What's behind the balance sheets?

Below is a complete breakdown of the balance sheet lines for 2018/2019. Moreover, each line is specified according to the most characteristic accounts for it, which are reflected in it. Of course, the specifics of economic activity in practice may leave their mark on this correspondence.

Also, the order of formation of accounting reports, as well as the reflection of certain indicators, is influenced by the accounting policy for accounting purposes adopted by the company.

The following is a breakdown of the balance sheet lines for the accounts in two tables - by asset and liability of the balance sheet.

VAT on balance

VAT in the balance sheet is displayed in 3 lines:

- 1220 “VAT on acquired values”;

- 1230 “Accounts receivable”;

- 1520 “Accounts payable”.

Lines 1220 and 1230 are in the “current assets” section, since these are current assets with increased liquidity - their turnover occurs during the year or during the normal operating cycle for the organization. Based on the same reasoning (calculations occur during the year), line 1520 is located in the “Short-term liabilities” section of the balance sheet liability.

There are certain features of reflecting tax for each of these lines.

ConsultantPlus experts explained how to correctly reflect VAT in accounting. Get trial access to the system and upgrade to the Ready Solution for free.

Explanation of lines for balance sheet assets

| Indicator name | Code | Which account data is used? | Algorithm for calculating the indicator |

| Intangible assets | 1110 | 04 “Intangible assets”, 05 “Amortization of intangible assets” | Dt 04 (excluding R&D expenses) – Kt 05 |

| Research and development results | 1120 | 04 | Dt 04 (in terms of R&D expenses) |

| Intangible search assets | 1130 | 08 “Investments in non-current assets”, 05 | Dt 08 – Kt 05 (all regarding intangible exploration assets) |

| Material prospecting assets | 1140 | 08, 02 “Depreciation of fixed assets” | Dt 08 – Kt 02 (all regarding material exploration assets) |

| Fixed assets | 1150 | 01 “Fixed assets”, 02 | Dt 01 – Kt 02 (except for depreciation of fixed assets accounted for in account 03 “Income-generating investments in tangible assets” |

| Profitable investments in material assets | 1160 | 03, 02 | Dt 03 – Kt 02 (except for depreciation of fixed assets accounted for on account 01) |

| Financial investments | 1170 | 58 “Financial investments”, 55-3 “Deposit accounts”, 59 “Provisions for impairment of financial investments”, 73-1 “Settlements on loans provided” | Dt 58 – Kt 59 (regarding long-term financial investments) + Dt 73-1 (regarding long-term interest-bearing loans) |

| Deferred tax assets | 1180 | 09 “Deferred tax assets” | Dt 09 |

| Other noncurrent assets | 1190 | 07 “Equipment for installation”, 08, 97 “Deferred expenses” | Dt 07 + Dt 08 (except for exploration assets) + Dt 97 (in terms of expenses with a write-off period of more than 12 months after the reporting date) |

| Reserves | 1210 | 10 “Materials”, 11 “Animals for growing and fattening”, 14 “Reserves for reducing the cost of material assets”, 15 “Procurement and acquisition of material assets”, 16 “Deviation in the cost of material assets”, 20 “Main production”, 21 “Semi-finished products own production”, 23 “Auxiliary production”, 28 “Defects in production”, 29 “Service production and facilities”, 41 “Goods”, 42 “Trade margin”, 43 “Finished products”, 44 “Sales expenses”, 45 “Goods shipped”, 97 | Dt 10 + Dt 11 – Kt 14 + Dt 15 + Dt 16 + Dt 20 + Dt 21 + Dt 23 + Dt 28 + Dt 29 + Dt 41 – Kt 42 + Dt 43 + Dt 44 + Dt 45 + Dt 97 (in part expenses with a write-off period of no more than 12 months after the reporting date) |

| Value added tax on purchased assets | 1220 | 19 “Value added tax on acquired assets” | Dt 19 |

