The next reporting campaign has begun, someone hastened to submit the first declarations, others are summarizing the results, extracting missing documents from their counterparties, or repeating with an experienced squint, “we’ll wait.” Not the worst approach - some accounting programs have not yet been completely updated: forms are not filled out correctly, errors occur. We decided to remind you what reporting methods exist, including free ones, who can use them and how, and the pros and cons of different options.

Obligation to submit an electronic declaration

Article 174 of the Tax Code of the Russian Federation states that the VAT return is submitted by payers and tax agents to the Federal Tax Service at the place of their registration no later than the 25th day of the month following the expired tax period.

Taxpayers are required to submit VAT electronically free of charge (we recommend the Federal Tax Service website). In 2020, only tax agents who are not VAT payers or who are exempt from the obligation to pay this tax, with the exception of those listed in paragraph 5 of Article 174 of the Tax Code of the Russian Federation, retained the right to file VAT returns on paper:

- persons who carry out business activities in the interests of another person on the basis of commission agreements, agency agreements providing for the sale and (or) acquisition of goods (work, services), property rights on behalf of the commission agent (agent);

- persons who carry out activities on the basis of transport expedition contracts;

- persons performing the functions of the developer.

For organizations and individual entrepreneurs with a small staff or no employees at all and regardless of the taxation system used by the taxpayer, no exceptions are provided. By virtue of the same Article 174 of the Tax Code of the Russian Federation, when submitting a VAT return on paper, it is not recognized as submitted with all the ensuing consequences. All VAT payers are, of course, interested in the rules for submitting reports online.

Cost of services

Prices for the service depend on the taxation system and the volume of work. The cost is:

- quarterly reporting for LLC: for the simplified tax system 1500 rubles, for the general tax system 2000 rubles;

- annual reporting for individual entrepreneurs without employees: for the simplified tax system 1800 rubles, for the general tax system 3000 rubles;

- annual reporting for LLC: for the simplified tax system 1500 rubles, for the special tax system 2000 rubles;

- sending documents by mail: 250 rubles;

- electronic submission of reports: 500 rub.

You can find out the price of other services by ordering a preliminary consultation.

Sanctions for violators

For violation of the procedure for submitting a VAT return, including failure to comply with the electronic form, an organization or individual entrepreneur is held liable for taxation:

- For failure to submit a declaration within the prescribed period, liability is provided for in Article 119 of the Tax Code of the Russian Federation. Its provisions introduce a fine of 5% of the amount of tax not paid within the period established by law, which was indicated for payment in this declaration. The fine is charged for each full or partial month from the day on which the legally established deadline for submitting the declaration falls. The maximum fine in this case is not more than 30% of the specified amount, and the minimum is not less than 1,000 rubles.

- For violation of the rule on submitting a VAT return in electronic form, sanctions are applied under Article 119 of the Tax Code of the Russian Federation, since such a report is considered not submitted.

In addition, for violation of the established deadlines for submitting VAT reports, officials of the organization may be brought to administrative liability under Article 15.5 of the Code of Administrative Offenses of the Russian Federation. In this case, they will be given a warning or a fine of 300 to 500 rubles. For a delay in filing a VAT return (including if it is sent in paper form) for more than 10 working days, tax authorities have the right to suspend transactions on the taxpayer’s bank accounts and electronic money transfers. This possibility is provided for in Article 76 of the Tax Code of the Russian Federation. Consequently, submitting a report on paper, violating the requirements of the law, is not at all profitable. We recommend that you carefully study how to submit VAT electronically via the Internet.

Simplified balance

A simplified balance sheet, like a standard one, consists of assets and liabilities. But the detail in it is much more modest. Assets include only five lines:

- “Tangible non-current assets” include fixed assets and unfinished capital investments - the difference between the balance of accounts 01 and 02, as well as the balance of account 08.3 “Construction of fixed assets”.

- “Intangible financial and other non-current assets” - results of research and development, unfinished investments in intangible assets, deferred tax assets, etc.

- “Inventories” - the sum of the balances on the inventory and cost accounts: 10, 41, 43, 45, 20, 44. Reduce the resulting amount by the balance of account 42 for the loan.

- “Cash and equivalents” - all balances in the cash register, on current and foreign currency accounts. According to accounting accounts, this data is contained in accounts 50, 51, 52.

- “Financial and other current assets” - debit balance for all accounts not taken into account in the previous lines, for example, 60, 62, 76, etc.

The passive includes six lines:

- “Capital and reserves” - credit balances on accounts 80, 83, 84 minus the balance of account 84 on debit.

- “Long-term borrowed funds” - the balance on the loan of account 67.

- “Other long-term borrowed funds.”

