not necessarily the acquisition during the period of its conduct. Therefore, you must document the fact of using the equipment purchased before registering an individual entrepreneur in business activities.

Ekaterina 03/29/2017 at 00:18 # Reply

payment of simplified tax system

Good afternoon Please tell me, if an individual entrepreneur had to pay a minimum tax in 2014, but this same tax will only be paid in 2021: what BCC should I pay according to? Which was before 01/01/17 or which is valid from 2021? Thank you

Natalia 03/29/2017 at 05:42 pm # Reply

Ekaterina, good afternoon. KBK minimum tax under the simplified tax system, credited to the budgets of constituent entities of the Russian Federation for tax periods expired before January 1, 2021 - 182 1 05 01050 01 1000 110.

Reaching the minimum tax

The tax rate according to the minimum tax scheme is applied in cases where its amount turns out to be greater than the tax calculated according to the general “simplified” rules. In other words, when, based on the results of the past year, one can state almost a loss. Therefore, the size of the gap between income and expenses will ultimately determine what exactly to pay to the treasury:

- Regular tax on the simplified tax system.

- Get off with the least tax (although in any case it will be higher than the first option).

According to the position of the Tax Service, in the case of combining several tax regimes, one of which is the simplified tax system D-R, the state levies a minimum tax on profits that are received only from the simplified tax regime.

It is possible that the minimum tax will have to be calculated and paid at the end of the reporting period. This happens when an individual entrepreneur or a company loses the right to this special regime during it. This means that the minimum tax (if the indicators are based on it) is transferred based on the results of the corresponding quarter in which the right to the simplified tax system D-R was lost. In this situation, there is no need to wait until the end of the calendar year.

Keep in mind: it will be considered a violation of the law to presumptuously pay the minimum tax during the year. You cannot rely on pre-calculated losses or “zero” losses for the quarter.

What expenses are taken into account under the simplified tax system “Income minus expenses”

During the period of economic activity, the company may request the application of this tax regime. But for this it is not enough to have a high cost share. The head of a company or entrepreneur must know exactly which expense items are taken into account and how to process them correctly.

The full list is given in Article 346.16 of the Tax Code of the Russian Federation. It is closed, that is, it excludes the possibility of introducing any types of costs other than those that have already been taken into account. The list is quite impressive, so for informational purposes we present the main provisions:

- Fixed assets (purchase of equipment, infrastructure development).

- Expenses for the creation of intangible assets.

- Payments under rental and leasing agreements.

- Material costs.

- Payroll and insurance.

- Payment for communication services.

- Taxes and fees, with the exception of the single tax on the simplified tax system.

- Purchasing goods for the purpose of subsequent resale.

There are also some nuances with permitted expenses. They will be recognized only if the appropriate payments have been made, there are economic justifications and supporting documentation. Note that some costs, for example, the purchase of goods for subsequent sale, are subject to special tax accounting.

Often, controversial situations between tax officials and company management arise due to the economic justification of certain costs. An example is the cost of employee services, in particular, the purchase of drinking water for coolers, which the company indicates in its reporting. But if the water in the tap is recognized as potable and does not require additional purification, the regulatory authority will not take them into account.

Individual entrepreneurs often have difficulty justifying business trips. According to the Federal Tax Service, travel expenses are taken into account only for hired workers.

The tax office often makes claims regarding the correctness of documentation confirming expenses.

In practice, such conflicts lead to the fact that the amount of tax deductions indicated by the taxpayer may be lower than the amount recognized by the inspectorate. And since the reporting algorithm involves identifying discrepancies after verification, the regulatory authority has the right to impose a fine for incorrect data.

Tax offset

Let's consider the situation: a business entity made advance payments to the treasury under the simplified taxation system. In the case of the simplified tax system D-R, the question arises: can these payments be taken into account in the amount of the minimum tax? The answer is yes.