| Accounts receivable | 1230 | 46 “Completed stages of work in progress”, 60 “Settlements with suppliers and contractors”, 62 “Settlements with buyers and customers”, 63 “Provisions for doubtful debts”, 68 “Settlements for taxes and duties”, 69 “Settlements for social insurance and security", 70 "Settlements with personnel for wages", 71 "Settlements with accountable persons", 73 "Settlements with personnel for other operations", 75 "Settlements with founders", 76 "Settlements with various debtors and creditors" | Dt 46 + Dt 60 + Dt 62 – Kt 63 + Dt 68 + Dt 69 + Dt 70 + Dt 71 + Dt 73 (except for interest-bearing loans accounted for in subaccount 73-1) + Dt 75 + Dt 76 (less reflected in accounts for VAT calculations on advances issued and received) |

| Financial investments (excluding cash equivalents) | 1240 | 58, 55-3, 59, 73-1 | Dt 58 – Kt 59 (in terms of short-term financial investments) + Dt 55-3 + Dt 73-1 (in terms of short-term interest-bearing loans) |

| Cash and cash equivalents | 1250 | 50 “Cash”, 51 “Current accounts”, 52 “Currency accounts”, 55 “Special bank accounts”, 57 “Transfers in transit”, | Dt 50 (except for subaccount 50-3) + Dt 51 + Dt 52 + Dt 55 (except for the balance of subaccount 55-3) + Dt 57 |

| Other current assets | 1260 | 50-3 “Money documents”, 94 “Shortages and losses from damage to valuables” | Dt 50-3 + Dt 94 |

Input VAT

Line 1220 “VAT on purchased assets”

Line 1220 reflects the amount of tax that the company will be able to deduct in the future. The remaining value (debit balance) for account 19 is transferred to this balance line.

To exercise the right to deduction, a number of conditions must be simultaneously met:

- the acquired assets are intended for the type of activity that is subject to VAT;

- the cost of acquired assets is reflected in accounting;

- there is a correctly issued invoice from the supplier.

You can see how to fill out line 1220 using an example in the Guide from ConsultantPlus. Trial access to the K+ system is provided free of charge.

For many organizations, account 19 is reset to zero at the end of the year, and in this case a dash is added to line 1220 of the balance sheet. The balance on account 19 may arise in such cases (all of them follow from the text of Articles 171 and 172 of the Tax Code of the Russian Federation):

- when exporting raw materials (the delay in accepting VAT for deduction is due to the fact that it is necessary to go through the procedure of confirming the fact of export);

- if the acquired assets are used by a company with a long production cycle (VAT is deductible only after the finished product is shipped to the buyer);

- if the supplier did not provide an invoice or the invoice was issued with significant violations;

- when the taxpayer decides to deduct it at a later period (before the expiration of 3 years from the date of registration of the acquired property).

NOTE! For organizations with large balances on account 19, it is better to detail the value of line 1220. This right is provided for in clause 6 of PBU 4/99 “Accounting statements of an organization” (approved by order of the Ministry of Finance of the Russian Federation dated July 6, 1999 No. 43n). This can be done by adding lines 12201, 12202, etc. Detailing is possible in the context of operations (purchase) by fixed assets, inventories, intangible assets and others.

Standardized expenses

A debit balance on account 19 can also be formed when paying expenses, which are normalized when calculating income tax. Thus, there are expenses that cannot be fully taken into account in the tax base when calculating income tax.

Read about what expenses are regulated and what the limits for rationing are in the material “Standards provided for by the Tax Code of the Russian Federation” .

Hand in hand, taking into account standardized expenses, comes the problem of deducting value added tax. That is, if these expenses are normalized, then the right to deduct VAT on them is also curtailed.

In this case, usually the final value of the indicator for calculating the standard becomes known only at the end of the year, and the expenses themselves can be collected throughout the year, and the accountant has the obligation to quarterly adjust the VAT amount as the base from which the standard is determined increases.

At the end of the year, some amounts of undeductible VAT may accumulate. Their last day of the year should be written off as other expenses, since tax amounts exceeding the amount corresponding to the calculated value of the standard will no longer be accepted for deduction.

