Transport tax in Russia applies to the majority of motorists in our country. This type of mandatory payment has been in place for many years and is a nightmare for car owners who are subject to the law requiring the payment of an annual contribution to the state.

Since 2012, there have been persistent rumors about its abolition, even the president himself spoke out in favor of abolishing the transport tax and searching for alternative solutions, however, this initiative regularly ran into bureaucratic barriers at various levels. Finally, in 2020 there are serious changes for the better.

Current legislature

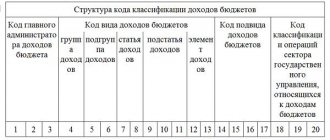

Transport tax is regional. This means that the constituent entities of the Russian Federation independently determine what rate to set for each tax period. Their actions are limited by federal law. Regions cannot set rates higher than the amount specified in the Tax Code of the Russian Federation (Chapter 28 of the Tax Code of the Russian Federation).

Federal legislation determines the tax base (what is taken as the basis for calculation), the object of taxation (for which vehicles the tax is paid and for which not), taxpayers (who must pay to the treasury), the tax period (when and for what period the tax is paid).

For 2021, taxpayers are considered to be the owners of vehicles on which tax must be paid.

The Tax Code defines transport that is not subject to tax:

- Rowing and motor boats of low power (up to 5 HP).

- Passenger cars equipped for disabled people.

- Sea and river vessels engaged in fishing.

- Passenger and cargo ships of any kind (airplanes, river transport) that are officially used for transportation.

- Agricultural transport used for agricultural work.

- Transport used by executive authorities and federal government agencies and used for military purposes.

- Vehicles that are officially recognized as stolen.

- Air ambulances.

- Drilling ships.

The tax is calculated based on the vehicle's power. For vehicles equipped with an engine, this is horsepower; for air transport - kilograms of force; for water - gross tonnage in registered tons.

The amount to be paid is determined for each unit of power.

The code specifies base rates; they can be increased by constituent entities of the Russian Federation, but not more than 10 times. The law allows for differentiated rates to be established, including the age of the car and the environmental class in the calculation (clause 3 of Article 316 of the Tax Code of the Russian Federation).

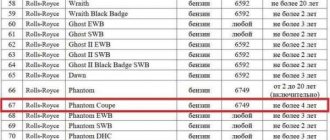

Tax calculations for individuals are carried out by tax authorities independently. A multiplying factor may be included in the formula. It is determined by the cost of the car and its age:

- 1.1 – for cars not older than 3 years , costing from 3 to 5 million rubles;

- 2 – for cars aged 5 years and younger with a cost of 5 to 10 million rubles;

- 3 – for cars not older than 10 years , costing from 10 to 15 million rubles or cars under 20 years worth more than 20 million rubles.

For whom has the transport tax been canceled for today?

There is a small category of citizens and cars that are exempt from paying transport tax. These include:

- cars for disabled people, provided that their engine power is less than 100 hp. and they were received through social security, or specially equipped cars for the disabled,

- tractors and a small range of special equipment used for agricultural purposes,

- cars are stolen and wanted.

All other car owners will have to pay transport tax by December 1 of the current year.

Transport tax in 2021

In 2021, federal transport tax legislation has not undergone radical changes. The amount to be paid is calculated based on the type of vehicle, its cost, power, period of use and the category to which it belongs.

Tax benefits

Federal legislation does not provide special benefits for transport tax payers. At the same time, the Tax Code allows for the independent establishment of benefits by constituent entities of the Russian Federation (Article 356 of the Tax Code of the Russian Federation). What benefits a car owner can claim depends on his region of residence. Most often, WWII veterans, disabled people, and pensioners fall into the preferential category. Recently, the legislative bodies of many regions have taken initiatives to introduce significant benefits for cars running on natural gas. For example, the Samara Provincial Duma Committee on Transport proposed introducing such a benefit at the beginning of 2021.

You can see what benefits are provided in each individual region on the official website of the Tax Inspectorate in the “Reference Information” section.

