It is not uncommon today for situations where the seller and buyer are in different cities or even countries. In this case, transportation may take several days and sometimes weeks. In this case, the seller’s responsibility is to draw up documents for the goods on the day they are sent. In this case, it turns out that the buyer will accept them on a completely different day, and maybe in another month. The transfer of ownership of the goods occurs at the time of shipment, but in this case the buyer has not actually received them yet, so accounting difficulties may arise. In this article we will look at how accounting of goods in transit occurs.

When carrying out transactions in accounting, it is recommended to use account 15 “Procurement/purchase of material assets”. If materials or raw materials are being transported, then sub-accounts are created for the specified account: “materials in transit”, “goods in transit” and “raw materials in transit”. Using account 15 is only possible for accounting for materials (goods) at accounting prices. However, you can retreat from this and take into account inventory items on 10 or 41 accounts at actual cost. Account 15 will only be used for goods in transit. The seller includes transportation costs in the price of the goods (41 invoices), or takes them into account separately in sales expenses (44 invoices).

In accounting, the supplier recognizes expenses from the sale of goods after ownership transfers to the buyer. Goods, the ownership of which is transferred at the moment of transfer of the goods from the seller to the recipient, are taken into account in account 45 until the ownership is transferred. When transferring the goods to the carrier, its value is written off from the credit of account 41 to the debit of account 45.

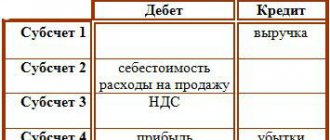

When transferring ownership of the goods to the buyer, the supplier must reflect the proceeds on the loan of account 90 (K90 subaccount “Revenue” D62) in the amount of the cost specified in the contract. At the same time, the cost of goods is reflected in expenses for ordinary activities (D90 subaccount 90.2 “Cost of sales” K45). Costs associated with the delivery of goods to the supplier are recognized in the seller's accounting as expenses for ordinary activities.

Supplier services at their cost are reflected in entry D44 “Sales expenses”

K60 “Settlements with suppliers and contractors.” Payments related to the delivery of goods to the buyer are written off by posting D90 K44 when recognizing revenue from the sale of goods. In the balance sheet, the cost of goods in transit is reflected in line 1210 “Inventories”.

Reflection of goods receipt at the “virtual” warehouse

After sending an order for a product to the supplier, he informs that he will be able to deliver the product by a certain date, or sends an electronic invoice to our address. To reflect the fact of receipt of an electronic invoice or the date of receipt of goods, we reflect in the system the arrival at the “virtual” warehouse.