What is considered a business trip?

The law contains a clear definition of what exactly can be considered a business trip. This is a trip during which you perform a work assignment for another company. In this case, the receiving party can be located either in the region where the subject is located or in another locality or country.

Trips to advanced training courses, as well as the temporary transfer of an employee to another structural unit located in the same area cannot be business trips, but such a transfer should not entail changes in the terms of the employment agreement.

However, an employee’s trip on instructions from management from the head office to the regional office and back will be considered a business trip.

The duration of the trip is determined by the management of the business entity and is specified in the business trip order or official assignment.

Attention: within 3 days from the date of return from a business trip, the employee must provide a report on the work done and documents confirming expenses.

How to submit an application for reimbursement of expenses?

It is important to create a worksheet with the costs and request for reimbursement. The author must become more attentive to all receipts, because every expense must be confirmed. A simple example: if there is no ticket to a business trip or a travel pass is missing, it will be difficult to prove that it was the business trip that caused the expenses. Anyone who has been on a business trip should write about the main expenses that will relate to business purposes. The time of the business trip is also indicated, for example, the start of departure is on the 10th of January, and the end is on the 20th of January.

Free legal consultation by phone:

8

Who cannot be sent on a business trip

Under normal conditions, the management of a business entity has the right not to ask the wishes of an employee when sending him on a business trip, since it will be the fulfillment of his direct job responsibilities.

However, the law establishes several categories for whom business trips are either completely prohibited or require prior written consent.

There is a ban on sending the following employees on business trips:

- A woman who is expecting a child;

- Workers who are minors at the time of travel. However, this prohibition does not apply if these employees have creative professions (actors, journalists, singers, etc.) or are professional athletes.

- Employees who perform labor duties on the basis of an apprenticeship contract.

Important: these employees are prohibited from being sent on business trips, even if they give written consent to this.

The following employees are required to obtain their written consent to be sent on a business trip:

- Women who have small children. Also included in this category are the only parents of children under three years of age;

- Single workers if their children are under five years old;

- Employees who have children with disabilities in their family;

- Workers who care for sick members of their family;

- Employees who have a disability and if their travel on a business trip will disrupt the recovery program.

For all these categories, before completing documents for a business trip, you must obtain written consent for this. In addition, the form must indicate that these employees are aware of their right to refuse the trip.

Attention: a rather complex case is the official trip of an internal part-time worker. The law does not prohibit sending such workers on trips. At the same time, there is no certainty about how exactly to mark this employee in the report card at the second place of work.

The law prohibits granting him unpaid leave or basic leave for such a period. It is optimal to provide him with additional paid leave for the specified period in the second place.

Duration of business trips

The duration of a business trip is set by the head of the company, who fixes this period when issuing an order for sending on a business trip.

The decision on how many days an employee should leave is determined by the production goals that are set for him, as well as the expected deadline for their implementation.

Attention: if the current regulations require the execution of a work assignment, then it is also necessary to indicate the duration of the trip.

Since sometimes it is not possible to take into account the influence of all factors, the duration of a business trip can be either reduced or increased. In these cases, it is necessary to issue a separate order from the company administration.

Previously, there were regulations that established that a business trip should be a trip of more than 1 day and a duration of no more than 40 days. If the travel period exceeded the specified limits, then it was necessary to issue an order for the transfer of the employee.

Attention: currently the current documents do not establish either the minimum duration of the trip or the maximum.

Sometimes there is confusion between the concept of business travel, as well as employees who are constantly traveling to perform their work functions.

In this case, it is necessary to understand what is a business trip and what is work that, on the basis of a formalized employment agreement, has a traveling nature. It is also necessary to distinguish a business trip from a transfer to work in another location.

Documents for business trip

Mandatory

Due to the fact that changes have been made to the legislation regulating business trips, now only two documents have the status of mandatory.

These include:

- A business trip order is the main document that sets out the goals, direction of the trip, duration, etc. A T-9 form or company letterhead is usually used for it.

- An advance report is a document with which an employee confirms expenses during a business trip. Must be submitted with accompanying documents (receipts, checks, etc.). The standard form AO-1 is used.

Additional

These documents do not need to be completed. However, the desire to use them must be reflected in the internal acts of the company.

- A travel certificate is a form on which the stamps of the receiving organizations are affixed. Sometimes the certificate form may include both a job assignment and an expense report.

- A work assignment is a document in which information about work on a business trip is entered. The standard T-10a form can be used.

- A task report is a form in which the employee must describe in detail the work done during the trip.

- Record book for employees going on business trips;

- Service memo - it must be drawn up to express a request for payment of expenses if the employee used personal transport.

What expenses in tax accounting include travel expenses?

If a business trip is related to production or sales, then travel expenses are included in tax accounting as other expenses (clause 12, clause 1, article 264 of the Tax Code of the Russian Federation).