Decoding lines for balance sheet liabilities

| Index | Code | Which account data does it use? | Algorithm for calculating the indicator |

| Authorized capital (share capital, authorized capital, contributions of partners) | 1310 | 80 “Authorized capital” | Kt 80 |

| Own shares purchased from shareholders | 1320 | 81 “Own shares (shares)” | Dt 81 (in parentheses) |

| Revaluation of non-current assets | 1340 | 83 “Additional capital” | Kt 83 (regarding the amounts of additional valuation of non-current assets) |

| Additional capital (without revaluation) | 1350 | 83 | Kt 83 (except for amounts of additional valuation of non-current assets) |

| Reserve capital | 1360 | 82 “Reserve capital” | Kt 82 |

| Retained earnings (uncovered loss) | 1370 | 99 “Profits and losses”, 84 “Retained earnings (uncovered loss)” | Or Kt 99 + Kt 84 Or Dt 99 + Dt 84 (the result is reflected in parentheses) Or Kt 84 - Dt 99 (if the value is negative, it is reflected in parentheses) Or Kt 99 - Dt 84 (same) |

| Borrowed funds | 1410 | 67 “Calculations for long-term loans and borrowings” | Kt 67 (regarding debts with a maturity date of more than 12 months at the reporting date) |

| Deferred tax liabilities | 1420 | 77 “Deferred tax liabilities” | Kt 77 |

| Estimated liabilities | 1430 | 96 “Reserves for future expenses” | Kt 96 (regarding estimated liabilities with a maturity period of more than 12 months after the reporting date) |

| Other obligations | 1450 | 60, 62, 68, 69, 76, 86 “Targeted financing” | Kt 60 + Kt 62 + Kt 68 + Kt 69 + Kt 76 + K86 (all in terms of long-term debt) |

| Borrowed funds | 1510 | 66 “Calculations for short-term loans and borrowings”, 67 | Kt 66 + Kt 67 (in terms of debt with a repayment period of no more than 12 months as of the reporting date) |

| Accounts payable | 1520 | 60, 62, 68, 69, 70, 71, 73, 75, 76 | Kt 60 + Kt 62 + Kt 68 + Kt 69 + Kt 70 + Kt 71 + Kt 73 + Kt 75 + Kt 76 (in terms of short-term debt, minus VAT calculations reflected in the accounts on advances issued and received) |

| revenue of the future periods | 1530 | 98 “Deferred income” | Kt 98 |

| Estimated liabilities | 1540 | 96 | Kt 96 (regarding estimated liabilities with a maturity period of no more than 12 months after the reporting date) |

| Other obligations | 1550 | 86 | Kt 86 (regarding short-term liabilities) |

Read also

31.07.2018

Cash flow and VAT statement.

In accordance with PBU 23/2011 “Cash Flow Statement”9 https://bmcenter.ru/Files/PBU-23-2011 - p15 the organization’s cash flows are reflected in the cash flow statement10 subdivided into current cash flows11. investment and financial transactions.

According to clause 16 of PBU 23/2011, cash flows are reflected in the report on a collapsed basis in cases where receipts from some persons determine corresponding payments to other persons. An example of such cash flows are indirect taxes as part of receipts from buyers and customers, payments to suppliers and contractors, and payments to the budget system of the Russian Federation or reimbursements from it.

From the above it follows that the amounts of receipts and payments of VAT should be reflected in the cash flow statement in a collapsed manner. The corresponding data is reflected, as a rule, as cash flows from current operations in the line “Other payments” or “Other receipts”.

The Ministry of Finance (Letter dated January 27, 2012 No. 07 02 18/01) recommends the following VAT reduction scheme:

VAT received - VAT paid - VAT to the budget + VAT refunded, where:

VAT received – tax received from buyers and customers; VAT paid – tax paid to suppliers and contractors; VAT to the budget is a tax transferred to the budget system of the Russian Federation; VAT refunded is a tax actually reimbursed from the budget (transferred to the company’s current account).

The resulting difference (if it is positive) is entered in the line “Other receipts” or (if the difference is negative) in the line “Other payments”.

A similar approach, by the way, is presented in Explanation 11-07 “Collapsed presentation of VAT in the statement of cash flows”12.

Example 2. Reimbursable VAT as part of payments to suppliers and contractors in the reporting period is RUB 650,000. VAT as part of receipts from buyers and customers in the same period - 800,000 rubles. VAT payments to the budget for this period amounted to 170,000 rubles.

