If an employee is officially employed at work, then, according to the Labor Code of the Russian Federation, he is entitled to wages for the work he has performed. Its size, as well as other payments and compensation, for example, bonuses, can be established both in the employment contract with the employee and in the collective agreement. The payment period is established at the legislative level. The online salary calculator allows you to calculate taxes paid by both the employer and employees.

How to use the calculator

Select the period for which you want to calculate contributions. This can be a full year or part of it; the calculator will automatically recalculate the amount of fixed contributions in accordance with the term.

If you worked as an individual entrepreneur for less than a full year, indicate the start and end date of your activity:

- start of activity - date of registration in the Unified State Register of Individual Entrepreneurs;

- end of activity - date of exclusion from the Unified State Register of Individual Entrepreneurs.

In the “Income” field, enter the amount of income for the year. For amounts exceeding 300,000, 1% must be transferred to the Pension Fund. We will discuss how to determine income below.

After entering the data, the calculator will automatically calculate the amount of contributions to be paid and display it at the bottom.

We will answer complex questions about calculations below.

What can be calculated with our salary calculator

In order to calculate wages and calculate taxes, you must fill out all the necessary source data points. Next, click on the “Calculate” button and get the calculated data, which can then be printed if necessary.

Features of our calculator:

- You can directly calculate taxes and receive the amount of wages in the hands of the employee and the calculation of all taxes paid by the employer and employee.

- Exclusive: in addition to the direct calculation, there is a reverse calculation! This is a very convenient function when you have the amount of the employee’s salary paid in hand after tax, and you need to calculate the amount of his income before tax.

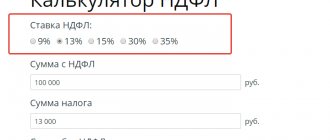

- It is possible to choose the personal income tax rate: 13% or 30%.

- All deductions are taken into account, both standard for children (including disabled people), in accordance with the requirements of the Labor Code, and other deductions that do not depend on income.

- Northern surcharges and the regional coefficient can be calculated.

- Contributions to the Social Insurance Fund for accidents can be set manually (the default rate is 0.2%).

Amounts of fixed insurance premiums

Officials annually index the amounts of fixed insurance premiums for entrepreneurs. Their size over the past five years is presented in the table.

| 2021 | 2020 | 2019 | 2018 | 2017 | |

| Pension Fund | 32 448 | 32 448 (20 318) | 29 354 | 26 545 | 23 400 |

| Compulsory Medical Insurance Fund | 8 426 | 8 426 | 6 884 | 5 840 | 4 590 |

| Total | 40 874 | 40 874 (28 744) | 36 238 | 32 385 | 27 990 |

Important! In 2021, individual entrepreneurs from affected industries will pay a fixed contribution to compulsory pension insurance in the amount of 20,318 rubles. The total amount of contributions is 28,744 rubles.

What is an advance

The main document that regulates the relationship between employer and employees is the Labor Code of the Russian Federation. But the concept of “advance” is not directly spelled out in it.

The need to pay wages in installments follows from the requirements of Art. 136 Labor Code of the Russian Federation. The law stipulates that employees must receive remuneration at least every half month.

More often than not, no one forbids it. In theory, an employer could pay employees weekly or even daily. But this is associated with unnecessary costs and hassle, so in most cases businessmen limit themselves to complying with the requirements of the law - i.e. Divide the monthly payment into two parts.

The first part, which the employee receives during the pay period, is traditionally called an advance.

What income to take to calculate 1% in the Pension Fund

The 1% contribution to the Pension Fund is calculated using the formula: (Income of individual entrepreneurs for the year - 300,000 rubles) × 1%

Note! The maximum amount of 1 percent contributions in 2021 is 259,584 rubles. The law sets the maximum amount that an entrepreneur must pay. It is equal to eight times the amount of fixed insurance premiums for compulsory health insurance (32,448 rubles × 8).

The procedure for determining the amount of income depends on the tax regime of the entrepreneur.

| Tax system | Income | Where to find the amount |

| BASIC | The amount of income subject to personal income tax, reduced by professional deduction (Article 210 of the Tax Code of the Russian Federation) | Difference between lines 050 and 060 of Appendix 3 to Section 2 of Form 3-NDFL |

| Unified agricultural tax | Income subject to agricultural tax (clause 1 of Article 346.5 of the Tax Code of the Russian Federation) | Column 4 KUDiR or line 10 of section 2 of the Unified Agricultural Tax declaration |

| UTII | Imputed income taking into account coefficients (Article 346.29 of the Tax Code of the Russian Federation) | Sum of lines 100 of section 2 of UTII declarations for the 1st-4th quarters |

| PSN | Potentially possible annual income (Article 346.47, Article 346.51 of the Tax Code of the Russian Federation). | — |