- “Short-term borrowed funds” - credit balance on account 66.

- “Accounts payable” is the sum of the balances on accounts 60, 62, 76, 68, 69, 70, 71, 73 and subaccounts 75.02.

- "Other short-term borrowings."

The result is a balance of assets and liabilities. These graphs must be equal.

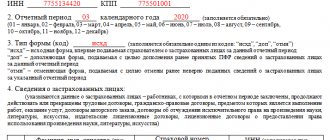

We generate an electronic VAT return

The electronic format of the VAT return 2021 and its annexes was approved by order of the Federal Tax Service No. ММВ-7-3/ [email protected] The procedure for submitting a tax return in electronic form via telecommunication channels was approved by order of the Ministry of Taxes of the Russian Federation dated April 2, 2002 N BG-3-32/ 169. Upload purchase/sale books generated in xls, xlsx or csv format using specialized operators for sending to the Federal Tax Service. These files will be automatically converted to xml format. The declaration is certified by an enhanced electronic signature of the established form (Article 80 of the Tax Code of the Russian Federation).

Electronic reporting tools

Any accountant understands that it is most convenient to submit VAT via the Internet using the program in which it was created. Transferring reporting from an accounting program to another resource is not immune to additional errors. We need a program that will allow you to submit VAT online and, if possible, free of charge. The first thing that comes to mind is the website of the Federal Tax Service of Russia. There is a “Taxpayer” program available there, which is absolutely free.

In addition, there are many offers on the market for accounting and reporting programs. Some of them are shareware, but most will still require some financial investment.

Free program from the Federal Tax Service

The Federal Tax Service is conducting a pilot project to operate software that ensures the submission of tax and accounting reports in electronic form via a website on the Internet. Taxpayers are given the opportunity to submit reports electronically completely free of charge. Although the “Help” button in each section provides instructions for filling out the corresponding section of the VAT return, this program does not provide support. You will have to track all software updates yourself. The user deals with all errors and malfunctions independently. It will not be possible to test the declaration before sending it.

In addition, in accordance with paragraph 3 of Article 80 of the Tax Code of the Russian Federation and paragraph 5 of Article 174 of the Tax Code of the Russian Federation, submit tax returns for value added tax using the Federal Tax Service service only if you have an electronic digital signature (EDS). You will have to buy it from any accredited certification center. That is, there will still be certain costs for sending reports in this way. In this regard, today it is not possible to submit a VAT return absolutely free of charge. It’s still worth taking a closer look at paid services.

Electronic reporting market

There are two ways to generate a VAT return and explanations in electronic form and send them to the tax office:

- straight;

- representative.

In the first case, the taxpayer organization must independently enter into an agreement with an electronic document management (EDF) operator. In addition, there are intermediary firms or special operators. The taxpayer becomes a subscriber under the agreement, he is provided with a program for sending reports, and an electronic digital signature is issued for the manager or other authorized person. In this case, the organization will need a special programmer who can configure the program, integrate it into the accounting program and update it regularly. For services, you will have to transfer money annually to the EDF operator.

In addition, there are so-called cloud services. In this case, the software is provided by the operator directly on the Internet and the user has the right not to install anything on their computers, and access to such a program is possible from any computer or laptop. The user receives full control over the submission of their reports and the ability to directly receive notifications and requests from the tax service.

The representative method is much simpler, but it does not guarantee control over the delivery of reports. In this case, the VAT return is sent through an organization that already has a software package installed that allows you to send reports to other organizations or entrepreneurs. Typically, such services are much cheaper than working directly with an operator. The tax authorities themselves do not welcome them; in this case, they have no feedback from the VAT payer.

Operator and program selection

In total, today there are 119 electronic document management operators registered and operating in Russia (see the full list on the Federal Tax Service website). An operator is a Russian organization that meets the requirements approved by the Federal Tax Service of Russia (clause 3 of Article 80 of the Tax Code of the Russian Federation, letter of the Federal Tax Service of Russia dated September 30, 2013 N PA-4-6/17542). Work only with those operators that are registered with the Federal Tax Service of Russia. Although the leaders in the EDI market are constantly changing, today the leaders in terms of the number of clients are:

- "Tensor" (product - VLSI);

- "Kaluga Astral" (product - "Astral Report" and many other projects where "Kaluga Astral" appears only as a special communications operator: "1C-Reporting", "Bukhsoft Online", "Moe Delo", "Sky" and others);

- "SKB Kontur" (products: "Kontur.Extern", "Elba" and "Accounting.Kontur");

- "Taxcom" (products: "Dockliner" and "1C-Sprinter").

