The authorized capital is an estimate of the contributions made by the founders at the time of creation of the LLC. The funds are stored in account 40. But the amount of the total capital is determined in conjunction with the unpaid share.

The authorized capital in the balance sheet is not fixed assets, but only the part that was contributed in advance by the owners. It is reflected in the charter and other documents of the company.

Dear readers! The article talks about typical ways to resolve legal issues, but each case is individual. If you want to find out how to solve your particular problem , contact a consultant:

8 (800) 700 95 53

APPLICATIONS AND CALLS ARE ACCEPTED 24/7 and 7 days a week.

It's fast and FREE !

Capital formation has some features that may vary depending on the legal form and type of ownership.

Based on the shares contributed, each founder receives certain rights to the company. The amount of funds also determines the net profit.

Balance sheet - reflection of payment of the authorized capital of an LLC using an example (posting)

So, accounting of the authorized capital in accounting is carried out on an analytical balance sheet account. 80. Let's look at the procedure for drawing up postings using an example.

The two founders decided to create Colossus LLC. The size of the authorized capital of the enterprise is 10,000 rubles. Moreover, the founder V.S. Smirnov is obliged to contribute fixed assets (Fixed Assets) to the company in the amount of 4,000 rubles. and cash in the amount of 4,000 rubles. And the founder Kovalev A.A. - only cash in the amount of 2,000 rubles.

The value of the capital of Colossus LLC has been fixed

The founder V.S. Smirnov introduced OS into the authorized capital of the enterprise

Founder Smirnov V.S. contributed funds to the authorized capital

Founder A. A. Kovalev contributed funds to the authorized capital

As a result of the entries made, the amount of authorized capital of 10,000 rubles will appear in line 1310 of the liability.

Accounting of authorized capital

- 01.12.2015

- Accounting

How to reflect the authorized capital in accounting?

The very first business transaction with which the activity of any organization begins is the reflection of the amount of the authorized capital, which is indicated in the constituent documents.

According to the law, namely the Instructions for the Application of the Chart of Accounts, the debt of the founders for contributions to the authorized capital is reflected by the posting:

Debit 75 “Settlements with founders” Credit 80 “Authorized capital”

First, let's look at what authorized capital is.

Authorized capital is the initial amount that the founders are willing to contribute to further support the company’s activities.

According to Article 15 of the Federal Law “On Limited Liability Companies”, contributions to the authorized capital can be money, securities, other things and property rights that are in monetary form.

According to the amendments to the Civil Code of the Russian Federation for 2021, the authorized capital can be paid only after the company is registered, but you also need to pay attention to reducing the period for its full payment. If earlier this period was 1 year from the date of state registration of the company, now it is 4 months. That is, if the company is registered with a minimum authorized capital, then its payment can be made in any installments within 4 months. After this period expires, the authorized capital of the company must be paid in full.

You can pay the authorized capital in two ways:

- deposit money into a current account at a bank branch, saying that this is payment by the founder of a share in the authorized capital;

— transfer money from the founder’s personal account to the organization’s account. In this case, the purpose of payment must also indicate that the transferred amount is the payment by the founder of a share in the authorized capital.

After the organization undergoes state registration, the authorized capital in the amount of the founders’ contribution is reflected in the credit of account 80 “Authorized capital” in conjunction with account 75 “Settlements with founders”. This should be reflected as follows.

The amount that the founders contributed to the authorized capital is reflected in account 80 “Authorized capital” once upon formation, and in subsequent months it remains unchanged. The 80th account can be changed only under one condition: if the founders of the company decide to change the value of capital and make any amendments to the constituent documents.

There is such a thing as the minimum amount of authorized capital. Its value may vary depending on what type of property a particular society has.

If previously a fixed amount of the minimum authorized capital was established for LLCs, while for JSCs and PJSCs the minimum amount depended on the size of the minimum wage, now the following figures are stated in paragraph one of Article 66.2 of the Civil Code of the Russian Federation:

— the minimum amount for LLCs and CJSCs is 10,000 rubles;

— the minimum amount for a joint-stock company is 100,000 rubles.

The 75th account exists for settlements with the founders. Contributions from the founders are entered into the credit of this account as they are received. Depending on the type of contribution that the founders decided to make, account 75 interacts with other accounts.

