S.A. Shilkin, head of the expert department of the magazine "Salary" Advance - salary for the first half of the month. But there is no such definition in the Labor Code. There is no procedure for calculating the advance; it is established by the company. In this case, the employer must take into account the requirements of the labor and tax inspectorates. Workers control the amount, and tax officials control the payment of personal income tax on salary payments. An error in the advance amount leads to dire consequences. If you pay too little, the labor inspectorate will punish you; if you pay too much, there is a risk that a tax inspector will file a claim for non-payment of personal income tax. We have found the ideal way to calculate an advance payment, which takes into account the requirements of both labor and tax legislation 100%.

What documents regulate the advance?

In no way, since the official term “advance” does not exist in labor legislation. This is a colloquial, established name for the first part of the salary, which must be paid at least twice a month (Article 136 of the Labor Code of the Russian Federation).

REFERENCE! The second part is traditionally called “pay” or “salary” itself, although in fact the salary is both payments together.

Question: Until recently, salaries in our organization were paid twice a month. Currently, they offered to write a statement refusing the advance payment and stated that the salary would be calculated once a month. Is this legal? View answer

Therefore, instead of the term “advance”, the legislation uses the expression “procedure for payment of wages”. And this procedure already has a strict documentary justification in the internal acts of the organization:

- collective agreement;

- internal rules of the company;

- individual employment contracts;

- Regulations on the enterprise.

Question: What type of income code should be indicated in the payment order when paying an advance (that is, from wage income for the first half of the month), if the employer withholds 70% of the salary from the salary once a month according to writs of execution, so that according to new writs the bank Didn't make the deduction yourself? View answer

Advance in proportion to time worked

Labor inspectors do not mind if you calculate the advance in proportion to the time worked (formula below). It is important for them that you take into account the requirement of the USSR Council of Ministers Resolution No. 566 dated May 23, 1957. The document establishes the rule: the amount of the advance for the first half of the month must not be lower than the worker’s tariff rate for the time worked. This position quotes:

- Ministry of Labor in letter dated 08/05/2013 No. 14-4-1702;

- The Supreme Court in its decision dated 06/06/2016 No. 29-AD16-10.

Formula. Advance based on time worked

Example 4

Calculation of the advance in proportion to the time worked Salary S.N. Erofeeva - 20,000 rubles. In February 2017 there are 18 working days. Erofeev worked the first half of the month from February 1 to February 15—11 working days. The company pays an advance on the 17th based on the salary in proportion to the time worked. How much advance payment will the employee receive? Solution The employee will receive an advance payment of 12,222.22 rubles on February 17. (RUB 20,000: 18 work days × 11 work days).

Personal income tax when calculating the advance in proportion to the time worked

The method of calculating the advance in example 4 above is fully consistent with the official recommendations of the Trudoviks. However, from the point of view of accountants and tax specialists, it is not good enough. Firstly, by the time the advance is calculated, the accountant must have complete information about the time worked in the first half of the month by each employee. But most employers do not want to close out timesheets twice a month. Secondly, difficulties may arise with calculating personal income tax. For example, an employee will go on sick leave on the 16th and will remain ill until the end of the month. At the end of the month there is no amount to be issued. It turns out that the advance is a month’s salary. But there is nothing to withhold personal income tax from. Let's look at this situation with an example.

Example 5

In the second half of the month, the employee was sick. Let's use the conditions of example 4 above. February 17 S.N. Erofeev received an advance for February in proportion to the time worked in the amount of 12,222.22 rubles. From February 16 to March 15, 2021, the employee was on sick leave. Erofeev has no right to deductions. How to withhold personal income tax from February salary? Solution On the day the advance was transferred - February 17, 2021, the accountant did not withhold personal income tax, since the Tax Code does not require this. After all, the date of receipt of income has not yet arrived. The employee has no time worked in the second half of February. The salary for time worked in February is 12,222.22 rubles. The personal income tax amount is 1,589 rubles. (RUB 12,222.22 × 13%). Based on the results of February, the accountant will not accrue additional salaries to Erofeev. On March 2 there is no amount to be issued. In this regard, the accountant does not have the opportunity to withhold personal income tax on this day. The accountant will withhold tax at the next payment of money - March 17, 2017 (Friday) from the advance payment for March, and will transfer the tax no later than March 20, 2021 (Monday).

