What does a sample personal income tax payment order look like in 2021? What are the features of paying income tax on wages? How to fill out the fields of a salary slip for personal income tax? Here is a sample of filling out a payment order to pay personal income tax in 2021.

We also advise you to read the article: “Payment order form”.

Directing funds to the budget

In 2021, filling out and submitting personal income tax reports on time is not enough if you need funds to pay income taxes to be taken into account in the budget in accordance with their purpose.

To do this, you must fill out a payment order to the Federal Tax Service in accordance with all official requirements. Otherwise, the organization and the federal treasury itself may simply not see the transferred funds. Then you will have to:

- clarify all payment details;

- check details;

- look for the mistake made.

Nobody says that the amounts paid will be lost. However, sometimes legal entities and individual entrepreneurs with staff, as a safety net, have to re-transmit the required amount in order to avoid troubles with relations with the Federal Tax Service.

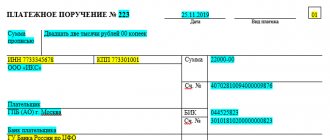

Thus, paying personal income tax in 2021 with a payment order that is generated according to a specific model requires close attention to avoid mistakes. Here is a payment order form that in 2021 legal entities can use to transfer personal income tax.

The form of payment order for personal income tax of the 2021 sample has not changed.

The form of the payment order is given in Appendix 2 to Bank of Russia Regulation No. 383-P dated June 19, 2012. The payment order for the payment of tax should be filled out according to the Rules established in Appendices No. 1, No. 2, No. 5 to Order of the Ministry of Finance of Russia dated November 12, 2013 No. 107n.

Fines and penalties for contributions to extra-budgetary funds

The Social Insurance Fund issues fines under two federal laws [2], as does the Pension Fund [3]. In addition, both funds can fine officials of the organization under Article 15.33 of the Administrative Code.

Fines and penalties for insurance pension contributions

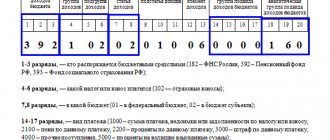

* Penalties (Article 25 of Law 212-FZ) for late payment and fines for non-payment of contributions (Article 47 of Law 212-FZ) - BCC of contributions for which the payment deadline was missed, but in categories 14-17 of the BCC, instead of 1000, 2000 (penalties) are indicated or 3000 (fine).

Example: KBK of insurance premiums for payment of the insurance part of the labor pension - 392 1 02 02010 06 1000 160, penalties for late payment should be paid to KBK 392 1 02 02010 06 2000 160, and the fine for non-payment to KBK 392 1 02 02010 06 30 00 160

* Fines for violation of the legislation of the Russian Federation on state extra-budgetary funds and on specific types of compulsory social insurance, budget legislation regarding the budget of the Pension Fund of the Russian Federation (except for Article 48-51 of Law 212-FZ) - 392 1 1600 140;

* Fines for violation of the legislation of the Russian Federation on state extra-budgetary funds and on specific types of compulsory social insurance, budget legislation regarding the FFOMS budget (except for Article 48-51 of Law 212-FZ) - 392 1 1600 140;

* Fines in accordance with Articles 48 - 51 of Federal Law 212-FZ - 392 1 1600 140.

Fines and penalties for insurance contributions to the Social Insurance Fund

* Penalties for late payment and fines for non-payment of contributions - KBC contributions for which the payment deadline has been missed, in categories 14-17 of the KBC instead of 1000, 2000 (penalties) or 3000 (fine) are indicated.

Example: BCC of insurance premiums for compulsory social insurance against industrial accidents and occupational diseases - 393 1 02 02050 07 1000 160, penalties are paid to BCC 393 1 02 02050 07 2000 160, 393 1 02 02050 07 3000 160.

* Fines for violation of the legislation of the Russian Federation on state extra-budgetary funds and on specific types of compulsory social insurance, budget legislation regarding the FSS budget - 393 1 1600 140

How are salaries taxed with personal income tax in 2021?