It is important to note that proof of payment of the authorized capital can be a payment receipt, on the basis of which the following transactions will be generated.

3 Comments

Thank you for the article. Although it seems to me that it would be nice to talk in such publications about how to do this directly in the online accounting “Sky”.

I agree with Nikolai. Make detailed instructions, at least for basic wiring.

Good afternoon Tell me the transactions when paying for a share in the authorized capital

Authorized capital and the procedure for its formation

A special resource for the formation of company funds is share capital.

This fund serves to implement the business activities of the company, the result of which is making a profit.

The value of the initial capital is indicated in the statutory documents and represents:

- For joint-stock companies - the sum of the nominal values of the company's shares purchased by shareholders. The minimum amount of authorized capital at the time of registration of a CJSC or OJSC is 100 or 1000 minimum wages, respectively.

- For an LLC, this is the minimum amount regulated by the legislation of the Russian Federation (at the time of registration it must be greater than or equal to ten thousand rubles), and contributions to the “treasury” of the enterprise by one or more founders in the amount of the established shares.

Main operations with authorized capital: sale, transfer

Today, when doing business, there are quite often cases where the founder sells his share of the initial capital.

There are several types of alienation of funds.

The most common include:

- · sale of a share within the company, that is, the amount of the authorized capital remains unchanged, the share distribution simply changes;

- · transfer of part of the initial capital to a person who is not a member of the founding council, that is, in this case, the amount of the authorized capital is reduced.

Based on the registration documents, the necessary entries are made in accounting.

For example, a company sells a share to one of the members of the founding board at its nominal value.

In this case, the following entries will appear in accounting:

- D 75 “Settlements with founders”, K 91–1 “Other income” (this entry reflects the proceeds received from the sale of the company’s share);

- D 91–2 “Other expenses”, K 81 “Own shares (shares)” (this entry reflects the write-off of the nominal value of the enterprise’s share).

In addition to the sale of shares in the authorized capital, quite often the management of the company has a need to increase its starting value.

The prerequisites for this operation may be, firstly, an insufficient amount of working capital, secondly, licensing requirements, as well as many other factors.

Return on debt capital, structure and analysis.

To increase the value of the authorized capital, as a rule, they use the enterprise’s own property, funds additionally contributed by the founders of the organization or newly arrived participants.

However, to achieve this goal, the company must take into account a number of conditions:

- debt to the organization for initial capital must be repaid in full;

- the amount of the increase should not be greater than the difference between the company's net assets and liabilities;

- the amount of net assets must exceed the amount of the authorized (share) capital of the enterprise.

In the accounting aspect, operations to increase the share capital are reflected in the same way as when forming the authorized capital.

For example, if this indicator increases due to additional contributions made by one or more participants, in this case, first posting D75 - K80 is made, and then with subsequent receipts of funds, account 75 is credited in correspondence with the accounts for cash or other assets.

We recommend reading: Regional maternity capital in the Belgorod region 2021

At the same time, postings are made between subaccounts of account 80 in the prescribed manner.

Since the authorized capital funds are the basis for the financial and economic activities of the company, they play a fundamental role in achieving the main goal - making a profit.

This post has no comments yet.

The optimal amount of the organization's equity capital

The amount of capital required for the effective operation of an organization depends on the direction of activity and the volume of transactions performed within one year. To determine the level of financial stability for a specific legal entity, insurance utilization ratios are used. Such indicators indicate the economic component of operations and do not affect accounting and tax accounting.

The agility coefficient shows the company’s ability to maintain the size of the capital stock and replenish working capital from internal sources. The indicator is calculated as the ratio of own working capital to the amount of capital insurance. The amount of working capital is determined based on the results of the second section of the balance sheet. In a financially stable company, the coefficient is at least 0.2.

The independence of a legal entity from creditors is determined by the autonomy coefficient. It is calculated as the ratio of the capital account to the balance sheet currency. If the indicator is more than 0.3, the company will have the necessary funds to pay off its obligations.

The financial stability ratio is characterized by the share of the company's assets that are financed by long-term borrowings. The indicator is defined as the ratio of the sum of capital assets and long-term liabilities to the balance sheet currency. For stable operations, the level of financial stability of the company must be 0.6 or higher. At this level, a legal entity has the ability to financially plan taking into account long-term financing of activities.