But if a business trip is related to the acquisition of a fixed asset, then it is safer to attribute travel expenses to its original cost, since, as a general rule, all expenses associated with the acquisition of fixed assets (except for VAT and excise taxes) are taken into account in their original cost (clause 1 of Art. 257 of the Tax Code of the Russian Federation).

In the same way, we recommend attributing travel expenses to the cost of inventories if the business trip was related to their acquisition (clause 2 of Article 254 of the Tax Code of the Russian Federation).

At the same time, from the Letter of the Federal Tax Service of Russia for Moscow dated May 19, 2009 N 16-15/049826, it follows that travel expenses do not increase the cost of the fixed asset, but are classified as other expenses.

If you want to classify travel expenses associated with the acquisition of fixed assets or inventories as other expenses, then it is better to first clarify this issue with your tax office.

How to arrange a business trip for an employee in 2018

Step 1. Create a travel order

To issue an order to send an employee on a business trip, you can use standard forms T-9, T-9a, or draw up an order in free form on the company’s letterhead.

Previously, the basis for issuing an order was a job assignment. This document had to be entered as a basis. Now in this column you need to indicate the details of the director’s order, memo, or leave this field blank.

The employee who is mentioned in the document must read it and put a confirming signature.

Important: if an employee uses his own vehicle to complete the trip, then this circumstance must be indicated in the order, or a separate order must be issued.

Step 2. Issue accountable money

If an employee goes on a business trip, he needs to receive funds to cover expenses - purchasing fuel, renting housing, paying for tickets, etc. He is also entitled to a daily allowance for each day of the business trip.

The cost limit for each of these areas should be set out in a local act for the enterprise.

The basis for the employee to be given the necessary funds is a business trip order. In addition, the employee can draw up a memo and set out the expected amount of expenses. However, in order for the cashier to issue it, the employee must have an executive visa.

If the trip is carried out within the country, then accountable funds can be issued from the cash desk in cash or transferred to the card.

Attention: if an employee goes abroad, then the daily allowance for the days when he travels through the territory of Russia is issued in rubles, and for the days he is in a foreign country - in foreign currency.

Step 3. Issue a travel certificate (if necessary)

Local regulations may indicate that when an employee is sent on a business trip, he must be issued a travel certificate.

The company can use different forms for these purposes, including those combined with a progress report, expense report, business trip assignment, etc.

The document also contains a place where receiving companies must affix their seals. But under the new law they are not considered mandatory.

Attention: it is also no longer necessary to keep a log of posted workers. But companies can use it at their own discretion, after securing the form.

The following data is usually recorded in the log:

- Information about the employee;

- The name of the company where he is going;

- City name;

- Days of departure and arrival;

- Mark on submission of the trip report to the accounting department.

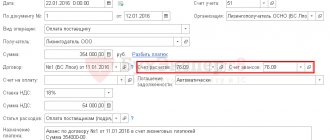

Step 4. Complete an advance report

Within 3 days from the moment the employee returns, he needs to draw up and submit to the accountant a report on expenses incurred in Form AO-1.

If this step is enshrined in internal documents, then a report on the work performed can also be submitted along with the advance report.

For such a document, a free form can be used, or column 12 in the official assignment form of the T-10a form can be used.

The employee must attach documents confirming travel expenses to the advance report:

- Documents confirming the employee’s accommodation - a hotel bill, a receipt for accommodation indicating the number of days and the cost of one day, an apartment rental agreement.

- Travel documents to the place of assignment and back - tickets, checks, receipts, etc.

- Documents to confirm the use of taxi services - receipts, tickets, etc.

- An official note on which the employee deciphers the expenses incurred when traveling by personal transport. Receipts from gas stations, etc. can also be attached to it.

- An official note explaining that the employee cannot provide supporting documents for the trip;

- Other supporting documents (for example, receipts for cellular communications).

Step 5. Return the unused amount to the cash register (if any)

If an employee has unspent funds after returning from a trip, he must return them to the cashier within 3 days from the date of submission of the advance report. When receiving them, the cashier must issue a receipt order.

The law determines that this amount can be withheld from wages, but only within a month from the end of the voluntary return period. If the specified month has passed, then money can only be recovered from the employee through a court decision.

Attention: an employee can voluntarily record a statement to deduct this amount from his salary. Based on it, an appropriate order should be issued. However, the amount of funds withheld cannot exceed 20% of the salary accrual for the specified period.

Step 6. Compensate for overspending by the employee (if necessary)

All expenses of an employee on a business trip are planned. However, it is impossible to take into account all points. And an employee on a business trip may require more funds than was originally determined.

Upon returning from a business trip, this individual draws up an advance report in which he records, among other things, unnecessary expenses. If he can prove that the expenses incurred are justified, then the overspending should be compensated by issuing money using a consumable or transferring it to a card.

To correctly make a decision on the validity of expenses incurred on a business trip, you need to consider the following points:

- These expenses were incurred for urgent reasons.

- Do the costs incurred have documentary evidence? In this case, the documents must be drawn up correctly.

