The employer has certain obligations to the employee, which are enshrined in the Labor Code. Let's look at the articles of the labor code on the payment of wages. The word “advance” is not used in the code of the Russian Federation; it is customary to call such a payment as wages for the first half of the month. We made this conclusion after considering articles 129 and 136 of the Labor Code of the Russian Federation.

Also, the articles of the code describe the timing of payment of an employee’s income: every half month the employee must be paid a portion of his earnings. In the labor and collective agreement, it is necessary to make a record of more precise dates for the provision of these payments to the employee. For example, on the 25th, an employee will receive part of the money earned for the first half of the month, and on the 10th of the next month, the employer must pay accrued amounts based on the results of work for the month.

For different structural units, you can set different paydays. This will allow the organization to plan its financial flows more freely. For example, administrative personnel should be paid income on the 28th and 13th, and operating personnel on the 25th and 10th.

But it is necessary to pay wages for the first half of the month before the 30th (31st) day (Article 136 of the Labor Code of the Russian Federation, letter of the Ministry of Labor dated 02.14.2017 No. 14-1/OOG-1293, letter of Rostrud dated 09.26.2016 No. TZ/5802-6-1).

If the payment date falls on a holiday or weekend, it is advisable to take advantage of the recommendations of the labor inspectorate and pay half of your earnings earlier. True, in such a situation, the next period between payments may exceed 15 days, but this will not be considered a violation. For example, payment deadlines are set on the 26th and 11th. October 11 will be a day off, therefore, wages for September must be paid to employees on Friday, i.e. October 9. And the next payment will be according to schedule, i.e. 26th, but only after 17 days. Such a deviation from the frequency of payments is not considered a violation of the Labor Code, because the employer fulfilled its obligations to the employee in compliance with all legal requirements.

What does the Labor Code of the Russian Federation say about the timing of payment of wages in 2021 - 2021

Salary terms are fixed in Art. 136 Labor Code of the Russian Federation. According to it, money for employees’ work should be transferred to:

- at least every half month; And

- no later than 15 calendar days from the end of the period for which the payment was accrued.

If the salary date approved by the employer falls on a weekend, the money is issued the day before.

IMPORTANT! Norms Art. 136 of the Labor Code of the Russian Federation are mandatory and cannot be violated even at the written request of an employee who wishes to receive money once a month.

As a rule, employers pay wages according to the following scheme: once a month they issue an advance and once a month the final payment, adjusted to the previously issued advance. With such a schedule and taking into account the norms of Art. 136 of the Labor Code of the Russian Federation, the deadlines for salaries for the first half of the month fall on the 16th–30th (31st), and for the second half - on the 1st–15th.

IMPORTANT! For large companies with a large number of structural divisions and a large staff, it is not prohibited to approve different salary payment dates for different departments (letter of Rostrud dated June 20, 2014 No. PG/6310-6-1).

All aspects of paying advances to new employees are in the article “Advance to a new employee in the first month of work.”

“Who are the judges?”

Curious - when and in what amount are salaries paid in the public sector? After all, Article 136 of the Labor Code also applies to this category of employers (Article 11 of the Labor Code of the Russian Federation). The answer is in the table below. All orders specified in it are registered with the Russian Ministry of Justice. This means that they comply with labor legislation (clause 12.1 of the Explanations, approved by order of the Ministry of Justice of Russia dated May 4, 2007 No. 88).