How is the authorized capital reflected in the balance sheet?

The full version of the scientific work is available in PDF format

Currently, the authorized capital has become one of the most important indicators of an organization’s performance. Since the creation of any legal entity involves determining in monetary terms the amount of initial (starting) capital. The Civil Code of the Russian Federation provides for its formation by all subjects [2]. Authorized capital as initial capital is a source of formation of the organization's funds necessary for carrying out financial and economic activities in order to make a profit. Today, the authorized capital is a kind of guarantee for creditors who provide investments, as well as for partners, employees and other participants in the company’s activities. The movement of the authorized capital is characterized by its weak maneuverability and rare changes, therefore the accounting of the authorized capital is not very voluminous, but despite this, it is very important, it is necessary to organize it correctly, because It is with accounting for the formation of the authorized capital that the work of any organization begins.

Authorized capital is one of the main indicators characterizing the size and financial condition of an organization. It is reflected in the amount registered in the constituent documents as a set of contributions (shares, shares at par value, shares) of the founders (participants) of the organization. The exception is investment funds, whose authorized capital in accounting and reporting is shown as it is paid and in actual amounts as of a certain date.

The amount of the authorized capital is reflected in the accounting registers only after registration of the statutory documents. The amount of the authorized capital reflected in the balance sheet of the enterprise must correspond to the amounts specified in the constituent documents.

At the time of registration, the authorized capital must be paid at least half, the remaining part must be paid within a year from the date of registration. If this requirement is not met, the company must announce a reduction in the authorized capital and register its reduction or terminate its activities through liquidation. If payment is not made in full on time, the share goes to the disposal of the joint-stock company (JSC), the money and property contributed to pay for the shares are not returned [3].

Which line of the balance sheet contains the equity indicator

Calculating equity capital in the balance sheet using the Ministry of Finance method is a procedure that involves using data from the following sections of the balance sheet:

- lines 1400 (long-term liabilities);

- lines 1500 (current liabilities);

- lines 1600 (assets).

Also, to calculate equity capital, you will need information showing the amount of debts of the founders of a business company (let’s agree to call them DOO), if any (they correspond to the debit balance of account 75 as of the reporting date), as well as deferred income, or DBP (account credit 98 ).

Introductory information

Judging by the number of links on the BukhOnline forum, the topic of accounting for authorized capital and transactions with it is very relevant. This material for novice accountants outlines the basic information and rules that must be remembered when accounting for authorized capital.

Authorized capital is an integral part of the enterprise's equity capital, which is widely used in assessing the financial condition of the enterprise. In particular, when assessing financial stability, business activity, and profitability.

The size of the authorized capital establishes the minimum amount of property of a business company, which is a guarantee of satisfying the interests of creditors. Depending on the form of ownership of the enterprise, the authorized capital is modified into share capital, mutual fund or authorized capital. I note that in the future we will mainly talk about the authorized capital of the LLC.

Amount of authorized capital

The procedure for the formation and size of the authorized capital of an LLC is determined by the Federal Law “On Limited Liability Companies” dated 02/08/98 No. 14-FZ. Article 14 of this law states that the minimum authorized capital of an LLC must be no less than ten thousand rubles.

The size of the authorized capital is determined exclusively by the founders and is recorded in the constituent documents.

Example 2

JSC "Vasilek" contributed an intangible asset to the authorized capital of LLC "Chrysanthemum" as a contribution to the authorized capital. The initial cost of the transferred asset was 100 thousand rubles, the amount of accrued depreciation was 25 thousand rubles, VAT related to the asset and previously accepted for deduction was 12 thousand rubles.

The cost of the non-monetary contribution was agreed upon by the founders and confirmed by the appraiser in the amount of 1 million rubles. In December 2007, changes were registered in the constituent documents to increase the authorized capital of Chrysanthemum LLC in the amount of 1 million rubles.

Accounts and transactions related to the authorized capital

In synthetic accounting, account 80 tells us about the authorized capital. Its balance is reflected in the liability line of the balance sheet of the same name and always corresponds to the amount that is recorded in the constituent documents (and not paid, as some accountants mistakenly believe). The authorized capital in the balance sheet is reflected in line 1310 “Authorized capital (stock capital, authorized capital, contributions of partners).” This line should contain the amount specified in the company's charter, even if it has been partially paid. In this case, the debt of the founders is subject to reflection in the group of articles 1230 “Accounts receivable”.

