An enterprise, at the request of its employee or on its own initiative, can accrue and pay financial assistance. In this article I want to tell you how to do this in 1C ZUP 8.3, in the form of step-by-step instructions.

Financial assistance refers to one-time payments. In previous versions of the 1C ZUP program, to reflect this type of accrual, there was a document “Registration of one-time accruals to employees of organizations.” Now he's gone. Many people have a question: how to calculate financial assistance? I’ll say right away that there is such a possibility, but initially it is disabled in the system.

Calculation of financial assistance in 1C ZUP 3.1

To accrue financial assistance to employees in 1C ZUP 3.1, configure the salary calculation; if necessary, you can further configure or create calculation types for accrual and register the financial assistance either in the document Material assistance or in the Vacation (if you need to accrue financial assistance for vacation).

To calculate financial assistance to former employees, use the document Payment to former employees .

Calculation procedure

The specific amount of financial assistance depends on the provisions of the internal regulations of the institution. Usually it is set in proportion to the following indicators:

- employee salary;

- tariff rate;

- average monthly salary.

Also, the amount of financial assistance may depend on the characteristics of the employee himself (more often

total work experience in the public sector). The exact terms are set out in the collective agreement, individual employee employment contracts or remuneration regulations.

For example, for civil servants the amount of financial assistance is set at two average monthly salaries. For other public sector employees, this amount can range from one to three salaries.

The calculation of the specific amount is carried out by the institution’s accounting department. In this case, for calculations only the salary amount established for the employee is taken into account, without taking into account bonuses (even if they are mandatory and monthly), additional payments and other monetary compensation.

Financial assistance in general (except for financial assistance for vacation)

Setting up 1C ZUP 3.1 for calculating financial assistance

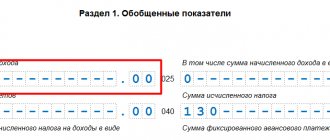

In the salary calculation settings, select the checkbox Material assistance is paid to employees (Settings - Payroll calculation - Setting up the composition of accruals and deductions - Financial assistance tab):

As a result of checking the box, three types of accrual will be added with the purpose Financial assistance :

Each of these types of accrual has its own specific tax settings and is used to register various types of financial assistance:

- Financial assistance at the birth of a child – not subject to insurance premiums and personal income tax if the accrued financial assistance does not exceed 50,000 rubles. for each child in favor of each of the parents, paid at a time and during the first year after the birth of the child (clause 8 of article 217 of the Tax Code of the Russian Federation; clause 3 of article 20.2 of Federal Law N 125-FZ). For such material assistance, a special personal income tax code is used in the accrual type settings 2762 and type of income from insurance premiums Financial assistance for the birth of a child, partially subject to insurance contributions;

- Tax-free financial assistance – used to register financial assistance, which is not subject to personal income tax and contributions in full. This type of material assistance includes material assistance in connection with the death of a family member or members (Clause 8 of Article 217 of the Tax Code of the Russian Federation). In the settings for this type of accrual, check the box Personal income tax is not assessed and type of income from insurance premiums Income completely exempt from insurance premiums, except for benefits from the Social Insurance Fund and military allowances.

- Material aid – used to register financial assistance for other (non-preferential) circumstances (for example, for family reasons, in connection with marriage), which is not subject to contributions and personal income tax in the amount of no more than 4,000 rubles. in a year. In the settings for this type of accrual, specify the personal income tax code 2760 and type of income from insurance premiums Financial assistance partially subject to insurance contributions.

If necessary, by copying based on these types of calculations, you can create new types of accrual if, for example, it is customary in an organization to divide financial assistance not only according to methods of taxation, but also on some other basis, for example, according to the method of reflection in accounting. Financial assistance is indicated and is carried out according to a separate document :

Using the document “Financial Assistance”

In the general case (except for financial assistance for vacation), accrual of financial assistance in 1C ZUP 8.3 is carried out in the document Material assistance , which becomes available after checking the checkbox Material assistance is paid to employees in the payroll settings.