| Salary of civil servants (Articles 50 and 73 of the Federal Law of July 27, 2004 No. 79-FZ “On the State Civil Service of the Russian Federation”) | |

| Document | Terms and amounts of payments |

| Official regulations of the central office of the Federal Service for Labor and Employment (approved by order of Rostrud dated April 2, 2007 No. 94-k), subp. 5 clause 4.2 | For the first half of the month - on the 16th day, for the second half - on the 1st day of the next month, for the time actually worked based on the time sheet |

| Official regulations of the central office of the Federal Agency of Scientific Organizations (approved by order of the Federal Agency for Scientific Organizations of Russia dated December 25, 2013 No. 9n), subp. 5 p. 17 | |

| Regulations on the salary of federal civil servants ... in the central office of the Federal Service for Military-Technical Cooperation (approved by order of the FSMTC of Russia dated September 7, 2012 No. 66-od), paragraph 7 | |

| For the first half of the month - from the 15th to the 17th of the current month as an advance payment at the rate of up to 40% of the average monthly salary; for the second half of the month - from the 2nd to the 5th day of the month following the billing month, based on the time actually worked minus previously paid advance amounts | |

| Regulations on remuneration of federal state civil servants of the central apparatus of the Federal Fisheries Agency (approved by order of Rosrybolovstvo dated March 14, 2012 No. 223), clause 1.3 | In the first half of the month, an advance is paid for the first half of the month at the rate of 40% of the salary for the time actually worked until the 19th day inclusive. Payment for the second half of the month is made until the 4th day inclusive of the month following the billing month |

| Official regulations of the Federal Service for Surveillance in Healthcare and Social Development (approved by order of Roszdravnadzor dated October 27, 2009 No. 8583-Pr/09), subp. 5 clause 4.3 | For the first half of the month - on the 19th of the current month, for the second half - on the 4th of the next month |

So feel free to borrow language from similar sources or refer to them without hesitation. This argument will be a win-win.

Elena Dirkova - editorial staff of the magazine "Practical Accounting"

What documents indicate the days of payment of wages?

The employer is obliged to fix a specific schedule for the transfer of salary money in its local regulations (LNA): internal labor regulations (ILR), collective or labor agreement. It is these 3 documents that Art. 136 Labor Code of the Russian Federation.

The wording of this article is designed in such a way that the question often arises: is it necessary to fix salary terms in all of the above documents or is one of them sufficient? The answer to it was repeatedly given by both officials and judges (letter of Rostrud dated March 6, 2012 No. PG/1004-6-1, ruling of the Moscow City Court dated December 24, 2012 No. 4g/5-12211/12).

For information on what to include in an employment contract, read the article “Procedure for concluding an employment contract (nuances).”

According to the explanations, it is enough that the deadlines are fixed in one of those given in Art. 136 Labor Code of the Russian Federation documents. Moreover, according to Rostrud, PVTR is a priority. He explains this by saying that the PVTR is a general document, the norms of which apply to all personnel, while an employment contract regulates relations with a specific employee, and a collective agreement may not be concluded at all.

In order to completely eliminate disputes with inspectors, you can do the following: fix the rules for issuing wages in the PVTR, and add a phrase in labor or collective agreements that refers to the PVTR: “salaries are issued in accordance with clause (here we indicate the clause number of the PVTR) of the rules labor regulations..."

Want another expert opinion? Sign up for a free trial of ConsultantPlus or, if available, proceed to the Salary Guide.

What to consider when setting payroll dates

Before approving salary dates, consider the possible risks and tax consequences. There are a number of slippery points that you should pay attention to:

- The expressions “every half month” and “twice a month” should not be confused. For example, the numbers 3 and 16 fit the definition of “twice a month,” but the rule of not exceeding a gap of 15 days is not followed here, since from the 16th to the 3rd it is more than half a month.

- It is dangerous to choose not clear dates, but a time period - for example, from the 1st to the 5th, as well as deadlines, for example, no later than the 5th and 25th. Firstly, Art. 136 of the Labor Code of the Russian Federation speaks of the need to establish specific dates, and secondly, there is a risk of confusion and exceeding the six-month interval between payments. The illegality of this approach is stated in the letter of the Ministry of Labor of the Russian Federation dated November 28, 2013 No. 14-2-242, the resolution of the Supreme Court of the Russian Federation dated May 15, 2014 No. 3-AD14-1, the ruling of the Trans-Baikal Regional Court dated September 5, 2012 No. 33-2867-2012.

