The Tax Code is one of the most dynamically changing laws in our country. As a rule, changes to the Tax Code of the Russian Federation do not bode well for either entrepreneurs or citizens.

Most often, changes are associated with increased taxes or stricter inspections. But there are exceptions when changes can, in certain cases, help ordinary citizens save money. This doesn't happen often, but it's definitely worth checking out.

Sometimes many people do not know about all the benefits and miss the opportunity to save. In our country we need to squeeze the maximum out of what we have.

Just recently, Federal Law No. 374-FZ of November 23, 2021 was adopted, which introduced important changes to the Tax Code of the Russian Federation; now a number of citizens can count on some tax benefits when paying taxes. Let's take a closer look.

How tax breaks work in Russia

Tax benefits are a “discount” on the payment of taxes, which is provided to certain categories of citizens on the basis of supporting documents. Some Russians are completely exempt from taxation, for example, pensioners do not pay property tax, and group I disabled people do not pay vehicle tax.

Tax benefits are provided at both the federal and regional levels

. Federal tax benefits are provided for in paragraph 1 of Article 56 of the Tax Code of Russia, and the categories of Russians are specified in Article 407 of the Tax Code of the Russian Federation.

It is worth noting that regions have the right to expand the categories of citizens who can apply for benefits, or to increase the amount of benefits, but not to reduce them.

In most cases, to apply for a benefit, you need to submit an application to the tax authority.

. If the application is not submitted, the tax benefit will not be provided.

NSL size

The size of the NSL directly depends on the minimum subsistence level for an able-bodied person (per month), established by law as of January 1 of the reporting tax year.

The subsistence minimum for able-bodied persons as of January 1, 2018, according to the draft state budget 2018, is provided in the amount of UAH 1,762

. Given this size in 2021, the NSL will be:

NSL in 2021, as before, will be applied to income in the form of wages, as well as payments equivalent to it, if the amount of such income does not exceed the subsistence minimum established for able-bodied persons as of January 1, 2021, multiplied by a factor of 1 ,4 and rounded to the nearest 10 UAH.

That is, the maximum salary

the usual NSL

can be applied in 2021 = 1762 x 1.4 =

2470 UAH

.

Which Russians are entitled to benefits?

Each tax has its own categories of beneficiaries and benefit amounts. Therefore, it is worth considering each tax benefit separately.

Tax benefits for transport tax: to whom and how much

Since the transport tax is a regional type, the categories of citizens who are entitled to benefits are established by local authorities. In order to find out whether a person can receive a transport tax benefit in his region, he needs to contact the local Federal Tax Service.

For example, in Moscow, they can receive a tax break on transport tax

the following citizens:

- veterans and disabled people of the Great Patriotic War;

- Heroes of the Soviet Union and Heroes of the Russian Federation;

- citizens who have been awarded the Order of Glory of three degrees;

- veterans and disabled combat veterans;

- former juvenile prisoners during World War II;

- disabled people of groups I and II;

- parent or other legal representative of a disabled child;

- one of the parents of a large family;

- "Chernobyl victims".

Such taxpayers are entitled to receive tax relief for one vehicle

. The benefit is 100% of the amount of transport tax for one car (that is, each benefit recipient may not pay tax on one car).

The engine power of a vehicle for which tax relief is not paid must be no more than 200 liters

.

With.

Moreover, the vehicle must be registered in the name of the beneficiary.

For the parent of a large family

Moscow authorities do not set restrictions on engine power. That is, a parent with many children has the right not to pay tax on one vehicle without taking into account engine power.

In addition, the transport tax on electric vehicles has been completely abolished

. That is, regardless of who owns the electric car, transport tax is not charged on it.

Benefits for property tax for individuals: to whom and how much

Categories of property tax beneficiaries are established by Article 407 of the Tax Code of the Russian Federation

. These include:

- disabled people of categories I and II;

- disabled since childhood;

- disabled children;

- Chernobyl victims;

- pensioners;

- participants of the Second World War and other military operations in the USSR;

- family members of a serviceman who have lost their breadwinner;

- Heroes of the Soviet Union and Heroes of the Russian Federation;

- citizens awarded the Order of Glory of three degrees.

The above categories of citizens are completely exempt from paying property tax

.

People with more than 3 minor children are partially exempt from paying property tax. They are provided with a benefit in the form of exemption from property tax in the amount of 5 square meters. m.

of the total area of the apartment or

7 sq.

m. from the area of a private house for each minor child.

Moreover, the tax benefit is provided for each type of property separately

.

Example. If there are 5 children in a family, 4 of which are minors. The family owns an apartment and a house. The property tax benefit will be presented in the amount of the cadastral value of 20 square meters. m. in relation to the apartment and 28 sq. m. in relation to a residential building. From an apartment area of over 20 sq. m. and from a house area of over 28 sq. m. m. property tax will be calculated as usual.

In addition, property tax is not charged on specially equipped premises for creative activities:

- studios;

- studio;

- galleries and other similar premises.

The main condition is that these premises are not used as housing

.

