- Transport tax rates in Moscow for 2015 - 2021 for:

- cars;

- motorcycles and scooters;

- buses;

- trucks;

- snowmobiles and motor sleighs;

- boats and motor boats;

- yachts;

- jet skis

- Transport tax calculator

- Transport tax rates in Moscow for 2014

- Transport tax rates in the Moscow region

- Procedure for calculating and paying transport tax

- Transport tax benefits in Moscow

- Tax benefits for pensioners - procedure for provision and sample application

- How to pay taxes online

- What to do if the car is sold by proxy

- Why didn't I receive a tax notice?

- Procedure for collecting arrears of taxes (penalties, fines)

- Useful links on the topic

Transport tax is regional - this means that it is calculated and paid on the basis of Chapter 28 of the Tax Code of the Russian Federation and the laws of the constituent entities of the Russian Federation on transport tax.

In Moscow, transport tax rates are established by Article 2 of Moscow Law No. 33 dated 07/09/2008 “On Transport Tax”.

Because The tax period for transport tax for individuals is a calendar year; transport tax rates for the next calendar year are established in the previous calendar year.

The concept of transport tax and its purpose

Taxpayers of this tax are vehicle owners (both individuals and organizations) . And vehicles are subject to taxation.

The transport tax exists to compensate for the damage that transport causes to the environment and directly to roads. Transport that is subject to tax:

- Cars and trucks;

- motorcycles;

- scooters;

- buses;

- aircraft;

- helicopters;

- motor ships, yachts;

- sailing ships;

- boats;

- snowmobiles;

- motor boats;

- jet skis.

Transport tax is paid on the territory of the constituent entity of the Russian Federation in whose territory it is established (that is, registered and put into effect).

How to find out about debt

The date for paying the vehicle tax is approaching, but for some reason the notification has not yet arrived. As mentioned above, this must be reported to the Federal Tax Service. It is also worth checking before December 1 whether you have tax debts. This is not difficult to do, and if in the end it turns out that the tax has already been assessed, you can avoid late payment and the accrual of penalties.

You can check whether you have any transport tax debt:

- on the Federal Tax Service website in the taxpayer’s personal account (for authorization, a registration card is required, which can be obtained from any department of the Federal Tax Service);

- on the Gosuslugi portal (registration on the site is required);

- on the website of the Federal Bailiff Service (an extreme case when there is already a court ruling in a debt case).

According to the experience of friends, the first method, although it requires an effort of will to go to the Federal Tax Service and get a registration card, is worth it. Access to your personal account allows you to track and pay any taxes on time. Regarding transport tax, another convenience is that tax notifications begin to arrive in your personal account. And therefore there is no risk that they will get lost somewhere, as sometimes happens with documents sent by mail.

The sooner you pay off your debt, the better. This is due to a “tricky” feature of tax law regarding the statute of limitations. As such, there is no statute of limitations for claiming a debt. In fact, a taxpayer who has unpaid tax always remains in debt, and the tax authority always has the right to demand this debt. The only way to get rid of old debt is to recognize it as uncollectible and write it off. This can be done in court, and both the tax authority and the taxpayer can go to court.

Video: how to write off transport tax debt

Calculation of transport tax

The amount of transport tax depends directly on the characteristics of the vehicle (object of taxation), in particular on the power of its engine. The principle is: “The more powerful the car, the higher the tax . There are standard rates and regional rates, which are set in rubles per 1 unit of horsepower.

| Car power | Rate (rub. per 1 horsepower) |

| Up to 100 horsepower | 2,5 |

| 100 - 150 horsepower | 4 |

| 150 - 200 horsepower | 5 |

| 200 - 250 horsepower | 6,5 |

| More than 250 horsepower | 8,5 |

The formula itself by which transport tax is calculated did not change in 2018 and is still calculated as follows:

tax rate * tax base * increasing coefficient.

What is the tax base? This is the base, which is determined by the engine power in horsepower. It is indicated on the vehicle registration document.

