- home

- Reference

- Privileges

Elderly Russians with official pensioner status can count on various social support measures. They receive payments from the state and can also stop working.

They are offered numerous additional payments and benefits that can significantly reduce their financial burden. Such assistance measures also include tax breaks that allow reducing payments on various property.

What taxes do pensioners pay and what benefits do they have?

In accordance with paragraph 2 of Art. 217 of the Tax Code of the Russian Federation, state pension provision does not fall under the group of taxable income. No tax is paid on the pension and is not deducted when calculating its amount.

The current tax legislation distinguishes between several main categories of taxes paid by individuals: federal, regional, local. These categories include all obligations that individuals, including pensioners, are required to comply with.

For convenience, each of these categories will be considered separately. It will also be determined whether pensioners are required to pay this type of tax, or have the right to receive benefits or a complete exemption.

List of relaxations

In 2021, the transition period continues, based on which the age at which citizens retire is changed. The procedure is currently performed by women aged 56.5 years and men aged 61.5 years.

Citizens who become pensioners automatically receive the opportunity to apply for various tax benefits. For them, the amount of land and property taxes is reduced. In many regions, transport tax payments are being reduced. If a person stops working, he does not pay personal income tax, since no income tax is charged on the pension.

Attention! Benefits can be not only federal, but also regional, and some require registration by the pensioner, so you must independently contact the Federal Tax Service with official applications for recalculation.

Personal income tax

In terms of income received by pensioners, with the exception of the state pension, no benefits are provided. For working pensioners, employers pay personal income tax in the same manner as for other employees.

If a pensioner is engaged in any income-generating activity, then he is obliged to pay personal income tax on time in the amount of 13% of income. The tax is classified as federal, so regional and local authorities cannot in any way influence the fulfillment of this obligation.

This obligation applies to all other types of income, including lottery winnings. Therefore, any income must be taxed. Here, pensioners are treated the same as all other citizens of the Russian Federation. Summary: pensioners pay income tax on income not specified in Art. 217 Tax Code of the Russian Federation.

There are no benefits for individuals, including pensioners. This rule most affects working pensioners, whose taxes are actually paid by the employer. Pensioners pay all federal taxes that apply to individual entrepreneurs and individuals, and specified in Article 13 of the Tax Code of the Russian Federation.

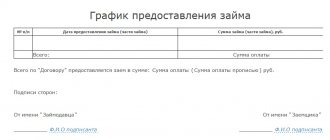

Procedure for applying for tax benefits

Tax benefits for pensioners on property taxes (real estate, transport and land) most likely will not have to be issued - the Federal Tax Service can track the property of each taxpayer and knows when a person retires.

If the benefits are not automatically connected, you need to contact the tax office with an application

. This application is single for 3 property taxes, its form can be found on the Federal Tax Service website https://www.nalog.ru/cdn/form/5686398.pdf

There is nothing complicated in filling out the application - all the data will need to be copied from the documents: pension certificate, car title, cadastral passport of the apartment.

The easiest way is to fill out an application on the tax service website by logging in through “Government Services”. But to send an application you need to have an electronic signature, which not everyone has.

Therefore, you will have to go to the Federal Tax Service. It is advisable to have with you documents confirming your right to benefits (this is a pension certificate) and documents for real estate, land or a car. But you can only take your passport with you - the Federal Tax Service is obliged to request information about the right to benefits

in other departments. The submitted application will be considered within 30 days.

By submitting an application for a tax benefit for one or more property taxes, a pensioner will receive them not only for the current year, but also for the previous 3 (if he then had the right to benefits, but did not use them). If this results in an overpayment, it will be refunded.

Exemption from taxation of pensions is automatic - such income is in principle not taxed. Therefore, no documents need to be submitted.

To exercise the right to a property deduction for personal income tax for the previous 3 years, a pensioner needs to provide a declaration in form 3-NDFL, and more than one. The declaration is submitted for the year in which the property was purchased, as well as for the previous 3 years

– if a person worked in them and paid personal income tax.

You can submit a declaration in order to then receive a property deduction during the entire year following the year in which the property was acquired (the standard declaration deadline of April 30 does not apply here).

The declarations themselves can be filled out through the special “Declaration” program, which is available on the Federal Tax Service website (https://www.nalog.ru/rn77/program/5961249/). Please note that it must be uploaded for the year for which the declaration is being submitted (their forms may have changed).

The completed declaration must be submitted to the Federal Tax Service (if there is no electronic signature). You will also need to have documents confirming your right to a tax deduction.

Transport tax

This type of tax is included in the regional category. That is, there is no single tax rate, as is the case with income tax. The final rate is set at the regional level, so this indicator may differ in two different regions of the Federation.

