For personnel records

Order (instruction) on hiring an employee (form N T-1)

Order (instruction) on hiring employees (Form N T-1a)

They are used for registration and accounting of employees hired under an employment contract and are filled out: Form N T-1 - for one employee, Form N T-1a - for a group of employees. Drawed up by the person responsible for hiring for all persons hired by the organization on the basis of a concluded employment contract.

When issuing an order (instruction) to hire an employee(s), the name of the structural unit, position (specialty, profession), the probationary period, if the employee is subject to a hiring test, as well as the conditions of employment and the nature of the work to be performed (according to part-time, by way of transfer from another organization, to replace a temporarily absent employee, to perform certain work, etc.). When concluding an employment contract with an employee(s) for an indefinite period, in the details “Date” (form N T-1) or “Work period” (form N T-1a), the “to” line (column) is not filled in.

An order (instruction) signed by the head of the organization or an authorized person is announced to the employee(s) against signature. Based on the order (instruction), the personnel service employee makes an entry in the work book about the employee’s hiring and fills in the relevant information in the personal card (form N T-2 or N T-2GS (MS), and the employee’s personal account is opened in the accounting department (form N T-54 or N T-54a).

Employee personal card (form N T-2)

Personal card of a state (municipal) employee (form N T-2GS(MS))

Filled out by an employee of the personnel service for persons hired on the basis of: an order (instruction) on hiring (form N T-1 or N T-1a); passport or other identity document; work book or document confirming work experience; insurance certificate of state pension insurance; military registration documents - for those liable for military service and persons subject to conscription for military service; a document on education, qualifications or the presence of special knowledge - when applying for a job that requires special knowledge or special training, as well as information provided by the employee. In some cases, taking into account the specifics of the work, in accordance with the current legislation of the Russian Federation, it may be necessary to present additional documents.

The personal card of a state (municipal) employee (Form N T-2GS(MS)) is used to record persons holding state (municipal) civil service positions.

When filling out clause 5 “Knowledge of a foreign language” of Section 1 of the forms, the degree of knowledge of the language is indicated: “I speak fluently”, “I read and can explain myself”, “I read and translate with a dictionary”.

Work experience (general, continuous, giving the right to a bonus for length of service, giving the right to other benefits established in the organization, etc.) is calculated on the basis of entries in the work book and (or) other documents confirming the relevant length of service.

When information about an employee changes, the corresponding data is entered into his personal card, which is certified by the signature of a personnel service employee.

The main documents on the basis of which section II “Information on military registration” is filled out are:

military ID (or temporary certificate issued instead of a military ID) - for citizens in the reserve;

certificate of a citizen subject to conscription for military service - for citizens subject to conscription for military service.

For citizens in reserve:

clause 1 “Reserve category” for reserve officers is not filled in;

clause 3 “Composition (profile)” - filled in without abbreviation (for example, “command”, “medical” or “soldiers”, “sailors”, etc.);

clause 4 “Full code designation VUS” - the full designation is written down (six digits, for example, “021101” or six digits and a letter, for example, “113194A”);

clause 5 “Category of fitness for military service” - written in letters: A (fit for military service), B (fit for military service with minor restrictions), C (limitedly fit for military service) or D (temporarily unfit for military service ). If there are no entries in the corresponding paragraphs of the military ID, category “A” is indicated;

in paragraph 7 “Registered with the military” is filled in (in pencil):

line a) - in cases where there is a mobilization order and (or) a stamp on the issuance and withdrawal of mobilization orders;

line b) - for citizens reserved with the organization for the period of mobilization and during wartime.

For citizens subject to conscription for military service:

clauses: clause 1 “Reserve category”, clause 3 “Composition (profile)”, clause 4 “Full code designation of military personnel” and clause 7 “Registered with the military” are not filled in;

clause 2 “Military rank” - the entry “subject to conscription” is made;

clause 5 “Category of fitness for military service” - written in letters: A (fit for military service), B (fit for military service with minor restrictions), C (limitedly fit for military service), D (temporarily unfit for military service ) or D (not fit for military service). Filled out based on the entry in the certificate of a citizen subject to conscription for military service;

Filling out items not specifically specified in the Instructions is carried out on the basis of information from the listed documents.

In paragraph 8 of Section II of the personal card of a citizen who has reached the age limit for being in the reserve, or a citizen declared unfit for military service due to health reasons, in a free line it is written about or “removed from military registration due to health reasons.”

In the section “Hiring, transfers to another job” with each entry made on the basis of an order (instruction) on hiring (form N T-1 or N T-1a) and an order (instruction) on transfer to another job ( form N T-5), the administration is obliged to familiarize the employee with a signature in column 6 of the form.

In the “Vacation” section, records are kept of all types of vacations provided to the employee during the period of work in the organization.

The “Additional information” section is filled out to completely record information about employees studying in educational institutions, to record working disabled people, etc.

Staffing table (Form N T-3)

It is used to formalize the structure, staffing and staffing levels of an organization in accordance with its Charter (Regulations). The staffing table contains a list of structural units, names of positions, specialties, professions indicating qualifications, information on the number of staff units.

When filling out column 4, the number of staff units for the relevant positions (professions), which provide for the maintenance of an incomplete staff unit, taking into account the peculiarities of part-time work in accordance with the current legislation of the Russian Federation, is indicated in the appropriate shares, for example 0.25; 0.5; 2.75, etc.