Analytical accounting for account 80 is carried out by founders, and in a joint-stock company, by type of shares.

The authorized capital is formed not only from cash (Dt 50, 51, 52 Kt 75), but also fixed assets, intangible assets (Dt 08 Kt 75), materials (Dt 10 Kt 75), securities and accounts receivable (Dt 58 Kt 75). These entries reflect the receipt of deposits.

It should be noted that the Charter of the company may establish types of property that cannot be contributed to pay for shares in the authorized capital of the company. We must also remember that property transferred as a contribution to the authorized capital becomes the property of the organization and cannot be reclaimed. An exception is made for contributions in the form of the right of use (Dt 97 Kt 75).

The very first posting of the newly created organization is: Dt 75 Kt 80 - formation of the authorized capital. It is done after the state registration of the enterprise on the basis of the decision of the founders and the charter.

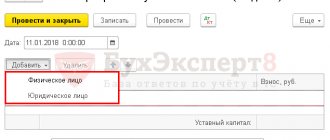

In 1C, the formation of the authorized capital occurs through an Accounting Certificate (in the “eight” - through manually entered transactions).

What is it and where does it come from?

Authorized capital on the balance sheet is required when creating an enterprise. At this moment, the owners do not have any common funds other than their own. Therefore, the founders invest certain shares in the company.

The authorized capital is expressed not only in monetary terms. It can be contributed by property, copyright. After the transfer of funds, each owner receives a certain number of shares.

The amount of capital is negotiated by the owners. The transferred amount is specified in the charter, therefore the capital is defined as authorized capital.

When creating an OJSC or CJSC, all funds are determined in the form of shares. They can later be exchanged for money or property. In this case, most often the shares are simply displayed in documents, but do not have a material expression to exclude counterfeits.

You can take into account the number of shares using a special register. It is a table in which data for each shareholder is recorded. Maintenance is carried out by special organizations, where accounting is based on tracking purchases and sales of shares.

When forming an LLC, no shares are issued. The owners fix their shares in the charter. Division can be done into equal parts.

Payment by the founders of their shares

Each founder of the company must pay in full his share in the authorized capital within the period determined by the agreement on the establishment of the company or, in the case of the establishment of the company by one person, by the decision on the establishment of the company. However, this period cannot exceed one year from the date of state registration of the company.

It is not permitted to release the founder of a company from the obligation to pay for a share in the authorized capital. At the time of state registration of the company, its authorized capital must be paid by the founders at least half.

After paying for the share in the authorized capital, the founder, losing ownership of the contributed property, receives the following rights:

- the right to receive net profit in proportion to the share of the founder;

- the right to receive the actual value of the share (in cash or in kind) in the event of withdrawal or expulsion from the company;

- the right to part of the company’s property after its liquidation;

- the right to participate in the management of the company, to receive information about its activities, etc.

What is an organization's equity

Equity capital (EC) is the amount of cash and property that will remain at the disposal of the company when all obligations are paid. From an economic point of view, this indicator determines the efficiency of the company, because one of its elements is retained earnings (loss). The final financial result can either increase the well-being of the company or worsen it if a loss occurs.

The insurance company ensures the continuity of the company's activities, ensuring financial security during unfavorable periods. At the same time, the indicator has a guarantee function, ensuring payment of obligations to creditors. The structure determines the share of income received by each owner of the legal entity, and also makes it possible to make decisions that affect operational and strategic activities.

Contribution of property to pay for the share

The monetary value of the property contributed to pay for shares in the authorized capital of the company is approved by a decision of the general meeting of participants. This decision must be made unanimously by the company's participants.

If the nominal value of a share (increase in the nominal value of a share), paid in kind, is more than twenty thousand rubles, an independent appraiser must be involved to determine the value of this property. The nominal value of a share (increase in the nominal value of a share) paid in non-monetary means cannot exceed the valuation amount determined by an independent appraiser.

By the way, overestimating the value of property contributed to the authorized capital can be fraught both for the participants of the company and for the independent appraiser. The fact is that they bear subsidiary liability for the obligations of the company in the amount of inflated value of such property.