The tax return form under the simplified tax system has the following offset procedure. That is, the payer transfers advance payments to the amount of the minimum tax within the framework of this document. There is no need to submit a separate application.

In case of underdistribution of advance payments, they can be counted in the future as advance payments under the simplified tax system. Duration: over the next three years.

Advance payments

Every person who pays the minimum tax under the simplified tax system according to the designated regime will regularly encounter them. Every quarter the entrepreneur must make a so-called “prepayment”. That is, every three months he transfers an advance payment to the budget. The amount required to be paid is calculated on an accrual basis from the very beginning of the year. And it must be transferred before 25 days have passed since the end of the quarter.

At the end of the year, the remaining tax is calculated and paid. At the same time, a tax return is submitted. Individual entrepreneurs must do this by April 30. For LLCs, the maximum period is March 31.

Accounting for expenses

Tax legislation provides for a procedure for accounting for the difference between the simplified and minimum tax for the previous year (clauses 6 and 7 of Article 346.18 of the Tax Code of the Russian Federation):

- It is included in expenditure indicators.

- It can also increase your losses.

Keep in mind: the difference can only be taken into account based on the results of the reporting period (year).

In simple terms, it is possible to include in expenses for 2021 the difference between the simplified and minimum tax, which was calculated and paid at the end of last 2018.

In any subsequent taxation period (up to 10 years), the accountant has the opportunity to include the specified difference in expenses or increase existing losses by it. The Ministry of Finance clarifies: you can immediately include in expenses the difference between the calculated and paid amount of the minimum tax and the tax that was accrued in accordance with the general procedure for taxation on the simplified tax system for several previous periods.

Results

Using the simplified tax system “income minus expenses”, at the end of the year, check what tax you will need to pay - calculated in the usual manner or the minimum.

If a minimum tax is payable, when paying, do not forget to deduct the calculated advance payments under the simplified tax system from the calculated amount. The difference between the minimum tax and the tax according to the simplified tax system, calculated in the usual manner, can be included in expenses (or the amount of loss can be increased by its amount) in subsequent tax periods. You can find more complete information on the topic in ConsultantPlus. Free trial access to the system for 2 days.

Transition to simplified tax system

To work on the simplified tax system, a person must submit a corresponding notification to the tax office. In the case of registering a new business, the application is submitted after tax registration, but no later than 30 days after the date of registration. If for some reason you missed the specified deadline, then the general tax system is automatically assigned.

The transition to simplifying an existing business is possible only from the next reporting year. To do this, you also need to fill out and submit a notification about the transition to the simplified tax system before the end of the fourth quarter of the current year.

Deadline for payment of simplified tax system 15%

Taxpayers are required to make advance payments no later than the 25th day of the month following the first quarter, half year and nine months (clause 7 of Article 346.21 of the Tax Code of the Russian Federation). Advance payment transfer dates:

- for the first quarter - no later than April 25;

- for half a year - no later than July 25;

- for nine months - no later than October 25.

The simplified tax system of 15% at the end of the year must be paid to the budget: individual entrepreneurs - no later than April 30 of the next year, LLC - no later than March 31 of the next year.

Automatically generate a tax payment invoice based on the data from the declaration and submit reports via the Internet

If the date of transfer of tax or advance payment falls on a weekend or holiday, then the money can be transferred on the next working day (Clause 7, Article 6.1 of the Tax Code of the Russian Federation).

When calculating the simplified tax system of 15% “income minus expenses,” organizations and entrepreneurs should not forget about the declaration. It is submitted to the Federal Tax Service: by entrepreneurs - no later than April 30 of the next year, by companies - no later than March 31 of the next year.

Right to special treatment in 2021

Most often, companies and individual entrepreneurs want to switch to a simplified taxation system in two cases:

- when they register for the first time and choose a tax regime;

- when they want to switch from OSNO.

This is only possible if the taxpayer meets the criteria established by Article 26.2 of the Tax Code of the Russian Federation.