In column 5 “Tariff rate (salary), etc.” the monthly salary is indicated in ruble terms according to the tariff rate (salary), tariff schedule, percentage of revenue, share or percentage of profit, labor participation coefficient (KTU), distribution coefficient, etc., depending on the remuneration system adopted in the organization in in accordance with the current legislation of the Russian Federation, collective agreements, employment contracts, agreements and local regulations of the organization.

Columns 6 - 8 “Bonuses” show incentive and compensation payments (bonuses, allowances, additional payments, incentive payments) established by the current legislation of the Russian Federation (for example, northern bonuses, bonuses for an academic degree, etc.), as well as those introduced at the discretion of the organization (for example, related to the regime or working conditions).

If it is impossible for an organization to fill out columns 5 - 9 in ruble terms due to the use of other remuneration systems in accordance with the current legislation of the Russian Federation (tariff-free, mixed, etc.), these columns are filled in in the appropriate units of measurement (for example, percentages, coefficients, etc. .).

Approved by an order (instruction) signed by the head of the organization or a person authorized by him.

Changes to the staffing table are made in accordance with the order (instruction) of the head of the organization or a person authorized by him to do so.

Registration card of a scientific, scientific and pedagogical worker (form N T-4)

It is used in scientific, research, scientific and production, educational and other institutions and organizations operating in the field of education, science and technology, to record scientific workers.

Filled out by an employee of the personnel service on the basis of relevant documents (diploma of Doctor of Sciences and Candidate of Sciences, certificate of associate professor and professor, etc.), as well as information provided by the employee about himself.

Clause 4 “Postgraduate professional education” indicates the name of the organization (institution) in which graduate, postgraduate, doctoral studies were completed, the date of its completion, as well as the number, series and date of issue of the corresponding certificate.

Item 5 “Academic degree” is filled out on the basis of the submitted documents (diplomas), including information about the field of science and the specialty of scientists.

In clause 6 “Academic title”, information about the academic title of professor and senior researcher in the specialty (for scientists), associate professor and professor in the department (for scientific and pedagogical workers) is filled out on the basis of the corresponding certificate.

For each scientific and scientific-pedagogical worker, a personal employee card is also maintained (Form N T-2).

Order (instruction) on transfer of an employee to another job (Form N T-5)

Order (instruction) on the transfer of employees to another job (Form N T-5a)

They are used to formalize and record the transfer of employee(s) to another job in the same organization or to another location together with the organization.

They are filled out by a personnel service employee taking into account the employee’s written consent, signed by the head of the organization or a person authorized by him, and announced to the employee(s) against signature. If an employment contract was not concluded with the employee (the employee was hired before 10/06/92) and his hiring was formalized by order, when filling out the unified form N T-5 “Order (instruction) to transfer the employee to another job” according to the line “Bases” indicates specific documents on the basis of which the employee will be transferred to another job (application, medical report, memo, etc.), and the details “Change to the employment contract” are not filled in. Based on the order (instruction) on transfer to another job, marks are made in the employee’s personal card (form N T-2 or N T-2GS (MS)), personal account (form N T-54 or N T-54a), and the corresponding entry in the work book.

Order (instruction) on granting leave to an employee (Form N T-6)

Order (instruction) on granting leave to employees (Form N T-6a)

They are used for registration and accounting of vacations granted to the employee(s) in accordance with the law, collective agreement, local regulations of the organization, and employment contract.

They are drawn up by a personnel service employee or a person authorized by him, signed by the head of the organization or a person authorized by him, and announced to the employee against signature. Based on the order (instruction) to grant leave, marks are made in the personal card (form N T-2 or N T-2GS(MS)), personal account (form N T-54 or N T-54a) and wages are calculated, due for vacation, according to Form N T-60 “Note-calculation on granting vacation to an employee.”

Vacation schedule (Form N T-7)

It is used to reflect information about the time of distribution of annual paid leaves of employees of all structural divisions of the organization for the calendar year by month. Vacation schedule - summary schedule. When compiling it, the provisions of the current legislation of the Russian Federation, the specifics of the organization’s activities and the wishes of employees are taken into account.

The vacation schedule is signed by the head of the personnel service and approved by the head of the organization or a person authorized by him, taking into account the reasoned opinion of the elected trade union body (if there is one) of this organization on the priority of granting paid vacations.

When the vacation period is postponed to another time, with the consent of the employee and the head of the structural unit, appropriate changes are made to the vacation schedule with the permission of the person who approved the schedule or the person authorized by him to do so. The transfer of vacation is carried out in the manner established by the legislation of the Russian Federation, on the basis of a document drawn up in any form.

Order (instruction) on termination (termination) of an employment contract with an employee (dismissal) (form N T-8)

Order (instruction) on termination (termination) of an employment contract with employees (dismissal) (form N T-8a)

They are used to formalize and record the dismissal of an employee(s). They are drawn up by a personnel service employee, signed by the head of the organization or a person authorized by him, and announced to the employee(s) against signature in the manner established by the legislation of the Russian Federation.

In the line (column) of forms N T-8 and T-8a “Grounds for termination (termination) of an employment contract (dismissal)” an entry is made in strict accordance with the wording of the current legislation of the Russian Federation with reference to the relevant article. In the line (column) “Document, number and date” a reference is made to the document on the basis of which the order is prepared and the employment contract is terminated, indicating its date and number (employee statement, medical report, memo, summons to the military registration and enlistment office and other documents) .

