If an organization acquires exclusive rights to a computer program that will be used for more than one year, then the costs of acquiring and creating the program form the cost of an intangible asset in accordance with the norms of PBU 14/2007. Since 2011 organizations have the right to independently determine the useful life of certain intangible assets (IMA), such as exclusive rights to inventions (sample, model), to use a computer program and database, to use the topology of integrated circuits, to breeding achievements, as well as ownership of " know-how" or a secret formula. There is a limitation in tax accounting - the useful life of intangible assets cannot be less than two years. In accounting, in accordance with clause 26 of PBU 14/2007, the useful life of intangible assets is determined based on: - the validity period of the organization’s rights to the result of intellectual activity or a means of individualization and the period of control over the asset; - the expected period of use of the asset, during which the organization expects to receive economic benefits (or use it in activities aimed at achieving the goals of creating a non-profit organization). The useful life of an intangible asset cannot exceed the life of the organization. Upon receipt of such a program, on the basis of an act drawn up in any form, an inventory card of the NMA-1 form is filled out. Based on the useful life determined upon acceptance of the program, and the depreciation method enshrined in the organization’s accounting policy, taking into account the requirements of PBU 14/2007, its depreciation is calculated from the month following the commissioning of the program. Example. Arsenal LLC in March 2011 acquired exclusive rights to a computer program worth 50,000 rubles. (excluding VAT) and intends to use this program for 5 years, which is confirmed by order. The accounting policy provides for the straight-line method of amortization of intangible assets. Arsenal LLC will make the following entries in its accounting records: In March 2011, Debit 04 Credit 60 - 50,000 rubles. – expenses for purchasing the program are reflected; Debit 60 Credit 51 - 50,000 rub. – the program has been paid for; Debit 04 Credit 08 - 50,000 rub. – the program was accepted for accounting as an intangible asset; From April 2011 to March 2021 inclusive Debit 20, 23, 25, 26, 44 Credit 05 - 833.33 rubles. (RUB 50,000/60 months) – depreciation of the program has been calculated for the month. ** For accounting purposes, the cost of intangible assets does not matter: the costs of acquisition or creation form the cost of an intangible asset, which is subject to depreciation over the useful life of the program (clause 6, 15 of PBU 14/2007). However, it has implications for tax accounting. If the cost of a software product exceeds 10,000 rubles, then such a program, just like in accounting, is recognized as an intangible asset for which depreciation is charged (clause 1 of Article 256, clause 3 of Article 257 of the Tax Code of the Russian Federation). If its cost is less than 20,000 rubles, then the costs of its acquisition as part of other expenses are written off as a reduction in the tax base at a time (clause 26, clause 1, article 264 of the Tax Code of the Russian Federation). However, most often, organizations do not receive exclusive rights to software products, but receive only the rights to use them based on a license agreement. When purchasing software, the buyer (Licensee) enters into a license agreement with the developer, the owner of the exclusive rights (Licensor), which defines the procedure and conditions for using the relevant software. The license agreement specifies its validity period. If the license agreement does not specify its validity period, the agreement is considered to be concluded for five years (clause 4 of article 1235, part 4 of the Civil Code of the Russian Federation). In this case, the costs of computer software should be considered as deferred expenses. Since these expenses generate income over a long period of time, the organization has the right to independently distribute them during the period of its use (clause 19 of PBU 10/99). Most often, companies write off these expenses in accounting evenly over the useful life of the program. And if it is not specified by the manufacturer, then they establish it themselves by appropriate order or in their accounting policies. Tax accounting provides for a uniform write-off of costs over the useful life of a software product (Clause 1 of Article 272 of the Tax Code of the Russian Federation). Accordingly, there is no difference in the reflection of the software purchase transaction in tax and accounting. Example. Arsenal LLC purchased a computer program worth 20,000 rubles in March 2011. (excluding VAT), the license agreement defines the period of use of the program as 2 years. Arsenal LLC will make the following entries: Debit 97 Credit 60 - 20,000 rubles. – expenses for purchasing the program are reflected; Debit 60 Credit 51 - 20,000 rub. – the program has been paid for; Debit 20, 23, 25, 26, 44 Credit 97 - 833.33 rub. (RUB 20,000/24 months) – 1/24 of the program cost was written off as part of the company’s current management expenses; These entries are reflected in accounting monthly for 24 months. ** When renewing the right to use the program, for example, purchasing new keys for an antivirus, renewal costs must also be distributed and written off evenly during its validity period.