In the cash flow statement, the collapsed result is RUB 20,000. is included in the “Other payments” line of the “Cash flows from current operations” section.

Links:

- Appendix 1 to Order of the Ministry of Finance of Russia dated July 2, 2010 No. 66n (hereinafter referred to as Order No. 66n);

- Approved by Order of the Ministry of Finance of Russia dated July 6, 1999 No. 43n. The document is applied to the extent that does not contradict the Federal Law of December 6, 2011 No. 402-FZ (Information of the Ministry of Finance of Russia No. PZ-10/2012);

- According to the Chart of Accounts and instructions for its use;

- When forming the accounting policy of an organization, it is assumed that the organization will continue its activities for the foreseeable future, it has no intention or need to liquidate or significantly reduce its activities and, therefore, obligations will be repaid in the prescribed manner;

- Approved by Order of the Ministry of Finance of Russia dated October 6, 2008 No. 106n;

- Posted on the website of the Foundation “NRBU “BMC” (www.bmcenter.ru);

- Appendix 1 to Order No. 66n;

- Approved by Order of the Ministry of Finance of Russia dated May 6, 1999 No. 32n;

- Approved by Order of the Ministry of Finance of Russia dated 02.02.2011 No. 11n;

- Appendix 2 to Order No. 66n;

- Cash flows that cannot be unambiguously classified are considered as cash flows from current operations (clause 12 of PBU 23/2011);

- Posted on the website of the NRBU BMC Foundation (www.bmcenter.ru).

What do you need to know about the accumulation register? ↑

In a specialized software environment called 1C: Accounting, there are elements such as accumulation registers.

It is thanks to them that it is possible to record movements:

- goods;

- materials;

- funds.

Registers make it possible to automate a variety of accounting areas:

- mutual settlements;

- long-term planning;

- inventory control.

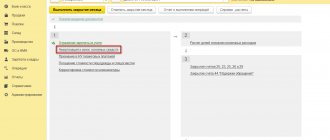

When using the savings register to automate VAT accounting on purchased assets, you should remember some features:

- the movement of inflow is indicated by the sign “+”, the movement of expenditure by the sign “-“;

- register entries are associated with the line number - it is important not to confuse them;

- When generating VAT, you must remember to control the uniqueness of records - it will not allow you to create identical values.

If you remember these features when preparing reports (declarations), then the occurrence of any problems is completely excluded.

The presence of an increased VAT on purchased values indicates the presence of some error in the savings registers, which must be corrected.

Find out tax deductions for VAT and the procedure for their application in the article: VAT deduction.

How to check your VAT return according to tax rules.

What services are not subject to value added tax?

VAT on purchased assets is no less important than other taxes.

Errors in its calculation can lead to serious problems with the tax office and the imposition of penalties.

Therefore, it is imperative to carefully monitor the correctness of the submitted data. This will save time and money.

Previous article: Filing VAT electronically Next article: How to calculate VAT penalties

The most common schemes

There are various schemes for constructing financial performance reports around the world.

Among all the reasons for their classification, we can highlight:

- by how the indicators are arranged;

- on the approach to grouping expenses;

- according to the methodology for disclosing the difference between income and expenses;

- by the method of determining financial results.

Based on which cost grouping scheme is used, the format of cost and expenses is determined. IFRS presents 2 types of classification: functional and natural. The first provides for distribution according to purpose, the second - according to the nature of the costs.

According to the functional diagram, costs are grouped into classes depending on their functions. Thus, the cost of sales includes commercial, administrative and other expenses. Enterprises using this scheme provide additional data on the nature of costs, including salaries of the organization's employees and depreciation charges made.

According to the natural scheme, costs are divided into the following groups:

- for materials;

- for remuneration of personnel;

- for the provided depreciation charges, etc.

An important difference between expense and cost schemes is the display in a natural scheme of changes in work in progress and finished goods inventories. In practice, both schemes are combined in financial statements for profit.

Classification of income statement formats

General information ↑

Value added tax on acquired assets is a tax that must be paid.

Since, according to the law, all profits received as a result of commercial activities must be taxed.

What it is

VAT on acquired assets is a tax that includes almost all information on various types of income received by the company.