The tax office itself calculates the tax and sends a notification to the car owner. The calculation will also include a benefit, but only if the Federal Tax Service is aware that the payer is entitled to it. The owner himself must track whether he has received a subsidy. This requires:

- Check whether the benefit is due in accordance with the tax laws of the region of residence.

- Calculate the tax amount using a calculator , including the benefit in the calculation.

- Compare the resulting amount with the one indicated in the tax notice.

- If the amounts do not match, you should contact the Federal Tax Service with a request for recalculation.

This can also be done online. At the same time, having a personal account on the tax office website is not required. On the Federal Tax Service portal you need to follow the links: Main page - Electronic services - Contact the Federal Tax Service of Russia - Appeal from an individual regarding a life situation.

The service was organized to speed up and facilitate the procedure for recalculating incorrectly assessed property taxes.

All changes from 2021

The latest amendment adopted regarding the transport tax was published back in September last year. And some of the provisions come into force on January 1, 2021.

Among the most significant legislative updates are the following:

- benefits for Platon payers have been canceled - trucks weighing over 12 tons previously paid less tax; from 2020, the relaxation from the Tax Code of the Russian Federation was removed,

- but there is good news: if previously it was possible to receive other benefits (for example, for disabled people and other road users) only by submitting an application, now they are provided automatically when calculated by the tax authority upon receipt of information from the Pension Fund or social security authorities; but the procedure for providing relief at the request of car owners has also been preserved.

Rates

Tax rates are also set by each region independently, with restrictions imposed by the Tax Code.

For automobiles, the base rate is calculated based on horsepower , measured in horsepower. For each power you will have to pay a certain amount of rubles.

Differentiation of the rate means that it can change based on the age of the car and its environmental class . The specific differentiation coefficient is determined by the regional leadership.

The rates of individual constituent entities of the Russian Federation can be found on the Federal Tax Service website in the section “Reference information on rates and benefits for property taxes.”

The difference between rates for the same car in different regions can reach 100 percent or more. For example, for a car with a capacity of 100 to 150 HP in the Altai Republic they will pay 14 rubles per unit, and in Bashkortostan - 35.

When a region has not established its own rates, those specified in the Tax Code are applied (clause 4 of Article 361 of the Tax Code of the Russian Federation).

Adoption of the bill: yes or no

We sincerely hope that the law will not be adopted. It can hit the wallets of car owners who actively use them very hard. Gasoline prices are already quite high, they continue to grow successfully, and there is also the possibility that they will be pushed higher than ever.

We remind you that the transport tax initially appeared seventeen years ago – in 2002. Then it was introduced to modernize the road infrastructure and improve the quality of roads. But a little later it became clear that this is an excellent source of funds for the treasury. And where they go from there next... is known only to those who lead them.

Accordingly, we draw the following conclusions:

- At the moment there is no law. It did not come into force.

- It could appear even next year, even in five years – whatever the Government decides, so it will be.

- The law will play into the hands of only a small part of the population who use their cars relatively inactively.

- Even for those who use a taxi, the cost of the trip will increase significantly.

That is, there are rather more minuses than pluses. If they do accept it, I would like to see a “combed” version, and not a stupid ripping off of people.

Owners of which vehicles are exempt from paying tax?

Many believe that these penalties apply only to car owners, but this is not entirely true - motorcycles, boats, ATVs, buses, yachts, tractors, helicopters and many other vehicles also require the deduction of financial resources to the state by their owners. Certain groups of people who own certain transport facilities are eligible for benefits in relation to the payment of fiscal contributions. Preferential transport is considered:

- Cars that act as gifts in certain social programs, as well as those that have been converted for drivers with a disability group. Moreover, such a car should not have more than a hundred horses under the hood;

- A car that has previously been subject to theft. This criminal fact and the remedy itself must be documented by the law enforcement service;

- Swimming devices that have an industrial purpose, designed for movement along rivers and seas;

- Vehicles used for agricultural purposes (for example, for transporting animals, milk, meat, eggs, straw, grain). This also applies to tractors and combines;

- Boats and boats equipped with an engine with a rated power not exceeding five horsepower.