Products for sending reports include:

- "Accounting.Kontur" (https://www.b-kontur.ru);

- “Astral Report” (https://astral.ppt.ru/);

- "Kontur.Extern" (https://kontur.ru/extern);

- “My Business” (https://www.moedelo.org/);

- “Sky” (https://nebopro.ru/).

All of these companies do not provide the opportunity to submit VAT for free via the Internet, but they all hold promotions during which they offer temporarily free reporting preparation. In addition, when establishing long-term cooperation, they almost always offer good discounts and the opportunity to submit VAT returns for a very reasonable fee.

Through an intermediary

It doesn’t matter how exactly the reporting will be submitted, because another person or organization will deal with this problem. Often, the representative will also prepare the reports themselves for you, but you can simply transfer the finished documents to the intermediary in paper or electronic form, depending on the interaction.

In any case, you must issue a power of attorney to represent your interests. If the power of attorney is issued by an organization, a simple form with the director’s signature and seal is sufficient. The individual entrepreneur is obliged to issue a notarized power of attorney (clause 3 of Article 29 of the Tax Code of the Russian Federation).

The representative can not only submit the report, but also sign it himself. This is relevant if, for example, an outsourcing company is involved in reporting. On the title page of the declarations you could see two codes - 1 for an individual entrepreneur or the head of a taxpayer organization and 2 - if the reporting is signed by a representative by proxy.

Pros:

- Someone else may prepare the reports;

- You don't have to travel or walk anywhere.

Minuses:

- There is no direct control over the situation; you need to receive confirmation that the representative has completed his task;

- It doesn’t matter who is actually to blame if the report is submitted late or with errors. The taxpayer will still have to answer, not the intermediary.

Suitable for: all organizations and individual entrepreneurs.

Risks: if you use the services of, for example, a private accountant or service organization, then you need to introduce clear regulations for interaction and exchange of documents, incl. confirmation of timely and complete submission of reports. Some managers or individual entrepreneurs transfer their electronic signature to an intermediary, which is absolutely forbidden to do. EDS can be used for selfish, fraudulent and other illegal purposes. We talked about how control over digital signatures is being strengthened to protect against unauthorized use.

Programs and prices

The leader in terms of price-quality-convenience ratio in the electronic reporting market is 1C-Reporting. Comparison with other special operators is presented in table form. As an example, we took the service of a legal entity during the year.

| "1C-Reporting" | "Astral Report" | "Sky" | "Bukhsoft Online" | "Circuit. Extern" | "My Business" | VLSI | Otchet.Ru | |

| Price per year | From 3,900 to 5,900 rubles. | from 2,900 rub. | From 100 to 170 rubles. for the report | Single price RUB 2,938. | From 2,900 rub. | From 9,996 rub. | 3,300 rub. | From 1,300 to 4,300 rubles. |

| Technology | Offline | Offline | Online | Online | Online | Online | Offline | Offline |

| Technical support | around the clock | around the clock | around the clock | daily from 07:00 to 19:00 | around the clock | around the clock | around the clock | around the clock |

| Checking the report | Yes | No | No | Yes | Yes | No | Yes | Yes |

Obviously, when choosing the optimal program, consider how it works:

- offline — the system is installed on the computer (copy on an external hard drive or flash drive);

- online - cloud technologies, work from any computer on the Internet.

From the table above it can be seen that the first group includes such software products as VLSI++ and Astral Report. The second group is a little more difficult. Not all online programs allow access from any device. For example, “Kontur.Extern” allows you to generate and send a VAT return directly on its portal in cloud mode, but you can only access the information from the computer on which the cryptographic information protection tool (CIPF) is installed. “Contour” is considered an online program only conditionally. Completely cloud-based programs are Bukhsoft, Moe Delo, Otchet.ru and Nebo.

To select a special operator, it is important to evaluate the ratio of the functions and options offered to their price among similar operators. More expensive options usually include additional services, such as checking the declaration before sending. In addition, users receive a regulatory framework for accounting and reporting and advice from experienced accountants. Ease of connection and configuration, as well as feedback from the Federal Tax Service of Russia, play an important role. In addition to sending the VAT return itself, you must receive from the Federal Tax Service a receipt of its receipt, as well as other requirements and notifications.

What type of letter to use

The subject can independently choose the method of sending reports to the tax office by mail. It is stipulated as a mandatory condition that an inventory of its contents must be drawn up for such a letter.

Sending can be done using one of the following options:

- By regular letter. This is the most accessible way to send correspondence. Payment for postal services is made per envelope, as well as for the weight of the item. The inventory must be drawn up on company letterhead in any form. However, most often the postal service employee refuses to visa her. This happens because a simple letter is not recorded in any way, and if it is lost during forwarding, it will be impossible to confirm the fact of sending.