There are situations when the owner sells his car without waiting for the end of the tax period (that is, the vehicle was in his ownership for less than 1 year). In this case, the former owner will have to pay the transport tax in full, taking into account the increasing coefficient (number of months of ownership / number of months in a year).

Increasing factor. Applies not only to new vehicles, but also to used ones. Let's look at the variation of the increasing coefficient in the table:

| Cost of the car (million rubles) | “Age” of the vehicle (number of years since the year of manufacture) | Increasing factor |

| 3-5 | Less than 3 years (inclusive) | 1.1 |

| 5-10 | Less than 5 years (inclusive) | 2 |

| 10-15 | Less than 10 years (inclusive) | 3 |

| More than 15 | Less than 20 years (inclusive) |

Every year, no later than March 1 of the current tax period, the Ministry of Industry and Trade of the Russian Federation publishes a list of cars that fall under the definition of “expensive” vehicles. This list can be seen by going to the official website of the Ministry of Industry, in the “Lists and Registers” section. An increasing factor is applied to the entire list of luxury cars.

If the owner of the vehicle does not have a multiplying factor for calculation, and he has been the owner of movable property for more than a year, then the tax payment formula is reduced to the calculation:

tax base * tax rate.

Transport tax on trucks in 2021

Transport tax is paid according to the rules established by the Tax Code of the Russian Federation (Chapter 28, Article 356) on the basis of the basic (state) rate. In this case, the purpose of the payment is to replenish regional budgets. Consequently, the transport tax for each region is approved at the legislative level of the constituent entities of the Russian Federation and is a mandatory payment for each car owner ( Chapter 28, Article 357 of the Tax Code of the Russian Federation ).

The tax period is the reporting year. Tax rates, determined by laws at the regional level, can be increased or decreased in relation to the base (state) rate. Their size is influenced by:

- engine power , measured in horsepower.

- Gross tonnage.

- Vehicle category.

- Year of car manufacture.

Moreover, in each subject of the Russian Federation and cities of administrative significance, the authorities determine who can use transport benefits.

Vehicles belong to different groups according to category and type (this information is in the registration certificate).

Car categories are divided into five groups:

- Motor transport (“A”).

- Passenger cars with a weight of no more than 3.5 tons and a number of passenger seats of no more than 8 (“B”) .

- Vehicles weighing more than 3.5 tons (“C”).

- Vehicles with passenger seats (“D”) .

- Trailers designed to travel with a vehicle (“E”) .

Each category and type of vehicle has its own rates. Tariffs for freight and passenger transport may differ several times.

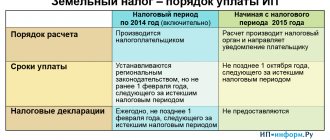

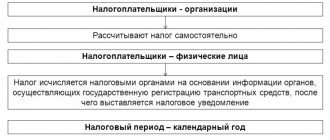

Features and differences of payment of transport tax for organizations and individuals

Transport tax rates are the same for both individuals and organizations. However, the main difference between the system is that tax is assessed to individuals by a specialized body, while organizations are required to calculate the amount of transport tax and advance payment themselves.

Typically, notifications to taxpayers begin to arrive in mid-summer. If tax authority specialists send a notification by mail to an individual by registered mail, then it is considered received after 6 days (clause 4 of Article 52 of the Tax Code of the Russian Federation). If the letter has not arrived and the recipient is not aware of the amount of his payment, then he can find out its approximate amount on the official website of the Federal Tax Service of the Russian Federation. The service is called “Tax calculator – Transport tax calculation”. The user's region is automatically determined on the electronic page. However, if necessary, it can be changed. To calculate the tax payment, you must enter the required data indicating the benefits that the citizen has.

Note! Calculating transport tax using this service is for informational purposes only!

The tax period for both individuals and legal entities is 1 year. Individuals and Individual Entrepreneurs must pay transport tax no later than December 1 of the year following the reporting year. In simple words, the payer must pay the tax for 2017 by December 1, 2021. The deadline for payment of transport tax for legal entities is set at the regional level, but not earlier than February 1 of the year following the reporting year. Unlike individuals, organizations must also make advance payments (no later than the 10th day of the second month following the reporting period).