People who own utility buildings with an area of less than 50 square meters. m

., intended for farming, are completely exempt from paying property tax on such structures. Also, property tax is not calculated on greenhouses, temporary buildings and cabins.

In Moscow, St. Petersburg and Sevastopol

Additional preferential categories of local residents and an increased amount of benefits for personal property tax may be established. For example, in Moscow there is a special procedure for providing property tax benefits for apartments.

Tax benefits for land tax: to whom and how much

Categories of beneficiaries for land tax are provided for in Article 391 of the Tax Code of the Russian Federation

. These include:

- disabled people of groups I and II;

- disabled since childhood;

- disabled children;

- Chernobyl victims;

- pensioners;

- veterans and disabled people of the Great Patriotic War;

- veterans and disabled combat veterans;

- Heroes of the Soviet Union and Heroes of the Russian Federation;

- full holders of the Order of Glory;

- parents with many children, provided that there are 3 or more minor children in the family.

Tax relief is provided in the amount of 100% for a land plot with an area of no more than 600 square meters

.

m.

The plot must be owned by the beneficiary, on the basis of perpetual use or lifelong inheritable ownership.

In addition, the authorities of Moscow, St. Petersburg and Sevastopol

may introduce additional benefits for local residents. For example, residents of Moscow who are beneficiaries have the right to further reduce the tax base for land tax by 1 million rubles. And Heroes of the Soviet Union, Heroes of the Russian Federation, full holders of the Order of Glory, “For Service to the Motherland in the Armed Forces of the USSR”, Labor Glory and Heroes of Socialist Labor are completely exempt from paying tax on one plot of land, regardless of its area.

Personal income tax benefits: who and what amount

Benefits from paying personal income tax are provided for certain types of income received for specific categories of citizens. They are established by Chapter 23 of the Tax Code of the Russian Federation. Thus, the following are exempt from personal income tax:

- donors in relation to the amount of remuneration for donated blood, breast milk or other assistance;

- pensioners in relation to the amount of the accrued pension and additional payments to it;

- individuals who received a lump sum payment in connection with the death of a pensioner, which is paid to former employers, in the amount of no more than 4 thousand rubles per year;

- veterans, disabled people and home front workers of the Second World War, as well as their widows, in relation to material assistance from the budget of the Russian Federation in an amount of no more than 10 thousand rubles per year;

- combat veterans and WWII participants in relation to state payments to veterans;

- disabled persons in relation to amounts of financial assistance in the amount of no more than 4 thousand rubles, which are provided for rehabilitation;

- citizens who participate in the detection and treatment of coronavirus (medical personnel and volunteers) in relation to incentive payments (compensation).

Tax deductions are also tax benefits. That is, a certain amount is deducted from the amount of income received. And then, from the resulting difference, personal income tax is calculated. Thus, standard tax deductions are presented:

- disabled people since childhood (500 rubles);

- disabled people of groups I and II (500 rubles);

- disabled people of the Second World War (3,000 rubles);

- Chernobyl victims and persons participating in the liquidation of the Chernobyl accident (3,000 rubles);

- Heroes of the Soviet Union and Heroes of the Russian Federation (500 rubles);

- parents and spouses of military personnel who died as a result of injury (500 rubles);

- others specified in Article 218 of the Tax Code of the Russian Federation.

Also, each parent can apply for a tax deduction for a child in the amount of 1,400 rubles for 1 and 2 children, 3,000 rubles for the third and subsequent children

, 12,000 rubles – for a disabled child.

If a divorced father or mother pays child support

, then they are also entitled to receive a tax deduction.

Recalculation of personal income tax when applying NSL

The Tax Code delineates the grounds on which the employer:

• is obliged to recalculate the amount of income accrued to the taxpayer in the form of wages and the amount provided by the NSL (clause 169.4.2 of the Tax Code);

• has the right to recalculate the amount of income accrued to the taxpayer, the amount of tax withheld, regardless of the fact of application of the Tax Tax Code (clause 169.4.3 of the Tax Code).

The employer has the obligation to recalculate the amount of income accrued to the taxpayer in the form of wages and the amount provided by the NSL:

• based on the results of each reporting tax year in which the tax return was provided;

• when making calculations for the last month of application of the NSL;

• when making a final settlement with an employee who terminates his employment relationship with the employer.

Recalculation consists of clarifying the monthly income paid during the year, taking into account the amounts that were accrued directly for the corresponding reporting months ( vacation pay, sick leave, etc.).

). Adjusted income is calculated each separately. The amount of taxable income calculated for each month is compared:

- with a maximum amount of income that gives the taxpayer the right to apply the tax return;

- with the amount of income determined for taxation at a rate of 18%.

Afterwards, final taxation is carried out (the amount of personal income tax is determined for each month separately).

If the annual estimated amount of personal income tax exceeds the actual tax withheld for the year, the amount of underpayment is determined. The amount of such underpayment is collected by the employer from the amount of any taxable income. And in case of insufficient amount - at the expense of taxable income of the following months until the amount of such underpayment is fully repaid.