- An insufficiently defined phrase will also be unsafe, for example: “salaries are paid no later than the 5th and 20th of each month.” After all, it is impossible to understand from such a phrase when an advance is given and when the final amount is given.

- When choosing convenient dates, you need to take into account the requirements of the Tax Code of the Russian Federation. Thus, the 15th day for the final payment turns out to be inconvenient, since the advance payment in this case falls on the 30th day, and this is the last day in many months. From the advance paid on the last day of the month, personal income tax will have to be withheld (clause 2 of Article 223 of the Tax Code of the Russian Federation, determination of the Supreme Court of the Russian Federation dated May 11, 2016 No. 309-KG16-1804). But in months that have 31 days, this is not necessary. This will create confusion for both the accountant and controllers.

To learn how to reflect the tax withholding date in 6-NDFL, read this article.

Is it permissible to pay salaries more than twice a month?

Yes, definitely. The Labor Code directly states that salaries are paid “at least every half month.” This means that restrictions are placed only on rarer payments to employees, but not on more frequent ones (letters from the Ministry of Labor of the Russian Federation dated 02/03/2016 No. 14-1/10/B-660, dated 12/06/2016 No. 14-1/B-1226 ).

If you wish, you can issue money not twice a month, but weekly and even daily. However, before switching to a more frequent frequency of salary payments, it is worth considering the feasibility of this: whether such a schedule will be convenient and beneficial for both employees and the employer himself.

Practice shows that this is beneficial for those employers who employ temporary staff; in other cases, the benefits of more frequent payment of money are completely unobvious, if not completely absent.

For information on how to conclude an agreement with a temporary worker, read the material “Art. 59 of the Labor Code of the Russian Federation: questions and answers.”

The weekly payment does not excite the staff either: according to repeated statistical surveys, the majority of employees would like to maintain a 2-time salary schedule.

Is it legal to pay wages ahead of schedule?

It is only legal if the payday falls on a weekend. In other cases, despite the fact that there is no violation of the rights of employees, it is not recommended to pay money earlier than approved by the employer’s LNA. This is fraught with claims from the labor inspectorate and the imposition of a fine.

As we have already found out, the Labor Code of the Russian Federation requires that the dates of payment of wages be clearly recorded in the employer’s LNA. By paying wages ahead of the approved date, strictly speaking, you will have to make appropriate changes to the LNA. However, it is unlikely that anyone will think about a global reworking of documents if the manager occasionally wants to meet employees halfway and issue, for example, a salary before the holidays (while the salary payment period falls on the day after the holiday). In addition, this may lead to an increase in the half-month period between payments, which is also not allowed.

Therefore, although the manager allowed the earlier payment of wages in the interests of the employees themselves, formally this situation is considered a violation (Part 1 of Article 142 of the Labor Code of the Russian Federation) and may lead to fines (Part 1 of Article 5.27 of the Code of Administrative Offenses of the Russian Federation). However, the risk of prosecution here is still small.

Notification to employees

If the employee has not signed an additional agreement to the employment contract, then the head of the enterprise recognizes the adjustment of the deadline for transferring salary as a change in labor conditions. In this case, the director of the company notifies each employee in writing about a future change in the time of salary transfer.

For your information

The employer sends notices to workers 2 months before making adjustments.

If the worker does not agree with the new demands of his superiors, then the manager has the right to fire him. In case of dismissal, the employer pays the worker a benefit in the amount of 50% of the average monthly salary (Articles 74 and 178 of the Labor Code of the Russian Federation).

What are the consequences of violating wage payment deadlines?

The employer's liability for such violations can be of two types: material and administrative.

Administrative liability applies only if the employer is at fault.

Primary administrative punishment (clause 1 of article 5.27 of the Administrative Code):

- warning or fine of 1,000–5,000 rubles. for officials;

- fine for the culprit - individual entrepreneur - 1,000–5,000 rubles;

- fine for the culprit legal entity - 30,000–50,000 rubles.