Popular programs do not apply to intangible assets

The vast majority of accounting, warehouse and other programs, regulatory frameworks, antiviruses, as well as electronic reporting services cannot be classified as intangible assets.

The fact is that by purchasing such software, organizations and entrepreneurs do not receive exclusive rights to it. Such rights remain with the developer, and the client receives only a license to use. This is usually clearly stated in the license agreement that is concluded at the time of purchase of the program. The absence of exclusive rights to an object means that one of the conditions for recognizing intangible assets (hereinafter referred to as intangible assets) has not been met. This conclusion follows from paragraph 3 of PBU 14/2007 “Accounting for intangible assets” and from paragraph 3 of Article 257 of the Tax Code of the Russian Federation. Accordingly, in both accounting and tax accounting, the cost of the program must be written off as expenses.

Postings in commercial structures

Operations where a commercial institution acquires the exclusive right to use a new program must be recorded in accounting by a set of correspondence:

- By the date of acquisition, to reflect the amount of expenses incurred, a transaction is generated between D08.5 and K60.

- At the moment when the program is installed and you can start using it, a record is created for the cost of the software with D04 and K08.5.

- Every month, when depreciation amounts are calculated, account 20 (or 26, 44) is debited while account 05 is credited.

If the program was purchased at a cost not exceeding 40 thousand rubles, then the accountant draws up the following set of transactions:

- When purchasing software, expenses are taken into account through correspondence D08.5 - K60.

- When the program is put into operation, account 04 is debited and account 08.5 is credited.

- The full cost of the software in tax accounting is immediately transferred to the enterprise’s expenses by entry between D20 (or 23, 26, 25, 44) and K04.

- Depreciation will be calculated in accounting; correspondence D20 (or 23, 26, 25, 44) - K05 is intended for this.

If an institution purchased the software and received non-exclusive rights to it, then:

- when making a one-time payment at the time of purchasing the software, account 97 is debited, account 60 is recorded as a credit;

- the software license is accounted for as a debit turnover in off-balance sheet account 012;

- Every month, part of the costs incurred is transferred to the expenses of the upcoming periods by posting D20 (or 23, 26, 25, 44) - K97.

IMPORTANT NUANCE! It is legally prohibited to use illegal versions of software. The use of pirated programs in work is punishable by civil and criminal law in Art. 1252 of the Civil Code of the Russian Federation and Art. 146 of the Criminal Code of the Russian Federation.

When carrying out the procedure for updating a software product or performing specialized maintenance, the money spent on this is shown in debit 20 (25, 23, 44, 26) and credit 60 of the account.

How to determine useful life

To properly take into account the program, you need to know the period of its use. Most often it is equal to the license validity period. This period is specified in the license agreement, the text of which is presented in the form of a separate document or posted on the packaging.

Another option is possible: the period of use of the program is equal to the validity period of the contract itself.

If the agreement and contract do not mention the term, then it is considered equal to five years. This is stated in paragraph 4 of Article 1235 of the Civil Code.