Payment deadline

Each region sets its own tax payment deadline, as well as its rate. Deadline for paying car tax:

- transport tax for legal entities in Moscow in 2021 - no later than February 5 of the year following the reporting year;

- vehicle tax collection for individuals - until February 1 of the year following the tax period.

You can pay the fee up to and including these dates. If the date falls on a holiday or weekend, then you can provide this option and pay in advance - three days before the end of the term, but not earlier.

Tax benefits

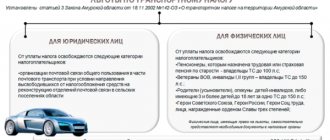

According to Moscow Law No. 33 of 07/09/2008 (as amended on 11/29/2017), not all enterprises pay a duty for the use of cars, motorcycles and special equipment. Transport tax benefits in Moscow apply to individuals and enterprises:

- companies that transport passengers by public transport, except taxis (buses, trolleybuses, metro, trams);

- enterprises that are registered in technology-innovation areas of Moscow. Including managers of these companies, as well as international branches;

- heroes of the USSR, the Russian Federation, WWII veterans, disabled people of groups I and II, one of the parents of a large family, a single parent of a disabled child are exempt from paying duties on one car;

- individuals who worked at the Chernobyl nuclear power plant during the accident;

- nuclear and hydrogen bomb testers;

- disabled people after radiation tests, as well as survivors of radiation sickness;

- The guardian of an incapacitated disabled person has the right not to pay the fee for one car.

In order not to pay funds to the tax budget, individuals write a statement about this, attaching the appropriate confirmation certificates. Preferences apply only to people who own cars and motorcycles with a power of up to 200 hp. With. For others, a full fee is paid. The preferential tariff does not apply to aircraft, watercraft, motor sleighs and similar vehicles.

Car malfunction is not a reason to refuse payment

Many car owners cannot afford to repair their car in a short time, because this work usually requires a decent amount of money, which is not so easy to quickly collect, as a result of which the repair process drags on for months and sometimes years. But at the same time, such cases do not fall under the preferential category; in such situations, you still have to pay a full tax. Some drivers try to cheat somehow, trying to save money by deregistering the car. But in such cases, you first need to weigh everything carefully, and only then make a decision. In this situation, this is due to the fact that the amount of the fee paid for registering a car is no less than the total fiscal contribution.

Why do owners of cars and other vehicles criticize this type of tax collection?

What is most criticized at the moment is the very principle of collecting financial resources from individuals, according to which payment amounts are calculated. So, for example, the amount of the tax, as already mentioned, directly depends on the engine size and its power, but nowhere in the legislative framework of this tax does it say how often the vehicle is operated during the year. According to car owners and experts who understand such issues, this principle of fundraising does not reflect its true goal - the accumulation of finances for road repairs. This is not surprising, because the degree of damage that a car causes to the road has practically no dependence on the amount of engine horsepower, but the frequency and duration of trips directly affects the wear of the road surface.

You will probably agree with the fact that a large number of people of retirement age exploit their “fruits of the domestic automobile industry” only a few times a year, when they need to go to a summer cottage located outside the city. The lion's share of the time the car is in the garage, however, it turns out that, despite this, the owner is obliged to pay the same amount of fees for it as the rest. As you know, not every foreign car with a powerful engine belongs to the category of new and comfortable, which is not taken into account by the authorities, which means that for owners of both new and obsolete vehicles, the amount of tax collection will be identical.

It should be noted that when purchasing a car, an individual is also required to pay a certain amount of excise duty on fuel. This means that the motorist is subject to double tax. Most developed countries in Europe and America do not practice such arrangements, but the government authorities of the Russian Federation are not surprised by this. People who own cars with serious damage and defects that make them almost impossible to use are also actively indignant.