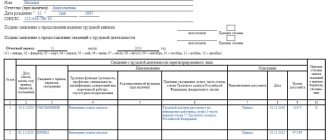

In the document:

- in the props Type of financial assistance select the type of accrual among accruals with a purpose Material aid:

- in the tabular section, indicate the employee or list of employees who are receiving financial assistance, and in the Result , indicate the amount of assistance paid.

When registering material assistance using personal income tax code 2760 (by default, this is the accrual type Financial assistance 503 is applied in a maximum amount of 4,000 rubles. Since 4,000 rub. - this is the amount of the annual deduction for financial assistance, then in the 1C ZUP 3.1 program it is tracked what amount according to deduction code 503 was applied to each employee in the current calendar year.

For Financial assistance at the birth of a child (personal income tax code 2762 ), it is important to indicate in the document the number of children in order for deduction 508 :

Payment of financial assistance

In the case of payment of material assistance during the inter-payment period, the payment in 1C ZUP 3.1 can be registered directly from the document Financial assistance using the Pay .

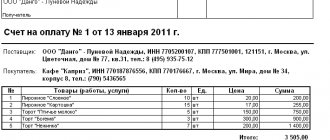

As a result, a Statement document will be created... with the payment method Financial Assistance and with an indication of this document Financial Assistance .

You can also create a statement independently, directly from the statement journal, by specifying the method of payment of Financial assistance and selecting the documents on which the payment is made.

Legislative regulation

The rules for payment of wages are established by Art. 136 Labor Code of the Russian Federation. The same article also indicates the need to pay for an employee’s vacation at least three days before it starts. But no other payments, except vacation pay, are no longer provided for in the current labor legislation.

However, Art. 135 and 144 of the Labor Code of the Russian Federation establish that individual enterprises, institutions and organizations can independently regulate issues of remuneration.

In particular, establish various bonuses and compensation for employees

payments. Officially, this is enshrined in internal local acts: collective agreements, agreements, provisions on bonuses and wages, etc.

However, for some categories of workers, not only the Labor Code, but also additional legislation applies. For example, in Art. 50 of the Federal Law “On the State Civil Service of the Russian Federation” establishes that civil servants may qualify for a number of additional payments in addition to the basic salary. In particular, one of these payments is financial assistance, which is provided when providing annual paid leave.

Financial assistance for vacation

To calculate financial assistance for vacation in 1C ZUP 3.1, in the salary calculation settings, select the Financial assistance when providing vacation (Settings - Salary calculation - Setting up the composition of accruals and deductions - Financial assistance tab):

As a result of checking the box, the accrual type Financial assistance for vacation . By default, the accrual type has a formula for calculating the amount that is a multiple of the salary (the multiple is set during the initial setup of the program). If necessary, the formula can be edited.

Reflect the accrual of financial assistance for vacation in 1C ZUP 3.1 with the document Vacation . To calculate such financial assistance, on the main tab, check the box Financial assistance for vacation :

As a result, on the Accrued (detailed) , a calculation will occur according to the accrual type Financial assistance for vacation :

Payment of financial assistance for vacation occurs along with vacation pay. The statement can be entered either directly from the Vacation the Pay command , or in the document journal Statement... , indicating the Vacation and the document itself according to which the payment is made.

Financial assistance to former employees

The employer can also pay financial assistance to former employees. To register such material assistance in 1C ZUP 3, in the salary calculation settings, select the checkbox Income is paid to former employees of the enterprise .

After this, in the Types of payments to former employees , define the settings for the financial assistance paid: personal income tax code and type of income from insurance premiums. Several types of financial assistance can be described with different settings, if required.

Specify the required type of payment in the document Payments to former employees , select former employees (from the directory Individuals ) and indicate the amount of assistance paid.

The document Payment to former employees in 1C ZUP is used for the purposes of accounting for personal income tax, contributions and generating data in the document Reflection of salaries in accounting . The document Statement of Calculation of Payments to Former Employees is not entered into the ZUP. It is assumed that settlements with former employees are recorded in the accounting program.