Tax policy is one of the most important attributes of the state and the full functioning of its institutions. Tax should be understood as a mandatory gratuitous payment to the state, which is made by legal entities and individuals with a certain frequency and at a specific rate.

In accordance with Russian legislation, all fiscal fees are divided into federal and local. This criterion determines which level of budget the collected funds are used to replenish.

Paying taxes is one of the duties of a citizen. Various types of sanctions are provided for failure to comply with the legal requirements of fiscal authorities. However, certain categories of persons are completely exempt from paying part of the tax payments.

We are talking about the most socially vulnerable of them, including pensioners. In particular, the latter are completely exempt from payments for property they own. In this regard , many pensioners who own vehicles are concerned about whether they are entitled to benefits associated with paying the corresponding tax. Let's look at it in more detail later in the article.

General information about transport tax

Transport tax 2021 for pensioners is a tax that each subject of the Russian Federation sets independently. But, there are general principles that apply to both individuals and legal entities, including pensioners.

As for physical Persons, then everything is quite simple here, the tax authorities independently calculate the percentage of taxes that need to be paid. After accrual, the citizen receives a letter with a receipt, and he needs to visit the bank to pay.

You can make a payment from your personal account (if created), for example, at the tax office. Or use the online banking service, there is a payment method through the State Services portal.

How to apply for a benefit

If a pensioner has grounds for receiving transport tax benefits, then he needs to submit a corresponding application to the Federal Tax Service. It should be noted that even if you have the right to a tax break, without an application from the citizen, the inspectorate will continue to accrue it.

Rules for filling out an application

The application for exemption from paying the fiscal fee has a strict and approved form.

The general rules for filling it out are:

- entering current, factual information;

- use of black ink (when handwritten);

- inadmissibility of corrections and blots;

The application is submitted with a set of documents identifying the citizen, as well as confirming the right to receive the corresponding benefit.

How to submit documents

The pensioner has the right to submit an application and related documents using one of several methods available to him.

- Personal appeal to the Federal Tax Service. A citizen can contact any tax office, even one located outside his place of residence.

- Through MFC. Multifunctional centers have convenient operating hours for citizens and are also located in almost every municipality. Please note that documents are not submitted to the tax office on the day they are submitted to the MFC.

- Electronic. You can submit an application through the State Services portal or your personal account on the Federal Tax Service website. To authenticate them, you will need an electronic digital signature.

- Through a representative. If a pensioner does not have the opportunity to submit documents personally, then a third party - a representative - can do this for him.

Attention! The authority of the representative must be confirmed by a properly executed power of attorney.

Federal legislation does not provide special benefits for pensioners in terms of exempting them from paying transport tax. However, such preferences are provided by regulations of some regions of the country. To apply for a benefit, a pensioner must contact the Federal Tax Service and provide documents confirming their right to it.

Do pensioners pay vehicle tax?

Cases have long been known to many when children register their cars in the name of their elderly parents. In this situation, pensioners are not exempt from paying tax, whether they own one vehicle or have more than one registered, they will still have to pay for them even if they are parked in a garage and not used.

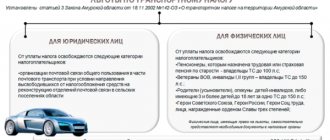

The following citizens do not pay taxes:

- Parents of large families.

- Disability of the first or second group.

- Parents or guardians of a child who has been disabled since childhood.

- Widows of military personnel who died in the line of duty.

- Veterans of WWII and any other military operations.

- Heroes of the USSR and Russia.

Questions and answers

Question No. 1. I am a pensioner, live in Moscow and own an expensive car. Are there any transport tax discounts for pensioners?

The legislation of the Russian Federation does not provide for transport tax discounts for owners of expensive cars. Even the fact of the car owner’s retirement age does not affect the amount of tax.

Question No. 2. Yesterday my car was stolen. Are there any transport tax benefits for pensioners whose car has been stolen?

You need to provide the Federal Tax Service with documents about the car theft, which will allow you to avoid paying tax.

Which vehicles are eligible for benefits?

Despite their advanced age, older people have to pay for their vehicle, plus expensive fuel and spare parts for repairs. Benefits apply to cars with engine power up to 100 horsepower , but in some regions there is a benefit for vehicles up to 150 horsepower .

Are there any benefits for pensioners

In general, the status of “pensioner” itself is not a basis for providing the opportunity not to pay transport tax. However, this applies only to the general procedure for providing benefits for the payment of the transport tax in question, provided for at the federal level.

Regional

Transport tax belongs to the category of local tax; in this regard, the subjects of the federation have quite broad powers and opportunities in terms of its assessment. They are also responsible for issues related to the provision of benefits to socially vulnerable categories of the population.

For example, in many of them, labor veterans, as well as disabled people of group III, are exempt from the need to make this fiscal payment.

Some regions establish that this benefit is also available to pensioners who have no other grounds for receiving it. It can be expressed either in complete exemption from tax or in a significant reduction in its amount, which may be associated, among other things, with the engine power of the vehicle.

In this case, the example of the Kirov region is quite typical. Thus, pensioners here pay only 50% of the accrued tax, but on the condition that they own a car with an engine power of no more than 150 horsepower. And, for example, disabled pensioners of group III receive a “discount” of 70% of the accrued payment.