When dismissing a financially responsible person, a document confirming the absence of material claims against the employee is attached to the order (instruction).

When terminating an employment contract at the initiative of the employer in cases determined by the current legislation of the Russian Federation, a reasoned opinion of the elected trade union body (if there is one) is attached in writing to the order (instruction) on the termination (termination) of the employment contract with the employee(s) (dismissal). this organization.

Based on the order (instruction) on the termination (termination) of the employment contract with the employee(s) (dismissal), an entry is made in the personal card (Form N T-2 or N T-2GS(MS)), personal account (Form N T-54 or N T-54a), work book, a settlement is made with the employee in the form N T-61 “Note-settlement upon termination (termination) of an employment contract with an employee (dismissal)”.

Order (instruction) on sending an employee on a business trip (form N T-9)

Order (instruction) on sending employees on a business trip (Form N T-9a)

They are used to register and record the assignment of employee(s) on a business trip(s). Filled out by a personnel service employee on the basis of an official assignment, signed by the head of the organization or a person authorized by him to do so. The order for sending on a business trip indicates the last name(s) and initials, structural unit, position (specialty, profession) of the traveler(s), as well as the purpose, time and place(s) of the business trip.

If necessary, the sources of payment for travel expenses and other conditions for sending on a business trip are indicated.

Travel certificate (form N T-10)

It is a document certifying the time spent on a business trip (time of arrival at the destination(s) and time of departure from it(es)).

At each destination, notes are made on the time of arrival and departure, which are certified by the signature of the responsible official and seal.

Issued in one copy by an employee of the personnel service on the basis of an order (instruction) on sending on a business trip (Form N T-9).

After returning from a business trip to the organization, the employee (accountable person) draws up an advance report (Form N AO-1) with attached documents confirming the expenses incurred.

Official assignment for sending on a business trip and a report on its implementation (Form N T-10a)

It is used for registration and accounting of official assignments for sending on a business trip, as well as a report on its implementation.

The official assignment is signed by the head of the structural unit in which the posted employee works. It is approved by the head of the organization or a person authorized by him and submitted to the personnel service for issuing an order (instruction) on sending on a business trip (Form N T-9 or N T-9a).

An employee arriving from a business trip draws up a brief report on the work performed during the business trip, which is agreed upon with the head of the structural unit and submitted to the accounting department along with a travel certificate (Form No. T-10) and an advance report (Form No. AO-1).

Order (instruction) on employee incentives (Form N T-11)

Order (instruction) on incentives for employees (Form N T-11a)

They are used to formalize and record incentives for success in work.

They are compiled based on the submission of the head of the structural unit of the organization in which the employee works.

They are signed by the head of the organization or a person authorized by him and announced to the employee(s) against signature. Based on the order (instruction), a corresponding entry is made in the employee’s personal card (form N T-2 or N T-2GS (MS)) and the employee’s work book.

When registering all types of incentives, except for monetary rewards (bonuses), it is allowed to exclude the details “in the amount of ____ rubles” from Form N T-11 “Order (instruction) to reward an employee.” ____ kop.”

Appendix 1 to the resolution of the State Statistics Committee of the Russian Federation dated January 5, 2004 No. 1

Instructions for the use and completion of primary accounting documentation forms for labor accounting and payment

For personnel records

Order (instruction) on hiring an employee (form N T-1)

Order (instruction) on hiring employees (Form N T-1a)

They are used for registration and accounting of employees hired under an employment contract and are filled out: Form N T-1 - for one employee, Form N T-1a - for a group of employees. Drawed up by the person responsible for hiring for all persons hired by the organization on the basis of a concluded employment contract.

When issuing an order (instruction) to hire an employee(s), the name of the structural unit, position (specialty, profession), the probationary period, if the employee is subject to a hiring test, as well as the conditions of employment and the nature of the work to be performed (according to part-time, by way of transfer from another organization, to replace a temporarily absent employee, to perform certain work, etc.). When concluding an employment contract with an employee(s) for an indefinite period, in the details “Date” (form N T-1) or “Work period” (form N T-1a), the “to” line (column) is not filled in.

An order (instruction) signed by the head of the organization or an authorized person is announced to the employee(s) against signature. Based on the order (instruction), the personnel service employee makes an entry in the work book about the employee’s hiring and fills in the relevant information in the personal card (form N T-2 or N T-2GS (MS), and the employee’s personal account is opened in the accounting department (form N T-54 or N T-54a).

Employee personal card (form N T-2)

Personal card of a state (municipal) employee (form N T-2GS (MS))

Filled out by an employee of the personnel service for persons hired on the basis of: an order (instruction) on hiring (form N T-1 or N T-1a); passport or other identity document; work book or document confirming work experience; insurance certificate of state pension insurance; military registration documents - for those liable for military service and persons subject to conscription for military service; a document on education, qualifications or the presence of special knowledge - when applying for a job that requires special knowledge or special training, as well as information provided by the employee. In some cases, taking into account the specifics of the work, in accordance with the current legislation of the Russian Federation, it may be necessary to present additional documents.

Personal card of a state (municipal) employee (form N T-2GS (MS) is used to record persons holding state (municipal) civil service positions.

When filling out clause 5 “Knowledge of a foreign language” of Section 1 of the forms, the degree of knowledge of the language is indicated: “I speak fluently”, “I read and can explain myself”, “I read and translate with a dictionary”.