Depreciation groups and classifier

Since 2021, a classification has come into effect, which was approved within the framework of Decree of the Government of the Russian Federation No. 1 of January 1, 2002. According to its standards, all fixed assets are divided into depreciation groups, the number of which is 10 . They are discussed in detail in the table.

| Depreciation group number | Useful life of fixed assets, terms are indicated inclusive | Example in practice |

| 1 | 1-2 years | Machines, complex mechanisms and pieces of equipment |

| 2 | 2-3 years | Pumps used for pumping liquid substances |

| 3 | 3-5 years | Radio-electronic mechanisms designed to provide communication |

| 4 | 5-7 years | Fences and fences made of reinforced concrete material |

| 5 | 7-10 years | Structures directly related to the forest industry |

| 6 | 10-15 years | Water wells |

| 7 | 15-20 years | Sewage and treatment plants |

| 8 | 20-25 years | Main wires |

| 9 | 25-30 years | Structures, excluding residential buildings |

| 10 | From 30 years old | Residential buildings |

To determine the depreciation group to which certain fixed assets belong, you must use the classifier . If there is no data in it, the specialist has the right to set the period independently, based on data on the service life specified in the technical documentation or the manufacturer’s recommendations.

Along with this, other OS classification criteria are applied. For example, according to the degree of exploitation in the enterprise's activities, funds are allocated in use, reserve, repair, and completion.

According to the ownership of the owner, they can be their own, leased, received for operational / trust management. Depending on their functional purpose, they may belong to the production and non-production groups. Based on their participation in the production process, they can be considered active and passive.

How to reflect the cost of the program in accounting

Last year and earlier, the cost of software was reflected in the debit of account 97 “Deferred expenses”, and then written off to current costs during the period of use.

Starting from 2011, this option raises certain doubts, since the rules for accounting for deferred expenses (abbreviated as FPR) have changed. According to the new rules, expenses relating to future periods are reflected in the balance sheet in accordance with the conditions for recognizing assets and are subject to write-off in the manner established for writing off the value of assets of this type*. Unfortunately, this formulation does not allow us to draw an unambiguous conclusion on how to reflect the BPR and whether the cost of the program can be attributed to them.

Nevertheless, antiviruses, regulatory frameworks, electronic reporting services and other software must still be taken into account in account 97, because such a requirement was retained in paragraph 39 of PBU 14/2007 “Accounting for intangible assets”. In addition, the programs must be shown as a debit to the off-balance sheet account. There is no suitable off-balance sheet account in the chart of accounts, so you can create one yourself.

In financial statements, the cost of software must be reflected in a new way. If previously the program, like all other BPOs, was shown in the “inventories” line, now it should be placed in the “other current assets” line.

Example 1

On October 31, 2011, the trade organization acquired a license to use the program. The cost of the license is 6,000 rubles, the validity period is 12 months.

The accounting policy stipulates that the company uses off-balance sheet account 015 to account for software.

In October, the accountant made the following entries: DEBIT 015 - 6,000 rubles. – the cost of the license is reflected; DEBIT 97 CREDIT 60 - 6,000 rub. – the cost of the license is taken into account as a deferred expense.

Starting in November, the accountant makes monthly entries: DEBIT 44 CREDIT 97 - 500 rubles. (RUB 6,000: 12 months) – the cost of the license is written off as current expenses.

Thus, for the period from November to December, the accountant wrote off an amount equal to 1,000 rubles on account 97’s credit. (500 + 500).

As of December 31, 2011, the debit of account 97 shows the value of 5,000 rubles. (6,000 - 1,000). This figure will be reflected in the annual balance sheet as part of other current assets.

In October 2012, the cost of the license will be completely written off as operating expenses. Then the following entry will appear in accounting:

LOAN 015 - 6,000 rub. – the cost of the license has been written off.

SPI when purchasing a used fixed asset

If a company calculates depreciation using the straight-line method, during the acquisition of an operating system that was in use, it can set this indicator based on the classifier, reducing its value by the number of years/months during which it was used by the previous owner.

Another option is to take the figure that was used by the previous owner and reduce it by the number of years/months that the property was used by the new owner. If the result is a zero or negative period, the company will be able to set it taking into account safety requirements and other aspects.

How to reflect the cost of the program in tax accounting

Companies that apply the general taxation system can take into account the costs of the program when taxing profits (subclause 26, clause 1, article 264 of the Tax Code of the Russian Federation). But the question remains controversial as to how costs should be formed using the accrual method: at a time when purchasing software, or gradually over the period of useful use.