Federal

Federal legislation does not allocate pensioners to a separate category of beneficiaries for the payment of transport tax. However, if they have other reasons for receiving relief, then they have the right to use it on a general basis.

Interesting!

Discussions about the need to amend tax legislation to provide transport tax benefits for pensioners at the federal level regularly arise among experts. However, given the shortage of funds in regional budgets and the poor quality of roads owned by federal subjects and municipalities, this idea is unrealizable in the near future.

Tax-free transport

Who has the right not to pay tax on vehicles - these are cars that were received from a social organization and are intended for transporting disabled people, and as mentioned earlier, the engine power should not be more than one hundred horsepower.

This type of transport also includes:

- equipment intended for agriculture and used, including for transportation;

- vehicles stolen and wanted.

Elena Smirnova

Pension lawyer, ready to answer your questions.

Ask me a question

Tax reduction is available to those citizens who own a vehicle and use it for public purposes, such as ships, airplanes and helicopters.

Legislative framework for taxation

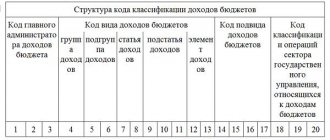

Payment for the use of personal transport is common and has always existed in Russia. Once such a payment was called a road tax, today it is a transport tax (TN), the funds from which are directed to the maintenance and development of road infrastructure. According to the current Tax Code (TC), this payment is classified as regional, and funds from it replenish the local budget.

Regulations

photo from the site poliksal.ru

The legislative basis on which to rely when calculating the transport tax for pensioners in the Moscow region and the city of Moscow is the following acts:

- Chapter 28 of the Tax Code of the Russian Federation, which regulates general provisions;

- Revision dated 04/01/2015 of Law No. 33 “On Transport Tax” dated 07/09/2008 Moscow;

- Revision dated October 22, 2014 of Law No. 129/2002-OZ “On transport tax in the Moscow region” dated November 16, 2002.

Information about whether pensioners pay transport tax in Moscow and Moscow Region, as well as about the amounts and payment deadlines accepted in the region, should be found in the last two documents.

Object of taxation

photo from the site www.soczaschita.ru

The all-Russian regulatory framework, in particular Article 358 of the Tax Code of the Russian Federation, clearly regulates the list of objects falling under this taxation article. According to it, the owners of the following types of vehicles are required to pay the TN:

- Ground transport – cars, trucks, motor vehicles (motorcycles, scooters), snowmobiles, buses, etc.

- Water types of transport – motor, sailing and non-self-propelled, as well as jet skis.

- Air modes of transport.

Categories of vehicles not subject to taxation

photo from the site www.avito.ru

The same Article 358 states that Moscow and Moscow Region do not charge transport tax to pensioners for owning the following objects:

- Passenger cars intended for use by people with disabilities, if they were received or purchased through social services. protection.

- Passenger cars with 100 hp engine. and less, which were received or purchased through social media. protection.

- Vehicles that are wanted, the legal fact of which is documented.

- Rowing boats.

- Motor boats with a power equal to or less than 5 horsepower.

Risk one

In recent years, evacuation services have become not just a mechanism in administrative proceedings, but an entire business with huge turnover. Car evacuation has been put on stream. Tow truck drivers, together with traffic police officers, work tirelessly, trying to “grab their piece of bread.” This is especially true in large cities, where the problem of parking is acute.

And the risk lies in the fact that only the owner of the car or a person acting on the basis of a power of attorney certified by a notary can pick up the evacuated car from the impound lot. Thus, when evacuating a car, each time you will have to take the elderly owner with you or issue a power of attorney in advance.

What else does the tax rate depend on?

You found out whether pensioners pay transport tax. Now let's discuss what decreasing and increasing coefficients exist and what they depend on.

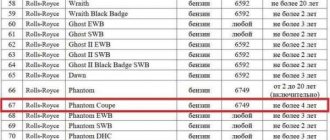

Government officials understand that the ownership of expensive cars can be covered by an appropriate amount of money. For new ground vehicles costing from 3 to 5 million rubles, an increased tariff is taken into account. Over time, from 2 to 3 years from the date of issue, the auto tariff decreases to a value of 1.1. With an age of up to 1 year, a coefficient will be applied to vehicles with the indicated price. equal to 1.5. After 1–2 years, the coefficient will decrease to the level of 1.3.

For a car with a purchase price of 5 to 10 million rubles and a service life of up to 5 years, the increasing coefficient will be equal to 2. Indicators of a car with a purchase price above 10 million rubles. and an operating period of up to 20 years are multiplied by the coefficient. with value 3.

A list of expensive machines with a pricing policy starting from 3 million rubles can be viewed on the official website of the Ministry of Industrial Trade - https://minpromtorg.gov.ru/.

Features of tax calculation

The calculation is made based on the number of full months during which the car was owned by its owner. Since such calculations are considered the prerogative of local authorities, accordingly, the size of the rate is also under their control. However, the calculation algorithm remains unchanged and is based on the characteristics of the vehicle.

To determine the amount of tax, the following parameters are taken into account:

- engine power;

- vehicle type;

- year of issue.