We remind you! Ignorance of the amount of the tax payment or simple forgetfulness of the taxpayer does not relieve him from responsibility and consequences (the accrual of fines and penalties)!

An individual becomes a transport tax payer from the day the vehicle is registered in his name. A citizen must pay tax at the place of his registration (clause 5 of Article 83 of the Tax Code of the Russian Federation).

If the owner of the vehicle changes his place of residence, and, accordingly, his registration, he is obliged to report these changes to the department of the tax authority according to his previous registration. The same rule applies to organizations (for their legal addresses). Article 85 of the Tax Code of the Russian Federation states that an organization is obliged to re-register all its vehicles at a new legal address within 10 days. And after that, you will have to pay transport tax at the new place of registration (letter No. BS-4-21/18669 dated September 19, 2017).

Payment of transport tax

Vehicle tax is paid by individuals. persons according to the notification received. This must be done before December 1 of the following year. For example, car taxes for 2021 must be paid by December 1, 2021.

The deadlines for paying taxes for legal entities are set by the state. organs of each subject. In this case, the deadline for payment should be set after February 1 of the year, since before this date organizations send tax returns to the Federal Tax Service. The procedure for an organization to pay vehicle tax for 2021 is as follows: before February 1, 2021, the organization submits a declaration to the tax authority, then from March to December 2021 (the specific month is determined differently in each region) pays the tax.

Pay taxes conveniently through your personal account on the Federal Tax Service website

Tax is paid in the area where the vehicle is registered. This is the place where the physical person lives. the person or located organization that is the owner. You can pay the tax at the bank and in its online application, in your personal account on the Federal Tax Service website.

Transport tax in the regions

Chapter 28 of the Tax Code of the Russian Federation reflects the main provisions that relate to transport tax. However, this is not the only regulatory act regulating this tax.

All nuances, rules and exceptions of transport tax are reflected in regional legislative acts.

Each subject of the Russian Federation has the right to independently draw up regulations governing transport tax. They reflect transport tax calculation rates, benefits, terms and payment procedures. Local authorities have the right to change the tax rate, but not more than 10 times the basic values. If the region has not established other rates, then the basic tax rates established by the Tax Code of the Russian Federation (Article 361 of the Tax Code of the Russian Federation) will be applied in this region.

It turns out that for the same car its owner will pay different amounts of transport tax, depending on the place of its registration.

It is local authorities who determine which categories of citizens will benefit from benefits. As a rule, the preferential category always includes enterprises belonging to the municipality. As for individuals, these are citizens - disabled people, pensioners and large families.

The collected fees are sent to regional budgets. The amounts received constitute a decent percentage of all budget revenue items.

To obtain reliable information about what rates apply in a particular subject of the Russian Federation, you can use the electronic service on the official website of the Federal Tax Service. Thanks to this service, any user can study the regulations governing the regional transport tax, as well as familiarize themselves with the list of benefits provided. Algorithm for familiarizing yourself with basic data on transport tax in the regions:

- Go to the official website of the Federal Tax Service of the Russian Federation;

- At the bottom of the page, click on the “Electronic Services” link.

- Among the many items, find “Reference information on rates and benefits for property taxes”;

- Select the type of tax you are interested in;

- Select a tax period;

- Select the subject of the Russian Federation of interest from the list provided;

- Confirm your selection by clicking the “Find” button.

The resulting form will reflect the legal act regulating transport tax in a particular region. You can get acquainted with it in more detail by clicking the button of the same name. Next, the user will receive the most detailed information about rates, deadlines for paying taxes and advance payments (for both individuals and organizations), as well as about tax deductions, federal and regional benefits.

Let's consider the maximum and minimum values of tax rates for transport tax by region of the Russian Federation in 2018. As comparable indicators, let’s take passenger cars with an engine power of 100 horsepower and 150-200 horsepower.

Transport tax - what is it?