The following transactions relate to this type of income:

- sale of goods;

- sale of services;

- the process of selling or buying valuables of various kinds.

The tax itself is usually reflected in the financial statements in account No. 19 (debit) under the name “VAT on acquired assets.”

This account also reflects:

- intangible assets;

- production and material inventories.

What problems might there be?

Most often, problems related to value added tax arise in two cases:

- When VAT on acquired assets is accepted for deduction upon application.

- When submitting a request to the tax authorities for a VAT refund (on purchased valuables in the case of the sale of imported goods).

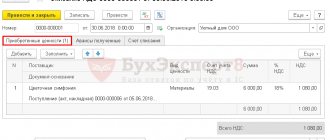

Beginning users of the 1C program experience some problems when they try to fill out a purchase book using a standard mechanism.

Sometimes all the necessary information simply does not fit. To get around this feature of the program, it is necessary to deduct not all VAT, but part of it.

The rest of the amount should just wait for some time in account No. 19. At the first opportunity, you can take the balance for deduction; there is quite an impressive reserve of time for this - three whole years.

Sometimes it happens that tax authorities refuse to refund VAT on purchased valuables based on the lack of invoices (Article No. 169 of the Tax Code of the Russian Federation).

If such a situation arises, it is necessary to be guided by Government Decree No. 914 dated 02.11.00.

According to it, the basis for registering invoices in the purchase book is payment documents (confirming payment of VAT) and a declaration (customs).

Which allows you to receive a refund when you provide these two documents. Invoices are not required.

Accounting for VAT on purchased assets ↑

All taxes must be subject to strict accounting, including value added tax. Since the appearance of various types of errors leads to questions from the tax inspectorate.

VAT inventory must be carried out without fail, so hiding errors from accountants and auditors will be quite problematic.

Formation of input VAT

Input VAT is a tax included in the price of goods purchased from a supplier who is also a payer of value added tax - this is currently regulated by the Tax Code of the Russian Federation, Art. No. 171 and art. 172.

Formation of input VAT is possible if:

- resources acquired for use in any operations are subject to VAT (production and subsequent sale of goods subject to VAT);

- when any material assets are taken into account;

- payment for resources has been made.

The formation of input VAT is not affected by the asset or liability owned by the enterprise. The only important thing is what the taxpayer company is in the chain of sale and production of goods and services.

Since the possibility of subsequent deduction of VAT when paying taxes directly depends on this. The VAT itself on purchased values is displayed in line 1220.

How to submit a VAT return electronically, see the article: Submitting VAT electronically.

What is the procedure for recovering VAT when switching to the simplified tax system?

It contains all the information on value added tax - if it should be charged. And this does not always happen.

Since if material assets are acquired for the implementation of any events or activities on which VAT is not paid, the tax is not displayed in line 1220.

It is simply written off as an expense or included in the cost of the acquired property itself.

Write-off of input tax

If certain conditions arise, input value added tax may be written off.

The easiest way to carry out this operation is for enterprises that use a simplified taxation scheme - income minus expenses. Moreover, current assets do not have any impact on this.

That is, the write-off of input tax is in no way related to accounts receivable or financial reserves.

According to current legislation, the amount of VAT can be included in the “expenses” column of an enterprise in the process of determining the object of taxation.

According to the Tax Code of the Russian Federation, or rather Art. No. 346 clause 1, an enterprise that is a payer of the tax in question has the right to deduct from the income received during the reporting period the amount of VAT on purchased goods (services).

It is only important that they are included in expenses in accordance with Art. No. 346 p. 16, 17.

This is what makes it possible, on absolutely legal grounds, to completely write off the VAT input tax on purchased assets as expenses.

It is only important that two conditions are met:

- all purchased goods must be expenses (according to the simplified taxation scheme);

- All goods purchased by the organization must be paid for at the time of reporting.

Performing the duties of a tax agent

In some cases, tax legislation imposes on an enterprise the duties of a tax agent in the presence of VAT on acquired assets.

As a rule, a tax agent is an enterprise that acts as a source of income for another organization.

The conditions under which a company becomes a tax agent are fully listed in Art. No. 161 of the Tax Code of the Russian Federation.

