The essence of the Unified Agricultural Tax tax 2021

The Unified Agricultural Tax system itself is one of 5 special tax regimes that are available to small businesses. Let us consider the very essence of the Unified Agricultural Tax special regime.

From the name it is clear that this tax relates to agriculture.

By choosing the Unified Agricultural Tax tax in 2021, you automatically get rid of taxes such as VAT and income and property taxes that are on the OSNO (general taxation system).

Agricultural activities for which the Unified Agricultural Tax can be applied:

- Plant growing;

- Livestock;

- Poultry farming;

- Fish farming.

In other words, the special tax regime of the Unified Agricultural Tax replaces the OSNO tax. And in this case it is necessary to report specifically on the Unified Agricultural Tax.

The Unified Agricultural Tax can be applied in conjunction with the UTII or PSN tax. In this case there will be separate taxation.

Despite the fact that it is allowed to use special UTII and PSN regimes with the Unified Agricultural Tax, the share of agricultural business must be at least 70% of the total business.

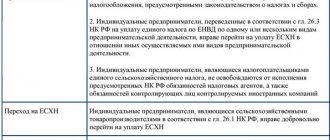

Conditions for transition

The law regulates the conditions that ensure the ability to pay agricultural taxes.

The basic rule that makes the transition possible is that the volume of agricultural production must exceed 70% of the total number of goods produced.

The use of agricultural tax is prohibited for companies or entrepreneurs engaged in the production of excisable goods, operating in the gambling business segment, or being budget-funded.

Special conditions have been established for the fish farm. More details in article 346.2.

Tax objects are income reduced by the amount of production expenses.

How to switch to the Unified Agricultural Tax in 2021

Switch to the Unified Agricultural Tax in 2021; you can submit a notice of application of the Unified Agricultural Tax until December 31, 2017, and in this case you can begin to apply the Unified Agricultural Tax from 01/01/2018.

I recommend submitting the notification itself somewhere on December 15, 2017, in order to be sure to receive permission to use the Unified Agricultural Tax in 2018. You do not have to wait until the last day, since you may not have time to register and you will not receive the right to apply the Unified Agricultural Tax.

Also, when submitting a notification about the transition to the unified agricultural tax, it is necessary to indicate the share of the agricultural business, as I said before - at least 70%.

Also, organizations and entrepreneurs who have just registered can switch to the Unified Agricultural Tax tax in 2021 - they are given 30 days to do this.

If organizations and entrepreneurs do not provide notification within the established time frame, then they do not have the right to apply the Unified Agricultural Tax.

When the Unified Agricultural Tax tax cannot be applied

- If the tax inspectorate refuses the right to apply a single agricultural tax;

- When the deadlines for submitting a notice of transition to the unified agricultural tax are violated;

- In the event that, at the end of the period, the taxpayer ceases to comply with the requirements of the special regime of the Unified Agricultural Tax.

If a taxpayer, being in the special unified agricultural tax regime in 2021, ceases to meet the requirements for which the unified agricultural tax is allowed to be applied, then he must notify the tax authorities about this within 15 days.

Who can apply the special regime of Unified Agricultural Tax in 2017

Taxpayers of the special regime of the Unified Agricultural Tax can be entrepreneurs, organizations and peasant farms that are agricultural producers.

Producers of agricultural products can be:

- Peasant farms (peasant farms);

- IP (individual entrepreneurs);

- LLC (limited liability company).

Regardless of the chosen form of ownership: peasant farm, individual entrepreneur or LLC, they must meet the following requirements:

- Produce agricultural products;

- Carry out primary processing and subsequent industrial processing of agricultural products;

- Sale of agricultural products.

All these requirements must be met simultaneously, that is, for example: you cannot simply sell agricultural products on the Unified Agricultural Tax.

All requirements are complex in nature and if they are violated, the entrepreneur is deprived of the right to apply the Unified Agricultural Tax.

Further, as I mentioned earlier, the share of agricultural business turnover should not be less than 70% of the total turnover of the organization.

Fishery organizations also have the right to apply taxation under the Unified Agricultural Tax.

Mandatory conditions for the transition to the Unified Agricultural Tax in 2021:

- The average number of employees should not exceed 300 people;

- 70% - the total turnover from the organization's activities.

The following organizations cannot apply the Unified Agricultural Tax:

- State, budgetary, as well as autonomous institutions;

- Organizations producing excisable goods;

- Organizations involved in the gaming business.

Liberation

When paying the Unified Agricultural Tax, entrepreneurs, along with organizations, may not have to pay some types of tax.

Payment of the unified agricultural tax is a reason for exemption from such payments as:

- Income tax (from enterprises), in this case the tax paid on dividend income and individual liabilities is excluded.

- Property tax (enterprises and individual entrepreneurs).

- VAT . An exception is the tax that is levied on the import of goods, as well as in the case of fulfillment of a partnership agreement or trust property management (from organizations, entrepreneurs).

- Personal income tax (for individual entrepreneurs) for employees personal income tax is paid in accordance with the established procedure.

This provision is regulated by Article 346.1 of the Tax Code.

Tax rate of the Unified Agricultural Tax

Let's look at what the Unified Agricultural Tax rates are:

- Standard tax rate for Unified Agricultural Tax in Russia = 6%;

- Unified agricultural tax rate for Crimea and Sevastopol from 2021 to 2021 = 4%.

How to calculate the amount of the Unified Agricultural Tax in 2021

Let's look at how to calculate the Unified Agricultural Tax:

Unified Agricultural Tax for Russia = tax base * 6%;

Unified agricultural tax for Crimea and Sevastopol = tax base * 4%.