Transport tax is a generally obligatory amount that owners of vehicles (vehicles) must pay in accordance with the procedure established by law.

Transport tax is a regional tax. This means that the money goes to the regional budget, and the specific amount of the tax and its other features are reflected in the laws of the regions of the Russian Federation. The tax is paid for each vehicle owned by the owner. It must be paid once a year. General information about the transport tax is contained in Chapter 28 of the Tax Code of the Russian Federation (TC RF).

What do we pay for?

The objects of transport tax are defined in Article 358 of the Tax Code of the Russian Federation. They are vehicles that are registered and registered in accordance with the requirements of the law, namely:

- mechanical vehicles (cars, motorcycles, buses, etc.);

- helicopters, airplanes;

- water vehicles (yachts, motor boats, speedboats, jet skis, etc.);

- motor sleighs, snowmobiles.

The same article of the Tax Code of the Russian Federation contains a detailed list of vehicles that are not subject to taxation. These include vehicles of low power or those necessary to perform socially significant tasks, for example:

- air, river, sea vessels for cargo or passenger transportation;

- medical aircraft;

- rowing boats and motorboats with a maximum power of 5 horsepower, fishing vessels;

- sea and river vessels, information about which is included in the Russian International Register of Ships;

- Vehicles used in agriculture;

- a car designed to transport disabled people;

- Vehicles owned by the state. bodies through which military service is carried out.

Agricultural machinery is not subject to transport tax

Stolen vehicles that have not yet been found at the time of tax payment are not subject to tax. In order not to pay tax on a stolen car you must:

- Contact the police to report the car theft. This will begin the investigation and search for the vehicle. Important: only those vehicles that are wanted are exempt from tax.

- Obtain a certificate from the police about the theft of a car.

- Write an application for tax exemption and send it along with a certificate of theft to the Federal Tax Service of the Russian Federation (FTS). This can be done by contacting the Federal Tax Service in person or in your personal account on the official website of this state. organ. You must bring the original or a copy of the certificate.

- Wait for notification from the Federal Tax Service about the results of consideration of the application. If the decision is positive, you will be exempt from transport tax.

An application for tax exemption and a certificate must be submitted every year. If for some reason it seems to you that searching for a car is a hopeless matter, then you can contact the traffic police and deregister the vehicle by writing an application to terminate the registration of the car.

Who pays

Transport tax payers are persons who own vehicles specified in paragraph 1 of Art. 358 Tax Code of the Russian Federation. That is, it is paid by individuals and organizations to which the vehicle is registered. Information about the owners is sent to the Federal Tax Service by the State Traffic Safety Inspectorate.

Privileges

Transport tax benefits can be federal and regional.

Federal benefits regarding vehicle tax are specified in the Tax Code. For example, special privileges are provided to individual owners of heavy vehicles included in the Register of Vehicles of the toll collection system.

The essence of the last benefit is that heavy trucks cause damage to the road surface. Therefore, truck owners were obliged to pay compensation to the Russian budget (the funds received go to road repairs), but at the same time they provided benefits in two forms:

- full exemption from vehicle tax is given if the compensation paid is greater than or equal to the vehicle tax;

- A “discount” on tax is given if the compensation paid is less than the amount of tax (calculated tax - payment amount = actual tax paid).

Payers of the Platon system reduce transport tax by the amount of this fee

The rules on regional benefits are contained in the laws of the constituent entities of the Russian Federation. Regional transport tax benefits may be provided to:

- veterans;

- disabled people;

- large families;

- owners of small vehicles;

- other categories of citizens.

It must be borne in mind that local benefits are individual for each region, and therefore they need to be clarified at the branches of the Federal Tax Service. Detailed information about tax benefits for a specific region can be obtained in the “Reference Information” section of the Federal Tax Service website.

To receive any benefit, you must contact the Federal Tax Service along with an application and documents for the benefit.

Video: owners of electric vehicles were offered exemption from transport tax

What does the tax depend on?

The amount of any tax, including transport tax, consists of the tax base and tax rate.