Officials believe that if the license agreement sets a period, then the costs of purchasing software should be taken into account evenly over this period (see letter of the Ministry of Finance of Russia dated 06/07/11 No. 03-03-06/1/331).

However, there is also an opposite point of view. According to it, costs can in any case be written off at a time, since the Tax Code does not contain any prohibitions in this regard. There are many examples in arbitration practice when judges supported this particular position (see, for example, decisions of the FAS Volga District dated 02.16.09 No. A55-9496/2008 and FAS Moscow District dated 09.07.09 No. KA-A40/6263-09) .

In our opinion, it is permissible to immediately include the full cost of the license in expenses. An organization that classifies such costs as indirect has an additional argument. Indeed, in accordance with paragraph 2 of Article 318 of the Tax Code of the Russian Federation, indirect costs are reflected in the period in which they arose.

Companies using the cash method can write off program costs as a lump sum without hesitation. The same applies to the “simplified” ones (they take into account these costs on the basis of subparagraph 19 of paragraph 1 of Article 346.16 of the Tax Code of the Russian Federation).

Maintain accounting and tax records for free in the web service

Accounting software

The Civil Code does not contain the concept of “software”.

But it is given in the “Modern Economic Dictionary” {amp}lt;1{amp}gt;: it is a set of computer programs that provides data processing or transmission. In turn, a computer program is a set of data and commands presented in an objective form, intended for the operation of a computer and other computer devices in order to obtain a certain result, including preparatory materials obtained during the development of a computer program, and the audiovisual displays generated by it (art. 1261 Civil Code of the Russian Federation). In accordance with paragraph 1 of Art. 1225 of the Civil Code of the Russian Federation, computer programs refer to intellectual property (the results of intellectual activity and equivalent means of individualization of legal entities, goods, works, services and enterprises that are granted legal protection). Intellectual rights are recognized for the results of intellectual activity and means of individualization, which include:

- exclusive right (relates to property rights);

- personal non-property rights;

- other rights (rights of succession, access, etc.).

https://www.youtube.com/watch?v=ytdevru

Based on paragraph 1 of Art. 1229 of the Civil Code of the Russian Federation, a citizen or legal entity that has an exclusive right to the result of intellectual activity or a means of individualization (right holder) has the right to use intellectual property at its own discretion in any way that does not contradict the law.

According to paragraph 1 of Art. 1233 of the Civil Code of the Russian Federation, the copyright holder may dispose of the exclusive right belonging to him in any way that does not contradict the law and the essence of such right, including:

- by alienating it to another person under an agreement (agreement on the alienation of an exclusive right). Under such an agreement, one party (the copyright holder) transfers or undertakes to transfer its exclusive right to the result of intellectual activity (means of individualization) in full to the other party (the acquirer);

- by granting another person (licensee) the right to use the result of intellectual activity (means of individualization) within the limits established by the agreement (based on a license agreement). In this case, the exclusive right does not pass to the licensee. An agreement that does not directly indicate that the exclusive right to a result of intellectual activity (means of individualization) is transferred in full is considered a license agreement, with the exception of an agreement concluded in relation to the right to use a result of intellectual activity specially created or being created for inclusion in a complex object.

Thus, an organization can acquire exclusive rights to the software or only the right to use a computer program (non-exclusive right). For accounting and tax purposes, this is the first thing you need to figure out.

3 p. 1 art. 1288 of the Civil Code of the Russian Federation is compensated, unless otherwise provided by agreement of the parties. Therefore, the contract must define the amount of remuneration or the procedure for determining it. If the subject of the contract is the development of a computer program, then the remuneration is usually determined in the form of a fixed amount.

A computer program created under an author's order agreement may become the object of intangible property if the agreement provides for the alienation to the customer of the exclusive right to the program, which must be created by the author. A computer program can be created to order. If a program was created under an agreement, the subject of which was its creation, the exclusive right to such a program on the basis of Art.