Work experience (general, continuous, giving the right to a bonus for length of service, giving the right to other benefits established in the organization, etc.) is calculated on the basis of entries in the work book and (or) other documents confirming the relevant length of service.

When information about an employee changes, the corresponding data is entered into his personal card, which is certified by the signature of a personnel service employee.

The main documents on the basis of which section II “Information on military registration” is filled out are:

military ID (or temporary certificate issued instead of a military ID) - for citizens in the reserve;

certificate of a citizen subject to conscription for military service - for citizens subject to conscription for military service.

For citizens in reserve:

clause 1 “Reserve category” for reserve officers is not filled in;

clause 3 “Composition (profile)” - filled in without abbreviation (for example, “command”, “medical” or “soldiers”, “sailors”, etc.);

clause 4 “Full code designation VUS” - the full designation is written down (six digits, for example “021101” or six digits and a letter, for example “113194A”);

clause 5 “Category of fitness for military service” - written in letters: A (fit for military service), B (fit for military service with minor restrictions), C (limitedly fit for military service) or D (temporarily unfit for military service ). If there are no entries in the corresponding paragraphs of the military ID, category “A” is indicated;

in paragraph 7 “Registered with the military” is filled in (in pencil):

line a) - in cases where there is a mobilization order and (or) a stamp on the issuance and withdrawal of mobilization orders;

line b) - for citizens reserved with the organization for the period of mobilization and during wartime.

For citizens subject to conscription for military service:

clauses: clause 1 “Reserve category”, clause 3 “Composition (profile)”, clause 4 “Full code designation of military personnel” and clause 7 “Registered with the military” are not filled in;

clause 2 “Military rank” - the entry “subject to conscription” is made;

clause 5 “Category of fitness for military service” - written in letters: A (fit for military service), B (fit for military service with minor restrictions), C (limitedly fit for military service), D (temporarily unfit for military service ) or D (not fit for military service). Filled out based on the entry in the certificate of a citizen subject to conscription for military service;

Filling out items not specifically specified in the Instructions is carried out on the basis of information from the listed documents.

In paragraph 8 of Section II of the personal card of a citizen who has reached the age limit for being in the reserve, or a citizen declared unfit for military service due to health reasons, in a free line it is written about or “removed from military registration due to health reasons.”

In the section “Hiring, transfers to another job” with each entry made on the basis of an order (instruction) on hiring (form N T-1 or N T-1a) and an order (instruction) on transfer to another job ( form N T-5), the administration is obliged to familiarize the employee with a signature in column 6 of the form.

In the “Vacation” section, records are kept of all types of vacations provided to the employee during the period of work in the organization.

The “Additional information” section is filled out to completely record information about employees studying in educational institutions, to record working disabled people, etc.

Staffing table (Form N T-3)

It is used to formalize the structure, staffing and staffing levels of an organization in accordance with its Charter (Regulations). The staffing table contains a list of structural units, names of positions, specialties, professions indicating qualifications, information on the number of staff units.

When filling out column 4, the number of staff units for the relevant positions (professions), which provide for the maintenance of an incomplete staff unit, taking into account the peculiarities of part-time work in accordance with the current legislation of the Russian Federation, is indicated in the appropriate shares, for example 0.25; 0.5; 2.75, etc.

In column 5 “Tariff rate (salary), etc.” the monthly salary is indicated in ruble terms according to the tariff rate (salary), tariff schedule, percentage of revenue, share or percentage of profit, labor participation coefficient (KTU), distribution coefficient, etc., depending on the remuneration system adopted in the organization in in accordance with the current legislation of the Russian Federation, collective agreements, employment contracts, agreements and local regulations of the organization.

Columns 6-8 “Additions” show incentive and compensation payments (bonuses, allowances, additional payments, incentive payments) established by the current legislation of the Russian Federation (for example, northern allowances, allowances for an academic degree, etc.), as well as those introduced at the discretion of the organization (for example, related to the regime or working conditions).

If it is impossible for an organization to fill out columns 5-9 in ruble terms due to the use of other remuneration systems in accordance with the current legislation of the Russian Federation (tariff-free, mixed, etc.), these columns are filled in in the appropriate units of measurement (for example, percentages, coefficients, etc. .)

Approved by an order (instruction) signed by the head of the organization or a person authorized by him.

Changes to the staffing table are made in accordance with the order (instruction) of the head of the organization or a person authorized by him to do so.

Registration card of a scientific, scientific and pedagogical worker (form N T-4)

It is used in scientific, research, scientific and production, educational and other institutions and organizations operating in the field of education, science and technology, to record scientific workers.

Filled out by an employee of the personnel service on the basis of relevant documents (diploma of Doctor of Sciences and Candidate of Sciences, certificate of associate professor and professor, etc.), as well as information provided by the employee about himself.

Clause 4 “Postgraduate professional education” indicates the name of the organization (institution) in which graduate, postgraduate, doctoral studies were completed, the date of its completion, as well as the number, series and date of issue of the corresponding certificate.

Item 5 “Academic degree” is filled out on the basis of the submitted documents (diplomas), including information about the field of science and the specialty of scientists.

In clause 6 “Academic title”, information about the academic title of professor and senior researcher in the specialty (for scientists), associate professor and professor in the department (for scientific and pedagogical workers) is filled out on the basis of the corresponding certificate.

For each scientific and scientific-pedagogical worker, a personal employee card is also maintained (Form N T-2).