Tax accounting of property received as a contribution

For tax accounting purposes, property received as a contribution to the authorized capital must be accepted at the value at which it was taken into account in the tax accounting of the transferring party. In this case, the value of the transferred property must be documented.

Forming the authorized capital with property in non-monetary form has its advantages: you can deduct VAT recovered by the owner (here an invoice is not needed), and write off the cost of such property as an expense when taxing. The main thing is that the primary documents are properly prepared and the cost of the accepted property is correctly formed. (For more information about the tax accounting of transferred property, see “How to register the transfer of property for related parties: contribution to the management company and contribution to property”).

Reference materials on the topic

Save the article to social networks:

The equity capital of an enterprise is its basic platform on which all further business development is built. The higher this indicator, the more stable the company is, the more attractive it looks to investors. Let's consider two variants of formulas and examples of how you can determine the amount of equity capital of an enterprise from the balance sheet.

Determination of equity

The equity capital of an enterprise is the totality of its net assets invested initially by the founders, plus retained earnings.

In fact, the company's equity capital consists of authorized capital, additional and reserve capital, retained earnings and various special funds. This also includes amounts after the revaluation of non-current assets and own shares purchased back from shareholders. In this case, the latter indicator is taken into account in the liabilities side of the balance sheet as negative and, when summed up, reduces the size of the company’s equity capital.

Authorized capital and net asset value

During the operation of an enterprise, an accountant needs to monitor whether the size of the authorized capital corresponds to the real value of the company’s property.

Recommended reading: Refund for a trip

For example, in practice a situation may arise when the authorized capital turns out to be greater than net assets. (Let me remind you that the value of net assets is determined according to the balance sheet as the difference between the value of all assets of the enterprise and its debt obligations (see order of the Ministry of Finance of Russia and the Federal Commission for the Securities Market No. 10n, No. 03-6/pz dated January 29, 2003 “ On approval of the procedure for assessing the value of net assets of joint stock companies." Moreover, the methodology is the same for LLCs and JSCs). In this case, the LLC cannot distribute profits between participants until it puts in order the ratio of net assets and authorized capital (clause 2 of Article 29 of Law No. 14-FZ).

There are two ways: reduce the authorized capital to the amount of net assets (Dt 80 Kt 84) or increase net assets.

You can quickly increase net assets through targeted assistance from the founders or through a positive revaluation of fixed assets. The second option is best used as a last resort. After all, this event should be annual and will lead to an increase in property taxes.

I will also add that if a company receives property from its participants to increase the value of its net assets, it does not generate taxable income. At the same time, the size of the share of the authorized capital owned by the founder does not matter (letter of the Ministry of Finance of Russia dated March 21, 2011 No. 03-03-06/1/160).

Sometimes it is necessary to increase the authorized capital. Most often, such an increase is made to increase the investment attractiveness of the enterprise. However, it may be due to licensing requirements, a lack of working capital, or the entry of a new participant. When increasing the capital, you also need to focus on net assets.

For example, if the authorized capital of an LLC is 50,000 rubles, and the value of net assets is 120,000 rubles, then the authorized capital can be increased by no more than 70,000 rubles. In this case, the down payment must be paid in full.

When increasing the authorized capital, its size is limited by the value of net assets, and when decreasing the authorized capital, it is limited to the minimum allowable amount.

What is the optimal average equity capital

Net asset figures must be at least positive. The presence of negative equity values in the balance sheet of an enterprise is most likely a sign of significant problems in the business - mainly in terms of the credit burden, as well as the sufficiency of highly liquid assets.

For information on how the insurance company is analyzed, read the material “How to analyze the equity capital of an enterprise?”

Most often, the average value of equity capital for the year is used for assessment, which makes it possible to most accurately determine its fluctuations over time. The formula for calculating the indicator is:

Sk = (Sk at the beginning of the year + Sk at the end of the year) / 2.

The data is taken from the balance sheet for the relevant reporting periods.

It is highly desirable that the amount of equity capital or net assets be higher than the amount of the company's authorized capital. This criterion is important primarily from the point of view of maintaining the investment attractiveness of the business. A business must pay for itself and ensure an influx of new capital. Sufficient equity capital is one of the most significant indicators of the quality of a company’s business model.

You can familiarize yourself with other approaches to assessing the quality indicators of a company’s business model in the article “How to read a balance sheet (a practical example)?”

