An acquiring agreement is concluded between the acquiring bank and an organization or entrepreneur who receives payment for their goods or services using bank cards.

Acquiring allows you to attract more customers by expanding payment methods and saves the organization’s resources, eliminating collection, worries about complying with the cash limit and ensuring the safety of funds.

Acquiring operations are applied:

- in online commerce when paying for goods through a website where the buyer enters his card details manually,

- in retail when paying through a POS terminal, which reads the buyer’s card data automatically.

Let's consider business transactions and acquiring transactions in both cases.

Acquiring and its types

Acquiring is a banking service that allows businessmen to receive revenue from payment cards. If the card is linked to a smartphone or smart watch with an NFC module, then the buyer can pay from the gadget, and they can also make the payment via the Internet - all this is also acquiring.

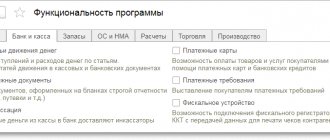

There are several types of acquiring:

1. Merchant - the buyer purchases a product or receives a service and pays with a card through a terminal located at the retail outlet.

2. Mobile - similar to a trading one, but the terminal is not installed permanently. It is carried by the courier delivering the goods or the driver of the vehicle. To communicate with the bank, the terminal is connected to a mobile phone or tablet.

3. Internet acquiring - an option for purchases in online stores and remote purchase of services (for example, air tickets). In this case, the card does not interact directly with the terminal. The buyer selects the desired product or service, and then enters his card details and PIN code in a special section on the website

Acquiring differs in the time at which money is credited to the seller’s current account.

1. Deferred enrollment. This option is used most often. It is inconvenient for a credit institution to process many small transactions at the time of their completion. Therefore, banks usually include in contracts provisions for the reimbursement of funds for acquiring transactions in 1-3 business days.

2. Enrollment “day to day”. Some banks, in order to attract customers, offer them crediting money to their account on the day the buyer pays. This option is often used by credit institutions that specialize in working with small businesses. This is convenient when receiving trading revenue on weekends or during long holidays

The peculiarity of acquiring is that the receipt of money from the buyer to the seller’s account does not occur instantly, but after 1–3 business days. There is also a commission for the provision of acquiring services, which the bank withholds from each transaction. These are the main features that affect accounting and tax accounting.

Liability for refusal to accept bank cards for payment

From January 1, 2015, administrative liability is provided for the seller’s refusal to accept a bank card for payment.

Rospotrebnadzor may fine entrepreneurs, organizations and their managers for violating the established payment procedure. The fines may be as follows:

- from 30,000 to 50,000 rub. – for organizations;

- from 15,000 to 30,000 rubles. - for officials. For example, the head of an organization, his deputy.

But entrepreneurs can be held accountable only as officials.

This procedure is established in Article 2.4, Part 4 of Article 14.8, Part 1 of Article 23.49 of the Code of the Russian Federation on Administrative Offenses.

It is worth noting that fines are provided only for non-acceptance of cards of the national payment system. An organization cannot be fined for failure to accept international payment system cards (Visa, MasterCard) (letter from Rospotrebnadzor dated July 22, 2015). The national payment system has not yet been launched in Russia. Thus, in fact, liability measures for non-acceptance of bank cards do not apply in Russia.

Acquiring accounting

The main transactions for acquiring in retail trade, services or when paying via the Internet will be the same. The reflection of acquiring in accounting depends only on the order in which funds are credited.

The proceeds are credited to the account on the day of payment

If the bank immediately transfers funds based on the results of the acquiring transaction, the transactions will be as follows.

| Wiring | The meaning of the operation |

| DT 62 - KT 90 | Revenue accrued for sales |

| DT 51 - KT 62 | Money were transferred to the account |

| DT 90.3 - KT 68.2 | VAT is charged if the seller pays this tax |

| DT 91 - KT 51 | Bank commission for acquiring services is included in other expenses |

Revenue is credited to the account later

If the money does not reach the seller’s account immediately, then additional acquiring transactions appear. To do this, use account 57 “Transfers in transit”.

| Wiring | The meaning of the operation |

| DT 62 - KT 90 | Reflected sales revenue |

| DT 57 - KT 62 | Funds are debited from the buyer's card |

| DT 91 - KT 57 | Bank commission for acquiring services is included in other expenses |

| DT 51 - CT 57 | Proceeds are credited to the seller's account minus commission |

In accounting, revenue from the sale of goods or the provision of services must be taken into account in full, even if in fact you receive the amount in your account minus the bank commission. The commission is applied to other expenses of the organization (clause 11 of PBU 10/99).

When to recognize revenue

In any of the options for working with a bank, proceeds from sales must be taken into account on the date of transfer of goods or provision of services to the buyer, regardless of the date of receipt of money into the account. This approach is used with the accrual method, which is used by almost all organizations for accounting.