Order (instruction) on transfer of an employee to another job (Form N T-5)

Order (instruction) on the transfer of employees to another job (Form N T-5a)

They are used to formalize and record the transfer of employee(s) to another job in the same organization or to another location together with the organization.

They are filled out by a personnel service employee taking into account the employee’s written consent, signed by the head of the organization or a person authorized by him, and announced to the employee(s) against signature. If an employment contract was not concluded with the employee (the employee was hired before 10/06/92) and his hiring was formalized by order, when filling out the unified form N T-5 “Order (instruction) to transfer the employee to another job” according to the line “Bases” indicates specific documents on the basis of which the employee will be transferred to another job (application, medical report, memo, etc.), and the details “Change to the employment contract” are not filled in. Based on the order (instruction) on transfer to another job, marks are made in the employee’s personal card (form N T-2 or N T-2GS (MS), personal account (form N T-54 or N T-54a), and a corresponding entry is made in the work book.

Order (instruction) on granting leave to an employee (Form N T-6)

Order (instruction) on granting leave to employees (Form N T-6a)

They are used for registration and accounting of vacations granted to the employee(s) in accordance with the law, collective agreement, local regulations of the organization, and employment contract.

They are drawn up by a personnel service employee or a person authorized by him, signed by the head of the organization or a person authorized by him, and announced to the employee against signature. Based on the order (instruction) to grant leave, marks are made in the personal card (form N T-2 or N T-2GS (MS), personal account (form N T-54 or N T-54a) and the wages due are calculated for vacation, according to form N T-60 “Note - calculation of granting vacation to the employee.”

Vacation schedule (Form N T-7)

It is used to reflect information about the time of distribution of annual paid leaves of employees of all structural divisions of the organization for the calendar year by month. Vacation schedule - summary schedule. When compiling it, the provisions of the current legislation of the Russian Federation, the specifics of the organization’s activities and the wishes of employees are taken into account.

The vacation schedule is signed by the head of the personnel service and approved by the head of the organization or a person authorized by him, taking into account the reasoned opinion of the elected trade union body (if there is one) of this organization on the priority of granting paid vacations.

When the vacation period is postponed to another time, with the consent of the employee and the head of the structural unit, appropriate changes are made to the vacation schedule with the permission of the person who approved the schedule or the person authorized by him to do so. The transfer of vacation is carried out in the manner established by the legislation of the Russian Federation, on the basis of a document drawn up in any form.

Order (instruction) on termination (termination) of an employment contract with an employee (dismissal) (form N T-8)

Order (instruction) on termination (termination) of an employment contract with employees (dismissal) (form N T-8a)

They are used to formalize and record the dismissal of an employee(s). They are drawn up by a personnel service employee, signed by the head of the organization or a person authorized by him, and announced to the employee(s) against signature in the manner established by the legislation of the Russian Federation.

In the line (column) of forms N T-8 and T-8a “Grounds for termination (termination) of an employment contract (dismissal)” an entry is made in strict accordance with the wording of the current legislation of the Russian Federation with reference to the relevant article. In the line (column) “Document, number and date” a reference is made to the document on the basis of which the order is prepared and the employment contract is terminated, indicating its date and number (employee statement, medical report, memo, summons to the military registration and enlistment office and other documents) .

When dismissing a financially responsible person, a document confirming the absence of material claims against the employee is attached to the order (instruction).

When terminating an employment contract at the initiative of the employer in cases determined by the current legislation of the Russian Federation, a reasoned opinion of the elected trade union body (if there is one) is attached in writing to the order (instruction) on the termination (termination) of the employment contract with the employee(s) (dismissal). this organization.

Based on the order (instruction) to terminate (terminate) the employment contract with the employee(s) (dismissal), an entry is made in the personal card (form N T-2 or N T-2GS (MS), personal account (form N T-54 or N T-54a), work book, a settlement is made with the employee according to form N T-61 “Note-settlement upon termination (termination) of an employment contract with an employee (dismissal)”.

Order (instruction) on sending an employee on a business trip (form N T-9)

Order (instruction) on sending employees on a business trip (Form N T-9a)

They are used to register and record the assignment of employee(s) on a business trip(s). Filled out by a personnel service employee on the basis of an official assignment, signed by the head of the organization or a person authorized by him to do so. The order for sending on a business trip indicates the last name(s) and initials, structural unit, position (specialty, profession) of the traveler(s), as well as the purpose, time and place(s) of the business trip.

If necessary, the sources of payment for travel expenses and other conditions for sending on a business trip are indicated.

Travel certificate (form N T-10)

It is a document certifying the time spent on a business trip (time of arrival at the destination(s) and time of departure from it(es).

At each destination, notes are made on the time of arrival and departure, which are certified by the signature of the responsible official and seal.

Issued in one copy by an employee of the personnel service on the basis of an order (instruction) on sending on a business trip (Form N T-9).

After returning from a business trip to the organization, the employee (accountable person) draws up an advance report (Form N AO-1) with attached documents confirming the expenses incurred.

Official assignment for sending on a business trip and a report on its implementation (Form N T-10a)

It is used for registration and accounting of official assignments for sending on a business trip, as well as a report on its implementation.

The official assignment is signed by the head of the structural unit in which the posted employee works. It is approved by the head of the organization or a person authorized by him and submitted to the personnel service for issuing an order (instruction) on sending on a business trip (Form N T-9 or N T-9a).

An employee arriving from a business trip draws up a brief report on the work performed during the business trip, which is agreed upon with the head of the structural unit and submitted to the accounting department along with a travel certificate (Form No. T-10) and an advance report (Form No. AO-1).