| simplified tax system "income" | Income subject to a single tax (Article 346.15 of the Tax Code of the Russian Federation) | Declaration under the simplified tax system “income” - line 113 of section 2.1.1 |

| Simplified tax system “income minus expenses” | Income subject to a single tax (Article 346.15 of the Tax Code of the Russian Federation), reduced by the amount of expenses (Article 346.16 of the Tax Code of the Russian Federation) | Declaration under the simplified tax system “income minus expenses” - line 213 of section 2.2 |

| Combination of special modes | Sum up taxable income | — |

The question of whether the simplified tax system “income minus expenses” needs to take into account expenses when calculating the amount of 300,000 rubles has long remained controversial. It has become known that the tax office is now recalculating 1% contributions and returning the overpayment to entrepreneurs who did not reduce their income for expenses in 2021. This happened after the publication of the ruling of the Constitutional Court of the Russian Federation dated January 30, 2020 No. 10-O. Check your personal account for overpayments and submit applications for 2017-2018.

Salary based on salary: documentation when calculating on a calculator

In order for an accountant to determine how to calculate wages based on salary, he needs to have the following data:

- An order to hire a specialist with a salary in accordance with the staffing table. Since the Labor Code of the Russian Federation contains a reference to the staffing table, often when checking by the labor inspectorate, the absence of this document is regarded as a violation.

- The official salary established for a given employee, the fixed amount of which is determined by an employment or collective agreement.

- The number of days worked by an employee in a calendar month is documented in a time sheet. The unified form of this document is mandatory for public sector organizations and approved by Order of the Ministry of Finance of Russia dated March 30, 2015 No. 52n, for other business entities unified forms, incl. the work time sheet (form T-13) and the work time sheet and calculation of wages (form T-12) are not mandatory for use (Law “On Accounting” No. 402-FZ of December 6, 2011). If an organization that is not a government organization decides not to use unified forms, it enshrines in its local regulations independently developed forms of documents for recording working hours.

When paying for the month worked, the employee must provide a pay slip, the form, procedure and frequency of submission of which the organization develops independently.

For what period should insurance premiums be calculated?

Entrepreneurs pay insurance premiums for themselves while they are registered in the Unified State Register of Individual Entrepreneurs. The period begins to run from the date of registration and ends on the day the entrepreneur is removed from the register.

If an individual entrepreneur has not worked for a full year, the easiest way to calculate contributions is to use a calculator. The fixed part of contributions to the Pension Fund and the Compulsory Medical Insurance Fund depends on the time of work; pension contributions at a rate of 1% do not depend on the time of work.

Under the special “Professional Income Tax” regime, a self-employed entrepreneur does not pay insurance premiums for himself. If the individual entrepreneur has violated the terms of the NAP, contributions must be counted from the date of loss of the right to the special regime. If the individual entrepreneur left the NPA voluntarily - from the moment of deregistration as self-employed.

Suspension of activities and lack of income are not grounds for non-payment. In general, individuals with the status of individual entrepreneurs who work only for hire, have registered disability, have retired, are in prison, etc. must pay contributions.

An individual entrepreneur may not pay contributions if there is no income, which is confirmed by documents. Such cases are listed in Art. 430 Tax Code of the Russian Federation:

- military service upon conscription;

- caring for a child under 1.5 years old, a disabled person of the 1st group or a person over 80 years old;

- living in an area where it is impossible to find work, with a spouse who is a contractor, a diplomatic representative, etc.

How to determine income received

Revenue is determined by all types of activities carried out by the payer.

Depending on the taxation system, income is determined as follows:

- OSNO - sales revenue minus VAT;

- STS - the amount of revenue reflected in KUDiR;

- Unified agricultural tax - the sum of proceeds from sales and the indicator of non-operating income;

- patent - there are two indicators: actual revenue received (the amount is reflected in the KUDiR) and the income tax calculated according to Article 346.51 of the Tax Code.

If an individual entrepreneur combines several modes, the revenue received is summed up.

Deadlines for payment of insurance premiums

Individual entrepreneurs are allowed to pay the annual amount of fixed contributions either at a time or in installments: once every six months, quarter or month. The main thing is to transfer the entire amount before December 31 of the current year.

Individual entrepreneurs can pay contributions at a rate of 1% next year, but no later than July 1 (clause 2 of Article 432 of the Tax Code of the Russian Federation).

Important! In 2021, individual entrepreneurs who are included in the SME register and work in affected industries can pay 1 percent contributions for 2021 later - November 2, 2021 in installments for a year.

If the payment due date falls on a weekend, holiday or non-working day, it is postponed to the next working day.