Criteria for switching to the simplified tax system in 2021 for companies:

- the amount of income for 9 months of 2021 did not exceed 112.5 million rubles, and annual income did not exceed 150 million rubles;

- the number of employees under all employment contracts and GAP is no more than 100 people;

- the residual value of fixed assets for the year does not exceed 150 million rubles;

- the company has no branches (only representative offices are allowed);

- the share of participation of other companies in the authorized capital of a legal entity is no more than 25%.

For individual entrepreneurs, the list of necessary conditions for switching to a simplified system is slightly smaller:

- no more than 100 employees; the residual value of fixed assets does not exceed 150 million rubles;

- annual income does not exceed 150 million rubles.

This might also be useful:

- VAT accounting for individual entrepreneurs using the simplified tax system in 2021

- Individual entrepreneur reporting on the simplified tax system without employees

- simplified tax system for individual entrepreneurs in 2021

- Sample filling and declaration form under the simplified tax system for 2021 in 2020

- The procedure for filling out a zero declaration according to the simplified tax system for individual entrepreneurs

- What taxes does the individual entrepreneur pay?

Is the information useful? Tell your friends and colleagues

Dear readers! The materials on the TBis.ru website are devoted to typical ways to resolve tax and legal issues, but each case is unique.

If you want to find out how to solve your specific issue, please contact the online consultant form. It's fast and free!

Example of tax calculation in 2019

Individual entrepreneur N.P. Ivanov came out with the following performance indicators at the end of the reporting period:

- income – 1 million rubles;

- expenses – 950 thousand rubles.

Tax rate (USN D-R) – 15%.

The tax amount according to the general procedure: (1,000,000 – 950,000) × 15% = 7,500 rubles.

Minimum tax: 1,000,000 × 1% = 10,000 rubles.

It is clearly seen that the minimum tax (10,000 rubles) is more than the amount that had to be paid to the budget according to the general rules for calculating tax on the simplified tax system (7,500 rubles). It follows from this that the treasury should receive a minimum tax amount of 10,000 rubles.

Read also

24.03.2019

The role of the tax burden in assessing the taxpayer

The definition of the tax burden in relation to working with taxpayers was introduced by the Federal Tax Service of the Russian Federation and is contained in its two main documents:

- Order of the Federal Tax Service of the Russian Federation dated May 30, 2007 No. MM-3-06/ [email protected] , dedicated to the total tax burden, calculated as the share of all taxes due in the accounting (excluding VAT) amount of sales proceeds.

- Letter of the Federal Tax Service of the Russian Federation dated July 17, 2013 No. AS-4-2/12722, which examines the tax burden in more detail (in terms of specific taxes and certain tax regimes with options for their calculation).

Note! Currently, the letter of the Federal Tax Service dated July 17, 2013 No. AS-4-2/12722 is not valid. It was canceled by Federal Tax Service letter No. ED-4-15 dated July 25, 2017/ [email protected] At the same time, the principle for calculating the tax burden given in it can still be used by controllers now. Therefore, we will still talk about it in detail further.

Both documents of the Federal Tax Service are devoted to the issues of verification and analysis of reports submitted by taxpayers in order to identify errors or intentional distortions in them, as a result of which candidates are selected for additional audit activities. At the same time, the results of processing the actual data of these reports are regularly entered into the first of them, making it possible to judge the average values of the level of tax burden and profitability indicators of industries.

Despite the obvious focus on the tax authorities, both of these documents contain information that is of definite value for the taxpayer, since it allows him to independently do the following when using this information:

- Assess the deviation of your business performance from national and industry averages.

- Calculate those reporting indicators that are important for the Federal Tax Service when assessing candidates for an on-site tax audit.

- Prepare convincing arguments to support the correctness of your position regarding the organization of accounting and tax calculation.

- Make forecast calculations of tax payments taking into account the prospects for the development of your activities.

- Compare options for available taxation systems in order to reduce the tax burden.