Small enterprises that keep records using a simplified scheme theoretically have the right to use the cash method in accounting, i.e. recognize revenue when money is received (clause 4 of PBU 9/99). In practice, almost no one does this, since with the cash method it is difficult to adequately assess income, expenses and the structure of the balance sheet.

We will help you choose a trade acquiring partner

Choose a partner

Accounting: pos-terminals

In accounting, reflect the costs associated with the purchase of a payment terminal in the generally established manner on account 08 “Investments in non-current assets”. The acceptance of the payment terminal for accounting should be reflected in account 01 “Fixed Assets”, to which open the subaccounts “Fixed Assets in Warehouse (In Stock)” and “Fixed Assets in Operation”.

Make the following entries in accounting:

Debit 08 Credit 60 (76) – reflects the cost of a payment terminal purchased for a fee, which will be included in fixed assets;

Debit 08 Credit 23 (26, 70, 76...) – reflects the costs of purchasing a payment terminal, which will be accounted for as part of fixed assets;

Debit 19 Credit 60 (76) – VAT is reflected on the purchased payment terminal, which will be accounted for as part of fixed assets, and the costs of bringing it to a state suitable for use;

Debit 01 subaccount “Fixed assets in operation” Credit 08 – the payment terminal was accepted for accounting and put into operation at its original cost.

This procedure follows from paragraph 20 of the Methodological Instructions, approved by Order of the Ministry of Finance of Russia dated October 13, 2003 No. 91n, and the Instructions for the chart of accounts.

In accounting, pay off the cost of the payment terminal by calculating depreciation. This procedure is provided for in paragraph 17 of PBU 6/01.

Payment terminal costing within the limit established in the organization’s accounting policy, but not more than 40,000 rubles. per unit can be reflected as part of inventories (clause 5 of PBU 6/01). This rule applies to assets for which the conditions of paragraph 4 of PBU 6/01 are met (paragraph 4, clause 5 of PBU 6/01).

The acquiring agreement may provide for the rental of payment terminals. Record payment terminals leased from the bank under an acquiring agreement in the generally established manner on off-balance sheet account 001 “Leased fixed assets.” The basis for this operation will be a document confirming the fact of transfer (for example, an acceptance certificate).

When receiving the property, make the following entries:

Debit 001 – a payment terminal was leased under an acquiring agreement.

Indicate the cost of the leased property in the valuation fixed in the contract. And if the cost is not indicated in the contract - in the conditional valuation: one object, 1 rub.

You can organize analytical accounting for account 001:

- by landlords;

- for each leased fixed asset.

The return of the payment terminal to the acquiring bank in the event of termination of the contract or for other reasons should be reflected in the accounting records in accordance with the generally established procedure. Make an entry in accounting:

Loan 001 – return to the bank of the leased payment terminal.

Such rules are provided for in the Instructions for the chart of accounts.

Expenses in the form of rent for received payment terminals should be reflected by posting:

Debit 44 Credit 60 (76) – reflects the rent for the payment terminal.

This procedure is provided for in the Instructions for the chart of accounts (accounts 44, 60 and 76).

Accounting for the return of goods paid for using acquiring

If the buyer paid for the goods with a plastic card, then he should also receive money for the returned goods on the card. Cash returns are allowed only for purchases that were paid for in cash (clause 2 of the Directive of the Central Bank of the Russian Federation No. 3073-U).

In accounting, calculations for the return of goods are reflected using reversal, that is, reverse postings. They are highlighted in red.

| Wiring | The meaning of the operation |

| DT 62 - KT 90 | Revenue reversed |

| DT 90.3 - KT 68.2 | VAT reversed |

| DT 62 - CT 57 | The refund application has been submitted to the bank |

| DT 57 - CT 51 | Money returned to buyer |

Upon return, the buyer must receive a full refund of the cost of the product. For the sale, you received payment into your account minus a bank commission, but you will have to compensate for this difference at your own expense. You cannot deduct a commission from the buyer.

There are no grounds for returning the commission in this situation - after all, the acquiring service was provided. However, some banks provide refunds of commissions under certain conditions: for example, if the buyer returns the goods after a short time - 3-5 days.

Choosing a bank to issue a card

Relations in the field of payment of wages are regulated not only by the Labor Code. Along with Article 136 of the Labor Code of the Russian Federation, Law No. 333-FZ of November 4, 2014 is in force, which regulates the procedure for paying remuneration to employees for work.