How to calculate a salary advance taking into account holidays

If there are holidays in the accrual month, the amount of the salary advance, calculated from the time actually worked, may seem disproportionate to the employee - more or less than half of the monthly salary. This is due to the fact that wages are directly related to the number of days worked, and one part of the month contains more working days (hours).

So, in May 2021, according to the production calendar, there are 14 working days, 3 paid non-working days from May 6 to 8, and the remaining 14 days are weekends and non-working holidays. From May 1 to May 15, employees who work a 5-day week and those who worked during non-working periods are subject to payment for 7 working days. For those who did not work on non-working days on May 6-8, 3 non-working days and 4 working days will be paid in the first half of the month.

Example

The employee’s salary is 42,000 rubles, on May 6-8 (3 days) he was subject to the regime of non-working paid days, and he worked the days from May 12 to 15 (4 days) in full?

How is the advance payment for May calculated? In this case, payment is due within 7 days (3 + 4):

42,000 rub. / 17 work. days x 7 days = 17294, 12 rub.

In the second half of the month, the employee will receive more:

42,000 rub. / 17 work. days x (17 working days - 7 days) = 24,705.88 rubles, however, the accounting department will withhold personal income tax from this amount from the entire amount of May earnings.

24,705.88 – 13% (17,294.12 + 24,705.88) = 19,245.88 rub. – amount to be paid for the second half of May.

How to pay dues

Transfer contributions to the Federal Tax Service at your place of residence through a bank - by bank transfer or by depositing cash. Please transfer contributions for compulsory medical insurance and compulsory health insurance in separate payment orders.

- BCC for contributions to community pension insurance 182 1 0210 160.

- BCC for contributions to compulsory medical insurance 182 1 0213 160.

For non-payment or late payment of contributions, the entrepreneur faces penalties (Article of the Tax Code of the Russian Federation) and collection of debt at the expense of property (Article of the Tax Code of the Russian Federation).

A fine under Article 122 of the Tax Code of the Russian Federation and criminal liability are not provided for, this was confirmed by the Ministry of Finance in a letter dated March 15, 2019 No. 03-02-08/16888. To the list of calculators

How is an advance calculated as a percentage of salary?

Some employers prefer to set the amount of the advance as a percentage of the salary according to the staffing table. This approach reduces the amount of accrual work, but payments do not take into account actual time worked.

Example

At Vympel LLC, the advance is 40 percent of the salary. Poletaev’s employee has a salary of 28,000 rubles. How the accounting department will determine the advance amount:

28,000 x 40% = 11,200 rub.

Since personal income tax is not withheld from the advance, Poletaev will receive 11,200 rubles in his hands.

However, the State Labor Inspectorate believes that the advance should be calculated based on the actual time of work or taking into account the volume completed (explanation on the official ]]>website of Rostrud]]>).

Roofing calculator

An easy-to-use roofing calculator will allow you to find out the amount of material required per square meter, the number of additional and component elements. If you find it difficult to complete the calculation, request a call back. Grand Line managers will provide you with detailed technical information about various types of roofing coverings, prices, terms of payment, delivery and will create an accurate estimate.

The roof calculation is carried out after taking the necessary measurements. The resulting dimensions must be entered into the appropriate fields of the calculator. When measuring, it is worth considering the following parameters:

- roof slope and geometry (single/gable, hipped, mansard, hip);

- the presence of hatches and other elements that are left without roofing.

Dimensions of drawings and building plans may differ significantly from actual dimensions.

The most accurate calculation will be made only by a highly qualified specialist. When calculating a complex roof, the roof is divided into separate planes and each element is measured.

Particular attention is paid to the size of the slopes.

Before making calculations, you must select a material (corrugated sheeting or metal tiles).

Each type of coating differs in the features of installation work, additional elements, and fasteners. For roofs with a slight slope, seam roofing is used.

Fold is a special seam with which metal sheets are connected to each other.

The program allows you to select the thickness of the metal and the color of the coating.

Thanks to a wide range of colors, you can choose the best option for your home.

Minimum payout amount

According to Article 133 of the Labor Code, if an employee has fully worked the time established by the employment agreement, the amount of his remuneration should not be lower than the minimum wage (minimum wage). For example, in 2021 this figure in Moscow is 17,561 rubles. Under working conditions at a rate of ½, wages cannot be less than 8,780.50 rubles, that is, in proportion to the established minimum:

Salary = 17,561*0.5 = 8,780.50 rubles

Calculation example No. 2. The Podsolnushko farm in the Krasnodar Territory had two employees in 2021: tractor driver Klyuev and driver Petrov. Klyuev is employed full-time and his salary is 11,000 rubles, Petrov works at a rate of ½ and his salary is 5,000 rubles. We will determine whether these payments in the prescribed amount do not violate labor laws.