VAT tax burden formula

The algorithm for determining the tax burden for VAT, recommended by the Federal Tax Service, is essentially similar to the formula for calculating this indicator for income tax: this is the quotient, expressed as a percentage, of dividing the amount accrued for payment according to the tax declaration by the volume of the tax base for it, established according to the data of the same declaration . However, for VAT, the tax base can be calculated in two ways, and, accordingly, there will be two formulas for calculating the amount of the burden.

The first method, when the calculation is made in relation to the tax base for the domestic market:

NNnds = 100 × Nnds / NBrf,

Where:

NNnds – tax burden for VAT;

VND – VAT due for payment on line 040 of section 1 of the declaration;

NBRF – tax base, calculated according to the figures in section 3 of the declaration (market of the Russian Federation).

The second method, in which the tax base is determined as the sum of the tax bases for the domestic market and for sales outside the Russian Federation:

NNnds = 100 × Nnds / (NBrf + NBexp),

Where:

NNnds – tax burden for VAT;

VND – VAT due for payment on line 040 of section 1 of the declaration;

NBRF – tax base, calculated according to the figures in section 3 of the declaration (market of the Russian Federation);

NBexp is the tax base, calculated as the sum of all lines 020 of section 4 of the declaration (export).

The tax base for section 3 (market of the Russian Federation) of the VAT return, based on the content of its current form, approved by order of the Federal Tax Service of Russia dated October 29, 2014 No. ММВ-7-3 / [email protected] , must be determined as the result of adding lines 010–070 columns 3, i.e. as the sum of bases by:

- sale of goods (works, services) at all applicable rates;

- sale of the enterprise as a complex;

- construction and installation work;

- advances received.

The taxpayer, based on his own goals, may choose a different base for calculating a similar indicator for this tax. For example, sales revenue taken from accounting records with VAT included.

Declaration form according to the simplified tax system and the procedure for filling it out

For 2021, according to the simplified tax system, you need to report according to the form from the order of the Federal Tax Service of the Russian Federation dated February 26, 2016 No. ММВ-7-3 / [email protected] . It is the same for payers with different tax objects, but the set of sheets to fill out is different. Typically, payers of the simplified tax system with the object “income minus expenses” fill out:

- title page;

- section 1.2;

- section 2.2.

If the subject is a recipient of targeted funds, then section 3 must also be completed.

Title page

Let's look at filling out the title line by line.

TIN . For an organization this is a 10-digit number, for an individual entrepreneur it is 12-digit, since individual entrepreneurs are individuals.

Checkpoint . Filled out by organizations; individual entrepreneurs do not have this code.

Page number. It must be specified in the format “001”, “002” and so on.

Correction number. When submitting the report for the first time, “0—” is entered. If an updated declaration is submitted, its serial number is indicated - “1—”, “2—” and so on.

Taxable period. The tax period code “34” is indicated, since the declaration is submitted for the year. Codes for reorganized companies and entities that cease operations or switch to another tax regime are given in Appendix No. 1 to the order approving the form.

Reporting year — 2021.

Tax authority code . Consists of two values:

- the first 2 digits are the region code;

- the last ones are the Federal Tax Service number.

Code at location (accounting) . Taken from Appendix No. 2 to the Order. There are three codes in total:

- 120 - for individual entrepreneurs;

- 210 - for the organization;

- 215 - for a successor who is not the largest taxpayer.

Title page (beginning)

Taxpayer . You must enter the full name of the organization as it is indicated in the constituent documents. If the declaration is submitted by an individual entrepreneur, his last name is indicated in the first line, his first name in the second, and his patronymic, if any, in the third.

Code of the type of economic activity according to the OKVED classifier. Can be found in the extract from the registry.

Information about reorganization and liquidation . The line is intended for reorganized companies; everyone else puts dashes in it. The codes are given in Appendix No. 3 to the Order.