1296 of the Civil Code of the Russian Federation belongs to the customer, unless otherwise provided by the agreement between the contractor (performer) and the customer. A computer program can be created when performing work under a contract or R&D agreement that did not directly provide for its creation. In this case, the exclusive right to such a program in accordance with Art.

1297 of the Civil Code of the Russian Federation belongs to the contractor (performer), unless otherwise provided by the agreement between him and the customer. Meanwhile, the exclusive right to the program can be transferred by the contractor (performer) to the customer. A computer program can be created by an employee of the organization as part of the performance of job duties. According to paragraph 1 of Art.

1295 of the Civil Code of the Russian Federation, a service work is a work created within the scope of labor duties established for the employee (author). The exclusive right to a work generally belongs to the author, as established by paragraphs. 1 item 2 art. 1255 of the Civil Code of the Russian Federation. But in relation to the official work of paragraph 2 of Art.

1295 of the Civil Code of the Russian Federation establishes a special rule according to which the exclusive right to a work for hire belongs to the employer, unless otherwise provided by an employment or other agreement between him and the author. It should be noted that works of service have characteristic features, the main of which is the existence of an employment relationship between the author of the work and the employer.

Labor relations arise on the basis of an employment contract concluded in writing between the employee and the employer, as established by Art. 16 of the Labor Code of the Russian Federation. An official work is accepted for accounting as intangible assets at the actual (initial) cost determined as of the date of its acceptance for accounting, which follows from paragraph.

6 PBU 14/2007. The list of expenses associated with the acquisition of intangible assets for a fee is determined by clause 8 of PBU 14/2007. When creating a computer program, in addition to the costs listed in clause 8, the initial cost of the program also includes the costs listed in clause 9 of PBU 14/2007. And the last condition that must be met in order for the computer program to be taken into account as part of intangible assets, is its lack of material form.

Difference between tax and accounting

If in accounting the costs of the program are taken into account as part of the RBP, and in tax accounting they are written off in full upon purchase, a taxable temporary difference arises. It, in turn, gives rise to a deferred tax liability, which should be accounted for in account 77 of the same name.

Example 2

On November 30, 2011, the production company acquired a license to use the program. The cost of the license is 4,800 rubles, the validity period is 24 months.

In accounting, the license is reflected as a deferred expense; in tax accounting, it is immediately written off as an expense.

In November, the accountant made the following entries:

DEBIT 97 CREDIT 60 - 4,800 rub. – the cost of the license is taken into account as a deferred expense; DEBIT 68 subaccount “Income Tax” CREDIT 77 - 960 rub. (RUB 4,800 x 20%) – deferred tax liability is reflected.

Starting in December, the accountant makes monthly entries:

DEBIT 20 CREDIT 97 - 200 rub. (RUB 4,800: 24 months) – the cost of the license is written off as current expenses; DEBIT 77 CREDIT subaccount 68 “Income tax” - 40 rubles. (RUB 200 x 20%) – the deferred tax liability is partially repaid.

Thus, the deferred tax liability will be finally settled in the period of write-off of the RBP, that is, in November 2013.

Changes and revisions of the SPI during operation of the OS

As already noted, an enterprise has the right to increase SPI if, in the course of changes occurring in relation to a fixed asset, its term has changed upward.

With all this, the establishment of a new period occurs within the periods that are established for the depreciation group that initially included this fixed asset. Due to modernization, the OS cannot be included in another group.

The change in useful life of fixed assets is presented in the video below.

Installation, customization and cloud services costs

Taxpayers who are on a common system have the right to take into account the costs of installation, adaptation, updating, fees for calling a specialist and other similar amounts when determining the tax base. The Russian Ministry of Finance shares the same opinion (see, for example, letter No. 03-03-06/1/826 dated November 27, 2007 and letter No. 03-11-04/2/100 dated April 12, 2007).