Order (instruction) on employee incentives (Form N T-11)

Order (instruction) on incentives for employees (Form N T-11a)

They are used to formalize and record incentives for success in work.

They are compiled based on the submission of the head of the structural unit of the organization in which the employee works.

They are signed by the head of the organization or a person authorized by him and announced to the employee(s) against signature. Based on the order (instruction), a corresponding entry is made in the employee’s personal card (form N T-2 or N T-2GS (MS) and the employee’s work book.

When registering all types of incentives, except for monetary rewards (bonuses), it is allowed to exclude the details “in the amount of ______ rubles” from Form N T-11 “Order (instruction) to reward an employee.” _____ kopecks.”

For recording working hours and settlements with personnel for wages

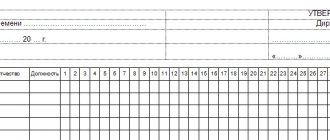

Time sheet and calculation of wages (Form N T-12)

Time sheet (form N T-13)

They are used to record the time actually worked and (or) not worked by each employee of the organization, to monitor employees’ compliance with the established working hours, to obtain data on hours worked, calculate wages, and also to compile statistical reporting on labor. When keeping separate records of working hours and settlements with personnel for wages, it is allowed to use section I. “Accounting for working hours” of the time sheet in Form N T-12 as an independent document without filling out section 2. “Settlements with personnel for wages.” Form N T-13 is used to record working hours.

They are drawn up in one copy by an authorized person, signed by the head of the structural unit, an employee of the personnel department, and transferred to the accounting department.

Notes in the Timesheet about the reasons for absence from work, work part-time or outside the normal working hours at the initiative of the employee or employer, reduced working hours, etc. are made on the basis of documents prepared properly (certificate of incapacity for work, certificate of performance state or public duties, written warning about downtime, application for part-time work, written consent of the employee to work overtime in cases established by law, etc.).

To reflect the daily working time spent per month for each employee, the timesheet is allocated:

in form N T-12 (columns 4, 6) - two lines;

in form N T-13 (column 4) - four lines (two for each half of the month) and the corresponding number of columns (15 and 16).

In forms N T-12 and N T-13 (in columns 4, 6), the top line is used to mark the symbols (codes) of working time costs, and the bottom line is used to record the duration of worked or unworked time (in hours, minutes) according to the corresponding working time cost codes for each date. If necessary, it is allowed to increase the number of boxes to enter additional details according to the working hours, for example, the start and end times of work in conditions other than normal.

When filling out columns 5 and 7 of the timesheet according to Form N T-12, the number of days worked is entered in the top lines, and the number of hours worked by each employee during the accounting period is entered in the bottom lines.

Working time costs are taken into account in the Timesheet either by completely recording appearances and absences from work, or by registering only deviations (absences, tardiness, overtime, etc.). When reflecting absences from work, which are recorded in days (vacation, days of temporary disability, business trips, leave in connection with training, time spent performing state or public duties, etc.), only codes are entered in the top line in the columns of the Timesheet symbols, and the columns in the bottom line remain empty.

When compiling a timesheet in Form N T-12 in Section 2, columns 18-22 are filled in for one type of payment and corresponding account for all employees, and when calculating different types of payment and corresponding accounts for each employee, columns 18-34 are filled in.

Form N T-13 “Working time sheet” is used for automated processing of accounting data. When drawing up a report card in form N T-13:

When recording accounting data for payroll for only one type of payment and a corresponding account common to all employees included in the Timesheet, fill in the details “type of payment code”, “corresponding account” above the table with columns 7-9 and column 9 without filling out columns 7 and 8.

when recording accounting data for payroll for several (from two to four) types of payment and corresponding accounts, columns 7-9 are filled in. An additional block with identical column numbers is provided for filling in data on types of payment if their number exceeds four.

Form N T-13 report cards with partially filled in details can be produced using computer technology. Such details include: structural unit, last name, first name, patronymic, position (specialty, profession), personnel number, etc. — that is, the data contained in the directories of conditionally permanent information of the organization. In this case, the form of the report card changes in accordance with the accepted technology for processing accounting data.

The symbols of worked and unworked time presented on the title page of Form N T-12 are also used when filling out the time sheet in Form N T-13.

Payroll statement (Form N T-49)

Payroll (Form N T-51)

Payroll (Form N T-53)

They are used to calculate and pay wages to employees of an organization.

When using a payroll slip in Form N T-49, other settlement and payment documents in Forms N T-51 and T-53 are not drawn up.

For employees receiving wages using payment cards, only a payslip is drawn up, and payroll and payslips are not drawn up.

The statements are compiled in one copy in the accounting department.

Payroll (forms N T-49 and N T-51) is made on the basis of data from primary documents recording production, hours actually worked and other documents.

In the “Accrued” columns, amounts are entered by type of payment from the payroll fund, as well as other income in the form of various social and material benefits provided to the employee, paid for from the organization’s profits and subject to inclusion in the tax base. At the same time, all deductions from the salary amount are calculated and the amount to be paid to the employee is determined.

On the title page of the payroll slip (Form N T-49) and the payroll slip (Form N T-53) the total amount to be paid is indicated. The permission to pay wages is signed by the head of the organization or a person authorized by him to do so. At the end of the statement, the amounts of paid and deposited wages are indicated.