The employer (including legal entities) is obliged, when paying wages, to calculate personal income tax from it and act as a tax agent, withholding the tax and transferring it to the budget (clause 1 and clause 2 of Article 226 of the Tax Code of the Russian Federation). As a general rule, personal income tax must be withheld upon actual payment of wages to the employee (clause 4 of article 226 of the Tax Code of the Russian Federation).

Deadline for payment of personal income tax on salary

Personal income tax from an employee’s salary must be transferred to the budget no later than the working day following the day of its payment (clause 6 of article 6.1, clause 6 of article 226 of the Tax Code of the Russian Federation).

Procedure for paying fines

The Federal Tax Service has the right to impose monetary sanctions on taxpayers for violations listed in the Tax Code of the Russian Federation. Such offenses include failure to meet reporting deadlines, failure to pay taxes on time, refusal to provide tax authorities with requested information, errors in registration procedures, etc. The amount of the fine is indicated in the decision or demand sent to the business entity.

Transfer of taxes, penalties and fines according to the decision of the Federal Tax Service is made in separate payments. It is unacceptable to combine these amounts in one order.

The law does not oblige companies to make all transfers on one day: the taxpayer has the right to split them into different dates. It is recommended to pay off the arrears first so that no penalties are charged on them. Next, the penalties themselves are transferred for the entire period of delay. The latter can be sent a fine, the main thing is to meet the deadlines specified in the demand.

What to consider when filling out

To answer the question of how to fill out a personal income tax payment order correctly in 2021 so that the funds can reach their intended destination, you need to be aware of some nuances:

- On line 101, each applicant must indicate their own status. This can be an ordinary individual (13) or a tax agent (02). If this individual entrepreneur transfers tax for himself, his status is 09.

- For line 104, it is important who exactly pays the tax and what its status is: a tax agent, an individual or a merchant for himself.

- If an organization has separate divisions, then the tax must be transferred to the location of each of them (its own checkpoint, OKTMO, another Federal Tax Service). From payments under civil law contracts, “isolated companies” also deduct personal income tax according to their details. A similar procedure is established for merchants with personnel on a patent or imputation.

When is vacation pay paid?

The deadline for paying vacation pay is three calendar days before the start of the vacation.

The start date of the vacation is recorded in the vacation schedule or in the employee’s application. That is, for example, an employee who goes on vacation on Friday must be paid vacation pay on Tuesday. If the payment day falls on a weekend or holiday, issue vacation pay the day before (Letter of Rostrud dated July 30, 2014 No. 1693-6-1).

Vacation pay can be issued along with your salary. The main thing is not to miss the payment deadlines. For example, the salary payment deadline is October 5. An employee who goes on vacation on October 6 must be paid vacation pay on October 2 and can transfer his salary. An employee who goes on vacation on October 9 can be given both salary and vacation pay on October 5.

Changes from 2021

From 01/01/2021, in the payment slip for the transfer of taxes and insurance contributions, you need to fill out 2 columns in a new way related to the recipient of the funds - the Federal Treasury. From October 2021, an updated list of payment grounds should be applied when repaying debts for past periods. In addition, a new BCC has been introduced for personal income tax on the income of an employee or founder, which during the year exceeded 5 million rubles.

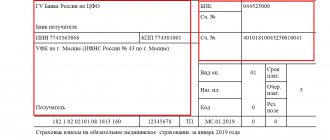

FIELDS 17 AND 15

These are the details of the recipient of the funds. The change in filling from 01/01/2021 is due to the transition to a new procedure for treasury services and a system of treasury payments. So:

- for field 17 – the new account number of the territorial body of the Federal Treasury (TOFK);

- for field 15 - from January 2021 you need to indicate the account number of the recipient's bank (this is the number of the bank account that is part of the single treasury account - UTS).

Note that until 2021, when paying taxes and contributions, field 15 was left empty.

In January-April 2021, in field 17 of the payment slip, you can enter both a new and an old TOFK account. And from 05/01/2021 - only new.