The tax base is a characteristic of the object of taxation that is important for calculating tax. Its main task is to “measure” the object of taxation. The tax base for transport tax is:

- engine power in horsepower (vehicles with engines);

- jet engine thrust (aircraft for which this characteristic can be determined);

- vehicle unit (other aircraft, watercraft).

The tax rate is the amount of payment per tax base (for example, per horsepower in the case of a car).

Since the transport tax is regional, rates for it in each region of Russia are set individually. The Tax Code of the Russian Federation determines only approximate average rates, which regions can reduce or increase by a maximum of 10 times.

For the transport tax, an increasing coefficient can be applied - the so-called luxury tax. You can find an exact list of coefficients in Article 362 of the Tax Code of the Russian Federation. This information is presented in a more convenient form on the Federal Tax Service website in the “Transport Tax” section.

The increasing coefficients are as follows:

- for a car worth from 3 to 5 million not older than 3 years - 1.1;

- worth from 5 to 10 million not older than 5 years - 2;

- worth from 10 to 15 million not older than 10 years - 3;

- valued at 15 million and not older than 20 years – 3.

How to calculate transport tax?

Go to the “Transport tax calculation” page.

Before you begin, be sure to indicate the region where your car is registered. Otherwise the calculation will be incorrect:

Next, fill in the appropriate fields. Data for the fields can be found from the PTS (vehicle passport). Click "Next":

You can skip the next step if your car is cheaper than 3 million rubles. Otherwise, select your car make and model:

After clicking the "Calculate" button, you will see the amount to be paid.

Minimum rates by region

| Region | Passenger car with 100 horsepower | Passenger car with a power of 150-200 horsepower |

| Sverdlovsk region | 0 | 32,7 |

| Kabardino-Balkarian Republic | 0-7 | 35 |

| Kaliningrad region | 2,5 | 35 |

| The Republic of Ingushetia | 5 | 10 |

| Krasnoyarsk region | 5 | 29 |

| Republic of North Ossetia-Alania | 7 | 20 |

| Transbaikal region | 7 | 20 |

Maximum rates by region

| Region | Passenger car with 100 horsepower | Passenger car with a power of 150-200 horsepower |

| Republic of Bashkortostan | 25 | 50 |

| Mari El Republic | 25 | 50 |

| Vologda Region | 25 | 50 |

| Kursk region | 25 | 50 |

| Saint Petersburg | 24 | 50 |

| Republic of Tatarstan | 10-25 | 50 |

Nuances of calculating tax on freight transport category “B”

The greatest uncertainty for car owners is the tax on flatbed cargo vehicles of category “B” (pick-ups) and on vehicles of the “ van ” vehicle type ( minibuses ), also belonging to category “B”.

Assuming that the letter “ B ” indicated in the PTS in the line “ Vehicle Category ” indicates that the car belongs to the category of passenger vehicles, the owner of such a car is surprised to receive a notification from the Federal Tax Service, in which the transport tax rate is calculated as for freight transport. As a rule, this rate is several times higher than for a passenger car. And this is not a mistake of the tax authorities, since the transport tax is calculated based on the rate, which is determined not by category “ B ”, but by the type of vehicle.

Category “ B ” only indicates that the following vehicles are permitted:

- maximum vehicle weight – no more than 3.5 tons;

- number of passenger seats – no more than 8 .

These restrictions precisely indicate category “ B ” in accordance with the Regulations on vehicle passports and vehicle chassis passports, approved. Order of the Ministry of Internal Affairs of Russia N 496, Ministry of Industry and Energy of Russia N 192 , Ministry of Economic Development of Russia N 134 of June 23, 2005 (clause 28) and Appendix 6 to the Convention on Road Traffic (clause 5) .

Thus, we can conclude:

- Category “B” is not always a passenger car . Trucks that fall under the specified criteria may also be included in this category.

- When it comes to determining the type of car, you cannot focus on category “B” .