Table 1. Codes for reorganized companies

| Code | Reorganization form |

| 1 | Conversion |

| 2 | Merger |

| 3 | Separation |

| 5 | Accession |

| 6 | Division with simultaneous accession |

| 0 | Liquidation |

Phone number. It is recommended to remember, because if you have questions about the declaration, the inspector may call.

Title page (continued)

The lower part of the title page of the declaration is intended for signature by the individual entrepreneur or company representative and confirmation of the accuracy of the information. Here you need to indicate:

- code “1” - if the declaration is submitted in person;

- code “2” - when submitted through a representative.

The following lines reflect the full name of the head of the company , and below is his personal signature and date. If the declaration is submitted by an individual entrepreneur, only a signature and date are added.

If the report is signed by a representative , then his full name is indicated. When the representative is a company, the full name of its employee authorized to file the declaration is indicated.

If the declaration is submitted through a representative, a document confirming his authority . A copy of it should also be attached to the report.

Title page (end)

Completing Section 1.2

This section collects summary information about income, advance payments and the amount of tax payable.

The top lines duplicate the INN and KPP, and also indicate the page number.

Lines 010, 030, 060 and 090 are for the OKTMO . It is necessary to indicate it in line 010; in the remaining lines it is necessary to indicate it only if it has changed. 11 categories are allocated for OKTMO. If the code is eight digits, the last three must have dashes.

In lines 020, 040, 070 tax advances are entered .

Lines 050, 080 reflect advance payments to be reduced.

Section 1.2

Next comes the final block of lines 100-120 . The calculation of indicators is made in Section 2.2 of the declaration. The value is indicated in one of the lines:

- Line 100 reflects the amount of tax to be paid additionally at the end of the year. This is the difference between the calculated tax amount and advance payments.

- Line 110 is intended to reflect the amount of tax to be reduced. This is the positive difference between the amount of advances paid and the calculated amount of the minimum tax.

- Line 120 reflects the amount of the surcharge if the taxpayer must pay tax under the simplified tax system “income minus expenses” in the minimum amount. This is the positive difference between the amount of the calculated minimum tax and advance payments.

Section 1.2 (continued)

Completing Section 2.2

In this section, the taxpayer reflects income and expenses for the year. They are indicated on an accrual basis for the quarter, half year, 9 months and year:

- lines 210-230 are intended to reflect income;

- lines 220-223 - to reflect expenses.

Section 2.2

Line 230 indicates the amount of loss from previous years, which reduces the tax base under the simplified tax system.

The following block of lines indicates the positive difference between income and expenses in each period:

- in line 240 - for the first quarter;

- in line 241 - by half year;

- in line 242 - based on the results of 9 months.

Line 243 reflects the tax base, which is calculated in the following way: income for the year (line 213) - expenses for the year (line 223) - the amount of losses from previous periods (line 230).

Section 2.2 (continued)

If, when calculating the values indicated on lines 240-242, amounts with a “-” sign are obtained, they are reflected accordingly in lines 250-252 (lines 240-242 are not filled in). Line 253 indicates the negative difference between income and expenses for the year (line 223 - line 213).

The next block is intended to reflect tax rates under the simplified tax system with the object “income minus expenses” . The standard rate is 15% , but regions are legally entitled to reduce it. The rate can be:

- 5-15% for all or certain categories of taxpayers.

- 0% for newly registered individual entrepreneurs from the sphere of production and consumer services, as well as from the social or scientific sphere. Tax holidays are established for 2 years.

The tax rate is reflected for each period separately in lines 260-263 .

The last block is intended to reflect the amounts of intra-annual advance payments and the tax calculated at the end of the year. Advance payments are calculated by multiplying the income for the relevant period by the tax rate. For example, for the first quarter the tax is calculated as follows: line 240 * line 260 / 100%. The corresponding rows are also multiplied for the remaining periods.

The amount of tax calculated for the year is indicated in line 273 .