There is one more aspect to the importance of equity in the balance sheet. If we mean net assets by it, then it must be equal to or exceed the size of the authorized capital. Otherwise, the company, if it is an LLC, is subject to liquidation (Clause 4, Article 90 of the Civil Code of the Russian Federation). Or it will be necessary to increase the authorized capital of the LLC to the amount of net assets. A similar scenario is also possible in relation to JSC (subclause 2, clause 6, article 35 of Law No. 208-FZ).

Read more about these situations and their consequences in the material “What are the consequences if net assets are less than the authorized capital?”

An idea of the amount of equity in the balance sheet is given by the value indicated in its line 1300. However, in its essence, equity corresponds to the concept of “net assets”. To calculate net assets, there is a formula approved by the Russian Ministry of Finance, based on balance sheet data, but taking them into account taking into account some nuances. The amount of equity capital is extremely important for assessing the financial position of the company. Of particular importance is its relationship with the size of the authorized capital.

Change of authorized capital and personal income tax

If the founder of the company is an individual, then when changing the size of the authorized capital, you should remember about personal income tax. Indeed, in this situation, in relation to its founders - individuals, the business company is a tax agent.

Article 217 of the Tax Code mentions the income of participants in a business company, which are exempt from personal income tax. This is income received as a result of the revaluation of fixed assets (funds) in the form of additional shares (shares, shares) received by them, distributed among shareholders or members of the organization in proportion to their share and types of shares, or in the form of the difference between the new and original par value of shares or their property share in the authorized capital.

In all other cases (for example, when the authorized capital is increased at the expense of retained earnings), the founder has taxable income. The taxpayer should include the increase in nominal value as “other income received by the taxpayer as a result of his activities in the Russian Federation” (subclause 10, clause 1, article 208 of the Tax Code of the Russian Federation).

The total amount of personal income tax is calculated based on the results of the tax period in relation to all income of the taxpayer, the date of receipt of which relates to the corresponding tax period (clause 3 of Article 225 of the Tax Code of the Russian Federation). In the case under consideration, the date of receipt of income is the date of the decision to increase the authorized capital of the company and, accordingly, the nominal value of the shares of each participant.

If the founders of the company do not work and do not receive any money from it, then it is not possible to withhold personal income tax. Considering that payment of personal income tax at the expense of a tax agent is not allowed, each founder must calculate and pay the tax independently (subclause 4, clause 1, article 228 of the Tax Code of the Russian Federation). In this case, the company, within a month from the moment of increasing the nominal share of the founder, must inform the tax office that it is not able to withhold personal income tax from the citizen, and at the end of the year, submit form 2-NDFL with the relevant information to the tax office.

If the authorized capital is reduced not due to its predominance over net assets (Dt 80 Kt 84), but by decision of the founders of the company by reducing the nominal value (Dt 80 Kt 75), the founders also have income subject to personal income tax (see letter from the Ministry of Finance dated 14.04 .11 No. 03-04-06/3-88).

If the authorized capital is reduced due to legal requirements, the organization itself does not receive economic benefits and should not include anything in income. If the reduction of the authorized capital is not dictated by the law, and the funds are not partially or fully returned to the participants, these funds are included in other income in accounting and in non-operating income in tax accounting.

Cases of increase

The authorized capital may change during the course of the company's activities. This is possible by attracting new investors.

You can do this in several ways:

- When increasing the authorized capital, funds must be received no later than 2 months after the decision is made. After the money is received, the results of the increase are summed up at the meeting.

- If a person is not a member of the company, but wants to receive a share, he will need to draw up an application. It specifies the amount of the deposit, the term and method of transferring the contribution. When his candidacy is approved, changes are made to the charter and they are registered with the tax service.

- In the balance sheet, these changes are reflected using entries D 50, 51 K 75, and D 75 K 80. They are not reflected in tax accounting, even if the amount is greater than the nominal amount. Companies use a simplified version of reflection.

- If you want to increase capital by revaluing the value of existing property, the shares of each participant are increased. Revaluation is carried out no more than once a year. In this case, postings D 01 K 83 and D 83 K 02, D 83 K 80 are issued.

- An increase in capital can be made at the expense of profits that were not subject to distribution. This is written as D 84 K 80. Tax accounting provides for the recognition of an increase as non-operating.