Calculation of the unified agricultural tax

The tax base for the Unified National Economic Economy is calculated as income reduced by the amount of expenses incurred.

At the same time, the list of costs according to the Tax Code of the Russian Federation is closed, containing more than four dozen items. To calculate the tax, a flat rate of 6% is applied. The exception is the Republic of Crimea and Sevastopol, where in 2021 its rate is 0%, and from 2021 to 2021 no more than 4%. These regions are given the right to independently determine the tax rate, but not more than that established by the code. To determine income and expenses, it is necessary to keep accounting records, and this requirement also applies to entrepreneurs. During the year, performance indicators are calculated on an accrual basis. The tax period is one year, and the reporting period is six months.

Let's look at the calculation of the single tax using an example.

Maslo LLC is a payer of the Unified Agricultural Tax. For the period from January to June 2015, income was received in the amount of 550,000 rubles. and incurred expenses in the amount of 175,000 rubles. Thus, when calculating the advance payment, it will be:

(550000-175000)*6%=22500 rub.

This amount must be transferred to the tax service before July 25, 2015.

Over the next six months from July to December 2015, Maslo LLC received income in the amount of 780,000 rubles and incurred expenses of 550,000 rubles. Since income and expenses are considered cumulative at the beginning of the year, the tax will be equal to:

((550000+780000)-(175000+550000))*6%=36300 rub.

We reduce this tax by the advance payment already paid:

36300-22500=13800 rub.

This transfer must be made no later than 03/31/2016. Until this moment, a declaration under the Unified Agricultural Tax must be submitted.

Unified agricultural tax reporting in 2021

Since the tax period for the Unified Agricultural Tax is 1 year, once a year it is necessary to submit a tax return for the Unified Agricultural Tax and prepare a KUDiR book for reporting purposes.

- For organizations (LLC) – the deadline for submitting the Unified Agricultural Tax declaration is March 31, 2018;

- For individual entrepreneurs and peasant farms, the deadline for submitting reports in the form of a Unified Agricultural Tax declaration is April 30, 2021.

That's all I wanted to tell you about the single agricultural tax in 2021.

If you have any questions, please ask them in the comments or in my VK group “ ”. Happy business to everyone! Bye!

Accounting policy

Conducting activities on the Unified Agricultural Tax requires paying tax based on the difference between income and expenses. To control this system, including from the state, it is necessary to keep records. One of these elements is KUDiR. It must be stitched and numbered. Each new tax period a new book should be created . All transactions are recorded in strict chronological order and confirmed by documents.

The development of tax accounting is carried out at the business planning stage. You should carefully study the documentation, inventory management and other points. The accounting policy is formalized by the tax authorities.

If individual entrepreneurs are used for accounting purposes, then organizations create accounting records . Accordingly, a competent and reliable accountant is needed. Remember that when combining different taxation systems, separate accounting is used.

Accounting policies are divided into two components: tax and accounting. The individual entrepreneur does not need to develop the second type. The essence of the first is reflected only in the maintenance of all documents confirming income and expenses, and the preparation of the tax base. The state does not require more.

The rules for the formation of accounting policies are defined in PBU 1/2008 “Accounting Policies of Organizations”, approved by Order of the Ministry of Finance of Russia dated October 6, 2008 No. 106n:

- working chart of accounts;

- forms of primary documents;

- regulations and frequency of inventory taking;

- document flow schedule;

- other decisions necessary for organizing accounting.

Instructions for filling

Detailed instructions for drawing up the Unified Agricultural Tax declaration were approved by Order of the Federal Tax Service of Russia dated July 28, 2014 No. ММВ-7-3/ [email protected]

Title page

INN and KPP: we register taxpayer codes. If the report is prepared by an individual entrepreneur, then do not fill out the checkpoint code, but put dashes.

Tax period: enter code “34” if you are submitting a report for a full calendar year. If the activity subject to the Unified Agricultural Tax has been discontinued, then enter code “96”. When switching to another taxation system - code “95”.

Reporting year: enter the year for which you are reporting.

Federal Tax Service code: enter the four-digit code of the receiving inspection.

Taxpayer codes by place of registration:

- 120 - the declaration for peasant farms and individual entrepreneurs is indicated;

- 214 - for Russian organizations;

- 213 - for the largest taxpayers;

- 331 - for foreign companies.

Next, indicate the full name of the taxpayer or full name. entrepreneur. Enter the OKVED code. Enter your phone number.

Fill out information about the person who signed the report only for the organization. Individual entrepreneurs put dashes in the corresponding section of the title page.

Section No. 1

Lines 001 and 003 are OKTMO codes that identify the municipalities in which taxpayers are registered.

In line 002 we indicate the amount of the advance for the first half of the year.

Line 004 is the amount of tax to be transferred to the budget.

Line 005 is filled in only if the advance payment exceeds the amount of the annual tax.

Section No. 2

We calculate the tax payable to the budget. We indicate in the appropriate lines of the form:

- income received by the taxpayer;

- the amount of costs incurred in the reporting period;

- tax base (the difference between income and expenses);

- the amount of losses that were received in previous periods;

- tax rate applicable in the region;

- calculated tax amount.

Section No. 2.1

Fill out this section only if the taxpayer incurred losses. The company has the right to take losses into account when calculating the tax base for 10 years. The 2021 loss can be taken into account up to and including 2029.

Section No. 3

Disclose information about the targeted funding received during the reporting period. If the taxpayer did not receive targeted property, charitable contributions, grants or other targeted investments, then section No. 3 does not need to be filled out.

Now check the report, sign and indicate the date of preparation.