How to explain to tax authorities the difference between the dates of receipt of income and withholding of personal income tax

In example 5 above, a significant time gap arose between the day the income was received and the date of personal income tax withholding. Inspectors will see this difference in form 6-NDFL (see example 6 below).

Example 6

Entries in 6-NDFL Let's continue the previous example. February 17 S.N. Erofeev received an advance of 12,222.22 rubles. This amount turned out to be his final salary for February (the date of receipt of income was 02/28/2017). The accountant withheld tax of 1,589 rubles. only March 17th. How to fill out a block of lines 100-140 in section 2 of form 6-NDFL? Solution See entries in section 2 of form 6-NDFL below (sample 4)

Sample 4. Fragment 6-NDFL for the first quarter of 2021

In the situation from example 6, the tax authorities, just as in example 2 at the beginning of the article, will ask you to explain why in section 2 of form 6-NDFL for the first quarter of 2021, line 100 contains the date - February 28, 2021, and in line 110 the date - March 17, 2021. After all, between these dates there was a payment of money to employees - March 2, 2021. The accountant must write an explanation. See sample explanations above (sample 2). Tax authorities will not charge a fine for false information in Form 6-NDFL. The accountant reflected truthful information in the report and did not violate the employee’s tax rights (letter of the Federal Tax Service dated 08/09/2016 No. GD-4-11/14515).

When is the advance paid?

The date separating the payment terms is chosen by the enterprise arbitrarily. The law does not give strict instructions in this regard, however, there are recommendations from Rostrud, the Ministry of Social Development of the Russian Federation and the Federal Service for Labor and Employment, based on the logic of things.

When is the advance payment and the second part of the salary paid ?

Since remuneration for labor must be paid for the time actually worked and occurs twice a month, it is quite logical to divide the month approximately in half and choose the 15th-16th as the payment date.

FOR YOUR INFORMATION! With this choice of payment dates, it is recommended to divide the salary into approximately equal parts.

However, in the absence of strict legal requirements, the entrepreneur has some freedom in choosing dates for salary payments. You just need to take into account some nuances:

- it is allowed to divide payments not necessarily into 2 parts, you can split the salary into smaller shares, paying it three or four times a month, then the logic for setting dates will be different;

- if the gap between the advance and pay is more than 15 days, then according to the law, the employee theoretically has the right to complain about the delay in wages, suspend work and even go to court;

- the selected time periods must be recorded in the internal documents of the organization.

NOTE! The time for paying the advance must be a specific date, not a period. It is impossible to schedule advance payments, for example, from the 5th to the 10th, and paydays from the 25th to the 30th. Thus, the requirement to comply with the frequency of payments is violated.

If the appointed date coincides with a weekend or holiday, the employee will receive the required advance payment the day before.

Question: Is it necessary to calculate and transfer personal income tax to the budget from an advance payment of wages (clause 2 of Article 223, clause 6 of Article 226 of the Tax Code of the Russian Federation)? View answer

The ideal advance is proportional to the salary, adjusted by a reduction factor of 0.87

In examples 4-6, the accountant calculated the advance in proportion to the time worked. But even compliance with these rules has led to the fact that personal income tax has to be withheld from accruals for the next month. Is there a hassle-free way to calculate the advance? Yes, I have. It is enough to calculate the advance in a proportional manner using a reduction factor of 0.87.

Example 7

Advance with adjustment by a factor of 0.87 Let's use the conditions of examples 4-6 and supplement them. The company’s local regulations establish that the advance is calculated in proportion to the time worked in the first half of the month, adjusted by a factor of 0.87. What amount of advance will S.N. receive? Erofeev, if: - the employee’s salary is 20,000 rubles; — did the employee work 11 working days in the first half of February? What entries will the accountant make in 6-NDFL? Solution The formula for calculating the advance in this version looks like this: The accountant applied the formula to calculate the advance for February. On February 17, the employee will receive an advance of 10,633.33 rubles. (RUB 20,000: 18 days × 11 days × 0.87). On February 28, the accountant will calculate the employee’s salary of 12,222.22 rubles, personal income tax - 1,589 rubles. (RUB 12,222.22 × 13%). On March 2, the accountant will withhold the advance and personal income tax from the employee’s salary. To be paid to the employee for the month - -0.11 rubles. (RUB 12,222.22 – RUB 1,589 – RUB 10,633.33). This is an error due to rounding of personal income tax (clause 6 of article 52 of the Tax Code of the Russian Federation). See the entries in section 2 of form 6-NDFL for the first quarter of 2021 below (sample 5).