Thus, an organization is obliged to play the role of a tax agent if:

- Confiscated material assets, various treasures, as well as values of other origins are sold.

- The property of a previously bankrupt enterprise or individual is purchased or sold.

- All kinds of goods and valuables of imported origin are sold.

The duties of the tax agent include withholding a certain amount from his own income, after which he must transfer it to the tax service within the time limits established by law.

Thus, in fact, the tax agent acts as an intermediary between the tax authorities and the taxpayer himself.

Payment of standardized expenses

Expenses that are regulated in the Tax Code, as well as in various decrees of the Russian government, include:

- on advertising (costs of advertising structures, banners and other types);

- employee insurance (voluntary) under contract;

- interest on loans taken by the organization for various purposes;

- related to the sale of printed materials (books);

- replenishment of the reserve for unconfirmed (doubtful) debts.

There are situations when some regulated expenses simply do not fit into the standard established by the Tax Code, Art. No. 270, paragraphs 42, 44. Therefore, these expenses cannot be deducted.

As a result, the organization is obliged to pay the balance of VAT, since it is not possible to include this tax in any non-operating expenses.

Examples

The company made an advance payment of 1.118 million rubles to pay for upcoming deliveries. Prepayment is 100% of the cost of the goods. VAT in this case is equal to 118 thousand rubles.

Also, in the reporting period under review, the same company received from its future customers an advance payment amounting to 708 thousand rubles. VAT in this case is equal to 108 thousand rubles.

All transactions performed are reflected in the financial statements as follows:

| the name of the operation | Sum | Debit | Credit |

| Transfer of advance payment to supplier | 1.118 million rubles | 60 | 76 |

| Amount of accrued value added tax | 180 thousand rubles | 68 | 76 |

| Transfer of advance payment from buyers | 708 thousand rubles | 51 | 62 |

| Value added tax on advance payments received from buyers | 108 thousand rubles | 76 | 68 |

| Capitalized material assets | 90 thousand rubles | 41 | 71 |

If you display tabular data in a unified form, the record will look like this:

| Cell | Sum |

| Line No. 1230 | 1 million rubles |

| Line No. 1520 | 600 thousand rubles |

Some nuances sometimes arise when distributing VAT amounts on acquired values related to indirect expenses.

They are resolved with the help of the Tax Code and relevant Government decrees that directly relate to this issue.

When drawing up a report, it is very important to mention that all types of debts (receivables and payables) are reflected in the corresponding section of the balance sheet.

Analysis of results

The main purpose of the financial results statement is to characterize the resulting performance indicators of the company:

- gross profit;

- profit/loss from product sales;

- profit/loss before tax;

- net profit/loss received for the reporting period.

This document is the main information source for analyzing the profitability of the company's activities, the profitability of its production and the amount of net profit. Explanations to the report include data related to the accounting policy of the enterprise, not included in the main content, but necessary for a qualitative assessment of its financial condition.

A sample copy of the SZV-M must be approved by the signature of the manager for the form to be valid.

How to draw up a notification about selected tax objects - read.

In this article we will write why a patent may be refused and what to do in this case.

This report interests the management of the enterprise most of all. Because it is he who talks about how the enterprise performed during the reporting period.

Let's look at the example of the simplest form:

The report has two main parts:

1. Profitable; 2. Consumables.

In the revenue part, from the sales volume of the enterprise for the reporting period (line 1), we subtract the cost of products sold (line 2). We get gross profit (line 3).

I strongly recommend entering the gross profit rate indicator (line 4). This metric shows how much of your total sales is profit.

The expenditure part consists of fixed expenses, the level of which does not directly depend on sales volume. (This rule is sometimes not fully observed, but more on that later).

Expense items (lines 6 to 21) are indicated conditionally. The expense items in your report may differ, the main thing is that you understand what expenses are included in these items. And the list of these expenses must correspond to the analytics of account 92 (Fixed or administrative expenses).

Next comes the amount of operating profit (Gross profit - Total expenses). Amount of income tax (line 23).

And the most important result: The amount of net profit. (Operating profit - Income tax). The result of the enterprise's work for the reporting period. The amount of net profit on the income statement should be equal to line 1.4 of the balance sheet liabilities "incl. during the reporting period".