Therefore, the transport tax does not fall under federal incentive programs. If benefits are provided, then only at the regional level. As practice shows, in a number of regions of the Russian Federation, concessions on this tax are provided for WWII veterans, labor veterans, heroes of the USSR (Russian Federation), and disabled people of certain groups.

For example, in Moscow, ordinary pensioners who are not included in the list of beneficiaries pay transport tax on the same basis as other categories of citizens. Therefore, to clarify this information, the pensioner needs to contact the territorial tax authorities at the place of residence (permanent registration).

The remaining regional taxes are the gambling business tax and the corporate property tax. They apply to legal entities and do not affect pensioners in any way. As a result: pensioners pay only transport tax among regional taxes. If a pensioner can count on a benefit, then for this he needs to submit an application to the tax authorities: these preferences are of a purely declarative nature.

Additional benefits for pensioners

In addition to tax exemptions, the state helps pensioners by providing other benefits. Let's look at the most useful of them.

Providing additional leave

Providing additional leave is a benefit that is provided to a pensioner along with exemption from certain payments.

Additional benefits for pensioners are a serious help

This means an exclusively unpaid vacation, which an elderly person will spend at the expense of his available funds, because wages are not saved. The following can receive this increase in days off from work:

- WWII veterans (no more than a month and five days in 12 months);

- citizens who have reached retirement age (plus two weeks in 12 months);

- citizens who have reached retirement age and are disabled (plus 2 months).

By the way, compensation for transportation costs spent on vacation trips is also provided. In this case, the state will pay the costs for pensioners living in the extreme northern regions or territories with the same living conditions. In this case, citizens must be unemployed and receive insurance compensation for old age or disability.

Payment for such travel is made once for a period of 24 months, that is, two calendar years, and only when traveling through the territory of the Russian Federation. The benefit does not apply to trips outside the country, to other countries.

This benefit can be obtained by contacting the local branch of the Pension Fund of the Russian Federation. Be sure to contact the location where you live. Compensation can be received in the following two ways:

- immediately in the form of purchased tickets;

- after purchasing tickets, providing documents confirming the costs incurred.

You can contact the Pension Fund not directly, but using a multifunctional center that handles all civil documentation. If you want to compensate for the cost of travel tickets, you must contact the authorities in advance and provide proof of your subsequent stay in a sanatorium or other similar institution. The confirmation is usually a voucher or other document of a similar nature, for example, an agreement concluded with an organization for the temporary rental of housing, for example, a house on the lake or a room in a tourist center building.

According to the rules, there are no special requirements for carrier companies; they can be either private or public. However, payment for transport is made only for transportation within Russian borders, including the Crimean peninsula.

Social assistance from the state

For citizens of retirement age whose average income is less than the minimum established in the constituent entity of the Russian Federation at the citizen’s place of residence, the state proposes to issue social assistance in the form of a pension supplement to the basic amount issued. Its size is determined by the difference between the cost of living and the amount of pension accruals for elderly non-working citizens. Among other things, some more civil categories that can receive this state support are legally defined.

In order for payments to be added to the pension, you need to write an application to the social protection authorities related to the citizen’s place of residence. Some varieties are independently assigned to specific citizens by local departments of the pension fund.

Property tax for individuals

This type is included in the category of local taxes. Taxpayers here are individuals who have ownership rights to property recognized as an object of taxation. Despite the fact that the tax is recognized as local, tax benefits introduced by Federal Law dated October 4, 2014 N 284-FZ are common to all.

Pensioners who have the right to receive a state pension, regardless of the circumstances, as well as persons who have reached 55 and 60 years of age (men and women). In addition to pensioners, federal legislation provides for a number of preferential categories (Article 407 of the Tax Code of the Russian Federation).

Personal property tax for pensioners: what are the benefits?

The benefit for pensioners is not expressed in a reduction in the tax rate or any other components of this tax. Federal legislation exempts pensioners from paying personal property taxes in respect of only one item of each type of property subject to taxation.

In accordance with paragraph 4 of Art. 407 of the Tax Code of the Russian Federation, the following types of taxable objects are recognized:

- Apartment, part of an apartment (share), room.

- Private house or part of a house.

- Premises used for professional creative activities - ateliers, workshops, studios, libraries, open thematic museums.

- Garage, parking space, parking space.

- Outbuildings whose area does not exceed 50 square meters. meters, and which are used for personal farming, individual housing construction, summer cottage farming, and gardening.

The bottom line is that one object from each category of property is exempt from tax. That is, this is one apartment, one residential building, one garage, and then on the same principle. If a pensioner has one house and one garage, then in both these areas he is completely exempt from paying taxes.