The employee independently, at his own discretion, chooses the bank through which he wishes to receive his money.

| IMPORTANT! It does not matter at all whether a citizen gets a new job or, while working for a company, decides to change the bank that serves him. In any case, the employer does not have the legal right to refuse to transfer money to the card of the selected bank |

The same position is enshrined in the Information message of Rostrud dated March 25, 2021. It should be remembered that if an employer opens a card for an employee in a “convenient” bank, then, according to paragraph 1 of Article 846 of the Civil Code of the Russian Federation, the employee may not use such an account.

If an employee is already working at the enterprise and decides to change the credit institution servicing him, then the application must be submitted to the director at least 5 days before the date of accrual.

One more nuance. All public sector employees are required to use exclusively MIR cards to receive wages. When using such cards, it does not matter which bank issued it.

Tax accounting of acquiring

As a result of the acquiring transaction, the businessman receives in his current account an amount less than what the buyer paid, since the bank withheld a commission. But to calculate income tax, VAT or the simplified tax system (USN), the revenue must be taken into account in full.

Example. Alpha LLC operates at OSNO. According to the acquiring agreement, the bank commission is 1.5%. Revenue per day from cards is 120,000 rubles.

The bank commission will be:

120,000 × 1.5% = 1,800 rubles

Money will be credited to your bank account:

120,000 – 1,800 = 118,200 rubles

Revenue excluding VAT for income tax:

120,000 / 120% × 100% = 100,000 rubles

The costs of paying the acquiring commission reduce the taxable base, both for income tax and for the simplified tax system “Income minus expenses” or Unified Agricultural Tax. It is impossible to deduct VAT from the bank commission, since it is not subject to this tax.

The procedure for recognizing revenue in tax accounting depends on the taxation regime. Under the simplified tax system and unified agricultural tax, income is taken into account only by the cash method, that is, on the date of payment. In this case, it is important to include in the proceeds all funds received from the buyer, otherwise the tax base will be underestimated.

To calculate income tax, the accrual method is usually used - revenue is recognized at the time of accrual, that is, when you transfer the goods or provide the service to the buyer. Small enterprises with revenues of up to 1 million rubles per quarter have the right to calculate income tax using the cash method. But in practice, almost no one does this so that there are no deviations between accounting and tax accounting.

BASIS: VAT

If an organization has purchased a payment terminal, after it is registered, deduct input VAT (Article 171 of the Tax Code of the Russian Federation). In this case, the following conditions must be met simultaneously:

- purchase of a payment terminal for carrying out transactions subject to VAT;

- availability of an invoice (adjustment invoice).

This is stated in Articles 169, 171 and 172 of the Tax Code of the Russian Federation.

All banking services (except for collection), including services provided under an acquiring agreement, are not subject to VAT (subclause 3, clause 3, article 149 of the Tax Code of the Russian Federation).

However, from the point of view of Chapter 21 of the Tax Code of the Russian Federation, the activity of a bank providing a payment terminal for rent is considered as the provision of paid services, which is subject to VAT. Accordingly, input VAT presented by the lessor bank can be deducted if there is an invoice and relevant primary documents (subclause 1, clause 2, article 171 and clause 1, article 172 of the Tax Code of the Russian Federation).

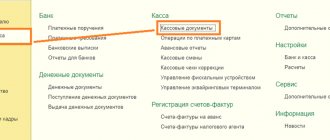

Acquiring documents

When paying by card, the seller is obliged to give the buyer a regular cash receipt and a slip, which is generated by the payment terminal. The slip contains basic payment data: amount, time, card details, terminal number.

An individual buyer can use a slip similar to a cash receipt to confirm the fact of payment (Article 493 of the Civil Code of the Russian Federation). For example, if a dispute arises regarding the return of goods.

For buyers of individual entrepreneurs or legal entities, one slip is not enough to confirm costs.

The slip does not contain all the necessary details that are in the check, for example, the seller’s TIN. Card payments are non-cash payments, so there is no need to include the amounts of acquiring receipts in the cash receipt order. But this revenue should be included in the cashier-operator’s journal. For non-cash receipts, columns 12 and 13 of the journal “Paid according to documents: quantity, amount” are intended.

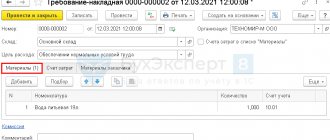

Retail sales report

If you need to reflect retail sales, then use a document with the appropriate name from the “Sales-Retail” section.

Information on both items sold and income is displayed here. In order to mark the fact of payment by payment card, you need to fill out a bookmark with the name “Non-cash payments”, noting the payment by card.

The document is carried out and informed about the following financial transactions:

- the price of the goods is written off - debit 62.R, credit 90.01.1;

- income from the sale is reflected - debit 57.03, credit 62.R;

- payment by payment cards is noted - debit 90.03, credit 68.02;

- VAT is taken into account - see invoice 57.03.