The minimum wage in the Krasnodar region in 2021 was 10,366 rubles. Klyuev’s salary exceeds this value, and therefore management does not violate his rights. But in relation to Petrov, their actions are illegal, since his rate is ½, then the amount of payment should not be less than 5,183 rubles.

It is worth remembering that the minimum wage in different regions is set individually. The table shows how the indicators differ. It all depends on the different levels of inflation in different regions and on the established cost of living. Wages for part-time work may be less than the minimum wage, but only in proportion to the rate.

| Region | Minimum wage size in 2021 |

| Bryansk region | 7,500 rubles |

| Murmansk region | 13,650 rubles |

| Tyumen region | 7,700 rubles |

| Moscow | 17,300 rubles |

Conclusion

An advance is a mandatory payment, the need for which arises from the requirement of the Labor Code of the Russian Federation to pay remuneration to employees twice a month.

Employers can determine the date of issue and the amount of the advance themselves, but taking into account the restrictions established by the Labor Code of the Russian Federation and the recommendations of regulatory authorities.

It is most convenient to set the date for issuing the advance from the 20th to the 29th, and the amount - in the amount of 40-45% of the monthly remuneration, taking into account the actual time worked for the first half of the month.

What salary should be indicated in the employment contract?

Experts disagree. Some believe that the employment contract should indicate the amount that the employee would be paid if they were working full time. Here you should indicate his personal schedule and make the following reservation: “Wages are calculated in proportion to the time worked.” So, if the full salary is, for example, 30,000 rubles.

, then this exact amount should appear in the employment contract. Further, it should be noted that the employee works four hours daily (20 hours per week) and receives a salary in proportion to the time worked. It is assumed that a person, based on this information, will independently calculate the final amount of his salary (15,000 rubles).

But there is another point of view, according to which the employment contract should stipulate not the full, but an already reduced salary. Proponents of this approach refer to Article 57 of the Labor Code of the Russian Federation. It states that the employment contract must contain the conditions for remuneration of the employee. Therefore, it is necessary to indicate information that relates specifically to this employee.

And if he works part-time, then the employment contract must contain a salary calculated based on his personal work schedule. With this design option, the employee is freed from the need to calculate his own salary, because the employer did it for him. As for the full salary, this is a general indicator that is reflected in the staffing table and other documents related to the company as a whole.

When to pay an advance

The employee must receive the final payment by the 15th of the next month. The advance payment date must be two weeks earlier. This means, if we do not consider February - from 16 to 30 or from the 17 to 31 of the current month.

However, it must be taken into account that if the advance is issued on the 16th-17th, then the salary must be paid immediately at the beginning of the next month. Calculating it so quickly can be difficult, especially in large enterprises.

It is possible to issue an advance on the last day of the month, but then problems with the tax authorities may arise. We'll tell you more about this below.

It turns out that it is most convenient to issue an advance in the period from 20 to 29 or until the 30th. The more time it takes accountants to calculate salaries, the later they need to set the date for payment of the first part of the remuneration.

The date of payment must be recorded in the company’s internal documents or in the employment contract. You cannot set a “floating” date, for example: from the 20th to the 25th (letter of the Ministry of Labor dated November 28, 2013 No. 14-2-242).

It is not prohibited to issue an advance before the due date. But you should remember that you will have to “move up” the salary payment date in order to maintain the two-week interval. Those. it is necessary to take into account whether the accounting employees will be able to summarize the results of the month in a shorter time.

Pre-holiday days with part-time work

Labor legislation stipulates that the pre-holiday day should be shortened by one hour. Employees registered at 0.5 rate also have the right to use this privilege. This benefit does not apply to the category of workers whose work should not be interrupted. The employer, in turn, can compensate for unused benefits with payments or additional rest.

Pre-holiday days are the days before official holidays. Their list is established long before the start of the calendar year and is available in any information source, along with the production calendar. If an official holiday falls on a Monday, then Friday is not a pre-holiday day.

Which days are considered pre-holidays: (click to expand)

- This category includes workdays on the eve of a holiday. For example, if February 23 falls on a Monday, then Friday does not fall under this definition and cannot be a shortened day.

- Religious customs established in the respective regions are also considered federal holidays. For example, Parents' Day in the Krasnodar Territory has been a day off for many years, by decree of the governor. And in Moscow it’s an ordinary working day.

For part-time workers who doubt their rights, the labor code states: employees registered at ½ rate have the same advantages and benefits along with everyone else: the right to paid leave, accrual of seniority and others. Based on this, employees who work part-time also work an hour less, and proper documentation of this fact is mandatory:

- Drawing up an order establishing a working hours schedule, which will clearly define this range, taking into account the lunch break;

- Instead of 8 hours worked, the timesheet must indicate 7, and for part-time workers, instead of 4, enter the number 3.