Sample 5. Fragment of section 2 of form 6-NDFL for the first quarter of 2017

Neither the labor inspector nor the tax inspector will fine the company if you write in the internal local regulations that you calculate the advance based on the salary in proportion to the time worked and include a reduction factor of 0.87 in the calculation.

Advance share of salary

What amount or share will the first payment of part of the salary be? The law does not answer clearly here either. Of the documents, this issue is indirectly addressed only by the somewhat outdated, but not yet repealed, Resolution of the USSR Council of Ministers No. 566, which states that the amount is established by the organization and should not be lower than the tariff rate.

Is it necessary to withhold alimony from advance wages ?

In modern entrepreneurship, various methods of calculating the advance interest are used, all of them are legal, the choice is up to the employer.

- Payment for actual working hours. The advance is paid on a set date in an amount corresponding to remuneration for the number of days or hours worked. However, it may vary monthly. This method is recommended in the letter of the Ministry of Labor No. 14-1/10/B-660; it must be mentioned in internal documents.

- Fixed percentage of the salary amount. It is more convenient for calculations, since it will be the same at constant wages. It is attractive for employees because they always know how much they can count on by a certain date. If the monthly payments are divided in half, it is convenient to pay half of the due remuneration. A level of 40% is also acceptable; a smaller share is not accepted.

- Fixed amount. An entrepreneur has the right to pay not a share of the salary, but a part of it in the form of the same amount, and recalculate the rest in accordance with the time worked. With this method, the advance payment will remain unchanged, and subsequent payments may differ under different remuneration systems (they will be the same for a fixed salary, but may change for hourly or piecework wages).

What the law says

Officials have not determined what percentage of the salary the advance represents. There is no specific value as a percentage of final earnings. In the current regulations there is only a vague definition that the amount of the advance payment is equal to half of the monthly earnings, calculated taking into account the days, shifts, and hours actually worked.

So, let's look at this calculation procedure using specific examples. General conditions: the collective agreement states that advance payment is made on the 16th of the month, based on the actual time worked. The day of payment is not included in the calculation.

Example #1

Sidorkin Sidor Sidorovich - head of the department, receives a salary of 100,000 rubles, works five days a week. The first half month worked completely.

Advance payment amount in September 2021: 100,000 / 20 working days × 10 days actually worked = 50,000 rubles.

Example No. 2

Skazochkin Ivanushka Petrovich works as a manager with a salary of 40,000 rubles per month. In September 2021, he fell ill from September 10, 2019, that is, he worked only 5 working days in the first half of September. The accountant made the calculation:

40,000 / 20 work. days × 5 days, working hours in fact = 10,000 rubles.

Example No. 3

Anfisa Ivanovna Princessova, project manager, with a salary of 75,000 rubles, went on regular leave from 08/27/2019, according to the approved vacation schedule, for 28 calendar days. Consequently, Anfisa Ivanovna is not entitled to an advance payment for the first half of September.

How to calculate the advance amount

The salary mass includes not only the tariff rate, but also compensation, social charges, allowances, bonuses, etc. They are taken into account when dividing the payment amount.

For an advance payment, you need to take into account part of the tariff rate (salary), bonuses for experience and qualifications, compensation charges, and social subsidies.

The bonus share, if it is due, may well not be included in the advance payment, since in most cases the bonus is accrued or not accrued depending on the results of the month, which has not yet expired at the time of payment of the advance payment.

Profit tax is required to be withheld from wages. How does it affect the amount of the advance? 13% of personal income tax is deducted at the end of the month, so the first payment occurs without this deduction. The same applies to contributions to social funds. They are deducted from the salary, and the advance is only part of it.

Allowances and surcharges

As you know, wages may not consist of a “bare” salary - it includes compensation, as well as bonuses, allowances and other additional payments. Should they be taken into account when calculating the advance payment? The Ministry of Labor answered this question by proposing the following option: the advance payment should take into account allowances that do not depend on the results of work for the month.