The indicator “Net profit rate” (line 26) demonstrates what share of net profit is contained in the total sales of the enterprise for the reporting period.

A very important point! VAT and profit and loss account

According to international standards, information in the profit and loss statement is reflected without VAT. Based on the logic that by removing this tax from the income and expenditure side, we get:

1. A more correct amount of net profit. 2. More correct figures for income and expenses, which in reality are inflated by the amount of this tax.

This is an absolutely correct approach if your company pays all taxes honestly.

But in the conditions of Ukraine, enterprises often prefer to “optimize” the amounts that are subject to payment to the budget as value added tax. And VAT is no longer similar in its essence to a tax, but to another cost (absolutely standardized, the amount of which is determined either by the approval of the head of the enterprise, or by agreements with the tax office). Therefore, I believe that for our domestic conditions, it is much more correct to show information in the income statement including VAT, and indicate the tax itself as an expense under the item “Taxes” (line 12).

In this example, I described the simplest type of income statement.

Let's look at two more. The only difference between them is the grouping of expenses.

Option 2

Fixed expenses are divided into two parts:

1. Sales expenses. That is, expenses that are directly related to the sale of products, but are not included in the cost of production. Isolating this type of expense allows you to more clearly understand the costs of selling products.

2. Operating expenses. All other fixed expenses.

This option, compared to the first, has the advantage that sales costs are presented more clearly.

The downside is that some expense items are divided between two blocks.

For example: wages or fuel costs, and in order to understand how much is spent on these items, you will have to add it up on a calculator.

Option 3

Fixed expenses are divided into three parts.

1. Sales expenses. Similar to the second option

2. Operating expenses. This block contains the largest expense items.

3. Other operating expenses. This block contains items with a small amount of expenses.

All the report options discussed above have the right to exist and it is up to you to decide which form is more suitable and implement it.

If you need the above report in Excel format, write to me. I'll drop it off for you. If a report is needed, but the proposed form is not suitable. Then come here.

This post is also available in: English

Account 46 in accounting

The accountant of Etalon M LLC reflects these transactions: Month Dr Kr Description of transaction Amount July 51 62.2 Reflection of advance payment from the customer 80000000 August 20 10.70.69, etc. Reflection of contractor costs for performing work 48000000 September 20 10.70.69 etc. Reflection of the contractor's costs for performing the work.1 Delivery of the first stage of work 65000000 90.2 20 Reflection of the write-off of the cost of work 45000000 90.9 99 Reflection of the financial result from the delivery of the first stage 20000000 October 46 90.1 Delivery of the second stage of work 90000000 20 10.70 ,69 etc d. Reflection of the costs of fulfilling the contract 38000000 90.2 20 Reflection of the write-off of the cost of work on the second stage 38000000 90.9 99 Reflection of the financial result from the delivery of the second stage 52000000 62.1 46 Write-off of the cost of work accepted by the customer on the project (65 million.

Questions on the topic under consideration

Question 1

The organization is on a simplified system. Is it necessary to fill out line 1220 when preparing annual reports?

Simplified people are a special type of taxpayers. As a rule, they do not work with VAT, however, they may have “input” VAT. In this regard, the company can establish in its accounting policy the provision that all VAT received with purchases is taken into account in account 19. In this situation, at the end of the period an account balance will be formed, and when drawing up the annual report, this balance will be transferred to line 1220.

Question 2

Can there be the same VAT amounts on lines 1220 and 1520 of the balance sheet?

No, they can't. The coincidence of the meaning of these lines is a pure coincidence, this is an error. Line 1220 is in the balance sheet asset and shows the tax on purchased assets that is not accepted for deduction. Line 1520 is in the liability side and reflects the company’s debt to the budget. There is probably no primary document for the purchase of goods. It is necessary to analyze and identify the error.

Reflecting VAT on the balance sheet is not as simple as it seems at first glance. Before drawing up the annual report, it is necessary to conduct a thorough check of all indicators, carry out reconciliations with counterparties, take into account the expenses that are accepted according to the standards, and only after that bring the information into the balance sheet. Since tax amounts can be reflected in both an asset and a liability, it is very important to understand which amount to report in which line. Line 1220 is not always filled in.