There are other changes in filling out payment slips from January 1, 2021.

Read the full review in the article “How to fill out payment order fields in 2021.”

Tax agent reporting

1) Calculation of 6-NDFL.

On January 1, 2021, Law No. 113-FZ of 05/02/2015 came into force, according to which every employer must submit personal income tax reports quarterly. That is, you need to report no later than the last day of the month following the reporting quarter.

• View a sample of filling out 6-NDFL.

• Read more: Quarterly personal income tax reporting 2021.

2) Certificate 2-NDFL.

It is compiled (based on data in tax registers) for each of its employees and submitted to the tax office once a year no later than April 1, and if it is impossible to withhold personal income tax - before March 1.

ATTENTION: by order of the Federal Tax Service of Russia No. ММВ-7-11/ [email protected] dated October 30, 2015, a new form 2-NDFL was approved. It is valid from December 8, 2015.

How to submit a 2-NDFL certificate:

- On paper - if the number of employees who received income is less than 25 people (from 2021). You can bring it to the tax office in person or send it by registered mail. With this method of reporting, tax officials must draw up in 2 copies a “Protocol for accepting information on the income of individuals for ____ year on paper,” which serves as proof of the fact that 2-NDFL certificates were submitted and that they were accepted from you. The second copy remains with you, do not lose it.

- In electronic form on a flash drive or via the Internet (number of employees more than 25 people). In this case, one file should not contain more than 3,000 documents. If there are more of them, then you need to generate several files. When sending 2-NDFL certificates via the Internet, the tax office must notify you of their receipt within 24 hours. After this, within 10 days the Federal Tax Service will send you a “Protocol for receiving information on the income of individuals.”

Also, together with the 2-NDFL certificate, regardless of the method of submission, a document is attached in 2 copies - Register of information on the income of individuals.

• Download the 2-NDFL certificate form.

• See Instructions for filling out 2-NDFL.

3) Tax accounting register.

Designed for personal data recording for each employee, including individuals under a GPC agreement. Based on this accounting, a 2-NDFL certificate is compiled annually.

Tax registers record income paid to individuals for the year, the amount of tax deductions provided, as well as the amount of personal income tax withheld and paid.

There is no single sample tax register for personal income tax. You must create the form yourself. For this purpose, you can use accounting programs or draw up a personal income tax-1 certificate based on the currently inactive personal income tax certificate.

But the Tax Code defines the mandatory details that must be in personal income tax registers:

- Information allowing identification of the taxpayer (TIN, full name, details of the identity document, citizenship, address of residence in the Russian Federation)

- Type of income paid (code)

- Type and amount of tax deductions provided

- Amounts of income and dates of their payment

- Taxpayer status (resident / non-resident of the Russian Federation)

- Date of tax withholding and payment, as well as details of the payment document

Example of a payment order for personal income tax 2021

In order to reduce the likelihood of making inaccuracies or errors when filling out, first of all, it is worth clarifying all the details. This can be done using a special service on the official website of the Federal Tax Service of Russia.

Details for paying personal income tax on the Federal Tax Service website

The second option is to get a memo with the details from the tax authority or find it on the Internet.

EXAMPLE

A personal income tax payment order for 2021, completed according to all the rules, should look like this:

Samples of all payments for 2021 can be viewed in the Consultant Plus system

Full and free access to the system for 2 days.

Read also

18.09.2020

Payment of sick leave benefits: terms

The deadline for paying sick leave is the next day of salary payment after the accrual of benefits. Benefits must be accrued within 10 days after the sick leave is submitted to the employer. For example, an organization (LLC) or individual entrepreneur issues salaries on the 22nd and 7th. The employee brought in sick leave on October 9. Then the benefit must be accrued no later than October 19, 2021, and paid along with the advance payment on October 22.

The employer finances the first three days of the employee’s illness. The remaining days are at the expense of the Social Insurance Fund. However, sick leave for child care is fully financed by the fund.