Repeated administrative punishment (clause 2 of article 5.27 of the Administrative Code):

- disqualification for 1–3 years or a fine of 10,000–20,000 rubles. for officials;

- fine for the culprit - individual entrepreneur - 10,000–20,000 rubles;

- fine for the culprit legal entity - 50,000–70,000 rubles.

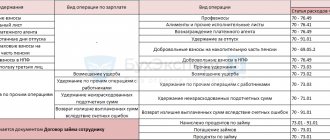

Financial liability (Article 236 of the Labor Code of the Russian Federation) is expressed in monetary compensation for each day of delay, calculated from 1/150 of the key rate of the Central Bank of the Russian Federation of the amount due for payment (minus personal income tax). This is the minimum amount of compensation, but the employer has the right to assign a larger amount. No application from the employee is required to receive it - it must be paid along with the delayed amounts.

IMPORTANT! Maternity compensation is paid regardless of whether the employer is to blame for violating salary deadlines.

In what other cases is the employer liable for financial liability? This publication will tell you.

New rules on advances

In 2021, officials clarified the rules for paying advance payments. They recommend:

- The size of the advance should not be determined arbitrarily; it should not be a larger or smaller part of the salary.

- It is prohibited to set an advance payment of a fixed amount for all employees.

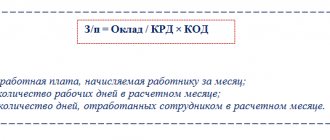

- Calculations must be carried out in proportion to the working time of employees.

- When determining the amount of the advance, it is necessary to take into account: salary and allowances. In this case, you cannot take into account those bonuses that are included in the final calculation of work for the month: bonuses for completing volumes, incentives for additional or night shifts.

- Incentive and compensation payments are taken into account at the time of salary calculation, that is, wages for the second half of the month worked.

Personal income tax is not paid on the advance amount; it must be deducted from the final salary amount. It is worth remembering that the difference between the advance payment and the final payment cannot be unreasonably increased.

How to make changes to documents and set the correct deadlines for paying wages

If for some reason you do not have LNA regulating the timing of salary transfers, they need to be done as quickly as possible. If the necessary LNAs exist, but the dates in them are indicated incorrectly, this should be promptly corrected:

- If possible, redo the document, but only if doing so will not cause inconsistencies with your other documentation.

- In order to change the collective agreement, assemble a commission of representatives of both parties - employees and employer. Document the results of the negotiations between the commission members in an additional agreement, in which you indicate the new salary terms.

- If salary dates were included in employment contracts, you will have to draw up additional agreements for each of them.

- Changes in the terms of payment of wages included in the PVTR are the easiest to formalize - to do this, it is enough to issue an order, which should be familiarized to each employee against signature.

You can see what such an order looks like here:

This might also be useful:

- Sick leave for pregnancy and childbirth

- Personal income tax withholding from wages and its return

- Compensation for staff reduction

- Daily travel expenses in 2021

- Do you need an accountant for an individual entrepreneur?

- Procedure for paying sick leave in 2021

Is the information useful? Tell your friends and colleagues

Dear readers! The materials on the TBis.ru website are devoted to typical ways to resolve tax and legal issues, but each case is unique.

If you want to find out how to solve your specific issue, please contact the online consultant form. It's fast and free!

Results

The frequency of payment of wages is established by Art. 136 Labor Code of the Russian Federation. It also obliges employers to set clear deadlines for issuing wages in the LNA. Failure to comply with these deadlines (or the absence of regulatory deadlines) falls under the articles of the Labor Code of the Russian Federation and the Code of Administrative Offenses of the Russian Federation on material and administrative liability.

Sources:

- Tax Code of the Russian Federation

- Labor Code of the Russian Federation

- Code of Administrative Offenses of the Russian Federation

You can find more complete information on the topic in ConsultantPlus. Free trial access to the system for 2 days.