In the payroll (form N T-49) and payroll (form N T-53), upon expiration of the payment period, an o is made against the names of employees who did not receive wages, respectively in columns 23 and 5. If necessary, the number of the presented document is indicated in the “Note” column of Form N T-53.

At the end of the payroll, after the last entry, a final line is drawn to indicate the total amount of the payroll. For the amount of wages issued, an expense cash order is drawn up (Form N KO-2), the number and date of which are indicated on the last page of the payroll.

In pay slips compiled on computer storage media, the composition of the details and their location are determined depending on the adopted information processing technology. In this case, the document form must contain all the details of the unified form.

Payroll register (Form N T-53a)

It is used for accounting and registration of payroll records for payments made to employees of the organization.

Maintained by an accounting employee.

Personal account (form N T-54)

Personal account (svt) (form N T-54a)

They are used to monthly reflect information about wages paid to an employee during the calendar year.

Filled out by an accounting employee.

Form N T-54 is used to record all types of accruals and deductions from an employee’s wages on the basis of primary documents recording production and work performed, time worked and documents for various types of payment.

Form N T-54a is used for automated processing of accounting data using computer technology (CT) using special programs and contains conditionally permanent details necessary for calculating wages. A copy of the printout of the pay slip, containing data on the components of wages, the amount and reasons for deductions made, and the total amount of money to be paid, is inserted (pasted) monthly into the employee’s personal account on paper. On the reverse side of the form or insert sheet, a breakdown of the codes (according to the coding system adopted by the organization) of various types of payments and deductions is given.

Calculation note on granting leave to an employee (Form N T-60)

It is used to calculate wages and other payments due to an employee when he is granted annual paid or other leave.

When calculating average earnings for vacation pay, column 3 shows the total amount of payments accrued to the employee for the billing period in accordance with the rules for calculating average earnings. Columns 4 and 5 indicate the number of calendar days and hours per hour worked in the billing period. The column “Number of hours of the billing period” is filled in when calculating vacation pay for an employee for whom a summarized recording of working time has been established.

Calculation note upon termination (termination) of an employment contract with an employee (dismissal) (form N T-61)

Used to record and calculate wages and other payments due to an employee upon termination of an employment contract. Compiled by a personnel service employee or a person authorized by him. The calculation of due wages and other payments is made by an accounting employee.

When calculating average earnings for payment of compensation for unused vacation, as well as deduction for vacation used in advance, column 3 shows the total amount of payments accrued to the employee for the billing period in accordance with the rules for calculating average earnings. Columns 4 and 5 indicate the number of calendar (working) days and hours per hour worked in the billing period. The column “Number of hours of the billing period” is filled in when calculating the payment of compensation for unused vacation to an employee for whom a summarized recording of working time has been established.

Certificate of acceptance of work performed under a fixed-term employment contract concluded for the duration of specific work (Form N T-73)

It is used to register and record the acceptance and delivery of work performed by an employee under a fixed-term employment contract concluded for the duration of a specific job.

It is the basis for the final or phased calculation of payment amounts for work performed.

It is drawn up by the employee responsible for accepting the work performed, approved by the head of the organization or a person authorized by him and submitted to the accounting department for calculation and payment to the contractor of the amount due.

- Back

- Forward

For recording working hours and settlements with personnel for wages

Time sheet and calculation of wages (Form N T-12)

Time sheet (form N T-13)

They are used to record the time actually worked and (or) not worked by each employee of the organization, to monitor employees’ compliance with the established working hours, to obtain data on hours worked, calculate wages, and also to compile statistical reporting on labor. When keeping separate records of working hours and settlements with personnel for wages, it is allowed to use section 1 “Accounting for working hours” of the time sheet in form N T-12 as an independent document without filling out section 2 “Settlements with personnel for wages”. Form N T-13 is used to record working hours.

They are drawn up in one copy by an authorized person, signed by the head of the structural unit, an employee of the personnel department, and transferred to the accounting department.

Notes in the report card on the reasons for absence from work, work part-time or outside the normal working hours at the initiative of the employee or employer, reduced working hours, etc. are made on the basis of documents prepared properly (certificate of incapacity for work, certificate of performance state or public duties, written warning about downtime, application for part-time work, written consent of the employee to work overtime in cases established by law, etc.).

To reflect the daily working time spent per month for each employee, the timesheet is allocated:

in form N T-12 (columns 4, 6) - two lines;

in form N T-13 (column 4) - four lines (two for each half of the month) and the corresponding number of columns (15 and 16).

In forms N T-12 and N T-13 (in columns 4, 6), the top line is used to mark the symbols (codes) of working time costs, and the bottom line is used to record the duration of worked or unworked time (in hours, minutes) according to the corresponding working time cost codes for each date. If necessary, it is allowed to increase the number of boxes to enter additional details according to the working hours, for example, the start and end times of work in conditions other than normal.

When filling out columns 5 and 7 of the timesheet according to Form N T-12, the number of days worked is entered in the top lines, and the number of hours worked by each employee during the accounting period is entered in the bottom lines.

Working time costs are taken into account in the Timesheet either by completely recording appearances and absences from work, or by registering only deviations (absences, tardiness, overtime, etc.). When reflecting absences from work, which are recorded in days (vacation, days of temporary disability, business trips, leave in connection with training, time spent performing state or public duties, etc.), only codes are entered in the top line in the columns of the Timesheet symbols, and the columns in the bottom line remain empty.