Value added tax

Initial event: when the company bought a risograph, along with the amount of 55 thousand, which was already mentioned, it had to transfer another 10 thousand rubles to the sellers as VAT.

Try to reflect this event in the balance sheet, and let's figure it out together.

First, let's find out what VAT means.

VAT stands for “value added tax.” This tax is added by the seller to the price of the item upon sale.

VAT is not an ordinary tax. Why is that?

Firstly, because VAT amounts are reflected in both the asset and liability side of the balance sheet.

Secondly, because ordinary taxes are paid by the enterprise directly to the state. They always flow out of the pocket of the enterprise and flow into the pocket of the state. And VAT flows from the buyer’s pocket into the enterprise’s pocket, and from the enterprise’s pocket flows into the pocket of the state. Let's find out how this happens.

The enterprise, fulfilling the will of the state, adds a certain amount - VAT - to the price of the goods it produces, and sells its products.

The buyer pays for the goods, the price of which includes the amount of VAT.

The seller, having received money for the products sold, transfers the amount of VAT belonging to the state to the budget.

It seems that everything is clear and there is nothing unusual in this tax. But we looked at only one side of the coin - when our company acts as a seller of its own products.

But in order to produce these products, the enterprise buys everything necessary for production (materials, equipment, etc.) and in this case itself acts as an ordinary buyer and pays VAT upon purchase, which the sellers added to the price of their goods.

And this is where the “most interesting” part comes in. Since VAT must flow into the pocket of the state from the buyer through the pocket of the seller, then when our enterprise acts as a buyer, the state returns to it the amount of VAT that it transferred to the seller.

In order not to get confused in complex calculations, the state introduced the following procedure:

1) first, each enterprise calculates the amount of VAT that it must pay to the state directly - that is, the amount from transactions in which our enterprise acted as a seller. This part of the VAT is reflected in the liability side of the balance sheet.

2) then the company subtracts from this figure the amounts that it has already paid to the sellers - that is, the amounts from transactions in which our company acted as the buyer.

Key Notes

General content framework

The financial performance report includes the following indicators:

- Income received and expenses incurred for ordinary activities. They include net revenue (received from the sale of products without VAT, excise taxes and other similar payments) and cost (excluding management and commercial costs). This group includes the gross profit of the enterprise, management costs, commercial expenses, profit or loss from the sale of goods, performance of work, and services.

- Operating income and expenses include interest that the company receives and pays, income from participation in other companies, other similar expenses and income of the company.

- Non-operating income and expenses, including profit or loss calculated before tax and from ordinary activities, as well as income taxes and other similar payments.

- Extraordinary expenses and income are reflected in a separate group.

- The final indicator is net profit.

Example KUDiR simplified taxation system income (6%)

Central indicators

The following main indicators can be highlighted in the Financial Results Report:

| Revenue | It characterizes the performance of the enterprise and the effectiveness of its management accounting. |

| Profit/loss from sales | This indicator is contained only in the full form of the report maintained by large firms. Its content includes the effectiveness of sales and all costs incurred for production, sales, and management. |

| Profit/loss from sales before tax | This indicator combines profit from ordinary activities with other income (from interest on loans, sales of fixed assets, participation in other companies, etc.) and expenses not related to the main work of the enterprise (for example, banking services). |

| Net income (loss | The resulting indicator of the company's performance. Reflects her real income minus all expenses incurred. Its distribution is one of the most important areas of management accounting. |

What is reflected in the structure

Based on the final indicators of the Report, it is clear from what the company received its financial result. They are compared with the same previous period. This structure makes it possible to analyze indicators not only at the reporting date, but also over time.

Not every company can receive VAT exemption. For example, this could be an LLC that supplies wheelchairs.

Accountants explained how tax calculations are carried out for advance payments of corporate property tax.

Often financial statements are needed for interim periods. Therefore, it is compiled based on the final data of closed months. Its indicators are needed by the economic department, management, owners, investors, banking institutions, and counterparties.

The financial results statement is structured in such a way that the most significant data (revenue, sales profit, cost) is reflected first. This is followed by indicators on indirect sources of income and expenses of the enterprise.

Blank simplified form KUDIR