- By registered letter. This is the most accessible option to send a registered letter. When it is handed over for forwarding, the employee is given a receipt, which will serve as proof that the letter was sent if the envelope is lost. The sender draws up the inventory himself, but the postal worker does not put a stamp on it. This means that the fact that the letter was sent can be confirmed by presenting a receipt, but it will not be possible to prove what exactly was in it. If the receipt is lost, then it will be quite difficult to confirm the shipment. The letter can be sent with notification of receipt.

- With the help of a valuable letter. Such a letter also belongs to the category of registered ones. But you can assign a “price” to it, which will be given to the sender if it is lost. To confirm the contents, the postal worker draws up an inventory of the attachment on his letterhead, puts a stamp there and gives one copy to the sender. The inventory in this case can also act as confirmation of sending the declaration to the Federal Tax Service. It is also acceptable to use a receipt notice with this letter.

Important! When sending reports via mail, it is best to use a valuable letter with a list of attachments. Since in the inventory you can indicate the entire list of documents to be sent. And prove to the tax office what specific reporting was sent in case the letter to the Federal Tax Service is lost.

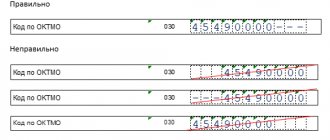

Checking the electronic VAT return

Before sending it to the Federal Tax Service, it is necessary to check the declaration: whether it is filled out according to the format, whether the control ratios are met, whether the transaction type codes are indicated correctly, and it is possible to check the counterparties for their reliability. The taxpayer himself has the right to do this with the help of control ratios used by the tax authorities during a desk audit. Such testing before sending the declaration to the Federal Tax Service will allow taxpayers to avoid submitting an incorrect report containing errors, eliminate unnecessary correspondence with the tax authority and the need to submit updated declarations to correct errors.

Of course, such checks are carried out using specialized testing programs. The tax service's online service does not provide this option. Among the most understandable and convenient programs for electronic submission of VAT returns in this regard, “Kontur” and “Bukhsoft” should be highlighted - only their report verification protocol contains transcripts that are understandable to most users. For example, Bukhsoft sends the following transcripts when testing a VAT return:

- error in the Sender ID element - decryption: “The file name must be unified, the letters are all capitalized. The file must have an identical name inside";

- error: “The value was not found in the sono directory” - interpretation: “This error indicates that the Tax Authority Code was entered incorrectly”;

- error: “The condition for the presence (absence) of the element File/Document/BookPurchase is not met when the value of the element Recognized8 is equal to “” - transcript: “The presence of Section 8 is not indicated in the report”;

- error: "" violates length constraint for '7'. It was not possible to analyze the attribute “CodeOper” with the value “” - explanation: “Most likely, your operation codes are incorrectly specified or not specified. In the purchase books and sales books, the journal of received and issued invoices. For more details, see Government Resolution No. 1137.”

Obviously, even a novice user will be able to understand such decodings and eliminate all shortcomings before the VAT report is received by the tax office.

Federal Tax Service requirements

The taxpayer is obliged not only to submit VAT, but in addition he has the following interrelated obligations (clause 5.1 of Article 23 of the Tax Code of the Russian Federation):

- ensure the acceptance of electronic notifications, demands and other documents sent via telecommunication channels by tax authorities within the scope of their powers;

- promptly (within six working days) send to the tax authority a receipt of receipt of such documents in electronic form;

- provide explanations for the electronic VAT declaration according to the TKS.

Tax authorities have the right to request such explanations if errors and (or) contradictions are identified in the declaration between the information contained in the submitted documents, or if the information provided by the taxpayer does not correspond to the information contained in the documents available to the tax authority and received by it during tax control. The format for providing explanations was approved by order of the Federal Tax Service of Russia dated December 16, 2016 No. ММВ-7-15/ [email protected] If the specified explanations are submitted on paper, such explanations are not considered submitted. If these requirements are not met, the Federal Tax Service has the right to block transactions on the payer’s account. The special operator is obliged to provide such an opportunity.

Application for confirmation of the main type of activity

The main type of activity must be confirmed every year by sending a corresponding application and documents to the Social Insurance Fund. The rate of contributions for injuries depends on it. If you do not confirm the type of activity, the fund will choose the most dangerous type of activity from your list, and you will have to pay premiums at an increased rate.

Who is renting ? Insurer organizations.

Deadlines for delivery. Submit your application for 2021 by April 15, 2021.

Form and delivery format. The application form is given in Appendix No. 1 to Order No. 55 of the Ministry of Health and Social Development dated January 31, 2006. It must be accompanied by a confirmation certificate from Appendix No. 2 and a copy of the explanatory note to the balance sheet.