Main changes in transport tax since 2018

One of the most popular and discussed news in the coming year was the news about the “2021 tax amnesty.” Amnesty Law No. 436-FZ came into force on December 28, 2021. At the initiative of the President of the Russian Federation, citizens were forgiven tax debt accrued before January 1, 2015. An interesting fact is that all debts and penalties were written off automatically (the law did not require an application or personal presence of debtors at the tax authorities).

Another, no less discussed piece of news were changes to the transport tax, approved by Law No. 335-FZ of November 27, 2017 “On Amendments to Parts One and Two of the Tax Code of the Russian Federation and Certain Legislative Acts of the Russian Federation.” Clause No. 68 of Article 2 of this Law states that the increasing coefficients for vehicles costing 3-5 million rubles (no more than 3 years have passed since the year of production) have been reduced.

From January 1, 2021, the coefficient for these categories of cars became 1.1. By the way, before the changes were adopted, the transport tax for the above categories of cars was applied depending on the age of the car. From 2021, for cars worth 3-5 million rubles, the increasing coefficient has been combined.

The standard transport tax rates across the country have not changed this year. There were only a few exceptions. For example, the local Duma of the Astrakhan region decided to increase rates for the following categories of vehicles ( Law of the Astrakhan region dated July 13, 2017 No. 38/2017-OZ ):

- buses and trucks with engine power exceeding 200 horsepower;

- motorcycles and scooters with an engine power of more than 35 horsepower.

And also in accordance with the Laws of the constituent entities of the Russian Federation, rates in the Republic of Mari El and the Pskov region have not changed significantly.

In 2021, changes also affected the tax return. Namely, its electronic form. The updated form of the transport tax declaration was approved by Order of the Federal Tax Service No. ММВ-7-21/668 dated December 5, 2021 . Now it does not require a taxpayer stamp.

On March 1, 2021, the list of “luxury” cars (worth more than 3 million rubles) was updated annually. As of April 26, 2021, the official website minpromtorg.gov.ru presents a list of 909 car brands that fall under the increasing coefficient.

A convenient innovation in 2021 is that now the taxpayer will be able to immediately indicate a tax benefit or deduction for a vehicle registered in the Platon .

What is the Plato system?

In 2015, a system was developed and put into operation that should cover budget losses for road repairs. But there is already a transport tax for these purposes; why and for whom was the Platon system created then?

This system is specialized for trucks. Namely, on heavy trucks weighing 12 tons or more. That is, trucks damage the road surface of federal highways and must compensate for this. The contribution to the system depends on the tariff rate and the kilometers traveled.

Interesting fact! The name of the system reflects its semantic purpose: Payment per ton - “Plato”.

Initially, truck owners paid both transport tax (in full) and transferred contributions to the system. That is, they bore a double financial burden. Don't forget about excise taxes on gasoline. Currently, the transport tax payment system for such cars has been improved.

From 2021, the amount of transport tax was allowed to be adjusted by the amount of contributions to the Platon system. If contributions to the system are equal to or greater than the amount for transport tax, then the taxpayer is generally exempt from the fiscal fee.

An exception is the situation when the taxpayer is the lessor, and the fee under the Platon system is paid by the lessee. Then the tax deduction is not provided to the taxpayer (letter of the Federal Tax Service of the Russian Federation dated February 17, 2017 No. BS-4-21/3029).

Currently, work is actively underway towards creating a unified control system for heavy trucks:

- Mass installation of special magnetic frames continues. These devices allow you to read truck license plates. And with the help of side cameras you can determine the exact dimensions;

- Heavy trucks are equipped with special equipment.

Sample of filling out a transport tax return for 2018

The organization owns a Hyundai Solaris car with an engine power of 123 hp, which was sold and deregistered on December 12, 2018. The car was produced in 2012 and registered on November 3, 2012. In the region (Moscow) there are no advance payments, the tax rate is 25 rubles/hp.

During the year, the organization owned the car for 11 months – from January to November.

The coefficient Kv for calculating tax for the year is 0.9167 (11 months / 12 months).

The calculated tax amount for 2021 is RUB 2,819. (123 hp x 25 rub/hp x 0.9167).

The amount of tax payable for the year is 2,819 rubles.