If there are two apartments and several parking spaces, then the pensioner chooses one apartment and one space for which he will not pay tax. The tax base will be calculated for the other apartment and other parking spaces. The same applies to all other categories: a pensioner can choose only one object from each category. For the rest you will have to pay tax in accordance with local regulations.

A benefit is provided only if the object is not used by the taxpayer for business purposes. The use of benefits is of a declarative nature. The pensioner must submit an application in the prescribed form to receive the benefit to the territorial tax authorities.

If a pensioner has not notified the tax authorities of his right to receive a benefit, the Federal Tax Service, upon receiving relevant information from other sources, receives grounds to apply the benefit unilaterally, without the knowledge of the taxpayer. In this case, the benefit applies to the object in respect of which the maximum tax amount is calculated. And such a mechanism is provided for all categories of taxable objects.

Who are pensioners?

It would seem that defining this category is simple. According to the majority of citizens, pensioners are people who have reached a certain age, which is provided for by law as a pension age. On the one hand, this is true, on the other hand, this definition does not represent all possible comprehensive characteristics. Let's see which citizens in the Russian Federation are recognized as pensioners.

Table 1. Categories of citizens related to pensioners according to the legislation of the Russian Federation

| Category of citizens | Description |

Women over 55 and men over 60 | Indeed, the most common type of this category of taxpayers is adults who have reached a certain age. Thus, women retire at the age of 55, men at 60. The situation is different for those citizens who are in the service of the state. For them, the retirement age will be 63 years and 65 years for women and men, respectively. These changes came into force relatively recently, which caused some public discontent. |

Persons recognized as disabled | According to the testimony of specialists from the medical and social bureau, a person can also be recognized as a pensioner. At the same time, the examination must reveal a citizen’s disability in order to recognize him as incapacitated or provide exemption from continuing to work. |

Receiving survivor benefits | People who receive a pension due to the death of a breadwinner, a relative, or necessarily a close one, who was the source of income, and, accordingly, the existence of a potential pensioner. |

Persons awarded with federal awards | Another category is represented by beneficiaries recognized as such for services to the state. Each of them received a federal award. Typically, these are people who:

|

The citizens listed above are legally pensioners, and at the same time differ from other categories regarding the payment of taxes.

Land tax

Land tax is included in the group of local taxes. Federal legislation establishes a list of benefits that reduce the tax base or completely exempt subjects from paying land tax.

Pensioners are entitled to receive such benefits. The mechanism for providing it is to reduce the tax base, based on a decrease in the area of the land plot by 600 square meters. meters. Land tax for individuals is calculated based on the area of the plot, therefore, if the total area is, for example, 1000 sq. meters, then the tax base will be calculated only on 400 square meters. meters (4 acres). Consequently, here we are talking, rather, not about complete exemption, but only about a reduction in the tax base.

Full exemption is due only if the tax base is 0, ― if the area of the plot is equal to or less than 600 square meters. meters. These amendments apply to areas located:

- Owned by the taxpayer.

- In lifelong inheritable ownership.

- For permanent (indefinite) use.

Regardless of the number of plots that a taxpayer owns or uses, the reduction in the tax base applies to only one of them. The pensioner independently sends a notification to the tax authorities, which marks one of the areas for which the benefit will be applied.

If the notification is not received, the Federal Tax Service has the right to obtain such information independently. If a pensioner owns several objects, the tax authorities apply the benefit to the one in respect of which the maximum tax amount is calculated.

Registration procedure

Federal Tax Service employees do not process benefits, so pensioners must take care of receiving benefits on their own. For this purpose, a special application is drawn up and submitted to representatives of the tax service. When visiting a Federal Tax Service office in person, you must have a passport and a pensioner’s certificate with you.

The procedure can be performed through the service’s personal account . After registration, the information in the application is entered automatically, so you just need to indicate the object for which the benefit will be issued.

Documents proving the citizen’s right to benefits are attached to the application.

These include:

- copy of the passport;

- a certificate from the Pension Fund, which confirms that the applicant is represented as a pensioner or pre-retirement person;

- papers for land, real estate or car.

Representatives of the Federal Tax Service request the missing documentation from other government agencies. The application is drawn up in the prescribed form, so a sample and form can be found on the service’s website or asked from the organization’s employees. The application is considered within 30 days, after which the pensioner is notified of the decision.

If the decision is positive, the citizen can request a recalculation of the overpaid tax for the previous three years.

Complete list of taxes paid by pensioners

These are the main taxes that pensioners are required to pay on an equal basis with other citizens. For each of the regional and local taxes, benefits may be provided. Where and exactly what benefits apply should be clarified locally. At the same time, a non-exhaustive list of mandatory taxes is as follows:

- Income tax - on all sources of income not expressly specified in Art. 217 Tax Code of the Russian Federation.

- Property tax for individuals.

- Transport tax.

