What payroll taxes need to be withheld?

“Salary” taxes, which the employer must calculate, withhold and transfer to the budget, can be divided into two large groups.

The first includes those amounts that are transferred at the expense of the employee. These payments are withheld from the salary when it is paid, and the employee receives less in person than was accrued before taxes. And the second group of mandatory contributions includes those amounts that are transferred at the expense of the employer. Let's look at each payment in more detail. Calculate your salary and benefits taking into account the increase in the minimum wage from 2021 Calculate for free

Contributions from employees

We are talking about personal income tax, which is deducted from employee remuneration and does not increase the tax burden on the employer. Personal income tax must be withheld from the wages of employees who are citizens of the Russian Federation and permanently reside in Russia at a rate of 13%. In the general case, such an employee will receive in person not the amount specified in the employment contract, but 13% less.

IMPORTANT. In some situations, the amount of salary from which tax is withheld can be reduced by deductions (clause 3 of Article 226 of the Tax Code of the Russian Federation). And then more than 87% of the amount written in the contract will be due for delivery “in hand”. For example, employees with minor children have the right to a deduction. The amount of deduction for the first and second child is 1,400 rubles each. per month, and for the third and each subsequent child - 3,000 rubles. per month (subclause 4, clause 1, article 218 of the Tax Code of the Russian Federation). For more details, see: “Children’s” deductions for personal income tax: what an accountant needs to know” and “An employee applied for a property or social deduction at the place of work: what an accountant should do.”

Calculate your salary and personal income tax with standard deductions for free in the web service

The amount of personal income tax on wages must be determined once a month - as of the last day of the month (clause 3 of Article 226, clause 2 of Article 223 of the Tax Code of the Russian Federation). When paying an advance, that is, wages for the first half of the month, personal income tax is not calculated and is not withheld. Consequently, in the middle of the month the employee receives exactly the accrued amount. But upon the final payment for the month, personal income tax is withheld from the amount paid, calculated from the entire salary, including the advance (clause 4 of Article 226 of the Tax Code of the Russian Federation). The employer must transfer to the employee the amount of the monthly salary minus personal income tax and the previously issued advance.

The deadline for payment of personal income tax withheld from employees to the budget is the next working day after the payment of wages at the end of the month (clause 6 of Article 226 and clause 7 of Article 6.1 of the Tax Code of the Russian Federation).

Calculate your advance and salary for free, taking into account all current indicators

What does not apply

It is worth noting that income coming from third party sources should not be taken into account in the calculation. So the payroll does not include:

- one-time bonuses accrued every year;

- expenses for sick leave payments arising after the third day of illness of the employee;

- payments transferred monthly to women who give birth until the child reaches the age of 1.6 years;

- all expenses incurred during the sending of an employee for training or retraining and transferred by bank transfer;

- all funds received or spent from third-party sources of income;

- financial assistance, which is provided after a written request from the employee;

- payment of dividends to employees.

When calculating payroll, you need to be guided by the data recorded in the time sheet, salary slips and staffing schedule of each employee. With their help, you can calculate payroll for any period, including an hour, which is especially necessary if you have a large staff of workers.

Contributions from employers

We are talking about four types of insurance premiums:

- for compulsory pension insurance (pension contributions);

- for compulsory health insurance (medical contributions),

- for compulsory social insurance in case of temporary disability and in connection with maternity (contributions for “sick leave”),

- for compulsory insurance against accidents at work and occupational diseases (contributions for “injuries”).

These revenues are used to pay pensions, finance free medical care under the compulsory medical insurance policy, pay for sick leave and child care benefits, and also compensate for damage to life and health caused by injuries in the workplace. These payments are transferred at the expense of the employer and are not deducted from the employees’ salaries.

Insurance premiums must be calculated on the last day of the month based on the full amount of the salary of each specific employee (clause 1 of Article 421 and clause 1 of Article 431 of the Tax Code of the Russian Federation, clause 9 of Article 22.1 of the Federal Law of July 24, 1998 No. 125-FZ ). In general, contributions are paid at the following rates: for pension insurance - 22% of salary, for health insurance - 5.1%, for sick leave - 2.9%. These contributions are transferred to the budgets of the funds, and their payment is controlled by the Federal Tax Service.

The rate of contributions “for injuries” depends on the OKVED code for the main type of activity of the organization or individual entrepreneur. FSS divisions annually set the amount of contributions for each policyholder. The minimum tariff is 0.2%, and the maximum is 8.5% of the amount of payments to employees. In this case, a discount or surcharge may be applied to the tariff. The size of the discount or surcharge cannot exceed 40% of the established tariff (Clause 1 of Art. Law No. 125-FZ).