If, as a result of the final settlement (the employment relationship is terminated), an amount of underpayment arises that exceeds the amount of payment for the last reporting period, then the outstanding part of such underpayment is included by the former employee in the declaration of property status and is paid by him independently.

Registration of tax benefits

Depending on the category of taxpayer and the type of tax benefit, they are provided:

- without a declaration

; - according to application

.

In an undeclared

In accordance with the procedure, benefits are provided for property tax and land tax for pensioners and disabled people of groups I and II. Information about the benefits provided is sent directly from the Pension Fund branch.

All other categories of beneficiaries must write an application to receive a tax benefit

. But depending on the benefit, the application must be sent to the Federal Tax Service or the employer.

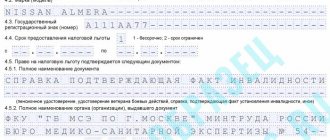

To receive a tax benefit or personal income tax deduction, a person writes an application addressed to the employer in any form. The statement states:

- Full name of the applicant;

- benefit category;

- sum.

to the application :

- child's birth certificate;

- certificate of residence in the Chernobyl zone;

- document confirming the disability group;

- other.

When applying for benefits for other types of tax, the application is sent to the Federal Tax Service inspection by Russian Post or during a personal visit

. The application is accompanied by a completed 3-NDFL declaration and other supporting documents (document on ownership of real estate or vehicle in respect of which the benefit will be provided). An application for benefits can be submitted to the MCF branch, through the taxpayer’s personal account on the website of the Federal Tax Service of Russia or through a confirmed profile on the State Services website.

Due to the risk of spreading coronavirus infection, tax authorities are accepting citizens by appointment

. It is advisable to check the work schedule of the MFC in your region. Some MFCs also provide appointments only by appointment.

If the taxpayer applied for the benefit before December 31, 2017

, then you do not need to reapply.

At the beginning of 2021, the tax authorities recommended filing an application for a tax benefit by May 20, if applying for the first time. But due to the coronavirus pandemic, it was almost impossible to submit an application within the specified time frame. From June 15, the Federal Tax Service resumed personal reception of citizens. Therefore, it is advisable for those beneficiaries who have not sent an application by Post or through State Services to visit the MFC or the local Federal Tax Service inspectorate in the near future

.

It is worth noting that a notification about the selected object for which a tax benefit will be presented can be sent to the tax service before December 1, 2021

.

Responsibility for violation of the procedure for applying NSL

As mentioned above, the NSL begins to be applied by the employer from the day the application and relevant supporting documents are received.

And if the application was submitted to more than one employer or the payer receives income that deprives him of the right to apply for an NSL (for example, receives a stipend in addition to wages), then such a payer is held accountable.

In this case, the employer will withhold funds from him in the amount of benefits provided and a fine in the amount of 100% of this amount. Also, such an employee loses the right to use NSL at all places of work.

Informing the taxpayer's employers about the presence of violations of the application of the Taxpayer Income Tax and notification of the presence of these violations is carried out by the supervisory authority (SFS).

Restoration of the right to use NSL is possible under the following conditions:

- submission by the taxpayer of an application for restoration of the tax return;

- repayment of tax underpayments arising in connection with the unlawful use of the tax levy;

- payment of a fine.

The NSL is renewed from the month following the month in which the above requirements are met.

minfin.com.ua

Obtaining tax benefits for past periods

If a person got a benefit a couple of years ago, but he has not used it before, then he can get a tax recalculation

. The tax authorities recalculate the previously paid term based on the application.

Tax recalculation and refund is possible within a period of no more than 3 years

(tax periods) that precede the year of filing the application and not earlier than the date the right to the benefit arises.

Example : A taxpayer could take advantage of property tax relief from 2015. However, he had not previously submitted an application for benefits. An application for recalculation of tax amounts was submitted on June 10, 2020.

Answer : The Federal Tax Service will recalculate the amounts of property tax paid for 2021, 2021 and 2021.

A response to an application for recalculation of previously paid tax is provided to the person within 10 working days. The period for tax refund is 1 month.

Interesting facts about taxes

In Russia, the history of taxation has quite a lot of interesting facts, here are a few of them:

- An interesting case occurred in the Tver region, where high-ranking officials refused income from suburban areas. This happened because the tax amount was 0.6 million rubles, and the cost of delivering the receipt was twice the cost of the tax.

- Many shady tax avoidance schemes are evidently seen in classic works of Russian literature. A striking example of this is the main character of the novel “Dead Souls”, Chichikov. The schemes described in the work are still successful, only adapted to modern times. They falsify certificates to achieve a variety of purposes. Companies that have large revenues do much more complicated and complicated things to avoid paying taxes.

- And sometimes tax law violators do desperate things. So, in Kirov, one of the restaurants was visited by an inspection from the tax office. Apparently, not everything was in order with the establishment’s taxes, since the cashier, having learned about the audit, began to eat the cash register tape, which led to injury. A tax officer who tried to stop a cafe employee who was eating evidence almost lost his finger.