- Land tax.

In addition to these payments, there is payment for utilities, which are commonly called taxes. Still, this is not an entirely correct point of view: utilities should be considered separately from taxes.

about the author

Anatoly Darchiev - higher education in economics with a specialty in “Finance and Credit” and higher education in law in the direction of “Criminal Law and Criminology” at the Russian State Social University (RGSU). Worked for more than 7 years at Sberbank of Russia and Credit Europe Bank. He is a financial advisor to large financial and consulting organizations. Engaged in improving the financial literacy of visitors to the Brobank service. Analyst and banking expert. [email protected]

Is this article useful? Not really

Help us find out how much this article helped you. If something is missing or the information is not accurate, please report it below in the comments or write to us by email

If a pensioner works

By law, individuals must pay personal income tax if they have income. But in the Tax Code of the Russian Federation there are incomes for pensioners that cannot be subject to taxes. These include:

- social pension supplement;

- insurance and savings payments;

- pension supplements and financial assistance;

- payments for medical services and sanatorium-resort treatment;

- monetary compensation from the state for medicine.

That is, if a pensioner receives additional payments from the state for retirement, then they cannot be subject to taxes, but if he works and his salary is calculated, then all taxes provided for a working person are withheld from it.

Comments: 0

Your comment (question) If you have questions about this article, you can tell us. Our team consists of only experienced experts and specialists with specialized education. We will try to help you in this topic:

Author of the article Anatoly Darchiev

Consultant, author Popovich Anna

Financial author Olga Pikhotskaya

What are provided

The legislation of the Russian Federation defines both types of support measures and categories of citizens who can use certain options. An important factor is a person’s place of residence, since some support measures are regulated at the subject level.

At the Federation level, support measures are regulated by the following articles of the Tax Code of the Russian Federation:

- Art. 217 (regarding personal income tax);

- Art. 391 (in part of land);

- Art. 407 (regarding property).

Subjects of the Federation can establish additional provisions, for example, reducing the tax base. You can find out the specifics of regional taxation on the website of the Federal Tax Service, in the “Reference Information” section.

First you need to select the tax you are interested in.

The system will issue a regional regulation establishing tax rates and payment terms.

By clicking on the “Details” button, you will be taken to a page where rates, regional benefits, etc. are indicated.

Lawyers' recommendations

Due to the fact that in all regions and cities there are different conditions related to taxes, pensioners often have questions about their rights in one case or another:

Yulia Krivoshapko: “An application for a benefit must be submitted to the Federal Tax Service. When filling it out, you need to pay attention to whether the validity period is indicated in the document. If it is not specified, an extension is not needed, and if it is mentioned, you will need to write the application again after the specified time.”

Roman Ordinartsev: “Pensioners who own a car with more than 100 horsepower are not entitled to any benefits, even if the owner of the car is disabled. Using transport with a high power rating not all year round, but from time to time, also does not give the right to receive any privileges. The tax office calculates the amount to be paid based on the date of registration of the car with the traffic police.”

Svetlana Tsyganova: “If a citizen did not know anything for any period of time about his ability to pay the tax office less than necessary, he can always write a statement about the overpayment, and after considering the case, the funds will be returned. However, the tax office can recalculate for a period of no more than the last 3 years.”

Before submitting an application to the Federal Tax Service of Russia, you need to make sure that the right to transfer part of your funds to the state has a legal basis. All regions of the Russian Federation have different policies in this situation, and in most cases the payment will depend only on the place of residence and registration.

How to apply

The answer to the question of how to apply for a tax benefit for a pensioner is as follows:

- contact your local Federal Tax Service office in person;

- send a set of documents by mail to the address of the local Federal Tax Service in the form of a registered letter;

- submit an application through the Federal Tax Service website;

- through your employer.

Documents you will need:

- Russian passport;

- certificate confirming status;

- TIN;

- documents on the ownership of the property for which a person claims a deduction.

Thus, the legislator, both at the Federation level and at the local level, has provided a number of concessions in the form of tax breaks for pensioners, while increasing the degree of their social protection.

Personal income tax

This fee is the main source of income for local budgets, therefore no benefits are provided at the federal level.

However, pension payments are not included in the tax base and, accordingly, are not subject to personal income tax. These are:

- pensions, social benefits;

- the amount of financial assistance from the employer to former employees who went on vacation, for sanatorium treatment, medical care, medications, but in the amount of no more than 4,000 rubles per year

In addition, by purchasing real estate, you can receive a personal income tax deduction. The conditions are the purchase at the expense of the senior citizen and the transfer of the object into his ownership.

Support measures of this type do not apply to real estate properties worth more than 300 million rubles.

You need to understand that if the property is used for profit (for example, renting out an apartment), the person will not receive any relief.