When compiling a timesheet according to Form N T-12 in Section 2, columns 18 - 22 are filled in for one type of payment and corresponding account for all employees, and when calculating different types of payment and corresponding accounts for each employee, columns 18 - 34 are filled in.

Form N T-13 “Working time sheet” is used for automated processing of accounting data. When drawing up a report card in form N T-13:

When recording accounting data for payroll for only one type of payment and a corresponding account common to all employees included in the Timesheet, fill in the details “type of payment code”, “corresponding account” above the table with columns 7 - 9 and column 9 without filling out columns 7 and 8;

when recording accounting data for payroll for several (from two to four) types of payment and corresponding accounts, columns 7 - 9 are filled in. An additional block with identical column numbers is provided for filling out data by types of payment, if their number exceeds four.

Form N T-13 report cards with partially filled in details can be produced using computer technology. Such details include: structural unit, last name, first name, patronymic, position (specialty, profession), personnel number, etc. — that is, the data contained in the directories of conditionally permanent information of the organization. In this case, the form of the report card changes in accordance with the accepted technology for processing accounting data.

The symbols of worked and unworked time presented on the title page of Form N T-12 are also used when filling out the time sheet in Form N T-13.

Payroll statement (Form N T-49)

Payroll (Form N T-51)

Payroll (Form N T-53)

They are used to calculate and pay wages to employees of an organization.

When using a payroll slip in Form N T-49, other settlement and payment documents in Forms N T-51 and T-53 are not drawn up.

For employees receiving wages using payment cards, only a payslip is drawn up, and payroll and payslips are not drawn up.

The statements are compiled in one copy in the accounting department.

Payroll (forms N T-49 and N T-51) is made on the basis of data from primary documents recording production, hours actually worked and other documents.

In the “Accrued” columns, amounts are entered by type of payment from the payroll fund, as well as other income in the form of various social and material benefits provided to the employee, paid for from the organization’s profits and subject to inclusion in the tax base. At the same time, all deductions from the salary amount are calculated and the amount to be paid to the employee is determined.

On the title page of the payroll slip (Form N T-49) and the payroll slip (Form N T-53) the total amount to be paid is indicated. The permission to pay wages is signed by the head of the organization or a person authorized by him to do so. At the end of the statement, the amounts of paid and deposited wages are indicated.

In the payroll (form N T-49) and payroll (form N T-53), upon expiration of the payment period, an o is made against the names of employees who did not receive wages, respectively in columns 23 and 5. If necessary, the number of the presented document is indicated in the “Note” column of Form N T-53.

At the end of the payroll, after the last entry, a final line is drawn to indicate the total amount of the payroll. For the amount of wages issued, an expense cash order is drawn up (Form N KO-2), the number and date of which are indicated on the last page of the payroll.

In pay slips compiled on computer storage media, the composition of the details and their location are determined depending on the adopted information processing technology. In this case, the document form must contain all the details of the unified form.

Payroll register (Form N T-53a)

It is used for accounting and registration of payroll records for payments made to employees of the organization.

Maintained by an accounting employee.

Personal account (form N T-54)

Personal account (svt) (form N T-54a)

They are used to monthly reflect information about wages paid to an employee during the calendar year.

Filled out by an accounting employee.

Form N T-54 is used to record all types of accruals and deductions from an employee’s wages on the basis of primary documents recording production and work performed, time worked and documents for various types of payment.

Form N T-54a is used for automated processing of accounting data using computer technology (CT) using special programs and contains conditionally permanent details necessary for calculating wages. A copy of the printout of the pay slip, containing data on the components of wages, the amount and reasons for deductions made, and the total amount of money to be paid, is inserted (pasted) monthly into the employee’s personal account on paper. On the reverse side of the form or insert sheet, a breakdown of the codes (according to the coding system adopted by the organization) of various types of payments and deductions is given.

Calculation note on granting leave to an employee (Form N T-60)

It is used to calculate wages and other payments due to an employee when he is granted annual paid or other leave.

When calculating average earnings for vacation pay, column 3 shows the total amount of payments accrued to the employee for the billing period in accordance with the rules for calculating average earnings. Columns 4 and 5 indicate the number of calendar days and hours per hour worked in the billing period. The column “Number of hours of the billing period” is filled in when calculating vacation pay for an employee for whom a summarized recording of working time has been established.

Calculation note upon termination (termination) of an employment contract with an employee (dismissal) (form N T-61)

Used to record and calculate wages and other payments due to an employee upon termination of an employment contract. Compiled by a personnel service employee or a person authorized by him. The calculation of due wages and other payments is made by an accounting employee.

When calculating average earnings for payment of compensation for unused vacation, as well as deduction for vacation used in advance, column 3 shows the total amount of payments accrued to the employee for the billing period in accordance with the rules for calculating average earnings. Columns 4 and 5 indicate the number of calendar (working) days and hours per hour worked in the billing period. The column “Number of hours of the billing period” is filled in when calculating the payment of compensation for unused vacation to an employee for whom a summarized recording of working time has been established.

Certificate of acceptance of work performed under a fixed-term employment contract concluded for the duration of specific work (Form N T-73)

It is used to register and record the acceptance and delivery of work performed by an employee under a fixed-term employment contract concluded for the duration of a specific job.

It is the basis for the final or phased calculation of payment amounts for work performed.

It is drawn up by the employee responsible for accepting the work performed, approved by the head of the organization or a person authorized by him and submitted to the accounting department for calculation and payment to the contractor of the amount due.