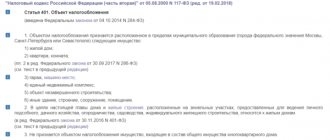

Line 280 reflects the amount of the minimum tax equal to 1% of the income received for the year . The indicators of lines 273 and 280 are compared, and the larger one is selected. This will be the amount of tax that the subject must pay for the reporting year. This is well illustrated in the following image:

Section 2.2 (end)

The company in the example closed two periods at a loss, due to which the total tax amount for the year is zero. Therefore, she must pay the minimum tax ( line 280 ). To calculate the surcharge, the amount of advance payments made within the year is subtracted from this amount. The final value is reflected in line 120 of section 1.2 .

Main criteria for OSNO

The main share of budget revenue comes from two taxes paid when applying OSNO: income tax and VAT. Therefore, the main part of the text of letter No. AS-4-2/ [email protected]

When considering income tax, the attention of the Federal Tax Service is drawn to:

- Losses reflected in the declaration.

- The tax burden on it is low: for legal entities in the production sector - less than 3%, for trading companies - less than 1%.

For VAT, two indicators are considered together:

- The percentage of deductions in the tax calculated from the tax base. It does not raise questions if it turns out to be below the average level for the constituent entity of the Russian Federation or the value of 89%. The calculation of this ratio does not include accruals and deductions of VAT of the tax agent, on advances and construction work.

- Low tax burden. Its quantitative indicators are not given in the said letter. In the absence of sales at a 0% rate, they can be considered low with the same figures as for income tax: less than 3% for production and less than 1% for trade. A high share of sales with a 0% rate will significantly change the picture of calculating the tax burden for this tax, but at the same time will serve to explain deviations from the average figures for the region or industry.

Based on the percentage ratio of the amount of these two taxes (if necessary, other taxes paid are added to them) and the amount of revenue shown in the profit and loss statement, the value of the total tax burden of the taxpayer using the OSNO system is judged.

Fines

If you do not submit a declaration according to the simplified tax system on time, a fine will follow based on Article 119 of the Tax Code. This is 5% of the tax amount for each full or partial month of delay . The fine cannot be less than 1,000 rubles, but at the same time cannot exceed 30% of the tax amount.

For non-payment of tax, a fine is provided under Article 122 of the Tax Code of the Russian Federation in the amount of 20 to 40% of its amount. In addition, late payment threatens to accrue penalties in the amount of 1/300 of the refinancing rate for each day of delay.

However, the most unpleasant consequence may be the blocking of the current account of the tax inspectorate in accordance with Article 76 of the Tax Code of the Russian Federation. Such a decision can be made if the declaration is not received within 10 days after the deadline .

What determines the size of the profit load

The tax burden for income tax is directly related to the value of the indicators that form the formula for its calculation:

- The calculated tax, the amount of which, in turn, directly depends on the applied rate. The usual rate is 20%, but in some cases it can be reduced (Article 284 of the Tax Code of the Russian Federation). The lower the tax, the lower the burden.

- Income from sales, determined according to tax accounting data and depending on the volume of ordinary activities of the taxpayer. Given the same tax amounts, the higher the income, the lower the tax burden will be.

- Non-operating income taken into account for tax purposes. For the same tax amount, the higher this income, the lower the tax burden.

In addition, the load is influenced by the following factors:

- The volume of sales expenses and non-operating expenses, the values of which directly affect the amount of the tax base from which the tax is calculated. The higher the expenses, the lower the tax.

- The presence of losses from previous years, which, if taken into account in the period under review, even in the presence of income (from sales and non-sales), can reduce the tax base and, accordingly, the tax itself to zero.

- The use of tax benefits, which, just like losses from previous years, can, despite the presence of income, significantly reduce the amount of tax.

If the load is determined from a different base (for example, from accounting income), its impact on the amount of the load will be the same as that of the indicators that make up the denominator of the calculation formula given in the letter from the Federal Tax Service.