Fill out and submit confirmation of the main type of activity via the Internet

Thus, even with the most “non-risky” activity from the point of view of injuries and taking into account the maximum discount, the employer must monthly transfer 30.12% of each employee’s salary to the budget. At high salaries, this figure decreases slightly. So, if an employee’s salary, determined on an accrual basis from the beginning of 2021, exceeds 912,000 rubles, then there is no need to pay any more sick leave contributions. And if the salary is more than 1,292,000 rubles, then the rate of pension contributions for payments exceeding this value will decrease from 22% to 10%.

Insurance premiums for the previous month must be transferred no later than the 15th day of the current month (Clause 3, Article 431 of the Tax Code of the Russian Federation, Clause 4, Article of Law No. 125-FZ). If this date falls on a weekend or holiday, the payment deadline is postponed to the next working day (Clause 7, Article 6.1 of the Tax Code of the Russian Federation).

Results

Employing companies are required to pay insurance premiums from the salaries of their employees. Contributions can be classified into 3 main types - regular, preferential and additional, with different rates.

You can learn more about the specifics of employers transferring contributions to state funds in the articles:

- “Where should I pay insurance premiums in 2020?”;

- “Material assistance and insurance contributions in 2021 - 2021”.

You can find more complete information on the topic in ConsultantPlus. Free trial access to the system for 2 days.

Who can apply reduced contribution rates

Some categories of taxpayers have the opportunity to reduce the burden on the wage fund and pay insurance premiums at reduced rates.

REFERENCE. In 2021, many payers of the single tax under the simplified tax system and UTII lost their right to preferential rates on contributions. In 2021, the circle of those who can pay reduced contributions has become even narrower.

In particular, the following employers can transfer insurance premiums at reduced rates in 2021:

- non-profit organizations (except for state and municipal institutions) that are under the simplified tax system and carry out activities in the field of social services for citizens, scientific research and development, education, healthcare, culture and art, or mass sports (with the exception of professional). Subject to certain conditions, they do not pay contributions for health insurance or sick leave at all, and the rate of contributions for pension insurance for them is 20% (subclause 7, clause 1, subclause 3, clause 2, and clause 7 of Art. 427 Tax Code of the Russian Federation);

- charitable organizations that are on the simplified tax system. These companies also transfer only pension contributions at a reduced rate of 20% (subclause 8, clause 1, subclause 3, clause 2 and clause 8, article 427 of the Tax Code of the Russian Federation);

- Russian organizations operating in the field of information technology. They pay contributions at the following rates: for pension insurance - 8.0%, for health insurance - 4.0%, for temporary disability and maternity insurance - 2.0%. To take advantage of the benefit, you must meet the criteria for the average number of employees (at least 7 people) and the share of income from IT activities (at least 90%), and also have an accreditation document (subclause 3, clause 1, subclause 1.1, clause. 2 and paragraph 5 of Article 427 of the Tax Code of the Russian Federation);

- organizations that produce cartoons (including as contractors and subcontractors), as well as organizations that sell rights to cartoons of their own production (regardless of the type of agreement) pay fees at the same rates as IT companies. At the same time, additional conditions have been established regarding the number of employees and the share of income from activities related to the sale of animation products and related works (services). Also, the organization must be included in the register of producers of animation products (subclause 15, clause 1, subclause 7, clause 2, clause 12, article 427 of the Tax Code of the Russian Federation);

- organizations that have the status of a participant in the Skolkovo project. Such companies have the right not to pay contributions for health insurance and insurance in case of temporary disability and maternity for 10 years from the date of receipt of this status. Pension insurance contributions must be made at a rate of 14 percent. Tariff benefits terminate if the total profit of a project participant exceeds RUB 300 million. This amount is calculated on a cumulative basis from the 1st day of the year in which the project participant’s annual revenue amounted to more than 1 billion rubles. (subparagraph 10, paragraph 1, subparagraph 4, paragraph 2 and paragraph 9 of Article 427 of the Tax Code of the Russian Federation, part 1 and part 4 of Article of the Federal Law of September 28, 2010 No. 244-FZ);