- The expense report presented to the company's management is correctly completed.

Amounts of overexpenditure on business trips must be compensated within three days from the date of submission of the advance report.

Otherwise, the employee may go to court to protect his rights, and he will have to pay not only these costs, but also interest for the use of amounts not paid on time.

Attention: if a business entity does not have the opportunity to repay the entire debt to the employee at once, a repayment schedule should be drawn up. It must be signed by both parties to the employment relationship.

Is it possible to send an employee on a day off?

Circumstances may develop such that the employee will have to complete the assigned tasks from the very beginning of the week. Therefore, he needs to go on a business trip on a day off.

Management must discuss this issue with the employee being sent on a business trip. The fact that the business trip period will begin to count from the day off must be recorded in the order. The employee will also need to obtain consent to work on a day off.

To avoid controversial situations, it is recommended that the order consider the issue of the working hours of a company employee sent on a business trip during the period that falls on his day off. This point must be taken into account in order to determine the procedure for remunerating the employee at this time.

For example, an employee goes on a business trip to another location. To do this, he needs to leave on Sunday evening by train. If you reflect that the employee goes on a business trip on Sunday evening, then only these few hours will be paid, and not the whole day.

Important: if the employer ignores this fact and determines that the employee should go on Sunday, he will have to pay for the whole day. Do not forget that work on holidays is paid double or single, with the employee being given the choice of any other day.

Calculation examples

Let's figure out how to calculate travel expenses using specific examples.

Example No. 1.

The employee was sent on a business trip around Russia for 5 days. On 03/12/2018 at 10:20 he bought a train ticket, on March 16 at 15:00 he returns. The daily allowance in the organization is 700 rubles.

The calculation is as follows: 5 days × 700 rubles. = 3500 rubles - daily allowance.

Example No. 2.

The employee was sent on a business trip for 10 calendar days, starting on November 5. The daily allowance established by the organization is 500 rubles per day. However, the ticket was purchased for 11/04/2018 (departure time 23:50). The return train ticket was purchased for November 15, 2018 (time 04:20).

Calculation of daily allowance: 12 days (from November 4 to November 16) × 500 rub. = 6000 rubles.

Example No. 3.

The company decided to send a specialist for 8 days. The daily allowance rate is 1000 rubles. in a day. Upon return, there was downtime due to a transport breakdown (2 days).

Calculation: 10 (8 + 2) days × 1000 rub. = 10,000 rubles.

IMPORTANT!

Since the amount of daily allowance exceeds the established limit, therefore, the accountant must withhold personal income tax and calculate insurance premiums.

Calculation procedure:

Personal income tax = (10,000 – (10 × 700)) × 13% = 3000 × 13% = 390 rubles.

Advance amount for travel expenses in hand = 10,000 – 390 = 9,610 rubles.

Insurance premiums: (10,000 – (10 × 700)) × 30.2% = 3000 × 30.2% = 906 rubles.

Can I extend or reschedule my business trip?

The current regulations do not provide for a ban on extending an employee’s business trip. It can also be transferred to a future trip when all the documents for it have already been prepared.

However, the regulations do not determine how to formalize this.

Extension of a business trip should occur on the basis of the publication and corresponding order of management, which is drawn up in any form.

It must include in its contents not only all the necessary details, but also the reason for the extension of the business trip and new dates for the business trip.

Attention: adjustments must be made to all previously issued documents. In them you need to carefully cross out the old date of the trip with one line, and indicate the new date on top. All this must be done so that the old record can be read.

The administration and responsible employees are responsible for recalculating previously issued daily allowances and increasing the amount of funds for a business trip due to an increase in its duration.

If the employee is already on a business trip, then all these funds must be transferred to him either by bank transfer, or by postal order or other method provided for this.

The law prohibits an employee from using his personal funds for these purposes. This rule applies to cases even when, by order of the administration, these expenses were reimbursed.

Attention: in order to reschedule business trips, you also need to prepare a corresponding order, which necessarily records the new dates of the employee’s trip on a business trip.

Corresponding changes must be made to previously issued documents, where old travel dates are crossed out and new dates are indicated at the top. There is no need to recalculate the daily and other expenses of an employee on a business trip, this is only a transfer; the duration of the trip remains the same.

Results

Standards for processing documentation related to sending employees on business trips have become more flexible since 2021 and have reduced the amount of paperwork for the enterprise’s personnel department.

However, a company’s expenses are not only cash costs, but also an item that reduces the tax base for calculating income tax, which is under the close attention of the Federal Tax Service. That is why the employer fights for every penny, sometimes becoming conservative: for example, using the previous rules for processing documents related to sending on a business trip. The main condition for this is the consolidation of all controversial issues in an internal regulatory document - the accounting policy of the enterprise. This will make it much easier for the tax authorities to prove that you are right regarding business trip expenses. You can find more complete information on the topic in ConsultantPlus. Free trial access to the system for 2 days.