With a simplified system, such costs can also be taken into account when determining the taxable base. Subclause 19 of clause 1 of Article 346.16 of the Tax Code of the Russian Federation states that expenses include amounts associated with the acquisition of the right to use computer programs, databases, and update costs. In our opinion, the cost of installation, adaptation and other related expenses are associated with the acquisition of a license, so they can be taken into account when taxing profits.

Let us add that in recent years the so-called “cloud” technologies have become very popular. Those who used them do not install the software on their computer. Instead, users go to the developer’s server and perform all the necessary operations there. The source data and calculation results are stored on the developer's server. This technology is also called “thin client”. The most famous example of this is the system for sending electronic reporting “Kontur-Extern”, as well as other services of the SKB Kontur company - a web service for calculating wages, salary taxes and contributions “Eureka”, a reference and legal web service “Normative”, web service for entrepreneurs and LLCs using special Elba modes, etc.

Payment for cloud or web services is nothing more than the costs associated with acquiring the right to use computer programs. Consequently, they can be taken into account in both the general and simplified taxation systems.

Documenting

Each operation performed at the enterprise is accompanied by documentation. To include objects in the OS and take into account the fact of their commissioning, the following documents :

- the act related to the acceptance and transfer of an asset, with the exception of buildings and structures, is filled out according to form No. OS-1;

- act on acceptance and transfer of buildings/structures (No. OS-1a);

- document on internal movement of fixed assets (form No. OS-2);

- repair (No. OS-3);

- inventory card (No. OS-6);

- write-off act (No. OS-4, 4a, 4b);

- accounting of equipment and its transfer (No. OS-14 and No. OS-15, respectively); if there are defects, form No. 16 is used.

These are the basic forms used in practice most often, depending on the operations performed with fixed assets.

If the program was purchased online

Often the right to use the program is purchased on the Internet. The buyer transfers money and in return receives an activation code, with which he downloads the software to his computer. Before installation, the client reads the text of the license agreement, presented in electronic form, and, using a special option, confirms his agreement with its terms. At the same time, the buyer does not have a “paper” agreement, act or other documents.

In such a situation, will it be possible to write off the cost of the license as an expense? We believe that it will not succeed, since there is no documentary evidence, and the conditions for recognizing expenses set out in Article 252 of the Tax Code of the Russian Federation are not met. The only way out is to ask the developer to send a “paper” version of the license agreement. In addition, it is better to pay for the license not from a mobile phone or from an electronic wallet, but from a regular bank account. Then, during the inspection, you can present the inspector with a payment order that is familiar to him, which, most likely, will allow him to avoid claims. Officials also come to similar conclusions (see, for example, letter of the Ministry of Finance of Russia dated September 28, 2011 No. 03-03-06/1/596).

*New edition of clause 65 of the Regulations on accounting and financial reporting in the Russian Federation, approved by order of the Ministry of Finance of Russia dated July 29, 1998 No. 34n.

Write-off of deferred expenses

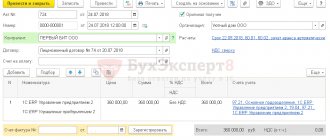

The operation is routine. It will be carried out according to the specified parameters (procedure for recognizing expenses, period, write-off account) automatically when performing the monthly “Closing the month” processing. The program itself will determine the need to write off the RBP and calculate the amount.

When performing the operation, a posting is generated according to the specified cost account (in our example, account 26), the amount is calculated based on the selected write-off start date and end date.

In the form of document movements on the “Calculation of write-off of deferred expenses” tab, the user can see the calculation of the write-off of BPR, write-off parameters, the amount of written off BPR and the balance.

Automatic write-off of future expenses will be performed by month-end closing processing until the end of the specified write-off period.

The transaction for writing off the RBP created at the end of the month is saved together with other period-closing transactions in the journal of routine operations (section “Operations” – Closing the period – Routine operations). The program allows you to create this operation manually, without using the “Month Closing” processing.