- organizations and entrepreneurs who, before December 31, 2021, received the status of participant in the free economic zone (FEZ) in the territories of the Republic of Crimea and Sevastopol. For 10 years from the date of receiving such status, they pay contributions at the following rates: 6 percent for pension insurance, 0.1% for health insurance and 1.5% for sick leave. These tariffs apply only to payments to employees involved in an investment project in the FEZ (subclause 11 clause 1, subclause 5 clause 2 and clause 10 article 427 of the Tax Code of the Russian Federation, art. 1, part 19 art., p 1 article of the Federal Law of November 29, 2014 No. 377-FZ);

- residents of the territory of rapid socio-economic development (PSED), who received this status no later than three years from the date of its creation, and residents of the TASED in the Far Eastern Federal District, also provided that the volume of investments is at least 500 thousand rubles. These employers, for 10 years from the date of receiving the specified status, pay contributions from the salaries of individuals employed in new jobs at reduced rates: 6 percent for pension insurance, 0.1% for health insurance and 1.5% for “ sick leave" (subclause 12 clause 1, subclause 5 clause 2 and clause 10.1 of article 427 of the Tax Code of the Russian Federation, part 10 and part 12 of article 13 of the Federal Law of December 29, 2014 No. 473-FZ, clause 1 and clause 4 of Article Federal Law dated 03.08.18 No. 300-FZ);

- organizations and individual entrepreneurs that have resident status in the free port of Vladivostok, if the volume of their investments is at least 5 million rubles. Within 10 years from the date of receiving this status, these policyholders can transfer contributions to pension insurance in the amount of 6%, to health insurance - 0.1%, to sick leave - 1.5%. Preferential tariffs apply to payments to persons employed in new jobs (subclause 13 clause 1, subclause 5 clause 2 and clause 10.1 of article 427 of the Tax Code of the Russian Federation, parts 10 and 12 of article 11 of the Federal Law of July 13. 15 No. 212-FZ, clause 4 of Article Federal Law dated 03.08.18 No. 300-FZ);

- organizations that are included in the unified register of residents of the Special Economic Zone in the Kaliningrad region after January 1, 2018. The contribution benefit is valid for 7 years (but not later than 2025), starting from the 1st day of the month following the month in which the policyholder was included in this register. With regard to payments to persons employed in new jobs, reduced tariffs can be applied in the following amounts: 6% for pension insurance, 0.1% for medical insurance and 1.5% for sick leave (subclause 14 p. 1, subparagraph 5, paragraph 2 and paragraph 11 of Article 427 of the Tax Code of the Russian Federation, Part 7 of Article of the Federal Law of January 10, 2006 No. 16-FZ).

Since April 2021, benefits have been introduced for small and medium-sized businesses (for more information about SMEs, see: “Small enterprise: what are the criteria for determining it in 2020”). Small and medium-sized businesses will be able to apply reduced contribution rates to the portion of payments based on the results of each (individual) month that exceeds the minimum wage. Namely:

- for compulsory pension insurance (both from payments within the base and above it) - 10.0%;

- for compulsory social insurance in case of temporary disability and in connection with maternity - 0%

- for compulsory health insurance - 5.0%

Calculate your salary, contributions and personal income tax for free in the web service

Example 2

Revenue is 1000 thousand rubles, costs excluding payroll are 500 thousand rubles, payroll is 100 thousand rubles, insurance premiums are 30 thousand rubles.

The “simplified” tax without taking into account the payroll will be equal to

STS1 = (1000 – 500) x 15% = 75 thousand rubles.

Taking into account payroll

STS2= (1000 - 630) x 15% = 55.5 thousand rubles.

Thus, the tax decreased by 75 - 55.5 = 19.5 thousand rubles.

Total additional fiscal burden due to payroll payments

DN = 30 – 19.5 = 10.5 thousand rubles, or 10.5% of the payroll amount.

Tax on income from salaries of foreign workers in 2020

Personal income tax on payments in favor of foreigners must be calculated taking into account the following features.

If an employee is a citizen of Belarus, Kazakhstan, Armenia or Kyrgyzstan, then, regardless of the basis on which he is in the territory of the Russian Federation, income tax from his salary is withheld at a rate of 13%. But it must be taken into account that if on the date of tax calculation such an employee has not yet stayed in the Russian Federation for 183 days (for the previous 12 consecutive months), then personal income tax is taken from the full amount of payments. He cannot claim any deductions. If an employee from a state that is part of the EAEU spent more than 183 days in Russia over the previous 12 months, then personal income tax from his salary must be withheld according to the same rules that apply to payments to Russian employees.