Let's look at an example. At Vasilek LLC, employees work in shifts, including at night. A tariff rate for 1 hour of work has been introduced. For the period of work from 22:00 to 6:00, the premium is 20% (Article 154 of the Labor Code of the Russian Federation, Decree of the Government of the Russian Federation dated July 22, 2008 No. 554). The internal documents of the company establish the following rules:

- monthly bonus - 1%;

- the advance is equal to the salary for the time actually worked in the first half of the month;

- Reserve deductions are made for the amount of personal income tax and other obligatory payments.

The employee's tariff rate is 300 rubles. During the first half of the month, he worked 3 shifts of 24 hours. Let's calculate how much advance he is supposed to pay:

- The total number of hours worked for the first half of the month was: 24 * 3 = 72 hours, including 8 * 3 = 24 hours at night.

- A 20% bonus for night work will be: 24 * 300 / 100 * 20 = 1440 rubles.

- The salary for the actual time worked without bonus will be: 72 * 300 = 21,600 rubles.

- Total amount of accrued salary: 21600 + 1440 = 23040 rubles.

- Reserve retention: 23040 / 100 * 13 = 4248 rubles.

- The employee's advance will be: 23040 – 4248 = 18792 rubles.

As for the 1% bonus, it is calculated based on the results of work for the month, therefore it is not taken into account in the advance amount.

The employer does not pay an advance

If an employer neglects his obligation to pay remuneration for work at least twice a month, this is a direct violation of the law. Such an administrative offense is subject to punishment, according to Article 5.27 of the Code of Administrative Offenses of the Russian Federation:

- officials who established an unlawful procedure for calculating salaries will have to pay a fine in the amount of 1-5 thousand rubles, and in the event of a relapse of such a violation - 10-20 thousand rubles, and possibly receive disqualification for 1-3 years;

- Individual entrepreneurs are required to provide at least two-time payments, otherwise they face a fine of 1-5 thousand or 10-20 thousand in case of repetition;

- a legal entity is liable to its employees for a fine of 30-50 thousand rubles, and repeated involvement is fraught with amounts of 50-70 thousand rubles.

IMPORTANT! The amount of fines is paid to the budget. Additionally, an employee who has suffered from late payment of salary has the right to demand compensation for its delay (Article 235 of the Labor Code of the Russian Federation).

Also read: where to go if you don’t get paid

Obligatory payments

In general, there is no need to pay personal income tax on the advance payment. After all, income in the form of wages is considered received only at the end of the billing period.

But if the advance payment date is set on the last day of the month, then the employee’s income from a tax point of view has already been generated. Therefore, officials believe that in this case the employer has an obligation to pay personal income tax (letter of the Ministry of Finance of the Russian Federation dated November 23, 2016 No. 03-04-06/69181).

Insurance premiums are also calculated at the end of the month based on all payments accrued during the period in favor of employees.

Therefore, to avoid controversial situations, do not schedule an advance payment on the last day of the month.

Accounting entries for advance payment

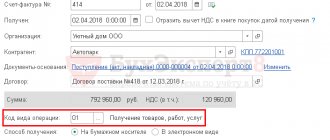

Accounting arrangements depend on the method of payment of the advance. Most often, it is transferred, like the rest of the salary, to a bank card . In this case, you must correctly indicate the purpose of the payment, mentioning the month of calculation, for example, “salary for half of August 2021.” Two entries are required: for the transfer of advance funds - debit 70, credit 50, and for the bank commission - debit 91-2, credit 51.

The law allows advance payment in other ways:

- in cash: you need to fill out a statement of the T-53 form provided for this or a KO-2 cash order;

- in non-monetary equivalent: part of the salary can be in kind, Art. 131 of the Labor Code of the Russian Federation allows this, regulating that its share should not exceed 20%; Thus, according to accounting, “transfer of finished products to payroll” occurs, and postings take place in 5 stages: revenue from finished products (debit 70, credit 50-1), writing off the cost of production (debit 90-2, credit 43), accrual VAT (debit 90-3, credit 68), profit or loss from transfer to salary account (debit 90-9 or 99, credit 99 or 90-9, respectively).