Draw up an employment contract with a foreign worker using a special constructor Submit an application

Similar rules apply to foreigners employed on the basis of a patent, or having the status of highly qualified specialists, as well as refugees and participants in the state program for the voluntary resettlement of compatriots. Personal income tax on the salaries of such employees is calculated at a rate of 13% from the first day of work. But they will receive the right to deductions only after they have spent 183 days in Russia over 12 consecutive months.

Personal income tax on the wages of a foreigner who does not belong to the categories listed above must be calculated at a rate of 30% until the time he spends in the Russian Federation exceeds 183 days in 12 months. As soon as this happens, the foreign worker will receive exactly the same rights that Russian workers have. This means that personal income tax will need to be withheld from his salary at a rate of 13%, and at the same time take into account deductions, if there are grounds for this. These provisions apply to all wages paid to a foreigner during the calendar year in which the condition of 183 days spent in the Russian Federation was met. Therefore, personal income tax on wages will need to be recalculated. The overpayment can be offset against the current salary. This means that for some time such a foreigner can receive a salary in full, without withholding personal income tax.

ATTENTION . Such credit is possible only within one calendar year. If, as of December 31, the overpayment has not been fully offset, then the employee will have to apply to the Federal Tax Service at his place of residence for a refund of the remaining amount (clause 1.1 of Article 231 of the Tax Code of the Russian Federation).

Fill out and submit 2‑NDFL online for free with new codes

Certificate of monthly

A certificate of monthly payroll may be needed if:

- the loan is being processed;

- the bank requested data to confirm the legality of the company’s actions, that is, to confirm that all funds withdrawn are credited to the employees’ account;

- inspection is carried out by employees of the Federal Tax Service or insurance funds.

This certificate may reflect payroll data not only for a specific month, but also for other periods. In addition, it may reflect planned indicators. However, there is no single form for this document, which allows the organization to use a company letterhead.

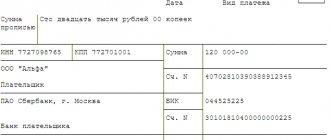

Sample form.

Regardless of the type of activity of the company, it is obliged to pay workers involved in production.

Payroll allows you to reflect all the company’s expenses for its employees, including wages and social benefits. With the help of payroll, the manager will be able to competently formulate the company's budget, which will prevent the possibility of bankruptcy.

Insurance premiums from the salaries of foreign workers in 2020

A little more complicated is the procedure for calculating insurance premiums for payments to foreigners. It is also important here which country the employee is a citizen of, but the time spent in the Russian Federation does not matter. But you need to take into account the document on the basis of which the foreigner is in Russia.

For employees from Belarus, Kazakhstan, Armenia and Kyrgyzstan, a general rule has been established: the salary accrued to such employees is subject to insurance contributions in the same manner as the salary of Russians (letter of the Federal Tax Service dated November 22, 2017 No. GD-4-11 / [email protected] and dated 02.14.17 No. BS-4-11/2686). An exception is made for highly qualified specialists from these countries (see below).

In relation to citizens of other states, it is necessary to additionally find out which document gives them the right to stay in the Russian Federation. So, if an employee has a residence permit or passport with the stamp “Temporary residence allowed,” then contributions to his salary are calculated according to the same rules as for the salaries of Russians (letter of the Ministry of Labor dated 02/09/16 No. 17-3/B-48 ). The same should be done if the employee has a refugee certificate (letter of the Ministry of Labor dated December 19, 2014 No. 17-3/B-620). As for persons who have received temporary asylum in the Russian Federation, contributions for sick leave must be transferred from their salaries at a preferential rate of 1.8% (letters from the Ministry of Labor dated 04/21/15 No. 17-3/10/B-2795 and dated 02/25/15 No. 17-3/B-79).

Prepare all documents for the transition to electronic work books

If the employee’s personal file (except for citizens of Belarus, Kazakhstan, Armenia, Kyrgyzstan or refugees) contains a migration card or data on an open visa, then medical contributions for payments in his favor are not charged, and contributions for “sick leave” are calculated at tariff 1, 8%. The remaining contributions (pension and “for injuries”) must be transferred according to the same rules as contributions from payments to employees - Russians (subclause 15, clause 1, article 422 and article 425 of the Tax Code of the Russian Federation, clause 1, article of the Federal Law dated 12/15/01 No. 167-FZ, clause 1 of Article 20.1 of the Federal Law of 07/24/98 No. 125-FZ, clause 1 of Article of the Federal Law of 12/29/06 No. 255-FZ).

But there is an exception here too. It concerns workers from China who temporarily (on a visa or migration card) arrived in the Russian Federation. Their salaries are subject to insurance contributions for sick leave at a rate of 1.8% and contributions for injuries at the general rate. Pension and medical contributions from the salaries of workers from China are not paid on the basis of an international agreement between our countries (letter of the Federal Tax Service dated September 11, 2019 No. BS-4-11 / [email protected] ).

Separate rules apply to highly qualified foreign specialists. If such an employee is a citizen of Belarus, Kazakhstan, Armenia or Kyrgyzstan and has presented a migration card or a document with a mark of crossing the border, then pension contributions do not need to be paid from his salary (letters from the Ministry of Finance dated July 12, 2017 No. 03-15-06/44430 and Federal Tax Service dated November 22, 2017 No. GD-4-11/ [email protected] ). And payments to specialists from other countries who are in the Russian Federation on the basis of an open visa or migration card are exempt from all contributions, except for contributions “for injuries” (subclause 15, paragraph 1, article 422 of the Tax Code of the Russian Federation, article 20.1 of Law No. 125- Federal Law, letter of the Ministry of Finance dated January 29, 2019 No. 03-15-06/5081).

As for those highly qualified specialists who have a residence permit or passport with the stamp “Temporary residence allowed”, their salaries are not subject to medical contributions. In this case, the remaining contributions must be calculated on a general basis (letter of the Ministry of Finance dated May 15, 2019 No. 03-03-06/1/34736). An exception is made for citizens of Belarus, Kazakhstan, Armenia and Kyrgyzstan living in Russia. The salaries of such specialists are subject to insurance contributions according to the same rules as the salaries of “ordinary” Russian workers (clause 3 of Article 98 of the Treaty on the EAEU).

Fill out, check and submit SZV‑M and RSV for free via the Internet

Example 3

The amount of revenue is 1000 thousand rubles, payroll is 80 thousand rubles. The total amount of contributions from the payroll will be equal to

VZ = 80 x 30% = 24 thousand rubles.

The “simplified” tax is equal to

STS = 1000 x 6% = 60 thousand rubles.

Because 24 thousand rubles. - this is less than 50% of 60 thousand rubles, then contributions are fully deducted from the tax amount.

A similar calculation can be made for UTII by substituting 7.5% into the formula (since the base rate for UTII is 15%). Instead of revenue, in this case, imputed (i.e., predetermined) income is taken, which greatly simplifies forecasting.

Payroll x 30% <= VD x 7.5%

Payroll <= VD x 25%

So, for UTII, wage contributions are fully “covered” by the benefit if the total payroll does not exceed 25% of imputed income.

Responsibility for non-payment of contributions and personal income tax

If an employer violates the deadline for paying insurance premiums, the tax authorities will charge him a penalty based on an article of the Tax Code of the Russian Federation. A fine for non-payment is possible only if the contributions were not transferred due to errors made in the calculation of contributions. Then a fine of 20 percent of the unpaid amount will be added to the penalties (clause 1 of Article 122 of the Tax Code of the Russian Federation).

With regard to personal income tax, different rules apply. Penalties on the tax amount are accrued only if the employer retained the money that was withheld from employees when paying them wages (letter of the Federal Tax Service dated 04.08.15 No. ED-4-2/13600). But a fine of 20 percent of the unpaid personal income tax amount will be issued to the tax agent in any case. Even if he did not withhold tax at all when paying wages (clause 1 of Article 123 of the Tax Code of the Russian Federation).

Generate a payment invoice for payment of tax (penalties, fines) in one click based on the request received from the Federal Tax Service

VAT

It would seem – what does VAT have to do with it? After all, the base for this tax is added value, and not payroll. But let's not rush...

Suppose a businessman works “to zero”, i.e. revenue (B) corresponds to costs (C). VAT is generally charged on all income received. And the “input” tax is deductible only from purchased goods, services, etc. for which suppliers have issued invoices.

But the cost consists not only of “external” purchases, it includes payroll and contributions accrued from it. Naturally, no invoices are issued for salaries, so it turns out that the taxable base for VAT is formed precisely at the expense of the payroll and charges on it.

Z = P + FOT x 1.3, where

P – cost of goods (services) purchased from suppliers, subject to VAT

VAT = B x 20% – P x 20%

Because B = Z, then

VAT = (P + payroll x 1.3) x 20% - P x 20%

VAT = payroll x 1.3 x 20% = payroll x 26%

It turns out that VAT can also be considered a payroll tax, and in this case its “rate” is 26%.